Lumber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436303 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Lumber Market Size

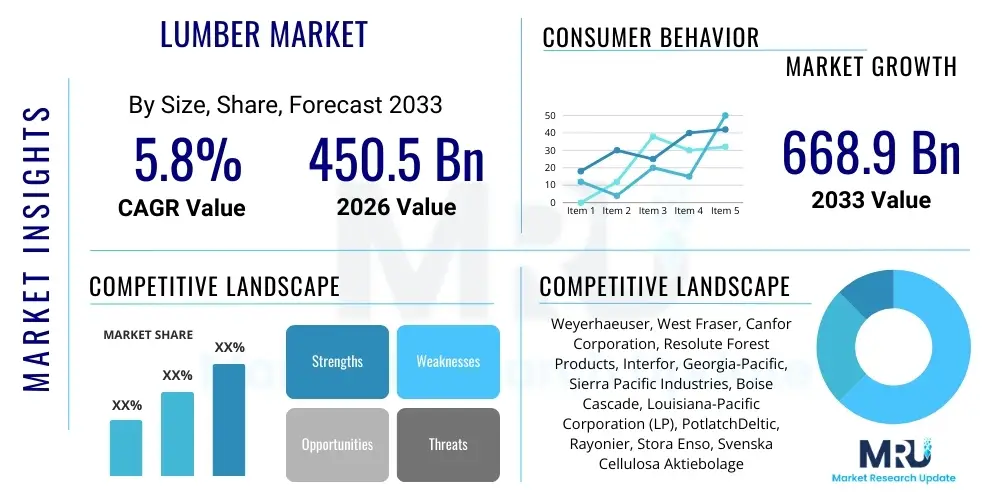

The Lumber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 668.9 Billion by the end of the forecast period in 2033.

Lumber Market introduction

The Lumber Market encompasses the sourcing, processing, and distribution of wood materials primarily used in construction, furniture manufacturing, and industrial applications. This vast global market is driven fundamentally by global population growth, urbanization trends, and the corresponding need for residential and commercial infrastructure. Lumber products range from basic rough-sawn dimensional lumber to highly engineered wood products like Glued-Laminated Timber (Glulam) and Cross-Laminated Timber (CLT), catering to diverse structural and aesthetic requirements across various end-use sectors. The inherent sustainability of wood, particularly when sourced from certified forests, positions lumber as a key material in the global push toward green building practices and reduced carbon footprints compared to materials like steel or concrete.

Key products within this market include softwood lumber, often derived from pine, spruce, or fir and predominantly used in structural framing due to its strength-to-weight ratio and cost-effectiveness, and hardwood lumber, such as oak, maple, and cherry, which is favored for flooring, cabinetry, and high-end millwork due to its density and aesthetic qualities. Major applications span residential housing construction, which remains the single largest consumer segment, followed by non-residential construction projects (e.g., commercial offices, schools, and hospitals) and repair & remodeling activities. The market's stability is often linked directly to prevailing interest rates and governmental policies affecting housing starts and infrastructure investment.

The primary benefits of utilizing lumber include its renewability, excellent insulation properties, ease of construction, and versatility. Driving factors include the rising demand for mass timber construction, which allows for faster and more sustainable construction of high-rise buildings; technological advancements in wood processing that improve durability and fire resistance; and robust economic growth in emerging markets, particularly across Asia Pacific, leading to increased investment in housing development. Furthermore, consumer preferences are shifting towards natural, environmentally friendly building materials, amplifying the demand for sustainably sourced forest products.

Lumber Market Executive Summary

The global Lumber Market is characterized by resilient growth, primarily fueled by a post-pandemic surge in residential repair and remodeling activities and a sustained need for affordable housing solutions worldwide. Business trends indicate a strong move toward vertical integration among major lumber producers, aiming to control the entire supply chain from sustainable forest management (SFM) to finished product distribution, thereby mitigating volatility associated with raw material sourcing and logistics. Geopolitical factors, trade tariffs, and fluctuating timber prices present ongoing challenges, necessitating agile procurement strategies. A notable shift in product mix is the accelerated adoption of engineered wood products (EWPs), which offer superior performance and design flexibility, especially in large-scale commercial and multi-family projects, driving higher average selling prices for advanced lumber solutions.

Regionally, North America continues to dominate the market in terms of production capacity and technological adoption, largely driven by the U.S. housing market's cyclical upturns and heavy investment in sustainable harvesting practices. However, the Asia Pacific region, led by rapidly developing economies like China and India, is emerging as the fastest-growing market, propelled by massive infrastructure projects and expanding middle-class demand for modern housing units. European markets, particularly Scandinavia and Central Europe, maintain a leadership position in sustainable forestry and mass timber innovation, setting global benchmarks for environmentally responsible wood utilization and contributing significantly to the demand for certified lumber products.

In terms of segmentation, the Softwood segment retains the largest volume share due to its ubiquity in North American and European structural applications, yet the Engineered Wood segment is experiencing the highest growth rate, reflecting the construction industry's demand for materials that meet stringent modern building codes related to strength and span length. The Residential Construction application segment remains the bedrock of market demand, though the Industrial segment, covering specialized packaging and heavy-duty applications, is showing steady resilience driven by global manufacturing output. Manufacturers are focusing on optimizing drying and treatment processes to enhance lumber durability and reduce construction waste, directly addressing contractor pain points related to material performance on-site.

AI Impact Analysis on Lumber Market

User queries regarding AI's influence in the Lumber Market primarily revolve around optimizing resource management, improving operational efficiencies in milling processes, and enhancing supply chain predictability. Common concerns include how AI can be used for automated defect detection in lumber sorting (grading), minimizing waste during cutting optimization, and predicting real-time demand fluctuations to manage volatile inventory levels. Users are highly interested in AI's role in sustainable forestry—specifically, utilizing machine learning algorithms on satellite and drone imagery for detailed forest inventory analysis, early detection of pest infestations, and maximizing sustainable yield without compromising forest health. The key expectation is that AI will transform lumber manufacturing from a traditional, manual process into a highly data-driven, precision industry, allowing producers to better navigate increasing pressure from environmental regulations and cost constraints.

- AI-driven optimization of log breakdown and cutting patterns in sawmills to maximize yield and minimize material waste.

- Predictive maintenance analytics applied to logging equipment and mill machinery to reduce unplanned downtime and operational costs.

- Automated quality control and grading systems using computer vision and machine learning for fast, accurate defect identification in finished lumber.

- Enhanced supply chain logistics through AI algorithms predicting optimal transport routes and inventory placement based on volatile construction demand signals.

- Utilizing satellite imagery and deep learning for sustainable forest inventory management, monitoring growth rates, and optimizing harvesting schedules.

- Forecasting lumber price trends and commodity market volatility using time-series analysis powered by artificial intelligence to inform procurement and sales strategies.

DRO & Impact Forces Of Lumber Market

The Lumber Market is significantly influenced by powerful and often conflicting forces—drivers pushing for growth, restraints curbing expansion, and opportunities for innovation, all encapsulated by the cumulative impact forces shaping strategic decisions. Major drivers include global urbanization, particularly in emerging economies, leading to sustained demand for housing and infrastructure, coupled with the increasing acceptance of wood as a preferred sustainable material in developed nations. Furthermore, the advancements in engineered wood technologies, such as the viability of Cross-Laminated Timber (CLT) for mid- to high-rise construction, are opening up market segments previously dominated exclusively by concrete and steel, drastically expanding lumber's potential application scope.

However, the market faces considerable restraints, notably the intense volatility in lumber commodity pricing, often exacerbated by trade disputes (such as softwood lumber tariffs between the US and Canada) and natural disasters impacting supply. Strict governmental regulations regarding sustainable forestry management and conservation efforts, while crucial for long-term supply, can impose short-term harvesting restrictions, constraining immediate supply response to sudden demand peaks. Labor shortages in both logging operations and sawmilling, along with rising energy costs for drying and processing, also increase operating expenses, presenting a continuous challenge to maintaining competitive pricing structures.

Opportunities for market players lie primarily in the rapid adoption of digitization across the value chain, from automated timber cruising and inventory tracking to e-commerce platforms facilitating direct sales to builders. The ongoing emphasis on carbon capture and sustainable sourcing creates a niche for producers offering verified, certified lumber (e.g., FSC or PEFC certified), capitalizing on corporate environmental, social, and governance (ESG) commitments. The collective impact forces show a strong trajectory toward modernization and sustainability, forcing traditional producers to invest heavily in technological upgrades and forest certification programs to remain relevant against the backdrop of fluctuating macroeconomic conditions and increasingly complex global supply logistics.

Segmentation Analysis

The Lumber Market is comprehensively segmented based on product type, processing level, application, and geography, providing critical insights into demand patterns and competitive landscapes. Segmentation analysis is crucial for stakeholders to tailor their product offerings, whether focusing on high-volume softwood for residential framing or specialized hardwood components for architectural millwork. The market structure reflects a bifurcated demand structure: high-volume, low-margin products driven by construction cycles, and specialized, high-margin products driven by aesthetic trends and industrial performance requirements. The shift towards engineered wood products (EWPs) represents a fundamental technological segmentation change, moving beyond traditional dimensional lumber into structurally advanced materials designed for modern building methods and superior strength characteristics.

- By Product Type:

- Softwood Lumber (e.g., Spruce, Pine, Fir - SPF)

- Hardwood Lumber (e.g., Oak, Maple, Cherry)

- By Process/Form:

- Rough Lumber

- Finished/Dressed Lumber

- Engineered Wood Products (EWPs) (e.g., Glulam, CLT, LVL, Plywood, OSB)

- By Application:

- Residential Construction

- Non-Residential Construction (Commercial, Industrial)

- Repair and Remodeling (R&R)

- Furniture and Joinery

- Packaging and Crating (Industrial Applications)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Nordic Countries)

- Asia Pacific (China, Japan, India, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Lumber Market

The value chain for the Lumber Market begins intensely in the upstream segment with sustainable forest management and logging operations, which involves timber cruising, harvesting, and primary transportation. Upstream activities are critical as they determine the quality, species mix, and initial cost of the raw material (logs). Efficiency here relies heavily on optimized road networks, advanced mechanized harvesting equipment, and adherence to strict environmental regulations, impacting the consistency of supply delivered to the sawmills. Technological investments in inventory management and GIS mapping are increasingly important at this stage to ensure resource sustainability and operational compliance.

Midstream processing involves the transformation of raw logs into usable lumber products through sawmilling, drying (kiln drying being essential for stability), planing, and grading. This stage represents the largest value-add, where operational efficiency and precision machinery directly influence the margin and the quality classification of the final product. Distribution channels, forming the crucial connection between the mill and the end-user, can be direct or indirect. Direct sales often go to large industrial customers or major prefabricated home builders, offering streamlined logistics. Indirect channels utilize intermediaries like wholesalers, distributors, specialized lumberyards, and large format retail home improvement stores (e.g., Home Depot, Lowe’s), which provide essential inventory holding and localized service to smaller construction firms and individual consumers.

Downstream analysis focuses on the end-users, primarily the construction sector (both residential and commercial), furniture manufacturers, and industrial packaging providers. The choice of distribution channel heavily depends on the downstream customer's size and required volume. For instance, high-grade architectural hardwoods often bypass traditional distribution channels, moving directly from specialized millwork facilities to custom cabinet shops. The shift towards just-in-time inventory management in the construction sector is placing increasing pressure on distributors to maintain reliable stock and prompt delivery, making supply chain resilience a significant competitive advantage in the final stages of the value chain.

Lumber Market Potential Customers

The primary consumers and buyers in the Lumber Market span various industries, but the construction sector remains paramount, driving the majority of global demand. Within construction, potential customers include large-scale residential developers focused on single-family and multi-family housing, who require vast quantities of dimensional softwood lumber (e.g., 2x4s, 2x6s) and sheathing materials like OSB and plywood. Furthermore, commercial general contractors specializing in mid-rise office buildings, institutional structures, and retail complexes are increasingly adopting advanced engineered wood products (EWPs) like CLT and Glulam, representing a rapidly growing segment of high-value clientele requiring complex, pre-fabricated components.

Beyond structural construction, a significant customer base exists in the manufacturing sector. Furniture manufacturers, ranging from high-volume assembly lines to bespoke artisanal workshops, rely heavily on hardwood lumber and high-quality panel products for cabinetry, tables, and seating. The industrial packaging sector—including companies that produce pallets, crates, and specialized shipping containers—constitutes another essential and often volume-driven customer segment, especially for rough or lower-grade lumber suitable for heavy-duty applications that prioritize strength and cost-efficiency over aesthetic appearance. The repair and remodeling (R&R) segment, serviced largely through retail outlets and local lumberyards, represents constant, counter-cyclical demand that helps stabilize the market during downturns in new construction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 668.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weyerhaeuser, West Fraser, Canfor Corporation, Resolute Forest Products, Interfor, Georgia-Pacific, Sierra Pacific Industries, Boise Cascade, Louisiana-Pacific Corporation (LP), PotlatchDeltic, Rayonier, Stora Enso, Svenska Cellulosa Aktiebolaget (SCA), Metsä Group, Binderholz, JD Irving, Koppers Holdings, Tolko Industries, Katerra, Norbord (now part of West Fraser) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lumber Market Key Technology Landscape

The technological landscape of the Lumber Market is undergoing a rapid evolution, moving away from purely mechanical processing towards advanced digitization and material science integration, primarily driven by the need for efficiency, reduced waste, and enhanced structural performance. A pivotal technological shift involves high-speed 3D scanning and optimization software used in modern sawmills. These systems utilize laser and X-ray technologies to map the internal structure of logs instantaneously, allowing computerized systems to determine the optimal cutting solution to maximize recovery of high-value dimensional lumber, often increasing yield by several percentage points and significantly improving profitability. Furthermore, the adoption of continuous dry kilns (CDKs) over traditional batch kilns has dramatically improved energy efficiency and reduced the time required for moisture content stabilization, ensuring lumber meets stringent quality and stability requirements for export and demanding structural applications.

Another crucial technological area is the advancement in engineered wood product manufacturing. Technologies related to the automated layup, gluing, and pressing of cross-laminated timber (CLT) and glulam are allowing for the mass production of large, structural timber components with precision tolerances. These innovations are critical for the 'Mass Timber' movement, enabling timber to be used as the primary structural element in larger commercial and multi-story residential buildings that require materials with predictable and verifiable strength characteristics. This manufacturing precision is supported by advanced computational design and Building Information Modeling (BIM), allowing architects and engineers to seamlessly integrate these custom-sized wood elements into complex building designs, streamlining on-site assembly and reducing construction timelines.

Finally, technology is profoundly influencing upstream forestry and material treatment. Geospatial technologies, including high-resolution drone mapping and specialized forest inventory software, are enabling precision forestry, leading to more sustainable harvesting practices and better planning of forest resources. In terms of product enhancement, advanced wood modification and treatment processes—such as thermal modification (thermally modified timber) and proprietary composite treatments—are significantly increasing the lumber's resistance to decay, moisture, and fire, opening up new opportunities for wood use in exterior applications and regions prone to severe weather conditions, thereby expanding the competitive scope against materials such as composite decking and treated chemical lumber.

Regional Highlights

- North America (U.S. and Canada): This region is characterized by high consumption per capita and advanced sawmilling infrastructure. Canada is a dominant global exporter, particularly of Softwood (SPF) lumber, heavily influencing international prices. The U.S. market is highly sensitive to housing starts and mortgage rates. Current trends focus on rebuilding aging infrastructure and increasing investment in domestic mass timber production facilities to localize supply chains and enhance regional energy efficiency standards in construction.

- Europe (Nordic and Central Europe): Europe leads in sustainable forestry practices and is the global hub for engineered wood innovation (CLT, Glulam). Countries like Sweden, Finland, and Austria maintain robust, certified timber resources. The demand is underpinned by strong green building policies and government initiatives promoting energy-efficient, low-carbon construction, driving high demand for premium, certified structural lumber products.

- Asia Pacific (China, India, Japan): APAC is the fastest-growing region, driven by explosive urbanization, massive residential construction programs, and rising incomes leading to greater demand for higher-quality building materials and furniture. While China remains the largest importer of logs and processed lumber globally, domestic production capabilities are increasing, coupled with a growing focus on imports from certified sustainable sources in Oceania and Russia to meet strict environmental quality standards.

- Latin America (Brazil, Chile): This region is a vital supplier of both tropical hardwood and plantation softwood, offering diverse species. Brazil, with its extensive forest resources, is focusing on balancing conservation efforts with commercial logging. The demand within the region is growing, primarily driven by internal infrastructure development and housing projects, though logistical challenges and regulatory complexities often affect market stability and export competitiveness.

- Middle East and Africa (MEA): MEA is highly reliant on imported finished and processed lumber, mainly for large-scale infrastructure projects, commercial developments, and high-end fit-outs. Demand often peaks with large governmental construction spending (e.g., Saudi Arabia’s Vision 2030 projects). Key market drivers are population growth and diversification from oil economies, necessitating long-term investments in residential and tourism infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lumber Market.- Weyerhaeuser

- West Fraser Timber Co. Ltd.

- Canfor Corporation

- Resolute Forest Products

- Interfor Corporation

- Georgia-Pacific LLC

- Sierra Pacific Industries

- Boise Cascade Company

- Louisiana-Pacific Corporation (LP)

- PotlatchDeltic Corporation

- Rayonier Inc.

- Stora Enso Oyj

- Svenska Cellulosa Aktiebolaget (SCA)

- Metsä Group

- Binderholz GmbH

- JD Irving, Limited

- Koppers Holdings Inc.

- Tolko Industries Ltd.

- Katerra (Assets acquired by others)

- Norbord (now part of West Fraser)

Frequently Asked Questions

Analyze common user questions about the Lumber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive demand in the global Lumber Market?

Demand is primarily driven by global residential construction activity, urbanization rates in developing countries, and the increasing adoption of sustainable building practices that favor wood over carbon-intensive materials like steel and concrete.

How is the volatility of lumber prices managed by major market participants?

Major participants manage price volatility through vertical integration (controlling forestry and processing), engaging in commodity hedging on futures markets, and utilizing advanced inventory management and long-term supply contracts with large builders.

What role does Engineered Wood play in the future of the Lumber Industry?

Engineered Wood Products (EWPs) like CLT and Glulam are pivotal, as they enable mass timber construction in mid- to high-rise buildings, significantly expanding lumber's structural applications and meeting modern building code requirements for strength and span.

Which geographical region exhibits the strongest growth potential for lumber consumption?

The Asia Pacific region, particularly countries undergoing rapid infrastructure expansion and industrialization such as China and India, demonstrates the strongest growth potential due to massive housing needs and increasing per capita consumption.

What technological advancements are optimizing lumber production efficiency?

Key technologies include AI-driven log scanning and optimization systems for maximizing yield in sawmills, predictive maintenance for machinery, and the implementation of continuous dry kilns (CDKs) to reduce processing time and energy consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laminated Veneer Lumber (LVL) Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Reclaimed Lumber Market Size Report By Type (.), By Application (Flooring, Paneling & Siding, Beams, Furniture, Others, , Residential, Commercial, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Laminated Veneer Lumber Market Size Report By Type (Cross Bended LVL and Laminated Strand Lumbar), By Application (Headers, Beams, Rim Board, Truck Bed Decking, and Others, By End User, Residential, Commercial, and Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Low Density Plumber Tape Market Statistics 2025 Analysis By Application (Aerospace, Appliance, Automotive, Chemical, Electronic and Electrical, Plumbing and Pipe, Others), By Type (White, Yellow, Pink, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Standard Density Plumber Tape Market Statistics 2025 Analysis By Application (Aerospace, Appliance, Automotive, Chemical, Electronic and Electrical, Plumbing and Pipe, Others), By Type (White, Yellow, Pink, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager