Lump Anthracite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431564 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Lump Anthracite Market Size

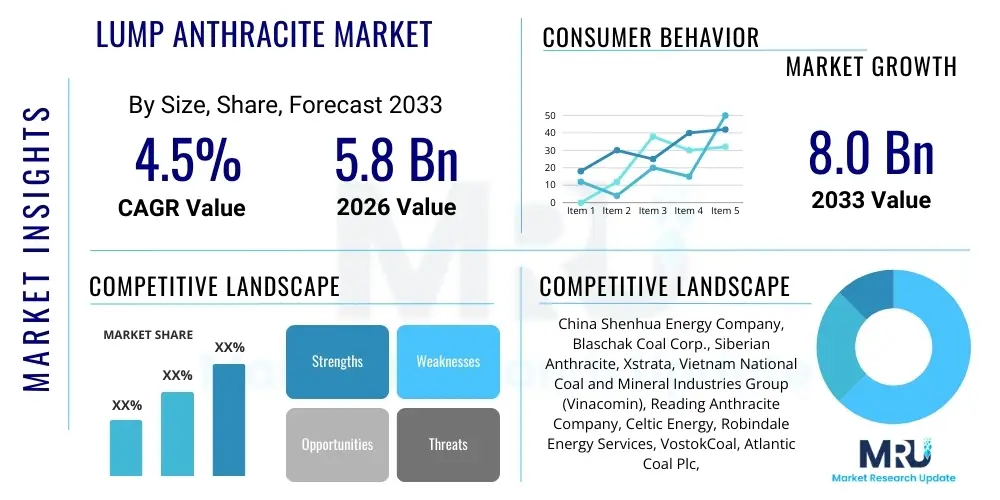

The Lump Anthracite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% CAGR between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Lump Anthracite Market introduction

Lump anthracite represents the highest rank of coal, distinguished by its high carbon content, low volatile matter, and low sulfur content, making it a premium fuel and a critical industrial raw material. This specific form, typically characterized by particle sizes above 10 millimeters, is particularly valued in processes requiring high thermal stability and consistent calorific output. Lump anthracite is favored over pulverized or fine anthracite in applications where physical integrity and superior permeability are paramount, such as in blast furnace injection or specific filtration systems. Its inherent properties position it distinctly within the energy complex, shielding it partially from the volatile price fluctuations observed in thermal coal markets primarily used for power generation.

The major applications of lump anthracite are concentrated in highly specialized industrial sectors. Foremost among these is the metallurgical industry, where it functions as a crucial reductant in the production of steel, ferroalloys, and silicon metal. Its purity ensures minimal contamination in these high-value metal processing applications. Furthermore, the chemical sector utilizes lump anthracite for manufacturing carbon electrodes, activated carbon, and specialized carbon materials. Its secondary yet significant role includes its use in water filtration systems due to its hardness and density, and in certain residential or commercial heating units where clean, long-burning heat is desired. The market demand is intrinsically linked to the performance of global heavy industries, particularly infrastructure and manufacturing growth in Asia Pacific.

Key driving factors sustaining the lump anthracite market include the persistent global demand for high-quality steel and specialized metal products, especially in emerging economies undergoing rapid industrialization. The benefits derived from using lump anthracite—such as increased energy efficiency, enhanced product quality due to low impurity levels (sulfur and ash), and reduced processing complexity—make it economically superior for certain high-specification end-uses compared to alternatives like coke or lower-grade coals. While environmental regulations impose significant constraints on the broader coal market, lump anthracite’s specialized, non-combustion-centric uses in high-temperature metallurgy and chemical production ensure its continued relevance, supported by ongoing technological improvements aimed at cleaner utilization.

Lump Anthracite Market Executive Summary

The Lump Anthracite Market demonstrates resilience, largely supported by robust business trends centered on specialized industrial requirements rather than bulk energy generation. Key business trends indicate a strategic shift by major producers toward optimizing beneficiation and processing techniques to meet stringent end-user specifications regarding size consistency, ash content, and purity. Capital investments are increasingly directed toward improving logistics and supply chain efficiency, particularly connecting high-purity mines in regions like Russia and Vietnam to key demand centers in East Asia. Consolidation among smaller mining operations and strategic alliances between miners and metallurgical companies are defining characteristics of the current competitive landscape, aiming to secure long-term, stable supply contracts. The overall market momentum reflects a maturity stage where incremental growth is derived from process intensification and geographical expansion into previously underserved specialized markets.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, driven primarily by China, India, and South Korea, which command the highest consumption rates due to their massive steel production and industrial base. While North America and Europe experience relatively flat or declining demand due to regulatory pressures and transition away from coal-dependent industries, their market value remains high due to demand for ultra-high-purity anthracite used in niche applications like carbon fiber precursors and advanced filtration. The Middle East and Africa (MEA) and Latin America represent emerging regional opportunities, correlating directly with ongoing infrastructure projects that necessitate specialized steel and metal production, fueling localized demand for high-grade reductants.

Segmentation trends reveal that the metallurgical application segment consistently holds the largest market share, driven specifically by the demand for low-volatile carbon sources essential for sinter plants and electric arc furnace operations. Segmentation by size indicates that medium-lump and large-lump products (e.g., 20mm to 50mm) often command a price premium due to their suitability for direct charging and enhanced physical stability within high-temperature reactors. There is a noticeable trend of increasing demand for processed, standardized anthracite, indicating that end-users are prioritizing consistency and quality control over simple raw material cost, further cementing the market's focus on specialty, high-specification products.

AI Impact Analysis on Lump Anthracite Market

User inquiries regarding AI's influence on the Lump Anthracite Market primarily focus on optimization across the supply chain, operational efficiency in mining, and the integration of predictive analytics for demand forecasting and quality control. Common concerns revolve around how AI can mitigate rising operational costs, enhance worker safety in harsh underground environments, and, critically, improve the consistency and purity of the final lump product to meet sophisticated metallurgical standards. Users also frequently question AI’s role in navigating complex regulatory environments by monitoring compliance related to extraction methods and logistics. The consensus expectation is that while AI will not directly affect the chemical composition of anthracite, it will revolutionize its discovery, extraction efficiency, processing, and strategic market positioning, ultimately stabilizing supply chains and potentially reducing the environmental footprint associated with conventional mining practices.

- AI-driven optimization of drilling and blasting patterns, reducing energy consumption and operational variability in mining.

- Predictive maintenance analytics applied to heavy mining equipment, minimizing unscheduled downtime and improving capital expenditure planning.

- Machine learning algorithms utilized for geological modeling and reserve estimation, leading to more accurate resource identification and optimized extraction trajectories.

- Implementation of AI in beneficiation plants for real-time quality assurance, utilizing computer vision systems to sort lumps based on size, ash content, and carbon purity, thereby increasing yield of high-specification products.

- Enhanced supply chain visibility and logistics optimization using AI to predict transportation bottlenecks and manage inventory levels effectively across global distribution networks.

- AI-enabled demand forecasting models, integrating economic indicators and steel production metrics to provide miners with accurate predictions, reducing inventory risk and improving contract negotiation strategies.

- Safety protocol enforcement through AI monitoring of worker behavior and equipment status in hazardous mining environments, leading to proactive risk mitigation.

DRO & Impact Forces Of Lump Anthracite Market

The market dynamics of lump anthracite are governed by a complex interplay of demand-side drivers rooted in industrial necessity and supply-side constraints, primarily environmental and regulatory. Drivers include the sustained need for high-purity carbon reductants in specialized metallurgy (steel, silicon, ferroalloys) and non-energy applications like filtration and chemical processing, where alternatives do not offer the same performance specifications. Restraints are predominantly centered on global efforts toward decarbonization, leading to increasingly strict environmental regulations on coal extraction and usage, coupled with high initial capital expenditure required for modern, compliant mining operations. Opportunities emerge from geographical shifts in industrial production, particularly the expansion of high-tech manufacturing in Asia, and the potential for developing cleaner, more efficient utilization technologies, such as advanced gasification or carbon capture integration, which could prolong anthracite’s industrial lifespan. These forces collectively define the market trajectory, emphasizing high-purity, specialty-grade products over bulk volumes.

The driving forces are particularly potent in the industrial sector. Lump anthracite acts as a necessary ingredient in crucial industrial processes that currently lack viable, scalable, and economically competitive substitutes. For example, in the production of high-grade steel necessary for automotive bodies or specialized machinery, the low impurity levels provided by anthracite are non-negotiable, ensuring the metallurgical integrity of the final product. Furthermore, rapid urbanization and large-scale infrastructure projects in developing nations inherently increase the demand for primary industrial inputs, maintaining a firm floor under the global consumption levels for specialized carbon materials. This specific, high-performance demand insulates lump anthracite from the market volatility affecting thermal coal used solely for electricity generation.

However, the restraints are significant and fundamentally structural. The overarching global policy shift favoring renewable energy sources and stringent climate mandates create financial hurdles and reputational risks for entities engaged in coal mining, regardless of the coal grade. Financing new anthracite mining projects becomes increasingly difficult due to ESG (Environmental, Social, and Governance) investment criteria adopted by major financial institutions. Moreover, the long and complex logistical chain required to transport high-grade anthracite from often remote mining sites to industrial end-users adds substantial operational costs, which, combined with unpredictable governmental policy changes (e.g., export tariffs or mining limitations), acts as a persistent dampener on potential market expansion. Navigating these environmental and financial pressures remains the greatest challenge for market participants.

Segmentation Analysis

The Lump Anthracite Market is strategically segmented to reflect the diverse purity requirements, particle size specifications, and varied end-user applications that dictate demand and pricing. Segmentation by type focuses primarily on the critical specifications of the coal, including fixed carbon content, ash percentage, and sulfur levels, distinguishing premium grades essential for specialized metallurgy from standard grades suitable for basic heating or general industrial use. Application-based segmentation reveals the market’s primary drivers, with the metallurgical sector being paramount, followed by chemical processing and filtration. Geographical segmentation, while important, often reflects regional industrial activity levels and availability of domestic reserves. Analyzing these segments provides a granular view of demand stability, price elasticity, and technological adoption within the niche sectors reliant on this high-purity carbon source.

- By Type (Grade/Purity):

- Ultra-High Purity Anthracite (Fixed Carbon >95%)

- High Purity Anthracite (Fixed Carbon 90%-95%)

- Standard Grade Anthracite (Fixed Carbon <90%)

- Low Ash Anthracite

- Low Sulfur Anthracite

- By Size:

- Small Lump (10mm - 20mm)

- Medium Lump (20mm - 50mm)

- Large Lump (>50mm)

- Processed and Sized Anthracite

- By Application:

- Metallurgical Industry

- Sintering and Pelleting

- Blast Furnace Injection

- Ferroalloys Production (Silicon, Manganese)

- Silicon Metal Manufacturing

- Chemical Industry

- Carbon Electrode Production

- Activated Carbon Manufacturing

- Carbon Fiber Precursors

- Filtration and Water Treatment

- Heating and Power Generation (Niche Markets)

- Other Industrial Uses (Cement, Specialty Ceramics)

- Metallurgical Industry

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., Russia, Ukraine)

- Asia Pacific (China, India, South Korea, Vietnam)

- Latin America (Brazil, Chile)

- Middle East & Africa (South Africa, Turkey)

Value Chain Analysis For Lump Anthracite Market

The value chain for the Lump Anthracite Market is complex and extends from primary extraction to specialized industrial consumption, involving distinct steps that add significant value. Upstream analysis focuses on geological exploration, resource assessment, and the actual mining processes, which are typically capital-intensive and subject to strict regulatory oversight. Given the specific geological requirements for anthracite formation, mining is often concentrated in a few key global regions. The midstream involves extensive processing, or beneficiation, including crushing, screening, washing, and sizing to achieve the exact specifications required by end-users—a crucial step for lump anthracite where size integrity is vital. Investment in sophisticated beneficiation technologies dictates the final purity and marketability of the product.

Downstream analysis is dominated by logistics and distribution. Due to the international trade nature of high-purity anthracite, reliable multimodal transportation (rail, barge, sea freight) is essential, adding considerable cost and complexity. Direct distribution channels involve long-term, contractual agreements between large miners and major industrial consumers, such as large integrated steel mills or chemical manufacturers, ensuring stable volume and consistent quality delivery. Indirect channels involve trading houses and specialized commodity brokers who manage inventory, financing, and smaller or intermittent sales to diverse industrial users. The effectiveness of the distribution channel is paramount, as the utility of lump anthracite often depends on its timely arrival and consistent supply to continuous industrial processes.

The primary value driver in this chain is not volume but quality and consistency. Miners who can guarantee ultra-low ash and sulfur content, coupled with precise sizing specifications, command premium prices. The interaction between upstream production capacity and downstream industrial demand for specialized materials ensures that the value chain remains highly sensitive to global metallurgical output levels and technological advancements in industrial processing. Efficient management of the direct and indirect sales mix allows producers to maximize price realization and hedge against market fluctuations, particularly in regions like Asia where demand is highly concentrated but geographically diverse.

Lump Anthracite Market Potential Customers

The primary potential customers and end-users of lump anthracite are concentrated within the heavy industrial sectors that rely on high-purity carbon sources for chemical reduction or structural stability under high heat. The largest consumer segment is the integrated steel industry, particularly those utilizing sinter plants and electric arc furnaces that require specific carbon additives to control slag chemistry and enhance energy efficiency. Ferroalloy producers, including manufacturers of ferrosilicon and ferromanganese, constitute another critical customer base, valuing anthracite's low reactivity and impurity profile to ensure the final metal quality. These customers are highly sensitive to price but prioritize consistency in ash and sulfur content, often seeking long-term contracts for security of supply.

Beyond metallurgy, the chemical industry represents a specialized, high-value customer segment. Manufacturers of specialized carbon products, such as carbon electrodes used in aluminum smelting and arc furnaces, and those producing sophisticated carbon materials like precursors for carbon fibers, rely on the inherent structural integrity and high carbon purity of lump anthracite. Furthermore, municipal and industrial water treatment facilities frequently purchase lump anthracite for use as a filter medium. Its physical hardness, angularity, and resistance to chemical attack make it an ideal material for removing suspended solids and improving water clarity in large-scale filtration beds. These customers prioritize long product lifespan and conformance to strict regulatory standards.

In summary, the buyer landscape is segmented into high-volume, cost-sensitive metallurgical buyers seeking consistent reductants; high-specification, quality-sensitive chemical and material manufacturers; and public sector/utility buyers focused on durable filtration media. Understanding the unique technical requirements of each end-user, such as specific particle size distributions or maximum impurity thresholds, allows suppliers to effectively tailor their processed product offerings and secure enduring commercial relationships within these niche, yet vital, industrial ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | China Shenhua Energy Company, Blaschak Coal Corp., Siberian Anthracite, Xstrata, Vietnam National Coal and Mineral Industries Group (Vinacomin), Reading Anthracite Company, Celtic Energy, Robindale Energy Services, VostokCoal, Atlantic Coal Plc, Paringa Resources, Jellinbah Group, Nippon Carbon Co., Shanxi Coking Coal Group, Glencore, Anglo American, Coal India Limited, Whitehaven Coal, Corsa Coal, Lehigh Anthracite |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lump Anthracite Market Key Technology Landscape

The technology landscape within the Lump Anthracite Market is primarily focused on enhancing extraction efficiency, improving product quality through sophisticated beneficiation, and mitigating environmental impact. In extraction, modern techniques utilize advanced computerized geological modeling and robotic mining equipment to target high-grade seams with greater precision, reducing waste and increasing yield per unit of effort. Automated tunneling machines and continuous miners, integrated with sensor technology, improve safety and operational speed in underground operations, which are common for high-purity anthracite deposits. Furthermore, optimizing ventilation and methane capture technologies is crucial, particularly in deep mines, addressing both safety concerns and environmental compliance simultaneously.

The most critical technological advancements are concentrated in the beneficiation and processing phase, where raw coal is refined into market-ready lump anthracite. Advanced separation technologies, such as Dense Medium Separation (DMS) and sophisticated jigging processes, are employed to achieve the ultra-low ash and sulfur content demanded by metallurgical customers. Furthermore, automated optical sorting and laser-induced breakdown spectroscopy (LIBS) are increasingly being piloted to provide real-time, non-destructive analysis of individual coal lumps, enabling highly precise segregation based on carbon content and impurities. This precision processing technology is essential for generating the premium, specialized grades that secure higher price points and maintain competitiveness against alternative carbon sources.

Finally, there is growing investment in technologies related to the cleaner utilization of anthracite, even for non-combustion purposes. Research is ongoing into advanced gasification techniques that could convert anthracite into synthesis gas (syngas) with reduced emissions, expanding its utility in the chemical sector. While large-scale carbon capture and storage (CCS) remains challenging for industrial processes, localized research is focusing on integrating carbon management practices within metallurgical plants that use anthracite. Overall, the technological evolution is market-driven, emphasizing high-purity production through automation and precise quality control, rather than fundamental changes in the raw material itself.

Regional Highlights

The regional dynamics of the Lump Anthracite Market are characterized by a significant supply-demand imbalance, with key production centers often geographically distant from the primary consumption hubs. Asia Pacific (APAC) stands out as the undisputed leader in consumption, driven by its massive and growing industrial base, particularly in steel, infrastructure, and chemical manufacturing. China, despite being a major producer itself, remains a massive consumer, especially for high-purity imports necessary for its highly refined industrial processes. South Korea and Japan also rely heavily on imported lump anthracite for their advanced metallurgical industries. This region’s growth trajectory is directly tied to national infrastructure spending and export-oriented manufacturing, ensuring sustained demand throughout the forecast period.

Europe and North America represent mature markets characterized by steady, specialized demand and dwindling domestic production capacity due to high operational costs and strict environmental regulations. In Europe, consumption is focused on specific industrial niches, such as filter media manufacturing and specialized heating applications, with most supply secured through imports from countries like Russia and Ukraine. North American demand, while robust in pockets (e.g., specialized steel production and chemical reductants), has seen market size contraction due to the shift towards natural gas and renewables. However, the requirement for ultra-pure grades in certain niche applications maintains the region’s high average market value per ton.

Russia is a globally critical region as a major producer and exporter of high-quality anthracite, particularly to the APAC and European markets. Its vast reserves and advanced mining infrastructure give it significant leverage in global trade. Conversely, regions like Latin America and the Middle East & Africa (MEA) are emerging demand centers. MEA's demand growth is correlated with burgeoning mining and construction activities, requiring regional or imported lump anthracite for local steel production and mineral processing. Latin American demand is concentrated in countries like Brazil and Chile, supporting their established, though often geographically isolated, heavy industries, indicating future potential for localized supply chain development.

- Asia Pacific (APAC): Dominant consumer market fueled by China, India, and South Korea; high demand for imported ultra-high purity grades for metallurgy and chemical production; market growth highly sensitive to infrastructure investment cycles.

- Europe: Mature market characterized by steady, high-value niche applications (filtration, specialized heating); dependence on imports; strict adherence to environmental regulations driving demand for cleaner processing.

- North America: Stable but selective consumption, focused on high-specification industrial processes; high operational costs limiting domestic production; strong emphasis on supply chain reliability and quality consistency.

- Russia and Ukraine (as production hubs): Critical global suppliers, especially for European and Asian markets; strategic positioning due to massive reserves of high-quality anthracite; trade flows heavily influenced by geopolitical factors and logistical capacity.

- Latin America and MEA: Emerging markets with accelerating demand linked to industrial expansion (cement, steel, construction); potential for new domestic extraction projects; market entry points focused on local supply security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lump Anthracite Market.- China Shenhua Energy Company

- Blaschak Coal Corp.

- Siberian Anthracite

- Vietnam National Coal and Mineral Industries Group (Vinacomin)

- Reading Anthracite Company

- Robindale Energy Services

- Celtic Energy

- VostokCoal

- Glencore

- Xstrata (now part of Glencore)

- Anglo American

- Paringa Resources

- Jellinbah Group

- Shanxi Coking Coal Group

- Corsa Coal

- Lehigh Anthracite

- Atlantic Coal Plc

- Whitehaven Coal

- Nippon Carbon Co. (as major consumer and processor)

- Coal India Limited

Frequently Asked Questions

Analyze common user questions about the Lump Anthracite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between lump anthracite and other grades of coal?

Lump anthracite is the highest metamorphic grade of coal, characterized by the highest fixed carbon content (typically >90%), minimal volatile matter, and low impurities (ash and sulfur). This makes it superior for industrial applications requiring high thermal stability, slow burn rates, and chemical purity, unlike thermal coal used primarily for power generation.

Which industrial application drives the highest demand for lump anthracite globally?

The metallurgical industry drives the highest global demand, utilizing lump anthracite primarily as a high-purity carbon reductant in the production of steel, ferroalloys (like ferrosilicon), and silicon metal. Its role is essential for maintaining the purity and quality specifications of these end products.

How do environmental regulations impact the lump anthracite market given the global shift toward renewables?

Environmental regulations impose significant constraints, particularly on mining operations and financing. However, the impact on lump anthracite demand is less severe than on thermal coal because its primary use is specialized industrial processing (non-energy) rather than bulk combustion, maintaining its necessary role in sectors like advanced materials manufacturing.

Which geographical region holds the largest market share in terms of lump anthracite consumption?

The Asia Pacific (APAC) region holds the largest market share in consumption, driven specifically by the industrial requirements of China, South Korea, and India. These economies use vast quantities of high-grade anthracite to support their expansive steel, cement, and chemical manufacturing sectors.

What technological advancements are most relevant to improving the quality of lump anthracite?

The most relevant technological advancements are concentrated in beneficiation, including Dense Medium Separation (DMS) and sophisticated sensor-based sorting (e.g., optical sorting). These techniques enhance real-time quality control, ensuring precise particle sizing and achieving the ultra-low impurity levels demanded by premium industrial customers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager