Lupin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437575 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Lupin Market Size

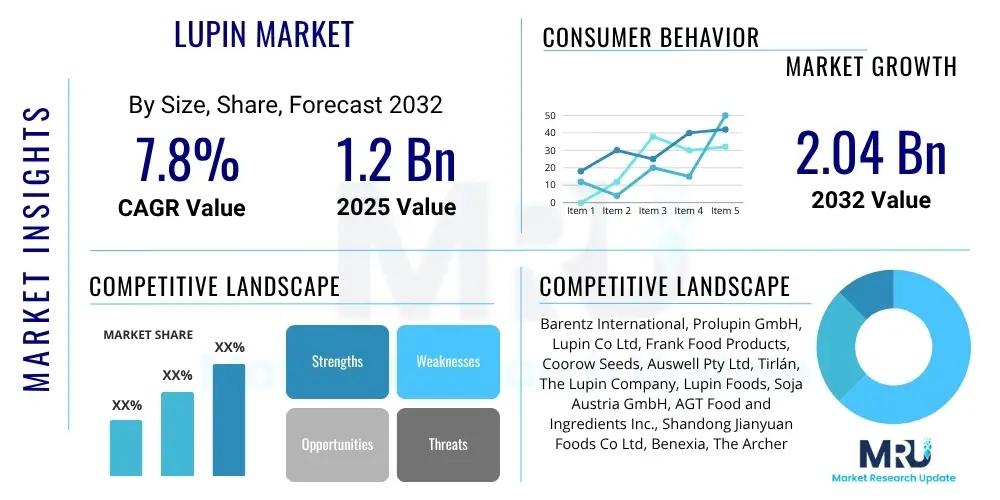

The Lupin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Lupin Market introduction

The Lupin Market encompasses the global trade and utilization of various species of lupin, particularly those used for human consumption, animal feed, and industrial applications. Lupin seeds, derived primarily from species like Lupinus albus (white lupin), Lupinus angustifolius (narrow-leafed lupin), and Lupinus luteus (yellow lupin), are gaining prominence due to their exceptional nutritional profile, characterized by high protein content (35-45%), dietary fiber, and low starch and oil levels. Historically recognized as a traditional crop in the Mediterranean and Andes regions, lupin is now globally commercialized as a sustainable, non-GMO, and gluten-free alternative to traditional protein sources like soy and pea, aligning perfectly with modern dietary trends focusing on plant-based nutrition.

The product description spans raw seeds, processed lupin flour, lupin protein isolates, concentrates, and lupin oil. Major applications are profoundly integrated across the food and beverage industry, serving as functional ingredients in bread, pasta, snacks, meat analogues, and dairy-free products, owing to their emulsifying and stabilizing properties. Furthermore, lupin’s low glycemic index and high fiber content make it highly beneficial in the functional food and nutraceutical sectors addressing metabolic health concerns. The animal feed segment represents another substantial application area, where lupin seeds replace conventional protein meals, particularly in aquaculture, poultry, and swine diets, due to their cost-effectiveness and high digestibility.

Key driving factors accelerating market expansion include the burgeoning consumer demand for sustainable and allergen-friendly plant proteins, especially in developed economies grappling with high rates of meat consumption and dietary restrictions. The superior functional properties of lupin protein compared to other pulses, such as better solubility and texture modification capabilities, enhance its attractiveness for food manufacturers seeking clean-label ingredients. Additionally, advancements in lupin breeding techniques, specifically the development of 'sweet' low-alkaloid varieties, have overcome historical taste barriers, further integrating lupin into mainstream food systems globally, thus sustaining the projected significant CAGR throughout the forecast period.

Lupin Market Executive Summary

The global Lupin Market is characterized by robust commercial interest, driven predominantly by shifting consumer preferences towards plant-based diets and sustainable protein sourcing. Business trends indicate significant investment in processing infrastructure, focusing on advanced fractionation techniques to yield high-purity protein isolates essential for premium food applications, particularly in the sports nutrition and vegan food sectors. Strategic collaborations between agricultural producers and major food manufacturers are intensifying, aimed at standardizing quality and expanding the geographic reach of lupin-based ingredients. Furthermore, sustainability reporting and the circular economy model are influencing procurement decisions, favoring lupin due to its nitrogen-fixing properties that improve soil health and reduce the need for synthetic fertilizers.

Regional trends highlight Europe, particularly countries like Germany, Italy, and the UK, as a dominant consumer hub, driven by stringent food labeling laws favoring non-GMO sources and a well-established functional food market. North America is experiencing the fastest growth trajectory, fueled by startups innovating with lupin in bakery and extruded snacks, actively leveraging the ingredient’s gluten-free and low-carb attributes. The Asia Pacific region, while currently smaller, presents immense long-term growth opportunities, especially in countries like Australia (a major producer) and emerging economies adopting Western dietary patterns and seeking sustainable feed alternatives for booming aquaculture industries. Regulatory harmonization regarding novel foods containing lupin protein remains a key regional consideration influencing market penetration rates.

Segment trends underscore the Flour and Protein Concentrate/Isolate segments as critical revenue generators. Lupin flour is widely adopted as a cost-effective, high-fiber additive in gluten-free baking mixes, whereas high-value protein isolates are indispensable for high-end applications such as protein shakes, nutritional bars, and sophisticated meat substitutes requiring texture and mouthfeel optimization. The Food & Beverage application segment maintains the largest market share, consistently benefiting from product diversification and strong marketing emphasizing lupin’s nutritional superiority over traditional legumes. The Sweet Lupin variety leads the type segmentation, overwhelmingly preferred by food processors due to its naturally low alkaloid content, minimizing the need for extensive processing to remove bitterness and enhancing consumer acceptance.

AI Impact Analysis on Lupin Market

User queries regarding AI’s influence on the Lupin Market primarily revolve around optimizing agricultural yields, predicting market demand fluctuations, and enhancing quality control during processing. Common concerns focus on how precision agriculture, powered by AI, can efficiently monitor soil health and water usage specific to lupin cultivation, thereby ensuring a stable supply of high-quality, low-alkaloid seeds. Users are also keenly interested in AI-driven predictive analytics for supply chain management, particularly regarding volatile commodity prices and the complex logistics of moving lupin from major production zones like Australia and Europe to consumption hubs. Expectations center on AI streamlining the selection of optimal lupin varieties for specific climatic conditions and accelerating new product development by simulating formulation efficacy using lupin ingredients, thereby speeding up market entry for novel food products.

- AI-Powered Precision Farming: Implementation of machine learning models for optimizing planting density, irrigation schedules, and nutrient management in lupin fields, leading to significant yield enhancement and reduction of operational costs.

- Genomic Selection Acceleration: Utilization of deep learning algorithms to analyze lupin genomic data, drastically shortening breeding cycles for new varieties with improved traits, such as higher protein concentration, disease resistance, and ultra-low alkaloid levels.

- Quality Control Automation: Deployment of computer vision systems and AI analytics in processing plants to instantly detect defects, alkaloid residue, and contamination in lupin seeds and flours, ensuring consistency and adherence to strict food safety standards.

- Demand Forecasting and Supply Chain Optimization: Application of predictive models using vast datasets (weather, trade, consumer trends) to accurately forecast global demand for lupin products, minimizing inventory waste and stabilizing price volatility.

- New Product Formulation Simulation: Use of AI to simulate the functional performance (emulsification, water binding, texture) of lupin proteins in various matrices (dairy alternatives, meat analogues), accelerating R&D and time-to-market for innovative applications.

- Climate Resilience Modeling: AI tools assessing the impact of climate change scenarios on lupin cultivation suitability across different regions, guiding strategic sourcing and expansion decisions for large agribusinesses.

DRO & Impact Forces Of Lupin Market

The Lupin Market is significantly shaped by compelling drivers, structural restraints, and emerging opportunities, collectively defining the impact forces on its trajectory. Key drivers include the overwhelming global demand for sustainable, high-protein plant-based ingredients, fueled by dietary shifts and ethical consumerism. Lupin's status as a non-GMO, gluten-free, and nitrogen-fixing crop positions it strongly against competitors like soy. However, the market faces major restraints, primarily the presence of bitter alkaloids in traditionally grown varieties, which necessitates extensive and costly debittering processes, potentially impacting final product cost and limiting raw material supply to low-alkaloid varieties. Additionally, limited consumer awareness and existing consumption habits favoring established proteins remain structural impediments to rapid global adoption.

Opportunities are predominantly clustered around technological innovation and market expansion. The development of advanced, cost-effective fractionation technologies is enabling the production of high-purity lupin protein isolates (90%+ protein content), unlocking high-value applications in clinical and sports nutrition markets. Furthermore, geographical diversification of cultivation beyond traditional areas (like Australia and the Mediterranean) into North America and Eastern Europe, supported by climate change adaptation, offers stability in supply. Strategic partnerships targeting the development of hybrid food products that blend lupin with other proteins (e.g., pea or rice) to achieve optimal functional and sensory profiles represent substantial areas for future growth and market penetration.

The immediate impact forces are dominated by regulatory scrutiny and competition. Increased regulatory approval of lupin ingredients across diverse jurisdictions (particularly in the EU and US for novel food status) acts as a powerful accelerating force. Conversely, intense competition from established and aggressively marketed plant proteins, such as pea, soy, and rice protein, requires lupin producers to invest heavily in marketing and scientific validation to demonstrate superior functional and nutritional benefits. Sustainability mandates and corporate commitments to reducing carbon footprints serve as strong impact forces compelling food service providers and retail brands to preferentially select crops like lupin, which offer environmental benefits.

Segmentation Analysis

The segmentation of the Lupin Market provides a granular understanding of the dynamics across different product forms, variety types, and end-user applications. This analysis is crucial for stakeholders to identify high-growth niches and optimize product development strategies. The market is fundamentally segmented by Type, differentiating based on alkaloid content and traditional classification, heavily influencing the target application. Furthermore, segmentation by Form highlights the processing level and value addition, ranging from commodity seeds and basic flour to highly refined protein isolates used in specialized manufacturing. Lastly, the Application segment delineates the primary industries consuming lupin products, dominated by the dynamic food and beverage sector, followed closely by the rapidly professionalizing animal feed market.

The application segment segmentation reveals that the food industry leverages lupin’s functional properties—such as water binding, emulsification, and texturization—to produce innovative, clean-label products. This ranges from improving the texture and shelf life of gluten-free baked goods to acting as a critical binding agent in vegan meat analogues. The demand within the nutraceutical and pharmaceutical segment is burgeoning, capitalizing on lupin peptides and its potential role in managing blood glucose levels and cardiovascular health, positioning it as a significant component in functional food formulations and dietary supplements.

Analyzing the segmentation allows market participants to tailor their offerings. For instance, companies focusing on the Animal Feed segment prioritize cost-effective, bulk seed or meal products, utilizing its high lysine content for monogastric animal diets. In contrast, manufacturers targeting the premium consumer packaged goods (CPG) space require the high purity and neutral flavor profile provided by protein isolates derived predominantly from sweet lupin varieties. The market’s evolution is characterized by a value shift from raw seeds towards highly processed, functional ingredients, reflecting increasing sophistication in food technology and greater consumer willingness to pay for validated nutritional benefits.

- By Type:

- Sweet Lupin (Low Alkaloid)

- White Lupin (Lupinus albus)

- Yellow Lupin (Lupinus luteus)

- Blue Lupin (Lupinus angustifolius)

- By Application:

- Food & Beverage (Bakery, Snacks, Dairy Alternatives, Meat Analogues, Beverages)

- Animal Feed (Poultry, Swine, Aquaculture, Livestock)

- Pharmaceuticals & Nutraceuticals (Dietary Supplements, Functional Foods)

- Cosmetics & Personal Care (Skin and Hair Care Products)

- By Form:

- Flour

- Seed

- Protein Concentrate/Isolate

- Oil

- Bran/Fiber

Value Chain Analysis For Lupin Market

The Lupin Market value chain begins with upstream activities focused on agricultural production, where R&D institutions and seed producers develop new, low-alkaloid, and high-yield lupin varieties. This stage involves sophisticated breeding and farming practices, primarily occurring in major producing regions like Western Australia and certain parts of Europe and South America. Upstream analysis highlights the critical role of agricultural input providers (fertilizers, machinery, irrigation) and the direct influence of climate conditions and government agricultural policies on raw material availability and cost structure. Efficiency in this stage, particularly minimizing alkaloid content through genetics, determines the quality and necessary subsequent processing required.

The midstream segment involves the processing and manufacturing of lupin ingredients. Raw lupin seeds are channeled through initial cleaning, hulling, and de-bittering processes (for traditional varieties). Subsequent sophisticated processing includes milling the seeds into flour, extracting oil, and applying wet or dry fractionation techniques to produce high-value protein concentrates and isolates. This segment requires significant capital investment in machinery and expertise in food technology, transforming a raw agricultural commodity into functional food ingredients. Quality control at this stage, particularly ensuring microbial safety and managing residual bitterness, is paramount to meeting stringent food industry standards and securing premium pricing for ingredients.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution channels are varied, including direct sales from large processors to major food manufacturers (B2B model), indirect sales through specialized ingredient distributors, and retail sales of consumer-packaged lupin products (e.g., lupin flakes, pasta, or prepared snacks). Direct channels facilitate customization and closer collaboration on formulation, while indirect distribution broadens geographic reach. The final stage involves the utilization of lupin ingredients by end-users—large food and beverage companies, animal feed producers, and specialty cosmetic manufacturers—who integrate the ingredients into final consumer products, where brand perception and marketing around plant-based benefits drive purchase decisions.

Lupin Market Potential Customers

The primary potential customers and end-users of the Lupin Market are highly diversified, reflecting the ingredient’s versatility across nutritional and functional applications. Food and beverage manufacturers constitute the largest customer base, specifically focusing on sectors specializing in gluten-free products, high-protein snacks, and the rapidly expanding market for plant-based meat and dairy alternatives. These manufacturers seek lupin for its superior emulsification, texture-enhancing capabilities, and clean-label appeal. They require consistent supply of high-purity protein isolates and specialized flour with stable functional properties to maintain product consistency and quality across mass production lines.

Another major customer segment resides within the animal feed industry, particularly producers of premium aquaculture and specialty livestock feed. Lupin, rich in protein and digestible amino acids like lysine, serves as an excellent, non-GMO alternative to soybean meal, which is often subject to volatile pricing and sustainability scrutiny. These customers prioritize bulk availability, competitive pricing, and certified nutritional data for optimal feed formulation. The shift towards sustainable feed ingredients in response to consumer demand for ethically sourced meat and fish further solidifies this segment as a crucial growth driver for bulk lupin seed and meal.

Beyond the high-volume segments, specialty buyers include nutraceutical and dietary supplement companies that utilize lupin’s specific bioactive compounds, such as peptides and specific fibers, for targeted health benefits (e.g., blood sugar control). Cosmetic formulators also represent a niche, high-value customer group, utilizing lupin oil and protein hydrolysates for anti-aging and moisturizing products due to their skin-firming properties. These customers prioritize quality certifications, traceability, and clinical evidence supporting the health or functional claims of the lupin derivatives, demanding highly refined, standardized ingredients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lupin Foods Pty Ltd., The Lupin Co., Bioriginal Food & Science Corp., Coorow Seeds, Lupina LLC, Prolupin GmbH, Tirlán (formerly Glanbia), ADM, Kerry Group, Vestkorn Milling, AGT Foods, Sementes, A. F. G. Agri, GrainSense, Puratos, Triticum, Goldfields Seeds, Lup'Ingredients, Viterra. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lupin Market Key Technology Landscape

The technological landscape of the Lupin Market is rapidly evolving, primarily driven by the necessity to overcome the inherent challenge of alkaloid removal and the demand for highly functional protein ingredients. A cornerstone technology is advanced seed breeding, utilizing genetic mapping and non-GMO techniques to develop new generations of ultra-low alkaloid (sweet) lupin varieties, significantly reducing the downstream processing costs associated with bitterness removal. Furthermore, precision agriculture technologies, including sensor-based monitoring and drone imagery, are being implemented at the cultivation stage to optimize growing conditions, predict disease outbreaks, and ensure consistent harvest quality, which is vital for industrial application consistency.

In the processing sector, sophisticated protein fractionation techniques represent the highest value technology. Wet fractionation, involving complex pH adjustments and membrane filtration (e.g., ultrafiltration and diafiltration), is essential for producing high-purity lupin protein isolates (LPIs) that achieve protein concentrations exceeding 90%. Dry fractionation methods, such as air classification, offer a more cost-effective and environmentally friendly alternative for producing protein concentrates and flours, avoiding large water consumption, though they yield lower purity levels. The choice of technology is strategically governed by the intended end-use, with high-end food applications demanding the advanced separation efficiency provided by wet processes.

Beyond protein extraction, extrusion technology is critical for the application phase. Extrusion, often utilized in the production of textured vegetable protein (TVP) for meat analogues and high-protein snacks, leverages lupin flour’s unique fiber and protein structure to create desirable textures and chewiness. Additionally, specialized drying techniques, such as spray drying and freeze-drying, are employed to preserve the functional integrity of sensitive ingredients like lupin peptides and hydrolysates, ensuring their effectiveness in nutraceutical formulations. Continuous technological advancement in these areas is crucial for improving the flavor profile, reducing processing costs, and expanding the functional scope of lupin ingredients across the global food system.

Regional Highlights

- Europe: Europe currently holds the largest share of the Lupin Market, driven by its well-established functional food sector, stringent non-GMO regulations, and high consumer acceptance of plant-based protein alternatives. The EU actively supports the cultivation of pulses like lupin through agricultural policies (e.g., Green Deal strategies) aimed at reducing reliance on imported soy. Countries such as Germany, the Netherlands, and the UK are major consumers, utilizing lupin flour extensively in specialized gluten-free baking and the rapidly growing meat alternative space.

- North America (U.S. and Canada): North America is projected to be the fastest-growing region, characterized by robust investment in food innovation and a proactive consumer base embracing high-protein, low-carb diets. Regulatory approval and market awareness are increasing, leading to startups incorporating lupin isolates into performance nutrition products, snacks, and ready-to-eat meals. The region focuses heavily on proprietary processing technology to manage flavor and achieve highly functional ingredients suitable for complex food matrices.

- Asia Pacific (APAC): The APAC region presents significant potential, driven by the massive animal feed industry, particularly aquaculture, where lupin meal is gaining traction as a sustainable and protein-rich feed component. Australia is a global powerhouse in lupin production (especially Lupinus angustifolius), exporting vast quantities of seeds. Rising middle-class incomes and increasing westernization of diets in countries like China and India are spurring demand for high-quality, imported plant-based ingredients for human consumption, positioning APAC as a major importer of processed lupin ingredients in the long term.

- Latin America (LATAM): LATAM is characterized by both traditional cultivation (especially Andean regions for indigenous varieties) and emerging commercial interest. Brazil and Chile are increasing their focus on lupin as a rotational crop and local protein source. The primary market opportunity lies in local food security initiatives and providing cost-effective alternatives for the regional livestock industry, although large-scale industrial processing capacity remains a development area.

- Middle East and Africa (MEA): The MEA region's lupin market is modest but expanding, primarily focused on localized consumption of raw seeds and early integration into specific animal feed formulations. Challenges include water scarcity affecting agricultural expansion, yet the inherent drought tolerance of certain lupin varieties offers potential for agricultural diversification, especially in North Africa and the Levant.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lupin Market.- Lupin Foods Pty Ltd.

- The Lupin Co.

- Bioriginal Food & Science Corp.

- Coorow Seeds

- Lupina LLC

- Prolupin GmbH

- Tirlán (formerly Glanbia)

- ADM

- Kerry Group

- Vestkorn Milling

- AGT Foods

- Sementes

- A. F. G. Agri

- GrainSense

- Puratos

- Triticum

- Goldfields Seeds

- Lup'Ingredients

- Viterra

- Bühler Group (Technology Provider Influence)

Frequently Asked Questions

Analyze common user questions about the Lupin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Lupin Market?

The primary factor driving growth is the escalating global consumer shift towards sustainable, non-GMO, and gluten-free plant proteins, positioning lupin as a superior functional alternative to traditional soy and pea ingredients in the clean-label food sector.

Which form segment of the lupin market holds the highest growth potential?

The Protein Concentrate and Isolate segment holds the highest growth potential due to increasing demand from high-value applications such as sports nutrition, clinical supplements, and sophisticated meat and dairy alternative products that require high purity and functional properties.

What are the main geographical hubs for lupin consumption and production?

Europe is the major consumption hub due to established functional food markets, while Australia is the largest global producer of lupin seeds, dominating the supply chain for international export and feed applications.

What technological challenge currently restricts the mass adoption of lupin?

The main technological challenge is the removal of bitter alkaloids present in traditional lupin varieties. Overcoming this requires costly debittering processes or relying solely on advanced, genetically bred, low-alkaloid 'sweet lupin' types.

How does lupin contribute to sustainable agriculture compared to other proteins?

Lupin is a crucial crop in sustainable agriculture because it fixes atmospheric nitrogen into the soil, significantly reducing the need for synthetic nitrogen fertilizers, thereby enhancing soil health and lowering the environmental footprint of farming operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lupin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Lupin Protein Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Organic Lupin Protein, Conventional Lupin Protein), By Application (Food and Beverages, Nutraceutical, Cosmetic and Personal Care, Animal Feed, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager