Luxury Boxes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434307 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Luxury Boxes Market Size

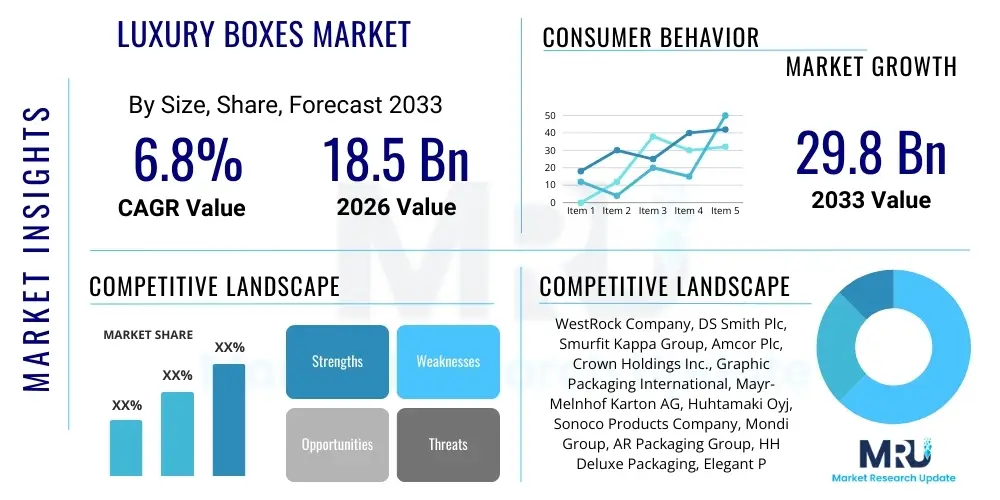

The Luxury Boxes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.8 Billion by the end of the forecast period in 2033.

Luxury Boxes Market introduction

The Luxury Boxes Market encompasses the design, manufacturing, and global distribution of specialized, high-fidelity packaging solutions primarily catering to the premium and ultra-premium segments of various consumer goods industries. These packaging formats are strategically engineered to serve as vital brand ambassadors, extending the product’s perceived value beyond its inherent function and transforming the moment of purchase or receipt into a memorable, high-touch brand experience. The key characteristic distinguishing luxury boxes from standard packaging is the meticulous attention to detail in material selection—involving rigid paperboard, exotic wood veneers, bespoke metal finishes, and advanced composite materials—combined with sophisticated conversion processes like precision die-cutting, intricate structural assembly, and high-quality decorative elements such as lenticular printing, deep embossing, and custom magnetic or ribbon closures. This market’s growth trajectory is intrinsically linked to the global expansion of disposable incomes, particularly the rapid proliferation of High-Net-Worth Individuals (HNWIs) in Asia and the Middle East, who drive demand for exclusivity and superior product presentation, positioning the luxury box as a necessary component of the high-end retail ecosystem.

The product portfolio within the Luxury Boxes Market is highly diversified, tailored to meet the exacting preservation, aesthetic, and security requirements of sectors such as fine jewelry and haute horology (watches), prestige cosmetics and niche fragrances, premium alcoholic spirits (e.g., limited-edition single malts and vintage champagnes), and high-end consumer electronics that emphasize sleek, minimalist design. For example, boxes designed for fine jewelry must incorporate internal systems for security and display, often using specialized velvet or suede inserts, whereas packaging for spirits must often withstand significant weight and temperature variations while displaying intricate structural geometry. Major benefits derived by adopting luxury packaging include unparalleled product differentiation in crowded retail spaces, robust reinforcement of brand heritage and quality commitment, and the significant uplift in the Average Selling Price (ASP) supported by superior presentation. Furthermore, high-quality, reusable luxury boxes often gain a secondary life as storage items, providing long-term brand presence in the consumer’s home, a subtle yet powerful marketing benefit known as "packaging persistence."

Key driving factors propelling the sustained expansion of this market are deeply rooted in contemporary consumer behavior and global macroeconomic trends. The exponential rise of e-commerce, especially within the luxury segment, necessitates packaging that ensures product safety through rigorous logistics while simultaneously delivering a curated unboxing moment that substitutes the in-store experience. This has led to heavy investment in mail-ready luxury box designs that resist external damage while maintaining internal pristine presentation. Additionally, the proliferation of global gifting culture and the increased frequency of promotional limited-edition releases across all luxury categories consistently fuel demand for complex, high-impact packaging solutions. Furthermore, the industry is driven by innovation in sustainable packaging design; brands are actively seeking alternatives to traditional plastic and foam inserts, gravitating towards thermoformed molded pulp, cellulose-based materials, and fully recyclable rigid paperboard assemblies. Manufacturers who successfully integrate high aesthetic value with verifiable environmental certifications (such as FSC) are strategically positioned to capture market share from brands committed to aligning their packaging with comprehensive corporate sustainability goals, thereby solidifying long-term market growth prospects.

Luxury Boxes Market Executive Summary

The current landscape of the Luxury Boxes Market reflects a pivotal shift toward digital integration and hyper-sustainability, defining the primary business trends that dictate competitive dynamics. Manufacturers are rapidly integrating digital workflow technologies, from design simulation (virtual prototyping) to digitally managed supply chains, enabling unprecedented agility in production, crucial for managing the short lifecycles of limited-edition luxury goods. A pervasive trend is the move away from standardized packaging aesthetics toward highly personalized and customized solutions facilitated by advanced digital printing and finishing capabilities, allowing brands to cater individual boxes to specific customer demographics or events. Economically, the market demonstrates resilience against global macroeconomic fluctuations, as high-end consumers often maintain spending levels, reinforcing the stability of the core luxury segment, though cost pressures remain intense due to rising prices for specialty certified raw materials, forcing innovation in material efficiency and structural design optimization.

Regional trends showcase a clear bifurcation in market growth drivers and focus. Asia Pacific (APAC) continues its dominance as the volume growth engine, specifically driven by China's expanding consumer base and strategic governmental support for domestic luxury manufacturing, where the focus is on scaling production capabilities while quickly elevating quality to global standards. In contrast, Europe and North America, as mature luxury markets, prioritize qualitative improvements, especially in technological enhancement and verifiable sustainability. European manufacturers, heavily influenced by strict EU directives, are leading the charge in developing fully circular luxury packaging systems, experimenting with materials like ocean-bound plastic composites and innovative bio-laminates. North America emphasizes smart packaging adoption, utilizing integrated sensors and digital identifiers to enhance security against counterfeiting, a crucial factor given the region's strong reliance on e-commerce distribution channels for high-value items.

Segment trends highlight the rigid box construction method maintaining premium status due to its superior durability, perceived quality, and suitability for complex magnetic or hinge mechanisms, especially in jewelry and spirits. However, the folding carton segment is experiencing rapid innovation, leveraging high-grade paperboard and complex structural folding to mimic the aesthetic appeal of rigid boxes at a lower cost and better shipping efficiency, particularly popular in the high-volume cosmetics sector. The luxury spirits application segment is projected to show the highest CAGR in value, driven by consumers' willingness to pay a substantial premium for rare or limited-release bottles, where the packaging often comprises a significant portion of the total perceived investment value. Overall, the market's strategic trajectory emphasizes efficiency, environmental accountability, and the seamless integration of physical packaging with digital consumer engagement platforms to secure future competitive advantage and meet evolving luxury standards.

AI Impact Analysis on Luxury Boxes Market

User queries regarding the integration of Artificial Intelligence (AI) into the Luxury Boxes Market predominantly center on its capacity to reconcile the often-conflicting demands of mass customization, high-end aesthetics, and supply chain efficiency. A major area of user interest is AI’s potential in generative design—specifically, whether algorithms can create novel, aesthetically superior structural and graphic designs that resonate with luxury consumer psychology while adhering to complex manufacturing constraints and material costs. Concerns often arise about the loss of human artistry and the risk of homogenizing luxury aesthetics if AI is over-relied upon for core design tasks. Furthermore, sophisticated users are keenly interested in how machine learning can analyze vast amounts of global consumer trend data, social media sentiment surrounding product launches, and historical sales data to predict optimal packaging attributes (e.g., color, texture, closure type) that maximize successful market reception for specific demographic segments.

The practical application of AI is revolutionizing pre-press and quality control phases within luxury box manufacturing. AI-powered Computer Vision systems are being deployed on high-speed production lines to conduct instantaneous, ultra-precise quality checks far exceeding human capability. These systems can detect microscopic flaws in foil stamping registration, minute variances in color saturation, or imperfections in laminate adherence, ensuring a near-zero defect rate which is critical for maintaining the luxury designation. This automated quality assurance minimizes material waste resulting from rejects and ensures that every piece of packaging leaving the factory floor adheres strictly to the brand’s exacting specifications. This efficiency gain, coupled with the reduction in manual inspection overhead, significantly enhances operational profitability, allowing manufacturers to allocate resources toward specialized craftsmanship and high-touch finishing processes that still require human expertise.

Moreover, AI is transforming the logistics and inventory management of high-cost luxury materials. Machine learning algorithms analyze complex variables—including global shipping delays, raw material supplier lead times, seasonal demand fluctuations for luxury products, and production line efficiency data—to generate highly accurate predictive models for inventory needs. This predictive capability prevents both costly overstocking of specialty papers and foils, and critical understocking that could halt an entire luxury product launch. In the context of hyper-personalization, AI plays an indispensable role by efficiently managing variable data streams (e.g., individualized messages, unique serial numbers, customized graphic variations) and seamlessly directing them to digital printing equipment, enabling the mass production of unique, tailored packaging units. This technological shift allows luxury brands to scale their bespoke offerings, transforming the definition of luxury from scarcity to highly personalized curation, thereby optimizing market responsiveness and strategic inventory alignment.

- AI Impacts in the Luxury Boxes Market:

- Generative Design Optimization: AI facilitates rapid prototyping of complex structural and aesthetic designs, adhering rigorously to specific brand identity, material constraints, and environmental certifications, significantly reducing the traditional design iteration timeline.

- Predictive Demand Forecasting and Material Procurement: Machine learning analyzes historical data, macroeconomic indicators, and real-time order flows to optimize the highly specialized and expensive inventory of raw materials (fine paper, custom hardware), minimizing waste and ensuring precise just-in-time delivery.

- Hyper-Personalization and Variable Data Management: Algorithms drive sophisticated customization of box elements (e.g., individualized messaging, sequential numbering, location-specific graphics) based on customer profile data, executed efficiently through digital printing systems.

- Automated Quality Control and Defect Reduction: High-resolution computer vision systems, powered by AI, autonomously scan finished packaging for microscopic aesthetic flaws (misregistration, scuffing, color variance) at production speed, guaranteeing adherence to the zero-defect standard of the luxury segment.

- Enhanced Security and Anti-Counterfeiting: AI processes data from embedded digital watermarks and NFC tags, analyzing patterns of package movement and access to instantly verify product authenticity and flag suspicious activities within the global supply chain, protecting brand equity.

DRO & Impact Forces Of Luxury Boxes Market

The trajectory of the Luxury Boxes Market is fundamentally shaped by a dynamic interplay between powerful market Drivers, significant operational Restraints, and latent strategic Opportunities, all magnified by pervasive global Impact Forces. A primary Driver is the relentless pursuit of experiential marketing by luxury brands; packaging is now viewed not merely as a container but as the physical stage for the highly sought-after 'unboxing experience,' often filmed and shared online, thereby generating organic promotional content. This focus compels brands to consistently invest in increasingly intricate and tactile designs, driving demand for specialized finishing and assembly capabilities. Furthermore, the massive shift toward premiumization across consumer goods—including everyday items like coffee, pet food, and household cleaning products—expands the addressable market for manufacturers capable of producing accessible luxury boxes that elevate perceived quality at lower volume price points. The demographic shift, placing increasing spending power in the hands of younger generations who prioritize unique product stories and superior aesthetics, serves as a continuous driver for bespoke design investment.

Operational Restraints pose considerable challenges, chief among them being the volatility and escalating cost of specialty raw materials, such as ethically sourced wood, certified sustainable paperboard, and precision metal alloys used for closures. The strict adherence to environmental regulations globally, particularly the need to eliminate non-recyclable plastic inserts and coatings while maintaining the durability and luxurious feel expected by consumers, requires substantial, continuous R&D investment. This material transition is complex because high-end aesthetics often conflict with recyclability—for instance, glossy, high-barrier laminates are essential for cosmetics but are often difficult to separate during recycling processes. Furthermore, the luxury box manufacturing process demands a highly specialized, often manual, skill set for final assembly and quality checks, leading to labor cost intensity and dependency on niche, skilled personnel, making scalability a complex and expensive endeavor, particularly in high-wage regions like Europe and North America.

Strategic Opportunities for growth are heavily concentrated in the area of technological integration and product-as-a-service models. The opportunity to integrate smart technologies (NFC, AR triggers) transforms the box into a gateway for personalized digital content, enhancing consumer engagement long after the purchase, unlocking new monetization potential via personalized loyalty programs and direct communication channels. The second major opportunity lies in the specialization of circular economy design—developing luxury boxes that are demonstrably easy to disassemble and recycle or that are designed for multiple, high-value reuse cycles, thereby achieving a premium positioning based on superior sustainability performance. The main Impact Forces accelerating these market dynamics include the rapid global consolidation of e-commerce logistics, requiring packaging capable of surviving complex, individualized shipping routes, and the intensifying scrutiny from regulatory bodies and consumers regarding the environmental footprint of all physical goods. Success in this market is increasingly predicated upon navigating these forces by delivering innovative, high-aesthetic, and environmentally justifiable packaging solutions at a competitive scale.

Segmentation Analysis

A detailed segmentation analysis of the Luxury Boxes Market provides critical insights into purchasing trends, growth pockets, and material preferences across various consumer verticals, illustrating the market's high degree of specialization. The material segmentation remains highly significant: rigid paperboard boxes dominate volume and widespread usage due to their structural versatility, excellent printing surface, and increasing compatibility with sustainable coatings, making them the default choice for cosmetics, confectionery, and smaller electronics. Conversely, segments like fine spirits and high-end watches exhibit an unwavering preference for wood and specialized metal packaging, which communicate permanence, heritage, and significant investment value. The material selection is a strategic decision for brands, directly influencing the consumer's initial tactile impression and perceived longevity of the contained product, necessitating manufacturers to maintain diverse material processing capabilities alongside stringent quality assurance protocols for each substrate.

Segmentation by application (end-use industry) reveals distinct market dynamics. The Cosmetics and Fragrances segment is the largest consumer by volume, characterized by rapid design changeovers tied to seasonal collections and promotional campaigns, demanding high flexibility and speed-to-market from packaging suppliers. The sector uses complex internal fittings (often custom thermoformed or molded fiber inserts) to secure fragile glass primary packaging, ensuring safe transit alongside superior visual presentation. In contrast, the Jewelry and Watches segment, though lower in volume, commands the highest average cost per box due to the required use of premium interior materials (silk, velvet) and high-security structural components (bespoke hinges, locking mechanisms), positioning the packaging itself as a legacy component of the product's value proposition.

The third critical segmentation revolves around the distribution channel, primarily distinguishing between brick-and-mortar retail packaging and e-commerce-optimized packaging. Retail packaging focuses primarily on immediate shelf appeal, high gloss, and visual intricacy to attract the shopper in a highly competitive environment. E-commerce packaging, however, requires structural engineering specifically designed for automated packing, labeling, and rigorous drop testing, often incorporating internal cushioning and minimal, integrated closures to enhance the consumer's unboxing ease without compromising safety. The accelerated growth of DTC (Direct-to-Consumer) luxury brands is fueling massive investment in this e-commerce packaging segment, pushing manufacturers to develop solutions that are simultaneously aesthetically pleasing, highly protective, and cost-efficient for shipping, driving innovation in lightweight yet strong structural designs to minimize volumetric weight and logistical costs globally.

- Key Market Segments:

- By Material:

- Paperboard (High-density Rigid Boxes, Folding Cartons, Set-up Boxes) - Dominant in volume for cosmetics and confectionery due to cost-efficiency and print quality.

- Wood (Solid Exotic Woods, Engineered Wood Products, Wood Composites) - Preferred for high-end spirits, watches, and commemorative boxes, emphasizing durability and perceived permanence.

- Plastic (Injection Molded, Thermoformed PET/RPET) - Used primarily for internal inserts and specialized structures, increasingly shifting to recycled or biodegradable polymers to meet sustainability mandates.

- Metal (Aluminum, Tinplate, Specialty Alloys, Custom Die-Cast Components) - Utilized for closures, hardware, and complete premium containers, especially in limited-edition spirit sets or unique tobacco packaging.

- Fabric/Textile Covered (Silk, Velvet, Leatherette) - Essential for jewelry and premium accessory packaging, focused on tactile quality and interior protection.

- By Application (End-Use Industry):

- Cosmetics and Fragrances - Highest volume consumer, focusing on aesthetic differentiation and seasonal variability.

- Jewelry and Watches - Highest value per unit, requiring security features and premium interior fabrics.

- Spirits and Beverages (Luxury Wines, Aged Whiskies, Premium Vodkas) - Driven by limited-edition releases and structural complexity.

- Confectionery and Gourmet Food - Focus on gifting, high graphic quality, and food-safe barrier materials.

- Consumer Electronics and Accessories (Premium Tier) - Emphasis on precision fit, structural integrity, and minimalist, high-tech aesthetics.

- Tobacco and Cannabis Products (Luxury Segments) - Requires complex regulatory compliant structures combined with high-end finishing.

- By Region:

- North America (High e-commerce penetration, focus on smart packaging and anti-counterfeiting).

- Europe (Leader in sustainability innovation and high-end design standards).

- Asia Pacific (APAC) (Fastest growth, driven by urbanization and rising affluent consumer class).

- Latin America (LATAM) (Growing demand for regional luxury spirits and cosmetics).

- Middle East & Africa (MEA) (Highest average perceived luxury level, focus on opulent, decorative packaging).

Value Chain Analysis For Luxury Boxes Market

The Value Chain for the Luxury Boxes Market is highly specialized and demanding, beginning with the meticulous procurement of certified raw materials in the upstream segment. Upstream analysis focuses on securing consistent, high-quality supplies of inputs, including luxury-grade paperboard (often requiring specific brightness, texture, and sustainable forestry certifications like FSC or PEFC), specialty coatings, custom-formulated inks, and specialized hardware such as precision-engineered magnetic closures, metal hinges, or bespoke ribbon materials. The supplier base in this segment is highly consolidated and global, requiring robust supplier qualification and auditing processes due to the critical impact of material quality on the final product's aesthetic and functional performance. Luxury box manufacturers often engage in strategic, long-term contracts with specialized mills and component producers to ensure priority access and stable pricing for premium materials, mitigating the substantial risk associated with global commodity price volatility and ensuring compliance with increasingly stringent environmental traceability mandates, which often necessitates verifiable chain-of-custody documentation for all inputs.

The core manufacturing (midstream) conversion process is characterized by advanced technological integration and specialized human craftsmanship. This stage encompasses structural engineering, often utilizing sophisticated 3D modeling software to design complex, multi-component box structures that maximize the unboxing experience while optimizing material usage. Key processes include high-precision offset and digital printing to achieve exact color matching (a non-negotiable standard for luxury brands), intricate finishing techniques such as deep-relief embossing, hot foil stamping with multiple passes, and specialized surface treatments like soft-touch laminations or spot UV varnishes that elevate tactile quality. Final assembly, particularly for rigid set-up boxes, often remains semi-manual or requires highly complex robotic automation to ensure flawless alignment and seamless integration of inserts and closures. The midstream stage is highly capital intensive, requiring continuous investment in state-of-the-art machinery capable of maintaining high-speed throughput while adhering to zero-defect quality control protocols, often leveraging AI-powered vision systems to maintain consistency across large production runs, particularly important for global brand launches.

The downstream distribution channel involves complex logistics catering to the high-value, sensitive nature of the product. Distribution channels are typically categorized into direct delivery to brand filling plants or assembly facilities (often JIT—Just-In-Time—to minimize client inventory holding costs) and indirect distribution through specialized, high-security packaging logistics providers who manage warehousing and multi-country delivery schedules. The shift towards e-commerce mandates specialized packaging logistics, requiring robust secondary and tertiary packaging to protect the luxury box itself during transit to the end consumer. Manufacturers must collaborate closely with luxury brands' fulfillment centers to ensure packaging is designed not only for presentation but also for efficient automated handling and serialization. The channel strategy is fundamentally driven by the need for speed, security, and traceability, often incorporating RFID or NFC tags directly into the packaging structure to monitor its passage through the supply chain, verify authenticity at various checkpoints, and ultimately facilitate direct digital engagement with the end-user, thereby closing the loop between the physical product and the digital marketing ecosystem.

Luxury Boxes Market Potential Customers

The clientele base for the Luxury Boxes Market is defined by a commitment to premium quality and brand differentiation, encompassing several highly specialized industrial sectors that utilize presentation as a core competitive tool. The most significant and structurally demanding customers are the large conglomerates dominating the global luxury goods sector. This includes the major players in the high-end jewelry, watch, and accessories market, where the box is regarded as a permanent component of the purchase, often designed to last generations and serve as a safe-keeping vessel. These customers demand archival-quality materials, superior durability, and sophisticated internal architectures designed to showcase the product perfectly upon opening, requiring manufacturers to act more as design partners than simple suppliers, focusing on bespoke engineering and rare material sourcing.

Another crucial customer segment involves the prestige divisions of multinational cosmetics, skincare, and fragrance companies. These customers require high-volume production capabilities coupled with extreme flexibility for rapid design changes driven by seasonal and limited-edition product cycles. The luxury packaging here serves a critical retail function: visually communicating the exclusivity and quality of ingredients in a competitive store environment. Manufacturers catering to this segment must excel in graphic fidelity, complex finishing techniques (e.g., highly reflective metallics, complex multi-layer screen printing), and high-speed assembly while adhering strictly to global standards for product safety and contact materials, often dealing with strict regulatory demands regarding solvent use and material toxicity.

Beyond traditional luxury, significant potential lies in the high-end spirits and gourmet food industries. Distillers of rare whiskies, premium tequilas, and vintage champagnes consistently commission luxury boxes that serve as presentation cases, often incorporating heavy, custom-formed wood, elaborate metal plaques, or integrated lighting elements to emphasize the bottle’s collectible status. For gourmet food and high-end confectionery, customers require packaging that balances sophisticated visual appeal with stringent requirements for food safety, barrier protection against moisture or oxygen, and designs optimized for gifting, necessitating specialized foil linings, non-toxic inks, and easy-open features that maintain the freshness and integrity of perishable high-value contents. The common denominator across all these diverse customer segments is the absolute rejection of compromise on material quality, structural execution, and aesthetic consistency, defining the high barrier to entry and specialized nature of the Luxury Boxes Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WestRock Company, DS Smith Plc, Smurfit Kappa Group, Amcor Plc, Crown Holdings Inc., Graphic Packaging International, Mayr-Melnhof Karton AG, Huhtamaki Oyj, Sonoco Products Company, Mondi Group, AR Packaging Group, HH Deluxe Packaging, Elegant Packaging, IPL Packaging, Virospack, Curtis Packaging, McLaren Packaging, Ebro Color, International Paper, Lihua Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Boxes Market Key Technology Landscape

The Luxury Boxes Market is currently undergoing a significant technological transformation, moving beyond traditional printing and assembly towards sophisticated digital and automated processes crucial for meeting the simultaneous demands of customization, quality, and speed. A cornerstone of this evolution is advanced digital printing technology, particularly high-speed, wide-format inkjet and electrophotography presses. These systems allow for the precise and consistent application of complex variable data, enabling true personalization where individual boxes within a large run can feature unique graphic elements, serial numbers, or localized language versions without requiring time-consuming plate changes. This capability is vital for supporting rapid, personalized limited-edition launches and for efficiently managing inventory across multiple global markets, fundamentally altering the economics of luxury customization by reducing Minimum Order Quantities (MOQs) and accelerating market entry.

In structural manufacturing, the key technological advancements lie in high-precision die-cutting and folding-gluing machinery specifically adapted for rigid paperboard and specialty substrates. Modern cutting-edge equipment incorporates highly responsive sensors and computer numerical control (CNC) systems to ensure flawless alignment of intricate, multi-layered components, which is critical for the seamless operation of closures like magnetic snaps or hidden hinges—hallmarks of high-quality luxury boxes. Furthermore, the finishing processes have been dramatically refined through automation; multi-station hot foil stamping machines can now execute highly detailed metallic effects with microscopic registration accuracy, integrating seamlessly with complex embossing and debossing operations that enhance the tactile appeal of the packaging. These technologies are often supported by robotic pick-and-place systems used in the final assembly of complex rigid boxes, ensuring dimensional consistency that would be difficult to achieve solely through manual labor, thereby optimizing quality control and production throughput.

Perhaps the most strategically significant technological shift is the integration of digital connectivity features, transforming the physical box into a component of the Internet of Packaging (IoP). This includes the discreet embedding of miniaturized NFC (Near Field Communication) tags or low-cost RFID chips during the manufacturing process. These technologies enable robust brand protection through secure, verifiable authentication accessible via a consumer's smartphone, instantly confirming the product's legitimacy and tracking its full chain of custody. Beyond security, these digital identifiers serve as direct marketing tools, triggering Augmented Reality (AR) experiences or personalized brand content upon tapping the box, significantly extending the consumer's engagement time and providing brands with valuable post-purchase interaction data. This fusion of physical craftsmanship with digital intelligence is critical for brands seeking to future-proof their packaging strategy against counterfeiting while capitalizing on the digital-native consumer segment.

Regional Highlights

Market activity and growth dynamics in the Luxury Boxes sector are heavily stratified across global regions, reflecting local economic power, luxury consumption habits, and regulatory frameworks.

- Asia Pacific (APAC): The APAC region, spearheaded by economic powerhouses like China, South Korea, and emerging markets in Southeast Asia, stands out due to its unparalleled growth rate. This rapid expansion is fundamentally driven by a steep increase in the middle and affluent classes, who are eager consumers of luxury cosmetics, high-end electronics, and imported spirits. APAC manufacturers are rapidly scaling their capabilities, focusing heavily on adopting efficient, high-volume production technologies. While cost efficiency is a consideration, the market increasingly demands packaging that incorporates local cultural aesthetics while adhering to global brand quality standards, making it a critical hub for both manufacturing and consumption.

- Europe: As the historic home of many prestigious luxury houses, Europe dictates global trends in design, sustainability, and quality benchmarks. The region maintains a high market share in terms of value, characterized by stable, high-value demand for bespoke packaging in haute couture, fine jewelry, and traditional spirits. The driving focus here is strict environmental compliance, pushing technological boundaries in material science, leading to the early and high-adoption rate of advanced sustainable materials (e.g., bio-based plastics, advanced recycled paperboard) and circular economy design principles across the supply chain, often setting the standards that other regions subsequently adopt.

- North America: The North American market is highly influenced by advanced e-commerce penetration, necessitating robust luxury packaging that minimizes transit damage while maximizing the unboxing experience delivered directly to the consumer’s home. Key demand segments include technology products (smart devices), premium wellness brands, and highly regulated industries such as luxury cannabis and specialized pharmaceuticals. North America exhibits high technological readiness, leading in the implementation of anti-counterfeiting measures and consumer-facing smart technologies like embedded NFC chips to ensure product provenance and enhance digital marketing interactivity.

- Latin America (LATAM): Growth in LATAM is localized and highly sensitive to macroeconomic stability. The market sees specific strengths in luxury packaging for regional specialties like high-end rums, tequilas, and local cosmetic brands. Manufacturers often face challenges related to sourcing specialty raw materials internationally, prompting a focus on developing local material supply chains and optimizing design to accommodate regional production constraints while still achieving a world-class luxury aesthetic. Brazil and Mexico represent the largest and most dynamic packaging consumer nations within this region.

- Middle East & Africa (MEA): Dominated by the Gulf Cooperation Council (GCC) states, the MEA region is characterized by exceptionally high per-unit packaging spending, driven by a strong culture of gift-giving and a preference for ultra-luxurious, ostentatious designs. Demand is highest for specialized fragrance and jewelry packaging, often incorporating bespoke materials like high-purity glass, custom metal detailing, and exotic veneers. The emphasis is on visual impact, weight, and intricate decoration, making this a critical market for specialized, low-volume, high-margin packaging production, though regional sustainability adoption lags behind Europe and North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Boxes Market.- WestRock Company

- DS Smith Plc

- Smurfit Kappa Group

- Amcor Plc

- Crown Holdings Inc.

- Graphic Packaging International

- Mayr-Melnhof Karton AG

- Huhtamaki Oyj

- Sonoco Products Company

- Mondi Group

- AR Packaging Group

- HH Deluxe Packaging

- Elegant Packaging

- IPL Packaging

- Virospack

- Curtis Packaging

- McLaren Packaging

- Ebro Color

- International Paper

- Lihua Group

Frequently Asked Questions

Analyze common user questions about the Luxury Boxes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are driving the adoption of sustainable materials in luxury packaging?

The primary drivers are stringent European Union regulations (e.g., plastic bans), increasing corporate social responsibility (CSR) mandates from major luxury brands, and strong consumer preference, particularly among Millennial and Gen Z buyers, for packaging utilizing molded fiber, biodegradable coatings, and certified recycled paperboard. Sustainability now acts as a key differentiator and a competitive necessity, pushing investment into closed-loop material systems and verified ethical sourcing practices.

How is e-commerce influencing the structural design requirements of luxury boxes?

E-commerce necessitates a dual focus: structural integrity to withstand complex parcel logistics (drop tests, multiple handling points) and enhanced aesthetic quality for the at-home unboxing experience. Designs are shifting towards robust rigid structures, custom protective inserts that eliminate the need for secondary, non-recyclable shipping materials, and streamlined opening mechanisms that maintain a sense of discovery while ensuring product safety throughout the delivery chain.

Which application segment currently holds the largest market share in terms of volume and why?

The Cosmetics and Fragrances segment currently holds the largest volume share. This dominance is driven by high production volumes, frequent product renewals, and the critical role packaging plays in differentiating similar products within competitive retail environments globally. The sector relies heavily on sophisticated printing and finishing to convey high perceived value to consumers.

What is smart packaging and how is it used to enhance luxury brand security?

Smart packaging integrates digital technologies like NFC/RFID tags or secure QR codes into the box structure. For security, these technologies provide instant product authentication and secure supply chain traceability, allowing brands and consumers to verify legitimacy, access verifiable product provenance information, and combat counterfeiting effectively by tracking every item individually through its lifecycle.

Why is the Asia Pacific region projected to exhibit the highest growth rate, and what are its market characteristics?

APAC’s high growth is attributed to rapid urbanization, significant increases in disposable income among the burgeoning affluent class, especially in China and India, and a strong cultural emphasis on gifting premium, branded products. The market is characterized by high demand for volume, rapid scaling capabilities, and an aesthetic preference for vibrant, highly decorated packaging solutions while concurrently improving quality to meet international luxury standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager