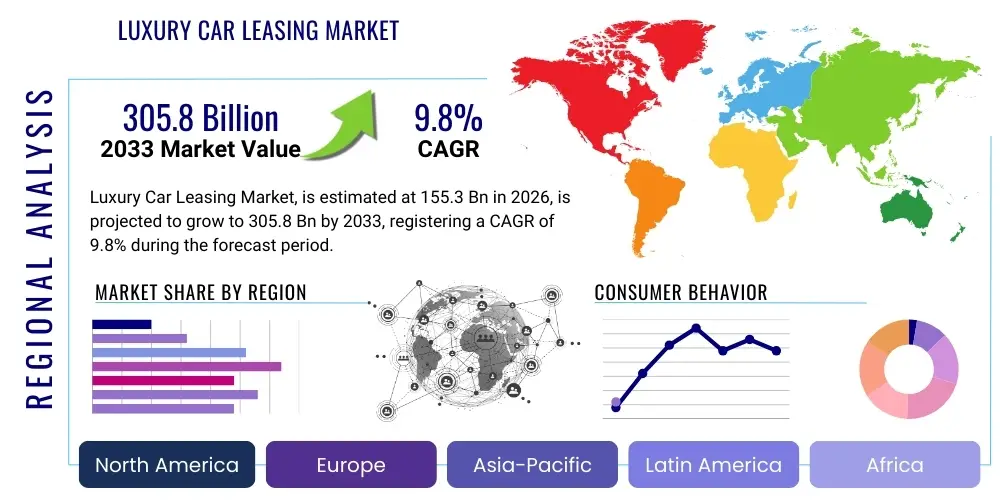

Luxury Car Leasing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440034 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Luxury Car Leasing Market Size

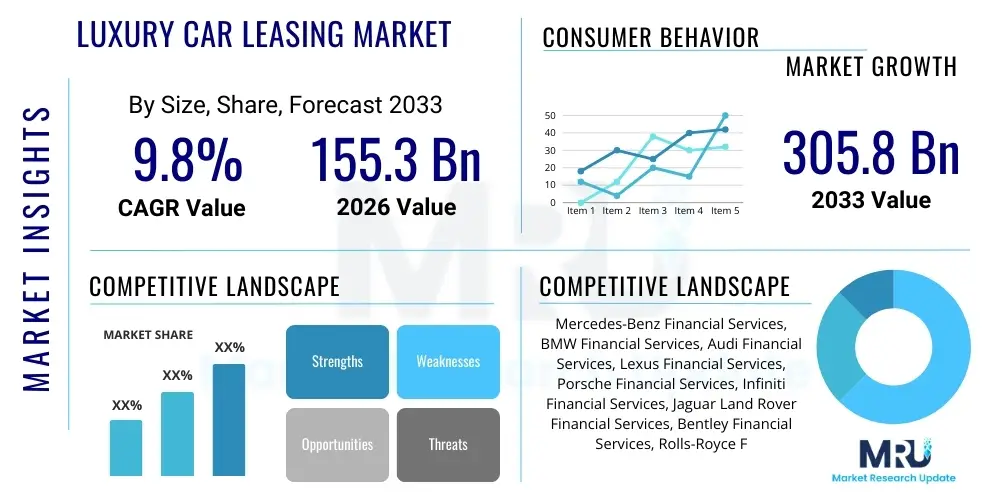

The Luxury Car Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 155.3 billion in 2026 and is projected to reach USD 305.8 billion by the end of the forecast period in 2033.

Luxury Car Leasing Market introduction

The Luxury Car Leasing Market encompasses the provision of high-end, premium vehicles to individuals and corporations through lease agreements, offering an attractive alternative to outright ownership. This segment caters to a discerning clientele seeking flexibility, access to the latest models, reduced upfront costs, and comprehensive maintenance packages, all while maintaining a sophisticated brand image. Products within this market range from opulent sedans and high-performance sports cars to spacious luxury SUVs and cutting-edge electric vehicles, sourced from prestigious manufacturers globally. Major applications span personal use for high-net-worth individuals, corporate fleet solutions for executive transport, and bespoke arrangements for diplomats or temporary assignments, addressing diverse needs for prestige, comfort, and advanced technology without the long-term commitment of purchase.

The primary benefits of luxury car leasing include predictable monthly payments, often lower than loan repayments for similar vehicles, and the ability to frequently upgrade to newer models equipped with the latest advancements in safety, infotainment, and performance. Lessees typically avoid the depreciation risk associated with vehicle ownership and benefit from warranties and service agreements that cover routine maintenance, ensuring a hassle-free experience. These advantages are particularly compelling for luxury consumers who prioritize access over ownership and desire the flexibility to adapt to evolving preferences and technological innovations. The convenience of returning a vehicle at lease end, without the complexities of resale, further enhances its appeal.

Driving factors for this market's robust growth are multi-faceted, including the increasing disposable incomes of affluent consumers worldwide and a growing preference for asset-light lifestyles, where access to luxury goods is prioritized over outright ownership. The continuous introduction of technologically advanced and environmentally friendly luxury vehicles by manufacturers fuels demand for leasing, as these models often come with higher sticker prices, making leasing a more accessible entry point. Furthermore, the expansion of corporate leasing programs, fueled by global business growth and the need for prestigious company vehicles, significantly contributes to market expansion. The strategic proliferation of digital leasing platforms and customized financial solutions by captive finance arms of luxury brands and independent leasing companies also plays a crucial role in making luxury car leasing more transparent and convenient for prospective clients.

Luxury Car Leasing Market Executive Summary

The Luxury Car Leasing Market is experiencing dynamic growth, driven by shifting consumer preferences towards flexible ownership models and the continuous innovation within the luxury automotive sector. Key business trends indicate a strong move towards integrated digital platforms for lease origination and management, enhanced personalization options for lease packages, and a growing emphasis on electric and hybrid luxury vehicles. Luxury car manufacturers are increasingly leveraging their captive finance arms to offer competitive leasing deals, effectively capturing a larger share of the market by providing seamless, brand-aligned services. Furthermore, there is a noticeable trend towards subscription-based models that offer even greater flexibility than traditional leases, allowing customers to switch between different luxury vehicles based on their evolving needs, thereby expanding the potential customer base beyond conventional lessees and introducing new revenue streams for providers.

Regionally, the market exhibits diverse growth patterns. North America and Europe remain dominant markets, characterized by high disposable incomes, established luxury automotive cultures, and sophisticated financial infrastructure supporting leasing services. However, the Asia Pacific region, particularly emerging economies like China and India, is rapidly gaining prominence, fueled by an expanding affluent class, urbanization, and a burgeoning desire for status symbols. Latin America and the Middle East & Africa also present significant growth opportunities, albeit at an earlier stage, with increasing investments in infrastructure and a growing appreciation for luxury lifestyles contributing to rising demand. Each region presents unique challenges and opportunities, requiring localized strategies that consider cultural nuances, regulatory environments, and economic specificities to effectively penetrate and expand market share.

Segmentation trends highlight a pronounced shift towards Luxury SUVs and Electric Vehicles (EVs) within the vehicle type category, reflecting global consumer preferences for versatile, high-riding vehicles and a growing environmental consciousness. Corporate leasing continues to be a robust segment, driven by the need for executive transportation and fleet upgrades, while personal leasing sees strong uptake from high-net-worth individuals seeking frequent upgrades and asset-light living. Lease duration shows a preference for medium-term agreements (3-4 years) balancing cost-effectiveness with access to newer models. The market is also witnessing the emergence of ultra-luxury segments, catering to an even more exclusive clientele with bespoke leasing solutions for vehicles exceeding standard luxury tiers. This granular segmentation allows market players to tailor their offerings more precisely, optimizing product-market fit and maximizing customer satisfaction in a highly competitive landscape.

AI Impact Analysis on Luxury Car Leasing Market

User questions surrounding AI's impact on the Luxury Car Leasing Market frequently revolve around how artificial intelligence will personalize the customer experience, enhance operational efficiency for leasing companies, and transform the maintenance and usage of luxury vehicles. Common concerns include data privacy implications of AI-driven analytics, the potential for AI to automate sales roles, and whether predictive maintenance systems will truly reduce ownership costs and improve vehicle uptime. Users also express interest in how AI might influence dynamic pricing models, fraud detection, and the integration of autonomous driving features into lease agreements. The overarching theme is an expectation for AI to deliver a more seamless, intelligent, and tailored leasing journey, from initial inquiry to vehicle return, while simultaneously addressing potential ethical and practical challenges associated with its widespread adoption.

- Personalized Customer Journeys: AI algorithms analyze customer preferences, driving habits, and financial profiles to recommend suitable luxury vehicles and tailor lease terms, offering highly customized financing options and insurance packages.

- Predictive Maintenance & Telematics: AI-powered telematics monitor vehicle health in real-time, predicting maintenance needs before failures occur, thereby reducing downtime, optimizing service schedules, and ensuring optimal performance and safety for luxury lessees.

- Dynamic Pricing & Risk Assessment: AI models leverage vast datasets to dynamically adjust lease pricing based on market demand, residual value forecasts, economic indicators, and individual lessee risk profiles, leading to more competitive and accurate offers.

- Enhanced Fraud Detection: AI algorithms identify suspicious patterns in lease applications, credit assessments, and usage data, significantly improving fraud detection capabilities and mitigating financial risks for leasing providers.

- Optimized Fleet Management: For corporate and fleet leasing, AI optimizes vehicle allocation, routing, and utilization, reducing operational costs and improving efficiency through intelligent scheduling and resource management.

- Chatbots & Virtual Assistants: AI-driven chatbots provide instant customer support, answer FAQs, assist with lease inquiries, and guide customers through the application process 24/7, enhancing responsiveness and user satisfaction.

- Autonomous Vehicle Integration: As autonomous luxury vehicles become more prevalent, AI will manage the complexities of their operation, maintenance, and regulatory compliance within leasing frameworks, potentially leading to new mobility-as-a-service models.

- Supply Chain Optimization: AI improves the efficiency of vehicle acquisition and remarketing processes by forecasting demand, identifying optimal purchasing times, and streamlining the sales of off-lease vehicles.

- Improved User Experience with In-Car AI: AI integrated into luxury vehicle infotainment systems, voice commands, and driver assistance features enhances the in-car experience, making the leased vehicle feel more intuitive and responsive to the lessee's needs.

- Data-Driven Product Development: Insights derived from AI analysis of leasing data inform luxury manufacturers about popular features, desired specifications, and emerging trends, influencing future vehicle design and development.

- Automated Documentation & Compliance: AI can automate the generation and verification of lease agreements, ensuring compliance with legal and regulatory requirements, reducing manual errors, and speeding up the contracting process.

- Brand Loyalty Enhancement: Through continuous personalized communication and proactive service based on AI insights, leasing companies can foster stronger relationships with lessees, driving repeat business and brand loyalty.

DRO & Impact Forces Of Luxury Car Leasing Market

The Luxury Car Leasing Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A significant driver is the escalating affluence globally, particularly among high-net-worth individuals and a growing middle-class segment in emerging economies, which fuels demand for premium experiences and status symbols without the full commitment of ownership. The evolving consumer preference for flexible ownership models, where access to the latest technology and models is prioritized over long-term asset holding, further propels leasing adoption. Additionally, the rapid pace of technological innovation in luxury vehicles, encompassing advanced driver-assistance systems (ADAS), sophisticated infotainment, and electric powertrains, makes frequent upgrades highly desirable, a need that leasing models are perfectly suited to address. Corporate demand for executive fleets and employee benefits, which often include luxury vehicles, also serves as a robust and consistent market driver, allowing companies to maintain a prestigious image while managing capital expenditure efficiently.

However, the market faces several notable restraints. High residual value risk is a perpetual challenge for leasing companies; accurately forecasting the future value of luxury vehicles, which can be subject to rapid depreciation due to new model releases or technological obsolescence, is critical but difficult. Economic downturns or periods of uncertainty can significantly dampen consumer confidence and corporate spending on luxury items, directly impacting leasing volumes. The high initial acquisition costs for luxury vehicles, even for leasing companies, require substantial capital investment and can limit the breadth of offerings or the ability to compete on price. Furthermore, the complexities of regulatory frameworks, varying across different countries and regions regarding taxation, depreciation rules, and consumer protection laws, add an extra layer of operational complexity and compliance burden for international leasing providers. The perception of not "owning" the asset, despite the practical benefits, can also be a psychological barrier for some potential customers who still prefer outright ownership as a status symbol.

Opportunities within this market are abundant and transformative. The burgeoning trend of subscription-based mobility models presents a novel avenue for growth, offering even greater flexibility than traditional leases by allowing users to swap vehicles frequently or access a portfolio of luxury cars for different occasions. The accelerating adoption of Electric Vehicles (EVs) within the luxury segment opens up new leasing possibilities, as EVs often come with higher purchase prices, making leasing an attractive entry point, while also aligning with environmental sustainability goals. The digitization of the entire customer journey, from online vehicle selection and credit application to contract signing and vehicle delivery, offers a chance to enhance efficiency, reduce friction, and provide a superior, seamless customer experience. Moreover, expanding into underserved geographic markets, particularly in rapidly developing regions with increasing wealth, presents substantial long-term growth potential. Customization and personalization of lease terms and bundled services, such as premium concierge services or exclusive access to events, can further differentiate offerings and attract a more discerning clientele.

External impact forces exert significant influence on the Luxury Car Leasing Market. Regulatory shifts, such as changes in emissions standards, taxation policies on luxury goods, or incentives for EV adoption, can directly impact vehicle costs, demand, and the financial viability of certain lease offerings. Technological disruption, particularly in autonomous driving capabilities, advanced connectivity, and battery technology, constantly reshapes consumer expectations and the value proposition of leased vehicles, necessitating continuous adaptation from leasing providers. Evolving consumer preferences, driven by generational shifts and a greater emphasis on sustainability and experiential luxury, compel market players to innovate their products and services. Macroeconomic conditions, including interest rate fluctuations, inflation, and currency exchange rates, directly affect the cost of financing for leasing companies and the affordability of luxury leases for consumers. Geopolitical stability and trade policies can also impact the availability and pricing of luxury vehicles through supply chain disruptions or tariffs. These forces demand a proactive and agile approach from market participants to navigate risks and capitalize on emerging opportunities effectively.

Segmentation Analysis

The Luxury Car Leasing Market is intricately segmented across various dimensions, reflecting the diverse preferences and needs of its high-value clientele. This segmentation allows market players to craft highly targeted strategies, from product development and marketing to pricing and service delivery, ensuring offerings resonate with specific customer cohorts. Understanding these segments is crucial for identifying growth pockets, optimizing resource allocation, and maintaining a competitive edge in a market defined by prestige and personalized experiences. The primary segmentation categories typically include vehicle type, lease type, lease duration, and end-user, each revealing distinct market dynamics and consumer behaviors that influence overall market trajectories and competitive landscapes.

- Vehicle Type

- Luxury Sedans: High-performance and ultra-comfortable sedans from brands like Mercedes-Benz, BMW, Audi, and Lexus, often leased by corporate executives and individuals prioritizing refinement and status.

- Luxury SUVs: Premium sport utility vehicles, including models from Porsche, Land Rover, Cadillac, and Volvo, catering to those requiring versatility, space, and a commanding presence, popular among families and for adventure-oriented luxury.

- Luxury Sports Cars: High-performance vehicles from Ferrari, Lamborghini, McLaren, and high-end Porsche models, typically leased by enthusiasts seeking exhilaration and exclusivity, often for shorter terms.

- Electric Vehicles (EVs): High-end electric models from Tesla, Porsche Taycan, Mercedes-Benz EQS, and BMW i7, appealing to environmentally conscious luxury consumers and those seeking cutting-edge technology and lower running costs.

- Hybrid Vehicles: Luxury cars combining electric and gasoline powertrains, offering a blend of fuel efficiency and performance, often serving as a transitional option towards full EVs.

- Lease Type

- Personal Lease: Agreements tailored for individual consumers, offering flexible terms for personal use, often chosen for private enjoyment and prestige.

- Corporate Lease: Leasing solutions for businesses and corporations, providing vehicles for executives, sales teams, or as part of employee benefits, focusing on fleet management efficiency and tax advantages.

- Fleet Lease: Comprehensive leasing programs for larger organizations managing a significant number of vehicles, often including services like maintenance, insurance, and fuel management.

- Subscription Models: Emerging flexible programs allowing users to access a range of luxury vehicles with a single monthly payment, offering greater agility than traditional leases and the ability to swap vehicles.

- Lease Duration

- Short-Term Lease (1-2 years): Preferred by those who desire frequent upgrades, wish to try multiple models, or have temporary needs, often for high-value or highly specific luxury vehicles.

- Medium-Term Lease (3-4 years): The most common duration, balancing cost-effectiveness with the ability to access relatively new models, suitable for a broad range of luxury lessees.

- Long-Term Lease (5+ years): Less common in the luxury segment but available for those seeking lower monthly payments over an extended period, or for specialized corporate fleet applications.

- End-User

- High-Net-Worth Individuals (HNWIs): Affluent individuals who prioritize access to the latest models, luxury experiences, and hassle-free vehicle management.

- Corporate Executives: Professionals and business leaders requiring premium vehicles for daily commutes, client meetings, and representing their company image.

- Businesses/Corporations: Companies utilizing luxury vehicles for executive transport, client hospitality, or as part of their corporate fleet.

- Celebrities/Public Figures: Individuals requiring discretion, specific high-end models, or customized security features, often on flexible terms for public appearances or privacy.

- Government/Diplomatic Missions: Entities requiring official vehicles that convey prestige and provide reliable, secure transport for dignitaries and officials.

Value Chain Analysis For Luxury Car Leasing Market

The value chain of the Luxury Car Leasing Market is a sophisticated ecosystem involving multiple interconnected stages, from vehicle manufacturing to end-user experience, each contributing to the overall value proposition. At the upstream end, the process begins with raw material suppliers providing components and specialized materials to luxury automotive manufacturers. These manufacturers, such as Mercedes-Benz, BMW, Audi, and Porsche, design, engineer, and assemble the high-end vehicles, integrating advanced technology, bespoke interiors, and powerful powertrains. Their focus on quality, brand prestige, and innovation is paramount, as these attributes directly influence the perceived value and desirability of the leased asset. Strong relationships between component suppliers and luxury OEMs are crucial for ensuring the timely delivery of high-quality, often custom, parts that meet stringent luxury standards, impacting both the production timeline and the final cost of the vehicle.

Moving downstream, the value chain encompasses the distribution and financing aspects. Luxury car leasing companies, which can be captive finance arms of manufacturers (e.g., Mercedes-Benz Financial Services) or independent leasing entities (e.g., Arval, LeasePlan), acquire these vehicles directly from manufacturers or through authorized dealerships. These companies then structure lease agreements, perform credit assessments, manage risk, and provide associated services like insurance, maintenance packages, and roadside assistance. The distribution channel primarily involves authorized luxury car dealerships, which serve as the primary point of contact for prospective lessees, showcasing vehicles, facilitating test drives, and handling the paperwork. Direct channels, increasingly prominent with digital transformation, allow customers to configure and apply for leases entirely online, bypassing traditional dealerships for certain aspects of the process. The efficiency and seamlessness of these distribution channels are critical for attracting and retaining a luxury clientele who expect a premium and convenient experience.

The ultimate stage of the value chain involves the end-user and the asset management cycle. Customers (individuals, corporations, or public entities) benefit from the use of luxury vehicles without the burdens of ownership, such as depreciation risk, maintenance costs, and resale hassles. After the lease term concludes, the vehicles are returned to the leasing company. This initiates the remarketing phase, where the off-lease vehicles are inspected, reconditioned if necessary, and then resold through various channels, including auctions, certified pre-owned programs at dealerships, or direct sales to used car markets. The effectiveness of this remarketing process is vital for leasing companies to recover residual value and maintain profitability. Efficient asset management, including diligent tracking of vehicle mileage, condition, and maintenance history throughout the lease term, is crucial for maximizing the resale value and closing the loop of the luxury car leasing value chain, ensuring a sustainable business model for all participants.

Luxury Car Leasing Market Potential Customers

The potential customers for the Luxury Car Leasing Market are a diverse yet specifically targeted group, primarily defined by their affluence, lifestyle choices, and professional needs. The core demographic includes high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) who possess substantial disposable income and prioritize access to the latest luxury models, often seeking to update their vehicles every few years. These individuals are drawn to leasing for its flexibility, lower upfront costs compared to purchase, and the convenience of avoiding depreciation risks and resale hassles. Their preference leans towards models that exude prestige, offer cutting-edge technology, and provide an unparalleled driving experience, aligning with their luxury lifestyle and desire for the best without the long-term commitment of ownership. This segment frequently utilizes luxury sedans, high-end SUVs, and increasingly, luxury EVs.

Another significant segment of potential customers comprises corporate executives and businesses. Companies often lease luxury vehicles to serve as executive transport, provide high-status company cars for senior management, or enhance their corporate image for client meetings and events. For businesses, leasing offers several advantages, including predictable monthly expenses, potential tax benefits, and efficient fleet management without significant capital outlay. This allows them to maintain a modern and prestigious vehicle fleet while conserving capital for core business operations. Corporate lessees typically favor luxury sedans and SUVs that combine comfort, advanced safety features, and a professional aesthetic, reflecting their brand values and commitment to quality. The demand from this segment is often driven by regional business growth, expansion of corporate fleets, and a desire to attract and retain top talent with attractive benefits.

Beyond these primary groups, other potential customers include celebrities and public figures who require specific high-end vehicles for appearances, personal use, or security, often on flexible or customized terms that align with their dynamic schedules. Government and diplomatic missions also constitute a niche market, leasing luxury vehicles for official transport, protocol duties, and ensuring the comfort and security of dignitaries. Moreover, a growing segment consists of affluent millennials and Generation Z consumers who, while having significant purchasing power, often prefer experiences and access over ownership, aligning perfectly with the asset-light nature of leasing. This demographic is particularly interested in technologically advanced vehicles, sustainable options like luxury EVs, and seamless digital experiences throughout the leasing process. Market players are increasingly tailoring their offerings to cater to the specific demands and digital native expectations of these younger, affluent segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.3 billion |

| Market Forecast in 2033 | USD 305.8 billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces | >|

| Segments Covered | >|

| Key Companies Covered | Mercedes-Benz Financial Services, BMW Financial Services, Audi Financial Services, Lexus Financial Services, Porsche Financial Services, Infiniti Financial Services, Jaguar Land Rover Financial Services, Bentley Financial Services, Rolls-Royce Financial Services, Ferrari Financial Services, Aston Martin Financial Services, Tesla Leasing, Santander Consumer USA, Ally Financial, GM Financial, Ford Credit, Arval, LeasePlan, ALD Automotive, Enterprise Leasing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Car Leasing Market Key Technology Landscape

The Luxury Car Leasing Market is increasingly influenced by a sophisticated array of technologies, fundamentally transforming how vehicles are designed, operated, and managed throughout their lease lifecycle. Connected car technology stands at the forefront, integrating vehicles with the internet and external networks, enabling features such as remote diagnostics, over-the-air (OTA) updates for software, and real-time traffic information. This connectivity enhances both the driving experience and the efficiency of fleet management for leasing companies, allowing for proactive maintenance scheduling and optimized resource allocation. Advanced Driver-Assistance Systems (ADAS), including adaptive cruise control, lane-keeping assist, and automated parking, are becoming standard in luxury vehicles, improving safety and convenience. These features not only attract lessees but also contribute to lower insurance premiums and reduced accident rates, benefiting leasing providers by preserving residual values.

Another critical technological advancement is the widespread adoption of digital platforms and mobile applications for the entire leasing process. These platforms allow prospective lessees to browse vehicle options, configure specifications, apply for credit, track their application status, and even sign contracts digitally, providing a seamless and paperless experience. Telematics systems, embedded within luxury leased vehicles, offer robust data collection capabilities, monitoring everything from mileage and fuel consumption to driving behavior and vehicle health. This data is invaluable for leasing companies in terms of risk assessment, dynamic pricing models, and managing end-of-lease vehicle conditions. For the lessee, telematics can enable personalized services, such as concierge support or geo-fencing features, further enhancing the luxury experience and adding value to the lease agreement.

The shift towards electric vehicles (EVs) and advanced powertrain technologies also represents a significant technological landscape change. Luxury EVs feature sophisticated battery management systems, rapid charging capabilities, and advanced electric motor designs that deliver superior performance and efficiency. Leasing companies are adapting by investing in charging infrastructure partnerships and offering specialized EV lease packages, making these high-tech vehicles more accessible. Furthermore, blockchain technology is beginning to show promise in improving the transparency and security of lease contracts, vehicle ownership transfers, and maintenance records, potentially streamlining administrative processes and reducing fraud. Artificial Intelligence (AI) and machine learning (ML) are being applied for predictive analytics in areas like residual value forecasting, customer behavior analysis, and fraud detection, making the leasing market more data-driven and efficient. These technological integrations are not merely add-ons but are becoming integral to the competitive landscape and service delivery within the luxury car leasing sector, shaping future market growth and innovation.

Regional Highlights

- North America: This region stands as a dominant force in the Luxury Car Leasing Market, driven by high disposable incomes, a strong automotive culture, and the presence of a large corporate sector. The United States, in particular, leads with sophisticated financial services infrastructure and a consumer base accustomed to leasing as a viable alternative to ownership. Canada also contributes significantly, mirroring many U.S. trends but with a slightly smaller market size. Demand is robust across all luxury vehicle types, with a growing interest in high-end SUVs and performance EVs. The presence of major luxury brands' captive finance arms, coupled with a highly competitive independent leasing sector, ensures a wide array of options and flexible terms for both personal and corporate clients. Digitalization of the leasing process and advanced telematics integration are also key trends here, improving efficiency and customer experience. Regulatory stability and consumer protection laws further foster a conducive environment for market growth.

- Europe: Europe represents another mature and substantial market for luxury car leasing, characterized by a diverse economic landscape and strong national luxury automotive brands. Germany, the UK, France, and Italy are pivotal markets, showcasing high penetration rates due to cultural preferences for premium vehicles, robust corporate leasing demand, and favorable tax incentives for company cars. There is a strong emphasis on sustainability, driving demand for luxury hybrid and electric vehicle leases. The region's dense urban centers also foster a preference for agile, yet luxurious, vehicles, often through short-to-medium term leases. Regulatory harmonization across the EU, coupled with strong consumer protection, creates a stable operating environment, though national variations in taxation and lease laws require localized strategies. The market is highly competitive, with both captive finance entities and strong independent leasing companies vying for market share through innovative offerings and customer-centric services.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for luxury car leasing, propelled by rapidly expanding economies, a burgeoning affluent population, and increasing urbanization, especially in countries like China, India, and Southeast Asian nations. China is the largest luxury car market globally and a key growth engine for leasing, with a strong demand for chauffeur-driven luxury sedans and large SUVs. India is experiencing significant growth, albeit from a smaller base, driven by rising entrepreneurial wealth and changing consumption patterns. Emerging markets in Southeast Asia are also showing promising potential. While ownership remains culturally significant in some parts, the younger, affluent demographic is increasingly open to leasing for its flexibility and access to the latest models. Challenges include varying regulatory environments, infrastructure development, and establishing widespread consumer trust in leasing models. However, the sheer size of the addressable market and the pace of wealth creation make APAC a critical region for future expansion and investment.

- Latin America: The Luxury Car Leasing Market in Latin America is in an earlier stage of development compared to other regions but shows significant potential for growth. Countries like Brazil, Mexico, and Chile are leading the adoption, driven by increasing foreign investment, a growing upper-middle class, and the expansion of multinational corporations. Economic volatility and varying regulatory frameworks present challenges, but the demand for luxury vehicles as status symbols and for corporate prestige is steadily rising. Leasing offers an attractive proposition in these markets by mitigating the high upfront costs and depreciation risks associated with luxury car ownership, which can be exacerbated by local economic conditions. Market penetration is still relatively low, indicating substantial untapped opportunities for international leasing companies and luxury brands willing to navigate the unique regional complexities and tailor their offerings to local purchasing power and preferences.

- Middle East and Africa (MEA): The MEA region is characterized by significant wealth in the Gulf Cooperation Council (GCC) countries, driving a robust demand for ultra-luxury and high-performance vehicles. Countries like the UAE, Saudi Arabia, and Qatar are major markets for luxury car leasing, fueled by a culture that values prestige, luxury, and the latest models. The high purchasing power of both individuals and corporations in these oil-rich nations makes leasing an attractive option for frequently upgrading to new, technologically advanced vehicles. Africa, while more nascent, shows promise in economically developing nations such as South Africa and Nigeria, where an expanding affluent class is emerging. Challenges in the broader African market include infrastructure development, economic disparities, and regulatory variations. However, the strong desire for luxury goods and the increasing presence of global luxury brands present clear opportunities for targeted leasing solutions, particularly in the premium SUV and performance car segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Car Leasing Market.- Mercedes-Benz Financial Services

- BMW Financial Services

- Audi Financial Services

- Lexus Financial Services

- Porsche Financial Services

- Infiniti Financial Services

- Jaguar Land Rover Financial Services

- Bentley Financial Services

- Rolls-Royce Financial Services

- Ferrari Financial Services

- Aston Martin Financial Services

- Tesla Leasing

- Santander Consumer USA

- Ally Financial

- GM Financial

- Ford Credit

- Arval

- LeasePlan

- ALD Automotive

- Enterprise Leasing

Frequently Asked Questions

What are the primary benefits of leasing a luxury car instead of buying one?

Leasing a luxury car typically offers lower monthly payments compared to financing a purchase, allowing access to higher-priced vehicles. It also provides flexibility to drive the latest models every few years, avoids the hassle of selling a used car, and often includes comprehensive maintenance packages, mitigating depreciation risk and ensuring predictable budgeting for a premium experience.

How does the Luxury Car Leasing Market differentiate itself from standard car leasing?

The Luxury Car Leasing Market focuses on high-end vehicles from prestigious brands, offering bespoke services, greater customization options, and often catering to a clientele with specific needs for status, advanced technology, and performance. Agreements typically include higher residual values, premium customer support, and access to exclusive models, emphasizing luxury and convenience throughout the lease term.

What impact do Electric Vehicles (EVs) have on the Luxury Car Leasing Market?

EVs are significantly impacting the Luxury Car Leasing Market by driving demand for sustainable and technologically advanced options. Their higher purchase prices often make leasing an attractive and accessible entry point, aligning with environmental consciousness and providing access to cutting-edge features. This shift is fostering new lease packages, charging solutions, and a growing segment of eco-conscious luxury lessees.

Which regions are experiencing the most significant growth in luxury car leasing?

The Asia Pacific (APAC) region, particularly countries like China and India, is currently experiencing the most significant growth in the Luxury Car Leasing Market. This surge is fueled by a rapidly expanding affluent class, increasing urbanization, and a growing preference for flexible, asset-light luxury consumption. While North America and Europe remain dominant, APAC offers the highest growth potential.

How is AI influencing the customer experience in luxury car leasing?

AI is transforming the luxury car leasing customer experience by enabling highly personalized recommendations for vehicles and lease terms based on individual preferences and financial profiles. It also enhances support through AI-powered chatbots, provides predictive maintenance alerts for optimal vehicle performance, and contributes to dynamic pricing models, creating a more tailored, efficient, and proactive leasing journey.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager