Luxury Chocolate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431973 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Luxury Chocolate Market Size

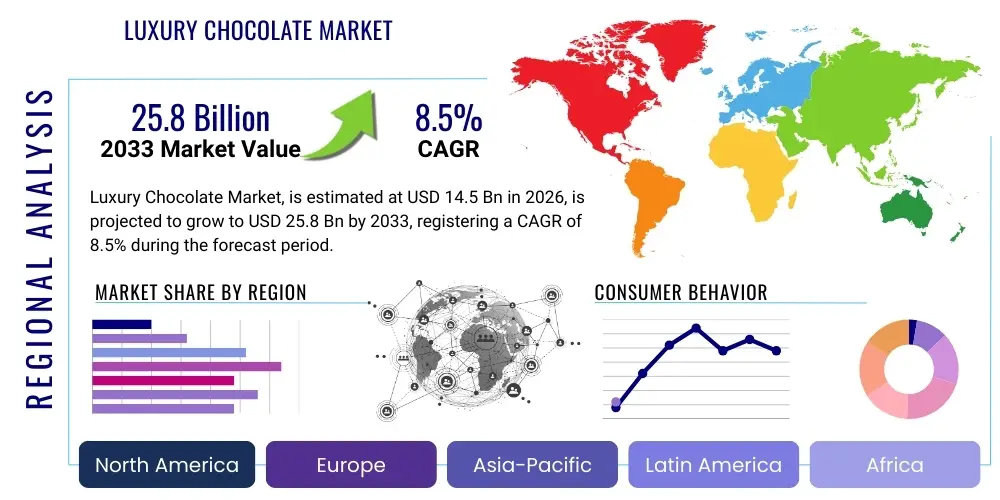

The Luxury Chocolate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $14.5 Billion USD in 2026 and is projected to reach $25.8 Billion USD by the end of the forecast period in 2033.

Luxury Chocolate Market introduction

The Luxury Chocolate Market encompasses high-end cocoa products distinguished by superior ingredients, artisanal craftsmanship, ethical sourcing, unique flavor profiles, and premium packaging. These products typically utilize fine flavor cocoa beans (such as Criollo or Trinitario), feature high cocoa content, and avoid artificial additives, setting them apart from mass-produced confectionery. Major applications of luxury chocolate include premium gifting, sophisticated personal consumption, culinary professional use in haute cuisine, and inclusion in high-end hospitality services. The inherent benefits derive from the indulgent sensory experience, perceived higher quality, and often, the traceability and ethical nature of the ingredients, appealing directly to affluent consumers seeking authentic, elevated food experiences.

Driving factors propelling this market expansion include the increasing consumer disposable income globally, particularly in emerging economies, coupled with a growing trend towards premiumization in the food and beverage sector. Consumers are demonstrating a willingness to pay a premium for quality, transparency, and narrative—often associated with single-origin beans or specific artisan makers. Furthermore, the robust global gifting culture, especially during major holidays and corporate events, consistently boosts demand for attractively packaged, high-status chocolate assortments. The focus on sophisticated dark chocolate varieties, which are often marketed with health benefits derived from antioxidants, also caters to the rising health-conscious consumer base that prefers quality over quantity.

Luxury Chocolate Market Executive Summary

The Luxury Chocolate Market is experiencing robust expansion driven by pronounced business trends favoring product innovation, direct-to-consumer (D2C) channels, and sustainable sourcing. Key businesses are investing heavily in limited-edition collaborations, personalized packaging options, and expanding their digital footprint to capture millennial and Gen Z luxury shoppers. The shift towards transparency in the supply chain, often marketed as 'bean-to-bar,' is becoming a non-negotiable expectation, influencing pricing strategies and brand loyalty. Moreover, vertical integration, allowing luxury producers to control quality from fermentation to finished product, is a defining competitive advantage shaping current business models.

Regionally, Europe remains the dominant market owing to its strong historical association with fine chocolate production and high per capita consumption of confectionery goods, led by countries such as Switzerland, Belgium, and France. However, the Asia Pacific (APAC) region, spearheaded by rapidly expanding affluent populations in China and India, presents the highest growth potential, largely fueled by rising urbanization and the adoption of Western gifting traditions. North America, particularly the United States, demonstrates significant uptake due to a strong preference for specialty and functional luxury chocolates, including those infused with unique botanicals or high-protein content, driven by health and wellness trends.

Segment trends indicate a strong consumer preference for Dark Chocolate products due to their perceived health benefits and intense flavor profiles, maintaining leadership over milk and white chocolate in the luxury segment. The Distribution Channel segmentation highlights the accelerating importance of E-commerce and specialized retail boutiques, offering personalized service and product narratives that mass grocery stores cannot replicate. Ingredients featuring single-origin traceability and certified organic status are demanding significant premiums, reflecting a segment-wide pivot towards ethical consumption and environmental responsibility, thereby defining the future growth trajectory.

AI Impact Analysis on Luxury Chocolate Market

Analysis of common user questions reveals strong interest in how artificial intelligence (AI) can enhance the consumer experience, optimize supply chains, and foster product innovation within the luxury chocolate sector. Key user concerns revolve around maintaining the artisanal integrity and human touch crucial to luxury branding while leveraging AI for efficiency. Users frequently inquire about AI's role in predicting flavor trends, personalizing gift recommendations, ensuring cocoa bean quality traceability via blockchain integration, and automating complex tasks like inventory management and demand forecasting for seasonal peaks. The consensus expectation is that AI will primarily serve as an enhancement tool, improving logistics and consumer personalization, rather than replacing the master chocolatier's craft, ensuring the scarcity and exclusivity of limited-edition products are managed efficiently.

- AI-driven supply chain optimization reducing waste and ensuring optimal humidity/temperature control for fragile cocoa beans during transit.

- Predictive analytics leveraging consumer data to forecast regional demand for specific flavor profiles (e.g., chili-infused vs. floral notes) and packaging styles.

- Enhanced quality control using machine vision systems to inspect the size, shine, and tempering quality of finished chocolate pieces, ensuring aesthetic perfection.

- Personalized marketing and gifting recommendation engines on e-commerce platforms, cross-referencing past purchases and declared preferences.

- Implementation of blockchain for transparent, secure, and instantaneous bean-to-bar traceability, verifying ethical sourcing claims for the discerning luxury buyer.

- AI models optimizing complex pricing strategies for fluctuating raw material costs (cocoa butter, sugar) while maintaining premium margins.

- Development of unique flavor combinations using AI algorithms that map ingredient interactions and sensory profiles, accelerating R&D cycles.

DRO & Impact Forces Of Luxury Chocolate Market

The Luxury Chocolate Market operates under a complex interplay of drivers, restraints, and opportunities that collectively form the impact forces determining its growth trajectory. Key drivers include the global expansion of high-net-worth individuals (HNWIs) who view luxury chocolate as a status symbol and a preferred high-end gift item. This trend is compounded by a shift in consumer behavior where discretionary spending is increasingly directed towards experiential and artisanal food items, prioritizing quality and unique narrative over sheer volume. Furthermore, the rising awareness of the perceived health benefits associated with high-cocoa dark chocolate varieties is drawing in a segment of consumers who previously avoided confectionery, bolstering demand for premium, low-sugar offerings.

However, significant restraints temper this growth. Foremost among these is the inherent volatility in the global price of fine flavor cocoa beans, highly susceptible to climate change, geopolitical instability in key growing regions, and crop diseases. Such volatility directly impacts the cost of goods sold, challenging the maintenance of stable premium pricing and high-profit margins. Additionally, the increasing consumer focus on health and anti-sugar movements, driven by governmental policies concerning obesity, poses a long-term existential threat, necessitating continuous innovation in sugar substitutes or extremely high-cocoa content products that appeal to restrictive dietary preferences.

Opportunities for market expansion are substantial, primarily through strategic penetration of emerging markets in Asia and the Middle East where Western luxury consumption is burgeoning. The expansion of direct-to-consumer (D2C) e-commerce platforms allows artisanal brands to bypass traditional retail markups and directly control the customer experience, offering personalization and subscription models. The trend towards functional and specialized chocolates—such as those that are vegan, gluten-free, or infused with adaptogens—provides fertile ground for product diversification and market capture among specific niche consumer groups. The combined impact forces strongly suggest continued market stratification, where brands that successfully marry ethical sourcing, technological integration (like AI traceability), and uncompromising quality will capture disproportionate market share, overshadowing those focused solely on traditional luxury status.

Segmentation Analysis

The Luxury Chocolate Market is strategically segmented across several critical dimensions, allowing key players to tailor product offerings and marketing strategies to diverse consumer groups and distribution channels. The primary segmentation categories include Product Type, focusing on the cocoa content and formulation (Dark, Milk, White); Distribution Channel, distinguishing between traditional retail and modern digital platforms (Offline and Online); and Ingredient Sourcing, emphasizing provenance and quality (Single-Origin, Organic, Fair Trade). This granular segmentation is vital for identifying premiumization opportunities, understanding evolving consumer preferences for traceability, and optimizing cold-chain logistics tailored to specific retail environments.

Further analysis delves into the End-User application, differentiating between Gifting, which requires elaborate packaging and presentation, and Self-Consumption, where flavor complexity and ingredient quality are paramount. The segmentation based on Flavor Profile (e.g., plain, nuts, fruits, spices) also plays a critical role, as luxury consumers often seek complex and experimental tastes. Given the market's emphasis on status and perceived value, packaging format (e.g., premium boxes, artisan bars, truffles) is another significant layer of segmentation, directly influencing the product's price point and its suitability for specific occasions, such as corporate gifting versus casual indulgence.

- Product Type:

- Dark Chocolate (High Cocoa Content, Single-Origin)

- Milk Chocolate (Premium Blends, Low Sugar Variants)

- White Chocolate (Specialty Inclusions, Unique Flavor Infusions)

- Distribution Channel:

- Offline Retail (Specialty Boutiques, Department Stores, Duty-Free)

- Online Retail (Company Websites, Luxury E-commerce Aggregators, Subscription Boxes)

- Ingredient Sourcing/Nature:

- Single-Origin/Estate Chocolate

- Organic Certified

- Fair Trade/Ethically Sourced

- Vegan/Plant-Based Luxury

- Application/End-Use:

- Gifting

- Personal Consumption

- Gourmet/Culinary Use

Value Chain Analysis For Luxury Chocolate Market

The Luxury Chocolate Market value chain is highly fragmented and characterized by stringent quality control at every stage, contrasting sharply with the mass market. The upstream analysis focuses intensely on the meticulous selection and sourcing of rare, fine flavor cacao beans (e.g., Criollo or Trinitario varieties), often sourced directly from specific farms or estates in regions like Venezuela, Madagascar, or Ecuador. Upstream activities involve careful fermentation and drying processes, which are critical determinants of the final flavor profile and require high skill levels and consistent monitoring. Unlike commodity cacao, luxury brands frequently engage in direct trade relationships with farmers, ensuring superior raw material quality, transparent pricing, and verifiable ethical sourcing, thereby justifying the premium price point early in the chain.

Midstream processing involves the highly specialized activities of roasting, conching, and tempering. Luxury chocolate makers often utilize proprietary or traditional methods (e.g., long conching times) to develop complex, nuanced flavors. This stage incorporates specialized machinery and highly skilled chocolatiers who oversee the transformation of cocoa mass into finished chocolate. Packaging, a critical component of the luxury proposition, is also integrated midstream, requiring high-end design, custom materials, and meticulous presentation to convey exclusivity and status, often involving bespoke limited-edition packaging runs that differentiate products on the shelf.

Downstream analysis highlights the complexity of distribution. Direct channels, through brand-owned boutiques and specialized e-commerce platforms, are pivotal as they ensure product integrity (especially concerning temperature control during shipping) and allow the brand to fully control the narrative and customer experience. Indirect distribution utilizes high-end retailers, gourmet food stores, and select duty-free locations, requiring strict adherence to cold chain logistics and visual merchandising standards. The emphasis is on limiting mass-market availability to maintain exclusivity, making the control of the distribution channel a key competitive factor for long-term brand equity preservation in the luxury segment.

Luxury Chocolate Market Potential Customers

Potential customers for the Luxury Chocolate Market primarily consist of high-net-worth individuals (HNWIs) and upper-middle-class consumers in developed economies who possess significant discretionary income and prioritize quality, experience, and ethical consumption over cost. These buyers are generally well-educated, brand-conscious, and value the story behind the product, seeking traceability, specific single-origin narratives, and sustainability credentials. The primary end-users are those purchasing for sophisticated gifting occasions, including corporate clients, high-status personal events (weddings, anniversaries), and holiday celebrations where presentation and perceived value are paramount.

A rapidly expanding segment includes affluent Millennials and Gen Z consumers who are increasingly driving the 'self-treat' economy. These younger buyers are motivated by flavor innovation, experimental ingredients (e.g., inclusions like lavender or exotic peppers), and aesthetically pleasing, highly 'instagrammable' packaging. This demographic is particularly receptive to D2C subscription models that offer curated selections and personalized experiences, valuing the convenience and exclusivity of receiving small-batch, artisanal products regularly, shifting consumption patterns from sporadic gifting to regular, quality indulgence.

Furthermore, the hospitality sector, including high-end hotels, Michelin-starred restaurants, and premium cruise lines, represents a crucial segment of business-to-business (B2B) buyers. These establishments purchase luxury chocolate for use in their desserts, as complimentary amenities for VIP guests, or for retail within their own gourmet shops. For these buyers, consistency, guaranteed quality, and reliable supply of specialized formats (e.g., baking couverture, mini bars) are the key purchasing criteria, often leading to exclusive partnership agreements with top-tier chocolate makers who can ensure large volumes of consistent, certified-quality product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion USD |

| Market Forecast in 2033 | $25.8 Billion USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lindt & Sprüngli (Lindt Excellence), Godiva Chocolatier, Ferrero (Ferrero Rocher/Premium Brands), The Hershey Company (Scharffen Berger), Artisan du Chocolat, Neuhaus, Teuscher Chocolates, Vosges Haut-Chocolat, Valrhona, Richart Chocolates, Pierre Marcolini, Patric Chocolate, Hotel Chocolat, Amedei, Zotter Schokoladen, Chocolaterie Bernard Callebaut, La Maison du Chocolat, Michel Cluizel, To’ak Chocolate. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Chocolate Market Key Technology Landscape

The technological landscape in the Luxury Chocolate Market is focused less on high-volume automation and more on precision, traceability, and consumer engagement. Advanced sensor technology and IoT devices are crucial in the upstream segment, particularly for monitoring the critical fermentation and drying stages of fine cocoa beans. These sensors provide real-time data on temperature, humidity, and pH levels, allowing master fermenters to achieve perfect flavor precursors consistently, which is impossible with traditional manual methods. Furthermore, specialized, precision-engineered conching machines are utilized midstream to manipulate flavor development over extended periods, maximizing smoothness and complexity without compromising the delicate aromatics inherent in high-quality beans, demanding high capital expenditure and specialized maintenance.

In the mid-to-downstream segments, the adoption of blockchain technology represents a fundamental technological shift, addressing the luxury consumer's demand for absolute transparency and ethical provenance. Blockchain provides an immutable digital ledger tracking the cocoa bean from the specific farm (single-estate) through shipping, processing, and sale, verifiable via QR codes on premium packaging. This technology substantiates premium pricing claims by guaranteeing the authenticity and ethical sourcing narrative, mitigating the risk of fraud or substitution with lower-grade beans. This integration of digital trust technology directly reinforces the core value proposition of luxury products.

Furthermore, technology is redefining the customer interface, especially through e-commerce. High-resolution 3D visualization and augmented reality (AR) features on luxury brand websites allow customers to virtually inspect the detail of premium packaging and the craftsmanship of the chocolates, enhancing the digital shopping experience. Crucially, sophisticated cold-chain logistics utilizing smart packaging and temperature-controlled tracking systems are essential. These technological solutions ensure that temperature-sensitive products arrive in pristine condition, preserving the crucial temper and aesthetic quality, thereby maintaining the luxury brand promise across global distribution networks, which is a major technical challenge unique to this sector.

Regional Highlights

- Europe: Europe, particularly Western Europe (Belgium, Switzerland, France, Germany), maintains its status as the global epicenter for luxury chocolate production and consumption. This region benefits from a deeply ingrained artisanal heritage, high disposable incomes, and sophisticated consumer palates that demand complex flavor profiles and guaranteed ethical sourcing (e.g., Fair Trade or organic). The market is mature but focuses on ultra-premium, small-batch, and experimental products.

- North America: Driven primarily by the United States, North America is a critical growth region characterized by a high willingness to pay for customized, specialty, and functional luxury chocolates. Trends here include high-cacao, low-sugar dark chocolates marketed for wellness benefits, alongside rapid growth in localized artisan ‘bean-to-bar’ movements challenging established European brands.

- Asia Pacific (APAC): APAC represents the fastest-growing region, fueled by rising urbanization and a rapid increase in the middle and affluent classes, particularly in China, Japan, and India. Luxury chocolate is strongly positioned as a prestigious corporate and personal gift item. Cold chain infrastructure improvements are essential for sustained growth, and brands must localize flavors to appeal to regional tastes (e.g., green tea or unique fruit infusions).

- Latin America: While a key source of fine flavor cocoa, the consumer market for finished luxury chocolate is nascent but growing. Local luxury brands are emerging, leveraging proximity to the source to emphasize terroir and freshness. Export activities of fine cocoa beans remain the dominant economic factor, but domestic consumption of high-end specialty products is gaining momentum among the urban elite.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) countries, where high disposable incomes and a strong luxury gifting culture create significant demand, especially during religious and cultural festivities. Retail is dominated by high-end mall locations and duty-free channels, demanding opulent presentation and high brand status.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Chocolate Market.- Lindt & Sprüngli

- Godiva Chocolatier

- Ferrero (Premium Brands Portfolio)

- The Hershey Company (Premium/Artisan Brands)

- Artisan du Chocolat

- Neuhaus

- Teuscher Chocolates

- Vosges Haut-Chocolat

- Valrhona

- Richart Chocolates

- Pierre Marcolini

- Patric Chocolate

- Hotel Chocolat

- Amedei

- Zotter Schokoladen

- Chocolaterie Bernard Callebaut

- La Maison du Chocolat

- Michel Cluizel

- To’ak Chocolate

- Dandelion Chocolate

Frequently Asked Questions

Analyze common user questions about the Luxury Chocolate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors differentiate luxury chocolate from mass-market chocolate?

Luxury chocolate is fundamentally differentiated by the quality and provenance of its ingredients, primarily utilizing fine flavor cocoa beans (e.g., Criollo or Trinitario) rather than bulk beans. Key differences also include artisanal production methods, extended conching processes, high cocoa content, ethical sourcing transparency (single-origin traceability), and premium, often bespoke, packaging. These elements contribute to a complex flavor profile and significantly higher price point, appealing to consumers seeking exclusivity and superior sensory experience.

How is the demand for luxury chocolate being influenced by sustainability and ethical sourcing?

Consumer demand for luxury chocolate is highly sensitive to sustainability and ethical sourcing claims. Modern luxury buyers, especially in North America and Europe, prioritize transparent supply chains, demanding proof that cocoa farmers receive fair compensation and that environmentally damaging practices are avoided. Brands adopting 'bean-to-bar' models, Fair Trade certification, and utilizing blockchain technology for traceability gain significant competitive advantage, validating their premium pricing strategy and building trust with the conscientious consumer base.

Which geographical region exhibits the strongest future growth potential in the luxury chocolate market?

The Asia Pacific (APAC) region, specifically emerging economies like China, India, and Southeast Asia, demonstrates the strongest future growth potential. This growth is underpinned by rising disposable incomes, rapid urbanization, and the adoption of Western gifting cultures. While Europe remains the largest established market, APAC's expanding affluent population and growing acceptance of luxury confectionery as a status gift item are expected to drive the highest Compound Annual Growth Rate (CAGR) through 2033.

What is the role of e-commerce in the distribution strategy for luxury chocolate brands?

E-commerce is critical for luxury chocolate distribution, enabling brands to utilize a Direct-to-Consumer (D2C) model which enhances margin control and allows for personalized customer engagement. Online platforms facilitate sales of highly customizable products, subscription boxes, and limited-edition items. Crucially, e-commerce requires advanced cold-chain logistics technology and specialized temperature-controlled packaging solutions to ensure product quality and integrity upon delivery, preserving the crucial temper that defines luxury chocolate.

How are health and wellness trends impacting product innovation in the luxury chocolate sector?

Health and wellness trends are driving significant innovation, pushing luxury brands to focus heavily on high-cocoa dark chocolate (70% and above) due to its perceived antioxidant benefits and lower sugar content. Product development is increasingly geared towards specialized dietary needs, including premium vegan formulations using plant-based milks (like oat or rice milk), gluten-free certification, and the inclusion of functional ingredients such as adaptogens, probiotics, or natural sweeteners, appealing to the quality-conscious, health-aware consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager