Luxury Cruise Ship Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438466 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Luxury Cruise Ship Market Size

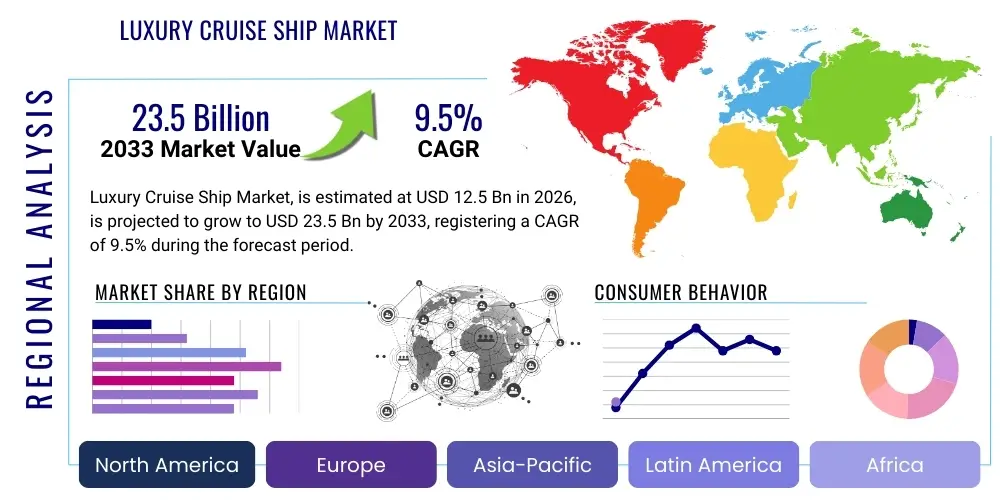

The Luxury Cruise Ship Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $23.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising population of High-Net-Worth Individuals (HNWIs) globally, coupled with a renewed post-pandemic interest in exclusive, long-haul experiential travel. The focus on niche itineraries, such as expedition cruising to polar regions and culturally immersive voyages, contributes significantly to premium pricing and overall market value growth.

Luxury Cruise Ship Market introduction

The Luxury Cruise Ship Market encompasses premium offerings defined by exceptional personalized service, low passenger-to-crew ratios, spacious and well-appointed accommodations (typically all-suite), superior gastronomic experiences, and unique, curated itineraries often accessing smaller ports inaccessible to mass-market vessels. These vessels serve an elite clientele seeking exclusivity, comfort, and high-quality experiential travel. Products within this market segment range from mega-yachts designed for ultra-luxury private charters to large, custom-built ships focusing on all-inclusive, five-star resort-style amenities, emphasizing health, wellness, and bespoke cultural immersion. The core promise of the luxury segment is unparalleled quality and seamless, stress-free travel planning.

Major applications for luxury cruise ships include global circumnavigations, expedition voyages (e.g., Antarctica, Galapagos, Arctic), river cruises focusing on wine and historical regions, and thematic ocean cruises centered around arts, literature, or specialized wellness retreats. The primary benefit derived by consumers is the combination of transportation, accommodation, and curated destination experiences into a single, highly refined package. Furthermore, the inherent privacy and controlled environment offered by luxury vessels appeal strongly to affluent travelers prioritizing security and personalized attention.

Driving factors propelling this market include the global increase in disposable income among the ultra-wealthy demographic, the prioritization of experience over material possessions, and technological advancements enabling safer, more sustainable, and longer-range cruising. Moreover, operators are continuously investing in vessel diversification, introducing smaller, purpose-built expedition ships and large luxury liners that meet stringent environmental standards, thereby broadening the market's appeal and capacity to cater to varied high-end travel preferences. These investments ensure that the luxury cruise sector remains at the forefront of maritime hospitality innovation and sustainability efforts.

Luxury Cruise Ship Market Executive Summary

The Luxury Cruise Ship Market is poised for robust expansion, reflecting strong global business trends centered on premiumization and experiential demand among High-Net-Worth Individuals (HNWIs). Key business trends include aggressive fleet expansion focused on smaller, high-tech expedition vessels, strategic mergers and acquisitions among established luxury brands to consolidate market share, and a significant shift toward sustainable marine fuel and zero-emission operational targets. Operators are leveraging digital transformation to enhance personalization, from pre-boarding concierge services to real-time, customized onboard offerings, driving customer loyalty and higher per-passenger spending.

Regionally, North America and Europe maintain dominance due to high concentration of affluent clientele and established cruising infrastructure, though Asia Pacific is emerging as the fastest-growing market segment, fueled by rapid wealth creation in countries like China, India, and Southeast Asia. The focus in Asia is on introducing tailored itineraries that respect local cultural preferences and offer exotic, remote island hopping. Latin America and the Middle East are also seeing increased investment, particularly in ultra-luxury yachting and short, high-value cruises targeting regional HNWIs seeking exclusive vacation options within proximate geographical boundaries. Geopolitical stability remains a critical factor influencing itinerary planning and regional market performance.

Segment-wise, the Expedition Cruise segment is experiencing explosive growth, driven by demand for authentic, remote, and often educational travel experiences, often leveraging advanced ice-class vessels. Meanwhile, the Vessel Size segment shows a dual trend: the continued demand for small, personalized ships (under 500 passengers) offering maximum access to small ports, alongside the introduction of large luxury ships (over 1,500 passengers) that function as floating ultra-resorts, offering expansive spa facilities, multiple dining venues, and integrated residential components. Technology adoption, particularly concerning enhanced safety systems and sustainable propulsion, cuts across all segments, ensuring long-term operational viability and brand credibility among environmentally conscious consumers.

AI Impact Analysis on Luxury Cruise Ship Market

Common user questions regarding AI's impact on the luxury cruise market typically revolve around how artificial intelligence can enhance personalization, whether it compromises the element of human service that luxury depends on, and how AI can improve safety and sustainability measures. Users are keenly interested in predictive maintenance systems minimizing itinerary disruptions, AI-driven itinerary optimization based on weather and passenger flow, and the use of machine learning to create hyper-personalized service profiles for HNWIs. Concerns often center on data privacy and maintaining the authenticity of luxury human interaction. The analysis reveals that users anticipate AI augmenting, rather than replacing, human staff, especially in background operations like logistics, safety, and inventory management, while directly enhancing the guest experience through seamless, invisible technology integration.

- AI-Powered Hyper-Personalization: Utilizes machine learning to analyze guest preferences, allowing staff to anticipate needs regarding dining, excursions, entertainment, and wellness treatments before requests are made.

- Predictive Maintenance and Safety: AI algorithms monitor hundreds of vessel parameters (engine health, hull stress, HVAC performance) to predict equipment failure, enabling preemptive repairs and significantly improving operational reliability and passenger safety.

- Dynamic Pricing and Yield Management: Sophisticated AI models optimize pricing strategies for cabins and ancillary services (spa, specialty dining) in real-time based on demand fluctuations, booking patterns, and demographic data, maximizing revenue yield.

- Automated Onboard Concierge Services: Integration of AI-driven chatbots and virtual assistants for non-critical guest inquiries (e.g., event timings, port information), freeing human staff to focus on high-touch, complex personal requests.

- Sustainability Optimization: AI assists in route planning to minimize fuel consumption based on currents and weather, and optimizes energy use across the ship's infrastructure (lighting, climate control) to reduce the carbon footprint per voyage.

- Advanced Security and Surveillance: AI-enhanced facial recognition and behavioral analytics systems improve security monitoring, access control, and rapid response capabilities, critical for high-net-worth clientele.

- Supply Chain and Inventory Management: Machine learning optimizes procurement of high-end goods (premium wines, exotic ingredients) and manages inventory across multiple dining venues and boutiques, reducing waste and ensuring consistent luxury product availability.

DRO & Impact Forces Of Luxury Cruise Ship Market

The Luxury Cruise Ship Market is fundamentally shaped by a confluence of powerful drivers (D), significant restraints (R), emerging opportunities (O), and external impact forces. Key drivers include the accelerated accumulation of wealth globally, the strong preference among affluent consumers for bespoke, highly exclusive travel experiences, and continuous innovation in ship design that supports niche markets like expedition cruising. However, the market faces constraints primarily related to high capital expenditure required for new vessel construction, which often entails multi-year delivery timelines. Regulatory complexity, particularly the tightening of environmental protection laws regarding emissions and waste disposal in sensitive cruising regions, presents a constant challenge. The most substantial restraint remains the potential for global health crises or geopolitical instability, which can immediately halt operations and erode consumer confidence in scheduled, long-term travel plans. Geopolitical risks, particularly in regions like the Middle East or specific Asian sea lanes, necessitate flexible and responsive itinerary adjustments, adding complexity to operational planning.

Opportunities for growth are abundant, focusing heavily on sustainability and destination expansion. The adoption of Liquefied Natural Gas (LNG), methanol, or future-proof zero-emission technologies offers a critical opportunity to appeal to eco-conscious HNWIs and secure long-term access to environmentally protected ports. Furthermore, the development of integrated residential components within luxury liners (cruising residences) taps into the desire for continuous, hassle-free global mobility among the ultra-wealthy. Expanding into untapped regional markets, especially secondary and tertiary ports in Asia and Africa, and creating unique land-based extension programs in partnership with high-end luxury resorts, further diversifies revenue streams and increases perceived value.

Impact forces acting upon the market are characterized by technological disruption and shifting consumer expectations. Digitalization compels operators to invest heavily in robust cybersecurity infrastructure to protect sensitive guest data and vessel systems. The influence of social media and ultra-niche travel influencers significantly impacts itinerary popularity and brand perception, requiring rapid, targeted marketing responses. The increasing severity and frequency of climate-related events necessitate advanced meteorological forecasting and vessel resilience measures. These forces collectively mandate continuous operational and strategic agility to maintain a competitive advantage in a segment where customer expectation for perfection is exceptionally high.

Segmentation Analysis

The Luxury Cruise Ship Market is intricately segmented based on core differentiators such as the type of vessel, the size (or capacity) of the ship, and the specific application or itinerary focus. These segmentations are critical for operators to tailor their offerings precisely to the nuanced demands of the affluent traveler, who often seeks specialized experiences. Vessel type segmentation differentiates between traditional large luxury liners offering resort-style amenities, specialized expedition ships built for rugged environments, and smaller, highly exclusive ultra-luxury yachts designed for bespoke charters. Capacity segmentation directly correlates with the level of personalized service offered, with smaller ships guaranteeing the lowest passenger-to-crew ratios, a hallmark of ultra-luxury. The application segment reflects the growing consumer demand for thematic and experiential voyages that transcend typical leisure travel.

- By Vessel Type:

- Luxury Liner (Traditional large, high-capacity, resort-style luxury)

- Expedition Ship (Ice-class, purpose-built for remote destinations)

- Luxury Yacht/Small Ship (Highly exclusive, under 200 passengers)

- River Cruise Vessel (Specialized inland luxury routes)

- By Vessel Capacity (Number of Passengers):

- Small (Under 500 Passengers)

- Mid-sized (500 to 1,500 Passengers)

- Large (Over 1,500 Passengers)

- By Application/Itinerary Focus:

- Adventure/Expedition Cruising (Polar, Galapagos, Remote Islands)

- Cultural & Historical Immersion (Mediterranean, Asia Pacific historical sites)

- Thematic & Wellness Cruises (Culinary, Arts, Spa/Health Retreats)

- Global/World Cruises (Long-haul, multi-month journeys)

- Private Charters

- By Booking Channel:

- Direct Booking (Operator Websites, Proprietary Sales Offices)

- Travel Agencies and Brokers (Luxury Travel Agents, Consortia)

- By Propulsion System (Emerging Segmentation):

- Traditional Marine Fuel (HFO/MGO)

- Liquefied Natural Gas (LNG)

- Hybrid/Battery Assisted Systems

- Methanol/Alternative Fuels (Future-proofing)

Value Chain Analysis For Luxury Cruise Ship Market

The value chain of the Luxury Cruise Ship Market is complex, beginning with capital-intensive upstream activities and concluding with highly personalized downstream guest experiences. Upstream activities involve conceptual design, financing, and high-specification shipbuilding, predominantly carried out by specialized European shipyards (Germany, Italy, Finland) capable of meeting the stringent quality and technological demands of luxury vessels, particularly regarding acoustics, interior finish, and complex environmental systems. This stage also includes securing advanced propulsion technology (like LNG systems) and procuring premium interior materials and fittings, often necessitating multi-billion-dollar investments and long lead times. Effective management of these upstream supply contracts is vital to maintaining operational timelines and quality standards, as delays or material shortages can significantly impact launch schedules and cost overruns.

Midstream operations involve the core cruising activities, including itinerary planning, securing berthing rights in exclusive ports, crew recruitment and intensive hospitality training (maintaining low passenger-to-crew ratios is crucial), and the operational management of the vessel, including complex logistics for luxury provisions, fuel bunkering, and waste management. The operational efficiency here directly impacts profitability and the quality of the guest experience. Crew expertise, especially in culinary arts, butler service, and expedition leadership, forms a major component of the luxury value proposition, requiring significant ongoing investment in human capital development and retention strategies.

Downstream activities focus entirely on the customer interface and distribution channels. Distribution relies heavily on sophisticated indirect channels, primarily specialized luxury travel advisors, consortia (like Virtuoso), and bespoke travel architects who cater exclusively to HNWIs. Direct channels, via proprietary sales teams and customized websites, are used for personalized booking and management of high-value world cruises and private charters. Post-cruise activities, such as loyalty programs, personalized follow-ups, and gathering detailed feedback, are essential for driving repeat business, which is highly valued in the luxury segment. The integrity of the luxury brand experience across all touchpoints, from initial booking through to post-voyage contact, is paramount for sustainable market growth. The entire value chain is underpinned by robust technological infrastructure supporting reservations, security, and onboard communication.

Luxury Cruise Ship Market Potential Customers

The primary customer base for the Luxury Cruise Ship Market consists overwhelmingly of High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) who possess significant disposable income and prioritize unique, high-quality, and exclusive experiential travel over conventional leisure options. These buyers typically fall into the demographic bracket of seasoned travelers, often aged 55+, who seek a combination of exploration, education, and unparalleled comfort without the hassles associated with independent, multi-location travel. Repeat customers are common, often utilizing loyalty programs and customizing itineraries extensively.

A rapidly growing segment of potential customers includes younger HNWIs (Millennials and Gen X) who are increasingly focused on sustainability, wellness, and adventure. This demographic often drives demand for specialized expedition cruises and vessels equipped with state-of-the-art health facilities and digital connectivity. These younger buyers demand transparency regarding environmental stewardship and are highly sensitive to corporate social responsibility efforts, making a brand's sustainability record a key purchasing criterion. They are also more inclined towards shorter, highly immersive luxury voyages rather than traditional, multi-month world cruises, valuing intense, focused experiences.

Institutional buyers, although a smaller volume, represent a significant value segment, including corporations seeking high-end venues for exclusive executive retreats, incentive travel programs, and product launches, often necessitating full-ship charters. These customers prioritize privacy, technological integration for high-level meetings, and flexibility in customizing onboard services and itineraries. The overarching characteristic of all potential customers in this market is their non-price sensitivity when quality, exclusivity, and personalized attention are guaranteed, placing maximum emphasis on the overall perceived value and flawless execution of the luxury experience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $23.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Regent Seven Seas Cruises, Seabourn Cruise Line, Silversea Cruises, Viking Ocean Cruises, Crystal Cruises, Ritz-Carlton Yacht Collection, Scenic Luxury Cruises & Tours, Ponant, Hapag-Lloyd Cruises, Azamara, Oceania Cruises, Explora Journeys, Four Seasons Yachts, Virgin Voyages (Scarlet Lady Class), Celebrity Cruises (Edge Class, Premium Segment), Windstar Cruises, Lindblad Expeditions, Aqua Expeditions, Uniworld Boutique River Cruises, Emerald Cruises. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Cruise Ship Market Key Technology Landscape

The technological landscape of the Luxury Cruise Ship Market is defined by a race towards sustainability, operational efficiency, and the integration of highly sophisticated guest-facing systems. Central to this landscape is the adoption of advanced propulsion technologies. Liquefied Natural Gas (LNG) engines are currently the standard for large new luxury builds due to their significantly lower sulfur and nitrogen oxide emissions compared to Heavy Fuel Oil (HFO). However, the industry is rapidly exploring alternative fuels, including methanol and hydrogen, alongside hybrid battery systems to meet future zero-emission targets, particularly for access to highly sensitive ecological zones like Norwegian fjords and the Antarctic Peninsula. These green technologies require substantial investment in onboard infrastructure and specialized bunkering capabilities.

Beyond propulsion, advanced maritime digitalization forms the backbone of modern luxury operations. This includes sophisticated integrated bridge systems (IBS) for precise navigation and route optimization, AI-driven energy management systems to minimize consumption across the vessel, and extensive implementation of Internet of Things (IoT) sensors for real-time monitoring of all critical operational components (predictive maintenance). For guest experience, high-speed, reliable satellite internet connectivity (often leveraging Starlink or similar LEO networks) is now a mandatory luxury amenity, enabling guests to maintain seamless digital engagement regardless of their geographical location, a crucial factor for business-minded HNWIs.

Finally, the guest experience is being revolutionized by customized technology integration. This includes keyless cabin entry via NFC or biometric scanning, fully personalized environmental controls (lighting, temperature, entertainment) accessible through tablets or smartphone applications, and advanced air purification and filtration systems (e.g., HEPA and UV-C technology) that address health and safety concerns post-pandemic. High-definition media walls, virtual reality experiences, and technologically advanced security monitoring systems further differentiate luxury offerings, ensuring both superior entertainment and peace of mind for the elite clientele.

Regional Highlights

- North America (Dominance and Innovation Center): North America represents the largest revenue share in the Luxury Cruise Ship Market, driven by the highest concentration of HNWIs, deeply entrenched cruising culture, and the presence of major cruise line headquarters. The region is characterized by demand for Caribbean, Alaskan, and trans-Atlantic luxury itineraries. It also serves as a crucial innovation hub, pushing demand for environmentally friendly ships and sophisticated, all-inclusive pricing models.

- Europe (Heritage and Expedition Focus): Europe is a mature luxury cruise market, focusing heavily on Mediterranean, Baltic, and Arctic expeditions. The region, especially Germany and the UK, shows a strong preference for culturally rich, small-ship experiences. European regulations, particularly those imposed by the EU and individual member states regarding emissions (e.g., in Venice or sensitive northern ports), strongly influence shipbuilding standards and accelerate the adoption of LNG and alternative fuel technologies.

- Asia Pacific (Fastest Growth Trajectory): The APAC region, driven by rapid wealth creation, is projected to exhibit the highest CAGR. Demand is localized, focusing on bespoke itineraries around Southeast Asian islands, Japanese coastlines, and Australasia. The growth is fueled by operators deploying newer, smaller luxury vessels specifically designed to cater to local preferences, including multi-generational travel and specialized culinary offerings. Infrastructure investment in new luxury-only cruise terminals is a key regional trend.

- Latin America (Niche Exploration): Latin America is crucial for specific niche segments, primarily the Antarctic expedition market originating from Ushuaia, Argentina, and the Galapagos luxury yachting sector in Ecuador. The market here relies on specialized, high-cost, short-duration voyages. Demand for repositioning cruises accessing the region from North America and Europe remains stable, appealing to seasoned travelers seeking exotic routes.

- Middle East and Africa (Emerging Hubs and Ultra-Luxury): The Middle East is rapidly developing as a luxury cruise hub, leveraging major investments in ports like Dubai, Abu Dhabi, and Jeddah. The focus is on ultra-luxury yacht charters and short, high-value cruises targeting the substantial UHNWI population within the GCC countries. Africa primarily serves as a destination for exotic, long-haul luxury itineraries (e.g., South Africa and the Seychelles), often utilizing smaller expedition vessels for deep coastal exploration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Cruise Ship Market.- Regent Seven Seas Cruises

- Seabourn Cruise Line

- Silversea Cruises

- Viking Ocean Cruises

- Crystal Cruises

- Ritz-Carlton Yacht Collection

- Scenic Luxury Cruises & Tours

- Ponant

- Hapag-Lloyd Cruises

- Azamara

- Oceania Cruises

- Explora Journeys

- Four Seasons Yachts

- Windstar Cruises

- Lindblad Expeditions

- Aqua Expeditions

- Uniworld Boutique River Cruises

- Emerald Cruises

- Marella Cruises (Premium Segment)

- Celebrity Cruises (Edge Series Suites)

Frequently Asked Questions

Analyze common user questions about the Luxury Cruise Ship market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers for the sustained growth of the Luxury Cruise Ship Market?

The sustained growth is driven primarily by the global rise in High-Net-Worth Individuals (HNWIs) seeking exclusive, highly personalized travel experiences and the industry's investment in specialized, high-value segments like expedition cruising. Continuous technological advancements in ship design, particularly those improving sustainability and onboard luxury amenities, also strongly propel market expansion, ensuring the product remains attractive and relevant to the affluent consumer base.

How is sustainability impacting the operational strategies of luxury cruise operators?

Sustainability is a core operational mandate. Luxury operators are heavily investing in alternative fuels, such as Liquefied Natural Gas (LNG) and methanol, and implementing advanced energy management systems. This shift is crucial for regulatory compliance in sensitive areas and is a key marketing differentiator, as environmentally conscious HNWIs increasingly prioritize brands demonstrating verifiable commitments to reducing their carbon footprint and preserving fragile ecosystems visited during voyages.

Which geographical region exhibits the fastest growth rate in the luxury cruising segment?

Asia Pacific (APAC) is projected to be the fastest-growing region in the Luxury Cruise Ship Market. This accelerated growth is attributed to rapid economic development and significant wealth creation across countries like China, India, and Southeast Asia. Operators are responding by introducing tailored itineraries, deploying smaller, culturally sensitive luxury vessels, and expanding port infrastructure specifically catering to the demanding Asian luxury traveler.

What role does technology play in defining the modern luxury cruise experience?

Technology is vital for both service personalization and operational efficiency. AI is used for hyper-personalization of services and predictive maintenance, ensuring flawless operations. Guests benefit from high-speed LEO satellite connectivity, keyless cabin entry, and integrated smart controls for their suite environment. Advanced air filtration systems and robust cybersecurity measures also form a critical technological layer enhancing guest safety and privacy.

What is the difference between a luxury cruise ship and an expedition cruise ship?

A traditional luxury cruise ship focuses on resort-style amenities, spacious suites, and culinary excellence, typically sailing on established routes. An expedition cruise ship is smaller, often possessing an ice-class hull and specialized zodiac boats, designed specifically to access remote, rugged, and environmentally sensitive locations (like the polar regions or deep Amazon) with a focus on educational programming, scientific observation, and immersive adventure, appealing to the explorer segment of HNWIs.

How does the high capital expenditure restrain market entry for new players?

The high capital expenditure acts as a significant barrier due to the specialized nature of luxury vessel construction. A single, purpose-built luxury cruise ship can cost hundreds of millions to over a billion USD, requiring sophisticated financing and multi-year planning. This, coupled with the necessity of maintaining low passenger-to-crew ratios (increasing operating costs) and the need for established brand trust among HNWIs, makes successful market entry highly difficult and limits the field primarily to established maritime corporations.

What are the primary factors HNWIs consider when selecting a luxury cruise operator?

HNWIs prioritize several key factors: the level of personalization and service exclusivity (low crew-to-guest ratio), the uniqueness and authenticity of the itinerary (access to small, restricted ports), the quality of gastronomy and onboard amenities (Michelin-star equivalent dining, large spa facilities), and the operator's reputation for safety, reliability, and environmental stewardship. The promise of an effortless, all-inclusive, high-value experience often outweighs simple price considerations.

What is residential cruising, and how does it fit into the luxury market?

Residential cruising involves luxury liners that contain a selection of permanent, privately owned residences or apartments onboard. This concept targets Ultra-High-Net-Worth Individuals (UHNWIs) seeking continuous, worry-free global mobility without maintaining multiple properties. It is an ultra-niche segment within the luxury market, combining the security and amenities of a high-end condominium with the constant travel flexibility of a cruise ship, representing the apex of luxury real estate and travel convergence.

How are changing consumer demographics affecting luxury cruise offerings?

Changing demographics, particularly the entry of younger (Millennial/Gen X) HNWIs, are compelling operators to diversify offerings. This new demographic demands shorter, more intense voyages, increased focus on health, wellness, and fitness facilities, and heightened digital connectivity. Operators are responding by integrating contemporary design, focusing on adventure and wellness themes, and enhancing transparency regarding ethical sourcing and sustainable operations.

Which shipbuilding nations dominate the construction of luxury cruise vessels?

Shipbuilding for the luxury segment is dominated by specialized European nations, particularly Italy (Fincantieri), Germany (Meyer Werft), and Finland (Meyer Turku). These shipyards possess the requisite expertise in constructing vessels that meet the complex specifications for luxury liners, including high safety standards, noise reduction technology, sophisticated interior finishes, and advanced green propulsion systems like LNG capabilities.

What cybersecurity risks are most prevalent for luxury cruise operators?

The most prevalent risks include the compromise of sensitive guest data (financial information, personal preferences, travel history), which is critical for personalized service, and operational technology (OT) attacks targeting navigation, propulsion, or power management systems. Given the high-profile nature of the clientele, maintaining robust, layered cybersecurity defenses is non-negotiable to protect both proprietary operational integrity and guest privacy.

How do luxury river cruises differentiate themselves from ocean cruises?

Luxury river cruises operate smaller vessels designed to navigate inland waterways, focusing intensely on deep cultural immersion, accessing city centers and historical sites unreachable by ocean liners. They offer highly inclusive packages, usually featuring all excursions, fine dining, and beverages, providing a more intimate, destination-centric experience compared to the larger, resort-style focus of luxury ocean cruising.

What impact do loyalty programs have on the luxury cruise market structure?

Loyalty programs are highly impactful, fostering significant customer retention and repeat business among the wealthy clientele. These programs often grant access to exclusive pre-sales, priority boarding, on-board spending credits, and elevated levels of personalized service (e.g., dedicated butlers or concierge teams), which strengthens brand dependence and effectively raises switching costs for high-value customers.

How are luxury cruise companies adapting their itineraries due to geopolitical risks?

Luxury cruise companies maintain highly flexible and responsive itinerary planning teams capable of making real-time adjustments. Due to geopolitical instability (e.g., in the Red Sea or certain Southeast Asian waters), operators increasingly utilize alternative, safer, but equally exclusive ports, or entirely substitute regions (e.g., replacing Middle East segments with extended European or Alaskan voyages) to ensure passenger safety and maintain brand reliability, often emphasizing obscure, secure destinations.

What is the current trend regarding crew-to-passenger ratios in the ultra-luxury segment?

The current trend in the ultra-luxury segment is maintaining exceptionally low crew-to-passenger ratios, often approaching 1:1 or better (e.g., 1 crew member for every 1.5 guests). This low ratio is fundamental to guaranteeing the highest standard of personalized, anticipatory service, which distinguishes the ultra-luxury tier from premium or mass-market cruising, validating the substantial price premium paid by guests.

How does the demand for private charters influence overall market growth?

Private charters, while representing a smaller volume of bookings, significantly influence market profitability and flexibility. They cater exclusively to UHNWIs, corporate groups, and large families seeking absolute privacy and bespoke itinerary control. This segment demands the highest tier of service and often utilizes the newest, most specialized luxury yachts and expedition ships, driving innovation in vessel design and service customization.

What are the challenges associated with adopting alternative marine fuels like Methanol?

Challenges include the need for extensive retrofitting or specialized new vessel design to accommodate methanol bunkering and storage, as methanol requires larger storage volumes than traditional fuels. Additionally, global bunkering infrastructure for methanol is still underdeveloped, limiting operational routes. Finally, although cleaner, methanol handling requires specialized crew training due to its different safety requirements compared to conventional marine diesel.

How important are culinary experiences in the luxury cruise offering?

Culinary experiences are exceptionally important, often serving as a primary differentiator. Luxury cruise lines invest heavily in partnerships with Michelin-starred chefs, offer multiple specialized dining venues (often without surcharge), and prioritize the sourcing of high-end, locally relevant ingredients. The dining experience is viewed not just as sustenance, but as a core cultural and experiential highlight of the voyage.

What is the anticipated impact of the 'residences at sea' concept on future vessel capacity?

The 'residences at sea' concept will likely lead to larger vessels overall in that specific niche, as the residences require substantial square footage and dedicated private amenities. However, since the number of residences is typically limited (e.g., 40-100 units), the overall passenger density remains extremely low. This concept influences design by mandating features closer to ultra-luxury real estate than traditional cruise ship cabins, requiring dedicated onboard property management services.

How do expedition cruise operators ensure the environmental integrity of sensitive destinations?

Expedition operators adhere strictly to international regulations (e.g., Polar Code, MARPOL) and self-imposed environmental policies, often exceeding mandated requirements. This includes using specialized, low-impact vessels, strictly controlling waste discharge, adhering to limited landing site visitation protocols, maintaining significant distances from wildlife, and employing expert naturalists to educate passengers and minimize human impact during shore excursions, ensuring preservation of the visited environments.

What is the significance of the shift towards all-inclusive pricing models in the luxury segment?

The shift towards truly all-inclusive pricing is highly significant as it aligns with the HNWI preference for convenience and stress-free travel, eliminating the need for frequent transactions. A fully inclusive model (covering flights, transfers, tips, beverages, shore excursions, and specialty dining) provides exceptional clarity and perceived value, reinforcing the luxury promise of seamless, effortless travel and acting as a powerful competitive tool against land-based luxury resorts.

How is predictive maintenance technology influencing operational costs?

Predictive maintenance, utilizing AI and IoT sensors, significantly reduces unexpected operational costs. By monitoring engine components and vital systems in real-time, operators can schedule maintenance precisely when needed, preventing catastrophic failures, minimizing time spent in dry dock, and avoiding costly last-minute itinerary cancellations, thereby enhancing vessel utilization rates and overall revenue reliability.

What are the key differences between luxury cruises and premium cruises?

Luxury cruises offer ultra-low passenger density, all-suite accommodations, complimentary ultra-premium beverages, all gratuities included, and typically feature 1:1 or 1:1.5 crew-to-guest ratios. Premium cruises (like upper-tier Celebrity or Holland America lines) offer enhanced amenities and service compared to mass-market but retain higher passenger volumes, charge extra for most specialty dining or beverages, and maintain lower crew ratios, offering a high-quality experience without the bespoke exclusivity of true luxury lines.

Why is safety and security a heightened priority in the luxury cruise sector?

Safety and security are heightened priorities because the clientele are high-profile individuals whose perceived safety risks are higher, and their expectations for discreet protection are absolute. This necessitates investments not only in advanced maritime safety systems but also in sophisticated, often invisible, security teams, access controls, and cybersecurity measures to protect guests and maintain the confidentiality associated with their travel movements.

How does the average length of a luxury cruise vary by demographic?

Older, retired HNWIs typically favor longer journeys, including world cruises spanning 60 to 180 days, maximizing travel time without interruption. Younger HNWIs (Millennials, Gen X) prefer shorter, more intensive voyages, often ranging from 7 to 14 days, especially for expedition or culturally focused itineraries, balancing vacation time with ongoing professional commitments. The average length is decreasing slightly overall due to the rise of the younger affluent segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager