Luxury Eyewear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432725 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Luxury Eyewear Market Size

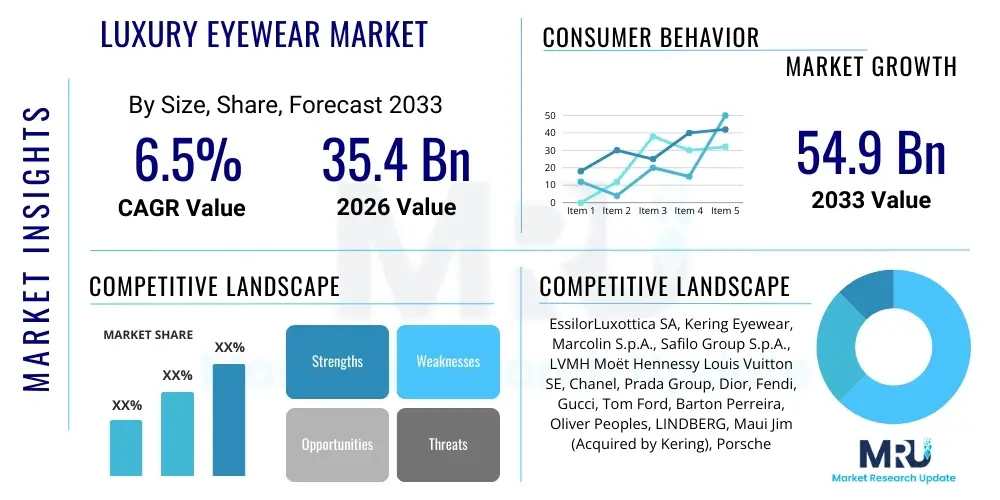

The Luxury Eyewear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 35.4 Billion in 2026 and is projected to reach USD 54.9 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fueled by several macroeconomic trends, including increasing disposable incomes among affluent consumers globally, a heightened focus on fashion accessories as status symbols, and continuous innovation in material science and design aesthetics. The market dynamics are characterized by a high degree of brand loyalty and the strategic control exerted by major luxury conglomerates over licensed and proprietary brands, ensuring stable pricing and perceived exclusivity. The luxury segment remains insulated from general economic fluctuations to a greater extent than mass-market eyewear, benefiting from its positioning as an investment piece and a crucial element of personal identity.

Luxury Eyewear Market introduction

The Luxury Eyewear Market encompasses high-end prescription spectacles, designer sunglasses, and specialized sports eyewear, distinguished by superior craftsmanship, exclusive branding, premium materials such as titanium, buffalo horn, high-grade acetate, and often incorporating intricate details like precious metal embellishments or gemstone inlays. These products transcend basic vision correction or UV protection, serving primarily as fashion statements, indicators of social status, and expressions of individual style, positioning them within the broader personal luxury goods category. Major applications include daily wear for corrective vision with an emphasis on style (optical frames) and outdoor use where fashion meets functional sun protection (sunglasses), often featuring advanced lens technologies like polarization or photochromic properties specific to luxury requirements.

The primary benefits offered by luxury eyewear extend beyond material quality to include enhanced consumer experience, guaranteed authenticity, access to limited-edition designs, and strong after-sales support often tied directly to the luxury brand's ethos. The perceived value proposition rests heavily on brand heritage, celebrity endorsements, and collaboration with renowned fashion houses, ensuring the products maintain an aspirational quality. Furthermore, the commitment to ergonomic design and exceptional durability inherent in high-end manufacturing processes contributes significantly to consumer satisfaction and willingness to pay a premium. This confluence of functional excellence and symbolic prestige underpins the entire market structure.

Driving factors for sustained growth include the global expansion of the middle class in emerging economies, particularly across Asia Pacific, where luxury consumption is rapidly increasing as a marker of newfound wealth and sophistication. The rising geriatric population also contributes, requiring high-quality, aesthetically pleasing prescription eyewear that meets sophisticated fashion needs. Continuous marketing investment by key industry players, focusing on digital platforms and personalized customer experiences, along with the cyclical nature of fashion trends that necessitate regular frame updates, further propels demand. Moreover, the integration of advanced digital features, such as smart technology overlays in luxury frames, is beginning to capture the interest of tech-savvy affluent demographics seeking functional innovation alongside aesthetic excellence, thus expanding the definition of luxury eyewear.

Luxury Eyewear Market Executive Summary

The Luxury Eyewear Market Executive Summary highlights a period of strategic consolidation and premiumization driven by powerful global business trends, resilient regional performance, and distinct segment shifts. Business trends indicate a strengthening grip by large vertically integrated luxury conglomerates, emphasizing direct-to-consumer (DTC) channels and sophisticated inventory management to preserve brand scarcity and optimize profit margins. There is a marked shift towards sustainability and ethical sourcing, influencing material choice and production narratives, which resonates strongly with the modern luxury consumer. Furthermore, digital transformation is paramount, leveraging Artificial Intelligence (AI) for personalized styling recommendations, virtual try-ons, and enhanced supply chain transparency, reinforcing the high-touch service expected in this premium sector.

Regionally, the Asia Pacific continues to emerge as the central engine of market expansion, led by escalating demand from China and India for European heritage luxury brands, viewing these items as critical lifestyle investments. North America and Europe, while mature, maintain their significance through consistent demand for established designer labels and serve as key hubs for launching experimental, high-fashion styles and technological innovations, thereby defining global aesthetic trends. Latin America and the Middle East show promising, albeit nascent, growth driven by high-net-worth individuals and targeted marketing efforts focusing on ultra-exclusive limited-edition collections that appeal to regional preferences for overt displays of luxury.

Segment trends reveal that the sunglasses category dominates in terms of volume and initial adoption, often serving as the gateway purchase for luxury consumers, driven by seasonal fashion cycles and the requirement for multiple pairs. However, the optical frames segment exhibits higher growth stability and profitability per unit, supported by mandatory vision correction needs and the increasing desirability of frames as a permanent fashion accessory. In terms of materials, high-performance, lightweight materials like specialized titanium alloys and premium Mazzucchelli acetate are seeing increased preference over standard plastics, reflecting the consumer desire for durability coupled with minimal aesthetic compromise, reinforcing the segmentation based on material quality and perceived longevity.

AI Impact Analysis on Luxury Eyewear Market

User queries regarding the impact of AI on the Luxury Eyewear Market predominantly center on three core themes: customization capabilities, enhanced customer experience (CX), and supply chain efficiency. Consumers and industry stakeholders frequently ask: "How can AI enable true personalized frame design based on facial geometry and fashion trends?", "Will virtual try-on experiences powered by AI replace physical retail consultation?", and "How is AI optimizing inventory to ensure scarce luxury items are available without overstocking?" These questions reflect a keen expectation that AI should elevate the exclusivity and service quality characteristic of the luxury sector, moving beyond simple automation to deliver hyper-personalized products and seamless, high-fidelity digital interactions that maintain brand mystique and pricing power. The consensus concern revolves around ensuring that the application of AI does not dilute the traditional craftsmanship narrative or dehumanize the luxury purchasing process, which is fundamentally built on emotional connection and bespoke service.

The integration of AI systems is fundamentally reshaping how luxury eyewear brands approach design, retail, and manufacturing, allowing for unprecedented levels of precision and personalization previously unattainable through traditional methods. AI algorithms are now sophisticated enough to analyze vast datasets of consumer purchasing behavior, social media trends, and regional aesthetic preferences, providing real-time feedback to design teams. This data-driven approach minimizes design risk and significantly shortens the time-to-market for new collections, ensuring that limited-edition and high-margin products align perfectly with anticipated seasonal demand. Furthermore, the application of machine learning in material science is facilitating the development of innovative, lightweight, and durable luxury materials, pushing the boundaries of frame engineering and aesthetic possibilities, thus continuously justifying premium price points and bolstering the market's luxury positioning.

In the operational sphere, AI is critical for maintaining the high-quality standards and perceived rarity essential to luxury branding. Predictive analytics optimize the stocking of niche components and high-demand SKU variants, mitigating the risk of stockouts for exclusive items while preventing excess inventory that might necessitate discounting—a practice detrimental to luxury brand equity. Moreover, AI-powered quality control systems, utilizing computer vision, inspect frames during various stages of manufacturing, ensuring flawless execution of intricate details and minimizing defects, thereby upholding the rigorous quality promise associated with luxury goods. This strategic deployment of AI ensures operational excellence supports, rather than compromises, the brand narrative of exceptional craftsmanship and meticulous attention to detail required by the discerning luxury clientele.

- AI-driven personalized styling recommendations based on facial metrics and existing wardrobe analysis.

- Enhanced virtual try-on technology providing realistic, augmented reality simulations across diverse lighting and environments.

- Predictive demand forecasting to optimize inventory levels for limited-edition and high-value frames, maintaining scarcity.

- Machine learning algorithms analyzing global fashion trends to inform future luxury frame aesthetics and material choices.

- Automated quality control systems (computer vision) ensuring flawless execution and defect reduction in high-end manufacturing.

- Optimized supply chain logistics for high-value components, ensuring efficient and secure transit of precious materials.

- Chatbots and personalized AI assistants providing 24/7 bespoke customer service and post-purchase follow-up.

DRO & Impact Forces Of Luxury Eyewear Market

The Luxury Eyewear Market is strongly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the core Impact Forces shaping its competitive landscape and future trajectory. Key Drivers include rapidly expanding wealth distribution, particularly in emerging markets, viewing high-end eyewear as a mandatory status symbol, coupled with the relentless marketing power and brand equity of global fashion houses. Restraints primarily involve the threat of counterfeit products that erode brand value and trust, the high barrier to entry due to licensing costs and strict quality control standards, and periodic economic uncertainties that, while less severe than in mass markets, can impact aspirational luxury spending. Opportunities lie in the technological fusion with smart eyewear features, the expansion into underserved demographic segments such as specialized luxury sports optics, and leveraging digital DTC channels to offer highly personalized, geographically unconstrained shopping experiences, thereby optimizing market reach and profitability.

The foremost impact force driving market expansion is the premiumization trend across global consumer spending, where customers increasingly prioritize quality, unique design, and brand storytelling over mere functional utility, justifying higher average selling prices. This desire for expressive individuality often translates into purchasing multiple pairs of luxury eyewear to match different occasions and outfits, significantly boosting purchase frequency within the affluent demographic. Conversely, the most significant restraining force is the increasingly stringent regulatory environment concerning product safety, material traceability, and ethical sourcing, particularly in European and North American markets. Compliance requires substantial investment in supply chain transparency and specialized material certification, increasing operational costs for luxury producers and presenting significant market barriers for smaller, non-compliant entrants, thereby maintaining the market concentration among established players.

The strategic opportunities presented by technological convergence, specifically the merging of traditional luxury aesthetics with subtle smart features, represent a pivotal point for market diversification and growth. Brands capable of seamlessly integrating augmented reality (AR) or advanced health monitoring into aesthetically pleasing luxury frames without compromising design elegance are poised to capture new high-net-worth consumers seeking functional luxury innovation. The impact forces underscore a marketplace where brand heritage, meticulous craftsmanship, and controlled distribution channels are leveraged not only to command premium prices but also to build enduring emotional connections with consumers, ensuring long-term loyalty and resilience against market volatility, which is the foundational competitive advantage within the luxury segment.

Segmentation Analysis

The Luxury Eyewear Market segmentation provides a granular understanding of the diverse consumer base and product specialization, crucial for targeted marketing and strategic resource allocation. The market is primarily segmented based on Product Type (Sunglasses, Optical Frames), Material (Metal, Acetate, Polycarbonate, others including precious metals/natural horn), Distribution Channel (Specialty Stores, Online Stores, Retail Stores, Optometry Clinics), and End-User (Men, Women, Unisex). Sunglasses consistently represent the largest segment in terms of revenue, driven by fashion cyclicality and ease of consumption, serving as an accessible entry point to a luxury brand. However, optical frames are experiencing faster growth, reflecting an increased societal acceptance of frames as a daily fashion accessory rather than purely a corrective aid, prompting high-frequency updates among high-income consumers.

Segmentation by material is highly indicative of luxury status and price point, where titanium and premium acetate models command significantly higher prices due to their durability, comfort, and potential for intricate design work. The growth in the use of sustainable and ethically sourced materials, such as bio-acetate and recycled metals, is a notable trend within the material segmentation, appealing to the environmentally conscious affluent buyer. From a distribution perspective, specialty luxury stores and exclusive brand boutiques remain critical for maintaining the high-touch experience and brand exclusivity, but the Online Stores segment is rapidly gaining ground, bolstered by advanced digital tools like AI-driven sizing and virtual try-ons, effectively bridging the gap between digital convenience and the necessary premium retail experience.

The end-user segmentation reveals balanced demand across gender lines, though unisex frames are increasingly gaining popularity, reflecting fluid modern aesthetics in design. The strategic focus remains on customizing marketing strategies to appeal distinctly to the psychographics of each segment; for instance, targeting high-fashion women with oversized, logo-prominent styles through collaborations with major fashion influencers, while appealing to the male segment with understated, technologically superior frames emphasizing material performance and heritage craftsmanship. Analyzing these segments allows companies to optimize product portfolios and distribution networks, ensuring that high-value, niche products reach the intended discerning customer base effectively.

- Product Type:

- Sunglasses (Classic, Aviator, Wayfarer, Specialized Fashion)

- Optical Frames (Full-Rim, Half-Rim, Rimless)

- Material:

- Metal (Titanium, Stainless Steel, Gold Alloys)

- Acetate (Premium Cellulose Acetate, Bio-Acetate)

- Polycarbonate/Nylon Composites

- Natural Materials (Buffalo Horn, Wood)

- Distribution Channel:

- Specialty Stores/Exclusive Boutiques

- Online Stores (Brand Websites, Luxury E-commerce Platforms)

- Retail Stores (Department Stores, High-End Malls)

- Optometry Clinics/Vision Care Centers

- End-User:

- Men

- Women

- Unisex

Value Chain Analysis For Luxury Eyewear Market

The value chain for the Luxury Eyewear Market is intricate, characterized by tightly controlled upstream sourcing, specialized manufacturing, and highly selective downstream distribution that preserves brand exclusivity and margins. The upstream segment involves the sourcing of exclusive, high-grade materials—premium acetates, specialized alloys like aerospace-grade titanium, and often precious metals or ethically sourced exotic natural materials. This stage demands rigorous quality checks, often incorporating long-term contracts with specialized suppliers to ensure material consistency and traceability, which is a significant component of the final product's luxury narrative. Design and prototyping are also crucial upstream activities, involving collaborations with high-profile fashion designers and utilizing sophisticated CAD/CAM technologies to achieve complex geometries and impeccable fit, distinct from mass-market production.

The downstream analysis focuses on marketing, sales, and post-sales service, which are critical for maintaining the luxury experience. Marketing activities are intensive, utilizing high-end editorials, global fashion week presence, and carefully managed celebrity endorsements to cultivate aspiration and desirability. Distribution is highly selective, managed through a mix of controlled direct channels (brand-owned boutiques and e-commerce) and authorized indirect channels (high-end department stores and specialized opticians). This selective distribution is paramount for controlling pricing integrity and preventing grey market activities, which could devalue the brand equity. The direct channels allow brands to capture higher margins and control the customer experience fully, offering personalized fittings and exclusive access to new releases.

The distribution channel landscape emphasizes exclusivity and expertise. Direct channels, including flagship stores and proprietary e-commerce platforms, are increasingly prioritized as they offer complete control over brand presentation and customer data, driving the highest level of personalization and service. Indirect channels, such as carefully vetted multi-brand luxury retailers and high-end optometry clinics, rely on rigorous training of sales staff to communicate the craftsmanship and technological superiority of the luxury product effectively. Optometry clinics are critical as they provide professional fitting and prescription services, positioning the eyewear as both a medical necessity and a luxury item. The careful balance between expanding digital reach through online channels and maintaining the physical, high-touch consultation in specialized stores defines the success of the distribution strategy in this premium market segment.

Luxury Eyewear Market Potential Customers

The primary potential customers and end-users of the Luxury Eyewear Market are discerning, high-net-worth individuals and affluent aspirational consumers who prioritize status, craftsmanship, and personalized expression over cost-efficiency. This demographic is typically characterized by high disposable incomes, cultural literacy regarding fashion heritage, and a strong propensity to invest in visible luxury goods that communicate success and refined taste. Geographically, these buyers are concentrated in major metropolitan areas globally, particularly established financial hubs in North America and Europe, and rapidly expanding urban centers across Asia Pacific, where luxury consumption acts as a prominent symbol of social mobility and achievement. Psychographically, the luxury eyewear customer seeks authenticity, rarity, and a seamless shopping experience; they expect exceptional customer service and value the story behind the product, including material provenance and the legacy of the designer.

Key subsets of buyers include the 'Affluent Professional,' who requires sophisticated, understated frames suitable for corporate environments, prioritizing titanium or minimalist designer aesthetics that convey authority and precision. Another significant segment is the 'Fashion Forward Youth' (Generation Z and Millennials), who view luxury eyewear, especially sunglasses, as essential elements of their social media presence and personal branding strategy, driving demand for bold, trend-led designs and limited collaborations. The 'Geriatric Affluent' segment, often overlooked, represents a stable demand for high-quality, comfortable optical frames that incorporate advanced lens technology, willing to pay a premium for frames that maintain aesthetic appeal while accommodating complex vision correction needs and lightweight design specifications for all-day wear.

For brands, understanding these end-users requires granular data on purchasing triggers, which often include seasonal collection launches, exclusive invitations to private viewings, and targeted digital advertising emphasizing exclusivity and craftsmanship. Potential customers are heavily influenced by independent designers and curated content from specialized luxury publications, demonstrating a move away from overt logo dependency towards subtle, recognizable design excellence. Therefore, successful marketing strategies must focus on cultivating brand community and providing a holistic luxury experience, from the moment of digital discovery through to post-purchase service, ensuring the perceived intrinsic value consistently justifies the premium price point, solidifying long-term customer loyalty and repeat purchases for both optical and sun segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.4 Billion |

| Market Forecast in 2033 | USD 54.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EssilorLuxottica SA, Kering Eyewear, Marcolin S.p.A., Safilo Group S.p.A., LVMH Moët Hennessy Louis Vuitton SE, Chanel, Prada Group, Dior, Fendi, Gucci, Tom Ford, Barton Perreira, Oliver Peoples, LINDBERG, Maui Jim (Acquired by Kering), Porsche Design, Cartier, Maybach Icons of Luxury, Gentle Monster, DITA Eyewear. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Eyewear Market Key Technology Landscape

The technology landscape within the Luxury Eyewear Market is undergoing transformative changes driven by advanced manufacturing techniques and the subtle integration of digital functionality, designed to enhance both aesthetics and user experience without compromising the luxury appeal. Key technologies include the widespread adoption of 3D printing (Additive Manufacturing) for prototyping and the creation of highly customized, lightweight frames. This technology allows for complex geometric structures that are impossible with traditional molding, enabling true bespoke fitting based on precise facial scans, which is a major differentiator in the high-end market. Furthermore, specialized PVD (Physical Vapor Deposition) and ion-plating techniques are used to apply durable, high-finish metallic coatings, ensuring longevity and maintaining the pristine appearance of premium materials like gold or platinum alloys, thereby reinforcing the investment value of the product.

Lens technology represents another critical area of technological innovation, where luxury brands invest heavily in research and development to offer superior visual clarity and protection. This includes proprietary photochromic lenses that adapt instantaneously to lighting changes, high-definition (HD) digital surfacing for prescription lenses that minimize peripheral distortion, and advanced anti-reflective coatings that are both scratch-resistant and highly aesthetically discrete. The push for technological superiority in lens features justifies the higher cost associated with luxury lenses, positioning them not just as functional components but as performance-enhancing optical instruments. Integration of biometric tracking sensors and micro-displays (smart features) is carefully managed to ensure they are discreetly incorporated into the frame design, avoiding a bulky or overly technical appearance, thereby merging technology seamlessly with high fashion.

Digital technologies are equally important in the commercial and customer engagement domain. Sophisticated CAD/CAM software is used not only for design precision but also for seamless integration with manufacturing processes, enabling flexible, on-demand small-batch production crucial for maintaining product exclusivity. For the consumer interaction, Augmented Reality (AR) try-on applications, fueled by precise facial recognition algorithms, are becoming standard across high-end e-commerce platforms, drastically improving confidence in online purchases of personalized luxury items. These technologies, collectively, are critical in maintaining the market's high barrier to entry by requiring significant capital investment in research and specialized equipment, ensuring that luxury production standards far exceed those of mass-market counterparts.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven primarily by the rising disposable income of the affluent consumer base in China, India, and South Korea. These markets exhibit a strong cultural preference for conspicuous consumption and high-brand visibility, making luxury eyewear a critical status symbol. China, in particular, represents a dominant force, with localized digital marketing strategies and the rapid expansion of luxury retail infrastructure fueling demand. The market here is characterized by high demand for European heritage brands, though local luxury designers, such as Gentle Monster from South Korea, are increasingly capturing significant market share by blending unique, avant-garde design aesthetics with global appeal. The regulatory environment is becoming more favorable for international brands, but regional consumer tastes demand specific sizing and styling adaptations.

- Europe: Europe remains the historical and spiritual center of the Luxury Eyewear Market, characterized by high concentration of key manufacturers, design houses, and stringent quality standards. Countries like Italy (home to EssilorLuxottica and Safilo) and France dictate global fashion trends and craftsmanship benchmarks. The market is mature but stable, maintaining growth through consistent demand for established heritage brands like Chanel and Dior, and a continuous flow of high-margin optical frames, supported by strong healthcare systems and discerning older populations. Sustainability and traceability of materials are crucial differentiating factors for European luxury buyers, driving innovation in bio-acetates and ethically sourced materials.

- North America: North America, particularly the United States, represents the largest single-country revenue generator and is characterized by a high willingness to embrace technological integration and digital retail. Consumers here drive demand for specialized, high-performance luxury sports eyewear and technologically advanced frames (including smart eyewear). The market is highly influenced by celebrity culture and rapid retail adoption of digital tools like virtual try-on, leading to strong growth in the online distribution channel for luxury brands. Brand loyalty is high, but consumers also demand convenience and personalized post-purchase service, pushing brands to heavily invest in seamless omnichannel experiences that blend physical and digital engagement.

- Latin America (LATAM): The LATAM region, notably Brazil and Mexico, shows significant potential but is hampered by economic volatility and higher import tariffs. Luxury demand is highly concentrated among the wealthiest segments, favoring globally recognizable, classic designs as secure luxury investments. Growth is predicated on the expansion of organized luxury retail channels and stability in local currencies, which affects the pricing accessibility of high-value imported goods. Despite challenges, the aspirational luxury segment is robust, viewing high-end eyewear as a key step into global luxury consumption.

- Middle East and Africa (MEA): The MEA market is heavily dominated by the Gulf Cooperation Council (GCC) countries, specifically the UAE and Saudi Arabia, driven by exceptionally high per capita spending among high-net-worth individuals. The demand profile favors ultra-exclusive, customized, and ornate frames often incorporating precious metals, unique jewel embellishments, and overt displays of brand luxury. Distribution is almost exclusively through high-end malls and luxury boutiques, where personalized, high-touch consultation and exclusivity are non-negotiable service standards. Market growth relies heavily on luxury tourism and targeted marketing towards regional aesthetic preferences for bold, status-driven designs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Eyewear Market.- EssilorLuxottica SA

- Kering Eyewear

- Marcolin S.p.A.

- Safilo Group S.p.A.

- LVMH Moët Hennessy Louis Vuitton SE

- Chanel

- Prada Group

- Dior

- Fendi

- Gucci

- Tom Ford

- Barton Perreira

- Oliver Peoples

- LINDBERG

- Maui Jim (Acquired by Kering)

- Porsche Design

- Cartier

- Maybach Icons of Luxury

- Gentle Monster

- DITA Eyewear

Frequently Asked Questions

Analyze common user questions about the Luxury Eyewear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trend in the Luxury Eyewear Market?

The growth is primarily driven by rising global disposable incomes among affluent consumers, the increasing perception of high-end eyewear as a necessary fashion accessory and status symbol, continuous product innovation in materials and design, and robust expansion in Asia Pacific markets, particularly China and India, where demand for luxury goods is escalating rapidly.

How significant is the impact of sustainable and ethical materials on luxury frame production?

Sustainability is increasingly critical in the luxury sector, influencing consumer choice among younger, affluent buyers. Brands are heavily investing in bio-acetates, recycled metals, and traceable materials. This shift is not only a moral imperative but also a key differentiator, allowing luxury brands to command premium pricing by aligning with eco-conscious consumer values and demonstrating supply chain responsibility.

Which distribution channel is showing the highest growth rate for luxury eyewear?

The Online Stores and Direct-to-Consumer (DTC) channels, including proprietary brand websites and specialized luxury e-commerce platforms, are exhibiting the fastest growth. This acceleration is supported by advanced digital engagement tools such as virtual try-on technology and AI-driven personalization, which successfully replicate the high-touch experience online while providing unparalleled convenience.

How are technology and AI utilized specifically in the luxury eyewear sector?

Technology, especially AI, is used to enhance customization through 3D printing for bespoke fitting, optimize inventory management to maintain scarcity and exclusivity, and refine the customer experience via personalized styling recommendations and advanced virtual try-on simulations. The goal is to seamlessly integrate innovation without diluting the craftsmanship narrative.

What are the primary challenges facing luxury eyewear manufacturers in mature markets?

Primary challenges include mitigating the pervasive threat of sophisticated counterfeiting that erodes brand integrity, navigating complex international regulatory standards related to material safety and import/export, and managing high operational costs associated with maintaining rigorous quality control and limited-batch production necessary for true luxury standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager