Luxury Fashion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431981 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Luxury Fashion Market Size

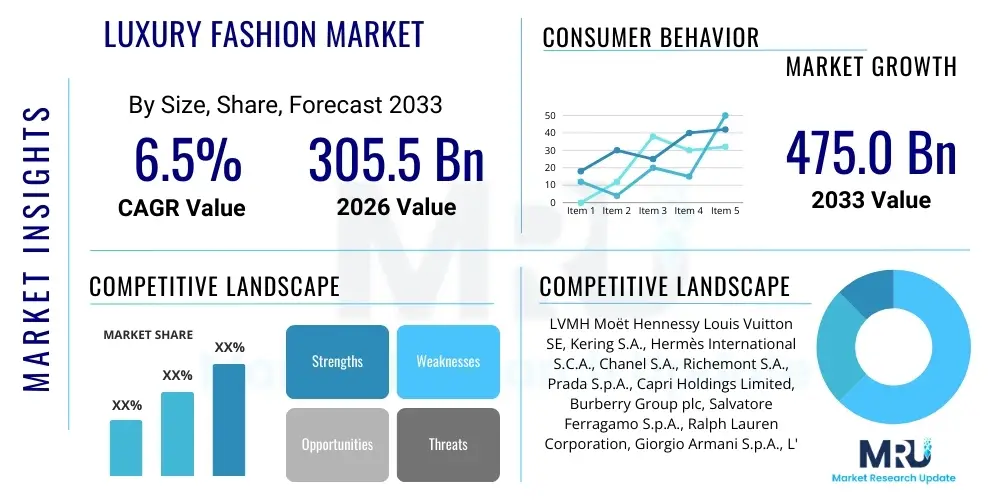

The Luxury Fashion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $305.5 Billion in 2026 and is projected to reach $475.0 Billion by the end of the forecast period in 2033.

Luxury Fashion Market introduction

The Luxury Fashion Market encompasses high-end, exclusive apparel, accessories, footwear, and leather goods characterized by superior quality, intricate craftsmanship, prestigious branding, and premium pricing. These products are often sold through exclusive boutiques, flagship stores, and specialized high-end e-commerce platforms, targeting affluent consumers globally who prioritize status, legacy, and exceptional material science over mass-market trends. The fundamental value proposition of luxury fashion rests on scarcity, heritage, and the intangible emotional connection fostered between the brand and the consumer, particularly in segments like haute couture and artisanal ready-to-wear.

Key applications of luxury fashion extend beyond mere utility, serving primarily as status symbols, investments, and expressions of personal identity and taste. The market is driven by several macroeconomic factors, including the rapid proliferation of ultra-high-net-worth individuals (UHNWIs) in emerging economies, notably in Asia Pacific, coupled with the persistent influence of social media on consumer aspirations. Furthermore, the increasing consumer focus on sustainability and ethical sourcing has mandated luxury brands to enhance supply chain transparency and incorporate durable, environmentally conscious materials, thereby reinforcing their premium positioning and long-term viability in a competitive retail landscape.

The primary benefit of participating in the luxury fashion market, for both consumers and producers, revolves around maintaining exclusivity and perceived value. For brands, high margins and brand loyalty secure long-term profitability, while for consumers, the purchase represents access to superior design expertise and lasting quality. Driving factors include globalization, which opens new markets for heritage brands, the digitalization of retail leading to immersive online experiences, and the strategic deployment of limited-edition collaborations that generate significant media attention and spike demand among younger, digitally native luxury buyers.

Luxury Fashion Market Executive Summary

The Luxury Fashion Market is undergoing a significant transformation, driven by an accelerating digital shift and a fundamental change in consumer demographics. Current business trends indicate a strong focus on direct-to-consumer (DTC) models, allowing brands unprecedented control over pricing, customer experience, and data analytics. Brands are investing heavily in personalized marketing and augmented reality (AR) technologies to bridge the gap between physical exclusivity and digital accessibility, ensuring the perceived scarcity remains intact even as sales channels diversify. The major shift lies in the integration of resale and circularity initiatives, with many established houses recognizing the economic and ethical imperative of managing their products' lifecycle, thus capitalizing on the booming secondary market.

Regionally, Asia Pacific (APAC) continues to serve as the undisputed engine of growth, specifically China, where domestic consumption of luxury goods has been strongly favored due to global travel limitations and governmental policies encouraging internal spending. Europe maintains its importance as the center of luxury production, heritage, and tourism-driven sales, though it faces increased scrutiny regarding tax implications and regulatory alignment across member states. North America, characterized by strong spending on accessories and high-end streetwear, demonstrates robust growth fueled by millennial and Generation Z consumers who are often earlier adopters of digital luxury concepts, including NFTs and digital wearables.

Segment-wise, accessories, particularly leather goods and premium footwear, remain the largest and most resilient categories, owing to their accessibility as entry-point luxury purchases and their long-term value retention. Ready-to-wear (RTW) is experiencing dynamic growth driven by seasonal collections and influential celebrity collaborations, emphasizing speed-to-market and limited drops. The key evolving trend within product segmentation is the blurring of lines between formal luxury and high-end casual wear (athleisure), necessitating continuous innovation in technical fabrics and functional design while preserving traditional luxury standards of quality and finish.

AI Impact Analysis on Luxury Fashion Market

User queries regarding AI's impact on luxury fashion predominantly center around two critical areas: maintaining exclusivity and authenticity in the face of scalable automation, and the personalized consumer journey from discovery to post-purchase support. Common themes include how AI can assist in predicting micro-trends without compromising brand uniqueness, ensuring ethical data use, and managing supply chain complexities, particularly in tracking rare materials and combating counterfeiting. Users are highly interested in generative AI's role in design processes—specifically, whether AI-generated elements will dilute the artistry and human touch inherent in luxury craftsmanship. Expectations are high for AI-powered virtual stylists and immersive shopping experiences that offer the tailored feel of in-person luxury consultancy at scale, addressing the paradox of mass personalization.

The assimilation of Artificial Intelligence (AI) into the Luxury Fashion Market is revolutionizing operational efficiency and enhancing customer engagement, moving beyond simple trend forecasting to deeply personalized interaction models. AI algorithms are crucial for analyzing vast datasets of consumer preferences, social sentiment, and purchasing behaviors, enabling brands to execute highly segmented marketing campaigns and optimize inventory placement globally. This data-driven precision helps mitigate risks associated with overproduction and subsequent markdowns, protecting the core luxury principle of scarcity. Furthermore, AI tools are employed in quality control, utilizing computer vision to detect microscopic flaws in materials and finishing, ensuring the physical product meets the stringent quality standards expected by the discerning luxury consumer.

Operationally, the impact of AI is most pronounced in streamlining the supply chain and combating illegal trade. Machine learning models predict demand fluctuations with greater accuracy than traditional methods, optimizing raw material procurement and production scheduling for bespoke or limited-edition items. For intellectual property protection, AI uses image recognition and blockchain integration to track luxury items from creation to consumer, providing verifiable digital proofs of authenticity. This capability is paramount in the secondary market, where maintaining consumer trust requires robust tools to distinguish genuine articles from high-quality replicas, securing the intrinsic value of luxury assets.

- AI-Driven Hyper-Personalization: Customizing product recommendations, virtual styling sessions, and targeted marketing campaigns based on granular historical purchase data and psychographic profiles.

- Predictive Trend Forecasting: Utilizing machine learning to analyze global fashion week data, social media buzz, and influencer metrics to anticipate subtle shifts in consumer preferences months in advance.

- Enhanced Supply Chain Visibility: Implementing AI and IoT sensors to monitor and optimize the sourcing of rare materials, ensuring ethical compliance and reducing lead times for artisanal production.

- Counterfeit Detection and Brand Protection: Employing computer vision and advanced pattern recognition to scan digital marketplaces and physical goods, protecting brand equity against imitation.

- Generative Design Assistance: Using generative AI tools to rapidly prototype new color palettes, material combinations, and initial sketches, augmenting—not replacing—human designers.

- Optimized Inventory Management: Forecasting localized demand across geographically disparate boutiques to minimize stockouts of core items and prevent excessive inventory buildup of seasonal collections.

- Virtual Try-On Experiences (VTO): Deploying Augmented Reality (AR) features powered by AI to allow customers to accurately visualize how apparel and accessories look on them before committing to a purchase.

DRO & Impact Forces Of Luxury Fashion Market

The Luxury Fashion Market dynamics are a complex interplay of inherent brand exclusivity and external economic and cultural forces. Key drivers (D) include the escalating disposable income in developing regions, the persistent "Veblen effect" where higher prices increase desirability, and the digital imperative forcing brands to innovate customer engagement. Restraints (R) primarily involve the high operating costs associated with maintaining artisanal production standards, susceptibility to global economic downturns which impact discretionary spending, and significant threats posed by the sophisticated global counterfeit industry. Opportunities (O) are concentrated in expanding the resale market through brand-certified programs, leveraging Metaverse platforms for virtual product sales, and capturing the Gen Z consumer base through impactful sustainability commitments. These factors collectively create the impact forces that shape market growth, demanding strategic balance between heritage preservation and rapid technological adoption.

Driving forces center on global wealth concentration and the democratization of luxury aspirations through digital platforms. The ability of luxury brands to create desirability through scarcity—often managed through tightly controlled production runs and exclusive distribution—is a primary economic driver. Furthermore, the rising awareness and demand for ethical and sustainable fashion are pushing legacy brands to integrate circularity into their business models, which, while initially costly, strengthens brand image and appeals to conscious affluent consumers. Technological drivers, specifically the implementation of advanced Customer Relationship Management (CRM) systems and data analytics, enable brands to nurture high-value customer relationships, significantly boosting Lifetime Value (LTV).

However, the market faces structural restraints that limit explosive growth. Economic volatility, exacerbated by geopolitical instability, can rapidly curtail luxury spending among high-net-worth individuals, leading to cyclical downturns. The labor-intensive nature of high-quality craftsmanship limits the speed and scale of production, preventing brands from capitalizing fully on demand spikes. Moreover, regulatory hurdles regarding material sourcing, particularly for exotic skins or precious metals, impose strict compliance requirements. The primary opportunity remains digital expansion—not just through e-commerce, but through engaging consumers in new virtual realities (e.g., Metaverse shopping experiences and digital twins of physical products), allowing brands to monetize both physical and virtual exclusivity.

Segmentation Analysis

The Luxury Fashion Market is methodically segmented based on Product Type, Distribution Channel, End-User, and Material. This structured approach allows brands and analysts to precisely target specific consumer groups and allocate resources effectively across the value chain. Product segmentation reveals the relative strength of categories such as accessories (the most dominant segment), compared to ready-to-wear, which is more volatile but central to brand identity. Distribution channel analysis highlights the ongoing importance of exclusive flagship stores and the rapidly accelerating shift towards branded e-commerce platforms, particularly for younger consumers who prioritize convenience alongside exclusivity. End-user segmentation typically divides the market between men, women, and the emerging gender-neutral/unisex category, reflecting changing societal norms regarding fashion consumption.

- Product Type:

- Apparel (Ready-to-Wear, Couture, Outerwear)

- Accessories (Handbags, Wallets, Belts, Ties)

- Footwear (Luxury Sneakers, Formal Shoes, Boots)

- Jewelry and Watches (High-End Timepieces, Fine Jewelry)

- Others (Eyewear, Fragrances, Cosmetics)

- Distribution Channel:

- Retail Stores (Flagship Stores, Brand Boutiques)

- Specialty Stores (Department Stores, Multi-Brand Luxury Retailers)

- E-commerce (Brand Websites, Third-Party Luxury Platforms)

- Airport Duty-Free and Travel Retail

- End-User:

- Women

- Men

- Unisex/Gender-Neutral

- Material:

- Leather Goods (Cowhide, Exotic Skins)

- Textiles (Silk, Cashmere, Merino Wool)

- Precious Metals and Stones

- Sustainable/Recycled Materials

Value Chain Analysis For Luxury Fashion Market

The value chain for the Luxury Fashion Market is highly intricate, characterized by vertical integration and stringent quality controls at every stage, contrasting sharply with fast fashion models. Upstream analysis focuses intensely on the sourcing of premium, often rare or ethically certified, raw materials such as fine leathers, exclusive silks, and certified precious metals. Manufacturers maintain proprietary relationships with specialized suppliers to ensure material traceability and quality consistency, which is fundamental to the luxury price point. Labor inputs, involving highly skilled artisans and master craftsmen, represent a significant portion of the cost structure in the midstream, where design, prototyping, and small-batch production occur, often maintaining manufacturing bases in countries renowned for heritage craftsmanship like Italy and France.

The downstream segment involves meticulously controlled distribution channels designed to uphold brand image and exclusivity. Direct channels, encompassing brand-owned flagship stores and official e-commerce platforms, are favored as they provide complete control over the customer experience, pricing, and visual merchandising—critical elements in preserving the luxury aura. Indirect channels, such as select high-end department stores and authorized multi-brand online retailers, are utilized strategically to expand market reach while adhering to strict brand guidelines regarding presentation and inventory management. The final stage involves extensive customer service, including bespoke alterations, repair services, and aftercare, which are integral parts of the luxury value proposition, enhancing customer loyalty and perceived product longevity.

The shift towards digital platforms has introduced complexity in maintaining channel integrity. Direct-to-consumer (DTC) models now drive the highest margins and enable direct data capture, essential for AI-driven personalization. However, the travel retail segment and traditional physical boutiques remain crucial for experiential purchasing and for reinforcing the sensory aspects of luxury—texture, scent, and physical atmosphere. Brands must carefully manage channel conflict, ensuring that pricing and product availability are consistent across all touchpoints, whether direct or indirect, to protect the equity and exclusivity inherent in the luxury product.

Luxury Fashion Market Potential Customers

The primary end-users and buyers in the Luxury Fashion Market are segmented into several distinct profiles, defined not only by their purchasing power but also by their motivations and engagement with the brand narrative. Traditionally, the market has been dominated by High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs)—the established luxury consumers who prioritize heritage, investment value, and exclusivity. These consumers frequently purchase haute couture and fine jewelry, viewing luxury goods as stable assets and symbols of enduring status. Their purchasing behavior is often characterized by high loyalty to specific heritage houses and a preference for personalized, discreet retail experiences provided through private client advisors.

A rapidly growing segment comprises the aspiring affluent, often younger professionals (Millennials and Gen Z) from emerging economies. These consumers are driven by visibility, brand recognition, and rapid trend adoption, leveraging social media extensively for product discovery and validation. They represent the primary buyers of entry-level luxury items, particularly premium sneakers, logoed accessories, and accessible ready-to-wear pieces, focusing on immediate gratification and aligning their fashion choices with digital influencer culture. This demographic demands frictionless omnichannel experiences and sustainability credentials, viewing ethical responsibility as an extension of luxury quality.

Furthermore, corporate buyers and gifting services constitute a consistent niche, purchasing luxury items for high-level client relations, employee rewards, or institutional collections. Geographically, potential customers are increasingly concentrated in Asia, specifically Mainland China, where a vast, newly wealthy middle and upper class exhibits high brand awareness and propensity for high-frequency luxury purchases. Understanding these segments requires brands to maintain a dual strategy: preserving the rarefied experience for established clients while creating dynamic, engaging, and digitally accessible narratives for the emerging consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $305.5 Billion |

| Market Forecast in 2033 | $475.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH Moët Hennessy Louis Vuitton SE, Kering S.A., Hermès International S.C.A., Chanel S.A., Richemont S.A., Prada S.p.A., Capri Holdings Limited, Burberry Group plc, Salvatore Ferragamo S.p.A., Ralph Lauren Corporation, Giorgio Armani S.p.A., L'Oréal Luxe, PVH Corp., Hugo Boss AG, Moncler S.p.A., Tod's S.p.A., Stella McCartney, Valentino S.p.A., Balenciaga, Tiffany & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Fashion Market Key Technology Landscape

The modern Luxury Fashion Market is fundamentally reliant on advanced technological integration to maintain exclusivity, enhance experiential retail, and ensure product integrity. Central to this landscape is the adoption of Blockchain technology, primarily used for product authentication and supply chain transparency. By creating an immutable digital ledger, brands can track the provenance of raw materials and confirm the authenticity of the final product, addressing consumer demands for ethical sourcing and effectively combating the persistent threat of counterfeiting, which is crucial for protecting the high valuation of luxury goods, especially in the secondary market. Furthermore, this technology facilitates the creation of Digital Twins, linking physical luxury items to unique digital assets (NFTs) that confer verifiable ownership and access to exclusive virtual content or communities.

The retail experience is being revolutionized by immersive technologies, chiefly Augmented Reality (AR) and Virtual Reality (VR). AR filters and applications enable customers to virtually try on clothing, accessories, and eyewear through their mobile devices, significantly reducing return rates and enhancing engagement both online and in physical stores. VR, particularly through Metaverse platforms, allows brands to launch immersive fashion shows, establish virtual boutiques, and sell digital-only collections (digital wearables), generating new revenue streams and engaging Gen Z and Millennial audiences in novel, brand-aligned ways. These technologies are crucial for bridging the gap between the sensory appeal of physical luxury and the convenience of digital shopping.

Data science and AI form the backbone of strategic decision-making. High-end brands utilize sophisticated predictive analytics tools to forecast localized micro-trends, optimize production quotas for limited-edition drops, and manage global inventory distribution with high precision. Robotics and advanced manufacturing techniques, while not compromising the hand-crafted nature of the products, are increasingly used in ancillary processes such as material cutting, prototyping, and logistics, speeding up time-to-market without sacrificing quality. The synergy between digital technology and traditional craftsmanship is defining the competitive advantage in the luxury sector, ensuring that innovation complements, rather than diminishes, brand heritage.

Regional Highlights

Regional dynamics within the Luxury Fashion Market are characterized by significant wealth disparities and diverse cultural consumption patterns, necessitating highly localized market strategies by global luxury houses. The collective performance of these regions dictates the overall market trajectory and future growth prospects for premium goods.

- Asia Pacific (APAC): APAC, spearheaded by Mainland China, remains the most dominant and rapidly expanding market globally for luxury fashion. Chinese consumers, driven by a strong desire for status affirmation and supported by rising domestic wealth, account for a vast percentage of global luxury sales. The market is defined by digital saturation, demanding sophisticated omnichannel engagement and partnerships with local social commerce platforms like WeChat and Tmall. Japan and South Korea also maintain strong, established luxury consumer bases, though their growth is more mature and characterized by a focus on quality, heritage, and unique, limited-edition collaborations. Southeast Asia (e.g., Singapore, Thailand) is emerging as a critical secondary growth vector. Luxury companies are strategically shifting focus from travel retail consumption to localized domestic spending, enhancing the regional significance of major metropolitan hubs.

- Europe: Europe serves as the undisputed historical and manufacturing core of the global luxury fashion industry, housing the majority of heritage brands, artisanal workshops, and flagship design studios in countries like France and Italy. Sales here are heavily bolstered by international tourism, although domestic European consumption remains robust, particularly in the UK and Germany, driven by high purchasing power and cultural appreciation for craftsmanship. The regional challenge lies in navigating complex regulatory environments, ensuring ethical supply chain compliance, and mitigating the impact of geopolitical events on tourist foot traffic. Europe continues to lead in brand innovation and maintaining the high-quality production standards synonymous with luxury.

- North America: North America, specifically the United States, represents a highly mature and diversified luxury market characterized by strong consumer interest in accessible luxury, footwear, and the fusion of high fashion with streetwear. The American consumer base, particularly the younger affluent segments (Millennials and Gen Z), are early adopters of new retail technologies, including direct-to-avatar (D2A) digital fashion and blockchain-verified products. Brands in this region often emphasize celebrity endorsements, personalized retail experiences, and rapid fulfillment capabilities. Growth is steady, driven by strong economic activity and a cultural openness to merging formal luxury aesthetics with casual, lifestyle-oriented branding.

- Middle East and Africa (MEA): The MEA region is a high-growth, high-spending market segment, particularly concentrated in the Gulf Cooperation Council (GCC) countries like the UAE (Dubai) and Saudi Arabia. Consumer behavior here is marked by an affinity for exclusive, opulent, and custom-made luxury items, often involving fine jewelry, high-end accessories, and private shopping experiences. The market benefits from significant investments in luxury tourism and retail infrastructure development, establishing hubs like Dubai as critical global luxury destinations. Africa presents nascent but long-term potential, focused initially on South Africa and Nigeria, where economic growth is slowly cultivating a luxury consumer base demanding tailored, regionally specific collections.

- Latin America: The Latin American market, while facing economic volatility in key countries like Brazil and Mexico, offers untapped potential for luxury brands. Demand exists primarily within major urban centers among the wealthy elite. The market is highly price-sensitive due to import tariffs and exchange rate fluctuations, compelling brands to adopt tailored pricing strategies and focus on secure, local distribution networks. E-commerce penetration is growing, but physical retail remains crucial for providing the exclusive, high-touch service expected by luxury buyers in this region. The consumer profile typically values tradition, family heritage, and strong brand narratives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Fashion Market.- LVMH Moët Hennessy Louis Vuitton SE

- Kering S.A.

- Hermès International S.C.A.

- Chanel S.A.

- Richemont S.A.

- Prada S.p.A.

- Capri Holdings Limited

- Burberry Group plc

- Salvatore Ferragamo S.p.A.

- Ralph Lauren Corporation

- Giorgio Armani S.p.A.

- L'Oréal Luxe (for high-end cosmetics/fragrances)

- PVH Corp. (through premium segments)

- Hugo Boss AG

- Moncler S.p.A.

- Tod's S.p.A.

- Stella McCartney

- Valentino S.p.A.

- Balenciaga

- Tiffany & Co.

Frequently Asked Questions

Analyze common user questions about the Luxury Fashion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current acceleration of luxury fashion sales globally?

The primary driver is the significant accumulation of wealth among Ultra-High-Net-Worth Individuals (UHNWIs) in Asia Pacific, especially China, coupled with the rapid integration of digital platforms. E-commerce and social media have democratized access to luxury brand narratives, stimulating consumption among younger, aspirational consumers (Millennials and Gen Z) who prioritize unique experiences and visible brand affiliation. Furthermore, the market benefits from the "Veblen Effect," where perceived value increases with higher pricing.

How is the Luxury Fashion Market adapting to increasing demands for sustainability and ethical production?

Luxury brands are responding by vertically integrating their supply chains to ensure full traceability (often via blockchain), investing in sustainable and recycled materials, and implementing circular business models, such as brand-certified repair and resale programs. This adaptation is crucial because modern affluent consumers view ethical sourcing and durability as fundamental characteristics of premium quality, thus reinforcing the luxury price point and brand trust.

What role does technology play in maintaining the exclusivity of luxury goods?

Technology, particularly Artificial Intelligence (AI) and data analytics, is used to manage scarcity by precisely forecasting demand and optimizing production limits for limited-edition items, preventing oversupply that could dilute brand equity. Blockchain technology secures exclusivity by providing immutable digital proof of ownership (NFTs or Digital Twins), protecting the high investment value of the physical item and combating sophisticated counterfeiting operations globally.

Which product segment is expected to show the highest growth rate in the near future?

The Accessories segment, particularly high-end leather goods (handbags) and premium footwear (luxury sneakers), is anticipated to maintain the highest growth trajectory. Accessories serve as crucial entry points for new luxury consumers and demonstrate superior resilience during economic fluctuations compared to ready-to-wear. Furthermore, the long-term investment value and resale potential of iconic luxury accessories contribute significantly to this segment's robust performance.

What is the impact of the Metaverse and digital wearables on traditional luxury brands?

The Metaverse presents a significant opportunity for luxury brands to create new revenue streams through the sale of digital-only fashion items (skins or wearables) and to host immersive virtual experiences that complement physical retail. This strategy allows brands to engage digitally native consumers, solidify brand relevance in emerging virtual spaces, and test design concepts without the material risk associated with physical production, extending the brand's reach and intellectual property into the virtual realm.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Affordable Luxury Fashion Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Luxury Fashion Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Accessories, Shoes, Clothes, Others), By Application (Man, Woman, Child), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager