Luxury High End Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431493 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Luxury High End Furniture Market Size

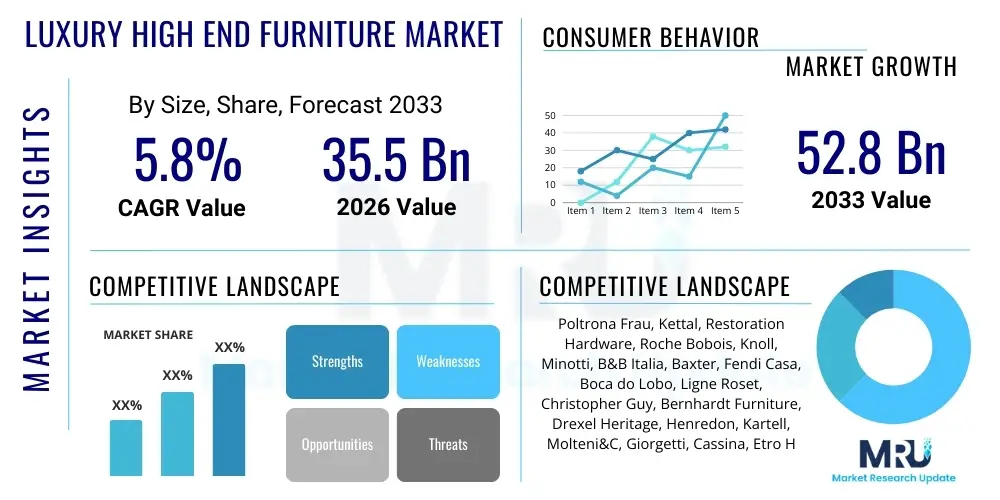

The Luxury High End Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 52.8 Billion by the end of the forecast period in 2033.

Luxury High End Furniture Market introduction

The Luxury High End Furniture Market encompasses finely crafted, exquisitely designed, and often bespoke furnishing products characterized by superior quality materials, exceptional durability, and high aesthetic value. These items serve not only a functional purpose but also act as status symbols, reflecting affluence and discerning taste. The products span across residential spaces, including living rooms, bedrooms, and dining areas, as well as high-end commercial applications like five-star hotels, corporate executive suites, and luxury retail establishments. This sector is defined by meticulous craftsmanship, the incorporation of rare woods, exotic leathers, high-grade metals, and exclusive fabrics, often involving collaborations with renowned interior designers and architects.

Major applications of luxury furniture include enhancing the ambiance of premium residential units, driving demand for bespoke interior projects, and outfitting the growing global hospitality sector, particularly boutique and luxury hotels focusing on unique guest experiences. The market is fueled by the continuous rise in global disposable income among High-Net-Worth Individuals (HNWIs), rapid urbanization in emerging economies leading to increased real estate development, and a cultural shift favoring durable, sustainable, and aesthetically unique possessions over mass-produced alternatives. Consumers in this segment seek exclusivity, heritage, and personalization, making custom design a significant growth engine.

The core benefits of participating in the luxury furniture market include accessing products with long lifecycles, superior ergonomic design, and investment value due to brand recognition and quality assurance. Key driving factors involve increasing consumer focus on interior aesthetics, the flourishing global residential construction sector targeting high-end buyers, and the influential role of social media and design publications that showcase premium lifestyle trends. Furthermore, the push towards integrating technology, such as smart features and sustainable materials, without compromising artisanal integrity, continues to stimulate innovation and market expansion.

Luxury High End Furniture Market Executive Summary

The global Luxury High End Furniture Market demonstrates robust growth, primarily driven by sustained economic prosperity among affluent consumers and increasing investment in the luxury hospitality sector worldwide. Business trends indicate a strong movement toward digital integration, where luxury brands leverage advanced virtual reality (VR) and augmented reality (AR) tools for customized design consultations and seamless online purchasing experiences, complementing their traditional brick-and-mortar showrooms. There is a noticeable consolidation among smaller, highly specialized artisan workshops and larger global conglomerates seeking to diversify their brand portfolio and supply chain resilience, enhancing operational efficiency and market reach. Sustainability and ethical sourcing have emerged as non-negotiable considerations, influencing material selection and manufacturing processes, subsequently impacting brand valuation and consumer loyalty within the premium segment.

Regionally, North America and Europe maintain dominance, owing to established markets, high consumer spending power, and a long tradition of furniture design and innovation. However, the Asia Pacific region, particularly countries like China, India, and the UAE, is experiencing the fastest growth trajectory. This acceleration is attributed to rapid wealth accumulation, large-scale luxury residential projects, and the increasing westernization of interior design preferences among the rising middle and affluent classes. Geopolitical stability and fluctuating currency values remain key variables influencing sourcing and import/export dynamics across different continents, prompting global manufacturers to strategically localize production or establish strong regional distribution partnerships to mitigate risk.

Segment trends reveal that the Residential application sector remains the largest consumer base, driven by permanent dwelling upgrades and vacation home furnishing projects, though the Commercial segment, especially luxury yachting and private aviation, is showcasing high-value, niche demand. In terms of material, natural wood and high-grade leather continue to command premium prices due to their durability and timeless appeal, while the metal and glass segments are experiencing increased demand driven by modern, minimalist design aesthetics. Distribution channel analysis highlights the growing importance of online platforms and brand-owned e-commerce sites, which provide global access to exclusive collections, though offline showrooms still retain critical value for experiential shopping, material assessment, and personalized consultation required for high-ticket purchases.

AI Impact Analysis on Luxury High End Furniture Market

Common user questions regarding AI's impact on luxury furniture often center on whether automation compromises artisanal quality, how AI can personalize design without losing human creativity, and its role in sustainable manufacturing and supply chain transparency. Users are keen to understand if AI-driven recommendations will truly capture nuanced luxury tastes or if they will merely standardize design. The general expectation is that AI will be used primarily as an optimization tool—enhancing the customization process, predicting future design trends based on vast consumer data, improving supply chain efficiency (especially regarding unique material sourcing), and creating hyper-realistic virtual showroom experiences. Concerns persist regarding the potential devaluation of traditional craftsmanship if design processes become excessively automated or algorithm-dependent, though manufacturers view AI primarily as a collaborative tool for designers, accelerating prototyping and complex calculations.

- AI-Driven Design Personalization: Algorithms analyze client portfolios, architectural plans, and past purchasing behavior to generate unique, hyper-personalized furniture concepts and material combinations, significantly accelerating the design consultation phase.

- Optimized Manufacturing and Prototyping: AI and machine learning enhance Computer Numerical Control (CNC) machinery accuracy for complex cuts and carvings, reducing material waste, improving precision, and speeding up the production of custom pieces while maintaining quality control.

- Predictive Trend Forecasting: AI models analyze social media chatter, global real estate trends, architectural movements, and luxury fashion cycles to accurately forecast future demand for specific styles, colors, and materials, optimizing inventory and reducing speculative production risk.

- Enhanced Supply Chain Transparency: Machine learning is used to track the provenance of rare or ethically sensitive materials (e.g., exotic woods, specialized metals), ensuring verifiable sustainability claims, crucial for brand trust in the luxury sector.

- Immersive Customer Experience (AR/VR Showrooms): AI powers hyper-realistic virtual showrooms and augmented reality apps, allowing potential customers globally to visualize high-end pieces accurately scaled and placed within their own homes, reducing the necessity for physical showroom visits.

- Automated Quality Control: AI vision systems inspect finished products for microscopic defects, surface imperfections, and consistency with original design specifications far faster and more reliably than manual inspection, upholding rigorous luxury standards.

DRO & Impact Forces Of Luxury High End Furniture Market

The dynamics of the Luxury High End Furniture Market are shaped by a delicate interplay of powerful drivers, significant structural restraints, and emerging opportunities that collectively determine market trajectory. The primary drivers revolve around the continuous expansion of the global wealthy population, particularly HNWIs and UHNWIs (Ultra High-Net-Worth Individuals), who view luxury furnishings not just as functional items but as investment pieces and critical components of personal branding and lifestyle expression. Coupled with this is the global surge in high-end residential and commercial construction, particularly in developing urban hubs, necessitating large volumes of premium, customized interior fittings. The increasing consumer demand for durable, sustainably sourced products also pushes manufacturers toward innovation, creating a competitive advantage for brands committed to transparency and ethical production.

Conversely, the market faces significant restraints. The dependence on highly skilled artisanal labor, which is often scarce and commands high wages, elevates production costs and limits scalability. Furthermore, the volatility and rising costs of premium raw materials, such as rare hardwoods, specific textiles, and high-quality leather, introduce supply chain risks and pressure profit margins. Economic uncertainties, including regional recessions or geopolitical trade disputes, can swiftly impact discretionary spending among the target consumer base, leading to delayed or canceled high-value furnishing projects. The lengthy product lifecycle of luxury furniture, while a core benefit, simultaneously acts as a restraint on replacement demand, requiring brands to continuously generate innovative designs to stimulate repeat purchases.

Opportunities for growth are plentiful, primarily concentrated in the digital sphere and emerging geographic markets. The rapid expansion of direct-to-consumer (D2C) e-commerce platforms and the deployment of immersive digital tools (like 3D modeling and visualization) allow luxury brands to bypass traditional distribution hurdles, accessing a broader, international clientele with lower overheads. Strategic focus on the customization and bespoke services segment offers substantial growth potential, catering to the unique requirements of architects and interior designers working on landmark projects. Moreover, vertical market opportunities, such as furnishing luxury yachts, private jets, and bespoke office environments, provide high-margin avenues for specialized luxury manufacturers who can deliver integrated, turn-key solutions requiring exceptional quality and complexity.

Segmentation Analysis

The Luxury High End Furniture Market is meticulously segmented based on product type, material composition, distribution channel, and end-user application, providing a nuanced view of consumption patterns and market concentration. Segmentation is critical for manufacturers to tailor their production, branding, and marketing strategies effectively to reach specific high-value customer niches. The complexity of the product offerings, ranging from classic handcrafted antiques to hyper-modern integrated smart furniture, necessitates clear divisions to analyze competitive landscapes and identify areas of unmet consumer demand. The functional and aesthetic requirements vary dramatically between residential and commercial buyers, further emphasizing the need for robust segmentation strategies.

By analyzing the segments, stakeholders gain insights into which material trends are currently commanding premium pricing, whether the convenience of online retail is overcoming the necessity for physical showrooms, and which geographical regions are prioritizing specific furniture types (e.g., large sofas versus compact modular units). For instance, the Commercial segment places a higher emphasis on durability, fire-retardant qualities, and compliance with hospitality standards, while the Residential segment prioritizes aesthetic exclusivity and personalization. Understanding the flow between these sub-markets allows companies to optimize their supply chain for both rapid prototyping (for bespoke residential orders) and scalable quality production (for large commercial contracts).

- Product Type:

- Sofas & Seating (Lounge Chairs, Sectionals, Ottomans)

- Tables (Coffee Tables, Dining Tables, Console Tables)

- Beds & Mattresses (Headboards, Frames, Luxury Sleep Systems)

- Cabinets & Storage (Shelving Units, Display Cabinets, Wardrobes)

- Outdoor Furniture (Loungers, Patio Sets, Weather-resistant Dining)

- Material Type:

- Wood (Solid Wood, Exotic Veneers)

- Metal (Stainless Steel, Brass, Bronze)

- Leather (Full-grain, Aniline, Nubuck)

- Fabric (Silk, Velvet, High-end Synthetics)

- Glass & Others (Marble, Stone, Specialized Composites)

- Distribution Channel:

- Offline (Exclusive Brand Stores, Multi-brand Retailers, Interior Designers/Architects)

- Online (E-commerce Platforms, Brand Websites)

- End-User:

- Residential (Apartments, Villas, Vacation Homes)

- Commercial (Hotels, Corporate Offices, Retail Spaces, Yachts/Aviation)

Value Chain Analysis For Luxury High End Furniture Market

The luxury high-end furniture value chain begins with highly selective upstream activities focusing on the sourcing of premium, often rare, raw materials. This includes ethically sourced exotic hardwoods, specialized metals requiring careful refinement, and top-tier textiles or leathers obtained from certified suppliers. Upstream analysis highlights that relationships with material providers are critically important, as material scarcity and quality assurance directly impact the final product's luxury positioning and cost structure. Due to the requirement for specific certifications (e.g., FSC for wood), procurement often involves complex, long-term contracts and robust vetting processes to maintain brand integrity and adhere to sustainability mandates, differentiating this sector significantly from standard furniture production.

The central manufacturing stage involves meticulous craftsmanship, often combining traditional artisanal skills (hand carving, marquetry, intricate stitching) with advanced technology (precision CNC machinery and 3D printing for complex components). Direct and indirect distribution channels define the final stages of the value chain. Direct channels, typically brand-owned flagship stores or dedicated e-commerce sites, allow for complete control over the customer experience, brand messaging, and pricing, facilitating personalized consultations essential for high-value sales. Indirect channels involve collaborations with exclusive high-end interior design firms, architecture studios, and selected multi-brand luxury retailers who manage the final placement and installation of the products, serving as crucial gatekeepers to the affluent clientele.

Downstream analysis is heavily concentrated on tailored logistics, installation, and after-sales service, which are non-negotiable for maintaining the luxury perception. Products require specialized handling, white-glove delivery services, and professional installation teams to ensure perfection upon arrival. Potential customers are often highly sensitive to the overall purchase experience, meaning that efficient, damage-free, and timely delivery is a significant competitive differentiator. This complex logistics network ensures that the product maintains its intrinsic value until it reaches the end-user, often involving detailed coordination between manufacturers, interior designers, and the final client's project management team.

Luxury High End Furniture Market Potential Customers

Potential customers for the Luxury High End Furniture Market primarily comprise High-Net-Worth Individuals (HNWIs) and Ultra High-Net-Worth Individuals (UHNWIs) who possess significant disposable income and place a high intrinsic value on quality, unique design, heritage, and exclusivity. These residential buyers are often undertaking full property renovations, designing new bespoke homes, or investing in luxury secondary residences globally. Their purchasing decisions are heavily influenced by the product's narrative, material provenance, and the reputation of the designer or manufacturer, seeking items that reflect their personal aesthetic achievements and enduring legacy.

In the commercial sphere, the main end-users or buyers include luxury hospitality groups, such as developers and operators of five-star hotels, exclusive resorts, and high-end boutique accommodation providers. These entities require durable, aesthetically impactful furniture that withstands heavy use while contributing significantly to the desired ambiance and brand identity. Furthermore, corporate entities, particularly those setting up executive boardrooms, private members' clubs, and premium real estate sales galleries, constitute significant buyers seeking furnishings that convey professionalism, stability, and success to their elite clientele and stakeholders.

A rapidly expanding segment of potential customers includes specialized interior designers and architectural firms who act as intermediaries, procuring high-end furniture on behalf of their wealthy clients. These professionals are critical influencers who prioritize reliable supply chains, customization flexibility, and adherence to project timelines. The emergence of the 'experience economy' also highlights potential customers in high-value, mobile assets, including private yacht builders and aviation fit-out companies, who demand highly customized, lightweight, and durable luxury furnishings tailored for specific mobile environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 52.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Poltrona Frau, Kettal, Restoration Hardware, Roche Bobois, Knoll, Minotti, B&B Italia, Baxter, Fendi Casa, Boca do Lobo, Ligne Roset, Christopher Guy, Bernhardt Furniture, Drexel Heritage, Henredon, Kartell, Molteni&C, Giorgetti, Cassina, Etro Home Interiors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury High End Furniture Market Key Technology Landscape

The technology landscape within the luxury high-end furniture market is characterized by the strategic integration of digital tools that enhance both the manufacturing precision and the client engagement experience, while carefully preserving the sanctity of traditional craftsmanship. Key technologies involve advanced Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems, which allow designers to model highly complex, curved, or multi-component pieces with millimeter precision, reducing errors in the prototyping phase. The use of sophisticated CNC machines and multi-axis robotics is increasingly prevalent, not to replace artisans, but to execute repetitive or geometrically challenging tasks, thereby freeing master craftspeople to focus on critical finishing and detailing work, ensuring consistency across high-volume custom orders.

On the customer-facing side, the adoption of Extended Reality (XR) technologies, encompassing Virtual Reality (VR) and Augmented Reality (AR), is transforming the sales process. Brands utilize AR applications that allow customers to place true-to-scale 3D models of potential furniture pieces within their actual physical spaces using a mobile device, mitigating risk associated with purchasing high-value items without physically seeing them in context. VR platforms are utilized to build immersive, virtual showrooms accessible worldwide, offering interactive experiences where clients can manipulate materials and finishes in real-time, greatly enhancing the remote design consultation process and facilitating international sales without significant physical presence.

Furthermore, supply chain technologies, particularly blockchain for material traceability and advanced Enterprise Resource Planning (ERP) systems, are being adopted to manage the complexity of bespoke orders and secure the provenance of luxury materials. The incorporation of 'smart furniture' technology—such as integrated wireless charging, hidden speakers, or adjustable mechanisms managed via apps—is a subtle, yet growing trend. This technology must be seamlessly integrated and aesthetically discreet, aligning with the minimalist and high-quality expectations of the luxury consumer, without visually disrupting the design integrity of the piece.

Regional Highlights

North America: North America, led primarily by the United States, represents a dominant segment in the global luxury furniture market, characterized by high consumer expenditure among a large base of HNWIs and a robust demand for high-end residential and commercial real estate. The region’s market is heavily influenced by contemporary and transitional design aesthetics, with a strong emphasis on customizable, environmentally friendly, and technologically integrated furnishings. Brands must navigate a highly competitive landscape where marketing strategies are increasingly focused on direct-to-consumer digital channels and flagship showroom experiences. Strong purchasing power, coupled with frequent renovation cycles in affluent urban centers like New York, Los Angeles, and Miami, sustains consistent, high-value demand, particularly for large-scale interior design projects.

- United States: Largest consumer base driven by resilient wealth generation, technological adoption in sales (AR/VR), and high spending on bespoke residential fittings.

- Canada: Stable demand focused on quality, durability, and a growing interest in European design houses, particularly in metropolitan areas like Toronto and Vancouver.

Europe: Europe remains the heartland of luxury furniture manufacturing, boasting a rich heritage of artisanal excellence and housing many of the world's most iconic luxury design houses, particularly in Italy (Milan), France (Paris), and the UK (London). The European market is defined by a strong preference for heritage brands, handcrafted quality, and timeless design (both classic and avant-garde). Although growth rates may be more measured compared to APAC, the average transaction value remains exceptionally high. The region is a key exporter, setting global trends in materials, craftsmanship, and design philosophy. Regulatory focus on sustainability and material traceability is particularly stringent here, driving product innovation toward certified and eco-conscious production methods.

- Italy: The global benchmark for design, craftsmanship, and material quality; hosts major trade shows like Salone del Mobile that define international trends.

- Germany: Strong demand for precision-engineered, durable luxury furniture, often favoring clean, functional, and minimalist aesthetics.

- United Kingdom: Significant market for high-end interior design services, driven by London’s global status as a wealth hub and constant refurbishments of prime residential properties.

Asia Pacific (APAC): The APAC region exhibits the fastest growth rate globally, propelled by rapidly accumulating wealth, accelerated urbanization, and expansive development of luxury infrastructure, including residential towers, five-star hotel chains, and premium retail spaces. Countries like China and India are major engines of growth, with rising numbers of local millionaires adopting western luxury lifestyle trends while also seeking pieces that integrate cultural heritage with modern sensibilities. The primary challenge for brands in this region involves establishing robust, authorized distribution networks and navigating diverse regulatory environments, though the sheer scale of luxury real estate development presents unmatched opportunities for volume high-end sales.

- China: Exponential growth driven by new HNWIs and large urban property developments; increasing appetite for recognized European luxury brands.

- India: Emerging market with high potential, characterized by a preference for customized and opulent designs, fueled by expanding domestic wealth.

- Japan: Mature luxury market focused on impeccable quality, sophisticated design, and understated elegance; strong appreciation for unique collaborations.

Middle East and Africa (MEA): The MEA region, particularly the GCC countries (UAE, Saudi Arabia, Qatar), is a crucial market for ultra-luxury goods, driven by government investment in tourism, hospitality, and mega-projects (e.g., NEOM). Demand is concentrated on extravagant, highly customized, and opulent furnishings for royal residences, high-end commercial projects, and luxury hospitality ventures. Buyers in this region often prefer large, statement pieces and place a high value on branded exclusivity and personalization. The market is highly price-insensitive but extremely demanding regarding quality and delivery timelines, making robust logistics and installation services essential for success.

- UAE (Dubai/Abu Dhabi): Center for global luxury retail and hospitality development, demanding bespoke, high-cost interior fittings for new hotels and premium residences.

- Saudi Arabia: Massive expenditure on infrastructure and luxury real estate diversification projects creating intense demand for high-volume, high-quality furniture contracts.

Latin America: The Latin American market for luxury high-end furniture is characterized by pockets of concentrated wealth, particularly in major cities like São Paulo, Mexico City, and Santiago. While smaller than other regions, it offers niche opportunities driven by local elite consumers and architectural projects focusing on contemporary design and locally sourced materials. Economic fluctuations and import tariffs present challenges, encouraging some local high-end production but primarily relying on established import channels for top global brands. Demand is highly selective, focusing on sophisticated, durable designs that reflect a fusion of international trends and regional aesthetics.

- Brazil: Largest luxury furniture consumer in the region, with a strong domestic design industry alongside imports, catering to wealthy urban populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury High End Furniture Market.- Poltrona Frau

- Kettal

- Restoration Hardware (RH)

- Roche Bobois

- Knoll

- Minotti

- B&B Italia

- Baxter

- Fendi Casa

- Boca do Lobo

- Ligne Roset

- Christopher Guy

- Bernhardt Furniture

- Drexel Heritage

- Henredon

- Kartell

- Molteni&C

- Giorgetti

- Cassina

- Etro Home Interiors

Frequently Asked Questions

Analyze common user questions about the Luxury High End Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Luxury High End Furniture Market?

The Luxury High End Furniture Market is projected to experience a steady Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by rising global affluence and high-value residential projects.

Which geographic region is exhibiting the fastest growth in the luxury furniture sector?

The Asia Pacific (APAC) region is demonstrating the fastest market growth, attributed to rapid urbanization, increasing disposable income among HNWIs in China and India, and significant investment in luxury hospitality infrastructure.

How is technology, specifically AI and AR, impacting luxury furniture purchasing decisions?

AI is used for predictive trend forecasting and hyper-personalization of designs, while Augmented Reality (AR) and Virtual Reality (VR) platforms enhance the remote customer experience, allowing clients to accurately visualize high-end pieces in their space before purchase, minimizing selection risks.

What are the primary challenges restraining the expansion of the Luxury High End Furniture Market?

Key restraints include the increasing cost and scarcity of ethically sourced premium raw materials, high dependence on specialized artisanal labor, and market volatility stemming from global economic uncertainty, which can defer discretionary high-value purchases.

Which segment holds the largest share of the Luxury High End Furniture Market by end-user?

The Residential segment, encompassing high-net-worth individuals furnishing villas, apartments, and secondary homes, currently holds the largest market share, though the Commercial segment (hotels, corporate offices) represents a rapidly growing high-value application area.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager