Luxury Hotel Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432955 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Luxury Hotel Furniture Market Size

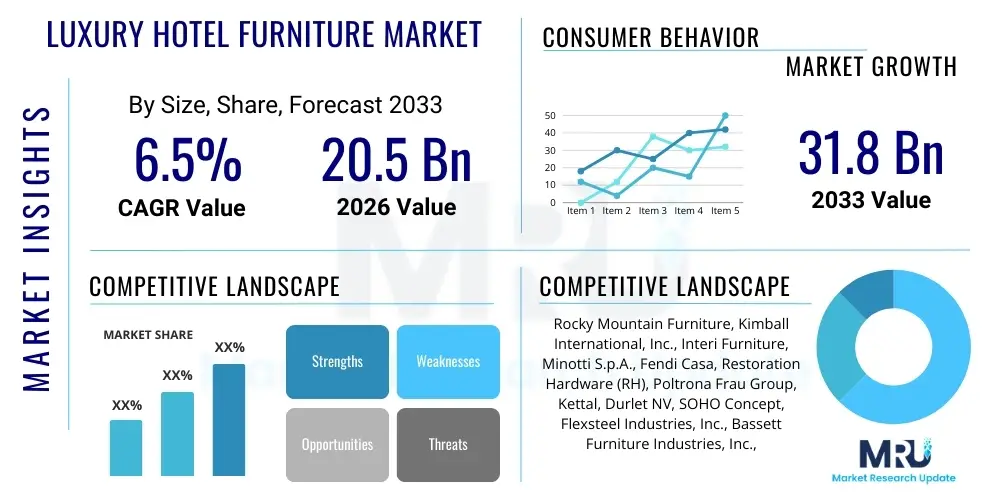

The Luxury Hotel Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $20.5 Billion in 2026 and is projected to reach $31.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the global resurgence in high-end travel and the increasing demand among luxury hospitality brands to differentiate guest experiences through bespoke, high-quality interior design and furnishings. Investment in renovating existing premier properties and the aggressive expansion of international luxury hotel chains, particularly in emerging economies, are key contributors to market valuation increases.

Luxury Hotel Furniture Market introduction

The Luxury Hotel Furniture Market encompasses the design, manufacture, and supply of high-end, custom-made, or designer furniture and fixtures specifically tailored for luxury hospitality environments, including five-star hotels, exclusive resorts, boutique establishments, and high-end serviced apartments. These products are characterized by superior material quality, intricate craftsmanship, durability, aesthetic appeal, and adherence to specific design themes and safety standards required by premium properties. The market provides comprehensive furnishing solutions covering guest rooms, lobbies, dining areas, conference facilities, spas, and exterior spaces, prioritizing comfort, exclusivity, and brand congruence. Luxury hotel furniture serves as a critical component in defining the ambiance and perceived value of a hospitality brand, directly influencing guest satisfaction and loyalty.

Major applications of luxury hotel furniture include furnishing guest suites where sophisticated casegoods, custom seating, and ergonomic fixtures are essential, as well as public spaces requiring grand, durable, and aesthetically striking pieces that handle high traffic while maintaining elegance. The primary benefits derived from these furnishings include enhanced property aesthetics, maximization of space efficiency, provision of exceptional guest comfort, and robust longevity due to high-grade materials and construction. Furthermore, customized luxury furniture allows hotels to achieve unique thematic designs, reflecting local culture or cutting-edge global trends, thereby creating memorable and distinctive guest experiences that justify premium pricing structures. This focus on bespoke design and quality construction minimizes replacement frequency, contributing to better long-term operational cost management.

Key driving factors propelling market expansion include the sustained growth in global tourism, particularly among high-net-worth individuals who demand superlative accommodations, and the intense competition among leading hotel groups forcing continuous investment in property upgrades and new construction. Furthermore, the rising emphasis on sustainable luxury, requiring furniture suppliers to adopt eco-friendly materials and ethical manufacturing processes, has become a significant driver, pushing innovation in design and material science. The trend toward experiential travel, where the hotel itself is considered a destination, further necessitates investment in signature furniture pieces that contribute significantly to the overall narrative and perceived luxury of the establishment, ensuring the market remains dynamic and growth-oriented.

Luxury Hotel Furniture Market Executive Summary

The Luxury Hotel Furniture Market is undergoing transformative growth fueled by aggressive expansion in the Asia Pacific and Middle East regions, coupled with a dominant trend toward hyper-customization and the integration of smart technology into furnishings. Business trends indicate a strong shift towards direct sourcing from specialized contract furniture manufacturers capable of handling large-scale bespoke orders, emphasizing robust supply chain management and speed of delivery. Regional trends show North America maintaining a stable demand based on frequent renovations, while APAC is witnessing unprecedented new property development, driving segment trends focused heavily on sustainable and technologically integrated casegoods and seating solutions. High-quality materials like ethically sourced wood, premium leathers, and innovative composite materials are defining the competitive landscape, where companies offering comprehensive design consultation alongside manufacturing capabilities are gaining significant market share by addressing the holistic needs of luxury developers.

Segmentation trends highlight the increasing dominance of the Casegoods segment, encompassing customized wardrobes, media consoles, and vanity units, due to their essential role in both aesthetic appeal and functionality within luxury suites. Simultaneously, the demand for sustainable luxury is influencing the Material segment, with greater preference for certified wood and recycled or low-VOC content textiles, reflecting the growing environmental accountability of global hospitality giants. Geographically, urbanization and infrastructure development in countries like China, India, and the UAE are creating immense opportunities, requiring suppliers to establish localized production or robust distribution networks. The market is also witnessing consolidation among small and medium-sized bespoke furniture makers, often acquired by larger international players seeking to expand their design portfolio and production capacity, thereby streamlining the highly fragmented supply side.

Overall, the market trajectory is characterized by a balance between timeless design and modern technological integration, ensuring furniture is not only aesthetically luxurious but also future-proofed for smart hotel operations. The challenge for stakeholders lies in managing the complexity of global supply chains, fluctuating raw material costs, and meeting increasingly stringent international design and fire safety standards specific to commercial luxury installations. Success in this specialized market relies on deep collaboration between designers, procurement teams, and manufacturers, focusing intensely on material provenance, craftsmanship integrity, and delivering projects within the critical timelines required by large-scale hotel development cycles, positioning quality and reliability as paramount competitive differentiators.

AI Impact Analysis on Luxury Hotel Furniture Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Luxury Hotel Furniture Market typically revolve around how AI can enhance the design process, optimize supply chain efficiency, and personalize the guest experience through furniture integration. Users frequently inquire about the use of generative design algorithms to create complex, unique furniture shapes that were previously impossible or cost-prohibitive to design manually, and how predictive maintenance using sensors integrated into furniture can extend product life and reduce maintenance costs for hotel operators. Key concerns often center on whether automation might erode the value of traditional craftsmanship, and how AI-driven personalization maintains the "luxury" feel, which is traditionally associated with bespoke, human-led design decisions. Users are particularly keen to understand the role of AI in material selection, optimizing factory floor layouts for custom production runs, and facilitating rapid prototyping based on real-time feedback from designers and clients, ultimately summarizing the expectation that AI will primarily serve as a powerful tool for accelerating customization and improving operational foresight without compromising artisanal quality.

The core themes emerging from user inquiries indicate a desire for faster, more precise, and highly personalized luxury furniture solutions. Expectations are high that AI tools will significantly minimize design iteration cycles, allowing luxury hotel groups to rapidly test and approve unique furniture concepts tailored to specific property demographics and architectural constraints. Furthermore, there is strong interest in using AI for demand forecasting within the procurement departments of hotel groups, ensuring that furniture orders for large projects are timed perfectly to minimize warehousing costs and delivery risks. This analytical application of AI promises to enhance project management significantly, a crucial factor given the typically high capital expenditure and tight construction schedules associated with luxury hotel projects. The ability of AI to simulate material wear and tear under various environmental conditions is also viewed as a critical benefit, informing decisions on durability and long-term investment value.

Ultimately, the consensus suggests AI will be an indispensable operational and creative partner in the luxury furniture sector. It is expected to democratize advanced customization capabilities, making bespoke solutions more scalable and cost-effective, while simultaneously enhancing the efficiency of traditional, high-touch manufacturing processes. The integration of AI-driven smart features—such as embedded climate control sensors, personalized lighting controls within headboards, or real-time occupancy monitoring via integrated seating—is also a major area of anticipated impact, transforming furniture from static décor into interactive elements of the luxury smart room ecosystem. This dual impact, affecting both back-end production and front-end guest interaction, solidifies AI's role as a key disruptive force for market optimization and experiential innovation.

- AI enhances generative design capabilities, allowing for rapid creation and visualization of complex, unique luxury furniture aesthetics tailored to specific architectural dimensions and brand guidelines.

- Predictive modeling optimizes material usage and reduces waste in the manufacturing process, contributing to sustainability goals crucial for high-end luxury brands.

- Supply chain AI tools are implemented for dynamic demand forecasting, inventory management of high-value raw materials, and risk assessment related to global logistics for custom orders.

- Robotics and AI-guided machinery improve precision in specialized tasks like intricate carving, precise cutting, and complex upholstery, supporting artisanal craftsmanship scalability.

- Integrated smart furniture sensors use AI for real-time monitoring of condition, usage patterns, and predictive maintenance scheduling, significantly increasing the furniture lifespan within hotel settings.

- AI-driven personalization engines assist hotel interior designers by suggesting material pairings and stylistic configurations based on global luxury trends and historical performance data of specific furniture types in similar properties.

- Virtual Reality (VR) and Augmented Reality (AR), often powered by AI algorithms, enable clients to interactively review and finalize luxury furniture designs in a simulated hotel environment before physical production begins, drastically reducing errors.

- Chatbots and AI assistants are increasingly used by luxury furniture suppliers for immediate, specialized customer service and technical support inquiries from global procurement teams regarding product specifications and project status updates.

DRO & Impact Forces Of Luxury Hotel Furniture Market

The Luxury Hotel Furniture Market is shaped by a confluence of accelerating drivers (D), significant constraints (R), and latent opportunities (O), creating powerful impact forces that influence strategic decision-making across the value chain. Key drivers include the continuous global investment in high-end tourism infrastructure and the relentless pursuit of unique, memorable guest experiences, compelling hotels to allocate substantial budgets towards customized, high-quality furnishings. Conversely, significant restraints include the volatility of global raw material prices, particularly premium wood and metals, coupled with complex, often slow, international trade regulations that hinder the timely delivery of bespoke products across continents. Opportunities are abundant in the burgeoning market segments of sustainable luxury and smart furniture integration, offering manufacturers a pathway to differentiate their offerings and command premium pricing. These DRO elements combine to form strong impact forces, primarily centered on sustainability pressures and the necessity for global suppliers to build highly resilient, localized, and ethically compliant supply networks to maintain competitive edge and manage inherent market risks effectively.

The impact forces currently defining the market landscape are predominantly driven by ESG (Environmental, Social, and Governance) mandates originating from major luxury hotel operators. These mandates force suppliers to adopt transparent sourcing practices, use certified materials, and minimize carbon footprints associated with manufacturing and transport, making sustainable innovation a critical impact factor. Another major force is the intense focus on design differentiation; as standardization risks commoditizing the luxury experience, suppliers must continuously collaborate with world-renowned designers to launch exclusive collections and custom pieces that establish brand identity. Furthermore, geopolitical instability and subsequent trade tariffs represent external impact forces that necessitate operational flexibility and diversification of sourcing locations, pushing manufacturers to near-shore or re-shore production where economically viable, directly affecting cost structures and lead times for high-value orders.

The strategic dynamics of the market are influenced heavily by the demand for rapid refurbishment cycles in mature markets like North America and Europe, requiring manufacturers to maintain large inventory reserves of semi-finished goods or highly modular designs to meet quick turnaround requirements. In contrast, emerging markets present forces related to large-scale new builds, demanding consistency in quality and volume production while adhering to local aesthetic preferences. Therefore, successful market navigation requires manufacturers to balance the conflicting demands of artisanal, one-off customization typical of boutique luxury and the industrialized efficiency necessary for servicing massive global chain contracts, where material provenance and verifiable quality control documentation are non-negotiable prerequisites for partnership.

Segmentation Analysis

The Luxury Hotel Furniture Market is highly segmented based on the type of furniture, the material used, the application environment within the hotel, and the distribution channel employed for sales. This segmentation is crucial as it allows manufacturers to specialize in specific product lines, such as high-end casegoods or custom outdoor furnishings, addressing the nuanced functional and aesthetic demands of different luxury property types. The diversity in materials, ranging from ethically sourced exotic woods and high-grade metals to innovative recycled composites, reflects the varied design specifications and sustainability commitments of global luxury brands. Analyzing these segments provides strategic insights into consumer preferences, investment priorities of hotel developers, and the most effective routes to market, enabling targeted product development and optimized sales strategies for this high-value sector.

- By Type:

- Casegoods (Wardrobes, Dressers, Headboards, Nightstands, Media Consoles)

- Seating (Sofas, Armchairs, Dining Chairs, Lounge Chairs, Benches, Ottomans)

- Tables (Dining Tables, Coffee Tables, Side Tables, Console Tables, Desks)

- Fixtures and Accessories (Mirrors, Decorative Lighting, Shelving Units, Luggage Racks)

- Outdoor Furniture (Loungers, Patio Sets, Cabanas, Specialty pieces designed for harsh weather)

- By Material:

- Wood (Solid Wood, Engineered Wood, Exotic Veneers, Certified Sustainable Wood)

- Metal (Stainless Steel, Brass, Aluminum, Wrought Iron, Powder-Coated Finishes)

- Fabric and Textile (Velvet, Silk, High-Performance Synthetics, Sustainable Recycled Textiles)

- Leather (Full-Grain, Top-Grain, Vegan Leather Alternatives)

- Stone and Composites (Marble, Granite, Quartz, Advanced Polymer Composites)

- By Application/Hotel Type:

- Business and Conference Hotels (Focus on durability, ergonomics, and integrated technology)

- Leisure and Resort Hotels (Emphasis on experiential design, outdoor resilience, and comfort)

- Boutique and Lifestyle Hotels (Demand for unique, highly curated, artisanal pieces)

- Extended Stay/Serviced Apartments (Requirement for residential-grade, multifunctional furniture)

- Casinos and Gaming Resorts (Need for specialized, high-durability seating and public area furnishings)

- By Distribution Channel:

- Direct Sales and Contract Manufacturers (Primary channel for large custom orders)

- Furniture Dealers and Agents (Intermediaries managing procurement and logistics)

- Online Portals and E-commerce (Growing importance for smaller replacement orders and accessories)

- Retail Showrooms (Used for showcasing design capabilities and capturing smaller luxury project opportunities)

Value Chain Analysis For Luxury Hotel Furniture Market

The value chain for the Luxury Hotel Furniture Market is complex, beginning with the highly selective sourcing of premium raw materials and culminating in the final installation and after-sales service at the luxury property. Upstream analysis focuses on material suppliers, particularly those providing certified exotic woods, high-grade metals, and exclusive textiles. The quality and ethical sourcing practices at this stage are paramount, as the luxury designation is inherently linked to material integrity and environmental responsibility. Manufacturers, acting as the core of the value chain, engage in meticulous design, precision engineering, and often, bespoke craftsmanship. They invest heavily in specialized machinery and highly skilled artisans to produce furniture that meets stringent commercial durability standards while achieving unparalleled aesthetic sophistication. Effective inventory management of these high-value materials is crucial to minimizing lead times and maintaining cost control.

The midstream phase involves manufacturing and distribution logistics, where efficiency in handling custom, large-volume orders determines competitiveness. Luxury furniture often requires specialized packaging, insured international shipping, and complex regulatory compliance across borders, necessitating robust logistics partnerships. Downstream analysis focuses on the final delivery, installation, and interaction with the end-users, primarily the luxury hotel groups, independent developers, and their interior design firms. The distribution channel is heavily skewed toward direct contract sales, where manufacturers work intimately with procurement teams and architects, often bypassing traditional retail routes to ensure seamless integration into the hotel's overall design narrative. This direct model facilitates greater control over customization and quality assurance from factory floor to hotel lobby.

Direct sales, which form the dominant distribution model, involve specialized sales teams engaging directly with hotel ownership groups and design agencies, negotiating contracts based on detailed specifications, compliance requirements, and complex installation schedules. Indirect channels, such as engaging through global procurement agencies or specialized hospitality furniture distributors, are utilized mainly for smaller, regional projects or for supplying standardized, high-volume items like office seating within business hotels. Regardless of the channel, superior project management and extensive after-sales support—including warranties and rapid replacement services for damaged components—are essential differentiators in the luxury segment. The integrity of the value chain is consistently audited by end-users to ensure consistency in quality, ethical practices, and delivery adherence, reinforcing the necessity for transparent and reliable operation at every stage.

Luxury Hotel Furniture Market Potential Customers

Potential customers in the Luxury Hotel Furniture Market are primarily institutional buyers characterized by high capital budgets and stringent quality requirements, centered around the global hospitality industry. The end-users or buyers of these bespoke products include large, international luxury hotel chains like Marriott (Luxury Brands), Hilton (Luxury Collection), Four Seasons, Mandarin Oriental, and Hyatt (Park Hyatt). These corporate entities consistently invest in new properties across high-growth global regions and mandate frequent renovations (typically every 5-7 years) for their existing premium portfolios, driving massive and recurrent demand for high-end furnishings. These clients seek reliable, volume-capable manufacturers who can deliver consistent quality and design integrity across multiple properties worldwide, often under a strict global procurement framework.

Beyond major global chains, independent luxury hotel developers and specialized boutique hotel groups constitute another vital customer segment. These clients often demand furniture that is exceptionally unique, highly artistic, and reflective of a strong individual brand identity, prioritizing design exclusivity and collaboration with high-profile furniture designers over sheer volume capabilities. Their orders, though smaller in quantity per project, frequently involve greater complexity in terms of customization and materials, requiring an artisanal approach from suppliers. Additionally, high-end residential developers building branded residences or luxury serviced apartments, often affiliated with a hotel brand, represent a growing tangential market segment, requiring furniture solutions that bridge commercial durability with residential comfort and style, necessitating sophisticated supplier partnerships.

Furthermore, specialized segments such as luxury cruise line operators and high-end exclusive membership clubs also act as key buyers, requiring bespoke furniture built to withstand unique environmental stresses (e.g., maritime conditions) while maintaining a level of opulence comparable to land-based luxury hotels. Procurement decisions for all these customers are heavily influenced by the recommendations of internationally recognized interior design firms and architectural consultancies specializing in hospitality projects, who often dictate the specific style, material quality, and preferred supplier list. Therefore, successful market penetration requires targeting not just the end-user (the hotel owner) but also the key influencers (the design and architectural firms) that shape the final purchasing specification, emphasizing long-term relationship building and demonstrable project history.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion |

| Market Forecast in 2033 | $31.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rocky Mountain Furniture, Kimball International, Inc., Interi Furniture, Minotti S.p.A., Fendi Casa, Restoration Hardware (RH), Poltrona Frau Group, Kettal, Durlet NV, SOHO Concept, Flexsteel Industries, Inc., Bassett Furniture Industries, Inc., Haworth Inc., Steelcase Inc., Herman Miller, Inc., KOKET, Boca do Lobo, Christopher Guy, Bernhardt Hospitality, Andreu World |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Hotel Furniture Market Key Technology Landscape

The technology landscape in the Luxury Hotel Furniture Market is defined by advanced manufacturing processes and the increasing integration of smart functionality aimed at enhancing both production efficiency and the final guest experience. On the manufacturing side, sophisticated Computer Numerical Control (CNC) machinery and five-axis cutting technology are crucial for achieving the precise tolerances and complex geometries demanded by high-end bespoke designs, particularly for intricate woodwork and metal fabrication. Digital twin technology is increasingly employed, allowing manufacturers to create virtual representations of furniture pieces for quality control, stress testing, and rapid prototyping before committing to expensive, full-scale production runs. This technological reliance ensures that the superior quality associated with luxury is maintained even when production volumes are high, bridging the gap between artisanal craft and industrial scale.

Furthermore, technologies supporting design and visualization have revolutionized client engagement. Advanced 3D rendering software, often utilizing ray tracing for hyper-realistic material presentation, allows clients (hotel operators and interior designers) to visualize the exact look and feel of custom furniture within the planned hotel environment before production commences. The rise of Augmented Reality (AR) and Virtual Reality (VR) tools provides immersive walkthroughs of furnished digital spaces, drastically accelerating the decision-making process and minimizing design errors, which are costly in the luxury segment. This digitalization of the design phase is critical for companies seeking to streamline international collaborative projects involving stakeholders across multiple continents, offering a competitive edge in project speed and accuracy.

In terms of product integration, the deployment of Internet of Things (IoT) technology is transforming luxury furniture into interactive components of the smart hotel room. This includes embedded charging stations (wireless and USB), integrated control panels for room automation (lighting, curtains, temperature), and subtle sensor technology within mattresses and seating to monitor occupancy or adjust settings automatically. The demand for seamless, invisible technology integration is high, ensuring that functionality does not detract from the luxurious aesthetic or the quality of the craftsmanship. Materials science also plays a technological role, with innovations in high-performance, stain-resistant, and fire-retardant textiles, as well as eco-friendly composite materials that meet stringent safety and sustainability standards demanded by modern, environmentally conscious luxury properties.

Regional Highlights

The Luxury Hotel Furniture Market exhibits strong regional disparities in growth dynamics and demand characteristics, heavily influenced by local tourism trends, economic development, and existing hospitality infrastructure. Asia Pacific (APAC) stands out as the primary growth engine, driven by massive urbanization, rising disposable incomes leading to increased domestic and international travel, and aggressive construction of five-star properties in emerging economies like China, India, and Southeast Asia. This region is characterized by a demand for furniture that harmonizes global luxury standards with specific local cultural aesthetics, often necessitating large volume contracts due to the scale of new developments.

North America and Europe represent mature, high-value markets, where growth is primarily sustained by robust cyclical renovation activities and the emergence of new boutique lifestyle hotels focused on highly individualized, small-scale luxury. In these regions, the emphasis is heavily placed on sustainability certifications, durability, and the prestige associated with European design heritage. Procurement decisions are often guided by strict environmental and safety regulations, pushing manufacturers toward certified sustainable wood, low-VOC finishes, and robust fire rating compliance, maintaining a consistent demand for premium, durable replacement furniture over new construction volume.

The Middle East and Africa (MEA), particularly the GCC nations (UAE, Saudi Arabia, Qatar), are experiencing intense luxury tourism development as part of long-term economic diversification strategies, driving exceptional demand for ultra-luxury, often elaborate and highly customized furniture solutions for mega-projects and exclusive resorts. Latin America shows nascent growth, focused primarily in key urban centers and established tourism hotspots, where economic stability dictates the pace of hotel investment. For manufacturers, successful engagement in these varied regions requires establishing localized distribution and sales support to navigate complex import duties, regional aesthetic preferences, and varying construction timelines, prioritizing local expertise alongside global quality consistency.

- Asia Pacific (APAC): Dominates market growth due to rapid luxury hotel construction, particularly in major metropolitan areas and resort destinations in China, India, Thailand, and Vietnam. Strong demand for scalable, high-quality custom casegoods and standardized luxury bedding elements.

- North America: Stable market defined by high average price points and a persistent requirement for renovation projects in established hotel inventory. Focuses heavily on furniture integrating smart technology and adhering to stringent fire and safety codes (e.g., California Technical Bulletin 117).

- Europe: Characterized by high value placed on artisanal quality, historical design integrity, and certified sustainable sourcing (FSC, PEFC). Demand is strongest in Western Europe for boutique hotels and historic property restorations requiring specialized, high-craftsmanship pieces.

- Middle East and Africa (MEA): High-growth area driven by government-backed tourism initiatives and massive resort developments. Demands exceptionally lavish, high-specification, and often large-scale public area furniture, requiring superior material resilience against harsh desert or coastal climates.

- Latin America: Emerging market with localized demand concentrated in business centers (e.g., São Paulo, Mexico City) and high-end coastal resorts. Growth is tied to regional economic stability and requires suppliers capable of navigating complex logistical and import challenges effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Hotel Furniture Market.- Rocky Mountain Furniture

- Kimball International, Inc.

- Interi Furniture

- Minotti S.p.A.

- Fendi Casa

- Restoration Hardware (RH)

- Poltrona Frau Group

- Kettal

- Durlet NV

- SOHO Concept

- Flexsteel Industries, Inc.

- Bassett Furniture Industries, Inc.

- Haworth Inc.

- Steelcase Inc.

- Herman Miller, Inc.

- KOKET

- Boca do Lobo

- Christopher Guy

- Bernhardt Hospitality

- Andreu World

Frequently Asked Questions

Analyze common user questions about the Luxury Hotel Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for custom luxury hotel furniture?

The primary drivers include the global competitive pressure among five-star hotel brands to differentiate the guest experience through unique aesthetics and superior quality. Increased investment in renovations and new property developments, particularly in APAC and the Middle East, necessitates bespoke furniture that meets specific design briefs, safety standards, and enhanced durability requirements for commercial use, moving away from mass-produced solutions.

How does sustainability influence material selection in the luxury hotel furniture sector?

Sustainability is a crucial differentiating factor. Luxury hotel operators increasingly mandate the use of materials certified by organizations like the Forest Stewardship Council (FSC) for wood products, low-VOC (Volatile Organic Compound) finishes, and high-performance recycled or ethically sourced textiles. Suppliers demonstrating verifiable environmental and ethical sourcing practices gain a significant competitive advantage by aligning with the corporate social responsibility goals of major hospitality chains.

Which segmentation (Type or Material) holds the highest market share in the luxury sector?

By Type, Casegoods (including headboards, wardrobes, and media consoles) typically holds the highest revenue share due to their high complexity, customization required, and essential presence in every luxury guest suite. By Material, certified high-quality Wood (solid and premium veneers) remains the foundational material, although high-grade, durable metal and innovative composite materials are rapidly increasing their market presence, especially for outdoor and public area installations requiring exceptional resilience.

What role does technology, specifically IoT, play in modern luxury hotel furniture?

IoT technology integrates seamlessly and often invisibly into luxury furniture, transforming static pieces into functional components of the smart room ecosystem. Examples include embedded wireless charging stations, personalized ambient lighting controls within headboards, subtle occupancy sensors for housekeeping efficiency, and climate control interfaces built directly into desks or nightstands. The objective is enhancing guest comfort, convenience, and operational intelligence without compromising aesthetic luxury.

Which region presents the greatest immediate growth opportunity for luxury hotel furniture manufacturers?

The Asia Pacific (APAC) region currently offers the greatest immediate growth opportunity, driven by sustained economic growth, a burgeoning middle and high-net-worth class, and rapid expansion in hospitality infrastructure, particularly in developing nations. Manufacturers focusing on large-scale production capabilities combined with local design adaptability and efficient supply chain logistics are best positioned to capitalize on the region's intense demand for new luxury furnishings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager