Luxury Kitchen Plumbing Fixtures Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435777 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Luxury Kitchen Plumbing Fixtures Market Size

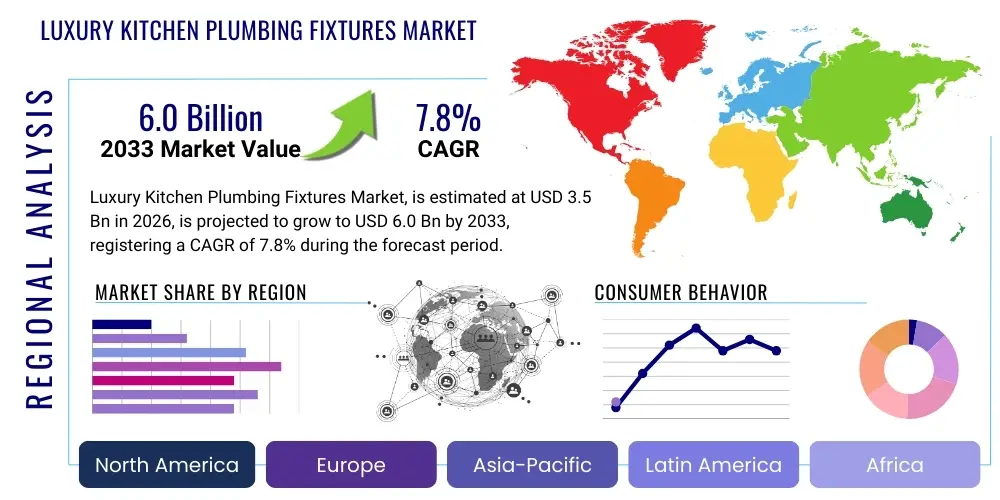

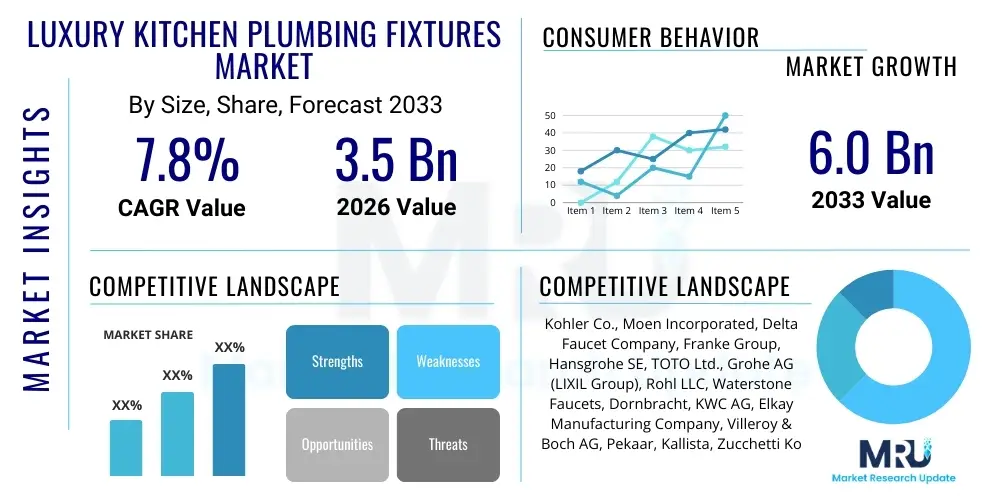

The Luxury Kitchen Plumbing Fixtures Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033.

Luxury Kitchen Plumbing Fixtures Market introduction

The Luxury Kitchen Plumbing Fixtures Market encompasses high-end, premium-priced components designed for sophisticated kitchen environments, prioritizing aesthetics, advanced functionality, and superior material quality. These products typically include designer faucets, bespoke sinks (often featuring specialty metals or composite materials), smart water delivery systems, and coordinated accessories that elevate the overall kitchen design. This market segment caters primarily to affluent homeowners, high-end residential builders, and hospitality sectors focused on luxury property development where performance and exclusivity are paramount considerations. The demand is heavily influenced by global wealth expansion, rising disposable incomes in emerging economies, and the increasing consumer trend towards kitchen renovations as a key element of home valuation and lifestyle enhancement.

The core product description revolves around durability, innovative design, and technological integration, such as touchless operation, precision temperature control, and water conservation features, all packaged within aesthetically pleasing finishes like polished nickel, matte black, or brushed gold. Major applications span luxury single-family homes, upscale multi-unit residential complexes (condominiums and apartments), and premium hospitality spaces, including five-star hotels and gourmet restaurants. The substantial benefits offered by these fixtures include enhanced kitchen ergonomics, improved hygiene through advanced material technology (e.g., antimicrobial coatings), significant energy and water savings, and the long-term investment value derived from using durable, high-quality components.

Driving factors stimulating this market include the growing focus on personalization and customization within home décor, the recovery and subsequent growth in the global construction sector targeting high-net-worth individuals, and continuous innovation by manufacturers leading to the introduction of smart fixtures compatible with home automation systems. Furthermore, increasing consumer awareness regarding sustainable and eco-friendly products is boosting the adoption of luxury fixtures that offer superior water efficiency without compromising flow or aesthetic appeal. The aspirational nature of luxury branding and the desire for professional-grade functionality in residential settings further solidify the market's trajectory toward robust expansion.

Luxury Kitchen Plumbing Fixtures Market Executive Summary

The Luxury Kitchen Plumbing Fixtures Market is experiencing robust growth driven by converging trends in high-end construction and technological sophistication. Business trends indicate a strong focus on direct-to-consumer digital sales channels, allowing premium brands to bypass traditional retail distribution and maintain higher margins while offering enhanced customer customization options. Strategic partnerships between luxury plumbing manufacturers and interior designers or custom cabinet makers are becoming essential to secure specifications in high-value projects early in the development cycle. Additionally, sustainability has transitioned from a niche requirement to a core business mandate, compelling companies to invest in eco-certified manufacturing processes and products offering significant water reduction, thereby attracting environmentally conscious affluent consumers.

Regional trends highlight North America and Europe as established markets characterized by mature demand for smart and technologically integrated fixtures, benefiting from strong consumer purchasing power and a culture of frequent high-end home renovation. However, the Asia Pacific region, particularly China and India, represents the fastest-growing market segment, fueled by rapid urbanization, significant growth in the high-net-worth individual population, and the expansion of luxury housing projects. Latin America and the Middle East continue to show promising growth, primarily driven by substantial government investments in large-scale infrastructure projects, including luxury resort developments and exclusive residential communities, which prioritize imported, high-quality European and American fixtures.

Segmentation trends reveal that Product Type segmentation, particularly advanced kitchen faucets featuring pull-down sprayers, motion sensors, and digital controls, commands the largest market share due to their frequent usage and technological complexity. In terms of material, brass and high-grade stainless steel remain dominant, although the adoption of composite materials and specialty finishes (e.g., PVD coatings) is growing rapidly due to their exceptional durability and unique aesthetic versatility. The application segment continues to be led by the residential sector, but the increasing number of luxury hotel and commercial catering projects globally provides a consistently expanding secondary market, driving demand for heavy-duty, commercial-grade luxury products designed for continuous operation and easy maintenance.

AI Impact Analysis on Luxury Kitchen Plumbing Fixtures Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Luxury Kitchen Plumbing Fixtures Market reveals concentrated interest in two main areas: optimizing design and manufacturing processes, and enhancing the end-user experience through smart home integration. Users frequently inquire about how AI can predict future design trends and material preferences, allowing manufacturers to reduce time-to-market for new collections. There is significant concern regarding the integration complexity of high-end fixtures with existing smart kitchen ecosystems (e.g., compatibility with Google Home or Amazon Alexa). Consumers also show high expectations for AI-driven maintenance and predictive failure alerts—asking if a luxury faucet can self-diagnose low water pressure or potential leaks before they occur, thus justifying the premium price point through unparalleled reliability and user convenience.

In manufacturing, AI is crucial for optimizing supply chains for bespoke components and performing advanced quality control. High-end fixtures often involve intricate casting, machining, and finishing processes where minute defects are unacceptable. AI-powered computer vision systems can inspect surface finishes, ensuring flawless application of PVD coatings or perfect alignment of complex mechanical parts, thereby drastically reducing waste and maintaining the brand's reputation for impeccable quality. Furthermore, predictive modeling helps manage volatile raw material costs (like brass and specialty metals) and ensures efficient inventory management for customized, low-volume orders typical of the luxury segment.

For the consumer, AI integration extends beyond simple voice activation. Advanced luxury fixtures leverage machine learning to personalize water usage profiles, such as remembering optimal temperatures for specific tasks (e.g., brewing coffee versus washing delicate produce) and automatically adjusting flow rates to minimize splashback based on sink geometry. This level of personalized, intelligent interaction transforms the fixture from a utility item into an integrated kitchen assistant, significantly boosting the perceived value. This digital sophistication ensures that luxury plumbing remains relevant in the broader smart home ecosystem, securing market penetration among tech-savvy affluent buyers.

- AI-driven Predictive Maintenance: Fixtures monitor performance metrics and alert users or maintenance professionals to potential issues (e.g., flow restrictions, subtle leaks).

- Optimized Manufacturing Quality: AI vision systems ensure zero-defect surface finishes and precise component assembly crucial for luxury branding.

- Personalized User Experience: Machine learning algorithms customize water temperature, pressure, and flow patterns based on usage habits.

- Design Trend Forecasting: AI analyzes consumer data and design sentiment to accelerate the development cycle of next-generation luxury collections.

- Enhanced Supply Chain Resilience: Predictive analytics optimize inventory for specialized materials and reduce lead times for custom orders.

DRO & Impact Forces Of Luxury Kitchen Plumbing Fixtures Market

The dynamics of the Luxury Kitchen Plumbing Fixtures Market are heavily influenced by a triad of market forces: Drivers, Restraints, and Opportunities (DRO). Key drivers include the global increase in high-net-worth individuals (HNWIs) leading to a greater demand for bespoke and designer homes, coupled with a cultural shift where the kitchen is viewed as the central entertainment hub, demanding professional-grade aesthetics and functionality. This is reinforced by sustained global real estate investment in luxury residential properties, particularly in emerging markets. Simultaneously, continuous technological innovation, such as the miniaturization of sensors and integration of IoT connectivity, compels consumers to upgrade older, less efficient fixtures, creating a perpetual replacement cycle in established markets. These drivers collectively push market valuation higher and encourage manufacturers to invest heavily in R&D.

However, the market faces significant restraints that temper growth expectations. The primary restraint is the inherently high cost associated with luxury raw materials (such as solid brass, copper, and specialized surface coatings) and meticulous, low-volume production techniques. This high cost can make these products vulnerable to economic downturns or fluctuations in building material commodity prices, leading to project delays or budget cuts in non-essential areas. Furthermore, the market struggles with intense competition from counterfeit and unauthorized premium replicas, particularly in regions with lax intellectual property enforcement, which undermines brand equity and potentially erodes legitimate market share. Installation complexity, requiring specialized professional labor, also acts as a restraint, limiting the DIY market segment typically accessible to standard fixture manufacturers.

Opportunities for expansion are abundant, centered around geographical diversification and product specialization. Major opportunities lie in penetrating the rapidly growing luxury renovation market in established economies, focusing on sustainable and water-saving fixtures that qualify for government incentives or certifications (like LEED). Furthermore, the integration of health and wellness features, such as advanced filtration systems built into high-end faucets, presents a strong avenue for product differentiation. The transition toward modular kitchen design and the rise of smart home compatibility standards offer manufacturers opportunities to create integrated plumbing suites that communicate seamlessly with other appliances, positioning them as essential components of the modern smart luxury home infrastructure, thus maximizing cross-selling potential and increasing average transaction values.

Segmentation Analysis

The Luxury Kitchen Plumbing Fixtures Market is comprehensively segmented based on material, product type, application, and distribution channel, providing a granular view of consumer preferences and investment areas. This segmentation helps manufacturers tailor their product lines and marketing strategies to specific end-user requirements and regional economic realities. The key segments reflect the interplay between aesthetic requirements (Material and Finish), functional needs (Product Type), and the purchase environment (Application and Distribution). Analyzing these segments is critical for identifying fast-growing niches, such as smart faucets within the Product Type segment, and high-value materials, such as PVD-coated stainless steel, which offer superior durability and unique color palettes.

- By Product Type: Faucets, Sinks, Accessories (e.g., Dispensers, Drains, Filtration Systems)

- By Material: Stainless Steel, Brass, Composite Materials, Specialty Metals (e.g., Copper, Titanium)

- By Application: Residential (New Construction, Renovation), Commercial (Hotels, Restaurants, Institutions)

- By Distribution Channel: Offline (Specialty Stores, Showrooms, Home Centers), Online (E-commerce Platforms, Brand Websites)

Detailed Analysis of Product Type Segmentation: The Faucets segment dominates the market share, driven by rapid innovation in digital and touchless technologies. Luxury faucets are no longer simple valves but complex, connected devices offering features like precise volumetric dispensing, temperature memory, and integration with voice assistants. Manufacturers are competing aggressively on design patents, focusing on ergonomic improvements and minimalist aesthetics that align with contemporary kitchen architecture. The premium pricing associated with these technologically advanced faucets ensures this segment retains its leading position in terms of market value, despite the smaller physical volume compared to standard fixtures.

The Sinks segment is characterized by a strong shift toward large-format, functional workstations. Luxury sinks often incorporate integrated cutting boards, drying racks, and multiple basin configurations, transforming the sink area into a comprehensive food preparation zone. Materials like granite composite and specialized thick-gauge stainless steel are preferred for their durability, sound-dampening qualities, and resistance to staining and heat. The demand for bespoke sizes and specialized finishes that match countertop materials is a defining trend, indicating high customization requirements from the end-user base in this high-end segment, particularly within new luxury residential construction projects that demand seamless integration.

Accessories, while smaller in volume, represent a crucial segment for maximizing profitability and ensuring a cohesive luxury experience. This includes high-end soap and lotion dispensers, sophisticated garbage disposal flanges, integrated water filtration taps, and decorative drain covers. The growth in this segment is driven by the consumer desire for complete, coordinated plumbing suites where every visible element reflects the premium brand aesthetic. High-margin items, such as multi-stage under-sink filtration systems that provide purified and mineralized drinking water, are seeing accelerated adoption, often bundled with primary fixture purchases to enhance total transaction value.

Detailed Analysis of Material Segmentation: Brass remains the foundational material for luxury faucet bodies due to its superior durability, malleability for complex designs, and corrosion resistance. In the luxury segment, lead-free brass alloys are standard, often finished with durable PVD (Physical Vapor Deposition) coatings or thick electroplating to achieve lasting aesthetic appeal in finishes like matte black, polished chrome, and brushed bronze. The perception of solid brass as an inherently high-quality material supports its premium pricing and enduring popularity among designers and homeowners alike who seek longevity.

Stainless Steel is paramount for sink manufacturing, especially in the thickest gauges (16-gauge or lower) to minimize dents and noise. Luxury stainless steel sinks often feature unique surface textures, such as proprietary satin finishes or hand-hammered looks, differentiating them from mass-market offerings. For faucets, high-grade 304 and 316 stainless steel are increasingly utilized for extreme durability and resistance to harsh chemicals, catering specifically to markets requiring highly robust, commercial-grade residential fixtures, further boosting its adoption within the ultra-high-end segment where resilience is critical.

Composite Materials, particularly granite and quartz composites, are gaining significant traction in the sink market. These materials offer exceptional resistance to scratching, chipping, and heat, alongside a vast range of color options that provide design flexibility previously unavailable with metal sinks. The high density and non-porous nature of these materials also appeal to hygiene-conscious consumers. The increasing sophistication in composite molding and finishing techniques allows manufacturers to produce sleek, integrated designs that mimic natural stone or concrete, providing a modern alternative to traditional metal sinks at a competitive luxury price point.

Value Chain Analysis For Luxury Kitchen Plumbing Fixtures Market

The value chain for the Luxury Kitchen Plumbing Fixtures Market begins with upstream activities focused on securing high-quality, often proprietary, raw materials. This typically involves sourcing lead-free brass ingots, high-grade stainless steel sheets, specialized ceramic cartridges, and advanced PVD coating chemicals. Given the quality mandate of the luxury segment, manufacturers prioritize long-term, direct relationships with certified material suppliers to ensure consistency and compliance with stringent international standards (e.g., low lead content regulations in North America and Europe). Upstream analysis also includes the specialized R&D involved in developing proprietary aesthetic finishes and patented internal components, such as high-efficiency aerators and precision digital valves, representing a significant investment cost.

The midstream process involves precision manufacturing, assembly, and finishing. Unlike standard fixtures, luxury products require extensive hand-polishing, intricate casting (often done via the lost-wax method for complex faucet shapes), and advanced assembly of electronic components. Quality control checkpoints are intensely rigorous, often utilizing computerized inspection systems to ensure flawless surface finishes and leak-proof performance. Packaging and logistics are also critical in the midstream, as luxury items demand specialized, protective packaging to maintain their pristine condition during transit to showrooms or job sites, reinforcing the premium brand perception upon unboxing.

Downstream activities are dominated by highly selective distribution channels. The primary channel involves specialized kitchen and bath showrooms, high-end interior design firms, and architectural specification teams, often referred to as indirect distribution. These intermediaries provide expert consultation and installation recommendations, which are vital for complex luxury products. Direct sales through brand-owned flagship stores or sophisticated e-commerce platforms also play an important role, offering direct access to consumers and allowing brands to control the narrative and pricing. The final stage involves professional installation and comprehensive after-sales service, which is a significant component of the luxury value proposition, guaranteeing long-term fixture performance and customer satisfaction.

Luxury Kitchen Plumbing Fixtures Market Potential Customers

The primary end-users and buyers in the Luxury Kitchen Plumbing Fixtures Market are high-net-worth individuals (HNWIs) undertaking new construction of custom homes or large-scale, high-end renovations of existing residences. These customers prioritize long-term quality, unique design elements, advanced technological features (such as smart functionality), and products that enhance the overall aesthetic value of their property. For this discerning segment, plumbing fixtures are viewed less as functional components and more as investments in interior architecture and expressions of personal style. Decisions are often heavily influenced by recommendations from architects, interior designers, and kitchen remodel specialists who frequently specify fixtures from established luxury brands known for design innovation and superior warranty service.

A rapidly growing segment of potential customers includes professional developers specializing in luxury multi-unit residential projects, such as premium condominiums and exclusive apartment complexes in metropolitan areas. These developers purchase fixtures in moderate bulk quantities but demand consistency, timely supply, and compliance with stringent commercial-grade durability standards, even within residential settings. For these institutional buyers, the perceived brand value of the installed fixtures contributes directly to the marketing and resale value of the property, making them highly sensitive to brand reputation and design alignment with the building's overall luxury theme. This segment drives volume demand for popular, high-performing luxury lines.

The commercial sector, specifically high-end hospitality and fine dining establishments, represents a distinct segment of potential customers. Luxury hotels and gourmet restaurants require fixtures that combine stunning aesthetics with extreme durability to withstand continuous heavy use and specialized cleaning regimens. They are primary buyers of robust, commercial-grade luxury products designed for high traffic, often prioritizing touchless technology for hygiene and operational efficiency. The prestige of installing recognized luxury brands in these public-facing spaces also serves as a subtle marketing tool, aligning the establishment's quality standards with the premium image of the installed fixtures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kohler Co., Moen Incorporated, Delta Faucet Company, Franke Group, Hansgrohe SE, TOTO Ltd., Grohe AG (LIXIL Group), Rohl LLC, Waterstone Faucets, Dornbracht, KWC AG, Elkay Manufacturing Company, Villeroy & Boch AG, Pekaar, Kallista, Zucchetti Kos, Blanco GmbH + Co KG, Fantini, Perrin & Rowe, Newport Brass |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Kitchen Plumbing Fixtures Market Key Technology Landscape

The technological landscape of the Luxury Kitchen Plumbing Fixtures Market is defined by the convergence of advanced material science, digital control systems, and integrated connectivity. A primary technological focus is on durable, aesthetic finishes, specifically Physical Vapor Deposition (PVD) technology. PVD coatings allow manufacturers to produce exceptionally hard, scratch-resistant finishes in unique colors (like brushed gold or matte gunmetal) that exceed the longevity and aesthetic stability of traditional electroplating. This technology is critical for maintaining the pristine appearance expected of luxury products over their long lifespan, resisting corrosion and tarnishing even in demanding kitchen environments, thereby justifying the significant price premium consumers pay for these specialized fixtures.

Another pivotal technological advancement is the integration of electronic control and sensor technology. This includes motion-sensing activation (touchless operation for faucets), digital temperature and flow control (allowing users to set precise measurements), and Bluetooth or Wi-Fi connectivity for integration into smart home systems. Advanced ceramic disc cartridges equipped with sophisticated sensors ensure precise control and prevent drips, enhancing water conservation efforts while providing a seamless user interface. The move towards low-voltage electronics in wet environments requires specialized engineering and certified waterproof components, ensuring both safety and reliable performance necessary for these high-value fixtures.

Furthermore, water quality and sustainability technologies are becoming standard features in the luxury segment. High-end faucets increasingly incorporate multi-stage filtration systems, including carbon block and reverse osmosis technology, often concealed seamlessly within the fixture or cabinet base. The development of high-efficiency aerators and flow regulators that maintain strong water pressure while significantly reducing water consumption (exceeding minimum required standards) is a major selling point. Material innovations also extend to sink construction, including advanced composite formulations that are resistant to thermal shock and bacteria growth, catering to the growing consumer demand for kitchen environments that prioritize health and hygiene alongside sophisticated design aesthetics.

Regional Highlights

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (UAE, Saudi Arabia, South Africa)

North America: Market Maturity and Innovation Adoption

North America holds a dominant position in the Luxury Kitchen Plumbing Fixtures Market, characterized by high consumer purchasing power, a strong culture of home renovation and remodeling, and early adoption of smart home technology. The U.S., specifically, drives demand due to a high volume of custom residential construction projects and a preference for large, professional-grade kitchen appliances and fixtures. Consumers here show a marked preference for products that offer connectivity, voice activation, and advanced water conservation features, often specifying brands known for robust warranties and comprehensive local service networks. Regulatory standards, such as those related to lead-free materials, also shape the product offerings, compelling manufacturers to adhere to stringent quality control, reinforcing the luxury brand commitment.

The competitive landscape in this region is intense, with both domestic industry giants and premium European imports vying for market share through targeted designer partnerships and extensive showroom presence. Key growth areas include metropolitan hubs like New York, Los Angeles, and Miami, where luxury high-rise developments continuously require top-tier fixtures. The market benefits significantly from the stability of the housing market and the tendency of affluent homeowners to view kitchen upgrades as crucial long-term investments that increase property valuation. Consequently, manufacturers prioritize the development of intuitive digital controls and customizable finishes tailored to regional design aesthetics.

Moreover, the rise of the specialized distributor and installer network in North America facilitates the sale of complex luxury fixtures. Architects and designers rely heavily on these distribution channels for product specification, material samples, and detailed technical support, ensuring that products are correctly integrated into sophisticated kitchen layouts. The demand for coordinating luxury accessories, such as filtered hot/cold water dispensers and integrated soap dispensers matching the primary faucet finish, is particularly strong, driving high average transaction values per installation project in the luxury renovation segment.

Europe: Design Heritage and Material Excellence

Europe represents a crucial market for luxury plumbing, deeply rooted in design heritage, precision engineering, and a focus on sustainability. Countries like Germany, Italy, and Switzerland house numerous globally recognized luxury brands that set international trends in both aesthetics and manufacturing quality. The European market prioritizes timeless design, heavy-duty materials (such as solid brass and high-end ceramics), and minimalist functionality, often influenced by contemporary architecture. Strict EU regulations concerning water usage and material composition also ensure high standards, driving innovation in efficient flow technology and lead-free material procurement, which further solidifies the region’s commitment to premium quality.

Demand is stable, fueled by steady luxury residential construction and a strong emphasis on preservation and high-quality restoration projects. Unlike North America, where technology integration is key, many European consumers place higher value on the tactile experience, mechanical precision, and the long-standing reputation of the brand. Showrooms and specialty boutiques are the preferred distribution channels, offering highly personalized consultation services necessary for bespoke installations. The market is less fragmented than others, with established brands holding strong positions based on centuries of craftsmanship and design authority, making brand loyalty a significant factor.

The U.K. and France demonstrate robust growth, particularly in urban centers, linked to the regeneration of high-value properties and the expansion of the high-end hospitality sector. There is an increasing adoption of PVD finishes and specialized materials to achieve unique kitchen aesthetics without compromising durability. Furthermore, sustainability concerns drive the popularity of fixtures certified for exceptional water efficiency, aligning with European green building codes. The blending of classic, elegant design with subtle technological enhancements (e.g., hidden sensor technology) is a defining characteristic of the successful luxury product lines in this region.

Asia Pacific (APAC): Fastest Growth Trajectory

The Asia Pacific region is the fastest-growing market globally for luxury plumbing fixtures, propelled by unprecedented economic growth, rapid urbanization, and a dramatic increase in the high-net-worth population, particularly in China and India. The demand here is characterized by an aspirational desire for global luxury brands, viewing them as status symbols indicative of wealth and sophistication. Large-scale infrastructure and residential projects, including integrated resort complexes and high-end smart cities, are major consumers of luxury plumbing, often importing fixtures from Western brands known for their superior quality and innovative design.

China leads the regional growth, driven by substantial investment in luxury housing and commercial real estate development. Consumers in APAC exhibit a high affinity for technological features, favoring smart faucets with digital displays, touch controls, and purification systems suitable for local water quality challenges. However, the market is highly diverse; while developed economies like Japan show strong demand for sophisticated, space-saving designs and meticulous craftsmanship, emerging economies prioritize aesthetic impact and brand recognition, leading to varied product line performance across the region.

Distribution in APAC often relies on strong partnerships with local developers and highly curated, exclusive brand showrooms in major financial districts. E-commerce penetration is rising rapidly, but for high-value purchases, physical inspection and expert consultation remain essential. Market participants must navigate complex regional supply chain logistics and varying import tariffs, emphasizing the importance of strong local presence and effective after-sales support to cater to the discerning and rapidly expanding base of affluent consumers throughout the area, from South Korea to Southeast Asian markets.

Latin America & Middle East and Africa (LAMEA): Emerging High-Value Markets

The LAMEA region presents fragmented but high-value opportunities for luxury plumbing fixture manufacturers. In the Middle East, particularly the UAE and Saudi Arabia, demand is exceptionally high, driven by massive government investments in luxury tourism, mixed-use developments, and ambitious residential projects (e.g., NEOM, Dubai Creek Harbour). These projects require fixtures of the highest caliber, often customized in materials like gold or specialized finishes to match opulent interior specifications. The climate dictates a strong preference for durable, corrosion-resistant materials capable of handling extreme temperatures and high mineral content in water supplies, often favoring high-gauge stainless steel and robust brass constructions.

Latin America, while influenced by macroeconomic volatility in countries like Brazil and Argentina, maintains a steady luxury segment driven by wealthy individuals seeking premium, imported goods that offer superior design and longevity compared to local alternatives. The market is sensitive to import duties and currency fluctuations, making robust local distribution and pricing strategies crucial for sustained success. Luxury consumption often centers in capital cities, focusing on exclusive residential areas and high-end retail developments that showcase international design trends. Brands successful in this region often emphasize products that combine European aesthetics with features built for local water pressure variations.

Overall, both sub-regions rely heavily on project-based sales and specification by architectural firms, rather than individual retail purchases. Success hinges on establishing reliable supply chains capable of handling large-scale commercial orders and offering dedicated technical support to large property developers. The demand consistently focuses on unique aesthetics, often including bold colors and highly polished metallic finishes, reflecting regional architectural styles and preferences for conspicuous luxury consumption in key financial and tourism hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Kitchen Plumbing Fixtures Market.- Kohler Co.

- Moen Incorporated

- Delta Faucet Company

- Franke Group

- Hansgrohe SE

- TOTO Ltd.

- Grohe AG (LIXIL Group)

- Rohl LLC

- Waterstone Faucets

- Dornbracht

- KWC AG

- Elkay Manufacturing Company

- Villeroy & Boch AG

- Pekaar

- Kallista

- Zucchetti Kos

- Blanco GmbH + Co KG

- Fantini

- Perrin & Rowe

- Newport Brass

Frequently Asked Questions

What are the primary factors driving the growth of the Luxury Kitchen Plumbing Fixtures Market?

Market growth is primarily driven by the rising global population of high-net-worth individuals, increasing consumer focus on kitchen remodeling as a home value investment, and rapid technological integration, including smart, touchless, and IoT-enabled fixtures.

Which product segment holds the largest value share in the luxury market?

The Faucets segment holds the largest value share due to the intense pace of technological innovation (digital controls, sensors, smart connectivity) and the high average selling price associated with these complex, feature-rich products compared to sinks and accessories.

How does the Asia Pacific region impact the global luxury plumbing market forecast?

Asia Pacific is projected to be the fastest-growing region, fueled by rapid urbanization, significant growth in luxury real estate development (particularly in China and India), and the strong aspirational demand for established European and North American luxury brands.

What role does sustainability play in high-end plumbing fixture selection?

Sustainability is a core driver; luxury consumers increasingly demand fixtures with superior water conservation features (high-efficiency aerators), lead-free materials, and eco-certified manufacturing processes, aligning ethical consumerism with premium product quality.

What material finish technology is essential for luxury fixtures?

Physical Vapor Deposition (PVD) coating is essential. PVD ensures exceptional durability, resistance to scratching and tarnishing, and allows for unique, sophisticated finishes (e.g., matte black, brushed brass) that meet the long-term aesthetic requirements of the luxury consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager