Luxury Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438197 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Luxury Rental Market Size

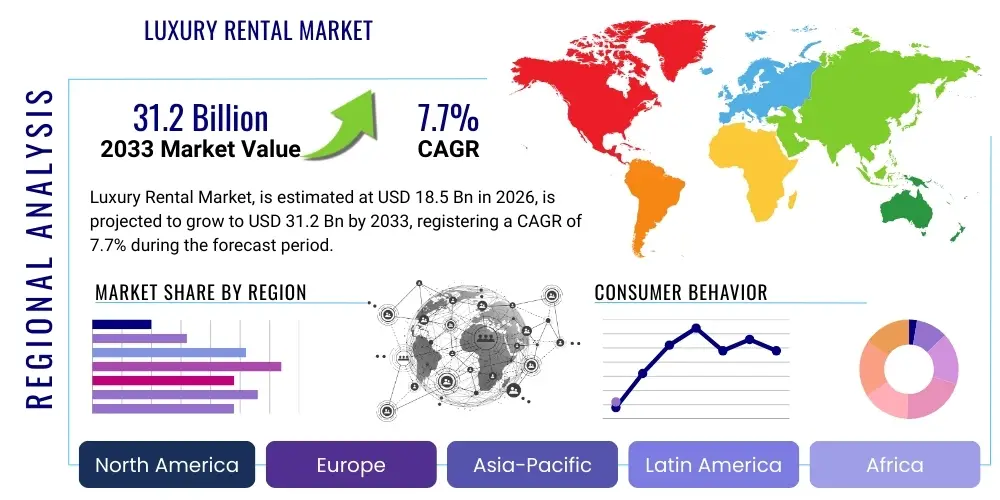

The Luxury Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.7% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 31.2 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global wealth concentration, the rising preference among High-Net-Worth Individuals (HNWIs) for experiential travel and flexible living arrangements, and the continuous development of exclusive, amenity-rich rental properties in prime global locations.

The valuation reflects a significant shift in consumer behavior, where ownership is being increasingly supplanted by high-end, flexible occupancy models. Market expansion is driven not only by traditional residential leasing but also by the burgeoning demand for short-term luxury villa rentals, private yacht charters, and exclusive event spaces. Factors such as geopolitical stability, favorable regulatory environments for foreign investment in certain luxury hubs, and the digitalization of booking and concierge services are key contributors to the projected financial expansion.

Luxury Rental Market introduction

The Luxury Rental Market encompasses high-value, exclusive properties and assets offered for temporary occupancy or use, catering primarily to the affluent demographic seeking privacy, premium services, and unique experiences without the long-term commitment of ownership. This market segment includes ultra-luxury apartments, expansive villas, private islands, high-end vacation homes, and specialized assets like prestige automobiles and private jets leased for extended periods. Key driving factors include the diversification of investment portfolios among the elite, the desire for frictionless living through comprehensive concierge services, and the global trend toward remote work flexibility which fuels demand for luxurious temporary residences in diverse geographical areas.

The primary applications of luxury rentals span across leisure tourism, corporate accommodation for senior executives, transitional housing during asset acquisition or renovation, and exclusive destination hosting for high-profile events. Product descriptions often highlight bespoke architectural design, state-of-the-art smart home technology, integrated wellness facilities, and highly personalized service provisions, differentiating them substantially from general rental market offerings. The distinct benefits offered to tenants include unmatched privacy, access to world-class amenities, enhanced security protocols, and immediate flexibility to relocate or terminate occupancy, mitigating the administrative burdens associated with property maintenance and management.

Furthermore, the market's dynamism is highly influenced by global economic health and the stability of the residential real estate market; often, when purchase prices become prohibitively high or volatile, HNWIs pivot toward high-quality rentals. Technological advancements, particularly in virtual reality tours and secure digital contracts, have streamlined the leasing process, broadening the market’s geographical reach. The convergence of lifestyle services, such as private chef integration and bespoke travel planning, embedded within the rental package, fortifies the premium nature and desirability of these luxury assets, securing the market's upward trajectory.

Luxury Rental Market Executive Summary

The Luxury Rental Market is characterized by resilient growth, driven by shifting perceptions of wealth management, increased global mobility among HNWIs, and the paramount importance of privacy and bespoke service integration. Current business trends indicate a strong move toward fractional ownership hybrid models and the expansion of branded residences managed by prestigious hotel groups, ensuring consistent service quality across diverse portfolios. Regional trends emphasize heightened investment in emerging luxury hubs in the Asia Pacific, particularly metropolitan areas like Singapore and Sydney, while traditional markets such as New York, London, and the French Riviera continue to command premium rates due to enduring prestige and established infrastructure. Segmentation analysis reveals the short-term rental segment, particularly villa and vacation rentals, outpacing long-term residential leasing due to the post-pandemic boom in personalized, private travel experiences, necessitating robust digital platforms and sophisticated property management infrastructure to handle high turnover and maintenance demands efficiently.

Key strategic challenges involve managing regulatory changes concerning short-term rentals in major urban centers and maintaining scarcity and exclusivity as more developers enter the market. To counteract saturation, leading market players are focusing heavily on differentiation through sustainability certifications and wellness-focused architectural designs. The integration of advanced security features, including biometric access and comprehensive surveillance systems, remains a primary requirement for securing high-net-worth clientele. Economic factors, such as fluctuating interest rates and global inflation, marginally affect this market, but the inherent inelasticity of demand from the ultra-wealthy ensures sustained rental income stability, making it an attractive asset class for institutional investors seeking stable, high-yield returns.

Looking ahead, the executive outlook forecasts a tightening of the ultra-luxury inventory, especially in coastal and primary metropolitan areas, intensifying competition among property management firms focused on retaining exclusive listings. Technology adoption is critical, specifically in leveraging predictive analytics to optimize pricing strategies based on seasonal demand, local event calendars, and global travel patterns. The convergence of residential rental services with high-end hospitality management is the dominant operational trend, establishing a gold standard for tenant experience. This continuous enhancement of service standards and inventory exclusivity is paramount for capital preservation and continued market leadership in the highly competitive luxury rental landscape.

AI Impact Analysis on Luxury Rental Market

Common user inquiries regarding AI in the Luxury Rental Market frequently revolve around personalized property recommendations, dynamic pricing mechanisms, enhanced security systems, and the automation of high-touch concierge services. Users are keen to understand how AI can streamline the cumbersome vetting process for high-value tenants, optimize lease agreements through smart contract technology, and provide predictive maintenance alerts to minimize disruption in exclusive properties. Key themes emerging from these questions include the expectation that AI should elevate the bespoke nature of the luxury rental experience, moving beyond mere chatbots to offer genuinely predictive and integrated services that align with the rigorous privacy and exclusivity demands of the clientele. There is a palpable concern about balancing the efficiency gained through automation with the necessary human touch required for high-end client relationship management, emphasizing the need for AI to act as an augmentation tool rather than a replacement for skilled human interaction.

The application of sophisticated AI algorithms allows property managers to analyze vast datasets relating to wealth indicators, behavioral patterns, and preference history of potential tenants, enabling unprecedented personalization in property matching and viewing scheduling. This predictive capability substantially reduces vacancy rates and minimizes the risk associated with luxury asset deployment. For instance, AI-driven tools can analyze market demand fluctuations in real-time, integrating data from high-profile global events (like major sporting tournaments or cultural festivals) to implement hyper-localized dynamic pricing models, maximizing rental yields for short-term luxury assets.

Furthermore, AI is pivotal in automating the operational backbone of luxury rental management. This includes using machine learning for sophisticated energy management within smart homes, optimizing utility consumption while maintaining tenant comfort, and implementing advanced physical and cyber security protocols. The integration of AI into tenant communication systems facilitates instantaneous, tailored responses to service requests, such as coordinating private travel logistics or specialized property adjustments, thereby elevating the overall service delivery and significantly enhancing tenant satisfaction scores, which are crucial metrics in the high-stakes luxury segment.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast equipment failure (HVAC, pools, security systems) before issues affect tenant experience.

- Dynamic Pricing Optimization: Real-time adjustment of rental rates based on demand signals, competitor pricing, and historical yield analysis.

- Personalized Concierge Automation: AI bots handling initial high-level requests and triaging complex service needs to human experts instantly.

- Enhanced Tenant Vetting: Machine learning algorithms analyzing financial stability, reputation, and risk factors for ultra-secure tenant placement.

- Virtual Staging and Viewing: AI generating photorealistic virtual tours and optimizing staging based on demographic profiles.

- Smart Home Integration: Centralized AI management of security, climate, lighting, and entertainment systems within the luxury property.

DRO & Impact Forces Of Luxury Rental Market

The Luxury Rental Market is propelled by strong Drivers (D), constrained by certain Restraints (R), and offers significant Opportunities (O), all molded by pervasive Impact Forces. Key drivers include the global surge in the wealth of HNWIs and UHNWIs, the flexibility and convenience offered by renting versus the high capital commitment of ownership, and the growing cultural preference for experiential luxury travel which favors short-term exclusive accommodations. These drivers ensure a consistent pipeline of demand for premium, managed properties, particularly in geographically desirable locations where real estate markets are highly illiquid or restricted. The market's resilience is further bolstered by the increasing sophistication of property management services that cater specifically to the complex needs of this discerning clientele, minimizing the friction points associated with transient high-end occupancy.

Conversely, major restraints facing the market involve regulatory hurdles, especially strict zoning laws and taxation policies targeting short-term rentals in prime tourist destinations, which can severely limit the available inventory and increase operational costs. Another significant restraint is the high barrier to entry for property owners and managers, necessitated by the huge capital investment required for maintaining ultra-high standards of property condition, security, and staffing. The reliance on highly personalized, skilled human capital for concierge services also represents an scalability challenge, impacting profitability when rapid expansion is desired. Furthermore, geopolitical instability in certain regions can drastically affect inbound luxury tourism and rental demand, introducing an element of localized market risk.

Opportunities in the market center on technological adoption, particularly in developing secure, seamless booking platforms utilizing blockchain for transparency in high-value transactions, and the expansion into niche segments such as wellness retreats and sustainably designed eco-luxury rentals. There is immense potential in integrating luxury rentals with private aviation and exclusive club memberships, creating synergistic luxury ecosystems that capture a larger share of the HNWIs’ discretionary spending. The dominant Impact Forces shaping the market include rapidly evolving digital consumption habits, increasing global tax scrutiny requiring complex financial structures, and the pervasive need for enhanced data security and privacy, making trust and reputation management paramount for sustained success in this exclusive domain.

Segmentation Analysis

The Luxury Rental Market is meticulously segmented across several dimensions to cater to the diverse needs of the affluent global consumer base. Primary segmentation is based on Property Type, distinguishing between apartments/condominiums, villas/houses, and specialized assets like yachts or private islands. Secondary segmentation focuses on Lease Duration (short-term, mid-term, and long-term rentals), which directly impacts service intensity and pricing models. Furthermore, the market is dissected by Application (Leisure/Vacation, Corporate/Business Travel, and Transitional Housing), reflecting the varied motivations behind the luxury rental choice. This granular segmentation allows operators to tailor their asset procurement, service provisioning, and marketing efforts precisely, optimizing occupancy rates and average daily rental yields across different property classes and seasonal demands.

Segmentation by property type is crucial as it dictates the required capital expenditure and maintenance protocol. Ultra-luxury villas, for instance, demand extensive groundskeeping, high security, and dedicated staffing, placing them in a distinct operational category compared to high-end serviced apartments which benefit from centralized building management efficiencies. The duration of the lease fundamentally influences the level of personalization; short-term vacation rentals emphasize immediate, immersive experiences and high-end concierge services, while long-term corporate rentals prioritize stability, advanced technological connectivity, and proximity to major business districts, requiring less frequent, but highly customized, intervention.

Geographical segmentation also plays a pivotal role, classifying markets into primary (e.g., London, New York, Paris), secondary (e.g., Miami, Dubai, Singapore), and tertiary/emerging luxury destinations (e.g., remote high-end wellness retreats or specific Caribbean islands). The interaction between these segments highlights market trends, such as the increasing demand for high-end residential apartments in financial hubs for long-term corporate assignments, contrasted with the seasonal spike in short-term villa bookings in established Mediterranean and Caribbean leisure destinations. Understanding these segmented dynamics is essential for developers and investors aiming to allocate capital effectively and generate maximized returns in this competitive landscape.

- By Property Type:

- Luxury Apartments/Condominiums

- Exclusive Villas and Private Estates

- Vacation Homes (Seasonal/Resort)

- Specialized Assets (Yachts, Private Islands)

- By Lease Duration:

- Short-Term Rentals (Less than 3 months)

- Mid-Term Rentals (3 to 12 months)

- Long-Term Rentals (More than 1 year)

- By Application:

- Leisure and Tourism

- Corporate and Business Stays

- Transitional Residential Solutions

- Event and Specialized Hosting

- By End-User:

- High-Net-Worth Individuals (HNWIs)

- Corporate Clients (Executive Housing)

- Celebrities and Public Figures

Value Chain Analysis For Luxury Rental Market

The Value Chain for the Luxury Rental Market begins with upstream activities focused on asset acquisition, meticulous property development, and exclusive interior design, demanding high capital investment and specialized expertise in luxury aesthetics and engineering. This stage involves sourcing prime real estate in sought-after locations, ensuring properties meet stringent standards for exclusivity, sustainability, and technological integration. Upstream operations are heavily influenced by global real estate market dynamics, construction costs, and securing permits for high-end developments. Successful value creation at this stage relies on establishing strategic partnerships with renowned architects, interior designers, and smart home technology providers to ensure the physical asset is positioned at the pinnacle of the luxury spectrum, thereby commanding premium rental rates.

The midstream involves critical operational phases: sophisticated property management, marketing, and leasing activities. Property management encompasses rigorous maintenance, high-end cleaning services, advanced security, and comprehensive insurance coverage. The leasing process requires specialized marketing, often using exclusive, invitation-only platforms and high-quality visual content (including 3D virtual tours), followed by highly confidential and bespoke contract negotiations. Distribution channels are typically dual: Direct channels involve dedicated in-house sales teams managing relationships with wealth managers and family offices, ensuring a highly discreet and tailored approach. Indirect channels utilize curated luxury real estate agencies, high-end travel advisors, and specialized online luxury booking platforms that vet both the properties and the clientele, ensuring brand alignment and quality control across the network.

Downstream activities center entirely on service delivery and post-occupancy relationship management, which is paramount for securing repeat business and positive referrals among the elite clientele. This stage includes comprehensive concierge services (private chefs, chauffeurs, security details, bespoke itinerary planning) provided during the stay, followed by professional exit procedures and prompt security deposit returns. Continuous client feedback analysis and proactive service enhancements solidify the downstream value proposition. The successful management of this value chain, ensuring seamless integration from acquisition (upstream) to exceptional service delivery (downstream), is critical to maintaining the premium positioning and high profitability margins characteristic of the luxury rental market.

Luxury Rental Market Potential Customers

The primary consumers in the Luxury Rental Market are High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) who seek flexible, high-security, and amenity-rich living environments tailored to their demanding schedules and lifestyles. This demographic includes successful entrepreneurs, corporate executives requiring premium transitional housing during relocations, high-profile celebrities, and affluent retirees seeking seasonal residences in diverse global locations. These buyers are typically characterized by an acute sensitivity to quality and service, often prioritizing discretion, privacy, and immediate access to top-tier amenities over cost considerations. Their purchasing behavior is heavily influenced by recommendations from trusted advisors, such as family office managers and private wealth consultants, making B2B outreach to these intermediaries a critical part of the marketing strategy.

A significant segment of potential customers also includes corporate entities that require ultra-high-end accommodations for visiting senior leadership, international delegations, or specialized project teams. These corporate buyers demand rigorous contractual compliance, robust IT infrastructure, and properties located strategically near global financial or technological hubs. Their emphasis is on efficiency, brand representation, and minimizing operational risk associated with housing key personnel. Furthermore, the luxury rental market increasingly targets the experiential travel segment, including affluent multi-generational families looking for exclusive, self-contained vacation properties where bespoke experiences—from private yacht excursions to personalized cultural tours—can be seamlessly integrated into their stay.

The common thread among all potential customers is the valuation of time and convenience; they are willing to pay a substantial premium for properties that offer turnkey solutions managed by professional, discreet teams. These clients view the luxury rental as a service rather than just a space, expecting anticipatory service provision, state-of-the-art safety features, and complete customization of the living environment. The market must consistently cater to niche requirements, such as pet amenities for luxury breeds, secure parking for exotic vehicle collections, and sophisticated media rooms, ensuring the rental experience mirrors or exceeds the quality of a five-star private residence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.2 Billion |

| Growth Rate | 7.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OneFineStay, The Private World, Inspirato, Exclusive Resorts, Mandarin Oriental Residences, Four Seasons Private Residences, Sotheby's International Realty, Christie's International Real Estate, Airbnb Luxe, Luxury Retreats (an Airbnb company), Belmond, Quintessentially, Knightsbridge Properties International, Luxury Home Rentals Worldwide, Eden Rock St Barths, The Set Collection, Habitat Residential, Elite Destination Homes, Stellar Residences, Leverage a Global Partner Network |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Rental Market Key Technology Landscape

The technological landscape within the Luxury Rental Market is defined by the integration of sophisticated systems designed to enhance security, personalization, and operational efficiency, thereby supporting the premium service promise. Smart Home Technology (SHT) constitutes a core pillar, encompassing advanced building automation systems for climate control, centralized lighting, automated blinds, and integrated entertainment units, all controllable via voice or unified digital interfaces. These systems are crucial for providing the seamless, personalized environment expected by HNWIs. Furthermore, the reliance on high-speed, secure connectivity (Fiber optics and private VPN setups) is non-negotiable, supporting the digital work and lifestyle requirements of executive tenants and remote workers who prioritize reliability and cyber security above all else.

Digitalization extends deeply into the management and transactional elements of the market. High-fidelity Virtual Reality (VR) and Augmented Reality (AR) tools are now standard for property viewing, allowing prospective tenants to conduct immersive, detailed walkthroughs of global properties remotely, minimizing the necessity for physical travel during the selection phase. Furthermore, the adoption of proprietary booking and concierge platforms utilizes AI and machine learning to manage client profiles, optimize seasonal pricing, and automate the provisioning of tailored local services. These platforms must be exceptionally secure, often incorporating end-to-end encryption to protect the sensitive financial and personal data of the clientele.

Security technology remains paramount; key innovations include biometric access control systems (fingerprint and facial recognition), perimeter surveillance integrated with predictive analytics to flag unusual activity, and dedicated secure communication channels. Beyond hardware, the burgeoning use of Blockchain technology for secure contract execution and fractional ownership recording is gaining traction, providing immutable proof of agreements and ensuring trust in high-value, cross-border transactions. This technological convergence ensures that luxury rental operators can deliver not only architectural excellence but also an unmatched, future-proofed living experience that aligns with the highest global standards of privacy and operational sophistication.

Regional Highlights

- North America:

North America, led primarily by the United States (New York, Los Angeles, Miami) and Canada (Toronto, Vancouver), is the most mature and dominant market segment globally for luxury rentals. The region benefits from a robust economy, a high concentration of UHNWIs, and established infrastructure for premium property management. Demand is highly segmented, with strong long-term corporate leasing in financial hubs and extremely high-priced short-term villa rentals in vacation hotspots like Aspen, The Hamptons, and South Florida. Regulatory environments, while varying by state and municipality, are generally sophisticated, leading to high operational standards and substantial investment in branded residences managed by luxury hospitality chains. The market is characterized by rapid adoption of smart home technology and a premium placed on privacy and exclusive community access.

- Europe:

Europe holds a significant share, driven by historical luxury destinations such as London, Paris, Geneva, and the Mediterranean coasts (French Riviera, Tuscany, Ibiza). This region excels in short-term seasonal rentals, leveraging its cultural heritage and diverse climate. London, despite recent geopolitical shifts, remains a key hub for long-term international executive leasing. European markets often face stricter regulatory frameworks concerning historical preservation and short-term letting restrictions, particularly in capital cities, which limit inventory expansion but drive up prices for licensed properties. The market is defined by traditional, high-touch services and properties often valued for their architectural history and unique location, demanding highly specialized maintenance and management expertise to preserve asset value.

- Asia Pacific (APAC):

The APAC region is the fastest-growing market, propelled by unprecedented wealth creation in countries like China, India, and Southeast Asia. Key luxury hubs include Singapore, Hong Kong, Sydney, and Tokyo. The demand is characterized by a preference for ultra-modern, newly constructed residences featuring state-of-the-art technology and integrated wellness facilities. Singapore serves as a major financial hub, driving long-term corporate rental demand. The tourism sector, particularly in destinations like Bali and Thailand, fuels significant growth in short-term luxury villa rentals. Challenges include fragmented regulatory environments and intense competition to secure exclusive, high-quality inventory that meets the specific, often multi-generational, living requirements of local HNWIs.

- Middle East and Africa (MEA):

The MEA market, heavily centered in the GCC countries, particularly Dubai and Riyadh, is undergoing rapid transformation, fueled by massive government investment in luxury infrastructure and tourism. Dubai is establishing itself as a global magnet for luxury short-term and long-term stays, offering world-class, newly built properties with exceptional security and hospitality services. Demand is boosted by expatriate executives and high-net-worth international visitors seeking tax-friendly environments and stable, ultra-modern living options. The market benefits from favorable investment policies but requires highly specialized cultural sensitivity and service provisioning to cater to the distinct preferences of local and international tenants.

- Latin America:

Latin America represents an emerging but growing segment, primarily focused on key metropolitan areas like São Paulo and Mexico City, and exclusive coastal destinations such as Punta del Este and Tulum. The market is highly susceptible to localized economic volatility but offers unique opportunities in bespoke, secluded luxury properties. Demand often comes from regional HNWIs seeking secondary residences or international clientele seeking experiential, high-security retreats. The operational challenge in this region is ensuring consistent security standards and leveraging local expertise to navigate complex administrative and ownership structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Rental Market.- OneFineStay

- The Private World

- Inspirato

- Exclusive Resorts

- Mandarin Oriental Residences

- Four Seasons Private Residences

- Sotheby's International Realty

- Christie's International Real Estate

- Airbnb Luxe

- Luxury Retreats (an Airbnb company)

- Belmond

- Quintessentially

- Knightsbridge Properties International

- Luxury Home Rentals Worldwide

- Eden Rock St Barths

- The Set Collection

- Habitat Residential

- Elite Destination Homes

- Stellar Residences

- Leverage a Global Partner Network

Frequently Asked Questions

Analyze common user questions about the Luxury Rental market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Luxury Rental Market?

The primary drivers are the sustained growth in the global population of High-Net-Worth Individuals (HNWIs), the increasing preference for flexible, service-rich living arrangements over traditional home ownership, and the strong demand for exclusive, private accommodations for experiential, short-term travel in prime global locations.

How is technology impacting pricing and personalization in luxury rentals?

Technology, particularly AI and machine learning, is utilized for highly accurate dynamic pricing optimization based on real-time demand, local events, and competitor analysis, maximizing yield. Furthermore, AI-driven platforms enable unprecedented personalization of property recommendations and tailored concierge services, significantly enhancing the tenant experience and operational efficiency.

Which geographical regions currently dominate the Luxury Rental Market?

North America (led by the US) and Europe (centered on traditional cities like London and Paris, and the Mediterranean) are the current market leaders due to high wealth concentration and established infrastructure. However, the Asia Pacific region, particularly Singapore and Sydney, is projected to exhibit the highest growth rate during the forecast period due to rapid wealth creation.

What are the main segments within the Luxury Rental Market by property type?

The main segments by property type include ultra-luxury apartments and condominiums, exclusive villas and private estates (often dominating the short-term vacation segment), and specialized luxury assets such as private islands and high-end yachts offered for lease. Each type requires distinct management and security protocols.

What distinguishes luxury rentals from standard high-end property rentals?

Luxury rentals are distinguished by their comprehensive integration of bespoke, anticipatory services, state-of-the-art security, absolute discretion, and high-quality, architecturally significant finishes. They offer a five-star hospitality experience delivered within a private residential setting, a critical differentiation from standard high-end leases which lack the premium level of managed services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager