Luxury Ski Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435938 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Luxury Ski Clothing Market Size

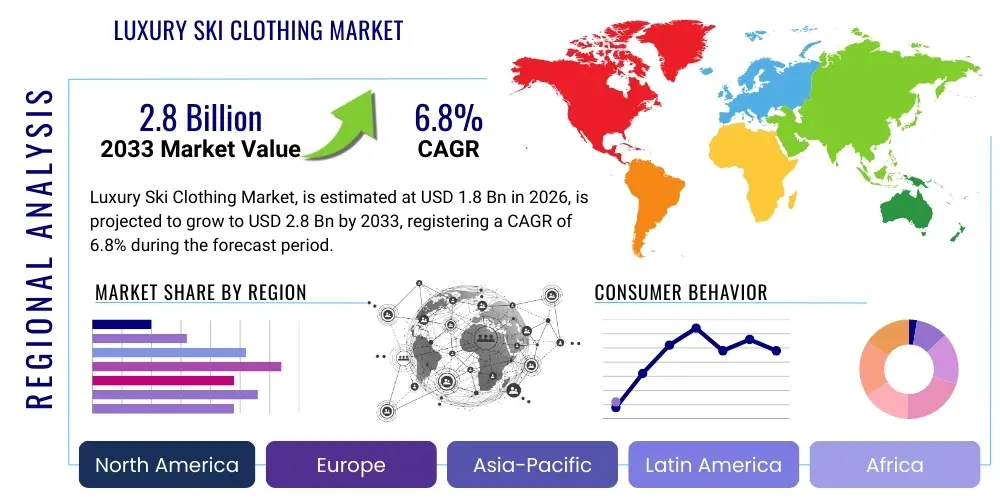

The Luxury Ski Clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Luxury Ski Clothing Market introduction

The Luxury Ski Clothing Market encompasses high-end apparel and accessories designed for cold weather sports, specifically skiing and snowboarding, characterized by superior technical performance, exclusive material composition, intricate craftsmanship, and strong brand prestige. These products blend aesthetic appeal with crucial functional attributes such as advanced waterproofing, breathability, thermal regulation, and ergonomic fit, targeting affluent consumers who seek both style and uncompromising protection on the slopes. The market is driven by increasing disposable incomes among the target demographic, the global expansion of high-end winter tourism, and a rising demand for garments that transition seamlessly from the mountain to exclusive après-ski settings.

Key product offerings include high-performance jackets, ski pants, thermal base layers, and specialized accessories like goggles and gloves, often incorporating innovative materials such as Gore-Tex Pro, highly specialized down insulation (e.g., 900+ fill power), and sustainable, bio-based synthetics. Major applications revolve around recreational skiing, competitive winter sports, and professional mountain exploration, where durability and reliability are paramount. The inherent benefits of luxury ski wear include enhanced safety through superior visibility and protection from extreme elements, improved comfort due to advanced moisture management, and the social status conveyed by exclusive designs and renowned brand logos.

Driving factors propelling market expansion include the increasing focus on experiential luxury, where consumers invest heavily in specialized gear for leisure activities, and the convergence of fashion and outdoor wear, leading to seasonal collaborations between luxury fashion houses and technical ski brands. Furthermore, product innovation centered on smart textiles, heating elements, and sustainable manufacturing practices is continually revitalizing consumer interest and justifying premium pricing models. The focus on sustainability, particularly the use of recycled materials and ethical supply chains, is becoming a non-negotiable expectation among high-net-worth individuals, further shaping product development and brand messaging within this premium sector.

Luxury Ski Clothing Market Executive Summary

The luxury ski clothing market is experiencing robust growth fueled by post-pandemic recovery in global travel, particularly within high-altitude luxury resorts, and a significant shift in consumer preference toward investment pieces that offer enduring quality and technical excellence. Key business trends include aggressive direct-to-consumer (DTC) strategies adopted by heritage luxury brands, emphasizing personalized shopping experiences and exclusive capsule collections. Additionally, the integration of digital technologies, such as 3D body scanning for bespoke fitting and augmented reality (AR) for virtual try-ons, is enhancing the customer journey and supporting higher price points. Strategic mergers and acquisitions are common as larger fashion conglomerates seek to incorporate niche, performance-driven ski wear brands into their portfolios to capture the affluent sports leisure segment.

Regionally, Europe, particularly the Alpine countries (France, Switzerland, Austria, Italy), remains the undisputed epicenter for luxury ski wear consumption and innovation, driven by a deeply ingrained ski culture and the highest concentration of high-end ski resorts globally. North America is characterized by rapid adoption of performance-luxury brands, with growth concentrated in wealthy urban centers and prominent ski destinations like Aspen and Vail. The Asia Pacific region, led by emerging affluent populations in China and South Korea, presents the highest growth potential, spurred by government initiatives promoting winter sports and the rising popularity of international ski travel among younger generations. These regions demand products tailored to unique climate conditions and cultural style preferences.

Segmentation trends highlight the increasing dominance of the Jackets and Outerwear segment, which represents the primary investment purchase for consumers, often featuring the most advanced material science and design detailing. Within the end-user category, the Men’s Luxury Ski Clothing segment traditionally holds a larger market share, but the Women’s segment is demonstrating faster growth, driven by specialized female-centric designs focusing on fit, aesthetics, and fashion integration. Distribution channel analysis indicates that brand-owned mono-brand stores and specialized luxury e-commerce platforms are gaining precedence over traditional multi-brand sports retailers, allowing brands greater control over pricing, inventory, and brand presentation, which is vital for maintaining an exclusive luxury image.

AI Impact Analysis on Luxury Ski Clothing Market

Users frequently inquire about how Artificial Intelligence (AI) can justify the premium price of luxury ski wear, focusing specifically on personalized fit, supply chain transparency, and predictive trend forecasting in highly seasonal markets. Key concerns revolve around the ethical use of consumer data collected via smart garments and the potential for AI to dilute the human element of luxury design and craftsmanship. The central expectation is that AI will primarily enhance efficiency and customization: optimizing inventory management to minimize waste (a critical sustainability factor for affluent buyers), designing hyper-personalized garments based on biometric data and environmental conditions, and improving customer service through sophisticated virtual styling assistants. Ultimately, the integration of AI is expected to streamline the operational complexities of a luxury market while elevating the bespoke nature of the consumer product.

- AI-Driven Design Optimization: Utilizing generative AI to simulate material performance under varying altitude and temperature conditions, leading to faster prototyping of technically superior garments.

- Personalized Sizing and Fit: Implementing machine learning algorithms based on 3D body scans and purchase history to recommend perfect sizing, drastically reducing returns and improving consumer satisfaction in the high-stakes e-commerce environment.

- Predictive Trend Forecasting: Analyzing global fashion trends, resort bookings, and social media sentiment to accurately forecast demand for specific colors, styles, and insulation levels, optimizing production volumes and timing.

- Supply Chain Transparency: Deploying AI and blockchain integration to track luxury materials (e.g., traceable down, ethically sourced merino wool) from origin to finished product, meeting consumer demand for sustainability and provenance.

- Customer Relationship Management (CRM): Using natural language processing (NLP) chatbots and AI-powered tools for 24/7 personalized customer service, including repair scheduling, warranty handling, and styling advice.

DRO & Impact Forces Of Luxury Ski Clothing Market

The market is predominantly driven by increasing global wealth concentration, leading to a growing segment of consumers prioritizing high-quality, high-performance apparel for leisure travel and sports. The experiential economy strongly supports this trend, as luxury consumers invest significant capital in specialized gear to enhance memorable experiences. Restraints include the highly seasonal nature of the business, which creates inventory and supply chain complexities, and the high initial investment required for sophisticated technical outerwear, which limits the addressable market size. Additionally, counterfeiting and the unauthorized sale of high-end brands pose an ongoing challenge, potentially eroding brand equity if not rigorously managed. Opportunities are abundant in sustainable innovation, particularly the development of circular economy models for high-tech garments and expansion into emerging markets, especially in Eastern Europe and Asia, where winter sports participation is rapidly increasing.

The impact forces influencing the luxury ski clothing market are intense competitive rivalry, driven by established heritage brands facing challenges from agile, digitally native luxury startups focused on niche technical excellence. Buyer power is moderately high; while consumers are brand-loyal, they are highly educated regarding material science and sustainability claims, demanding transparency and value commensurate with the premium price. Supplier power is also significant, especially for proprietary high-tech textiles (e.g., specialized membranes, ethically certified down providers), necessitating strong, long-term contractual agreements. The threat of substitutes is relatively low, as conventional activewear cannot replicate the technical demands and aesthetic prestige of true luxury ski wear. However, rental services offering high-end ski outfits present a mild substitution threat in short-term markets, particularly among younger consumers.

Overall, the driving forces significantly outweigh the restraints in the current climate, underpinned by the luxury consumer’s inelastic demand for superior quality and prestige. The integration of advanced technical materials, coupled with strategic marketing emphasizing heritage, exclusivity, and sustainability, acts as a powerful lever for market expansion. Brands that effectively navigate the complexities of ethical sourcing and transparent supply chains, while simultaneously delivering cutting-edge performance, are best positioned to capitalize on the sustained growth in global luxury sports tourism and high-net-worth leisure spending.

Segmentation Analysis

The Luxury Ski Clothing Market is segmented based on product type, end-user, material, and distribution channel, providing a granular view of consumer behavior and market dynamics. This detailed segmentation allows manufacturers to tailor product development, pricing strategies, and marketing campaigns to specific, highly profitable niches. Product segmentation reveals a strong focus on outer layers—jackets and pants—due to their technical complexity and high visibility, which command the highest average selling prices. Material segmentation underscores the market's reliance on high-performance synthetic materials and ethically sourced natural fibers, reflecting the dual consumer demand for technical superiority and environmental responsibility.

End-user segmentation clearly defines the primary target demographics, with men and women representing the largest consuming groups, each requiring specific design considerations related to thermal properties, cut, and fashion integration. Children’s luxury ski wear, while smaller, is a growing segment driven by affluent families investing in high-quality gear for their offspring. Distribution channel segmentation is crucial, demonstrating the ongoing shift from traditional retail to exclusive brand-owned channels and specialized e-commerce platforms, which ensure brand control and provide a premium shopping experience essential for the luxury sector. Analyzing these segments helps stakeholders understand which consumer profiles are driving the highest growth and where strategic investments in production and distribution should be prioritized.

- By Product Type:

- Jackets and Outerwear

- Pants and Salopettes

- Base and Mid Layers (Thermal Wear)

- Accessories (Gloves, Hats, Goggles, Helmets)

- By End-User:

- Men

- Women

- Children

- By Material:

- Natural Fibers (e.g., Merino Wool, Down)

- Synthetic Materials (e.g., Polyester, Nylon, Proprietary Membranes like Gore-Tex)

- Blended Fabrics

- By Distribution Channel:

- Brand-Owned Stores (Mono-brand Boutiques)

- Specialty Retail Stores (Luxury Multi-brand Sports Retailers)

- Online Retail (E-commerce Platforms and Brand Websites)

- Department Stores (High-end Luxury Sections)

Value Chain Analysis For Luxury Ski Clothing Market

The luxury ski clothing value chain begins with highly specialized upstream analysis, focusing on the sourcing of proprietary and ethically certified raw materials. This stage involves close collaboration with chemical and textile innovators to secure exclusive technical fabrics, such as advanced hydrophobic membranes, recycled synthetics, and certified traceable down or wool. Because quality and sustainability provenance are key differentiators in the luxury segment, manufacturers must exert rigorous control over material suppliers, often engaging in exclusive long-term contracts. The manufacturing stage is characterized by high precision and low volume, typically involving specialized European or North American facilities capable of seam-sealing, intricate tailoring, and complex thermal bonding required for high-performance luxury outerwear. Quality assurance is paramount, often involving advanced testing protocols far exceeding industry standards.

Downstream analysis focuses heavily on maintaining the brand's luxury positioning through selective and controlled distribution. Direct distribution channels, including flagship stores and proprietary e-commerce sites, are favored as they allow brands to control pricing, visual merchandising, and the overall customer experience, which is integral to the luxury narrative. Indirect channels, such as high-end multi-brand luxury retailers and select department stores (e.g., Harrods, Saks Fifth Avenue), are utilized but carefully curated to ensure they align with the brand image. These retailers often offer personalized fitting services and tailored advice, reinforcing the premium proposition.

The distribution channel strategy is highly segmented: Direct channels provide the highest margin and brand control, essential for product launches and showcasing limited editions. Indirect channels offer broader geographical reach and visibility among existing luxury shoppers. Effective logistics and inventory management are critical, given the high value of the stock and the seasonal demand cycles. Brands invest heavily in sophisticated Enterprise Resource Planning (ERP) systems and logistics partners capable of handling high-value goods globally, ensuring rapid fulfillment to affluent customers who expect instant gratification and seamless service, regardless of whether they purchase online or in a boutique located in a ski resort.

Luxury Ski Clothing Market Potential Customers

The primary potential customers for luxury ski clothing are High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) globally, particularly those who regularly participate in skiing or snowboarding at exclusive resorts such as Courchevel, St. Moritz, Aspen, and Whistler. This demographic is characterized not only by high disposable income but also by a deep appreciation for craftsmanship, technical excellence, and sustainability, viewing their apparel as an investment that signifies status and refined taste. These buyers are often seasoned skiers who demand uncompromising performance in extreme conditions and seamless integration of high fashion into their athletic gear. They value exclusivity, personalization, and brand heritage.

A secondary, yet rapidly expanding, customer segment includes the emerging affluent populations in Asian markets, particularly in urban centers of China, South Korea, and Japan, where winter sports participation and international luxury travel are growing trends. These consumers are typically younger, highly digitally engaged, and influenced by fashion trends, seeking garments that offer significant 'Instagrammability' alongside performance. They often enter the market through high-profile collaborations between sportswear brands and global fashion designers. Additionally, affluent non-skiers who frequent high-altitude resorts for social or business purposes represent another key segment, purchasing luxury outerwear for warmth, style, and status during après-ski events and resort downtime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moncler, Canada Goose, Bogner, Fusalp, Perfect Moment, Kjus, Helly Hansen (Premium Lines), Spyder (Luxury Collections), Goldbergh, Aztech Mountain, Cordova, Toni Sailer, Mammut (High End), Arc'teryx (Veilance/High-End), Descente, Rossignol (Exclusive), Phenix, Peak Performance, J. Lindeberg, Prada Linea Rossa, Dior Ski Capsule. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Ski Clothing Market Key Technology Landscape

The technology landscape in the luxury ski clothing market is defined by continuous innovation in material science and garment construction aimed at maximizing performance without sacrificing aesthetics or sustainability. A major focus is on proprietary membrane technology (e.g., Gore-Tex Pro, Dermizax NX) which offers superior hydrostatic head ratings (waterproofing) and exceptional Moisture Vapor Transmission Rate (breathability), essential for intense activity in alpine environments. Additionally, technologies related to insulation are evolving, with brands moving beyond traditional down to specialized synthetic fills (e.g., PrimaLoft Gold) and hybrid constructions that offer warmth even when wet, ensuring reliability and longevity, critical factors for justifying luxury pricing.

Beyond materials, smart clothing integration is an emerging trend. While still nascent, some luxury brands are incorporating flexible electronics, such as integrated heating panels controlled via smartphone applications, micro-sensors for tracking performance metrics, and Recco reflectors for enhanced mountain safety. These technological additions cater to the high-tech expectations of affluent consumers who demand connectivity and quantifiable performance data from all their gear. The focus is always on seamless integration, ensuring the technology does not compromise the garment's sophisticated design or fit. Furthermore, advanced laser cutting, ultrasonic welding, and specialized seam taping techniques are replacing traditional stitching methods, creating lighter, stronger, and more watertight apparel.

Sustainability technology also forms a critical part of the landscape. This includes the implementation of PFC-free Durable Water Repellent (DWR) finishes to eliminate harmful chemicals, the increased use of recycled and bio-based polymers in shell fabrics, and the deployment of blockchain technology to trace the origin of ethical materials. Brands are competing not just on technical performance but on their ability to offer verifiable, transparent sustainability credentials, utilizing specialized dyeing processes that reduce water consumption and energy-efficient manufacturing processes. This technological push is essential for maintaining market relevance among environmentally conscious luxury buyers.

Regional Highlights

Regional dynamics significantly influence the Luxury Ski Clothing Market, with consumption patterns, brand preferences, and growth rates varying across key geographies. Europe, primarily the Western European countries forming the Alpine arc (Switzerland, France, Austria, Italy), serves as the traditional stronghold. This region boasts a mature ski culture, high concentration of established luxury brands (Bogner, Fusalp), and the highest density of high-spending tourists, making it the largest revenue generator. European luxury consumers tend to prioritize heritage, craftsmanship, and timeless design alongside performance, leading to a stable and highly brand-loyal market.

North America, spearheaded by the United States and Canada, represents a dynamic and innovation-focused market. Growth here is driven by a strong appetite for technical performance brands and products that seamlessly bridge the gap between mountain functionality and urban street style (e.g., Moncler, Canada Goose). Consumer behavior in this region is influenced heavily by fitness trends and the outdoor lifestyle, valuing material innovation and high visibility designs. The proliferation of luxury retail outlets in key metro areas and ski towns ensures easy access for the affluent customer base.

Asia Pacific (APAC) is poised for the fastest expansion, driven primarily by China’s rising middle and upper classes, enthusiastic participation in winter sports following major international sporting events, and the expansion of high-quality ski infrastructure. Consumers in APAC often perceive luxury ski wear as a status symbol and are highly responsive to marketing collaborations featuring celebrities and fashion influencers. While currently a smaller overall market share than Europe or North America, the projected rate of new customer acquisition and spending growth in countries like China and South Korea positions APAC as the primary opportunity for future market penetration and strategic brand investment over the forecast period.

- Europe: Dominant market share due to established ski infrastructure, strong heritage brand presence, and high volume of luxury winter tourism. Focus on quality, craftsmanship, and sustainability certifications.

- North America: High growth driven by demand for performance-luxury hybrids and strong consumer emphasis on technical innovation and functional design for challenging environments.

- Asia Pacific (APAC): Fastest growing region, fueled by rising disposable income, government promotion of winter sports, and strong consumer demand for international luxury brand exclusivity and trend-forward aesthetics.

- Latin America and Middle East & Africa (MEA): Emerging markets focused on specialized, high-end expedition gear and travel-focused luxury winter apparel, catering to consumers traveling to global ski destinations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Ski Clothing Market.- Moncler

- Canada Goose

- Bogner

- Fusalp

- Perfect Moment

- Kjus

- Helly Hansen (Premium Lines)

- Spyder (Luxury Collections)

- Goldbergh

- Aztech Mountain

- Cordova

- Toni Sailer

- Mammut (High End)

- Arc'teryx (Veilance/High-End)

- Descente

- Rossignol (Exclusive)

- Phenix

- Peak Performance

- J. Lindeberg

- Prada Linea Rossa

Frequently Asked Questions

Analyze common user questions about the Luxury Ski Clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Luxury Ski Clothing Market?

The Luxury Ski Clothing Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033, driven by increasing global affluence and high-value tourism.

Which geographical region is currently leading the Luxury Ski Clothing Market?

Europe, particularly the countries surrounding the Alpine region (France, Switzerland, Italy, Austria), currently holds the largest market share due to its established ski culture, high concentration of luxury resorts, and strong presence of heritage ski wear brands.

How does sustainability influence purchasing decisions in luxury ski clothing?

Sustainability is a critical factor; affluent consumers prioritize brands utilizing ethically sourced materials (traceable down, recycled synthetics) and transparent supply chains, viewing eco-conscious production as a fundamental aspect of modern luxury value and provenance.

What key technological innovations are shaping luxury ski apparel?

Key innovations include the development of proprietary, ultra-high-performance hydrophobic membranes for waterproofing, advanced hybrid insulation materials, and the nascent integration of smart textiles for biometric monitoring and integrated heating elements.

Which distribution channels are most critical for luxury ski clothing brands?

Brand-owned mono-brand stores and dedicated luxury e-commerce platforms are the most critical channels, as they provide maximum control over the premium brand narrative, customer experience, and exclusive product offerings.

Competitive Landscape and Brand Strategy in Luxury Ski Clothing

The competitive landscape of the luxury ski clothing market is characterized by intense rivalry among heritage ski specialists, high-fashion houses with specialized performance lines, and a few technologically advanced outdoor brands pushing into the luxury segment. Competition centers not merely on price, which is inelastic in this sector, but overwhelmingly on technical differentiation, brand exclusivity, and compelling storytelling centered on heritage and mountain performance. Brands like Moncler and Canada Goose leverage extensive brand recognition and fashion-forward aesthetics to appeal to the aspirational luxury buyer, often utilizing limited-edition collaborations with major designers to generate media buzz and reinforce exclusivity. Smaller, highly specialized brands such as Kjus or Fusalp compete by focusing obsessively on technical fit, ergonomic design, and proprietary material patents, appealing directly to the expert skier who demands the absolute best in on-mountain performance.

Successful brand strategy requires a delicate balance between performance legitimacy and high-fashion sensibility. Modern luxury ski brands must maintain credible performance credentials—proven waterproofing, thermal regulation, and durability—while simultaneously dicturing high-altitude style. This dual mandate necessitates significant investment in both R&D for advanced textiles and high-profile marketing campaigns, often featuring sponsorships of elite athletes or highly curated visual content filmed in breathtaking alpine locations. Furthermore, control over distribution is paramount; luxury brands often limit their wholesale partners to ensure consistent pricing and a controlled presentation environment, emphasizing the premium nature of the shopping experience, whether in a resort boutique or via a sophisticated, personalized e-commerce interface.

A crucial differentiator emerging in the competitive strategy is the commitment to circularity and ethical sourcing. Brands are actively competing on their quantifiable sustainability metrics, such as the percentage of recycled content, traceability of animal-derived materials (like down), and fair labor practices. This emphasis on corporate social responsibility (CSR) is increasingly non-negotiable for the discerning, environmentally aware luxury consumer. The brands that manage to integrate cutting-edge performance with verifiable ethical credentials, presented through a highly exclusive and desirable aesthetic, are those solidifying their market position and commanding the highest customer loyalty and long-term brand equity.

Emerging Market Trends and Future Outlook

Several key emerging trends are set to redefine the Luxury Ski Clothing Market over the forecast period. The trend toward "Ski-Leisure" or performance lifestyle wear is blurring the lines between technical sportswear and high-end casual fashion. Consumers increasingly seek versatile garments that are fully functional on the slopes but stylish enough for sophisticated urban or travel use. This demand for versatility is driving innovations in lighter, more tailored silhouettes and subtle branding, moving away from overtly technical aesthetics and toward sleek, minimalist designs that maintain maximum performance capabilities. This movement is leading to significant expansion in the base layer and mid-layer segments, which are becoming fashion-forward items in their own right, often made from advanced merino wool blends or specialized thermoregulating synthetics.

The expansion of rental and subscription models, particularly in the premium segment, is a significant emerging trend, driven primarily by younger affluent consumers who value access over ownership and seek novelty without commitment. High-end rental services offer consumers the chance to wear the latest, most expensive gear for a short period, appealing to those concerned with the environmental footprint of fast fashion or who ski infrequently. While this presents a minor challenge to outright purchasing volumes, it also serves as an effective, high-touch marketing channel, potentially leading to future brand loyalty. Luxury brands are cautiously exploring how to manage high-quality rental fleets without compromising their exclusivity or perceived quality.

In terms of geographical outlook, the focus is shifting eastward. While North America and Europe provide stability and volume, future hyper-growth will emanate from markets that are rapidly developing their winter sports infrastructure and culture, particularly in East Asia. Brands are investing heavily in localized marketing strategies, understanding that seasonal trends and sizing requirements may differ significantly from established Western markets. Furthermore, the increasing accessibility of indoor ski centers in non-traditional winter regions is expanding the potential customer base year-round, offering an opportunity to decouple sales cycles slightly from the highly seasonal outdoor ski calendar, providing a critical avenue for smoother inventory management and revenue stream diversification.

Regulatory and Compliance Environment

The luxury ski clothing market operates under a complex framework of international regulations concerning material safety, consumer protection, and increasingly, environmental standards. Material composition is strictly governed, particularly regarding the use of chemicals in DWR treatments. The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation sets high standards for chemical safety, necessitating that luxury brands, who often use complex synthetic treatments, adhere to the strictest global rules to ensure their products are marketable in key European regions. The move toward PFC-free water repellents is now a regulatory expectation, pushing brands to invest heavily in innovative, environmentally benign alternatives that still deliver top-tier performance.

Compliance also extends to ethical manufacturing and transparency mandates. Regulations in various jurisdictions demand verifiable proof regarding the sourcing of animal products, such as down and wool. Luxury brands must adhere to standards like the Responsible Down Standard (RDS) or similar certifications to ensure ethical treatment of animals and traceable supply chains, a requirement that significantly complicates the sourcing process but is essential for maintaining brand reputation among conscious consumers. Failure to provide adequate certification can result in boycotts or regulatory fines, making supply chain auditing a critical operational expense.

Furthermore, labeling and consumer information regulations require clear, accurate, and standardized reporting of product performance specifications, including waterproofing ratings (hydrostatic head), breathability (MVTR), and thermal capacity. Because luxury apparel justifies its price through superior technical specifications, misrepresentation or lack of compliance in labeling can lead to significant litigation or recalls. Brands must ensure that claims regarding sustainability (e.g., percentage of recycled content) are substantiated by third-party verification to avoid 'greenwashing' penalties, particularly in regions with robust consumer protection laws like the US and EU, cementing compliance as a foundational pillar of market entry and sustained operation.

Sourcing and Sustainability Initiatives

Sourcing luxury materials for ski clothing is a strategic imperative that blends performance requirements with stringent sustainability criteria. For high-performance shells, the focus is on utilizing durable, high-denier fabrics made from certified recycled polyester or nylon, often derived from post-consumer waste, without compromising the technical integrity of the waterproof and breathable membranes. Brands collaborate with textile mills to develop exclusive, low-impact versions of materials like Gore-Tex, minimizing water and energy usage during production. For insulation, the move is toward traceable, responsibly sourced natural down, certified by standards like RDS, or advanced synthetic alternatives that offer comparable warmth-to-weight ratios with a smaller environmental footprint, often incorporating bio-based polymers.

Sustainability initiatives go beyond material input and encompass the entire product lifecycle. Luxury brands are exploring circular economy models tailored for complex technical garments, which are traditionally difficult to recycle due to their multi-layered construction (shell, membrane, lining, insulation). Initiatives include offering robust repair and maintenance programs to maximize garment longevity, implementing take-back schemes for end-of-life products, and designing garments with eventual disassembly and recycling in mind. These programs not only reduce waste but also strengthen customer loyalty by positioning the product as a valuable, long-term investment rather than a disposable seasonal item.

A key focus area in sustainability is reducing the reliance on harmful chemicals, particularly Per- and Poly-Fluoroalkyl Substances (PFCs), which have long been used in DWR finishes. Brands are actively transitioning to PFC-free DWR treatments, navigating the technological challenge of maintaining excellent water repellency while meeting escalating environmental safety standards. The communication of these sustainability efforts is crucial in the luxury sector; transparency via digital product passports or blockchain technology allows consumers to verify the ethical claims of the materials and manufacturing processes, establishing trust and justifying the premium charged for environmentally responsible luxury apparel.

Digitalization and E-commerce Strategy

Digitalization and e-commerce represent the fastest-evolving segment within the luxury ski clothing market's distribution framework. For luxury brands, the online channel is not merely a sales platform but a primary driver of brand storytelling, customer acquisition, and personalized service delivery. E-commerce platforms are meticulously designed to mimic the exclusivity and high-touch experience of a physical boutique, featuring high-resolution imagery, detailed technical specifications, and rich media content that conveys the garment's craftsmanship and performance credentials. This focus on digital aesthetics and experience is crucial for maintaining the luxury perception in a screen-based environment.

The e-commerce strategy heavily leverages technology for personalized customer journeys. Artificial intelligence and machine learning are employed to analyze browsing data, recommend complementary accessories (e.g., gloves, base layers), and notify customers about limited-edition drops or personalized fitting events. Furthermore, brands utilize Augmented Reality (AR) tools for virtual try-ons, allowing consumers to visualize the fit and style of high-cost items before purchase, a crucial feature that mitigates the high return rates often associated with premium online apparel. Digitalization also supports international sales, providing seamless localized experiences, including currency conversion, duty calculation, and rapid, high-security shipping options.

Beyond sales, digitalization optimizes operational efficiency. Brands use integrated digital systems to manage inventory across global boutiques and warehouses, crucial for ensuring high-value, highly seasonal stock is deployed efficiently. Digital marketing, particularly through Instagram, TikTok, and high-end digital publications, is used to target affluent demographics with highly specific content related to mountain travel, lifestyle, and aspirational sports. The integration of Customer Relationship Management (CRM) systems with e-commerce platforms ensures that every digital interaction contributes to a holistic customer profile, enabling luxury brands to offer tailored loyalty programs and exclusive access to new collections, solidifying long-term customer value.

Regional Analysis Deep Dive: Key Consumption Drivers

North America (NA) is driven by the culture of high-performance outdoor pursuits and a strong discretionary spending capacity. Key drivers include the popularity of high-end resorts in Colorado, Utah, and British Columbia, and a consumer base that highly values technology and brand identity. NA consumers often prefer brands that successfully integrate technical performance with practical, everyday luxury—products they can wear for resort-to-town travel. Marketing success is often tied to collaborations and limited releases that create hype among a younger, digitally savvy affluent cohort. The proximity to major technical outdoor apparel innovators also fuels competition and rapid technological adoption in this region.

Europe remains the foundation of the luxury ski market. Its drivers are historical—a deeply rooted skiing tradition, the presence of numerous iconic luxury ski destinations (e.g., St. Moritz, Courchevel), and the location of most heritage luxury ski wear houses (e.g., Bogner, Fusalp). European consumers prioritize investment pieces, focusing on longevity, repairability, and classic styling that transcends fleeting trends. Demand is high for custom tailoring and bespoke services, emphasizing craftsmanship that often supports local, specialized manufacturing within the Alpine regions. The market here is mature, meaning growth is more incremental, focused on high-margin customization and specialized, high-performance expedition gear.

Asia Pacific (APAC) is the primary future growth engine. The rapid expansion is motivated by the "Experience Economy" and the rising prestige associated with international travel and elite sports participation among the newly affluent. Key drivers include government support for winter sports (notably in China) and an intense focus on brand status. APAC consumers, particularly in China and South Korea, are highly responsive to global luxury fashion trends and celebrity endorsement, often favoring bold colors, visible logos, and fashion-forward silhouettes. This region presents challenges related to logistics and localized fitting requirements but offers unprecedented opportunities for volume growth and establishing new luxury consumption patterns outside the traditional Western winter sports season.

Product Innovation and Design Trends

Product innovation in luxury ski clothing is dictated by the confluence of extreme technical demands and high aesthetic standards. The most significant design trend is the application of body-mapping technology, which involves strategically placing different materials—such as high-abrasion resistance fabrics on shoulders, highly breathable membranes in core sweat zones, and flexible insulators around joints—to optimize movement, thermal regulation, and durability simultaneously. This advanced construction allows designers to create lighter garments that offer greater warmth and protection than older, bulkier models, appealing directly to the performance needs of expert skiers.

Furthermore, modularity and adaptability are core design philosophies. Luxury jackets are increasingly designed with features like zip-out down liners that can be worn separately, adjustable ventilation systems (pit zips, mesh panels), and interchangeable hood systems, allowing a single high-investment garment to function across a wider range of temperatures and activity levels. This adaptability enhances the perceived value and utility of the expensive item. Color palettes and aesthetic trends are also moving toward sophisticated, non-traditional mountain colors—deep charcoals, earth tones, and muted metallics—alongside classic monochrome options, moving away from high-visibility colors except where safety demands.

The integration of specialized accessories is another area of innovation. Luxury brands are extending their material expertise into gloves and goggles, ensuring seamless compatibility and aesthetic integration with their core outerwear line. For instance, gloves might feature advanced insulation tailored for extreme cold but designed with sleek leather accents and subtle branding. Helmets and goggles are often co-developed with optical specialists to offer superior anti-fog technologies, high-contrast lenses, and integrated communication systems, ensuring that every piece of the ensemble reflects the same commitment to uncompromising luxury and cutting-edge performance, thereby enhancing the overall consumer experience and market segment growth.

Financial Outlook and Investment Considerations

The financial outlook for the Luxury Ski Clothing Market remains positive, supported by the inelastic demand characteristics of the affluent consumer base and sustained growth in global luxury travel. Investment considerations should focus on brands with strong proprietary technology portfolios, demonstrated commitments to verifiable sustainability, and diversified geographical revenue streams, particularly those successfully penetrating the rapidly expanding APAC market. Brands with high Gross Margin percentages, resulting from stringent supply chain control and Direct-to-Consumer (DTC) sales dominance, are expected to yield the highest returns.

Key financial metrics to monitor include Average Selling Price (ASP) growth, which must be sustained by continuous product innovation (e.g., smart features, unique materials) to justify escalating premium pricing. Inventory turnover is also critical, given the high value and seasonal nature of the stock; efficient use of AI-driven demand forecasting is essential for minimizing end-of-season markdowns and preserving brand equity. Companies that are vertically integrated or have secured exclusive, long-term contracts with specialized textile manufacturers are better insulated against raw material price volatility, offering more predictable financial performance.

Strategic financial investments should also target opportunities in adjacent markets, such as high-end ski equipment rentals and luxury winter resort wear, which complement the core ski apparel market. Furthermore, capital expenditure should prioritize enhancing digital infrastructure, including e-commerce platforms and supply chain digitization, to support global scalability and the personalized customer service required at this price point. Overall, the market promises robust, steady growth, rewarding businesses that master the balance between heritage exclusivity, technical innovation, and responsible manufacturing practices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager