Luxury Skincare Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432224 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Luxury Skincare Products Market Size

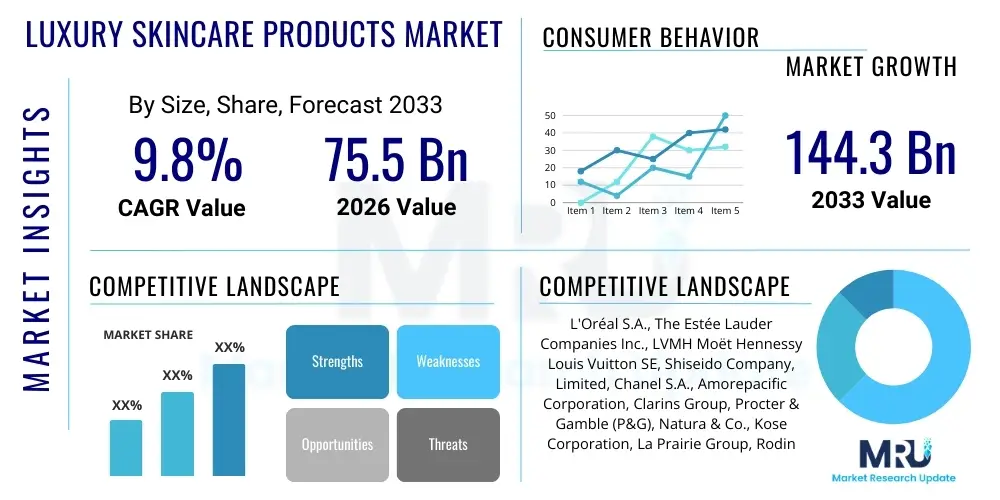

The Luxury Skincare Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 75.5 Billion in 2026 and is projected to reach USD 144.3 Billion by the end of the forecast period in 2033.

Luxury Skincare Products Market introduction

The Luxury Skincare Products Market encompasses high-end, premium, and ultra-premium beauty formulations characterized by superior ingredient quality, advanced scientific research, exclusive branding, and high price points. These products typically include facial moisturizers, specialized serums, anti-aging creams, targeted treatments, and luxury cleansers, often incorporating rare or patented active ingredients such as high-grade peptides, proprietary bio-engineered complexes, potent botanical extracts, and advanced delivery systems (e.g., encapsulated retinol or liposomes). The primary function of these products extends beyond basic hydration to provide significant corrective, preventative, and indulgence benefits, catering to consumers seeking visible results, exclusivity, and a superior sensory experience.

Major applications of luxury skincare are deeply rooted in addressing complex dermatological concerns related to aging, environmental damage, hyperpigmentation, and sensitivity. Key consumer demographics prioritize efficacy, seeking clinical validation and highly concentrated formulas over mass-market alternatives. The benefits derived from these luxury items include enhanced skin elasticity, reduction of fine lines and wrinkles, improved texture and tone consistency, and optimized barrier function. Furthermore, the psychological benefit of luxury consumption—associated with self-care, status, and wellness—significantly contributes to sustained demand across affluent consumer bases globally. The product's appeal is increasingly tied to sustainability, ethical sourcing, and transparency regarding active ingredient concentrations.

Driving factors propelling this market include rising disposable incomes in emerging economies, particularly in Asia Pacific; the expanding influence of digital media and beauty influencers promoting sophisticated self-care routines; and the demographic surge in the middle-aged population keenly focused on anti-aging solutions. Additionally, advancements in cosmetic science, leading to the introduction of novel, high-performance ingredients, continually justify the premium pricing structure. The market also benefits from strategic marketing focused on heritage, exclusivity, and personalized beauty consultations, reinforcing the perceived value proposition that differentiates luxury offerings from standard premium segments. Brand loyalty remains exceptionally high in this sector, driven by consistent product quality and exclusive user experiences.

Luxury Skincare Products Market Executive Summary

The Luxury Skincare Products Market exhibits robust growth driven by elevated consumer willingness to invest in preventative anti-aging solutions and highly personalized beauty regimes. Current business trends indicate a significant shift toward 'clean beauty' and sustainable luxury, forcing established brands to reformulate and enhance supply chain transparency while maintaining product exclusivity. Strategic mergers and acquisitions are common, as large conglomerates seek to absorb innovative, niche luxury brands specializing in biotech or rare botanical ingredients. E-commerce channels and direct-to-consumer (DTC) models are rapidly gaining dominance, offering brands greater control over narrative, pricing, and personalized customer interaction, thereby redefining the traditional retail landscape which historically relied heavily on department stores and specialized boutiques.

Regionally, the Asia Pacific (APAC) market, particularly China, South Korea, and Japan, remains the primary growth engine, fueled by deeply ingrained cultural emphasis on skincare rituals and rapidly expanding high-net-worth individual populations. North America and Europe, while mature, continue to show resilience, focusing on clinical efficacy and sophisticated ingredient stories, with a growing subset of consumers prioritizing "skintellectualism" and complex multi-step routines. Emerging markets in Latin America and the Middle East are accelerating their consumption rates, driven by aspirational buying and the proliferation of international luxury retailers and online platforms, although logistics and localized marketing tailored to specific climates pose unique challenges for market penetration.

Segment trends reveal that facial serums and specialized treatments (e.g., masks and ampoules) are experiencing the fastest uptake, reflecting consumer preference for targeted, high-concentration products. Anti-aging remains the dominant functionality segment, though demand for products focused on urban pollution defense and microbiome balance is rapidly rising. Distribution channel analysis highlights that brand-owned physical stores and flagship locations are crucial for maintaining the luxury experience and brand identity, complementing the high volume of sales generated through specialized online beauty retailers. Furthermore, the segment dedicated to male luxury skincare, while smaller, is growing significantly as gender norms soften and men increasingly adopt sophisticated grooming habits, pushing brands to diversify product lines specifically tailored for masculine skin needs.

AI Impact Analysis on Luxury Skincare Products Market

Common user questions regarding AI's impact on luxury skincare center on whether artificial intelligence can truly replicate the personalized consultation experience, how AI-driven diagnostics will influence purchasing decisions, and if automated manufacturing will dilute the exclusivity and handcrafted perception associated with luxury products. Users frequently inquire about the reliability of AI-powered skin analysis apps, the security of their biometric data, and the potential for AI to create hyper-personalized, one-of-a-kind formulations sold at a premium. The key theme is the expectation that AI should enhance, not diminish, the exclusivity and efficacy of luxury skincare, moving beyond generic recommendations to truly bespoke solutions while addressing concerns about the preservation of brand heritage and the human element in high-touch retail environments.

- AI-driven personalized consultation platforms enhance customer experience by offering tailored product recommendations based on real-time skin diagnostics.

- Predictive analytics optimize inventory management, reducing waste and ensuring stock availability of high-demand, limited-edition luxury lines.

- Machine learning accelerates R&D by identifying novel ingredient synergies and optimizing formulation stability and efficacy, shortening time-to-market for innovative products.

- Computer vision and deep learning facilitate advanced quality control and authentication processes, combating counterfeiting which plagues the high-value luxury market.

- Virtual try-on technologies and augmented reality (AR) significantly boost online engagement and conversion rates, bridging the gap between digital retail and experiential luxury shopping.

- Generative AI assists content creation for sophisticated marketing campaigns, ensuring brand messaging resonates with highly discerning, segmented luxury consumer groups.

- Robotics and automation are being integrated into ingredient sourcing and blending processes to ensure precise dosage and minimize human error while maintaining contamination control, especially for sensitive biotechnical ingredients.

DRO & Impact Forces Of Luxury Skincare Products Market

The dynamics of the Luxury Skincare Products Market are profoundly shaped by accelerating consumer demand for high-efficacy, scientifically validated anti-aging solutions (Driver), tempered by the prohibitive costs associated with research, ingredient sourcing, and premium manufacturing (Restraint). Opportunities are predominantly found in the technological integration of hyper-personalization via diagnostics and the geographical expansion into high-growth Asian markets. These forces interact to create a competitive landscape where innovation, supply chain integrity, and brand storytelling determine market dominance, collectively representing the powerful impact forces driving segmentation and pricing strategy. The inherent cyclical nature of consumer spending habits, particularly regarding non-essential luxury items, also acts as a critical external force that brands must strategically mitigate through loyalty programs and perceived value enhancement.

Drivers: The fundamental driver is the global aging population, coupled with increasing awareness regarding the importance of long-term skin health and preventative care, propelling investment in high-priced anti-aging serums and treatments. Furthermore, the sustained influence of social media and beauty expertise, which emphasizes sophisticated, layered skincare routines, normalizes higher spending on specialized products. The technological sophistication in ingredient encapsulation and delivery systems allows luxury brands to continuously introduce products with verifiable clinical results, justifying the premium price point and sustaining consumer interest in efficacy over volume.

Restraints: Significant restraints include the high initial investment required for sophisticated scientific research and development, which translates directly into high retail prices, limiting the market to affluent demographics. Counterfeiting and the saturation of the 'clean beauty' trend, which necessitates continuous and costly sourcing audits and certifications, pose operational challenges. Economic volatility, particularly recessionary pressures, can lead to consumers trading down from ultra-luxury items to premium or masstige brands, placing financial pressure on market growth trajectories, especially in price-sensitive emerging markets.

Opportunities: Key opportunities lie in leveraging digital transformation to offer hyper-personalized skincare experiences, including custom-blended formulations based on individual skin microbiome analysis or genetic profiles. There is significant potential in expanding the male grooming segment within the luxury framework, offering sophisticated, specialized lines. Furthermore, penetrating Tier 2 and Tier 3 cities in rapidly developing Asian economies (like China and India) provides substantial long-term growth avenues, provided the brands adapt their distribution and communication strategies effectively to localized preferences and regulatory environments.

Impact Forces: The overarching impact force is the heightened consumer expectation for sustainability and ethical sourcing; failure to meet these standards severely damages brand perception and market share among conscientious luxury buyers. The competitive pressure from biotech startups and niche luxury brands specializing in highly concentrated formulas compels established players to continuously innovate or acquire smaller disruptors. Regulatory changes, particularly concerning ingredient safety (e.g., EU regulations), necessitate frequent and costly reformulations, which is a structural impact force unique to the global beauty industry. Lastly, the impact of direct-to-consumer (DTC) digital channels dictates marketing expenditure and requires substantial investment in digital infrastructure to maintain the high-touch customer relationship expected in the luxury segment.

Segmentation Analysis

The Luxury Skincare Products Market is meticulously segmented based on product type, end-user demographics, and distribution channels, reflecting the industry’s focus on catering to specific consumer needs and purchasing behaviors. Product segmentation distinguishes between functional categories such as facial care, body care, and specialized treatments, with facial care consistently dominating due to the high consumer investment in appearance and anti-aging remedies. Distribution channel analysis is critical, illustrating the shift from traditional physical retail to sophisticated online platforms and exclusive brand boutiques, which are essential for preserving the premium brand experience and controlled pricing strategy. End-user segmentation increasingly highlights the expanding influence of the male consumer segment and the targeted marketing towards specific age groups seeking preventative or corrective treatments.

- Product Type

- Facial Care (Moisturizers, Cleansers, Toners, Serums, Masks)

- Body Care (Lotions, Creams, Oils, Sun Care)

- Eye Care (Creams, Serums)

- End-User

- Women

- Men

- Functionality

- Anti-aging

- Hydration/Moisturization

- Skin Brightening/Anti-pigmentation

- Acne & Oil Control

- Sun Protection

- Distribution Channel

- Specialty Stores & Brand Boutiques

- Department Stores

- Online Retail (Brand websites, E-commerce platforms)

- Pharmacies & Medical Spas

Value Chain Analysis For Luxury Skincare Products Market

The luxury skincare value chain is defined by its rigorous quality control, exclusivity in raw material sourcing, and high emphasis on research and development (R&D), resulting in a substantially higher cost structure compared to mass-market products. Upstream activities involve sourcing rare, proprietary, or highly concentrated active ingredients, often requiring specialized cultivation or bio-engineering techniques, which necessitates strong, long-term relationships with certified suppliers. Midstream activities, primarily focusing on advanced manufacturing and specialized formulation, involve stringent laboratory testing, sophisticated blending processes, and meticulous packaging design, where the aesthetics and sensory experience of the product container itself contribute significantly to the perceived luxury value. The high investment in R&D ensures product differentiation and clinical validation, acting as the primary value driver.

Downstream activities center on distribution, sales, and post-purchase service, all designed to maintain brand prestige. The distribution channel is often carefully controlled, utilizing direct distribution through exclusive brand boutiques or high-end department stores to ensure the retail environment aligns with the brand image. The proliferation of direct and indirect channels is managed to offer both convenience (indirect via authorized luxury e-tailers) and an immersive brand experience (direct physical stores). Indirect distribution through carefully selected retailers ensures wide market reach while maintaining price integrity. Direct channels, especially brand websites, facilitate hyper-personalized customer data collection, enabling targeted marketing and custom product offerings, enhancing long-term customer loyalty and lifetime value.

Effective value chain management in this sector mandates absolute transparency and traceability, particularly concerning sustainable and ethical sourcing claims, which are non-negotiable for the luxury consumer. The focus is heavily placed on maximizing gross margin through pricing power justified by superior ingredients and advanced formulation technologies, rather than merely optimizing logistical efficiency. The final element involves robust after-sales service, including personalized follow-ups, loyalty programs, and expert consultations, reinforcing the high-touch, exclusive relationship between the luxury brand and its clientele. This ensures that the entire product journey, from ingredient sourcing to consumer application, is synonymous with exclusivity and quality.

Luxury Skincare Products Market Potential Customers

The primary potential customers for the Luxury Skincare Products Market are affluent, high-net-worth individuals (HNWIs) and high-earning professionals, predominantly residing in metropolitan areas across North America, Western Europe, and high-growth Asian cities. These consumers prioritize quality, efficacy, and brand heritage over price, viewing skincare as an investment in wellness and preventative health rather than merely a cosmetic expense. This demographic is highly educated regarding ingredients and formulation science, often seeking clinical data and personalized consultation before making a purchase. Their purchasing decisions are significantly influenced by specialized beauty advisors, dermatologist recommendations, and exclusive peer referrals.

A rapidly expanding segment of potential customers includes aspirational luxury buyers, particularly younger millennials and Generation Z consumers in emerging markets. Although they may not possess the wealth of HNWIs, they allocate a substantial portion of their disposable income towards accessible luxury items, including high-end serums or moisturizers, often purchased through curated online platforms. These consumers are driven by social media trends, influencer endorsements, and a desire to participate in sophisticated self-care rituals. Brands must cater to this segment by offering accessible entry-point luxury products while maintaining the exclusivity associated with the core high-end offerings.

Furthermore, the specialized demographic of consumers seeking highly targeted therapeutic solutions, often recommended by dermatologists or aesthetician clinics, represents another crucial customer base. This group includes individuals requiring specific treatments for chronic skin conditions, post-procedure recovery, or advanced anti-aging intervention. For this segment, the clinical efficacy and ingredient concentration are paramount, justifying the ultra-premium pricing. Brands that successfully bridge the gap between cosmetic luxury and medical-grade performance capture this highly loyal and specialized clientele, enhancing their credibility across the broader market spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 75.5 Billion |

| Market Forecast in 2033 | USD 144.3 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., The Estée Lauder Companies Inc., LVMH Moët Hennessy Louis Vuitton SE, Shiseido Company, Limited, Chanel S.A., Amorepacific Corporation, Clarins Group, Procter & Gamble (P&G), Natura & Co., Kose Corporation, La Prairie Group, Rodin Olio Lusso, Sulwhasoo, Valmont Group, Sisley Paris, Augustinus Bader, Tatcha, Dr. Barbara Sturm, Dior Beauty, Guerlain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Skincare Products Market Key Technology Landscape

The technology landscape within the luxury skincare market is heavily skewed towards advanced biotechnological manufacturing and sophisticated delivery systems designed to enhance ingredient stability and penetration. Microencapsulation technology is pivotal, protecting delicate active ingredients like Vitamin C and retinol from degradation until they reach the target layer of the skin, thereby maximizing efficacy and justifying the high ingredient cost. Furthermore, bio-fermentation and proprietary cellular extraction techniques are widely utilized to produce highly pure, concentrated ingredients, such as specialized peptides, growth factors, and exclusive marine extracts, which form the core of patented luxury formulations. This commitment to superior biotechnological processing underpins the clinical claims made by luxury brands.

Beyond ingredient formulation, digital technology is transforming the consumer interface and product experience. Diagnostic tools utilizing AI-powered imaging and spectroscopy provide consumers with precise, personalized skin analysis at home or in-store. These tools inform hyper-personalized product recommendations or even facilitate custom compounding of serums tailored to real-time skin needs, leveraging the concept of 'Skintellectualism' among affluent buyers. Moreover, the integration of blockchain technology is emerging as a critical tool for transparency, allowing luxury brands to provide consumers with an immutable record of ingredient sourcing, ethical status, and product authenticity, further bolstering trust and brand credibility in a market segment sensitive to counterfeiting.

The manufacturing process itself is incorporating sophisticated robotics and sterile laboratory environments to handle highly potent and expensive raw materials with precision, minimizing waste and ensuring batch consistency—a non-negotiable trait for luxury products. Advances in sustainable packaging technology, including refillable systems and bio-degradable materials, are also rapidly gaining traction. While not directly related to efficacy, sustainable packaging is a technological necessity driven by consumer ethics, requiring significant R&D investment to ensure premium aesthetics and product preservation are maintained while meeting stringent environmental mandates, further embedding technology throughout the entire product lifecycle.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth for the luxury skincare market, predominantly driven by markets in China, South Korea, and Japan. The region benefits from a deep-rooted cultural emphasis on comprehensive skincare routines (the 10-step Korean routine, for instance), combined with rapidly increasing disposable incomes among the burgeoning middle class and HNWIs. South Korea serves as a global innovation hub for cosmetic biotechnology and formulation trends, influencing luxury product development worldwide. Chinese consumers, in particular, show a strong affinity for ultra-premium anti-aging products and are heavily influenced by digital platforms and Key Opinion Leaders (KOLs) when making purchasing decisions, necessitating tailored digital marketing strategies.

- North America: This region, led by the United States, is characterized by a strong consumer preference for clinically validated, ingredient-driven luxury brands, often referred to as "cosmeceuticals." The market here is highly mature and competitive, focusing on targeted treatments and products addressing specific concerns like sensitive skin, pollution defense, and advanced sun protection. The growth is sustained by high consumer spending on aesthetic procedures and the resultant need for high-end post-treatment care products, often sold through medical spas and specialized clinics, linking luxury skincare closely with wellness and clinical efficacy.

- Europe: Europe represents a heritage market segment, with consumers valuing classic, established French and Italian luxury brands known for their exclusivity, botanical ingredients, and long-standing history. The European market, especially in countries like France and Germany, is driven by strict regulatory standards concerning ingredients, pushing brands toward highly transparent and sustainable sourcing. The emphasis is often on the sensorial experience, elegant packaging, and the narrative of brand heritage, though modern consumers are increasingly integrating scientific efficacy into their purchase criteria.

- Middle East and Africa (MEA): While smaller, the MEA market, specifically the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), demonstrates high potential due to exceptionally high per capita spending power among the elite population. Luxury purchases are aspirational and status-driven, favoring globally recognized high-end brands. Challenges include specialized product development to address climate-related skin issues (intense heat and humidity) and the need for localized distribution channels that cater to unique retail preferences, such as high-end shopping malls and private retail consultations.

- Latin America: This region shows promising growth, particularly in Brazil and Mexico, fueled by increasing urbanization and the rising popularity of international beauty trends disseminated through social media. Consumers are price-sensitive compared to North America or Europe but show a high willingness to spend on luxury facial care products perceived as offering superior, long-lasting results. Distribution is often complex, requiring careful navigation of local regulations and reliance on specialty drugstores and authorized importers to reach affluent urban populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Skincare Products Market.- L'Oréal S.A. (includes brands like Lancôme, Biotherm, Kiehl's)

- The Estée Lauder Companies Inc. (includes brands like La Mer, Clinique, Aveda)

- LVMH Moët Hennessy Louis Vuitton SE (includes brands like Dior Beauty, Guerlain)

- Shiseido Company, Limited (includes brands like Clé de Peau Beauté, Shiseido Ginza Tokyo)

- Chanel S.A.

- Amorepacific Corporation (includes brands like Sulwhasoo)

- Clarins Group

- Procter & Gamble (P&G) (Luxury Beauty division)

- Natura & Co.

- Kose Corporation

- La Prairie Group

- Valmont Group

- Sisley Paris

- Augustinus Bader

- Dr. Barbara Sturm

- Tatcha

- Rodin Olio Lusso

- 111SKIN

- Hourglass Cosmetics (Estée Lauder Subsidiary)

- Dr. Hauschka

Frequently Asked Questions

Analyze common user questions about the Luxury Skincare Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Luxury Skincare Products Market?

The Luxury Skincare Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033, driven primarily by anti-aging demand and rising consumer affluence in APAC.

Which distribution channel is most critical for maintaining brand exclusivity in luxury skincare?

Specialty Stores and Brand-Owned Boutiques are crucial for maintaining brand exclusivity and controlling the consumer experience, though online retail through official brand websites is increasingly important for personalized DTC engagement.

How is AI technology transforming product personalization within the luxury skincare sector?

AI is transforming personalization by enabling real-time skin diagnostics via apps and in-store devices, leading to hyper-personalized product recommendations or the creation of custom-blended formulations based on individual skin needs and profiles.

What are the primary factors restraining growth in the Luxury Skincare market?

The primary restraints include the high costs associated with proprietary ingredient sourcing and advanced R&D, which result in premium retail pricing, limiting market access, alongside significant challenges posed by product counterfeiting.

Which geographical region is currently the dominant driver of market expansion?

The Asia Pacific (APAC) region, particularly driven by robust demand in China and South Korea, is the most significant driver of market expansion due to high consumer interest in sophisticated skincare rituals and rapidly increasing disposable incomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager