Luxury Tableware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434417 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Luxury Tableware Market Size

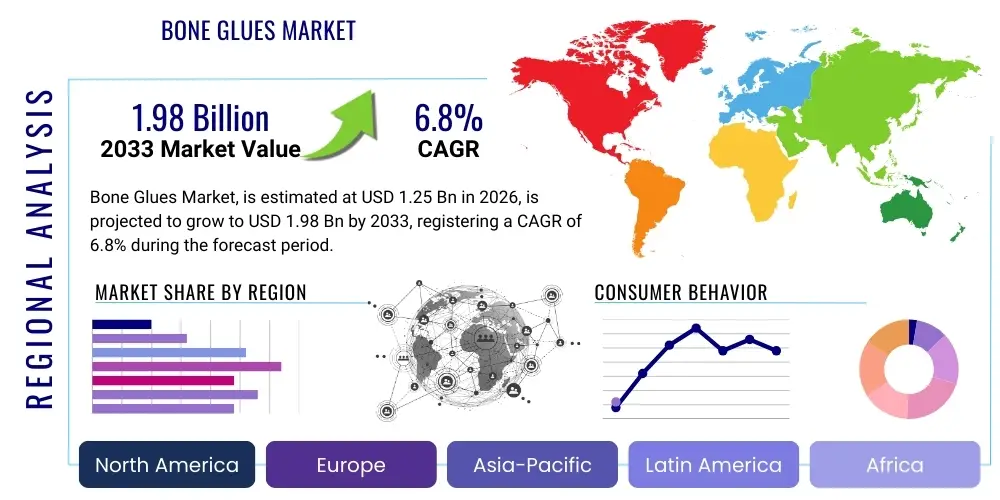

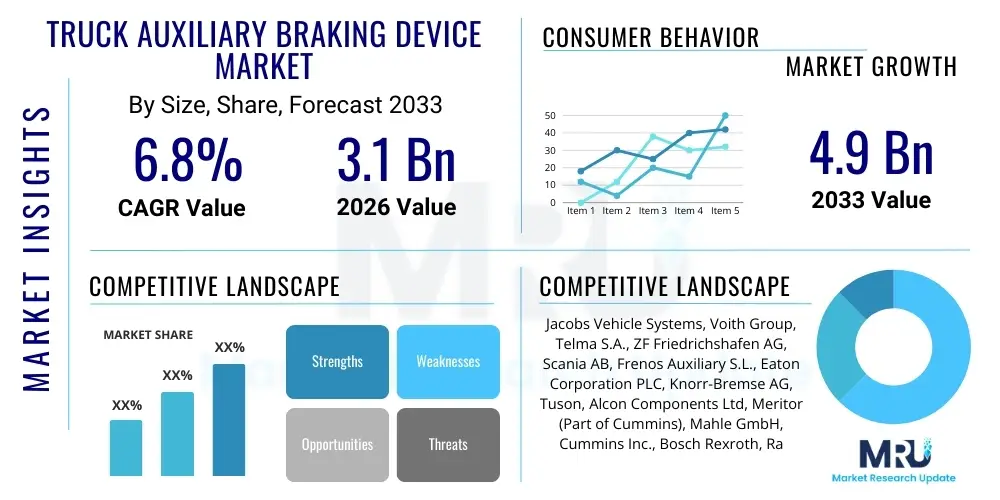

The Luxury Tableware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by rising disposable incomes among High-Net-Worth Individuals (HNWIs), particularly in emerging economies, coupled with a renewed global focus on home décor, experiential dining, and high-end gifting. The demand is further amplified by the hospitality sector's continuous upgrade cycles, requiring premium, durable, and aesthetically superior tableware to enhance the guest experience in five-star hotels and fine dining establishments.

Luxury Tableware Market introduction

The Luxury Tableware Market encompasses high-end dining and serving accessories crafted from premium materials such as fine bone china, crystal, sterling silver, and high-grade porcelain, often featuring bespoke designs, intricate hand-painting, and limited edition releases. These products serve not merely a functional purpose but operate as status symbols and investment pieces, enhancing the ambiance of sophisticated dining environments. Major applications span residential use among affluent consumers, institutional purchasing by luxury hotels and resorts, corporate gifting, and specialized collecting. The primary benefits include superior durability, aesthetic exclusivity, historical brand prestige, and the capability to elevate culinary presentation. Key driving factors include the globalization of luxury consumption, increased spending on personalized home aesthetics, the growth of the global luxury hospitality sector, and sustained marketing efforts emphasizing heritage and craftsmanship.

The product description highlights items that fall into the upper echelon of the homeware sector, distinguishing themselves through unparalleled material quality, meticulous manufacturing processes, and significant brand legacy. Unlike mass-market alternatives, luxury tableware often involves proprietary glazes, specialized firing techniques, and complex design geometries, justifying the premium price points. The intrinsic value proposition lies in the blend of art and functionality, where pieces transition from serving items to decorative accents. The shift toward personalized aesthetics post-pandemic has further reinforced the market's trajectory, as consumers seek distinctive elements to differentiate their private dining spaces and entertaining styles.

Furthermore, the market's resilience is underpinned by its critical role in the luxury gifting economy. High-end tableware sets are frequently chosen for significant life events, such as weddings and anniversaries, acting as enduring symbols of celebration and wealth. This segment provides a consistent demand floor, regardless of minor economic fluctuations. The emphasis on sustainability and ethical sourcing is also becoming a subtle driver, with consumers increasingly favoring brands that demonstrate transparency in their material provenance and manufacturing labor practices, adding another layer of value beyond pure material cost and design complexity.

Luxury Tableware Market Executive Summary

The Luxury Tableware Market is characterized by robust business trends focusing on digitalization of retail, strategic brand collaborations, and a strong emphasis on customizable products to meet discerning consumer tastes. Regional trends indicate sustained dominance in North America and Europe, which host the majority of legacy luxury brands, but rapid growth is accelerating across the Asia Pacific (APAC), particularly China and India, driven by the expanding middle class and rapidly accumulating wealth. Segment trends reveal that fine bone china maintains the largest market share due to its perceived quality and lightness, while crystal and glassware segments are experiencing rapid innovation, focusing on lead-free compositions and unique color treatments. The overall competitive landscape is consolidating, with established houses acquiring niche artisanal brands to broaden their design portfolios and capture specialized market segments, ensuring brand ubiquity across diverse channels, including exclusive online platforms and flagship physical boutiques.

In terms of operational shifts, there is a pronounced move towards experiential marketing, where brands are establishing partnerships with elite culinary institutions and celebrity chefs to showcase their products in real-world high-end settings. This approach not only validates the quality but also provides crucial social proof, significantly influencing purchase decisions among HNWIs who prioritize curated experiences. Supply chain resilience is a key focus, especially following global disruptions, leading companies to strategically diversify sourcing of primary materials—such as high-grade kaolin for porcelain—and invest in localized, specialized manufacturing facilities to mitigate logistical risks and maintain the critical 'Made In' provenance associated with luxury goods.

The financial health of the market remains strong, supported by high average transaction values and relative immunity from downturns that affect mass-market goods. Investment is heavily directed towards sustainable packaging solutions and enhancing the omnichannel retail experience. The integration of advanced inventory management systems and sophisticated customer relationship management (CRM) platforms is becoming standard practice, enabling hyper-personalized marketing campaigns and effective management of limited-edition stock releases. This strategic maneuvering is crucial for maintaining the necessary balance between exclusivity and accessibility, a core challenge in the luxury consumer goods space.

AI Impact Analysis on Luxury Tableware Market

User inquiries regarding AI's impact on the Luxury Tableware Market frequently revolve around personalization capabilities, supply chain optimization, and the preservation of artisanal craftsmanship against automation. Consumers and industry stakeholders are keen to understand how AI can assist in predicting emerging color palettes and design trends without sacrificing the uniqueness inherent in hand-finished products. Key concerns center on whether generative AI will democratize design to the point of devaluing exclusivity and how machine learning can enhance operational efficiencies, such as defect detection in manufacturing or optimizing complex global logistics networks, while maintaining the brand promise of flawless quality and timely delivery. The consensus expectation is that AI will act primarily as an intelligence layer—facilitating faster design iterations, improving inventory accuracy, and creating highly targeted consumer marketing profiles—rather than replacing the core artisanal skills required for creation.

AI's influence is already manifesting in several transformative areas, particularly in enhancing customer engagement and predictive analytics. Machine learning algorithms are being utilized to analyze vast datasets of past sales, social media trends, and luxury sector reports to forecast demand for specific patterns, materials, and specialized product dimensions up to 18 months in advance. This predictive capability significantly reduces waste associated with overproduction and ensures that high-value, limited-edition runs are accurately sized to meet verified market desire. Furthermore, AI-powered chatbots and virtual assistants are providing high-touch, personalized consultation services 24/7, guiding affluent clients through complex customization options, crystal matching, and archival sourcing, thereby mimicking the exclusivity of a private sales appointment in the digital realm.

The manufacturing process, though inherently reliant on skilled manual labor, is seeing AI integration for quality control and efficiency gains. High-resolution visual inspection systems powered by deep learning are capable of identifying minute imperfections in glaze consistency, pattern alignment, and material integrity (like micro-fractures in crystal) far more reliably and quickly than the human eye. This automation of defect detection guarantees the rigorous quality standards expected in the luxury segment. Additionally, AI optimizes furnace and kilning schedules in ceramic production, adjusting temperature profiles dynamically based on real-time material properties, leading to energy savings and improved batch consistency, which is vital when dealing with sensitive, high-cost raw materials like bone ash and fine metallic accents.

- AI enhances demand forecasting for bespoke and limited-edition collections.

- Machine learning optimizes supply chain logistics for fragile, high-value shipments.

- Generative AI assists designers by rapidly prototyping new colorways and complex patterns.

- AI-powered visual systems ensure rigorous quality control and defect detection in manufacturing.

- Chatbots provide 24/7 personalized consultation for luxury clients and customization services.

DRO & Impact Forces Of Luxury Tableware Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping the sector's growth trajectory. Key drivers include the exponential increase in global wealth distribution, fostering a larger base of consumers capable of purchasing premium goods, alongside the cultural shift prioritizing home entertaining and interior aesthetics (the "cocooning effect"). Restraints primarily involve the high production costs associated with manual craftsmanship and premium raw materials, the vulnerability of the supply chain to geopolitical disruptions affecting raw material sourcing (e.g., specific minerals for glazes), and the threat posed by high-quality counterfeits attempting to mimic established designs. Opportunities lie in expanding into nascent luxury markets in APAC and MEA, leveraging sustainable materials to appeal to younger wealthy consumers, and integrating augmented reality (AR) technologies for virtual product trials. The dominant impact force is the relentless pursuit of product differentiation through artistic collaboration and material innovation, ensuring brands maintain a distinct separation from mass-produced counterparts.

Drivers related to experiential luxury are particularly potent. The modern consumer, especially Millennials and Gen Z HNWIs, increasingly values story, heritage, and unique experiences over mere material possession. Luxury tableware brands are capitalizing on this by emphasizing the narrative behind the craftsmanship, offering exclusive factory tours, and collaborating with Michelin-starred chefs to link their products directly to high culinary art. This cultural integration transforms the purchase from a transaction into an acquisition of an artifact with an accompanying prestige narrative. Furthermore, the burgeoning luxury residential real estate sector globally requires commensurate high-end furnishings and fittings, naturally driving bulk purchases of luxury tableware by interior design firms and property developers.

Despite these growth drivers, the primary restraint remains the intrinsic lack of scalability in true luxury production. The time-intensive nature of hand-painting, etching, and specialized firing limits output capacity, creating bottlenecks during periods of high demand. This scarcity, while maintaining exclusivity, restricts the total achievable market volume and revenue growth. Addressing this requires careful strategic balancing—investing in highly skilled artisan training programs while selectively applying technology (like advanced 3D printing for mold creation) only to tasks that do not compromise the finished product’s artisanal integrity. Success in this market is determined by a brand's ability to navigate these forces, maximizing the perceived value derived from tradition and exclusivity while strategically embracing modern logistics and digital marketing tools.

Segmentation Analysis

The Luxury Tableware Market is comprehensively segmented based on material, product type, application, and distribution channel, providing a granular view of consumer preferences and market profitability across various niches. This stratification allows luxury brands to tailor their product development, pricing strategies, and marketing campaigns to specific high-value demographics. Material segmentation is critical, as the choice of raw material—such as Fine Bone China (FBC), crystal, porcelain, or sterling silver—dictates the final price point, durability characteristics, and aesthetic appeal of the collection. The most significant trend within segmentation is the rapid adoption of FBC for daily use luxury, moving beyond its traditional role as purely formal dining ware, while high-end crystal continues to dominate specialized segments like stemware and decorative centerpieces, demonstrating sustained consumer appetite for exquisite drinking experiences.

Product type analysis reveals that dinnerware sets (plates, bowls, serving dishes) constitute the largest revenue stream, reflecting foundational household requirements and frequent use in formal entertaining. However, complementary categories such as specialized crystal stemware (for specific wine varietals) and high-quality flatware (sterling silver or high-grade stainless steel) often command higher per-unit prices and contribute significantly to margin expansion. Application segmentation underscores the duality of the market, serving both the highly fragmented, high-margin residential segment, which prioritizes customization, and the consolidating, volume-driven commercial sector (luxury hotels and resorts), which demands standardized quality and high replacement rates for professional use.

Distribution channel segmentation highlights the ongoing strategic shift toward direct-to-consumer (DTC) models via brand-owned boutiques and specialized e-commerce platforms. While traditional luxury department stores remain relevant for visibility and discovery, brands are increasingly utilizing their own digital channels to control brand narrative, manage exclusivity, and capture higher profit margins by bypassing intermediary retail fees. The ability to offer a seamlessly integrated omnichannel experience—where a client can customize a silver cutlery set online and pick it up at a physical boutique—is now essential for retaining market relevance and appealing to globally mobile, tech-savvy affluent consumers who demand convenience without compromising service quality.

- By Material: Fine Bone China, Porcelain, Crystalware, Sterling Silver/Metalware, Earthenware.

- By Product Type: Dinnerware Sets, Stemware and Drinkware, Flatware and Cutlery, Serveware (Serving Dishes, Platters), Decorative Items.

- By Application: Residential Use (Individual Consumers), Commercial Use (Hotels, Restaurants, Yachts, Corporate).

- By Distribution Channel: Offline (Brand Boutiques, Department Stores, Specialty Retail), Online (Brand Websites, E-commerce Platforms).

Value Chain Analysis For Luxury Tableware Market

The value chain for the Luxury Tableware Market is complex and highly specialized, beginning with stringent upstream analysis focused on the sourcing of high-purity raw materials. For porcelain and china, this involves securing specialized kaolin clay, feldspar, and quartz, often sourced from specific geological regions known for material quality. Crystalware production demands high-grade silica sand and precise metallic oxides for coloring and clarity. Since material quality directly dictates the final product's prestige and durability, brands invest heavily in long-term supply agreements and proprietary material blending techniques. The initial manufacturing stage is characterized by intensive, skill-dependent processes—mold creation, casting, firing (often multiple times at precise temperatures), and initial glazing—where labor costs and technical expertise represent a significant portion of the cost of goods sold (COGS).

Midstream activities revolve around craftsmanship and design. This phase involves highly specialized artistic labor, including hand-painting, intricate gilding (using precious metals like 24-karat gold or platinum), and manual etching in the case of crystal. Quality control checkpoints are numerous and rigorous, often requiring products to pass through the hands of multiple certified master craftspeople. These processes, coupled with brand management and intellectual property (IP) protection, solidify the product's luxury status. Distribution channels, forming the downstream element, are bifurcated into direct and indirect routes. Direct distribution (DTC) includes flagship stores and proprietary e-commerce, offering maximum margin control and brand experience fidelity. Indirect channels involve carefully selected high-end department stores and specialized retailers who act as trusted intermediaries, providing market reach in areas without a physical brand presence.

The downstream analysis emphasizes the importance of secure and specialized logistics. Luxury tableware, being fragile and high-value, requires bespoke packaging, insured transit, and often white-glove delivery services, particularly for large, expensive sets or customized orders. The distinction between direct and indirect distribution centers on control; direct channels allow for meticulous management of presentation, pricing, and after-sales service (such as repair and replacement), which is critical for maintaining brand trust. Indirect channels leverage the retailer’s established affluent customer base but necessitate strict contracts regarding merchandising and pricing integrity. Overall, the value chain demonstrates that the highest value is generated not solely by raw materials but by the highly skilled labor, heritage reputation, and control exercised over the customer experience through premium distribution logistics.

Luxury Tableware Market Potential Customers

The primary customer base for the Luxury Tableware Market consists of High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) globally, who purchase these items for personal use, collection, or high-level entertaining. These individual buyers are characterized by high disposable incomes, a strong appreciation for cultural heritage, and a predisposition toward acquiring enduring, aesthetically superior assets that reflect their status and curated lifestyle. This segment frequently engages in bulk purchases for furnishing secondary residences, yachts, and private jets. The decision-making process for this demographic is heavily influenced by brand legacy, material rarity, and the opportunity for unique customization or commissioning bespoke, limited-edition designs that guarantee exclusivity.

A significant institutional segment constitutes the second major customer group: the global luxury hospitality and fine dining sectors. This includes five-star hotels (e.g., Four Seasons, Mandarin Oriental), exclusive resorts, cruise lines, and Michelin-starred restaurants. These buyers prioritize durability under frequent commercial use, standardized quality across large orders, and the ability of the tableware to harmonize with their overall brand aesthetic and dining concept. Their purchasing cycle is driven by renovation schedules and brand standardization updates, creating a consistent B2B demand for both classic and newly released contemporary designs that can withstand rigorous commercial washing and handling processes.

Furthermore, corporate entities and luxury gifting services represent a growing customer base. Corporations often purchase high-end tableware sets as prestigious executive gifts, retirement acknowledgments, or celebratory tokens. The gifting segment, whether corporate or personal (e.g., wedding registries), focuses on sets that convey timeless value, easy portability, and high brand recognition. These customers seek out products that maintain their value and convey a sense of genuine investment. Market efforts targeted at this segment often focus on special packaging, monogramming services, and partnerships with leading wedding planners and luxury gift concierge services to capture these high-volume, event-driven sales opportunities effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wedgwood, Royal Doulton, Meissen, Bernardaud, Christofle, Lenox, Waterford, Villeroy & Boch, Hermès Tableware, Baccarat, Tiffany & Co. Home, Mikasa, Royal Copenhagen, Noritake, Saint-Louis, Ginori 1735, Puiforcat, Vista Alegre, Moser, Kosta Boda |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Tableware Market Key Technology Landscape

The Luxury Tableware Market, while highly rooted in traditional craftsmanship, is subtly integrating advanced technologies to enhance precision, quality, and operational efficiency without compromising the core artisanal appeal. The key technological developments focus primarily on material science and sophisticated manufacturing control. In ceramics, advancements in computer-aided design (CAD) and 3D printing are accelerating the prototyping phase, allowing designers to rapidly test complex molds and intricate forms before committing to expensive manual production runs. Furthermore, proprietary developments in nano-glazing and high-performance firing techniques (utilizing advanced kilns with precise digital temperature control) are enhancing the durability, chip resistance, and whiteness of fine bone china and porcelain, thereby maintaining quality standards required by commercial clients.

For crystalware, technological innovation centers on creating lead-free crystal compositions that maintain the clarity, brilliance, and acoustic properties of traditional leaded crystal, addressing growing consumer concern about material safety. This involves complex material engineering and precise blending of barium oxide, zinc oxide, or potassium oxide. Additionally, automated, laser-guided cutting and etching technologies are used to achieve geometric precision in decorative cuts on crystal that are difficult to replicate consistently by hand, allowing artisans to focus their skills on the final, most intricate finishing touches. These tools do not replace the artisan but serve as extensions, ensuring perfection in repetitive or precision-critical initial stages.

Across the entire segment, digital technologies are redefining the consumer experience. Augmented Reality (AR) applications allow potential customers to virtually place tableware settings on their own dining tables before purchasing, significantly reducing buyer hesitancy related to scale and color matching. Moreover, blockchain technology is being explored by leading brands to provide immutable provenance tracking for limited-edition sterling silver sets or high-value art pieces, verifying authenticity and ownership history, which adds a layer of trust and investment value crucial for UHNW buyers. These technological adoptions are strategically implemented to optimize logistics, verify quality, and enhance the high-touch customer journey.

Regional Highlights

The global Luxury Tableware Market exhibits distinct characteristics across major regions, driven by cultural consumption patterns, local wealth concentration, and the presence of historic manufacturing centers.

- North America: This region is characterized by high consumption driven by strong disposable incomes and a pervasive culture of specialized home entertaining. The US market demands both classic European heritage brands and modern, minimalistic designs. The market here is highly receptive to digital sales channels and advanced customization services, making it a critical hub for luxury e-commerce strategies.

- Europe: As the historical epicenter of luxury tableware production, Europe hosts the majority of legacy brands (e.g., Meissen, Wedgwood, Baccarat). Demand is sustained by tradition, high replacement rates in the luxury hotel sector, and the enduring prestige associated with European craftsmanship. Germany, France, and the UK remain crucial for both manufacturing and consumption, focusing heavily on sustainability certifications and material provenance.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the burgeoning wealth in China, India, and Southeast Asia. Consumers here show a strong affinity for gold-accented, intricate, and elaborate designs often used for significant ceremonies and gifting. Japan maintains a strong domestic market for traditional high-quality porcelain and is a major manufacturing base for global brands.

- Middle East and Africa (MEA): Growth in the MEA region, particularly the Gulf Cooperation Council (GCC) states, is exceptionally strong, driven by large-scale luxury real estate development and the culture of opulent hospitality and celebratory feasting. Demand heavily favors crystalware, ornate gold flatware, and highly personalized services catering to Royal families and expatriate UHNW communities.

- Latin America: This region presents localized pockets of strong luxury demand, primarily concentrated in metropolitan areas of Brazil and Mexico. The market often relies on imported European brands, though local artisanal pottery and decorative ceramics also capture a share of luxury home décor spending, especially those emphasizing cultural motifs and natural materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Tableware Market.- Wedgwood

- Royal Doulton

- Meissen

- Bernardaud

- Christofle

- Lenox

- Waterford

- Villeroy & Boch

- Hermès Tableware

- Baccarat

- Tiffany & Co. Home

- Mikasa

- Royal Copenhagen

- Noritake

- Saint-Louis

- Ginori 1735

- Puiforcat

- Vista Alegre

- Moser

- Kosta Boda

Frequently Asked Questions

Analyze common user questions about the Luxury Tableware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Luxury Tableware Market?

The market growth is primarily driven by rising global disposable incomes among HNWIs, increased consumer focus on premium home entertaining and interior aesthetics (the cocooning effect), and sustained investment and replacement cycles within the luxury hospitality sector worldwide. The demand for personalized and collectible items also significantly contributes to market expansion.

Which material segment currently holds the largest market share in luxury tableware?

Fine Bone China (FBC) currently holds the largest market share due to its exceptional whiteness, durability, lightness, and long-standing association with high quality and formal dining. However, the crystalware and sterling silver segments maintain higher average selling prices per unit, crucial for margin expansion.

How is digital transformation impacting the distribution channels for luxury tableware?

Digital transformation is pushing brands toward Direct-to-Consumer (DTC) models through proprietary e-commerce sites, allowing greater control over pricing and brand narrative. Omnichannel integration, which combines physical boutique experiences with online customization tools (like AR visualization), is essential for high-touch customer service and attracting digitally native affluent buyers.

What role does sustainability play in the purchasing decisions of luxury tableware consumers?

Sustainability is increasingly important, particularly among younger affluent demographics. Consumers prioritize transparency in material sourcing (e.g., ethical mining for silver/gold accents), demand lead-free crystal compositions, and favor brands that demonstrate reduced environmental impact in their manufacturing processes and packaging, viewing sustainability as an added layer of ethical luxury value.

Which geographical region is projected to exhibit the fastest growth rate in this market?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to exhibit the fastest growth rate. This acceleration is attributed to rapid wealth accumulation, strong cultural traditions involving elaborate ceremonial dining and gifting, and high demand for opulent, prestige-driven luxury items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager