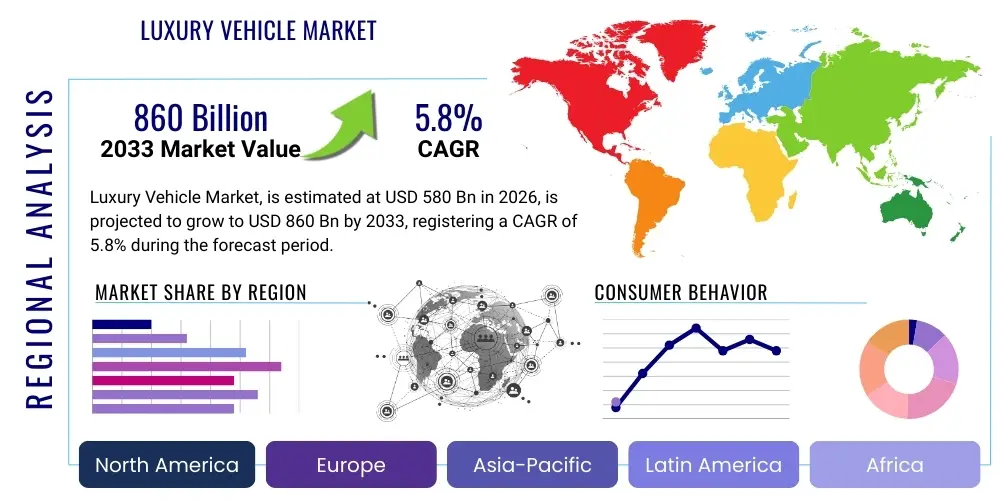

Luxury Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438734 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Luxury Vehicle Market Size

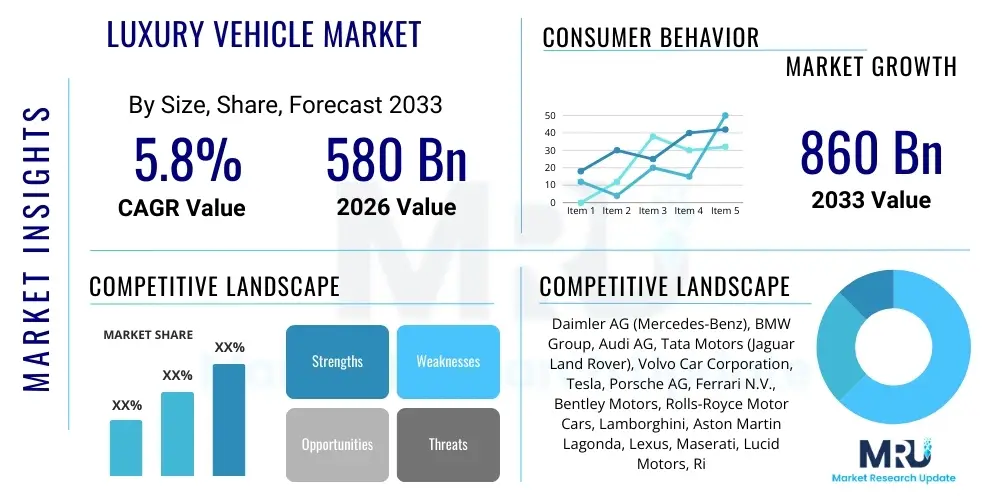

The Luxury Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 580 Billion in 2026 and is projected to reach USD 860 Billion by the end of the forecast period in 2033.

Luxury Vehicle Market introduction

The Luxury Vehicle Market encompasses the design, manufacturing, distribution, and sale of high-end automobiles characterized by superior performance, advanced technology, premium materials, exceptional craftsmanship, and exclusive branding. These vehicles typically target affluent consumers seeking prestige, personalized experiences, and cutting-edge automotive innovations that extend beyond basic transportation needs. The primary product descriptions include ultra-luxury sedans, performance sports cars, high-end SUVs (Sport Utility Vehicles), and bespoke electric vehicles (EVs), all defined by customization options and exclusive after-sales services. Major applications involve personal use, corporate executive transport, and status symbol representation, catering to the distinct demands of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs).

The core benefits derived from this market segment include unparalleled driving dynamics, enhanced safety features utilizing sophisticated sensor technology, and luxurious cabin environments crafted from ethically sourced and high-quality materials such as premium leather, exotic wood veneers, and brushed metals. Furthermore, owning a luxury vehicle often signifies exclusivity and access to specialized brand communities and events. These benefits are continuously being enhanced by integrating seamless connectivity features and advanced driver-assistance systems (ADAS), appealing directly to the technologically savvy modern consumer.

Key driving factors propelling market expansion include the rapid increase in global wealth, particularly in emerging economies of Asia Pacific; sustained consumer confidence among the affluent class; and the ongoing technological transition toward electrification and autonomous capabilities. The shift towards Sustainable Luxury, where brands offer electric or hybrid models without compromising performance or design, is also a significant market catalyst. Furthermore, targeted marketing strategies focusing on personalized experiences and limited-edition models maintain high brand desirability and sustained demand across established geographies like North America and Europe.

Luxury Vehicle Market Executive Summary

The Luxury Vehicle Market is poised for substantial growth, driven fundamentally by shifting business trends favoring personalized luxury experiences and the rapid adoption of electric powertrain technology within the high-end segment. Business trends indicate a move away from mass production scaling toward highly customized, made-to-order manufacturing processes that enhance exclusivity and allow manufacturers to capture higher margins. Furthermore, digital retail platforms and direct-to-consumer models are reshaping distribution, allowing brands to maintain tighter control over customer relationships and pricing strategies. Innovation in sustainable materials and circular economy initiatives is also becoming a critical differentiator, influencing brand perception and purchasing decisions among environmentally conscious HNWIs.

Regionally, Asia Pacific is emerging as the fastest-growing market, primarily fueled by significant economic development and a burgeoning population of millionaires and billionaires, particularly in China and India. North America and Europe, while mature, remain dominant revenue generators, focusing heavily on adopting high-performance electric luxury vehicles (ELVs) and advanced ADAS features. Regional trends highlight divergent demands: while Asian consumers often prioritize rear-seat comfort and technological novelty, Western consumers place greater emphasis on dynamic driving performance and brand heritage. Regulatory environments mandating lower emissions are also accelerating the electrification curve across all key geographic markets.

In terms of segmentation trends, the SUV category continues to dominate sales volume, representing the democratization of luxury and appealing to family-oriented, affluent buyers seeking versatility without compromising prestige. Simultaneously, the Battery Electric Vehicle (BEV) segment within luxury vehicles is experiencing exponential growth, driven by new model introductions that redefine performance benchmarks and interior technology standards. Moreover, the shift towards Subscription and Mobility-as-a-Service (MaaS) models, while nascent, is gaining traction among younger affluent demographics who value flexibility over outright ownership. The Ultra-Luxury category (vehicles priced above $250,000) is also demonstrating robust resilience, proving impervious to general economic fluctuations due to the inelastic demand characteristics of UHNWIs.

AI Impact Analysis on Luxury Vehicle Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Luxury Vehicle Market center primarily on how AI will enhance the driving experience, personalize cabin environments, and revolutionize manufacturing efficiency. Users frequently inquire about the reliability and ethical implications of Level 4 and Level 5 autonomous driving systems powered by AI, seeking assurances regarding safety and control retention. Key themes include the expectation of hyper-personalized vehicle settings that learn driver and passenger habits (e.g., climate control, infotainment preferences, and seat adjustments), the role of predictive maintenance driven by AI diagnostics, and how AI can streamline bespoke manufacturing processes, making complex customization requests viable. There is also significant consumer interest in how AI assistants within the vehicle will offer concierge-level services and manage complex daily tasks seamlessly, transforming the vehicle into an integrated extension of the owner's digital life.

The integration of AI is fundamentally reshaping the value proposition of luxury vehicles, moving them beyond mechanical excellence toward integrated digital platforms. AI algorithms are crucial for developing highly sophisticated ADAS that lead to enhanced safety, such as collision avoidance and adaptive cruise control systems that operate with near-human intuition. Furthermore, AI is critical in optimizing the performance of electric powertrains, managing battery life, and regulating thermal dynamics to maximize range and longevity—a vital feature for high-performance electric luxury models.

In the manufacturing sphere, AI is being deployed for quality control through automated inspection systems and optimizing complex supply chains to manage the procurement of rare or highly specialized components required for custom builds. This allows luxury manufacturers to deliver unique, high-quality products faster and more efficiently, maintaining the critical element of exclusivity. AI-driven generative design is also exploring novel aerodynamic and aesthetic possibilities, pushing the boundaries of automotive engineering and design, thus ensuring that luxury vehicles maintain their competitive edge in innovation.

- AI powers Level 4/5 autonomous driving systems, enhancing safety and reducing driver fatigue.

- Hyper-personalization of interior settings, including infotainment, climate, and ambient lighting, is managed by AI learning algorithms.

- Predictive maintenance uses AI diagnostics to schedule services proactively, minimizing downtime for affluent owners.

- AI optimizes battery management systems (BMS) in Electric Luxury Vehicles (ELVs), maximizing range and efficiency.

- Generative AI assists designers in creating novel, high-performance exterior and interior aesthetics.

- AI-driven production quality control systems ensure flawless execution in bespoke manufacturing processes.

- In-car AI assistants offer sophisticated, voice-activated concierge services and seamless digital integration.

DRO & Impact Forces Of Luxury Vehicle Market

The Luxury Vehicle Market is primarily driven by the increasing global population of High-Net-Worth Individuals (HNWIs) and their sustained desire for status symbols, exclusivity, and personalized automotive experiences. The rapid pace of technological innovation, particularly in electrification, autonomous driving, and advanced connectivity (5G/V2X), acts as a strong driver, compelling luxury brands to continuously refresh their portfolios with cutting-edge features. Furthermore, favorable macroeconomic conditions in key emerging markets facilitate higher discretionary spending on premium goods. These drivers are amplified by the impact forces of brand loyalty and the inherent human desire for self-expression through high-value assets, ensuring sustained demand regardless of minor economic volatility.

However, significant restraints challenge market expansion. High purchase prices, coupled with escalating maintenance and insurance costs, naturally restrict the consumer base. Regulatory complexities, especially stringent global emissions standards (e.g., Euro 7, CAFE standards), necessitate substantial R&D investment in powertrain technologies, potentially increasing final vehicle costs. Moreover, disruptions in the global supply chain, particularly for high-grade semiconductors and rare-earth materials vital for battery packs and advanced electronics, pose ongoing operational risks that can delay production of highly anticipated models.

Opportunities abound, particularly in the rapid development of the Battery Electric Luxury Vehicle (BELV) segment, which offers established brands a chance to redefine their core competencies and attract a younger, environmentally aware affluent clientele. The personalization and customization market presents substantial opportunity for increased margins through bespoke manufacturing programs and specialized trim levels. Furthermore, expanding the definition of luxury mobility to include premium subscription services and high-end certified pre-owned programs allows manufacturers to tap into wider consumer segments while retaining high residual values, thereby strengthening overall brand equity and market penetration strategies.

Segmentation Analysis

The Luxury Vehicle Market is meticulously segmented across multiple dimensions to accurately capture diverse consumer preferences and operational strategies. Key segmentation categories include Vehicle Type, covering Sedans, SUVs, Sports Cars, and Convertibles; Propulsion Type, differentiating between ICE (Internal Combustion Engine), Hybrid, and BEV (Battery Electric Vehicle); and Pricing Tier, which separates Entry-Level Luxury, Mid-Tier Luxury, High-End Luxury, and Ultra-Luxury categories. This granular approach is vital for manufacturers to tailor their product development, marketing efforts, and distribution strategies to specific consumer cohorts based on wealth level, regional tastes, and functional needs, ensuring maximized profitability and brand positioning.

The Vehicle Type segmentation reveals a clear market shift towards luxury SUVs, which combine high-status branding with practical utility, appealing strongly to global consumers. Concurrently, the Propulsion Type segment demonstrates the strategic imperative of electrification. While ICE models still hold significant market share, the BEV segment is the growth engine, driven by governmental mandates and increasing consumer willingness to adopt high-performance electric platforms, especially in regions with robust charging infrastructure and supportive incentives. Pricing Tier segmentation dictates technological inclusion and material exclusivity, with Ultra-Luxury brands focusing on handcrafted components and extremely limited production runs to maintain scarcity and astronomical pricing.

Further segmentation includes distribution channels (direct sales vs. dealerships) and application (personal vs. fleet). Understanding these segment dynamics allows stakeholders to analyze competitive positioning and identify underserved niches, such as the growing demand for specialized luxury armored vehicles or highly secure executive shuttles. The overall segmentation structure confirms that market growth is increasingly reliant on innovation in electric powertrains and the ability to offer tailored, integrated digital experiences that seamlessly blend physical luxury with cutting-edge connectivity and autonomous capabilities.

- By Vehicle Type:

- Luxury Sedans

- Luxury SUVs/Crossovers

- Luxury Sports Cars

- Luxury Hatchbacks/Wagons

- Luxury Convertibles/Roadsters

- By Propulsion Type:

- Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

- By Pricing Tier:

- Entry-Level Luxury (e.g., $50k – $80k)

- Mid-Tier Luxury (e.g., $80k – $150k)

- High-End Luxury (e.g., $150k – $250k)

- Ultra-Luxury (Above $250k)

- By Distribution Channel:

- Dealerships

- Direct-to-Consumer (Online and Brand Stores)

Value Chain Analysis For Luxury Vehicle Market

The value chain for the Luxury Vehicle Market is characterized by highly specialized processes and strict quality control across every stage, beginning with upstream activities focused on proprietary design and sourcing of exclusive materials. Upstream analysis involves intensive research and development (R&D) in areas such as lightweight chassis construction, advanced battery technology (for BEVs), and ergonomic design focused on unparalleled passenger comfort. Sourcing is critical, requiring secure partnerships with specialized suppliers for bespoke components—such as exotic wood veneers, handcrafted leather, and custom-engineered alloy components—ensuring material exclusivity and high ethical standards. Manufacturers maintain deep vertical integration in core areas like engine or platform design to protect intellectual property and maintain performance supremacy.

Midstream activities encompass sophisticated, often low-volume, manufacturing processes where precision and craftsmanship take precedence over high-volume efficiency. These processes frequently involve specialized production lines for bespoke customization, allowing individual customers to specify materials, colors, and unique features. Quality assurance is exceptionally rigorous, often involving multiple stages of human inspection alongside advanced robotic diagnostics, ensuring that every vehicle meets the brand's stringent standards for fit, finish, and performance. Inventory management focuses on minimizing stock and maximizing the speed of fulfilling custom orders, reflecting the made-to-order nature of high-value products.

Downstream analysis details the complex distribution channel, which heavily relies on both direct and indirect methods. Indirect channels utilize highly exclusive, authorized dealerships that provide specialized, high-touch sales and after-sales service tailored to affluent clients, often incorporating private viewing rooms and personalized delivery experiences. Direct channels, increasingly used by newer entrants (especially BEV focused brands) and for online customization, allow manufacturers greater control over pricing and customer data. Post-sale activities, including specialized servicing, certified pre-owned programs, and exclusive customer relationship management (CRM) initiatives, are crucial for maintaining high residual values and reinforcing brand loyalty, which are essential components of the luxury experience.

Luxury Vehicle Market Potential Customers

The primary segment of potential customers for the Luxury Vehicle Market consists of High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs), defined by significant liquid assets and high disposable income. These buyers are typically successful entrepreneurs, senior corporate executives, or professionals with established careers in high-earning sectors such as finance, technology, real estate, and entertainment. They seek vehicles that not only provide superior performance and comfort but also serve as tangible expressions of their personal success, refined taste, and societal status. Purchase decisions are often driven by brand heritage, design aesthetics, technological inclusion, and the availability of extensive personalization options, allowing the vehicle to reflect the owner's unique identity.

A rapidly growing secondary segment includes younger, affluent professionals (often millennials and Gen Z) who have achieved significant wealth through technology startups or e-commerce ventures. This group values sustainable luxury and cutting-edge digital integration, often prioritizing electric vehicle options that align with environmental responsibility while still offering high performance and connectivity. They may prefer flexible ownership models, such as subscription services or leasing, over traditional outright purchase, focusing on access to the latest models and features rather than long-term asset retention. Their expectations are high regarding seamless digital interaction, over-the-air updates, and hyper-personalized in-car digital experiences.

Furthermore, corporate fleets and executive transport services represent a specialized customer base. Large corporations and governments purchase luxury vehicles for executive travel and official duties, where safety, reliability, and discreet luxury are paramount. These buyers prioritize features like advanced security systems, armored options, and spacious, technology-equipped rear passenger cabins. Geographically, potential customers are heavily concentrated in mature wealth centers like North America and Western Europe, but growth potential is highest in rapidly expanding wealth hubs across the Asia Pacific region, particularly in urban centers where vehicle ownership is a clear measure of economic achievement and social standing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Billion |

| Market Forecast in 2033 | USD 860 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler AG (Mercedes-Benz), BMW Group, Audi AG, Tata Motors (Jaguar Land Rover), Volvo Car Corporation, Tesla, Porsche AG, Ferrari N.V., Bentley Motors, Rolls-Royce Motor Cars, Lamborghini, Aston Martin Lagonda, Lexus, Maserati, Lucid Motors, Rivian, General Motors (Cadillac), Hyundai Motor Group (Genesis), Karma Automotive, McLaren Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Vehicle Market Key Technology Landscape

The Luxury Vehicle Market is a primary incubator for pioneering automotive technologies, often debuting innovations years ahead of the mass market. The current key technology landscape is dominated by the strategic convergence of Electrification, Autonomous Driving Systems, and Hyper-Connectivity. Electrification technology centers on developing proprietary, high-density battery architectures that support extended range without compromising interior space, along with 800V charging capabilities that drastically reduce charging times. Luxury BEVs leverage specialized thermal management systems and sophisticated energy recuperation software to ensure sustained high performance, differentiating them significantly from conventional electric vehicles. Furthermore, the integration of specialized materials like carbon fiber and advanced aluminum alloys is crucial for maintaining lightweight structures necessary for optimal performance and efficiency, regardless of the heavy battery packs.

In terms of autonomous capabilities, luxury brands are heavily investing in sensor fusion technologies, combining high-resolution LiDAR, radar, and advanced camera systems powered by robust, AI-driven onboard computing platforms (often utilizing NVIDIA or Qualcomm chipsets). The focus is shifting from basic driver assistance (Level 2) toward conditional automation (Level 3), allowing the vehicle to manage complex tasks like highway piloting under certain conditions. These systems are designed to be seamless, intuitive, and highly reliable, maintaining a core commitment to safety while providing a truly relaxed driving or passenger experience. The software stack must be capable of receiving frequent Over-The-Air (OTA) updates to continuously improve functionality and introduce new features post-sale.

Connectivity is another defining technological pillar, transforming the vehicle cabin into a mobile digital office or entertainment hub. This involves integrating 5G capability for high-speed data transfer, facilitating advanced Vehicle-to-Everything (V2X) communication, and supporting sophisticated infotainment systems that manage multiple high-definition displays, augmented reality navigation, and personalized user profiles. Advanced Human-Machine Interface (HMI) design, incorporating sophisticated gesture control, haptic feedback, and natural language processing (NLP) for voice commands, ensures that the complex technological features are accessible and non-distracting, upholding the luxury standard of effortless interaction. Biometric sensors are also being incorporated to personalize security and maintain driver alertness, ensuring both exclusivity and enhanced safety.

Regional Highlights

- North America: Dominance in Technology Adoption and High-End Demand

North America, particularly the United States, represents a foundational market for luxury vehicles, characterized by a mature affluent consumer base and early adoption of performance-focused technologies. The region exhibits strong demand across all segments, with a notable preference for high-end luxury SUVs and large performance sedans. The market here is highly competitive, driven by established European brands and increasingly challenged by domestic electric luxury entrants like Tesla, Lucid, and Rivian, who are pushing the boundaries of connectivity and software-defined vehicle architecture. Regulatory shifts, coupled with federal and state incentives, are significantly accelerating the transition towards high-performance Battery Electric Vehicles (BEVs).

The focus in North America is heavily placed on digitalization and in-car technology, where consumers expect seamless integration with their existing digital ecosystems. High disposable incomes ensure that the Ultra-Luxury segment remains robust, often prioritizing bespoke customization and limited-edition models. Furthermore, the extensive road infrastructure encourages the purchase of vehicles designed for long-distance comfort and advanced autonomous highway driving features. Key cities like Los Angeles, New York, and Miami serve as major sales hubs, reflecting concentrated HNWI populations and sophisticated automotive retail experiences.

- Europe: Heritage, Sustainability, and Regulatory Pressure

Europe remains the epicenter of luxury automotive manufacturing and design, housing most of the world's most iconic luxury brands. The market is defined by a deep appreciation for driving dynamics, brand heritage, and meticulous craftsmanship, with consumers showing a strong preference for high-end sedans and performance sports cars, although the luxury SUV segment is rapidly expanding. Stringent emission regulations imposed by the European Union are the primary external force reshaping this market, driving aggressive investment in plug-in hybrids (PHEVs) and full Battery Electric Vehicles (BEVs).

Sustainability is a critical differentiator in Europe, appealing to environmentally conscious consumers who demand not only zero-emission driving but also ethically sourced and sustainable cabin materials. Countries like Germany, the UK, and France lead sales, with Northern European countries pioneering the highest rates of luxury EV adoption. The competitive landscape involves legacy brands fiercely defending market share by leveraging decades of engineering expertise and transforming their iconic model lines into electrified variants without compromising their core performance identity, often focusing on advanced handling and driver engagement.

- Asia Pacific (APAC): Growth Engine and Demographic Shift

Asia Pacific is the fastest-growing region globally for the Luxury Vehicle Market, largely propelled by the immense wealth accumulation in China, India, and emerging Southeast Asian nations. This region’s demand is characterized by consumers who often prioritize rear-seat luxury, technological spectacle, and explicit displays of status. Long-wheelbase versions of luxury sedans and premium SUVs are particularly popular, reflecting the prevalence of chauffeur-driven use in major urban centers.

China is the single largest market for many luxury manufacturers, demanding rapid deployment of the latest connectivity features and advanced infotainment systems tailored to local digital ecosystems (e.g., Baidu, Tencent integration). Market growth in India is rapidly catching up, driven by first-time luxury buyers. Regional trends also show a strong willingness to adopt electric luxury vehicles, provided the local charging infrastructure can support the increasing volume. APAC represents a crucial strategic focus for all major luxury brands aiming to secure long-term global volume and revenue expansion.

- Latin America (LATAM): Niche Demand and Import Dynamics

The Luxury Vehicle Market in Latin America is characterized by high import duties, fluctuating currency values, and localized concentrations of high net worth individuals, primarily in countries like Brazil, Mexico, and Chile. The market size is smaller compared to APAC or North America, but it serves as an important niche for high-margin sales. Demand often focuses on imported models, with an increasing necessity for robust, secure vehicles capable of handling diverse road conditions and often incorporating enhanced security features due to regional factors.

The consumer base in LATAM is highly brand-conscious, favoring established European marques that signify global prestige. While electrification is developing, it is lagging due to infrastructure challenges; thus, high-performance ICE and hybrid SUVs dominate the sales mix. Mexico, due to its manufacturing ties and trade agreements, often serves as a key gateway for distributing luxury vehicles across the region, while Brazil offers substantial domestic assembly potential for premium brands seeking to circumvent high import tariffs.

- Middle East and Africa (MEA): Ultra-Luxury Focus and Performance Requirements

The MEA region, largely driven by the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia, Qatar), exhibits one of the highest concentrations of Ultra-Luxury demand globally. Consumers prioritize unparalleled performance, extreme exclusivity, and overt displays of wealth. The extreme climate conditions necessitate specialized engineering for powerful air conditioning systems and durability in high temperatures, influencing vehicle specification and design requirements. The high density of UHNWIs supports strong sales of bespoke, limited-edition vehicles, often exceeding $500,000.

While the adoption of electric vehicles is currently lower than in Europe, major strategic initiatives in countries like the UAE and Saudi Arabia are rapidly investing in smart city infrastructure, signaling future growth potential for electric luxury vehicles. Currently, demand is dominated by high-performance SUVs and sports cars featuring large displacement engines. South Africa serves as the primary sub-Saharan hub for luxury vehicle consumption, reflecting its comparatively more developed automotive retail and service infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Vehicle Market.- Daimler AG (Mercedes-Benz)

- BMW Group

- Audi AG

- Tata Motors (Jaguar Land Rover)

- Volvo Car Corporation

- Tesla Inc.

- Porsche AG

- Ferrari N.V.

- Bentley Motors

- Rolls-Royce Motor Cars

- Lamborghini S.p.A.

- Aston Martin Lagonda

- Lexus (Toyota Motor Corporation)

- Maserati S.p.A.

- Lucid Motors

- Rivian Automotive, Inc.

- General Motors (Cadillac)

- Hyundai Motor Group (Genesis)

- Karma Automotive

- McLaren Group

- Pininfarina S.p.A.

- Koenigsegg Automotive AB

Frequently Asked Questions

Analyze common user questions about the Luxury Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Luxury Vehicle Market?

Market growth is primarily driven by the expanding global population of High-Net-Worth Individuals (HNWIs), sustained demand for status symbols, and the rapid technological shift toward high-performance electric vehicles (BEVs) offering superior connectivity and driving dynamics.

How is the shift to electrification impacting luxury car manufacturers?

Electrification is forcing luxury brands to invest heavily in proprietary battery technology, 800V charging infrastructure, and software development. It allows new market entrants to challenge established players by prioritizing digital experience and sustainable performance.

Which regional market holds the highest growth potential for luxury vehicles?

The Asia Pacific (APAC) region, particularly China and India, holds the highest growth potential due to rapid wealth creation and an increasing affluent consumer base that prioritizes technological features and executive comfort in luxury SUVs and sedans.

What role does Artificial Intelligence (AI) play in the modern luxury vehicle?

AI is crucial for enabling Level 3 and Level 4 autonomous driving, delivering hyper-personalized cabin experiences (HMI customization), optimizing electric powertrain efficiency, and facilitating predictive maintenance services for enhanced ownership experience.

What are the most popular segments within the Luxury Vehicle Market?

Luxury SUVs and Crossovers currently dominate sales volume globally, favored for their versatility and high status. Within the propulsion segment, Battery Electric Vehicles (BEVs) are the fastest-growing category due to new model introductions and performance enhancements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Autonomous Luxury Vehicle Market Statistics 2025 Analysis By Application (Personal, Commercial), By Type (BEV, Hybrid, ICE, FCEV), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Luxury Vehicle Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Compact Luxury Cars, Mid-size Luxury Cars, Full-size Luxury Cars, Luxury Crossovers & Minivans, Luxury SUVs), By Application (General use, Collect), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager