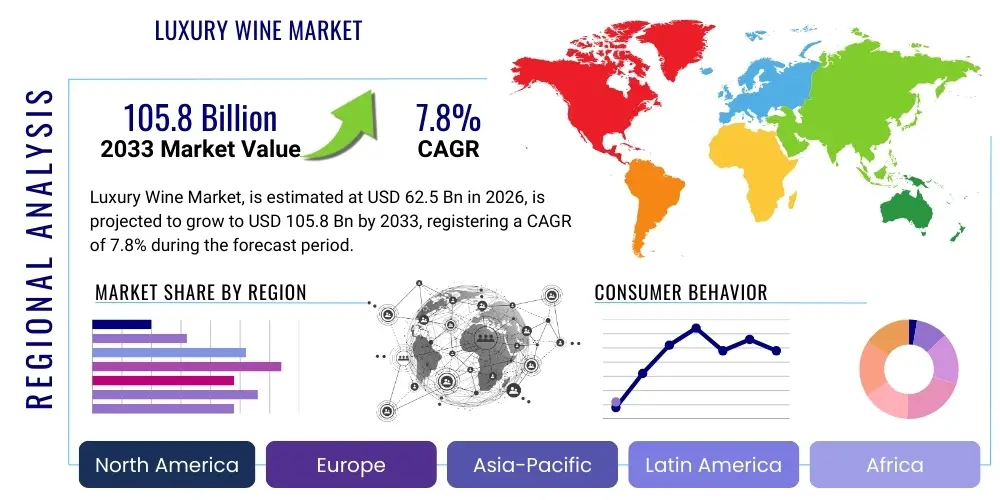

Luxury Wine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438031 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Luxury Wine Market Size

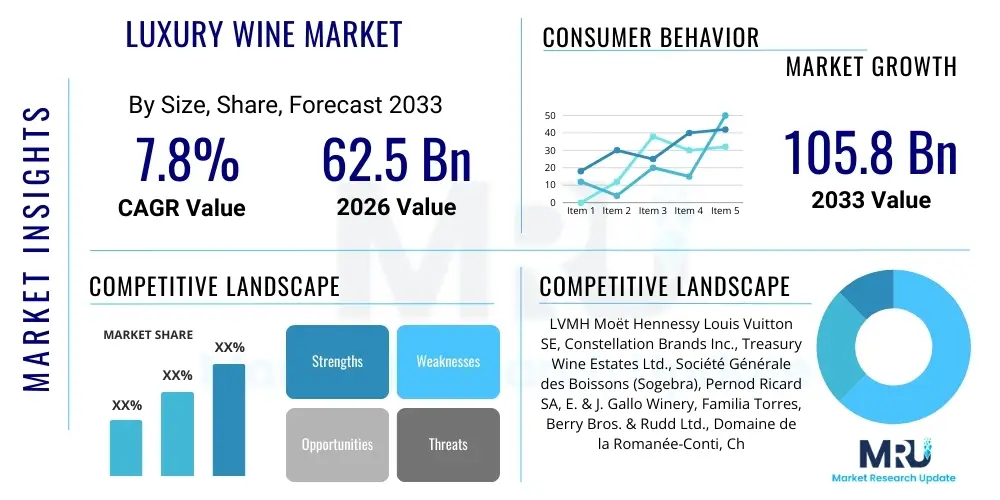

The Luxury Wine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 62.5 Billion in 2026 and is projected to reach USD 105.8 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the increasing disposable incomes across emerging economies, particularly in the Asia Pacific region, coupled with a persistent global demand for premium, high-quality, and exclusive alcoholic beverages. Consumer preferences are rapidly shifting towards products that offer unique provenance, historical significance, and superior craftsmanship, factors inherently associated with luxury wine offerings.

Market growth is intricately linked to the rising interest in wine collecting and investment, where rare vintages from established regions like Bordeaux, Burgundy, and Tuscany command increasingly high prices at auctions and private sales. These investment-grade wines function not only as consumption goods but also as tangible assets, attracting high-net-worth individuals (HNWIs) seeking portfolio diversification. Furthermore, the expansion of sophisticated retail channels, including dedicated luxury wine boutiques and online platforms specializing in rare and vintage bottles, facilitates global accessibility and elevates the perceived value of these premium products, reinforcing the market’s robust financial outlook.

The stabilization of global supply chains post-pandemic, combined with innovations in packaging and preservation technologies, also contributes positively to the market dynamics. Winemakers are leveraging advanced techniques to ensure the quality and authenticity of high-value shipments across continents. While economic volatility in certain regions presents intermittent challenges, the underlying cultural appreciation for fine dining and luxury lifestyle experiences consistently underpins the demand for luxury wines, ensuring sustained momentum and validation of the high projected CAGR throughout the forecast period.

Luxury Wine Market introduction

The Luxury Wine Market encompasses high-end, premium, and ultra-premium wines characterized by their limited production, exceptional quality, strong brand heritage, and elevated price points, often exceeding standard market pricing thresholds due to factors like terroir, vintage scarcity, and meticulous vinification processes. These products are typically sourced from renowned appellations globally, including classified growths in France, specific single vineyards in Italy, and cult producers in the New World regions like Napa Valley and Barossa Valley. Major applications of luxury wines extend beyond mere consumption to encompass status signaling, corporate gifting, fine dining pairing, and, increasingly, asset investment within alternative investment portfolios.

The primary benefits derived from the luxury wine segment include the assurance of superior quality and consistency, a rich historical narrative and provenance that enhances the consumer experience, and significant aging potential, often translating into increased value over time. For consumers, engaging with luxury wine signifies participation in a sophisticated cultural movement, while for producers, it enables premium pricing strategies that reflect the intensive labor and specific geographical advantages involved in the production of these limited goods. Key driving factors fueling this market include the growing HNWI population globally, particularly in Asian markets, the proliferation of specialized wine education and connoisseurship, and the successful integration of e-commerce platforms enabling global access to rare vintages.

Furthermore, globalization and increased international tourism have exposed a broader base of affluent consumers to exclusive wine regions and brands, amplifying cross-border demand. Regulatory stability concerning quality standards (such as PDO and DOCG classifications) provides consumers with necessary assurance regarding authenticity, thereby fostering trust in high-value transactions. The consistent marketing efforts by established luxury conglomerates, often linking wine brands with broader luxury lifestyle segments (fashion, art, travel), further solidify the aspirational value proposition, acting as a perennial driver for sustained market growth and price appreciation in the premium tiers.

Luxury Wine Market Executive Summary

The Luxury Wine Market exhibits robust resilience, driven fundamentally by shifting global wealth concentration towards emerging markets and sustained interest from established luxury consumers seeking unique, authenticated, and investment-grade assets. Current business trends indicate a strong focus on digital transformation, with producers implementing advanced traceability solutions, often utilizing blockchain, to combat counterfeiting and guarantee provenance, which is crucial for maintaining consumer trust at the premium price point. Regionally, the Asia Pacific continues its trajectory as the primary engine of demand growth, led by China and Hong Kong, which serve as major hubs for both consumption and investment-grade wine trading, necessitating supply chain adjustments and focused marketing strategies tailored to Asian consumer preferences, such as preference for specific regional styles like fine Burgundy.

Segment trends highlight the sustained dominance of still luxury wines, particularly red varieties, though high-end sparkling wines, especially prestige Cuvées from Champagne, are experiencing accelerated growth due to increasing usage in celebrations and luxury experiences worldwide. Distribution trends show a critical pivot towards the Direct-to-Consumer (DTC) model, particularly through specialized winery clubs and exclusive online allocations, allowing producers to capture higher margins and establish closer relationships with their high-value clientele. Concurrently, the importance of the specialized fine wine retail channel and high-end restaurants (On-Trade) remains paramount for brand building and immediate consumption in luxury settings, balancing the necessity of both digital and physical presence.

In terms of competitive dynamics, the market is characterized by consolidation among large luxury goods groups acquiring established vineyards, alongside boutique producers leveraging heritage and hyper-local production to maintain exclusivity. Sustainability and ethical sourcing have emerged as non-negotiable considerations, influencing purchasing decisions among younger, affluent consumers, prompting widespread adoption of organic and biodynamic viticulture practices. Overall, the market remains highly fragmented yet characterized by exceptional entry barriers related to land ownership, heritage, and brand equity, ensuring the sustained premiumization and high valuation of established luxury wine brands.

AI Impact Analysis on Luxury Wine Market

User queries regarding AI in the Luxury Wine Market predominantly revolve around three critical themes: supply chain integrity, precision viticulture efficiency, and personalized consumer experiences. Consumers and investors are concerned about how AI can guarantee the authenticity of rare bottles and prevent fraud in secondary markets, seeking reassurance that high-value assets are protected by robust digital verification systems. Winemakers are interested in AI’s capability to optimize vineyard management—specifically concerning predictive disease modeling, optimal harvesting times, and managing the effects of climate change on terroir definition—to maintain quality standards despite environmental pressures. Finally, users question how AI-driven analytics can enhance the purchasing journey, moving beyond simple recommendations to offering highly personalized allocations and investment advice based on consumption patterns and cellar potential.

AI’s influence is revolutionizing the upstream segment of the luxury wine value chain by facilitating hyper-efficient operational management, thus safeguarding the quality that defines the market. Machine learning algorithms analyze vast datasets encompassing weather patterns, soil composition, vine stress indicators, and historical yield data to generate precise recommendations for irrigation, pruning, and canopy management. This capability is crucial for luxury producers operating under strict appellation rules, where maintaining consistency year-over-year is vital for brand integrity and market positioning, particularly as climate variability threatens traditional winemaking practices. By optimizing vineyard inputs and processes, AI ensures that the raw material—the grapes—meets the stringent quality criteria required for ultra-premium wine production.

In the midstream and downstream segments, AI tools are fundamentally altering logistics, inventory management, and consumer engagement. AI-powered image recognition and sophisticated natural language processing (NLP) are being deployed on e-commerce platforms to provide detailed, instant information on provenance, tasting notes, and suggested pairings, catering to the highly informed luxury consumer. Furthermore, the integration of AI with blockchain technologies offers an unprecedented level of transparency and immutability for tracking bottles from the cellar to the consumer, drastically reducing the risk of counterfeiting. This enhancement of authenticity assurance is critical for auction houses and secondary markets, where AI models can quickly detect fraudulent labels or misrepresentations, thereby sustaining the high valuation of rare vintages and bolstering investor confidence in the luxury wine sector.

- AI-driven predictive analytics optimize vineyard management, minimizing climate-related risk and maintaining vintage quality consistency.

- Machine learning enhances supply chain traceability and authenticity verification, reducing counterfeiting risks for high-value bottles.

- AI personalizes the customer experience through customized recommendations, investment portfolio management, and dynamic pricing strategies.

- Robotics and automation, guided by AI, increase efficiency in labor-intensive processes like sorting and bottling while maintaining precision.

- Advanced data analysis supports crucial decision-making regarding blending, aging duration, and oak barrel selection, impacting final product quality.

- AI improves demand forecasting for specific limited releases, optimizing inventory allocation for exclusive mailing lists and global distributors.

DRO & Impact Forces Of Luxury Wine Market

The Luxury Wine Market is shaped by a confluence of influential factors: Drivers center on the global proliferation of wealth, especially the expanding HNWI demographic in Asia, coupled with the increasing cultural appreciation for unique, heritage-rich consumables and the function of wine as an investment asset. Restraints primarily involve the inherent limitations of production, as quality is tied strictly to fixed land (terroir) and weather volatility, alongside high taxation on luxury goods in several key markets and the persistent threat of sophisticated counterfeiting schemes. Opportunities are vast, focusing on leveraging digital transformation for greater market reach (DTC models), expanding into previously untapped ultra-luxury segments (e.g., hyper-aged wines), and capitalizing on the sustainability movement through certified organic and biodynamic luxury offerings. These dynamics collectively constitute the impact forces, which dictate market fluidity, price stability, and competitive strategy within this elite consumer segment.

Key drivers extend beyond wealth growth; they include the experiential economy, where high-value wines are integral to luxury travel, exclusive events, and five-star gastronomy, establishing a strong emotional connection with the product. The increasing specialization of wine education and certifications (like Master of Wine and sommelier programs) creates a highly knowledgeable consumer base actively seeking out rare and complex products, driving demand for nuanced, top-tier wines. Furthermore, the strategic marketing efforts by luxury brand conglomerates that own multiple vineyards integrate these wines into a broader lifestyle portfolio, enhancing their visibility and aspirational value among the global elite, reinforcing their role as status symbols necessary for upscale social interaction and professional networking.

Conversely, the principal restraints impose structural limitations on the market’s scalability. Unlike mass-market goods, luxury wine production is fundamentally constrained by strict geographic boundaries (appellations) and specific climatic conditions, making supply inherently inelastic. Climate change is rapidly becoming a significant restraint, forcing producers to adopt costly mitigation strategies, which in turn elevates production costs and market prices. Additionally, market volatility and geopolitical instability can rapidly impact consumer sentiment and auction prices, especially concerning investment-grade wines. Finally, the complexity of international trade regulations, tariffs, and distribution logistics for sensitive, high-value goods acts as a permanent frictional force, making market entry and expansion challenging for smaller, independent luxury producers seeking global reach.

Segmentation Analysis

The Luxury Wine Market is meticulously segmented based on wine type, color, distribution channel, and geographical origin, allowing for precise market targeting and strategic analysis of consumer preferences within the ultra-premium category. Understanding these segments is crucial because pricing, perceived value, and consumer engagement strategies vary dramatically across different wine types and origins. Still wines dominate in terms of volume and investment activity, but sparkling wines, particularly those from specific delimited regions, command the highest average unit price. The increasing sophistication of digital distribution models also necessitates a detailed analysis of the shift from traditional wholesale to exclusive direct-to-consumer platforms that cater specifically to the high-net-worth individual.

- By Wine Type:

- Still Wine (Dominates the investment and ultra-premium segments, led by Bordeaux, Burgundy, and Super Tuscans)

- Sparkling Wine (Includes Prestige Cuvées of Champagne and high-end Méthode Traditionnelle wines)

- Fortified Wine (Luxury Port, Sherry, and Madeira with significant aging potential)

- By Color:

- Red Wine (Highest market share due to prevalence in collection and aging potential)

- White Wine (High-end Riesling, White Burgundy, and specific Rhône varietals)

- Rosé Wine (Limited but growing ultra-premium Provençal and other niche luxury offerings)

- By Distribution Channel:

- On-Trade (Restaurants, Hotels, Bars, Fine Dining Establishments – crucial for brand presentation and immediate consumption)

- Off-Trade (Retailers, Supermarkets, Specialized Wine Stores, Auction Houses – important for volume sales and investment transactions)

- Direct-to-Consumer (DTC – Winery Cellar Door Sales, Wine Clubs, Exclusive Online Allocations – highest margin channel)

- By Origin:

- Old World (France, Italy, Spain, Germany – highest historical value and provenance)

- New World (USA, Australia, Chile, Argentina, South Africa – growing segment, often focused on varietal purity and modern winemaking)

Value Chain Analysis For Luxury Wine Market

The Luxury Wine Market value chain is characterized by rigorous quality control and high barriers to entry at the upstream level, emphasizing land ownership and meticulous viticulture. The upstream segment involves the specific cultivation of grapes, where the concept of terroir—the unique combination of soil, climate, and topography—is paramount, dictating the ultimate quality and scarcity of the product. Investments in prime vineyard land and sustainable, often organic or biodynamic, farming practices are essential for achieving the prestige required for luxury classification. The production phase (midstream) focuses on traditional, low-intervention oenology, extended aging in specialized oak barrels, and precise blending, ensuring the wine adheres to the highest appellation standards and maintains vintage integrity, which significantly impacts the downstream market value.

The downstream distribution channel is complex, involving both direct and indirect routes designed to maintain exclusivity and prevent price dilution. Indirect channels rely heavily on specialized fine wine importers, wholesalers, and dedicated retail outlets, including reputable auction houses that authenticate and trade rare vintages. These intermediaries must possess specialized climate-controlled storage and expert knowledge to handle the sensitive, high-value inventory. Direct channels, comprising winery-specific allocation lists, exclusive wine clubs, and personalized cellar door sales, are increasingly favored by producers as they offer higher margins, greater control over pricing, and the ability to cultivate deep, direct relationships with high-net-worth buyers, enhancing brand loyalty and perception of exclusivity.

Effective management of both distribution strategies is critical for market success. The On-Trade channel, consisting of Michelin-starred restaurants and luxury hotels, serves a vital function in brand validation and immediate high-end consumption, acting as powerful marketing tools. Authentication processes, increasingly supported by technology such as NFC tags and blockchain, are integrated throughout the chain to safeguard the wine's provenance as it moves from the producer to the final consumer or investor. The premium pricing strategy inherent to luxury wine requires that every stage of the value chain, from vineyard management to final delivery, reflects the brand’s commitment to unparalleled quality, rarity, and historical narrative.

Luxury Wine Market Potential Customers

The primary consumers and buyers in the Luxury Wine Market are high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) globally, characterized by their high disposable income, sophisticated consumption habits, and a strong propensity for experiential luxury goods. This demographic segment includes successful entrepreneurs, corporate executives, and established professionals who view luxury wine not only as a beverage but as a crucial element of their lifestyle, a tool for social signaling, and often, a core component of their personal asset portfolio. Geographically, potential customers are concentrated in major metropolitan centers across North America, Western Europe, and rapidly growing urban centers in the Asia Pacific region, particularly Greater China and Singapore, where wine collecting is a prominent status symbol.

Beyond individual consumers, the market also targets institutional and commercial buyers, including specialized fine wine investment funds, which purchase wine in bulk for long-term cellaring and speculation, driving demand for top-tier vintages. Furthermore, the luxury hospitality sector—Michelin-starred restaurants, 5-star hotels, and exclusive private clubs—constitutes a vital customer base, relying on diverse and prestigious wine lists to enhance their service offering and attract affluent patrons. These institutional buyers value reliable sourcing, expert storage facilities, and wines with established critical acclaim and recognized longevity, often making large-volume, recurring purchases of the most desirable releases.

A burgeoning segment of potential customers includes the younger generation of affluent millennials and Generation Z individuals who are increasingly educated about wine and actively seek sustainable, ethically produced, and personalized luxury goods. This group, while valuing heritage, is more receptive to New World luxury offerings and innovative distribution methods, such as online allocations and virtual cellar management services. Producers are therefore tailoring engagement strategies, including personalized digital content and immersive winery experiences, to capture the loyalty and significant spending power of this future luxury consumer demographic, ensuring market continuity and evolving demand patterns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 62.5 Billion |

| Market Forecast in 2033 | USD 105.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH Moët Hennessy Louis Vuitton SE, Constellation Brands Inc., Treasury Wine Estates Ltd., Société Générale des Boissons (Sogebra), Pernod Ricard SA, E. & J. Gallo Winery, Familia Torres, Berry Bros. & Rudd Ltd., Domaine de la Romanée-Conti, Château Lafite Rothschild, Château Margaux, Accolade Wines Ltd., Antinori, Jackson Family Wines, Bollinger, Gruppo Italiano Vini S.p.A., Ridge Vineyards, Vega Sicilia, Harlan Estate, Screaming Eagle. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Wine Market Key Technology Landscape

The Luxury Wine Market relies heavily on advanced technological integration, primarily focused on securing product authenticity and optimizing vineyard resilience against climate change. Blockchain technology represents a foundational shift, offering an immutable, decentralized ledger to record the entire provenance of a wine bottle, from grape harvest and barrel selection to final sale, providing consumers and investors with verifiable proof of origin and eliminating opportunities for counterfeiting. This is critical for investment-grade wines whose value is fundamentally tied to their verifiable history and storage conditions. Furthermore, advanced packaging and tracking technologies, such as tamper-proof seals, QR codes linked to digital birth certificates, and near-field communication (NFC) chips, provide real-time verification upon purchase and consumption, significantly boosting consumer confidence in the integrity of ultra-premium products.

In the viticulture stage, IoT (Internet of Things) devices and sensor networks constitute a vital technological layer. These sensors monitor hyper-localized meteorological data, soil moisture levels, and vine health parameters with granular precision. This data is fed into sophisticated AI and machine learning models, enabling precision agriculture techniques that maximize grape quality while minimizing resource use, especially crucial in regions facing water scarcity or unpredictable weather events. Satellite imagery and drone surveillance are also employed to assess canopy density and identify specific vineyard microclimates requiring targeted intervention, ensuring that the consistency and quality standards expected of luxury wines are maintained despite external environmental pressures.

Additionally, technology is transforming the customer-facing aspects of the luxury wine business. High-definition virtual reality (VR) and augmented reality (AR) tours offer immersive winery experiences to potential international buyers who cannot travel, enhancing brand narrative and historical engagement. Advanced Customer Relationship Management (CRM) systems, integrated with AI, analyze purchasing history and preferences to automate highly personalized communication and allocation offers for mailing list members. These digital tools ensure that the limited supply of luxury wines is efficiently and exclusively distributed to the most valuable customers, reinforcing the sense of rarity and personalized service that defines the luxury market experience.

Regional Highlights

The Luxury Wine Market exhibits distinct regional dynamics driven by wealth accumulation, historical consumption patterns, and trade infrastructure. Europe, historically the epicenter of luxury wine production (France, Italy, Spain), remains crucial, dominating the supply side and maintaining a significant share of internal consumption, primarily fueled by traditional high-net-worth families and established collector bases. However, its market growth rate is surpassed by the Asia Pacific region, which has emerged as the most critical consumer and investment hub globally, necessitating strategic investment in sophisticated logistics and brand presence tailored to local cultural preferences and emerging wealth centers.

North America, particularly the United States, represents a highly developed market characterized by strong consumer knowledge, diverse consumption habits, and a robust secondary market. The US acts as a major buyer of both Old World and New World luxury wines, demonstrating a willingness to embrace premium offerings from regions like California (Napa Valley) and Washington State. The maturation of the US collector base and the effective utilization of DTC channels have solidified North America's position as a high-value, stable market segment, characterized by consistent demand across various price points within the luxury spectrum.

The Asia Pacific market, led by mainland China, Hong Kong, and Japan, is the primary driver of future market expansion. Demand here is characterized by an emphasis on investment-grade Bordeaux and Burgundy, viewing wine as a tangible, portable asset. Hong Kong serves as a crucial trading gateway and tax-efficient auction center. Meanwhile, the Middle East and Africa (MEA) and Latin America, though smaller in scale, offer nascent opportunities within their burgeoning affluent expatriate and local elite communities, where luxury wine consumption is rapidly becoming integrated into upscale hospitality and private consumption patterns, though these regions face higher regulatory hurdles.

- Asia Pacific (APAC): Highest growth region; driven by HNWI accumulation in China and India; key hubs in Hong Kong and Singapore for trading and investment; preference for established French classics.

- Europe: Largest supply base (France, Italy); mature consumer market; focus on heritage and appellation integrity; strong internal consumption and global export dominance.

- North America: Significant consumer market (US); robust secondary market activity; strong performance of domestic luxury producers (Napa, Sonoma); extensive adoption of DTC and e-commerce models.

- Latin America (LAMEA): Emerging potential, primarily focused on major economies like Brazil and Mexico; local luxury wine production (Chile, Argentina) gaining international recognition; consumption driven by urban affluence.

- Middle East and Africa (MEA): Niche market driven by expatriate populations and luxury tourism sectors; consumption heavily concentrated in specific liberalized zones and high-end hospitality venues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Wine Market.- LVMH Moët Hennessy Louis Vuitton SE

- Constellation Brands Inc.

- Treasury Wine Estates Ltd.

- Société Générale des Boissons (Sogebra)

- Pernod Ricard SA

- E. & J. Gallo Winery

- Familia Torres

- Berry Bros. & Rudd Ltd.

- Domaine de la Romanée-Conti

- Château Lafite Rothschild

- Château Margaux

- Accolade Wines Ltd.

- Antinori

- Jackson Family Wines

- Bollinger

- Gruppo Italiano Vini S.p.A.

- Ridge Vineyards

- Vega Sicilia

- Harlan Estate

- Screaming Eagle

- Baron Philippe de Rothschild SA

- Tignanello (Antinori)

- Penfolds (Treasury Wine Estates)

- Louis Jadot

- Marchesi Frescobaldi

- Sassicaia (Tenuta San Guido)

- Opus One Winery

- Mouton Rothschild

Frequently Asked Questions

Analyze common user questions about the Luxury Wine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Luxury Wine Market?

The Luxury Wine Market is predominantly driven by the significant increase in the global high-net-worth individual (HNWI) population, particularly in Asia Pacific, coupled with the rising status of fine wine as a tangible investment asset. Sustained demand for authenticated, high-provenance products, and the expansion of efficient global e-commerce and auction platforms further fuel market acceleration and price appreciation in limited vintages.

How is climate change impacting the production and pricing of luxury wines?

Climate change acts as a major restraint by introducing volatility and unpredictability to traditional terroir definitions, potentially altering the style and availability of established luxury wines. Producers are forced to invest heavily in adaptive technologies like precision viticulture, which increases operating costs. This scarcity and complexity contribute directly to higher consumer prices for established, highly rated vintages, intensifying their status as rare commodities.

Which geographical region represents the most significant opportunity for luxury wine producers?

Asia Pacific, especially the markets of Greater China and Southeast Asia, represents the most significant opportunity. This region displays the fastest rate of wealth creation and a strong cultural affinity for acquiring luxury investment assets. Producers are actively focusing on sophisticated marketing and tailored distribution strategies to meet the escalating demand for iconic Old World classified growths and emerging New World cult wines in this affluent market base.

What role does technology, specifically blockchain, play in the Luxury Wine Market?

Technology, particularly blockchain, is essential for addressing the critical market concern of authenticity and fraud prevention. Blockchain provides an immutable digital ledger for tracking a bottle’s history from the vineyard to the cellar, guaranteeing provenance, storage conditions, and ownership transfer. This transparency is vital for maintaining investor confidence and justifying the high transaction value of rare and investment-grade wines in the secondary market.

What is the significance of the Direct-to-Consumer (DTC) channel for luxury wine brands?

The DTC channel holds high significance as it allows luxury wine brands to bypass intermediaries, enabling them to capture higher profit margins and exert complete control over pricing and brand messaging. Furthermore, DTC facilitates the establishment of direct, personalized relationships with high-value customers through exclusive allocation lists and wine clubs, fostering exceptional brand loyalty and enhancing the perceived exclusivity of limited-release products.

How do investment funds influence the price dynamics of the luxury wine segment?

Investment funds are powerful market influencers; their large-scale purchases of top-tier vintages remove significant quantities of supply from the consumption market, creating artificial scarcity. This collective purchasing strategy drives up auction prices and subsequent retail prices, treating fine wine less as a consumable beverage and more as a financial instrument, thereby stabilizing and appreciating the value of the most desirable labels.

What are the key differences between Old World and New World luxury wines in market strategy?

Old World luxury wines (e.g., France, Italy) leverage centuries of heritage, strict appellation laws (terroir focus), and established critical acclaim, positioning themselves based on provenance and tradition. New World luxury wines (e.g., US, Australia) emphasize varietal purity, innovative winemaking technology, high scores from key critics, and often utilize aggressive DTC strategies to rapidly build brand equity, appealing to modern connoisseurs.

What constitutes the primary barriers to entry in the Luxury Wine Market for new producers?

The primary barriers are rooted in the finite nature of critical resources: access to and ownership of prime vineyard land (terroir), which is exceptionally costly and limited; the necessity of significant capital investment in long-term inventory (aging requirements); and the time-intensive process required to build and establish brand heritage, reputation, and critical acclaim necessary to command ultra-premium prices against established global icons.

Is there a noticeable trend towards sustainability and ethical sourcing in the luxury segment?

Yes, there is a pronounced and increasing trend towards sustainability. Affluent, socially conscious consumers are prioritizing luxury wines with certified organic, biodynamic, or sustainably farmed designations. Producers are actively responding by investing in eco-friendly packaging and regenerative agriculture practices, often integrating these efforts into their core marketing narratives to align with modern ethical consumption values.

Beyond still red wine, which wine type shows the strongest growth potential in the luxury segment?

Luxury sparkling wine, particularly high-end Prestige Cuvées from Champagne and comparable traditional method sparkling wines, displays the strongest accelerated growth potential. This segment benefits from its integral role in global celebrations, luxury hospitality, and its increasing recognition among collectors for its investment potential and inherent association with premium experiential consumption moments globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager