Luxury Wines and Spirits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438959 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Luxury Wines and Spirits Market Size

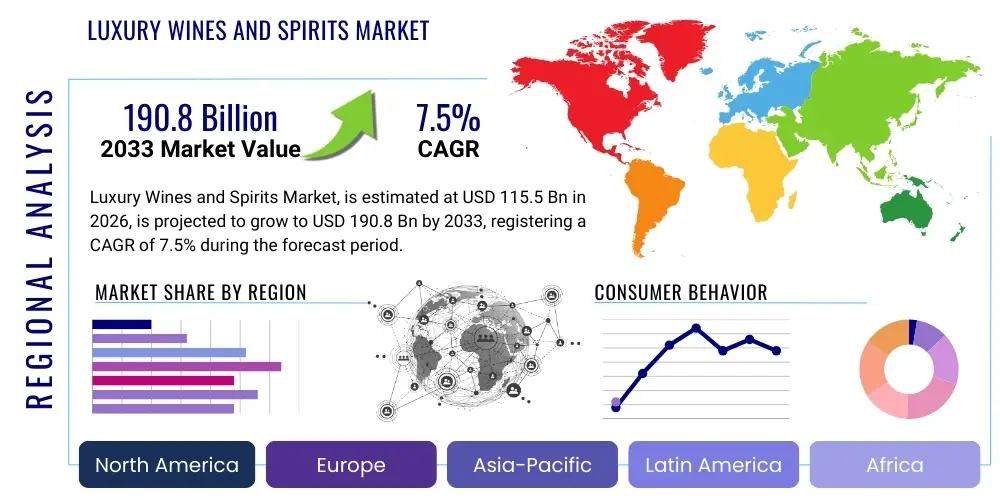

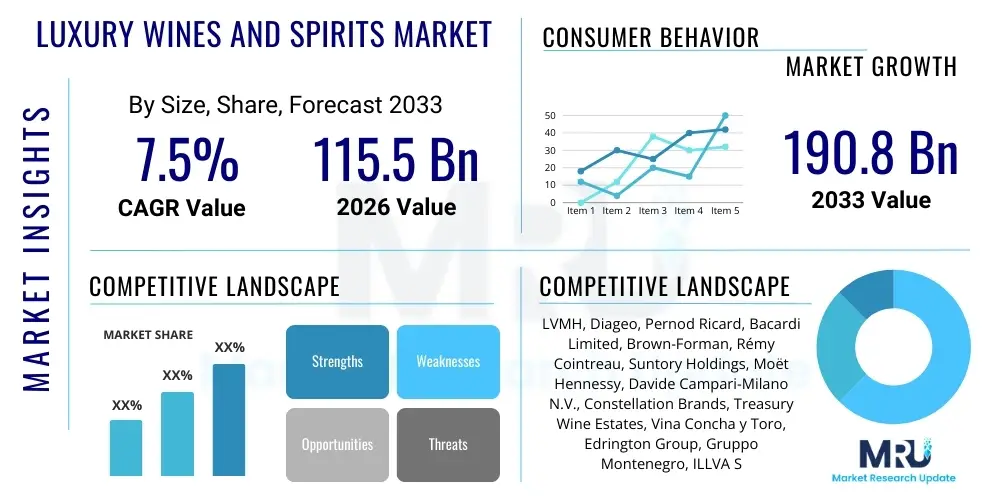

The Luxury Wines and Spirits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 190.8 Billion by the end of the forecast period in 2033.

Luxury Wines and Spirits Market introduction

The Luxury Wines and Spirits Market encompasses ultra-premium, prestige, and highly exclusive alcoholic beverages characterized by superior quality, artisanal production methods, limited availability, and high price points. These products extend beyond typical consumer goods, embodying heritage, exclusivity, and status, making them highly desirable for affluent consumers, collectors, and high-end hospitality sectors. The category includes, but is not limited to, rare vintage champagnes, aged single malt whiskies, limited edition cognacs, ultra-premium tequilas, and exceptional fine wines from world-renowned vineyards. Major applications span celebratory consumption, investment portfolios (as liquid assets), gifting, and exclusive dining experiences. Key benefits driving market adoption include the perception of superior taste and craftsmanship, the societal status derived from ownership and consumption, and the tangible appreciation in value over time, particularly for collectible items. The market is primarily driven by rising disposable incomes among High Net Worth Individuals (HNWIs) globally, expanding e-commerce platforms offering authenticated luxury bottles, and increased consumer interest in provenance, sustainability, and unique, personalized luxury experiences.

Luxury Wines and Spirits Market Executive Summary

The Luxury Wines and Spirits Market is experiencing robust expansion, fueled primarily by the globalization of luxury consumption and the strong performance of e-commerce channels which provide wider access to limited-edition releases and authentic provenance verification. Key business trends include aggressive brand acquisitions by major conglomerates seeking to consolidate premium portfolios, increased focus on sustainable packaging and ethical sourcing, and the integration of blockchain technology to combat counterfeiting and enhance supply chain transparency. Regionally, Asia Pacific, particularly China and India, remains the dominant growth engine due to rapid wealth creation and a deep-seated cultural appreciation for gifting high-status alcohol. Europe maintains its importance as the nucleus of production (especially for French wines and Scotch whisky) and a mature consumption hub. Segment trends reveal that ultra-premium brown spirits, particularly rare whiskies and aged rums, are outpacing traditional luxury wine segments in terms of price appreciation and collector demand, largely driven by millennials entering the luxury consumer base. Furthermore, the ready-to-drink (RTD) sector, while traditionally mass-market, is seeing the emergence of premium, low-ABV (alcohol by volume) luxury offerings tailored for health-conscious affluent consumers, signaling diversification in product format.

AI Impact Analysis on Luxury Wines and Spirits Market

User queries regarding AI's impact on the luxury alcohol sector predominantly center on how technology can enhance personalization, ensure product authenticity, optimize supply chain logistics for high-value goods, and predict future vintage quality. Consumers are keen to know if AI can provide definitive proof of provenance, especially for secondary market transactions involving multi-million dollar bottles, and how it contributes to tailored luxury experiences, such as predicting flavor profiles preferred by individual clients or curating personalized cellars. The consensus expectation is that AI will be a critical tool for operational efficiency and consumer confidence, rather than product creation itself, which remains highly reliant on human expertise and artisanal tradition. AI is expected to revolutionize customer relationship management (CRM) by anticipating consumption patterns of HNWIs and enabling proactive, highly exclusive marketing communications.

- Enhanced personalized marketing and customer relationship management (CRM) based on HNWI purchasing histories.

- Implementation of sophisticated fraud detection algorithms to authenticate vintage bottles and prevent counterfeiting in high-value transactions.

- Optimization of complex, temperature-sensitive global supply chains using predictive analytics to minimize loss and ensure product integrity.

- AI-driven vineyard and distillery management systems for optimizing yield quality and forecasting environmental risks (e.g., climate change impact).

- Chatbot and virtual sommelier services offering expert product recommendations and investment advice based on market trends.

DRO & Impact Forces Of Luxury Wines and Spirits Market

The market is defined by strong consumer demand driven by global wealth accumulation (Driver), yet constrained by issues of supply scarcity and vulnerability to environmental changes impacting production (Restraint). Opportunities lie in technological adoption for provenance tracking and expansion into emerging markets where luxury spending power is rapidly increasing. These forces collectively dictate market trajectory, influencing investment decisions, brand strategies, and the overall stability of ultra-premium pricing structures.

Drivers: A primary driver is the significant global increase in the number of HNWIs and Ultra High Net Worth Individuals (UHNWIs), particularly in Asia and the Middle East, who view luxury spirits and fine wines as essential lifestyle markers and viable investment assets, often yielding higher returns than traditional commodities. Furthermore, the sustained cultural trend of premiumization, where consumers consciously choose higher-quality, higher-priced products for significant occasions or status signaling, continues to boost sales volumes in the prestige categories. E-commerce platforms, particularly those specializing in fine and rare spirits, have dramatically improved market reach, connecting limited-edition products directly with global collectors, thereby intensifying competitive dynamics and driving prices upward.

Restraints: The market faces severe restraints related to inherent supply limitations, as the production of luxury items like aged Scotch or specific vintage Bordeaux is temporally constrained and cannot be easily scaled to meet sudden demand surges. Counterfeiting remains a persistent challenge, particularly in emerging markets, eroding consumer trust and necessitating significant investment in anti-fraud technologies like specialized labeling and DNA tagging. Regulatory hurdles, including high excise duties and complex international trade tariffs on high-ABV products, inflate costs and complicate distribution channels. Finally, the growing threat of climate change directly impacts the quality and quantity of agricultural inputs (grapes, barley), posing long-term risks to traditional production regions.

Opportunities: Significant opportunities exist in the integration of Web3 and blockchain technologies to create immutable digital certificates of authenticity (NFTs) tied to physical bottles, thereby maximizing transparency and collector value. Producers can strategically target rapidly emerging consumer demographics, such as high-earning Gen Z and Millennial investors who are increasingly interested in alternative liquid assets and unique brand stories. Furthermore, product innovation focusing on non-alcoholic or low-ABV luxury beverages and customized blending services caters to evolving consumer preferences towards wellness while maintaining the premium experiential quality associated with the category. Developing robust direct-to-consumer (DTC) models allows brands to capture higher margins and build deeper, personalized relationships with their most valued clientele.

- Drivers: Global growth of HNWIs; investment appeal of rare spirits; cultural premiumization trend.

- Restraints: Supply scarcity and lengthy aging processes; regulatory complexity and high tariffs; threat of counterfeiting.

- Opportunities: Blockchain adoption for provenance; expansion into emerging Asian luxury markets; rise of personalized luxury gifting.

- Impact Forces: Strong positive impact from wealth generation, mitigated by significant supply chain vulnerability to climate events and external economic instability.

Segmentation Analysis

The Luxury Wines and Spirits Market is comprehensively segmented based on product type, distribution channel, and geographic region, reflecting the diverse consumption habits and sourcing preferences of affluent buyers globally. Product categorization separates the market into high-growth brown spirits, resilient fine wines, and niche premium white spirits, each appealing to different investment and consumption motivations. Distribution channels are critical, distinguishing between the traditional, high-touch retail experience and the rapidly expanding digital landscape, including specialized e-commerce platforms and auction houses that facilitate secondary market trades. Understanding these segments is vital for brand positioning, ensuring that marketing efforts align with the channel most preferred by the target demographic—be it the exclusivity of on-trade venues or the convenience of online collectors' networks.

- Product Type:

- Luxury Wines (Vintage Bordeaux, Burgundy, Prestige Champagne)

- Luxury Spirits (Aged Scotch Whisky, Cognac, Single Malt Whisky, Ultra-Premium Tequila, High-End Gin/Vodka)

- Distribution Channel:

- Off-Trade (Retail Stores, Specialized Liquor Stores, Supermarkets/Hypermarkets)

- On-Trade (Hotels, Restaurants, Bars, Exclusive Clubs)

- Online (E-commerce Platforms, Brand Websites, Auction Houses)

- Price Point:

- Ultra-Premium

- Prestige

- Iconic

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Luxury Wines and Spirits Market

The value chain for luxury wines and spirits is characterized by intensive upstream processes that prioritize quality, authenticity, and scarcity, which justifies the high margins generated downstream. Upstream activities involve rigorous selection of raw materials (finest grapes, specific grains, water sources), extensive aging processes often spanning decades, and meticulous artisanal production methods overseen by master distillers or cellar masters. This stage is highly proprietary and capital-intensive, focusing on heritage and consistency rather than speed or volume. The midstream involves bottling, packaging (often utilizing high-end materials like crystal decanters), certification, and ensuring proper storage conditions, crucial for maintaining the liquid asset's integrity and investment value.

Downstream analysis highlights the critical role of specialized distribution channels. Direct channels, such as exclusive winery allocations or distillery tours with direct sales, allow brands to maintain control over pricing, consumer experience, and brand narrative. Indirect channels rely on a highly curated network of specialized wholesalers, luxury retailers, and fine dining establishments (on-trade) that possess the expertise to handle and market these high-value products appropriately. The shift towards online auction houses and specialized e-commerce platforms has significantly streamlined the secondary market, making transactions more global and transparent, yet demanding robust logistics for secure, insured shipping.

The distribution landscape requires careful navigation to preserve brand exclusivity and price integrity. Direct sales often include exclusive events or cellar visits, enhancing the experiential aspect of the purchase for the high-net-worth client. Indirect distribution, while broadening market reach, relies heavily on strong retailer relationships where product knowledge and presentation are paramount. The high profitability of this market segment is directly linked to maintaining perceived scarcity throughout the chain, ensuring that every touchpoint—from vineyard soil to final glass—reinforces the product’s exceptional quality and investment status.

- Upstream Analysis: Raw material sourcing, cultivation, fermentation/distillation, extended aging, quality control by experts (Master Distillers/Cellar Masters).

- Midstream Analysis: Specialized bottling and luxury packaging, authentication (holograms, unique identifiers), secure warehousing and inventory management.

- Downstream Analysis (Distribution Channels): Direct-to-Consumer (DTC) allocation programs, Specialized Off-Trade Retail, Premium On-Trade (Michelin-starred restaurants), International Auction Houses, E-commerce specialized in rare and vintage items.

- Key Margin Drivers: Provenance verification, aging time, brand heritage, and perceived scarcity.

Luxury Wines and Spirits Market Potential Customers

The primary consumer base for the Luxury Wines and Spirits Market consists of High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs), defined by significant investable assets and a propensity for conspicuous consumption. These buyers utilize luxury alcohol not just for personal enjoyment but also as a demonstration of wealth, cultural sophistication, and as a highly portable, appreciating investment asset. They are typically discerning, placing high value on detailed product narratives—such as the exact vintage, the specific cask number, or the history of the producer—and often seek personalized services, private tastings, and exclusive pre-allocations of limited releases. Geographically, potential customers are concentrated in major financial hubs across North America, established European capitals, and rapidly growing wealth centers in Asia Pacific and the Middle East.

A rapidly growing segment includes sophisticated collectors and investors who view rare bottles as alternative investments, often integrating them into diversified financial portfolios. Unlike simple consumption, these buyers focus intensely on provenance, storage conditions, auction performance history, and market speculation. This group drives the secondary market, utilizing online platforms and specialized auction houses, and their demands heavily influence pricing floors and ceilings for iconic brands. Furthermore, luxury hospitality venues, including five-star hotels, exclusive members' clubs, and high-end cruise lines, serve as significant institutional buyers, curating prestige cellars to enhance the guest experience and justify premium pricing for on-site consumption.

Another crucial target segment comprises the younger generation of affluent consumers—Millennials and high-earning Gen Z professionals—who are increasingly adopting luxury consumption patterns earlier in life. While they appreciate heritage, this group also demands transparency regarding sustainability, social responsibility, and often prefers innovative, smaller-batch, or craft luxury products over established mega-brands. Their consumption is often driven by social media trends and experiential value, leading them to prioritize unique cocktail experiences and modern presentation. Successful engagement with this demographic requires digital authenticity and aligning brand values with environmental and ethical consciousness.

- Primary Consumers: High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs) seeking status and personal consumption.

- Investors/Collectors: Buyers focused on asset appreciation, authenticity, and secondary market potential (e.g., wine futures, rare whisky casks).

- Institutional Buyers: Luxury hospitality (five-star hotels, gourmet restaurants), private jets, and high-end corporate gifting services.

- Emerging Demographics: Affluent Millennial and Gen Z consumers prioritizing ethical sourcing, unique experiences, and digital provenance verification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 190.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH, Diageo, Pernod Ricard, Bacardi Limited, Brown-Forman, Rémy Cointreau, Suntory Holdings, Moët Hennessy, Davide Campari-Milano N.V., Constellation Brands, Treasury Wine Estates, Vina Concha y Toro, Edrington Group, Gruppo Montenegro, ILLVA Saronno S.p.A., HiteJinro, Louis XIII, William Grant & Sons, Patron Spirits International AG, La Martiniquaise. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Wines and Spirits Market Key Technology Landscape

The luxury wines and spirits sector is increasingly adopting advanced technologies primarily to address the critical issues of counterfeiting, supply chain integrity, and consumer engagement. Blockchain technology represents the most transformative advancement, enabling the creation of decentralized, immutable digital records of a product's journey from production to consumer. This digital certification, often tied to a near-field communication (NFC) chip embedded in the bottle or packaging, provides definitive, tamper-proof proof of provenance, dramatically boosting consumer confidence and stabilizing secondary market valuations for rare assets. Furthermore, sophisticated inventory management systems leveraging IoT sensors are used in high-security, climate-controlled storage facilities to monitor and regulate environmental factors (temperature, humidity), crucial for preserving the quality of aged products.

The application of Artificial Intelligence (AI) and Machine Learning (ML) is becoming vital in optimizing vineyard and distillery operations. ML algorithms analyze vast datasets encompassing historical weather patterns, soil composition, and previous yield quality to predict future vintage excellence and recommend optimal harvest timing or blending ratios, maximizing the quality output of luxury goods. In the customer-facing realm, augmented reality (AR) and virtual reality (VR) technologies are enhancing the consumer experience, allowing brands to deliver rich, immersive narratives about their heritage, production processes, and tasting notes directly through smart packaging or exclusive app experiences, bridging the gap between physical consumption and digital storytelling.

Advanced packaging technologies, including secure seals, personalized engraving techniques, and micro-tagging, are employed as primary defensive measures against fraud, ensuring that the integrity of the product matches its premium pricing. These technical solutions are not merely operational tools but integral parts of the luxury value proposition, demonstrating a brand's commitment to quality and providing reassurance to investors and end-users. Future technological expansion is expected to focus heavily on integrating sustainability tracking, allowing consumers to verify the carbon footprint and ethical sourcing claims of their high-end purchases via digital platforms.

- Blockchain and Distributed Ledger Technology (DLT): Used for creating verifiable digital identities (NFTs/digital passports) and ensuring tamper-proof provenance tracking.

- Near-Field Communication (NFC) and QR Codes: Embedded in packaging for instant digital authentication, consumer engagement, and accessing detailed production histories.

- IoT Sensors: Deployed in aging facilities and transportation to monitor and maintain optimal climate control for high-value inventory.

- Artificial Intelligence (AI) and Machine Learning (ML): Applied for predictive analytics regarding vintage quality, climate impact mitigation, and highly customized CRM strategies.

- Augmented Reality (AR): Enhancing brand storytelling through interactive packaging and virtual cellar tours accessible via mobile devices.

Regional Highlights

Geographically, the Luxury Wines and Spirits Market displays distinct growth patterns and consumption preferences, with traditional markets providing stability and emerging regions driving momentum. Europe remains the historical heartland of production and consumption, particularly Western Europe (France, UK, Italy), dominating the fine wine and traditional spirits categories (Cognac, Scotch Whisky). High consumption rates among established wealthy populations, coupled with a robust infrastructure for auctions and secondary market trading, ensure its continued relevance. However, regulatory maturity and limited population growth mean future expansion hinges mainly on price appreciation and investment activities rather than volume growth.

North America, led by the United States, represents the largest single-market opportunity in terms of consumer spending, driven by a diversified affluent population and a high degree of product experimentation. The US market displays strong demand for ultra-premium brown spirits (bourbon, Japanese whisky, single malt Scotch), high-end tequila, and prestige champagnes. The region benefits from early adoption of e-commerce for luxury alcohol and a thriving cocktail culture that fuels innovation across all spirit categories. Consumer preferences are strongly influenced by culinary trends and media, ensuring dynamic and rapid adoption of new luxury niches.

Asia Pacific (APAC) is the undisputed powerhouse for future market expansion. Countries like China, Hong Kong (as a trading hub), Singapore, and increasingly India, are witnessing exponential growth in HNWIs, leading to massive increases in luxury alcohol consumption for gifting, status signaling, and investment. Specifically, the demand for rare Cognac, expensive Bordeaux wines, and highly collectible whiskies has driven APAC to hold significant market share in secondary trading and auction sales, often dictating global prices for the rarest bottles. This region's growth is underpinned by cultural traditions prioritizing high-value hospitality and business gifting.

The Middle East and Africa (MEA), particularly the UAE and Saudi Arabia (through high-end tourism and non-alcoholic premium substitutes), are rapidly emerging markets. Luxury spirits consumption in this region is tightly linked to high-end tourism, expatriate populations, and the regional hub status of cities like Dubai. Latin America presents high potential but is often constrained by economic volatility and complex import tariffs, making market entry challenging but rewarding for brands that secure premium positioning.

- Asia Pacific (APAC): Highest projected CAGR; dominated by wealth creation in China, India, and Southeast Asia; focus on investment-grade spirits and prestige wines for gifting.

- North America: Largest consumer market by value; strong demand for ultra-premium brown spirits (Tequila, Bourbon, Scotch) and leadership in digital distribution channels.

- Europe: Core production hub (France, UK, Italy); stable consumption driven by heritage brands and robust secondary market activity (auctions).

- Middle East & Africa (MEA): Growth tied to luxury tourism and expatriate communities; increasing focus on high-end non-alcoholic luxury alternatives in certain regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Wines and Spirits Market.- LVMH (Moët Hennessy)

- Diageo plc

- Pernod Ricard

- Bacardi Limited

- Brown-Forman Corporation

- Rémy Cointreau S.A.

- Suntory Holdings Limited

- Davide Campari-Milano N.V.

- Constellation Brands Inc.

- Treasury Wine Estates Limited

- Vina Concha y Toro S.A.

- Edrington Group

- Gruppo Montenegro S.p.A.

- ILLVA Saronno S.p.A.

- HiteJinro Co., Ltd.

- Patrón Spirits International AG (Part of Bacardi)

- William Grant & Sons Ltd.

- Louis XIII Cognac (Rémy Cointreau)

- La Martiniquaise

- The Macallan (Edrington)

Frequently Asked Questions

Analyze common user questions about the Luxury Wines and Spirits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What drives the valuation of luxury wines and spirits in the secondary market?

The valuation is primarily driven by scarcity, provenance, critical ratings (e.g., Parker scores), the age of the liquid, and brand heritage. Authenticity verified by advanced technology (blockchain) and storage conditions are increasingly critical factors influencing collector confidence and price appreciation.

How does the threat of counterfeiting impact luxury alcohol brands?

Counterfeiting erodes brand trust and results in significant financial losses. Brands counteract this by investing heavily in anti-fraud measures, including secured closures, tamper-evident seals, and digital authentication technologies like NFC chips, ensuring products remain verifiable and trustworthy assets.

Which product segment is currently showing the highest investment return?

While fine wines, especially Bordeaux and Burgundy, remain stable, the ultra-premium aged brown spirits category, particularly rare single malt Scotch whisky and Japanese whisky, has demonstrated superior growth rates and investment returns due to extreme scarcity and global collector demand.

What role does sustainability play in luxury wine and spirit consumption?

Sustainability is increasingly important to affluent, younger consumers. They prioritize brands demonstrating ethical sourcing, reduced carbon footprints, organic production methods, and sustainable packaging. Brands that provide transparent digital proof of these efforts gain a significant competitive advantage.

How are emerging technologies like AI and blockchain being used in this market?

AI is used for predictive vintage quality analysis and optimizing customer personalization, while blockchain technology is crucial for providing unalterable digital certificates of provenance (digital passports/NFTs), drastically enhancing supply chain transparency and ensuring product authenticity for high-value items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager