Luxury Womenswear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438059 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Luxury Womenswear Market Size

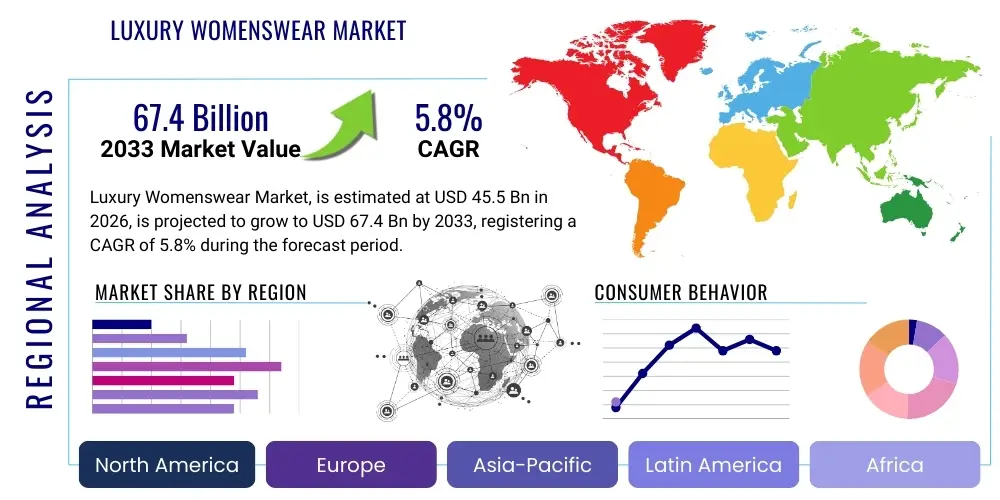

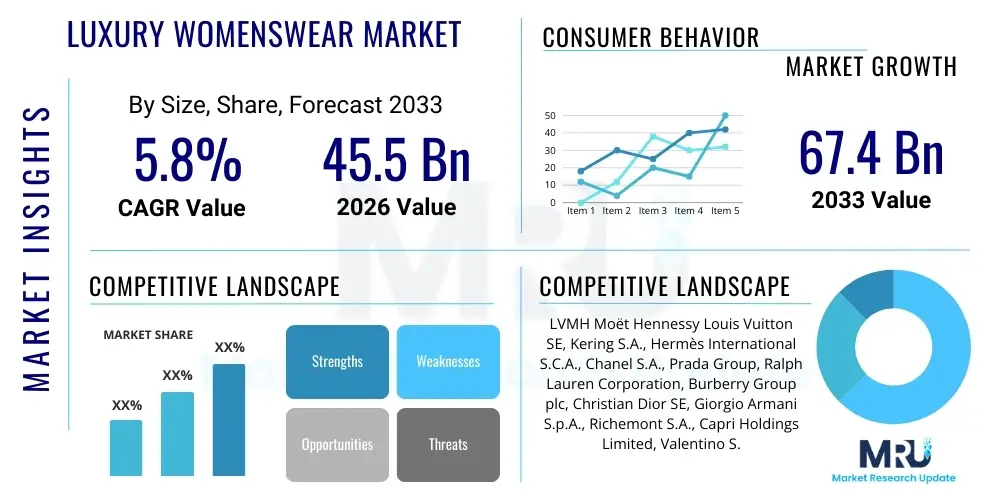

The Luxury Womenswear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 67.4 Billion by the end of the forecast period in 2033.

Luxury Womenswear Market introduction

The global luxury womenswear market is defined by the meticulous integration of exclusivity, superior craftsmanship, and enduring design principles tailored specifically for the affluent female consumer base. This segment encompasses a broad spectrum of high-value products, ranging from meticulously crafted haute couture garments and high-end ready-to-wear collections to indispensable accessories such as signature handbags, fine leather goods, and high-performance, aesthetically elevated footwear. The core product description emphasizes utilization of rare or ethically sourced materials, artisanal production techniques often preserved across generations, and a commitment to stylistic longevity that transcends fast-fashion cycles. Brands operating in this sphere leverage strong historical narratives and cultural cachet to justify premium pricing structures, successfully cultivating a deep sense of emotional connection and investment value among their clientele. The market’s dynamism is perpetually linked to cultural shifts, demographic wealth accumulation, and the effective projection of brand identity across global digital platforms, necessitating complex strategic planning and execution.

Major applications for luxury womenswear are intrinsically linked to aspirational lifestyles and high-profile social and professional commitments, extending from executive boardroom attire and highly curated casual wear to bespoke gowns for gala events and exclusive social gatherings. The utility derived from these purchases is multidimensional, encompassing tangible benefits like exceptional durability and comfort afforded by sophisticated fabrics and construction, alongside intangible psychological benefits. These intangible rewards include the reinforcement of social standing, the expression of refined personal taste, and the inherent satisfaction derived from owning items associated with historical excellence and limited accessibility. The strategic purchase of luxury items, particularly accessories, often serves as a key mechanism for consumers to signal affiliation with elite social strata and global fashion communities. This signaling function is continually amplified by media visibility and targeted celebrity endorsements, which reinforce the items’ status as cultural currency.

Key driving factors sustaining the robust expansion of the luxury womenswear market include the accelerating global trend of wealth transfer towards female inheritors and entrepreneurs, resulting in an increasingly autonomous and demanding consumer profile. Furthermore, the imperative for digitization has fundamentally transformed market access, enabling European legacy brands to effectively penetrate high-growth Asia Pacific markets through localized, high-quality e-commerce experiences and highly personalized marketing initiatives. Brands capable of effectively marrying traditional artisanal methods with technological innovation—such as implementing blockchain for provenance tracking or utilizing AI for hyper-personalization—are strategically positioned to capitalize on the dual consumer demand for authentic heritage and modern convenience. The market's resilience is further cemented by the shift in consumer value perception, where investments in high-quality, long-lasting luxury items are increasingly favored over transient, low-cost consumption, aligning with broader sustainability consciousness.

Luxury Womenswear Market Executive Summary

Current business trends within the luxury womenswear market reveal a critical pivot toward establishing comprehensive brand ecosystems and enhancing vertical integration to maximize control over the customer journey and profitability metrics. The emphasis on the Direct-to-Consumer (DTC) model has intensified, necessitating substantial upfront investment in flagship store development, personalized client relationship management (CRM) infrastructure, and advanced in-house digital platforms capable of replicating the physical boutique experience online. Strategically, luxury conglomerates are engaging in targeted portfolio optimization, acquiring niche, high-growth brands that appeal to specialized demographic segments, such as sustainable luxury adherents or avant-garde fashion enthusiasts, thereby insulating the overall business against cyclical risks associated with reliance on heritage flagships. Additionally, the proliferation of certified pre-owned luxury marketplaces is forcing brands to actively participate in the circular economy, recognizing that secondary market participation extends brand life and reinforces investment value, an attractive proposition for the savvy luxury buyer who views purchases as enduring assets.

Regional dynamics confirm the undeniable gravitational pull of the Asia Pacific (APAC) region, which continues to drive the overwhelming majority of global growth, largely insulated from economic slowdowns observed in established Western territories. Specifically, the Chinese domestic market, buoyed by highly affluent younger consumers (Gen Z) prioritizing personalized streetwear and accessories, necessitates rapid adaptation of product lines and marketing calendars, demanding localization in digital communication and product style. Conversely, the foundational markets of Europe (Italy, France) remain indispensable as centers for design innovation and high-end manufacturing expertise, acting as the necessary global arbiters of quality and trend by hosting key fashion weeks and maintaining highly skilled artisan bases. North America, while mature, excels in adopting retail technologies, particularly integrating virtual reality (VR) and Augmented Reality (AR) shopping environments, serving as a vital testing ground for next-generation luxury retail strategies that prioritize convenience and instant gratification within the high-end segment, driving growth through technological superiority.

Segmentation analysis underscores the continued economic strength and stability provided by the Accessories category, specifically iconic handbags and leather goods, which consistently deliver superior margins and serve as the most effective funnel for acquiring new luxury consumers. Within the apparel segment, the blending of technical performance wear with traditional luxury materials, often referred to as 'couture comfort' or luxury athleisure, remains a highly disruptive trend, reshaping traditional wardrobes toward versatility and understated opulence, reflecting post-pandemic lifestyle changes. Distribution trends clearly illustrate the diminishing strategic importance of traditional wholesale department stores, replaced by a dual channel approach: immersive mono-brand physical boutiques for high-value transactional experiences and proprietary e-commerce sites engineered for hyper-personalized digital transactions. This dual strategy ensures consistent brand messaging and pricing integrity across all touchpoints, safeguarding luxury equity against commodity perception while maximizing revenue capture.

AI Impact Analysis on Luxury Womenswear Market

User inquiries surrounding the impact of Artificial Intelligence (AI) in luxury womenswear center predominantly on how technology enhances personalization, optimizes inventory management to maintain exclusivity, and improves the overall digital shopping experience while preserving the high-touch element of luxury service. Common questions revolve around AI’s sophisticated role in predicting nuanced, micro-fashion trends months in advance, ensuring supply chain transparency from rare raw material sourcing to final authenticated sale, and automating bespoke customer service interactions using sophisticated NLP models while rigorously retaining the personalized, human-centric approach essential for luxury branding. There is notable concern regarding stringent adherence to global data privacy regulations (e.g., GDPR) and the ethical governance of consumer behavioral data collected by AI systems, alongside high expectations that AI and machine vision will drastically reduce the prevalence of product counterfeiting by improving complex authentication processes throughout the secondary market. The overarching theme is the integration of AI to drive unprecedented operational efficiency, creative enhancement, and hyper-personalization without, critically, diluting the intrinsic value, heritage, and exclusivity associated with high-end luxury goods.

AI is rapidly transforming critical functions within the luxury womenswear ecosystem, moving beyond simple operational efficiency to fundamentally reshape client engagement and even contribute to the creative processes. Machine learning algorithms are now indispensable tools for analyzing vast datasets encompassing historical sales, real-time social media sentiment, runway feedback, and geopolitical consumption indices to forecast precise product demand with unprecedented accuracy, often predicting regional material preferences and style acceptance. This highly refined predictive capability is absolutely vital for managing limited-edition product drops and maintaining the desired, strategic levels of scarcity—a non-negotiable cornerstone of luxury branding and investment value preservation. Furthermore, generative AI is actively being integrated into advanced design departments, assisting creative directors by rapidly visualizing hundreds of variations of new concepts, optimizing intricate fabric pattern placements to reduce waste, and simulating how designs will perform and fit across highly diverse global body types and styling contexts, thereby accelerating the time-to-market for new luxury collections while ensuring superior fit consistency and minimal resource utilization.

The successful implementation of AI-powered personalization engines on proprietary luxury e-commerce platforms significantly elevates the perceived value and quality of the digital customer journey. These intelligent engines meticulously analyze a consumer’s entire digital footprint, purchase history, specific browsing behavior, and stated preferences to curate highly relevant and timely product recommendations, provide sophisticated digital styling advice, and even pre-emptively notify clients of inventory drops—effectively replicating the bespoke, trust-based experience of an in-store personal shopper or private client advisor. Beyond the customer-facing elements, AI is crucial for optimizing complex international logistics by modeling potential supply chain disruptions, dynamically allocating inventory based on regional demand spikes, and verifying the authenticity of products through sophisticated image recognition linked to Blockchain databases. This technological reliance ensures that established luxury brands can scale their massive global operations efficiently while rigorously preserving the exclusivity, material integrity, and controlled narrative of their extremely high-value merchandise in a demanding, fast-paced global market environment.

- AI-driven Trend Forecasting: Predictive analytics supporting design and inventory decisions to ensure exclusivity, strategic scarcity, and minimize costly unsold stock accumulation.

- Hyper-Personalization Platforms: Utilizing machine learning to tailor product recommendations, bespoke marketing communications, and personalized digital styling services for high-net-worth clients globally.

- Supply Chain Traceability: Enhancing end-to-end transparency and operational efficiency from the initial sourcing of luxury materials to the final secure delivery, ensuring complete traceability and ethical compliance documentation.

- Authenticity Verification Systems: Utilizing complex machine vision and AI-linked blockchain technology to provide instantaneous, verifiable authentication, rigorously combating sophisticated counterfeiting operations and safeguarding brand equity.

- Generative Design and Prototyping: AI tools assisting creative directors in conceptualizing, rapidly prototyping digital visualizations, and optimizing material cutting and placement to enhance production sustainability.

- Advanced CRM and NLP: Automated, yet highly customized, client service and relationship management using sophisticated natural language processing (NLP) to handle complex queries with a high degree of luxury professionalism and discretion.

DRO & Impact Forces Of Luxury Womenswear Market

The core drivers of the sustained growth observed in the Luxury Womenswear Market are deeply rooted in the persistent rise of the global affluent consumer base and their increasing expenditure on non-essential, status-defining goods, underpinned by robust economic fundamentals in key regions. Specifically, the escalating financial independence and accumulated spending power of professional women globally, particularly those rising to executive positions or succeeding as entrepreneurs in dynamic markets, directly fuels demand for premium professional, social, and leisure attire. This economic empowerment is synergistically combined with the cultural influence of highly pervasive social media and globalized entertainment platforms, which continuously elevate aesthetic standards and set new benchmarks for aspirational consumption, promoting high-end brands to younger demographics eager to acquire luxury goods as cultural tokens. Furthermore, ongoing technological advances in the development of sustainable material science and precision manufacturing techniques allow brands to credibly offer products that meticulously align with contemporary ethical and environmental values, further justifying premium price points and attracting the globally conscious segment of affluent consumers.

However, the market faces significant structural restraints, primarily stemming from profound global economic volatility and localized geopolitical instability, which directly and immediately impact consumer confidence and discretionary spending, particularly noticeable during periods of elevated global inflation or prolonged recessionary concerns across established Western luxury markets. The persistent, evolving challenge of digital and physical counterfeiting, despite continuous technological countermeasures and legal actions, continues to dilute brand value, undermine revenue potential, and necessitate vast, ongoing investment in intellectual property protection and complex authentication infrastructure. Furthermore, maintaining the delicate perception of exclusivity and rarity while simultaneously pursuing aggressive global expansion into high-volume markets, such as certain regions of China, is a complex strategic balancing act; overexposure or excessive proliferation of highly sought-after luxury items can rapidly diminish their desirability and status appeal among the critical, core ultra-high-net-worth customer base, demanding disciplined inventory control and highly segmented, targeted marketing strategies.

Opportunities for future value generation are primarily centered on maximizing digital engagement and achieving strategic market penetration. Geographically, there is immense untapped potential in rapidly developing economies, particularly in localized urban centers across Southeast Asia (e.g., Vietnam, Indonesia) and specific, high-wealth pockets in Africa and Latin America where established luxury retail consumption is nascent but rapidly accelerating, showing high elasticity of demand. Technologically, the adoption of advanced data analytics and predictive AI enables unprecedented levels of demand forecasting and personalization, transforming passive shoppers into loyal, high-value clients through bespoke product offerings and unique virtual experiences in nascent digital environments like the Metaverse. Finally, the strategic implementation of circular economy models, including certified luxury rental and resale programs, allows brands to monetize their products across their entire lifecycle, attracting a broader consumer base while simultaneously burnishing their environmental credentials and appealing to a desire for investment longevity.

Segmentation Analysis

Segmentation analysis is a critical strategic tool for dissecting and understanding the highly heterogeneous consumption patterns that characterize the multi-faceted Luxury Womenswear Market. The market is primarily dissected based on Product Type, sophisticated Distribution Channel structure, and End User Age Group, with each categorization revealing distinct, quantifiable growth trajectories, evolving consumer preferences, and strategic opportunities. Product segmentation critically highlights the substantial divergence between high-margin accessories (such as handbags, fine footwear, and statement jewelry), which are inherently less susceptible to rapid fashion cycle obsolescence and often act as stable, reliable growth engines, versus the more trend-dependent apparel category (including ready-to-wear, specialized evening wear, and seasonal outerwear), which fundamentally drives brand image, cultural relevance, and media visibility. Understanding these nuanced product dynamics is absolutely essential for rigorous inventory planning, optimizing seasonal collection drop calendars, and executing precise manufacturing lead times to capture maximum value and maintain scarcity.

A further, equally crucial segmentation focuses intensively on Distribution Channels, distinguishing strategically between brand-owned, vertically integrated mono-brand stores and flagship boutiques, which afford the ultimate control over the refined brand experience, client relationship management, and pricing integrity, and external multi-brand physical retailers (like department stores) and curated online platforms, which provide crucial broader market accessibility and highly diversified geographical reach. The accelerating strategic shift towards the Direct-to-Consumer (DTC) model, executed predominantly through proprietary, high-tech e-commerce platforms, is fundamentally redefining traditional channel dynamics. This shift is driven by the imperative for enhanced first-party data collection capabilities, enabling highly granular, personalized marketing, and providing greater agility in responding to real-time market fluctuations, thereby reducing reliance on third-party intermediaries and increasing gross margins significantly.

Age demographics also play an increasingly vital, transformative role in shaping segmentation strategies. While older generations (Baby Boomers, Gen X) often exhibit strong loyalty to heritage brands, prioritizing timeless classics, exceptional craftsmanship, and discreet luxury branding, Millennials and Gen Z increasingly favor brands that visibly demonstrate robust social responsibility, engage in disruptive collaborations (e.g., street style influences), and maintain a strong, authentic digital presence. This younger, influential segment is rapidly pushing the overall luxury market segment towards casual luxury, technologically innovative materials, and strategically limited-edition product drops, demanding fluidity between high fashion and everyday functionality, fundamentally influencing the product design pipeline across all major luxury houses.

- By Product Type:

- Apparel (Ready-to-Wear, Haute Couture, Evening Wear, Casual Wear, Outerwear)

- Footwear (Heels, Boots, Sneakers, Sandals, Technical Performance Luxury)

- Accessories (Handbags, Small Leather Goods, Scarves, Belts, Sunglasses, Hair Accessories)

- Jewelry and Watches (Fine Jewelry, Fashion Jewelry, High Horology)

- By Distribution Channel:

- Monobrand Stores/Brand-Owned Boutiques (Flagships, Pop-ups)

- Specialty Retailers (High-end Department Stores, Curated Multi-brand Boutiques)

- E-commerce (Brand Websites, Third-party Luxury Platforms, Social Commerce)

- By Material:

- Silk and Fine Natural Fibers (Cashmere, Alpaca)

- Fine Leather and Exotic Skins (Regulated Sourcing)

- Sustainable/Innovative Fabrics (Bio-based, Recycled, Technical Textiles)

- By Region:

- North America (U.S., Canada)

- Europe (France, Italy, UK, Germany)

- Asia Pacific (APAC) (China, Japan, South Korea, India)

- Latin America (LATAM) (Brazil, Mexico)

- Middle East and Africa (MEA) (UAE, Saudi Arabia)

Value Chain Analysis For Luxury Womenswear Market

The luxury womenswear value chain is profoundly characterized by an intense, quality-driven upstream focus on securing unparalleled raw material quality, ensuring verifiable ethical sourcing credentials, and maintaining access to specialized, high-skill craftsmanship, followed by an extremely controlled downstream distribution methodology engineered to maintain brand scarcity and rigidly enforce premium pricing positioning. Upstream analysis critically highlights complex and often proprietary activities such as the specialized sourcing of rare materials—including certified organic silks, highly specialized grade cashmere, unique, traceable exotic leathers, and ethically mined precious stones—which requires cultivating long-standing, trust-based relationships with specialized, certified suppliers who can guarantee both material superiority and complete end-to-end traceability documentation. This initial stage demands significant and continuous investment in materials R&D to develop innovative, highly sustainable, and high-performance textiles that successfully meet the rapidly increasing ethical and aesthetic standards of the modern luxury consumer. The inherent complexity, time expenditure, and artisanal nature of manufacturing, which is often purposefully concentrated within traditional luxury hubs like Tuscany, Paris, and Milan, constitute a major, non-negotiable cost center and serve as the single most critical source of competitive differentiation and quality assurance.

Downstream activities are strategically dominated by intensive brand marketing, global image cultivation, and meticulously controlled distribution networks designed specifically to safeguard the luxury brand’s equity and pricing integrity. Unlike the volume-driven models of mass-market fashion, luxury brands minimize reliance on widespread wholesale distribution, instead favoring direct channels (DTC) to manage consumer perception, control inventory flow, and guarantee pricing consistency globally. The primary distribution channels are rigorously segmented into direct sales and extremely selective indirect sales. Direct channels encompass strategically positioned flagship stores, high-performance dedicated e-commerce sites, and highly personalized client services (including private trunk shows and exclusive concierge shopping appointments), offering complete, end-to-end control over the holistic customer experience and allowing for direct, unfiltered data capture, which fuels CRM systems. These direct, high-touch interactions are foundational for cultivating deep, multi-generational loyalty among High-Net-Worth Individuals and achieving the highest sustainable profit margins.

Indirect distribution involves strategic, selective partnerships with a small number of approved high-end department stores (like Saks Fifth Avenue or Selfridges) and rigorously vetted specialized third-party luxury e-tailers (such as MATCHESFASHION or Mytheresa). While these indirect channels provide strategic augmented market penetration and access to new geographical pools of consumers, they necessitate stringent contractual agreements to ensure meticulous adherence to the brand’s visual standards, guaranteed pricing minimums, and strict exclusivity agreements on inventory allocation. The overarching luxury value chain is driven much less by conventional short-term cost efficiency metrics and overwhelmingly more by preserving intrinsic brand heritage, guaranteeing uncompromising quality control, and maximizing the immersive, highly personalized experiential element of luxury consumption. This intense focus allows the luxury sector to strategically justify the substantial markups applied throughout the entire process, from the initial, costly sourcing of materials through manufacturing to the final, highly anticipated point of sale, reinforcing the perception of intrinsic value and lasting investment.

Luxury Womenswear Market Potential Customers

The primary potential customers, or end-users, of the Luxury Womenswear Market represent a highly sophisticated, financially empowered cohort, meticulously categorized not only by the sheer volume of their disposable wealth but more critically by detailed psychographics, including their core values, elaborate lifestyle demands, and their distinct willingness to pay ultra-premiums for specific non-material attributes like verifiable heritage, absolute exclusivity, or demonstrable sustainability commitments. The core purchasing demographic consists of Ultra High-Net-Worth Individuals (UHNWIs) and High-Net-Worth Individuals (HNWIs) who view the acquisition of haute couture, rare fine jewelry, and iconic accessories not as mere consumption, but as strategic investment pieces and indisputable symbols of their enduring status and achievement. This elite group demands highly confidential, bespoke services, often requiring discreet, highly relationship-driven interactions and expects unparalleled quality, absolute rarity, and guaranteed product provenance from the luxury houses they patronize.

A secondary, but profoundly influential and rapidly expanding, segment comprises the rising global affluent middle class, often strategically termed 'aspirational luxury consumers' or 'HENRYs' (High Earners, Not Rich Yet). Although this group may not regularly invest in bespoke haute couture collections, they are extremely active and influential buyers of accessible, entry-level luxury items, particularly highly recognizable accessories such as signature handbags, designer sunglasses, and premium branded sneakers, which function effectively as highly attainable, visible status symbols and social currency. This segment demonstrates high responsiveness to digitally driven marketing campaigns, highly selective influencer endorsement strategies, and rapid brand collaborations, relying extensively on curated e-commerce platforms for seamless accessibility and efficient consumption, thereby significantly driving the high-volume growth and expansion strategies for many international luxury conglomerates and their accessory lines.

Furthermore, a critically important modern customer segment driving contemporary luxury trends is the ethically conscious, socially engaged Millennial and Generation Z consumer. This younger, digitally savvy clientele possesses growing affluence and meticulously values comprehensive transparency, demonstrably sustainable sourcing, and visible social activism from the brands they choose to patronage. They are the principal driving force behind the accelerated demand for verifiable ethical luxury materials, the growth of the certified pre-owned luxury market, and the integration of robust Environmental, Social, and Governance (ESG) criteria into brand narratives. For luxury brands, successfully attracting and retaining the long-term loyalty of these complex segments mandates the integration of genuine, robust sustainability commitments and innovative digital engagement strategies alongside the rigorous preservation of the core values of uncompromising material quality and timeless, enduring design that fundamentally defines the luxury sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 67.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH Moët Hennessy Louis Vuitton SE, Kering S.A., Hermès International S.C.A., Chanel S.A., Prada Group, Ralph Lauren Corporation, Burberry Group plc, Christian Dior SE, Giorgio Armani S.p.A., Richemont S.A., Capri Holdings Limited, Valentino S.p.A., Dolce & Gabbana S.r.l., Balenciaga S.A., Stella McCartney, Loro Piana S.p.A., Salvatore Ferragamo S.p.A., Saint Laurent, Tom Ford International, Alexander McQueen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Womenswear Market Key Technology Landscape

The contemporary technological landscape supporting the Luxury Womenswear Market is undergoing a rapid, sophisticated evolution, strategically focused on creating seamless, high-fidelity omni-channel experiences, dramatically enhancing product traceability mechanisms, and integrating innovative, data-driven approaches into traditional design and production processes. Digitalization efforts are heavily centered around the accelerated adoption of high-definition 3D visualization and proprietary virtual try-on technologies, typically utilizing advanced Augmented Reality (AR) systems. These technologies fundamentally enhance the consumer's confidence in making high-value online purchases, thereby drastically reducing return rates and successfully bringing the historically high-touch in-store advisory experience directly into the consumer's personal digital realm. Furthermore, sophisticated Customer Relationship Management (CRM) systems powered by predictive Artificial Intelligence are absolutely essential for harvesting detailed, longitudinal client purchasing and behavioral data, allowing brands to precisely anticipate complex purchasing behavior and offer highly personalized, proactive service, meticulously maintaining the intimacy and discretion required for sustained success in high-end luxury sales, irrespective of the physical distance separating the brand and the client.

A second, critically important area of technological integration is the mandated deployment of advanced supply chain transparency technologies, principally focusing on the integration of Blockchain technology and high-performance Radio-Frequency Identification (RFID) systems. Blockchain offers an immutable, cryptographically secured record-keeping capability, providing highly verifiable, secure proof of a product’s precise origin, detailed material sourcing chain, and complete ownership history. This addresses profound consumer concerns regarding absolute product authenticity, rigorous ethical production standards, and sustainable practices—factors that have become paramount prerequisites for the discerning modern luxury buyer. Concurrently, miniature RFID tags, discreetly embedded into luxury garments and accessories, enable precise, real-time inventory tracking and dynamic automated stock control. This ensures optimal stock levels are maintained across geographically dispersed global boutiques and proactively prevents critical stockouts of exclusive, high-demand items, thereby rigorously upholding the crucial perception of scarcity and meticulously controlled distribution essential for luxury brand management.

The long-term technological trajectory involves strategic, significant exploration into the emerging Web3 landscape, including the Metaverse and related decentralized applications. Major luxury houses are actively investing heavily in the creation of verifiable digital twin products (often termed 'phygital goods') and strategically issued Non-Fungible Tokens (NFTs) that function either as digital certificates of guaranteed ownership, or which grant exclusive access rights to private, virtual events, early collection previews, or highly specialized services. This expansive technological frontier not only unlocks entirely new, highly profitable digital revenue streams but also strategically engages the globally influential, younger, digitally native luxury consumer cohort, proactively positioning the luxury brands for sustained relevance and market dominance in future digital consumption spaces. Furthermore, sophisticated robotics and automation systems are being cautiously, yet effectively, adopted in highly repeatable, non-artisanal aspects of material preparation and quality assurance within manufacturing, aimed at enhancing dimensional precision and consistency without ever compromising the core, signature hand-crafted quality and artisanal integrity that fundamentally defines the luxury product.

Regional Highlights

The Asia Pacific (APAC) region stands out indisputably as the central, most powerful engine driving the vast majority of global luxury womenswear market expansion, demonstrating unparalleled consumption growth and robust economic resilience. This market dominance is primarily attributed to the massive market potential of Mainland China, where local consumption has been profoundly fueled by advantageous government policies (such as reduced import duties) encouraging wealthy citizens to purchase domestically rather than engaging in international luxury tourism, coupled with the rapid, explosive accumulation of generational wealth among highly educated young urban professionals. Other strategically key growth markets within APAC include South Korea and Japan, characterized by extremely discerning consumers who place exceptional value on brand heritage, technological innovation, and impeccable quality, alongside rapidly industrializing Southeast Asian nations like Singapore, Vietnam, and Thailand, which are fast establishing themselves as vital regional luxury retail hubs. The region's sheer scale, combined with its technologically vast, digitally-engaged population, makes it the prime strategic target for dedicated e-commerce expansion and highly granular, localized digital marketing campaigns, often utilizing regional social media platforms.

Europe, serving historically and spiritually as the undisputed home of global luxury fashion, retains its immense and critical significance in the global market landscape, functioning as the primary benchmark for design excellence and material quality. Countries such as Italy and France are vital not just as mature consumer markets but, more importantly, as indispensable global centers of operational excellence for design innovation, high-end artisanal manufacturing, and the centralized headquarters for the world’s leading luxury conglomerates (e.g., LVMH and Kering). While the achievable growth rates within Europe may present as more moderate and stable compared to the explosive pace observed in APAC, European markets consistently command the highest average transaction values globally and continue to exert unparalleled influence over global trend cycles, largely driven through iconic runway shows, centralized media visibility, and the preservation of artisanal craft clusters. The European market focuses intensely on the maintenance of impeccable artisanal integrity and compelling heritage storytelling to continually attract both domestic clientele and high-spending international luxury tourists.

North America, specifically the vast market of the United States, represents a mature but highly innovative and rapidly evolving luxury market. This region is distinguished by its leadership in the rapid adoption of cutting-edge digital retail technologies, its aggressive commitment to sustainable luxury and circular fashion practices, and the profound integration of elevated casual wear (luxury athleisure) into traditional high fashion wardrobes. Consumer demand across North America is characterized by a high willingness to pay for comprehensive customization, sophisticated experiential retail formats, and exclusive brands that visibly align with contemporary social, environmental, and ethical narratives. Concurrently, the Middle East and Africa (MEA) region exhibits exceptionally strong, centralized demand for ultra-luxury goods, heavily driven by significant wealth concentration within the GCC states. Consumption here focuses predominantly on elaborate, high-end evening wear, investment-grade fine jewelry, and highly customized services meticulously tailored to specific regional cultural preferences, demanding unparalleled levels of service and exclusivity.

- Asia Pacific (APAC): Unrivaled market growth engine, primarily driven by Mainland China's accelerated domestic consumption and the emergence of younger, digitally affluent HNWIs. Strategic focus on localization and expansive digital channel integration.

- Europe: Essential global center for manufacturing, design leadership, and brand heritage (Italy, France). Characterized by the highest average transaction values and foundational demand for exclusive haute couture and elevated ready-to-wear collections.

- North America: Global leader in pioneering digital innovation, rapid sustainability adoption, and the proliferation of high-tech experiential retail formats. Strong consumer base demanding modern, versatile, and ethically sourced high-quality luxury items.

- Middle East & Africa (MEA): High growth potential fueled by centralized high net worth in the GCC region. Defined by ultra-high per-capita spending, focused on bespoke, custom-designed, investment-grade jewelry and elaborate formal apparel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Womenswear Market.- LVMH Moët Hennessy Louis Vuitton SE

- Kering S.A.

- Hermès International S.C.A.

- Chanel S.A.

- Prada Group

- Burberry Group plc

- Christian Dior SE

- Giorgio Armani S.p.A.

- Richemont S.A.

- Capri Holdings Limited (Versace, Jimmy Choo)

- Valentino S.p.A.

- Dolce & Gabbana S.r.l.

- Balenciaga S.A.

- Stella McCartney

- Loro Piana S.p.A.

- Salvatore Ferragamo S.p.A.

- Saint Laurent

- Tom Ford International

- Alexander McQueen

- Moncler S.p.A.

Frequently Asked Questions

Analyze common user questions about the Luxury Womenswear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Luxury Womenswear Market in Asia Pacific?

The primary growth drivers in Asia Pacific are the unprecedented rise in disposable income among young urban populations, favorable government tax incentives promoting domestic luxury consumption (especially in China), and high digital penetration that allows global brands to reach younger, aspirational consumers effectively through localized platforms.

How is ethical and verifiable sustainability influencing purchasing decisions in luxury apparel?

Sustainability is now a non-negotiable purchasing criterion. Affluent consumers increasingly prioritize verifiable traceability, demanding ethical sourcing of all materials (e.g., certified sustainable silk or innovative leather alternatives), and favoring brands committed to circular business models (including certified resale and rental programs). Brands demonstrating robust commitment to ESG criteria gain substantial competitive advantage and consumer loyalty.

What is the definitive role of proprietary E-commerce in the highly controlled distribution of high-end luxury goods?

E-commerce is critical for achieving strategic global reach, facilitating hyper-personalization, and maintaining pricing control. While physical mono-brand boutiques remain paramount for high-touch experiences, brand-owned DTC online channels, often utilizing sophisticated AR/VR technology, are driving the majority of growth volume, especially for accessories and highly sought-after, limited-edition entry-level luxury items, ensuring a seamless omni-channel customer journey.

How are technology, specifically AI and Blockchain, impacting luxury design, authentication, and exclusivity?

Technology aids in maintaining exclusivity by using AI for highly accurate predictive trend forecasting and inventory optimization, ensuring that brands preserve the crucial element of scarcity for limited product drops. Furthermore, Blockchain technology provides immutable product authentication and provenance tracking, rigorously preserving the product's investment value and combating the significant dilution of brand equity caused by counterfeits globally.

Which product segment offers the highest stability, profitability, and entry points for new luxury consumers?

The accessories segment, particularly high-margin leather goods (iconic handbags, small leather goods, and premium footwear), typically offers the highest operational stability and profitability. These products serve as reliable and aspirational entry points for new luxury buyers and are significantly less subject to rapid seasonal obsolescence and markdown pressure compared to seasonal ready-to-wear apparel collections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager