Lyophilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434280 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Lyophilizer Market Size

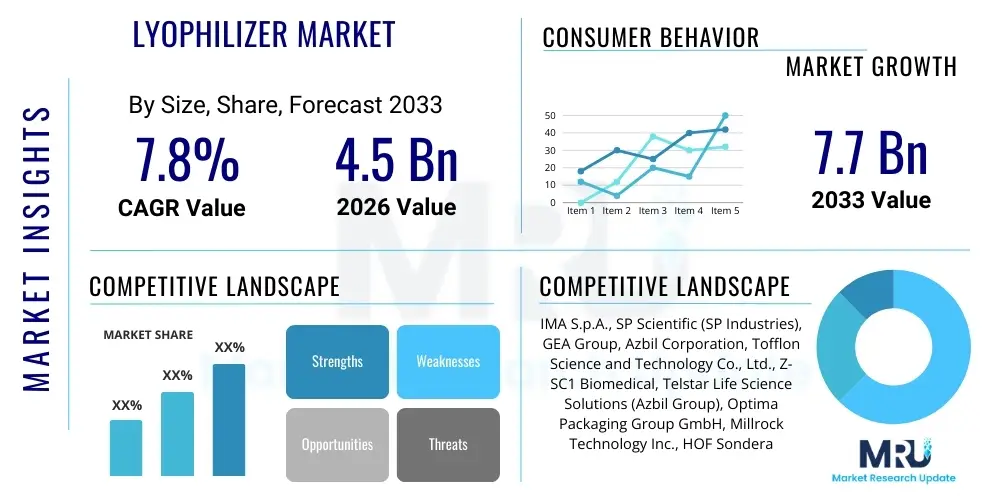

The Lyophilizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for stable, long-shelf-life biopharmaceuticals, including advanced therapeutic proteins, sensitive vaccines, and complex diagnostic reagents. The inherent capabilities of lyophilization to preserve the structural and biological integrity of thermally sensitive materials make it indispensable in modern pharmaceutical manufacturing, positioning the market for sustained high-value growth throughout the forecast period.

Lyophilizer Market introduction

The Lyophilizer Market encompasses the equipment, services, and associated technologies used for freeze-drying, a process that removes solvent, typically water, from frozen material via sublimation under vacuum. This highly specialized technique is critical for preserving sensitive, high-value products that degrade quickly in liquid or ambient conditions. The primary product offering includes diverse lyophilizer types such as industrial-scale production units, pilot-scale units for clinical trials, and small laboratory benchtop models, all designed to maintain precise temperature and pressure control during freezing, primary drying, and secondary drying phases. The sophisticated machinery requires stringent validation protocols to meet global regulatory standards, notably those enforced by the FDA and EMA.

Major applications of lyophilization span the entire biopharmaceutical and healthcare spectrum. Key sectors driving adoption include the manufacturing of novel vaccines (such as mRNA and subunit vaccines), complex injectable drugs, monoclonal antibodies (mAbs), and various biotherapeutics. Beyond pharmaceuticals, lyophilizers are integral to producing stable diagnostic kits, advanced surgical implants, and high-quality nutraceuticals. The process significantly enhances product stability, drastically extends shelf life, and substantially reduces the costs and logistical complexities associated with cold chain storage and transport, which is particularly beneficial for global distribution in developing regions and for pandemic preparedness initiatives requiring rapid deployment of stable countermeasures.

Driving factors underpinning the market growth include the robust global pipeline of biological drugs, the increasing prevalence of chronic diseases necessitating specialized therapeutics, and technological advancements focusing on cycle optimization and efficiency. Innovations such as controlled nucleation and automated loading/unloading systems are improving throughput and product quality consistency. Furthermore, the rising investment in research and development activities across both academic institutions and commercial entities, coupled with stringent regulatory requirements emphasizing product purity and long-term stability, continuously fuel the demand for advanced, compliant lyophilization systems and supporting services like preventive maintenance and validation protocols.

- Product Description: Equipment used for freeze-drying (sublimation) to preserve temperature-sensitive biological and pharmaceutical products, extending shelf life and stability.

- Major Applications: Vaccines, Monoclonal Antibodies, Recombinant Proteins, Complex Diagnostics, Parenteral Drugs, Probiotics, and Advanced Cell and Gene Therapies.

- Key Benefits: Extended product shelf life, enhanced stability, elimination of cold chain dependence for distribution, and preservation of biological activity.

- Driving Factors: Growing biopharmaceutical sector, increasing complexity of therapeutic molecules, technological advancements in cycle optimization, and global vaccine production mandates.

Lyophilizer Market Executive Summary

The Lyophilizer Market is experiencing a period of significant growth, characterized by strong capitalization in the biopharmaceutical sector and increasing focus on manufacturing efficiency. Business trends indicate a marked shift towards fully automated, clean-in-place (CIP) and sterilize-in-place (SIP) systems, driven by strict regulatory requirements for sterility and consistency in high-volume production. Key market participants are investing heavily in modular and customizable lyophilizers that can integrate seamlessly into continuous manufacturing platforms, thereby reducing batch processing times and minimizing operational footprint. Furthermore, there has been a noticeable consolidation and partnership activity, particularly between equipment manufacturers and contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs), to offer integrated, end-to-end processing solutions from formulation development to final packaging.

Regionally, North America maintains its dominance due to a highly mature biopharmaceutical ecosystem, extensive R&D spending, and the presence of major global pharmaceutical companies and technology innovators. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by government initiatives to bolster domestic pharmaceutical production, rapid expansion of biotechnology startups in countries like China and India, and increasing accessibility to high-quality healthcare infrastructure. European markets remain robust, emphasizing sustainable manufacturing practices and adopting advanced control systems to meet stringent environmental and quality standards. The dynamic growth across these geographies underscores the global necessity of advanced preservation techniques for complex medical products.

Segment trends reveal that the Pharmaceutical & Biotechnology segment continues to be the largest application area, driven predominantly by the expanding pipeline of biological drugs and the critical need for stable vaccine platforms. Technologically, the Tray Lyophilizers segment, specifically industrial-scale units, accounts for the largest market share due to their applicability in large-batch pharmaceutical processing. Looking forward, the services segment—including maintenance, validation, and calibration services—is anticipated to grow at a faster rate than the equipment segment itself, reflecting the complexity and mandatory regulatory maintenance associated with sophisticated lyophilization technology. The increasing adoption of advanced process analytical technology (PAT) and digitalization within lyophilization cycles is set to optimize energy consumption and improve overall product quality assurance metrics.

- Business Trends: Shift towards high-throughput, automated freeze-drying solutions; increased outsourcing to CDMOs; focus on energy-efficient designs and continuous processing integration.

- Regional Trends: North America leading in market size; APAC exhibiting fastest growth due to expanding generic and biopharma manufacturing base; Europe prioritizing sustainable technology adoption.

- Segments Trends: Pharmaceutical & Biotechnology application segment dominance; high growth anticipated in the Services segment (maintenance and validation); preference for large-scale production lyophilizers.

AI Impact Analysis on Lyophilizer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Lyophilizer Market primarily revolve around cycle time reduction, prediction of critical quality attributes (CQAs), and achieving energy efficiency. Users frequently ask how machine learning (ML) models can optimize the primary and secondary drying phases, traditionally the most time-consuming steps, and whether AI can accurately predict product collapse or eutectic temperatures using minimal sample data. A core theme is the integration of AI-powered Process Analytical Technology (PAT) to move from batch control to real-time, dynamic cycle adjustment, ensuring optimal product moisture content and amorphous structure stability. Concerns often center on the validation requirements for AI algorithms in GxP environments and the cost-benefit analysis of implementing complex AI infrastructure into existing manufacturing setups.

AI is transforming lyophilization by enabling sophisticated data analysis and predictive modeling that was previously impossible using conventional statistical methods. ML algorithms can analyze vast historical batch data, incorporating inputs from manifold pressure, shelf temperature, condenser temperature, and residual moisture sensors, to build highly accurate predictive models for successful drying endpoint determination. This capability significantly reduces the need for conservative, overly long drying cycles, which traditionally accounted for wasted energy and suboptimal throughput. By accurately identifying the maximum allowable shelf temperature during primary drying without causing product collapse, AI minimizes processing time while safeguarding critical product quality attributes like potency and reconstitution time. This predictive capability is vital for handling complex or novel formulations that lack extensive prior processing history.

Furthermore, AI-driven solutions are enhancing equipment reliability and maintenance. Predictive maintenance (PdM) models, trained on sensor data (vibration, heat signatures, vacuum pump performance), can forecast component failure with high accuracy, allowing manufacturers to schedule maintenance proactively, thereby minimizing costly unplanned downtime. In the formulation development stage, AI accelerates screening processes by simulating drying behavior for different excipients and drug concentrations, drastically reducing the experimental resources required to establish a robust lyophilization protocol. The integration of computer vision and deep learning in automated loading/unloading systems also improves quality control by detecting subtle inconsistencies or vial defects in real-time. This comprehensive integration of AI optimizes the entire lifecycle of lyophilized product manufacturing, ensuring faster time-to-market and superior consistency.

- Cycle Optimization: ML algorithms predict optimal primary and secondary drying end-points, reducing cycle duration by up to 30% while preserving product quality.

- Predictive Maintenance (PdM): AI analyzes sensor data to forecast equipment failures (e.g., vacuum pump degradation, refrigeration system issues), maximizing uptime.

- Formulation Development: Simulation models accelerate the screening of excipients and thermal profiles, facilitating rapid development of robust freeze-drying recipes.

- Quality Control: Computer vision systems, powered by deep learning, enable real-time detection of product defects, residual moisture inconsistencies, and vial integrity issues during processing.

- Energy Efficiency: AI dynamically controls shelf temperature and vacuum based on real-time process monitoring, minimizing energy expenditure without compromising product CQAs.

- PAT Integration: Enables dynamic, closed-loop control of the lyophilization process by linking real-time sensor data (e.g., capacitance manometer, tuned laser diode absorption spectroscopy) to predictive models.

DRO & Impact Forces Of Lyophilizer Market

The Lyophilizer Market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaped by regulatory pressures and technological advancements. The primary driver is the accelerating demand for high-value biopharmaceuticals, particularly temperature-sensitive vaccines and biological macromolecules, which necessitate preservation via lyophilization to ensure efficacy and stable distribution. Coupled with this is the robust growth in the Contract Development and Manufacturing Organization (CDMO) sector, which increasingly invests in state-of-the-art lyophilization capacity to serve a diverse client base requiring complex manufacturing solutions. These factors, combined with technological shifts toward greater automation and process analytical technology (PAT), create a powerful upward force on market expansion and innovation.

Restraints, however, pose significant challenges to sustained growth. The initial capital investment required for industrial-scale lyophilizers, along with their associated cleanroom setup and specialized validation protocols, is exceptionally high, particularly deterring smaller biotechnology firms. Furthermore, the high energy consumption inherent in maintaining ultra-low temperatures and high vacuum levels contributes substantially to operational expenditures and raises sustainability concerns. Another considerable restraint is the extended cycle time associated with lyophilization, often spanning several days, which can bottleneck high-volume production lines. Regulatory hurdles, specifically maintaining compliance with GxP standards and validating new, complex automated systems, also present ongoing challenges that require specialized expertise.

Opportunities in the market center on addressing these restraints through technological evolution and diversification. The emergence of novel applications in areas such as cell and gene therapies, personalized medicine, and advanced diagnostics provides new high-growth niches requiring specialized, smaller-scale lyophilization equipment. Manufacturers are focusing on developing continuous lyophilization processes that promise to reduce cycle times and improve efficiency, offering a substantial competitive advantage over traditional batch processing. Furthermore, leveraging sustainable engineering practices, such as optimizing refrigeration systems and implementing AI-driven control to reduce energy consumption, presents a major opportunity for market players to appeal to environmentally conscious pharmaceutical clients and meet increasing global sustainability targets. This blend of technological innovation and market diversification is crucial for future expansion.

- Drivers:

- Explosion of the Biologics and Biosimilars pipeline requiring stable formulation.

- Increasing global demand for stable vaccines, particularly in emerging and pandemic-prone regions.

- Rising adoption of outsourcing services (CDMOs) investing heavily in specialized lyophilization capacity.

- Technological advancements promoting automation and precision in cycle control.

- Restraints:

- Prohibitively high initial capital expenditure and specialized infrastructure requirements (cleanrooms, HVAC).

- High energy consumption and operational costs associated with maintaining ultra-low temperatures and vacuum integrity.

- Extended processing times inherent in batch freeze-drying, limiting high-volume throughput.

- Stringent and complex regulatory validation requirements (GxP compliance).

- Opportunity:

- Development and commercialization of continuous lyophilization technologies.

- Expansion into niche applications such as advanced cell therapies and personalized medicine diagnostics.

- Focus on developing energy-efficient and sustainable lyophilizer designs using advanced refrigeration techniques.

- Integration of AI and digital twins for predictive modeling and enhanced process understanding.

- Impact Forces:

- Technological Force: High impact; drives efficiency, reduces cycle time, and improves product quality consistency.

- Regulatory Force: High impact; dictates design requirements (CIP/SIP), validation complexity, and market entry barriers.

- Economic Force: Medium-to-High impact; initial cost acts as a barrier, but long-term stability benefits drive adoption.

- Application Force: High impact; new biopharma products consistently increase the base demand for preservation technology.

Segmentation Analysis

The Lyophilizer Market is extensively segmented based on scale, type, application, and end-user, reflecting the diverse requirements of the pharmaceutical, biotechnology, and food industries. Analyzing these segments provides critical insights into purchasing patterns and technological preferences across different operational environments. The segmentation by scale—encompassing industrial, pilot, and laboratory units—highlights the dual market needs: high-throughput capacity for commercial production (industrial units) versus flexibility and small volume capacity required for R&D and clinical trials (pilot and lab units). The type segmentation, primarily focusing on tray, manifold, and rotary units, underscores the preference for tray lyophilizers in large-scale pharmaceutical applications where precise temperature control and uniform drying across numerous vials are paramount.

The Application segment remains the most influential driver of revenue, with the Pharmaceutical & Biotechnology sector dominating the market due to the proliferation of biologics, which almost universally require lyophilization for long-term stability. Within this category, vaccines, complex proteins, and advanced sterile injectables command the largest share. Conversely, the Food Processing & Preservation segment, while smaller, is witnessing steady growth fueled by the demand for instant meals, gourmet coffee products, and specialized ingredients that retain flavor and nutritional value upon reconstitution. The Diagnostic segment is also rapidly expanding, driven by the need to stabilize sensitive enzymes and reagents used in molecular diagnostic kits and point-of-care testing devices, ensuring their reliability across varied storage conditions.

End-user segmentation differentiates between pharmaceutical and biotechnology companies (the largest buyers), Contract Manufacturing Organizations (CMOs), and academic/research institutions. CMOs represent a high-growth end-user segment, rapidly acquiring the latest, large-capacity, and highly automated systems to provide specialized freeze-drying services for multiple clients globally. Academic and research institutions typically purchase smaller, highly flexible benchtop models for formulation studies and early-stage drug development. The services segment, including custom cycle development, routine maintenance, and qualification (IQ/OQ/PQ) services, is an increasingly crucial part of the market ecosystem, reflecting the necessity for highly regulated environments to maintain peak equipment performance and GxP compliance throughout the equipment lifecycle.

- By Scale: Industrial-Scale Lyophilizers, Pilot-Scale Lyophilizers, Laboratory-Scale Lyophilizers.

- By Type: Tray Lyophilizers, Manifold Lyophilizers, Rotary Lyophilizers.

- By Application: Pharmaceutical & Biotechnology (Vaccines, Injectable Drugs, Biologics), Food Processing & Preservation, Medical Diagnostics, Other Applications (Floriculture, Chemicals).

- By End-User: Pharmaceutical & Biotechnology Companies, Contract Manufacturing Organizations (CMOs) & Contract Research Organizations (CROs), Academic & Research Institutions.

- By Component: Equipment (Condensers, Vacuum Systems, Drying Chambers, Control Systems), Services (Maintenance, Validation, Calibration, Training).

Value Chain Analysis For Lyophilizer Market

The value chain for the Lyophilizer Market initiates with upstream activities involving the sourcing and refinement of specialized components and raw materials. This stage is dominated by suppliers of high-grade stainless steel for chambers and shelves, advanced refrigeration components (compressors, heat exchangers), and sophisticated control system electronics (PLCs, sensors, monitoring software). Quality control and adherence to material standards are critical here, as the final equipment must withstand extreme temperature fluctuations, high vacuum conditions, and rigorous cleaning procedures (CIP/SIP). Key relationships exist between lyophilizer manufacturers and specialized industrial component suppliers, ensuring technological synchronization and reliability in essential subsystems like vacuum pumps and cold traps, which are integral to operational efficiency.

The core of the value chain is the manufacturing, assembly, and integration phase, where highly specialized engineering expertise is required. Manufacturers design, fabricate, and assemble the complete lyophilization unit, integrating the critical subsystems and developing proprietary control software tailored for complex cycle management. This stage involves extensive testing, validation, and adherence to strict engineering standards (e.g., ASME, PED). Following manufacturing, the distribution channel plays a crucial role. Distribution can be direct, where large, specialized manufacturers sell and install industrial units directly to major pharmaceutical clients, providing comprehensive installation qualification (IQ) and operational qualification (OQ) services. Alternatively, indirect channels, involving authorized distributors and sales agents, are often utilized for smaller laboratory and pilot units, particularly in geographically dispersed markets.

Downstream activities center on installation, post-sale services, and end-user operation. Once the equipment is installed, validation and qualification services (PQ—Performance Qualification) are mandatory and often outsourced to specialized service providers or handled directly by the manufacturer’s technical team. These services, along with routine preventive and corrective maintenance, calibration, and cycle optimization support, constitute a high-margin services segment critical for regulatory compliance. The end-users—primarily pharmaceutical firms and CDMOs—then utilize the equipment for production, focusing on formulation science, process scaling, and continuous product quality monitoring. The circular flow of information from end-user feedback back to manufacturers drives continuous innovation in control systems, energy efficiency, and automation levels, sustaining the overall technological advancement of the market.

Lyophilizer Market Potential Customers

The primary and most significant segment of potential customers for lyophilizers consists of large-scale multinational Pharmaceutical and Biotechnology Companies. These entities drive demand for high-capacity, fully automated, and highly compliant production lyophilizers used in the commercial manufacture of blockbuster biological drugs, recombinant proteins, and stable injectable formulations. Their purchasing decisions are heavily influenced by regulatory compliance history, technical expertise in cycle optimization, and the long-term total cost of ownership (TCO), making reliability and validation support paramount. The growing pipeline of complex biological entities necessitates continuous investment in expanding and upgrading their freeze-drying capacity, solidifying their position as the market’s anchor consumers.

A rapidly expanding customer base is the Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs). As pharmaceutical companies increasingly outsource non-core manufacturing processes and formulation development, CDMOs require diverse and flexible lyophilization capabilities, ranging from small-scale development units to multi-batch industrial systems. CDMOs seek modular, versatile equipment that can handle multiple product types and satisfy varied client requirements simultaneously. Their purchasing is driven by the need for quick turnaround times, flexibility in batch sizes, and the ability to offer specialized services such as sterile loading and robotic vial handling, thereby attracting a broad array of biotech startup and established pharma clients.

Further potential customers include organizations involved in public health and research. Government vaccine manufacturers, public health institutions focused on pandemic preparedness, and specialized blood banks or tissue engineering labs require dedicated lyophilization capabilities to stabilize critical health supplies. Academic institutions and university-affiliated research laboratories constitute another segment, typically purchasing smaller, cost-effective benchtop and pilot units for research on novel drug delivery systems, material science applications, and early-stage formulation screening. For these research-focused buyers, ease of use, ability to handle small, precious samples, and advanced monitoring capabilities are key purchasing criteria, distinct from the large-scale production requirements of commercial manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IMA S.p.A., SP Scientific (SP Industries), GEA Group, Azbil Corporation, Tofflon Science and Technology Co., Ltd., Z-SC1 Biomedical, Telstar Life Science Solutions (Azbil Group), Optima Packaging Group GmbH, Millrock Technology Inc., HOF Sonderanlagenbau GmbH, RAE (Refrigeration & Environmental Control), Labconco Corporation, Cuddon Freeze Dry, Freezedry Specialties Inc., Lyo-Tech Scientific, Martin Christ Gefriertrocknungsanlagen GmbH, IKA Werke GmbH & Co. KG, BIA Separations (Sartorius Stedim Biotech), Leybold GmbH (Atlas Copco), Fedegari Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lyophilizer Market Key Technology Landscape

The Lyophilizer Market technology landscape is characterized by innovation aimed at improving process efficiency, enhancing product quality assurance, and reducing overall utility consumption. A critical advancement is the integration of Process Analytical Technology (PAT) tools directly into the drying chamber and associated systems. Techniques such as Tunable Diode Laser Absorption Spectroscopy (TDLAS) and Pressure Rise Tests are employed in real-time to monitor the sublimation rate and determine the drying endpoint with precision. This real-time monitoring allows for dynamic cycle adjustments, moving away from static, validated recipes, ensuring that products are neither under-dried (leading to instability) nor over-dried (leading to wasted cycle time and energy). The utilization of advanced sensor technology is foundational to modern quality by design (QbD) principles applied in lyophilization.

Automation and containment represent another pivotal technological trend, especially for industrial-scale units handling highly potent or sterile injectable drugs. Fully automated loading and unloading systems, often employing robotics and isolator technology, minimize human intervention, thereby drastically reducing contamination risks and improving operator safety when dealing with cytotoxic compounds. These systems seamlessly integrate with upstream washing and filling lines and downstream capping and inspection processes, creating a high-throughput, closed manufacturing environment essential for GxP compliance. Furthermore, the development of sophisticated control systems incorporating supervisory control and data acquisition (SCADA) platforms enables comprehensive data logging, electronic batch record management, and remote diagnostics, crucial for regulatory auditing and process traceability.

Innovations in energy management and cycle design are crucial for addressing operational cost restraints. Controlled Nucleation technology, such as the use of pressurized inert gas (e.g., FreezeBooster), ensures uniform ice crystal formation across all vials simultaneously. This uniformity is vital for consistent drying, reducing the variability often seen in standard lyophilization where freezing is stochastic. By creating a uniform starting point, controlled nucleation allows for more aggressive and shorter primary drying cycles without risking product collapse. Concurrently, manufacturers are focusing on eco-friendly refrigeration technologies, transitioning away from high Global Warming Potential (GWP) refrigerants towards natural alternatives, and utilizing highly efficient compressors and heat recovery systems to align with global sustainability initiatives and reduce the substantial energy footprint historically associated with freeze-drying operations.

- Process Analytical Technology (PAT): Implementation of TDLAS, manometric temperature measurement (MTM), and pressure rise testing for real-time monitoring and endpoint determination.

- Controlled Nucleation: Techniques like LyoStab or FreezeBooster to standardize ice crystal size and distribution, improving uniformity and reducing primary drying time.

- Advanced Automation: Integration of robotic loading/unloading systems, vial handling systems, and isolator technology to ensure sterility and high throughput in contained environments.

- Energy Efficiency Systems: Utilization of cascade refrigeration systems, natural refrigerants (CO2, hydrocarbons), and optimized condenser designs to minimize power consumption.

- Digitalization & Software: Integration of SCADA, cloud-based data management, and predictive modeling software (Digital Twins) for enhanced process control, simulation, and predictive maintenance.

- Continuous Lyophilization: Development of novel tunnel-type or fluid-bed freeze dryers designed to move away from traditional batch processing, promising significant cycle time reduction.

Regional Highlights

North America: Market Dominance and Technological Leadership

North America, encompassing the United States and Canada, currently holds the largest share of the global Lyophilizer Market revenue. This dominance is attributed to the presence of a vast and highly capitalized biopharmaceutical industry, which drives consistent demand for high-end, complex lyophilization equipment. The region is a global leader in drug discovery and development, particularly in advanced therapies such as oncology drugs, gene therapies, and novel vaccines, all of which heavily rely on freeze-drying for stability. Stringent regulatory oversight by the U.S. FDA mandates the adoption of the latest GxP-compliant technologies, including sophisticated containment and automated loading systems, favoring suppliers offering validated, high-quality solutions and comprehensive service contracts. The mature ecosystem, coupled with significant governmental and private funding in life sciences R&D, ensures that North America remains the primary market for technological innovation and early adoption of continuous and AI-integrated lyophilization platforms.

The concentration of major Contract Development and Manufacturing Organizations (CDMOs) in the US further strengthens the market. These CDMOs are strategically investing in expanded lyophilization capacity to manage the outsourcing needs of numerous biotech startups and large pharmaceutical firms, often requiring customized, flexible batch processing capabilities. Furthermore, the US emphasis on domestic resilience, highlighted by recent public health crises, has prompted significant investment in local vaccine and pharmaceutical manufacturing infrastructure, driving bulk purchasing of industrial-scale lyophilizers. The high disposable income and advanced healthcare infrastructure allow for greater expenditure on specialized, high-cost equipment and associated validation services, maintaining the region's premium pricing structure and robust market valuation.

- Key Market Driver: Largest R&D expenditure globally in biopharmaceuticals and presence of major pharmaceutical headquarters.

- Regulatory Landscape: Highly stringent FDA regulations necessitate continuous upgrades to automated, GxP-compliant equipment (CIP/SIP).

- Technological Trend: Early adoption of continuous processing and AI/PAT integration for cycle optimization.

- Key Countries: United States (Primary revenue generator), Canada.

Europe: Focus on Sustainability and Manufacturing Excellence

Europe represents the second-largest market, characterized by strong pharmaceutical manufacturing bases in Germany, Switzerland, the UK, and France. The European market is highly focused on quality, regulatory harmonization (EMA), and increasingly, environmental sustainability. European equipment manufacturers are often leaders in designing energy-efficient lyophilizers, utilizing natural refrigerants and advanced heat recovery systems to comply with demanding EU environmental policies and reduce operational costs. The demand here is driven by both large-scale vaccine production and specialty pharmaceutical manufacturing, particularly generics and biosimilars that require cost-effective, high-throughput processes.

The trend towards modular and flexible manufacturing facilities within Europe drives demand for customized, compact lyophilization solutions that can be rapidly deployed and reconfigured. Research institutions and technology hubs across Europe are actively involved in optimizing the freeze-drying process, collaborating with manufacturers to integrate advanced monitoring techniques and digital twin technology for simulation purposes. The strong presence of established pharmaceutical players and dedicated CDMOs ensures a stable and sophisticated market environment. Investment in digitalization and automation remains high, aiming to improve batch consistency and shorten the time required for regulatory approval of new production lines, making compliance expertise a critical competitive differentiator.

- Key Market Driver: Robust established pharmaceutical manufacturing sector; increasing focus on biosimilar production.

- Regulatory Landscape: Harmonized EMA regulations; strong emphasis on sustainability and energy efficiency standards.

- Technological Trend: High demand for customized, modular systems; leadership in green refrigeration technology adoption.

- Key Countries: Germany, Switzerland, UK, France, Italy.

Asia Pacific (APAC): Fastest Growth Trajectory

The Asia Pacific region is forecast to exhibit the highest CAGR during the projected period, driven by unparalleled infrastructure development and rapid expansion of domestic pharmaceutical production capabilities. Countries like China, India, and South Korea are heavily investing in biotechnology parks and increasing R&D spending, aiming to transition from generic drug manufacturing hubs to innovators of novel biopharmaceuticals. This transition necessitates the immediate adoption of modern, industrial-scale lyophilization equipment to meet international quality standards for export and domestic consumption. Government initiatives supporting local pharmaceutical self-sufficiency, particularly concerning vaccine production and emergency preparedness, act as powerful catalysts for market growth.

Market growth in APAC is further fueled by the rising prevalence of chronic diseases, leading to increased demand for complex injectable medicines, and expanding healthcare access for large populations. While pricing sensitivity remains a factor in certain sub-regions, the focus is shifting toward acquiring reliable, long-lifecycle equipment, often sourced from Western or established Asian manufacturers. The region also represents a massive opportunity for the aftermarket services segment, as newly deployed complex equipment requires extensive local expertise for installation, qualification, and ongoing maintenance. Local partnerships between global equipment providers and regional distributors are key strategies for market penetration and maximizing service reach across the diverse geographic landscape.

- Key Market Driver: Rapid expansion of domestic biotech and pharmaceutical manufacturing; substantial government investment in R&D and healthcare infrastructure.

- Regulatory Landscape: Evolving standards harmonizing towards ICH guidelines; emphasis on increasing GxP compliance for export markets.

- Technological Trend: Significant purchasing of large-scale industrial units to support high-volume production of vaccines and biosimilars.

- Key Countries: China, India, Japan, South Korea, Australia.

Latin America (LA) and Middle East & Africa (MEA): Emerging Opportunities

Latin America and the Middle East & Africa regions represent promising, albeit nascent, markets for lyophilizers. Growth in LA is primarily concentrated in Brazil and Mexico, driven by increasing public health spending, expanding local manufacturing capabilities for generics, and addressing regional vaccine needs. The demand focuses on balancing cost-effectiveness with reliability, often leading to the adoption of pilot and medium-scale units suitable for regional supply chains. Infrastructure development remains a challenge, necessitating robust and easily maintainable equipment.

In the MEA region, the market is stimulated by strategic government investments in healthcare diversification, particularly in countries like Saudi Arabia and the UAE, which are establishing specialized pharmaceutical manufacturing zones (e.g., DuBiotech) to reduce import dependence. Demand is high for high-end, reliable equipment for stabilizing specialty drugs and developing local vaccine programs. Furthermore, international aid organizations often require robust, portable lyophilizers to stabilize diagnostic kits and life-saving drugs for distribution in remote areas. The service and support ecosystem is critical here, necessitating comprehensive training programs for local technicians to manage complex equipment in challenging operational environments.

- Key Market Driver: Government initiatives to establish local pharmaceutical manufacturing hubs; growing investment in healthcare infrastructure diversification.

- Technological Trend: Focus on reliable, robust mid-scale units and necessary service agreements due to potential logistical challenges.

- Key Countries (LA): Brazil, Mexico, Argentina.

- Key Countries (MEA): Saudi Arabia, UAE, South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lyophilizer Market.- IMA S.p.A.

- SP Scientific (SP Industries)

- GEA Group

- Azbil Corporation

- Tofflon Science and Technology Co., Ltd.

- Z-SC1 Biomedical

- Telstar Life Science Solutions (Azbil Group)

- Optima Packaging Group GmbH

- Millrock Technology Inc.

- HOF Sonderanlagenbau GmbH

- RAE (Refrigeration & Environmental Control)

- Labconco Corporation

- Cuddon Freeze Dry

- Freezedry Specialties Inc.

- Lyo-Tech Scientific

- Martin Christ Gefriertrocknungsanlagen GmbH

- IKA Werke GmbH & Co. KG

- BIA Separations (Sartorius Stedim Biotech)

- Leybold GmbH (Atlas Copco)

- Fedegari Group

- Coriant Technologies

- MechaTech Systems Ltd.

- Techni-Pharm

- Büchi Labortechnik AG

Frequently Asked Questions

Analyze common user questions about the Lyophilizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological trends are currently shaping the design of industrial lyophilizers?

Industrial lyophilizer design is primarily shaped by the need for increased automation, regulatory compliance, and efficiency. Key trends include the integration of robotic loading/unloading systems for aseptic processing, the adoption of Process Analytical Technology (PAT) like TDLAS for real-time monitoring of sublimation, and the development of controlled nucleation techniques to ensure batch uniformity and reduce cycle times.

How does lyophilization contribute to the stability and shelf life of modern vaccines and biopharmaceuticals?

Lyophilization is critical because it removes water, which is a key driver of chemical degradation and microbial growth, from thermally sensitive biological materials. By converting the product into a stable, porous cake, it halts degradation reactions, enabling storage at ambient or refrigerated temperatures (instead of frozen), thereby extending shelf life from months to several years while maintaining biological potency.

What are the primary operational challenges faced by manufacturers implementing large-scale lyophilization?

Primary challenges include the high initial capital investment and operational costs (due to energy consumption and complex validation protocols), the extended duration of the batch cycle (often 3–5 days), and ensuring absolute uniformity and consistency of drying across thousands of vials in a single batch to meet stringent quality requirements (CQAs).

Which application segment accounts for the highest revenue share in the Lyophilizer Market?

The Pharmaceutical and Biotechnology segment consistently accounts for the highest revenue share. This is driven by the necessity to stabilize high-value, temperature-sensitive products such as monoclonal antibodies, complex recombinant proteins, and novel vaccine formulations, ensuring their integrity throughout the global distribution chain.

What role does Artificial Intelligence (AI) play in optimizing the lyophilization process?

AI plays a transformative role by utilizing Machine Learning (ML) algorithms to analyze historical process data, predict critical quality attributes (e.g., residual moisture), and dynamically adjust parameters (shelf temperature, vacuum) in real-time. This leads to reduced cycle times, minimized risk of product collapse, and significant improvements in energy efficiency and process robustness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager