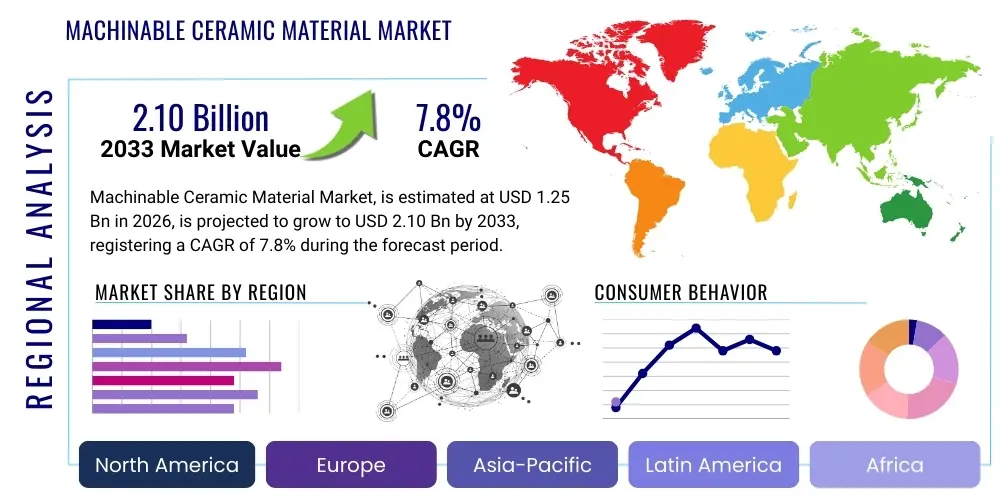

Machinable Ceramic Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438104 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Machinable Ceramic Material Market Size

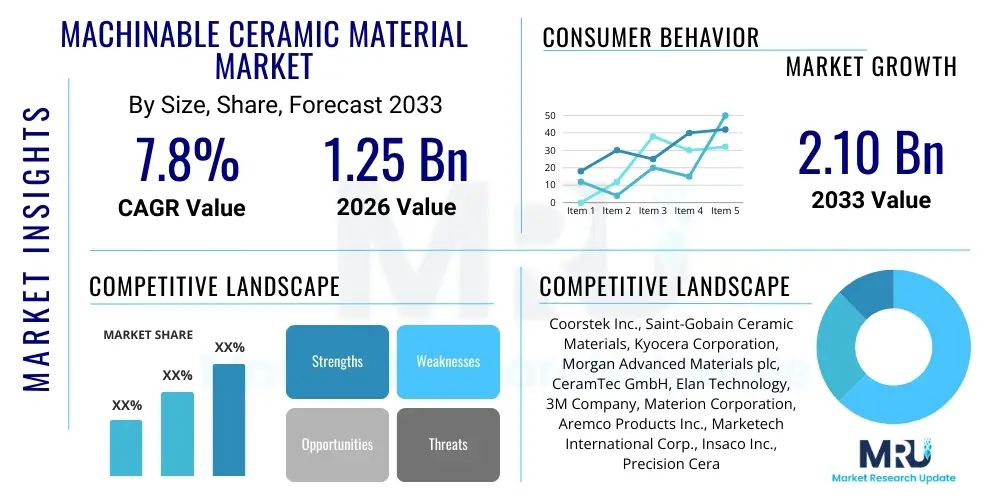

The Machinable Ceramic Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.10 Billion by the end of the forecast period in 2033.

Machinable Ceramic Material Market introduction

Machinable ceramic materials represent a specialized class of advanced technical ceramics, distinct from traditional counterparts due to their unique ability to be precisely shaped and contoured using conventional, high-speed machining techniques, such as standard carbide tooling, without requiring extensive diamond grinding or firing after shaping. These materials, predominantly including compositions like Boron Nitride (BN), Macor (fluorophlogopite mica-glass ceramic), and specific grades of Aluminum Silicate, offer an unparalleled combination of properties: excellent dielectric strength, high thermal shock resistance, chemical inertness, and stability in extreme temperature environments. Their inherent precision and rapid prototyping capabilities make them indispensable in industries where stringent tolerances and superior material performance are non-negotiable, effectively bridging the gap between high-performance materials and complex geometrical requirements.

The primary applications driving the market expansion are concentrated in sectors demanding high reliability and purity. The semiconductor industry utilizes machinable ceramics extensively for components within plasma etching and deposition equipment, thermal management systems, and precision tooling due to their low outgassing and resistance to corrosive process gases. Furthermore, the aerospace and defense sectors rely on these ceramics for insulators, microwave windows, and high-temperature structural components where lightweight yet robust materials are essential. The medical device industry, particularly in electrosurgical equipment and implant testing fixtures, also constitutes a significant end-user base, leveraging the material’s biocompatibility and ease of sterilization, alongside its exceptional electrical insulating properties.

Key benefits driving market adoption include significantly reduced manufacturing costs and turnaround times compared to fully dense, non-machinable ceramics, which typically require lengthy and expensive post-sintering diamond grinding processes. This speed-to-market advantage is crucial in dynamic sectors like microelectronics and research and development prototyping. Major driving factors propelling future growth involve the global push toward device miniaturization, which mandates components with extremely tight tolerances, and the increasing operational severity in industrial environments, suchating materials capable of withstanding higher temperatures, greater mechanical stress, and aggressive chemical exposure. The rapid expansion of 5G infrastructure and advanced packaging technologies further solidifies the demand for high-performance dielectric and thermal management solutions provided by machinable ceramics.

Machinable Ceramic Material Market Executive Summary

The Machinable Ceramic Material Market is experiencing robust growth fueled primarily by technological advancements in the semiconductor and aerospace industries, demanding materials that offer both superior thermal and electrical performance and ease of fabrication. Current business trends indicate a critical shift toward customized material formulations, where manufacturers are developing application-specific machinable ceramics optimized for specific environments, such as ultra-high vacuum compatibility or enhanced microwave transparency. Strategic mergers, acquisitions, and partnerships are increasingly common as companies seek to consolidate expertise in complex material synthesis and expand their geographical reach, particularly into high-growth manufacturing hubs in Asia. Furthermore, there is a growing focus on improving manufacturing efficiency, leveraging advanced subtractive manufacturing techniques and digital twin technologies to optimize material usage and reduce waste, mitigating the inherently high cost associated with these specialized materials.

Regionally, Asia Pacific (APAC) currently dominates the market, driven by the colossal manufacturing output of electronics, semiconductors, and specialized industrial equipment originating from China, South Korea, Taiwan, and Japan. This region benefits from heavy government and private investment in next-generation microchip fabrication plants and high-tech defense industries, positioning it as the central engine for demand growth. North America and Europe, while representing mature markets, maintain high revenue shares due to their leadership in aerospace, medical technology, and highly specialized research and development activities. The strong regulatory environment in these Western regions, particularly regarding material traceability and performance certification for critical applications, necessitates the use of premium, high-quality machinable ceramics, ensuring sustained high average selling prices (ASPs).

Segment trends confirm that Boron Nitride (BN) based ceramics constitute the largest material segment, largely due to their exceptional thermal conductivity, thermal shock resistance, and superb dielectric properties, making them indispensable in electronics and high-temperature furnace applications. The rising complexity of medical imaging equipment and the increasing demand for precision components in minimally invasive surgery are accelerating the growth of mica-glass ceramics (like Macor) due to their near-zero porosity and ease of machining into complex geometries. Future growth opportunities are heavily influenced by the emergence of additive manufacturing techniques tailored for ceramic powders, promising to further reduce lead times and enable the creation of previously impossible designs, thereby democratizing access to complex ceramic components.

AI Impact Analysis on Machinable Ceramic Material Market

Common user questions regarding AI's impact on the machinable ceramic material market revolve around several key themes: the potential for AI to accelerate material discovery and formulation, how machine learning can optimize the traditionally complex and iterative ceramic manufacturing processes, and the role of AI in quality control and defect prediction during machining. Users are keen to understand if AI can democratize access to these specialized materials by lowering costs through efficiency gains, or if it will primarily benefit large corporations capable of investing in complex AI infrastructure. There is also significant curiosity about AI’s capacity to handle the inherent material variability present in ceramic processing, which often leads to machining difficulties and waste. These concerns distill down to the core expectation that AI should enhance material consistency, predict optimal machining parameters, and drastically shorten the R&D cycle for new ceramic compositions, ensuring higher yield rates for complex parts.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize several critical stages within the machinable ceramic lifecycle. In the early stages of material science, AI/ML models are being deployed to screen thousands of potential compositional variations, rapidly predicting optimal sintering temperatures, grain structures, and mechanical properties before costly lab synthesis begins. This accelerated R&D significantly reduces the time-to-market for novel ceramics, such as high-purity aluminum nitride variants or advanced Boron Nitride composites, required for emerging technologies like quantum computing components or next-generation energy storage systems. By optimizing these complex chemical formulations, AI ensures that the resulting material exhibits the exact balance of properties—thermal stability, dielectric constant, and, crucially, machinability—required by the end-user.

Furthermore, AI is instrumental in the downstream manufacturing and quality assurance processes. Advanced generative design and topological optimization algorithms assist engineers in designing components that maximize material performance while inherently considering machinability constraints. In the machining phase itself, real-time sensor data from CNC machines—monitoring vibration, torque, temperature, and tool wear—is fed into ML models. These models predict potential tool failure or surface defects before they occur, allowing for proactive adjustment of feed rates and speeds, which is paramount when working with inherently brittle materials. This precision minimizes scrap rates and ensures that expensive, complex ceramic components meet the rigorous tolerance specifications demanded by high-reliability sectors such as space technology and medical implants, thereby solidifying AI's role as a critical enabler of high-yield, complex ceramic part manufacturing.

- AI-driven material informatics accelerates the discovery of novel ceramic compositions with enhanced machinability.

- Machine Learning models optimize CNC parameters (feed rate, spindle speed) in real-time, reducing tool wear and improving surface finish quality.

- Predictive maintenance algorithms minimize downtime and scrap rates by detecting anomalies during the sintering and machining phases.

- Generative design tools utilize AI to create complex component geometries that inherently consider manufacturing constraints and material weaknesses.

- AI enhances quality control through automated vision systems that rapidly detect microscopic cracks or defects in post-machined parts.

DRO & Impact Forces Of Machinable Ceramic Material Market

The dynamics of the Machinable Ceramic Material Market are driven by the relentless expansion of high-tech industries, primarily semiconductors and aerospace, requiring materials that can withstand extreme operational conditions while allowing for complex, cost-effective shaping. The primary Drivers include the exponential growth in global semiconductor fabrication capacity (driven by IoT, AI processing, and 5G deployment), requiring high-purity, thermally stable plasma chamber components, and the increasing demand for high-performance insulating materials in sophisticated military and commercial avionics. However, the market faces significant Restraints, notably the high initial cost of raw materials (like high-purity Boron Nitride powder) and specialized processing equipment, coupled with the inherent brittleness and low fracture toughness of ceramics, leading to manufacturing challenges and higher scrap rates compared to metals. The highly specialized nature of the processing expertise required further limits broader market participation.

Significant Opportunities emerge from two distinct fronts: the integration of ceramic materials into advanced Additive Manufacturing (AM) processes (ceramic 3D printing), which promises unparalleled design freedom and reduced material waste, and the increasing adoption of machinable ceramics in the burgeoning renewable energy sector, particularly in high-voltage insulation components for smart grids and fusion research equipment. Furthermore, material innovation focused on developing ceramic matrix composites (CMCs) with improved fracture toughness while maintaining machinability characteristics presents a lucrative pathway. The strategic importance of achieving supply chain resilience and reducing reliance on a few concentrated geopolitical regions for critical raw materials also encourages investment in localized processing facilities and novel material synthesis techniques, offering diversification potential.

The Impact Forces shaping the market trajectory are powerful and interconnected. The technological complexity (high R&D intensity) dictates that only firms with significant intellectual property in powder synthesis and processing can compete effectively, leading to high barriers to entry. Regulatory scrutiny, particularly concerning materials used in medical, defense, and nuclear applications, acts as a stringent filter, ensuring adherence to high-quality standards. Economically, the pricing power is relatively high due to the lack of viable substitutes for extreme environments, although cyclical downturns in the semiconductor market can temporarily dampen demand. The confluence of these forces ensures that while the market is niche, it is highly valuable and protected, rewarding innovation in both material science and advanced manufacturing methodologies that lower the final cost of complex components.

Segmentation Analysis

The Machinable Ceramic Material market is comprehensively segmented based on the specific material type, which dictates performance characteristics and processability, and by the end-use industry, reflecting the diverse application requirements across technological sectors. The material segmentation highlights the dominance of Boron Nitride due to its exceptional thermal performance, followed closely by the precision-oriented mica-glass ceramics and various oxide ceramics tailored for structural integrity. The end-use segmentation reveals the semiconductor industry as the primary consumer, driven by continuous technological refresh cycles and the need for purity, while the aerospace and medical sectors provide consistent, high-value demand for mission-critical components. Understanding these segments is crucial for strategic market positioning and product development, enabling manufacturers to target specific industrial needs with optimized material solutions and fabrication services.

- By Material Type:

- Boron Nitride (BN)

- Mica-Glass Ceramics (e.g., Macor)

- Aluminum Silicate

- Aluminum Nitride (AlN)

- Alumina (Select grades with enhanced porosity/machinability)

- Others (Calcium Silicate, Zirconia-based composites)

- By Application/End-Use Industry:

- Semiconductor & Electronics (Wafer handling, Plasma components, Insulators)

- Aerospace & Defense (Microwave windows, Insulators, Thermal barriers)

- Medical & Healthcare (Surgical fixtures, Electrosurgical tips, Prosthetic testing)

- Electrical & Power Generation (High-voltage insulators, Furnace components)

- Industrial & Research (Vacuum components, Fixtures, Prototypes)

- By Form:

- Rods and Bars

- Plates and Sheets

- Custom Shapes and Forms

Value Chain Analysis For Machinable Ceramic Material Market

The value chain for machinable ceramic materials is complex, beginning with the highly specialized extraction and purification of elemental raw materials, predominantly boron, aluminum, silicon, and mica, which requires stringent purity standards to ensure material performance consistency. The Upstream Analysis focuses heavily on advanced powder preparation, including synthesis, calcination, and milling, where particle size distribution and phase purity are meticulously controlled, often involving proprietary processes to create the specific microstructure necessary for subsequent machinability (e.g., the fine, interlocking crystal structure in mica-glass ceramics or the hexagonal layered structure of Boron Nitride). Suppliers in this segment invest heavily in R&D to optimize powder morphology, directly impacting the final component’s performance and cost structure.

The core manufacturing stage, or midstream process, involves forming the raw powder into bulk shapes, primarily utilizing techniques such as hot pressing, isostatic pressing (HIP), and pressureless sintering, followed by a preliminary shaping process. Crucially, machinable ceramics require a unique intermediate state or specific composition that allows for conventional machining before or after a stabilizing heat treatment. The Downstream Analysis centers on the precision machining services, where specialized service providers utilize advanced CNC equipment and diamond or carbide tooling to achieve the ultra-precise tolerances required by end-users (often in the micron range). These machinists are integral, as the material's value is realized through high-precision finishing, requiring deep expertise in ceramic handling and minimizing induced stress and microfractures.

Distribution channels are typically mixed, tailored to the specific end-user industry. The Direct Channel is dominant for large OEMs in aerospace, defense, and high-volume semiconductor applications, where direct engagement facilitates custom material development, rigorous quality certification, and long-term supply agreements. The Indirect Channel, involving specialized distributors and material job shops, serves smaller enterprises, research laboratories, and rapid prototyping needs, offering stock shapes (rods, plates) and quick-turn machining services. Overall, the value chain is characterized by high integration between material synthesis expertise and precision machining capabilities, ensuring that the specialized material properties translate effectively into functional, highly reliable components delivered to the mission-critical end-use applications.

Machinable Ceramic Material Market Potential Customers

The primary consumers of machinable ceramic materials are organizations operating in technology-intensive sectors that require components combining superior electrical and thermal insulation with structural integrity in extreme environments. End-Users/Buyers include major Original Equipment Manufacturers (OEMs) in the semiconductor fabrication equipment sector, such as those producing sputtering and etching systems, who demand components like focus rings, plasma showerheads, and susceptors made from high-purity Boron Nitride or Aluminum Nitride for contamination-free processing within vacuum chambers. These buyers prioritize material purity, low particle generation, and exceptional thermal shock resistance, often requiring materials certified for ultra-high vacuum (UHV) compatibility, making them a cornerstone demand segment for specialized ceramic suppliers.

Another significant customer cluster resides within the aerospace, defense, and scientific research communities. Aerospace contractors utilize these materials for radomes, antenna housings, and electrical insulators in high-performance aircraft and space vehicles where weight reduction and reliability under extreme temperature cycling are paramount. Defense agencies and their contractors require bespoke components for guided missile systems and sensor protection. Furthermore, large-scale physics research facilities, including fusion reactors (e.g., ITER) and particle accelerators, are constant buyers of machinable ceramics for critical insulation, vacuum gaps, and internal fixtures due to their high dielectric strength and radiation resistance, where failure is not permissible, driving demand for premium, highly certified materials.

The medical device industry, particularly companies specializing in minimally invasive surgical tools and high-frequency electrosurgical systems, represents a rapidly growing customer base. They utilize machinable ceramics, often Macor, for insulation tips, probes, and specialized fixtures required for holding sensitive materials during sterile processes or high-temperature soldering operations. These customers are driven by the need for biocompatibility, dimensional stability under sterilization cycles (autoclaving), and the material's ability to be machined quickly into complex, ergonomic shapes for single-use or reusable instruments. Essentially, the core customer profile is defined by businesses where performance margins are narrow and material reliability directly impacts product functionality and regulatory compliance, justifying the premium pricing of machinable ceramic components and services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.10 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coorstek Inc., Saint-Gobain Ceramic Materials, Kyocera Corporation, Morgan Advanced Materials plc, CeramTec GmbH, Elan Technology, 3M Company, Materion Corporation, Aremco Products Inc., Marketech International Corp., Insaco Inc., Precision Ceramics USA, HP Technical Ceramics, Meller Optics, Advanced Ceramic Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Machinable Ceramic Material Market Key Technology Landscape

The technological landscape of the Machinable Ceramic Material Market is defined by continuous innovation across both material synthesis and advanced subtractive manufacturing techniques necessary to handle these high-performance, yet sensitive, substances. At the fundamental material level, key technologies involve sophisticated powder metallurgy techniques such as hot-pressed sintering (HPS) and hot isostatic pressing (HIP). HPS is particularly crucial for manufacturing high-density Boron Nitride blocks, ensuring the anisotropic structure that enhances its thermal management properties while maintaining consistent machinability. Novel material compositions focus on enhancing existing properties, such as creating Boron Nitride composites with reinforcing phases to modestly improve fracture toughness without compromising the ease of shaping, addressing a major restraint of pure ceramic forms.

In terms of component fabrication, the technology centers on precision CNC machining utilizing ultra-hard tooling. While machinable ceramics allow for carbide tooling, achieving micron-level tolerances and superior surface finishes often requires diamond-tipped cutting tools, managed by high-stiffness, high-precision machining centers equipped with advanced thermal compensation systems. Surface finishing technologies are equally vital; techniques like lapping, polishing, and specialized etching are used to remove subsurface damage induced during rough machining and achieve the mirror-smooth surfaces required for semiconductor plasma applications, where surface roughness directly impacts process purity and component lifespan. The development of advanced metrology tools, including non-contact optical profiling systems, ensures that the complex geometries meet the required dimensional stability before final integration.

Furthermore, emerging technologies are rapidly gaining traction, notably the integration of additive manufacturing (AM) for ceramic components. While AM currently focuses more on non-machinable, fully dense ceramics (like Alumina and Zirconia), hybrid technologies combining AM for near-net shape production followed by precision machinable ceramic finishing are evolving. This approach minimizes material waste and machining time. Digitalization across the manufacturing chain, leveraging IoT sensors and high-fidelity simulation software, is optimizing the entire process flow. This includes simulating thermal gradients during sintering and predicting stress distribution during machining, allowing manufacturers to move from trial-and-error prototyping to data-driven manufacturing, ultimately boosting yield rates and reducing the high manufacturing overhead associated with these specialized materials.

Regional Highlights

- Asia Pacific (APAC): APAC is the leading and fastest-growing region, primarily driven by massive investments in the semiconductor supply chain in countries like China, Taiwan, South Korea, and Japan. The region's vast manufacturing base for consumer electronics, coupled with rapid development in 5G and advanced packaging, ensures sustained, high-volume demand for Boron Nitride and Aluminum Nitride components for thermal management and plasma processing equipment. Government policies supporting domestic technological self-sufficiency further accelerate localized production and consumption.

- North America: This region holds a significant share, characterized by high-value, low-volume consumption across the aerospace, defense, and medical sectors. The presence of major defense contractors and leading medical device manufacturers drives the demand for highly certified, premium machinable ceramics, especially Macor, for applications requiring stringent reliability and traceability standards. Innovation in research institutions and private high-tech startups also sustains a strong market for rapid prototyping and specialized component testing fixtures.

- Europe: Europe maintains a strong market presence, particularly in Germany (automotive/industrial automation), France (aerospace/defense), and the UK (medical/R&D). The region focuses heavily on precision industrial applications and scientific instrumentation. Stringent environmental and safety regulations push manufacturers toward using advanced, chemically inert materials, supporting consistent demand for high-performance machinable ceramics in specialized industrial machinery and energy infrastructure.

- Latin America (LATAM): The LATAM market is currently nascent but growing, primarily driven by investments in telecommunications infrastructure and localized industrial manufacturing upgrades. Demand is concentrated in key industrial centers like Brazil and Mexico, focusing mainly on electrical insulation components and general industrial prototyping, typically relying on imported materials from established Asian and North American suppliers.

- Middle East and Africa (MEA): Growth in MEA is highly sector-specific, primarily tied to defense procurements and the burgeoning oil and gas sector (for specialized sensing and downhole equipment where high temperatures are common). Investments in advanced technology hubs, such as those in the UAE and Saudi Arabia, are slowly creating new niche opportunities for high-performance ceramic materials in localized R&D and clean energy projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Machinable Ceramic Material Market.- Coorstek Inc.

- Saint-Gobain Ceramic Materials

- Kyocera Corporation

- Morgan Advanced Materials plc

- CeramTec GmbH

- Elan Technology

- 3M Company

- Materion Corporation

- Aremco Products Inc.

- Marketech International Corp.

- Insaco Inc.

- Precision Ceramics USA

- HP Technical Ceramics

- Meller Optics

- Advanced Ceramic Technology

- Vesuvius plc (Foseco)

- Ferro Corporation

- Goodfellow Corporation

- Momentive Technologies

- Superior Technical Ceramics (STC)

Frequently Asked Questions

Analyze common user questions about the Machinable Ceramic Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material driving growth in the machinable ceramic market?

Boron Nitride (BN) is the dominant material driving market growth, especially within the semiconductor and electronics industries, due to its exceptional thermal stability, high dielectric strength, and superior thermal shock resistance, which are critical for plasma processing equipment and thermal management solutions.

How do machinable ceramics differ fundamentally from conventional technical ceramics?

Machinable ceramics possess unique microstructures, often incorporating soft phases like mica or having tailored porosity, allowing them to be shaped using standard CNC equipment and carbide tools. Conventional technical ceramics typically require significantly more expensive and time-consuming diamond grinding post-sintering to achieve precision tolerances.

Which end-use industry represents the largest consumer segment for these materials?

The Semiconductor and Electronics industry is the largest end-use segment. Machinable ceramics are essential for high-purity components in wafer fabrication equipment, critical for processes like plasma etching and deposition, ensuring minimal contamination and extreme thermal tolerance.

What are the main restraints hindering widespread adoption of machinable ceramics?

The primary restraints are the high cost of specialized raw materials and the inherent mechanical limitations of ceramics, specifically their low fracture toughness and brittleness, which necessitate complex and costly precision machining processes to minimize scrap rates and ensure reliability.

How is ceramic 3D printing impacting the machinable ceramic sector?

Ceramic 3D printing (Additive Manufacturing) offers an opportunity by enabling the production of near-net-shape components, significantly reducing the amount of material that needs to be removed through traditional machining. This hybrid approach lowers material waste and shortens lead times for highly complex geometries, complementing, rather than replacing, precision machining.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager