Machine Screws Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438168 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Machine Screws Market Size

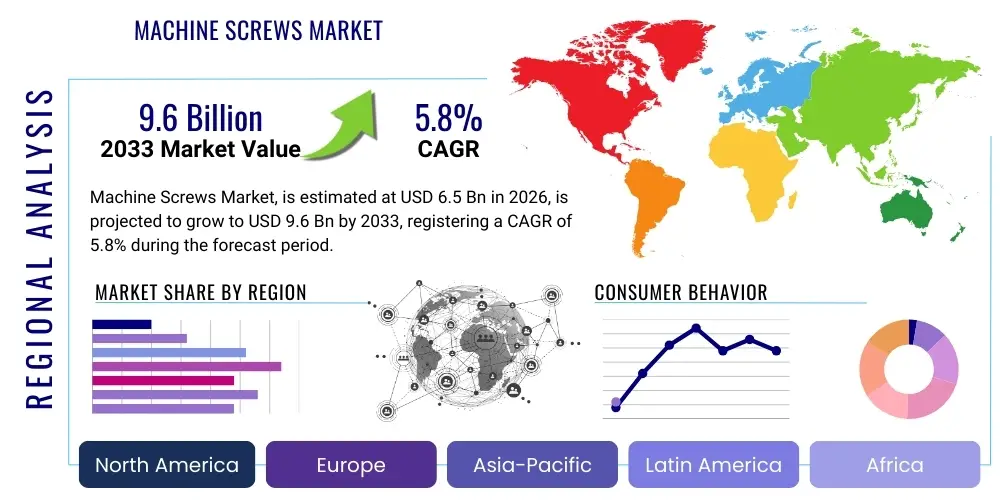

The Machine Screws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Machine Screws Market introduction

The Machine Screws Market encompasses the production, distribution, and utilization of threaded fasteners designed to be used with a nut or tapped hole. These components are characterized by their uniformity and precision threading, distinguishing them from wood screws or self-tapping screws. Machine screws are vital in assembly processes where vibration resistance, high tensile strength, and reliable coupling are paramount. They are typically available in various materials, including stainless steel, carbon steel, and brass, catering to specific needs concerning corrosion resistance and load-bearing capacity. The standardization provided by bodies like ANSI, ISO, and DIN ensures interchangeability and quality across global supply chains, reinforcing their essential role in standardized manufacturing.

Major applications for machine screws span critical industrial sectors, prominently featuring in the assembly of consumer electronics, automotive components, complex industrial machinery, and intricate aerospace systems. In the electronics sector, micro and miniature machine screws are indispensable for securing circuit boards and casings in smartphones, laptops, and medical devices, demanding high precision and non-magnetic materials. Conversely, larger machine screws are crucial for heavy-duty applications, such as assembling engine parts, structural components in construction equipment, and high-pressure valves in the oil and gas industry. The versatility and customization options available in terms of head style (e.g., pan, flat, hex), drive type (e.g., Phillips, slotted, Torx), and plating options drive their ubiquitous adoption.

Key driving factors for market growth include the robust expansion of global manufacturing capabilities, particularly in Asia Pacific, coupled with the accelerating pace of urbanization and infrastructural development worldwide. Furthermore, the sustained demand from the consumer electronics industry, characterized by shorter product lifecycles and the continuous miniaturization of devices, necessitates high-volume production of specialized machine screws. Regulatory standards focusing on product safety and reliability also favor the use of standardized, high-quality machine screws over inferior fastening methods, providing a reliable foundation for market stability and expansion over the forecast period. Technological advancements in coating and surface treatment, aimed at improving durability and reducing galvanic corrosion, further enhance product performance and application scope.

Machine Screws Market Executive Summary

The Machine Screws Market is experiencing dynamic shifts, propelled by key business trends centered around material innovation and supply chain efficiency. There is a discernible trend toward lightweighting in sectors like automotive and aerospace, driving the demand for high-strength, low-density materials such as specialized aluminum alloys and advanced polymers in screw manufacturing. Furthermore, manufacturers are increasingly adopting Industry 4.0 principles, integrating automated quality control and predictive maintenance into fastener production lines to ensure zero-defect output and reduce operational costs. Sustainability initiatives are also influencing procurement decisions, favoring suppliers who can demonstrate reduced environmental impact through energy-efficient processes and the use of recycled materials, transforming the competitive landscape.

Regionally, the Asia Pacific (APAC) market maintains its dominance, primarily fueled by massive manufacturing bases in China, India, and Southeast Asian nations that serve both domestic and global demands for electronics and machinery. North America and Europe, while mature, are characterized by high demand for specialized, high-performance machine screws, particularly in high-reliability sectors such as medical devices and defense technology, where stringent specifications and traceability are mandatory. The growth in Latin America and the Middle East & Africa (MEA) is intrinsically linked to rising infrastructure investments and the development of local automotive assembly plants, presenting emerging opportunities for specialized distribution channels and local manufacturing partnerships.

Segment trends highlight the burgeoning importance of stainless steel machine screws due to their superior corrosion resistance and longevity, making them essential in harsh or outdoor environments. The Hex Head and Pan Head segments continue to command significant market share due to their ease of installation and high torque transmission capabilities, crucial for industrial applications. Concurrently, the electronics and automotive application segments are expected to exhibit the highest growth rates, driven by the electrification of vehicles and the perpetual expansion of IoT devices requiring miniature, highly reliable fasteners. Custom-engineered screws, designed for specific complex assembly challenges, represent a high-value niche demonstrating robust growth, signaling a move towards tailored fastening solutions rather than strictly off-the-shelf products.

AI Impact Analysis on Machine Screws Market

Common user questions regarding AI's impact on the Machine Screws Market frequently revolve around how artificial intelligence and machine learning (ML) can improve manufacturing precision, predict equipment failure in production environments, and optimize complex global supply chains. Users are keen to understand if AI can reduce the variability in screw dimensions, automate defect detection beyond human capacity, and forecast material demand fluctuations more accurately to prevent stockouts or overstocking of specific screw types. Key themes emerging from these inquiries include enhancing fastener quality assurance through computer vision systems, optimizing factory floor layout and workflow using predictive algorithms, and utilizing generative design to create novel screw geometries tailored for additive manufacturing, promising superior performance characteristics.

- AI-driven quality control utilizes high-speed vision systems and machine learning to detect microscopic defects and dimensional inaccuracies in real-time, drastically reducing scrap rates.

- Predictive maintenance algorithms analyze sensor data from threading and heading machines, forecasting potential breakdowns before they occur, thus maximizing uptime and production efficiency.

- Supply chain optimization through AI models improves demand forecasting for raw materials (steel, brass) and finished goods inventory management, minimizing storage costs and lead times.

- Generative design tools, powered by AI, are used to optimize screw weight and strength properties, particularly beneficial for aerospace and electric vehicle applications requiring lightweighting.

- AI enhances logistics planning by dynamically optimizing shipping routes and warehousing operations for high-volume, low-margin components like machine screws, leading to significant cost savings.

DRO & Impact Forces Of Machine Screws Market

The Machine Screws Market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its trajectory. Key drivers include the exponential growth in global electronics manufacturing and the rebound in automotive production, particularly the proliferation of electric vehicles (EVs), which utilize specialized lightweight fasteners. Restraints primarily involve the volatility in raw material prices, notably steel and non-ferrous metals, which squeeze profit margins for manufacturers, alongside the intense competitive pressure from low-cost producers, particularly in general-purpose screw categories. Opportunities are concentrated in developing specialized, high-performance screws for niche applications—such as titanium screws for medical implants or tamper-proof screws for security systems—and expanding market penetration through advanced e-commerce distribution channels, leveraging digital platforms to reach a fragmented buyer base. These forces collectively create a moderate impact, requiring market participants to focus on efficiency and specialization to mitigate commodity risks and capitalize on high-growth sectors.

Segmentation Analysis

The segmentation of the Machine Screws Market provides a critical understanding of the varying demands across different end-user industries and product requirements. The market is primarily categorized based on material composition, determining factors like corrosion resistance and strength; head type, affecting usability and assembly aesthetics; application, identifying major consumption sectors; and product type, differentiating standard and specialized threads. Detailed analysis of these segments is crucial for strategic planning, enabling manufacturers to tailor their production capabilities and marketing efforts towards the most lucrative and fastest-growing niches, such as precision fasteners required for miniaturized electronic components or high-tensile screws demanded by industrial machinery manufacturers.

- By Material:

- Stainless Steel

- Carbon Steel

- Brass

- Aluminum

- Nickel Alloys

- By Head Type:

- Pan Head

- Flat Head

- Oval Head

- Round Head

- Hex Head

- Truss Head

- By Application:

- Automotive

- Electronics

- Construction

- Industrial Machinery

- Aerospace & Defense

- Consumer Goods

- By Product Type:

- Standard Thread

- Fine Thread

- Metric Thread

- Imperial Thread

Value Chain Analysis For Machine Screws Market

The value chain for the Machine Screws Market begins with upstream activities focused on raw material procurement, primarily encompassing steel mills and non-ferrous metal suppliers. Key considerations at this stage include sourcing high-quality wire rod or bar stock that meets stringent metallurgical specifications for strength and malleability required for cold forging or machining processes. Manufacturers prioritize suppliers offering competitive pricing, consistent quality, and reliable delivery schedules, as raw material costs constitute a significant portion of the final product price. Efficiency in upstream logistics and long-term contracts are crucial for mitigating price volatility risk, which is inherent in the global metals market, ensuring stable input costs for high-volume fastener production.

The core manufacturing stage involves forming, threading, heat treating, and surface finishing. Machine screw manufacturers employ sophisticated cold-heading and rolling techniques for high throughput and dimensional precision. Quality control is paramount here, utilizing advanced measuring equipment and automation to ensure adherence to tolerance limits mandated by industry standards such as ISO and DIN. Downstream activities involve warehousing, packaging, and distribution to various end-user segments. Packaging plays a critical role, ranging from bulk industrial containers to specialized retail blister packs, often including anti-corrosion treatments to maintain product integrity during transit and storage. Inventory management systems are essential for handling the vast range of screw specifications, sizes, and materials efficiently, minimizing obsolescence.

The distribution channel is bifurcated into direct and indirect routes. Direct sales are common for large volume Original Equipment Manufacturers (OEMs), particularly in the automotive and aerospace sectors, where bespoke designs and high technical support are required, fostering strong manufacturer-client relationships. Indirect channels dominate the maintenance, repair, and operations (MRO) segment and smaller-scale buyers, relying heavily on specialized industrial distributors, wholesale fastener houses, and digital e-commerce platforms. The rise of sophisticated B2B e-commerce sites has streamlined the indirect channel, offering extensive catalogs and rapid fulfillment capabilities. Successful channel management requires balancing centralized warehousing for efficiency with localized distribution networks for fast, just-in-time delivery demanded by modern manufacturing schedules, maximizing market reach and customer convenience.

Machine Screws Market Potential Customers

Potential customers for machine screws are highly diversified, reflecting the product's role as a foundational component in nearly every engineered product. The primary end-users fall into major industrial categories that require high volumes of reliable, standardized fasteners for assembly. These customers include large Automotive Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers, using screws for securing interior panels, electronic control units, and engine components. The Electronics sector, covering manufacturers of smartphones, computing hardware, and industrial automation equipment, represents a high-growth segment demanding miniature and specialized non-magnetic fasteners. Furthermore, producers of heavy Industrial Machinery, such as robotics, agricultural equipment, and construction machinery, constitute a stable, high-volume customer base requiring robust, high-tensile machine screws capable of withstanding extreme stresses and vibrations in demanding operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fastenal, Würth Group, ITW, Penn Engineering, LISI Group, Nifco, Bulten AB, Stanley Black & Decker, Precision Castparts Corp., ARaymond, Bossard Group, Dokka Fasteners, ATF Inc., Albany Fasteners, EJOT Group, KVT-Fastening, MNP Corp, Bolt and Nut Inc., Jiangsu Xingchang, Shanghai Prime Machinery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Machine Screws Market Key Technology Landscape

The technology landscape in the Machine Screws Market is characterized by continuous refinement in manufacturing precision and material science, aimed at increasing fastener performance and reducing production cycle times. A primary technological focus is on advanced cold forging (cold heading) techniques, which utilize high-speed, multi-stage forming machines to achieve complex head geometries and tighter dimensional tolerances with minimal material waste compared to traditional machining. These advanced systems incorporate real-time monitoring and closed-loop feedback controls, ensuring consistent mechanical properties across massive production runs, which is vital for compliance in sensitive industries like aerospace and medical devices. Furthermore, the integration of automation and robotics within the manufacturing process minimizes human error and significantly boosts throughput, sustaining the high-volume demand from sectors like consumer electronics.

Material technology plays an equally critical role, with continuous research into high-strength alloys and specialized coatings. Nanotechnology-based coatings are increasingly being adopted to enhance corrosion resistance, reduce friction during installation, and prevent galling in stainless steel applications. For critical structural applications, such as in wind turbines or heavy industrial gearboxes, manufacturers are leveraging advanced heat treatment processes like induction hardening and carburizing to improve the core strength and wear resistance of carbon steel screws without compromising ductility. This metallurgical specialization allows machine screws to operate reliably under extreme temperature variations and dynamic loads, expanding their functional limits.

Digitalization and the adoption of Computer-Aided Manufacturing (CAM) systems are transforming tool design and process planning, allowing for rapid prototyping of specialized screw types. The utilization of 3D scanning and dimensional inspection systems provides non-contact, ultra-precise quality assurance, feeding data back into the production line for immediate adjustments. Furthermore, the rise of specialized fastening solutions includes the development of self-locking, anti-vibration, and quick-release machine screws. These innovative designs often incorporate features like pre-applied thread lockers or specialized thread forms that enhance retention under harsh operating conditions, addressing critical customer needs for maintenance-free and reliable assemblies in demanding B2B applications.

Regional Highlights

Regional dynamics within the Machine Screws Market are strongly correlated with global manufacturing migration patterns, local infrastructure investment, and technological adoption rates across key industrial sectors. Asia Pacific (APAC) stands as the dominant market, driven by its unparalleled capacity for electronics manufacturing and automotive production. Countries such as China, Vietnam, and India are not only major consumption centers but also global manufacturing hubs for various types of machinery and consumer goods, resulting in massive, continuous demand for standardized machine screws. This region benefits from lower operating costs and a highly integrated supply chain, supporting high-volume, cost-effective production for export worldwide. The emphasis on localized fastener production and the expansion of domestic automotive industries further solidify APAC's leading position.

North America and Europe represent mature, high-value markets focused on advanced technical requirements. In these regions, the primary demand centers around specialized, certified, and high-performance machine screws used in aerospace, medical technology, and high-reliability industrial automation. European countries, particularly Germany and Italy, are global leaders in machinery manufacturing and high-end automotive production, requiring screws made from specialty materials (e.g., titanium, high-grade stainless steel) and demanding strict adherence to environmental and regulatory standards. Growth in North America is sustained by the revitalization of domestic manufacturing and significant investments in defense and renewable energy infrastructure, driving requirements for complex, technically superior fastening systems.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting moderate growth, largely dependent on macroeconomic stability and investment cycles in construction and resource extraction. LATAM's growth is tied to automotive assembly plants and infrastructure projects, particularly in Brazil and Mexico. The MEA region, heavily influenced by the Gulf Cooperation Council (GCC) states, sees demand linked to large-scale construction, oil & gas operations, and diversification efforts into non-oil sectors like tourism and manufacturing. While these regions rely heavily on imports, there is a growing trend towards establishing local assembly and distribution centers to reduce logistical costs and improve response times for industrial customers, creating localized opportunities for international manufacturers.

- Asia Pacific (APAC): Dominates the market due to massive electronics, automotive, and general manufacturing output; focused on high-volume, cost-competitive production (China, India, South Korea).

- North America: High demand for aerospace-grade, medical, and specialized high-reliability fasteners; emphasis on technological superiority and stringent quality control.

- Europe: Strong market for high-performance screws driven by advanced machinery manufacturing (Germany, Italy) and stringent environmental compliance.

- Latin America (LATAM): Growth fueled by automotive production and infrastructure development, presenting opportunities for local assembly and distribution partnerships.

- Middle East & Africa (MEA): Emerging market growth linked to major construction projects, energy sector requirements, and industrial diversification initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Machine Screws Market.- Fastenal

- Würth Group

- ITW (Illinois Tool Works Inc.)

- Penn Engineering (PennEngineering)

- LISI Group

- Nifco

- Bulten AB

- Stanley Black & Decker

- Precision Castparts Corp.

- ARaymond

- Bossard Group

- Dokka Fasteners

- ATF Inc.

- Albany Fasteners

- EJOT Group

- KVT-Fastening

- MNP Corp

- Bolt and Nut Inc.

- Jiangsu Xingchang

- Shanghai Prime Machinery

Frequently Asked Questions

Analyze common user questions about the Machine Screws market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a machine screw and a wood screw?

A machine screw is designed with uniform threads to mate precisely with a pre-tapped hole or a nut, requiring a specific thread pitch and size. Conversely, a wood screw has tapered threads designed to cut its own mating threads into wood or softer materials, providing clamping force without needing a pre-tapped hole.

Which materials offer the best corrosion resistance for machine screws?

Stainless steel, particularly grades 304 and 316, offers excellent inherent corrosion resistance, making them ideal for outdoor, marine, or chemical processing environments. Specialized brass and nickel alloy screws also provide high resistance to rust and galvanic corrosion in specific demanding applications.

How does the rise of electric vehicles (EVs) impact the demand for machine screws?

The EV sector significantly increases demand for machine screws, focusing on lightweight materials (e.g., aluminum, reinforced plastics) and specialized fasteners for securing complex battery packs and sensitive electronic control units (ECUs), requiring high thermal and vibrational stability.

What are the key drivers of machine screw pricing volatility?

Pricing volatility is primarily driven by fluctuations in the global commodity markets for raw materials, especially steel, aluminum, and brass wire rod. Energy costs and international tariffs on metals and finished goods also contribute significantly to price instability in the supply chain.

What is the typical lifespan of a machine screw in an industrial application?

The lifespan of a machine screw varies widely but is primarily determined by its material, applied load, environmental conditions (corrosion), and whether it is subject to fatigue or vibration. Properly selected and installed screws in non-corrosive environments can often last the lifetime of the equipment they secure, often exceeding 20 years.

Which head type is preferred for applications requiring maximum torque transmission?

The Hex Head (or socket head cap screw, which is often related) is generally preferred for applications requiring maximum torque transmission and high clamping force, due to its ability to be driven by wrenches or hex keys, minimizing the risk of cam-out compared to slotted or Phillips drives.

What is the role of surface treatment in machine screw performance?

Surface treatments, such as zinc plating, nickel plating, or specialized organic coatings, are applied to enhance crucial performance characteristics, including corrosion resistance, lubricity for easier installation, and overall aesthetic appearance, extending the fastener's operational life in various atmospheres.

How are Industry 4.0 technologies changing machine screw manufacturing?

Industry 4.0 technologies, including IoT sensors, machine learning, and automation, are being implemented to enable predictive maintenance on manufacturing equipment, optimize cold-forming processes for higher precision, and integrate real-time quality assurance systems, leading to reduced waste and improved efficiency.

What are the major applications driving demand for miniature machine screws?

Miniature machine screws are in high demand primarily from the consumer electronics industry, utilized in the assembly of small devices such as smartphones, smart watches, specialized medical diagnostic equipment, and drone components where space and weight constraints are critical.

Which region currently holds the largest market share for machine screws?

The Asia Pacific (APAC) region currently holds the largest market share due to its concentration of high-volume manufacturing activities, particularly in electronics assembly and automotive component production across countries like China, South Korea, and Japan.

What is the function of fine thread machine screws compared to standard thread types?

Fine thread machine screws possess a greater number of threads per unit length, offering finer adjustment capabilities, greater resistance to loosening under vibration, and often higher tensile strength due to the increased stress area, making them crucial for precision and high-load assemblies.

What challenges do counterfeit machine screws pose to the market?

Counterfeit screws pose significant risks related to product failure, liability, and reputational damage, as they often fail to meet specified material composition, strength ratings, and dimensional tolerances, leading to compromised structural integrity in critical assemblies, necessitating strict sourcing protocols.

How important is standardization (ISO, ANSI) in the machine screws market?

Standardization is critically important as it ensures interchangeability, defines specific mechanical and dimensional requirements, and facilitates global trade. Adherence to standards like ISO 4017 and ANSI B18.6.3 guarantees that screws meet universal quality and performance benchmarks, simplifying procurement and assembly across international supply chains.

What opportunities exist for biodegradable or sustainable machine screws?

Opportunities exist in developing screws made from specialized bio-based or recyclable polymers for consumer goods and non-structural applications where environmental impact is a key consideration. This niche addresses the growing corporate demand for sustainable manufacturing practices and resource efficiency.

Why is the aerospace industry a demanding segment for machine screws?

The aerospace industry demands machine screws with exceptional strength-to-weight ratios, extreme temperature resistance, and absolute traceability, often requiring exotic materials like titanium and nickel alloys, along with stringent certification processes to ensure zero-failure critical fastening.

What are the typical drive types found on machine screws?

Common drive types include Slotted, Phillips, Hex Socket (Allen), Torx (Star drive), and combination drives. The selection depends on the required torque, prevention of cam-out, and ease of assembly in high-speed manufacturing environments, with Torx and Hex offering superior torque capabilities.

How is B2B e-commerce affecting the distribution of machine screws?

B2B e-commerce platforms are streamlining the distribution process by offering extensive online catalogs, detailed technical specifications, 24/7 ordering, and rapid fulfillment, particularly benefiting Maintenance, Repair, and Operations (MRO) buyers and smaller manufacturers seeking quick access to specific fastener types.

What restrains the growth potential of the machine screws market?

Major restraints include the inherent price competition, especially in commodity segments, which limits profit margins, coupled with the instability of global raw material supply chains, making long-term cost planning challenging for manufacturers.

How does miniaturization in electronics affect machine screw design?

Miniaturization necessitates the design and production of micro machine screws with extremely tight tolerances, often requiring specialized, non-magnetic materials and advanced manufacturing processes to ensure reliability within extremely confined and sensitive electronic assemblies.

Which application segment is forecasted to experience the highest CAGR?

The Electronics application segment, fueled by continuous innovation in consumer devices, IoT expansion, and 5G infrastructure deployment, is forecasted to exhibit one of the highest Compound Annual Growth Rates (CAGRs) due to persistent, high-volume demand for precision fasteners.

What is cold heading and why is it preferred for machine screw production?

Cold heading is a manufacturing process that uses high-pressure dies at room temperature to form the head and sometimes the initial thread of a screw. It is preferred because it significantly increases the material's strength, saves material compared to machining, and enables very high-speed, cost-efficient production runs for standard screws.

In value chain terms, what constitutes the downstream activity for machine screws?

Downstream activity primarily involves processing, such as packaging (bulk or retail), specialized anti-corrosion treatments, inventory warehousing, and the final distribution through wholesale, retail, or B2B direct channels to the various end-user manufacturing or MRO sites.

Why are specialized nickel alloy machine screws used in the oil and gas industry?

Nickel alloy screws (e.g., Inconel) are used in oil and gas primarily because they offer exceptional resistance to extreme temperatures, high pressure, and severe corrosive environments, including exposure to hydrogen sulfide and chlorides, ensuring long-term operational integrity of critical equipment.

What is the significance of traceability in the aerospace machine screws market?

Traceability is critical in aerospace, requiring that every batch of screws can be tracked back to its original raw material heat lot and quality control records. This ensures that in the event of failure, the root cause can be identified, upholding rigorous safety and regulatory compliance standards.

How do varying regional building codes influence machine screw demand in construction?

Regional building codes often dictate the required material grades, thread specifications, and surface treatments for fasteners used in structural and non-structural applications, influencing demand towards certified screws that comply with local seismic, fire, and load-bearing requirements, particularly in construction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager