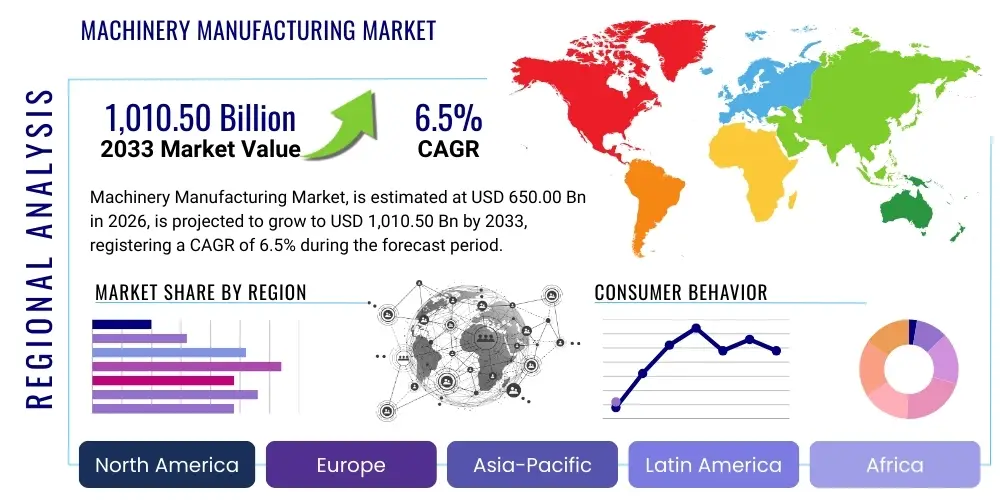

Machinery Manufacturing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437760 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Machinery Manufacturing Market Size

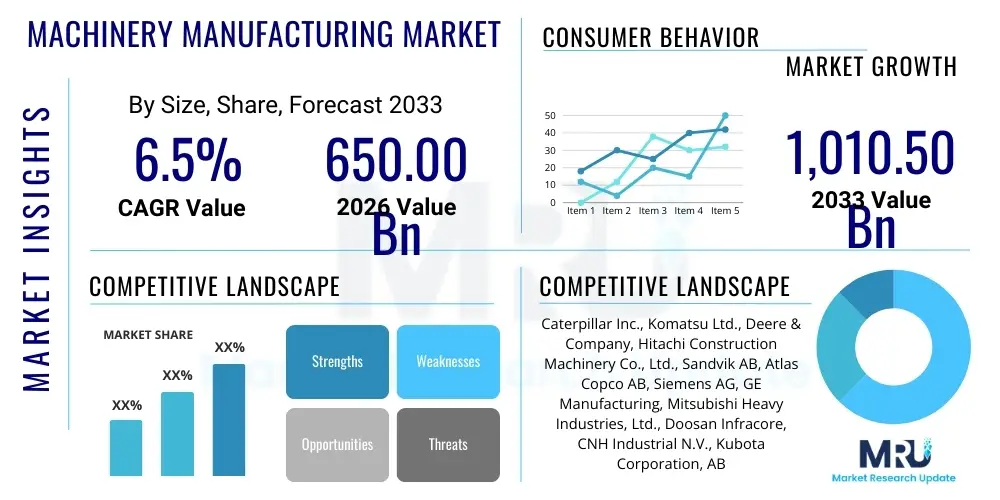

The Machinery Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 650.00 billion in 2026 and is projected to reach USD 1,010.50 billion by the end of the forecast period in 2033.

Machinery Manufacturing Market introduction

The Machinery Manufacturing Market encompasses a vast and diverse industrial ecosystem dedicated to designing, producing, and distributing mechanical equipment used across virtually every sector of the global economy, including construction, agriculture, mining, material handling, and general industrial automation. This market is characterized by complex product offerings ranging from highly specialized computer numerical control (CNC) machines and industrial robotics to heavy-duty earthmoving equipment and agricultural machinery. The primary function of these products is to enhance productivity, efficiency, and reliability in operational processes for end-user industries. Key applications include sophisticated automation systems in automotive assembly lines, precision tooling in aerospace, and high-capacity processing equipment in chemical and food and beverage manufacturing. The foundational strength of this market lies in its direct correlation with global infrastructure development, industrial output, and technological advancements aimed at optimizing manufacturing processes.

The core benefits derived from advanced machinery manufacturing include improved production scalability, enhanced precision in fabrication, reduced operational costs through energy efficiency, and elevated safety standards for workers. The evolution of this market is heavily influenced by the shift toward Industry 4.0 principles, which integrate connectivity, data analytics, and cyber-physical systems into manufacturing assets. This paradigm shift requires manufacturers to produce 'smart' machinery equipped with sensors and IoT capabilities, enabling predictive maintenance and real-time performance monitoring. Such integration transforms machinery from simple capital expenditure assets into critical components of a connected production network, driving demand for technologically superior and customized equipment globally.

Several critical driving factors underpin the sustained expansion of the Machinery Manufacturing Market. Rapid urbanization, particularly in emerging economies, necessitates significant investments in construction and infrastructure machinery. Simultaneously, the global emphasis on renewable energy infrastructure spurs demand for specialized machinery required in wind turbine and solar panel production and installation. Furthermore, the persistent labor shortage in developed nations is accelerating the adoption of industrial robotics and automated material handling systems, making automation machinery indispensable for maintaining competitive operational efficiency. Geopolitical shifts and reshoring trends in manufacturing also contribute, as companies invest heavily in domestic, often highly automated, production capabilities to secure supply chains.

Machinery Manufacturing Market Executive Summary

The Machinery Manufacturing Market is currently experiencing robust growth, primarily fueled by massive global capital expenditure cycles centered on infrastructure modernization, the widespread implementation of Industry 4.0 standards, and the increasing sophistication of industrial automation technologies such as robotics and advanced CNC systems. Key business trends indicate a strong move toward digitalization, servitization (offering equipment-as-a-service models), and sustainability, with manufacturers focusing on producing energy-efficient and recyclable equipment. Companies are prioritizing strategic mergers and acquisitions to consolidate technological expertise in niche areas like additive manufacturing and industrial IoT, thereby enhancing their integrated product offerings and achieving economies of scale. Furthermore, the reliance on advanced materials, including composites and high-strength alloys, is shaping product design toward lighter, faster, and more durable machinery, appealing to performance-driven industries like aerospace and defense.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of production volume and demand, driven by China's extensive manufacturing base and India's rapid infrastructure buildout. However, North America and Europe are leading in the adoption of high-value, digitally integrated machinery, reflecting higher labor costs and the strong push for fully autonomous factory environments. These developed regions are strategic hubs for research and development (R&D) in specialized sectors like precision agriculture and advanced construction equipment, setting global benchmarks for technological integration and regulatory compliance. Latin America and the Middle East & Africa (MEA) are emerging as significant growth areas, particularly in heavy machinery, capitalizing on large-scale mining projects, oil and gas investments, and governmental initiatives focused on national industrialization programs.

Segmentation analysis reveals that the industrial machinery segment, encompassing material handling and power transmission equipment, holds the largest market share due to its ubiquitous application across manufacturing sectors. However, the specialized machinery segment, particularly robotics and machine tools, is projected to exhibit the fastest growth CAGR, driven by the intense push for factory automation and precision engineering required for advanced product manufacturing. Within the material type segment, machinery built using advanced composites and lightweight metals is seeing accelerated demand, promising significant operational efficiencies. The interplay between software integration (e.g., predictive maintenance algorithms) and hardware performance is becoming the central competitive differentiator across all market segments, necessitating deep partnerships between traditional machinery manufacturers and specialized software developers.

AI Impact Analysis on Machinery Manufacturing Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Machinery Manufacturing Market frequently revolve around practical implementation, return on investment (ROI), job displacement concerns, and the necessary data infrastructure. Users seek to understand how AI can move beyond simple diagnostics to enable true autonomy in machine operation and maintenance. Key themes emerging from user analysis focus on AI’s capacity to optimize production scheduling, predict component failures with extreme accuracy (predictive maintenance 2.0), enhance robotic dexterity for complex tasks, and facilitate self-correction and continuous improvement in CNC machine tooling paths. There is a strong expectation that AI will redefine the lifecycle of machinery, moving toward intelligent assets that require minimal human intervention for operational excellence and lifecycle management. Concerns often center on data security, proprietary intellectual property (IP) protection in connected systems, and the high initial capital investment required for comprehensive AI integration across legacy machinery fleets.

The integration of AI fundamentally alters the design, operation, and servicing of manufacturing equipment. In the design phase, generative design algorithms powered by AI are enabling engineers to rapidly develop optimized machine parts that minimize material use and maximize structural integrity, achieving designs previously unattainable through conventional methods. During operation, AI-driven control systems allow machinery to adapt instantly to fluctuating environmental conditions, material inconsistencies, or input variation, ensuring consistent, high-quality output and significantly reducing scrap rates. This level of adaptability makes customized, small-batch manufacturing economically viable, transforming traditional mass production models. Moreover, AI models are critical in optimizing energy consumption across entire factory floors by coordinating machine usage based on demand forecasts and energy pricing, addressing increasing sustainability mandates.

Furthermore, AI is pivotal in reshaping the aftermarket service landscape. By analyzing vast datasets generated by connected machines (telematics, vibration analysis, temperature readings), AI algorithms can anticipate required repairs or parts replacements weeks in advance, transitioning service models from reactive breakdown management to proactive, condition-based maintenance. This predictive capability minimizes costly unplanned downtime, which is a major pain point for end-users, thereby increasing customer satisfaction and profitability for machinery providers through sophisticated service contracts. The use of machine learning in quality control—inspecting finished products or components at high speed with superior accuracy compared to human inspectors—is also becoming standard, ensuring that machinery consistently meets stringent industry specifications, especially in regulated industries like medical devices and aerospace.

- AI-enabled Predictive Maintenance (APM) reduces unplanned downtime by up to 50%.

- Generative Design algorithms optimize machine component geometry for weight and strength.

- AI vision systems automate quality inspection, improving defect detection accuracy.

- Reinforcement Learning (RL) trains industrial robots for complex, non-repetitive assembly tasks.

- AI optimizes factory floor logistics, including automated guided vehicle (AGV) routing and material flow.

- Intelligent control systems allow machinery to self-calibrate and adapt to operational variability in real-time.

- AI facilitates advanced energy management and optimization of machine operational cycles based on demand.

DRO & Impact Forces Of Machinery Manufacturing Market

The Machinery Manufacturing Market is shaped by a powerful confluence of Drivers, Restraints, and Opportunities (DRO), collectively forming the market's Impact Forces. Key drivers include accelerating global infrastructure spending, particularly in emerging economies focused on urbanization and modern transport networks, which directly fuels demand for construction and material handling equipment. The relentless pursuit of operational efficiency and cost reduction across all manufacturing sectors mandates increased investment in industrial automation, robotics, and advanced machine tools, establishing automation as a non-negotiable driver. Opportunities are abundant in the transition toward sustainable and green machinery, focusing on electric power trains, hydrogen fuel cells, and machinery manufactured with circular economy principles. Furthermore, the integration of advanced digital twins and simulation software offers manufacturers a significant avenue for value-added services and operational efficiency improvements, allowing for virtual commissioning and real-time performance optimization.

However, the market faces significant restraints. High initial capital investment required for advanced, digitally integrated machinery poses a barrier to entry, particularly for Small and Medium Enterprises (SMEs). The complexity associated with implementing and integrating new digital technologies, coupled with a critical shortage of skilled technical labor capable of maintaining and programming sophisticated automated systems, hampers faster adoption rates globally. Furthermore, the machinery manufacturing sector is highly vulnerable to macroeconomic instability, interest rate fluctuations, and supply chain disruptions, especially concerning critical components like semiconductors and high-precision sensors, which can drastically affect production timelines and costs. Geopolitical tensions and rising trade protectionism also create uncertainty, complicating international market access and potentially fragmenting global supply chains, forcing localized manufacturing adjustments.

The principal Impact Forces driving strategic decisions within this market revolve around technological disruption and global economic shifts. The rapid advancement of additive manufacturing (3D printing) technologies is gradually disrupting traditional tooling and prototyping methods, pressuring established manufacturers to adapt their production processes. Regulatory pressures, especially those related to carbon emissions and worker safety (e.g., EU machinery directive updates), necessitate continuous, costly redesigns of equipment, acting as both a restraint and an opportunity for innovation in clean technology. Overall, the market's trajectory is determined by the manufacturers' ability to balance high-cost innovation required for smart, connected machinery against the price sensitivity and demand stability of diverse global end-user sectors, while strategically navigating complex, often volatile, international trade environments and resource availability constraints.

Segmentation Analysis

The Machinery Manufacturing Market is segmented based on product type, end-user industry, operational mode, and geographic region, reflecting the diverse applications and technological sophistication inherent in the sector. Segmentation provides a granular view of market dynamics, highlighting areas of high growth such as industrial automation and construction equipment, which are driven by distinct global investment patterns. Analysis across these dimensions is crucial for strategic planning, revealing specialized niche markets (e.g., medical device manufacturing machinery) that demand extreme precision and regulatory compliance, contrasting with high-volume sectors like agricultural machinery, where durability and cost-efficiency are paramount. The product segmentation is highly representative of the technological maturity, with advanced segments rapidly adopting smart features and IoT capabilities.

By End-User, the market is broadly categorized into sectors like Construction, Automotive, Agriculture, Food & Beverage, and Mining. The performance of these segments is tightly coupled with global commodity prices, urbanization rates, and specific industry output requirements. For instance, the automotive segment's investment in machinery is focused heavily on lightweight material processing and electric vehicle (EV) battery production equipment, requiring specialized automation tools. Conversely, the construction sector relies on heavy-duty, robust equipment designed for large-scale earthmoving and lifting operations. Understanding these distinct requirements is essential for manufacturers tailoring their product portfolios and aftermarket services.

Furthermore, segmentation by operational mode—ranging from conventional mechanical operation to fully automated and robotic systems—indicates the market's ongoing digital transformation. The shift towards connectivity is evidenced by the rapid growth of the "smart machinery" sub-segment, which includes integrated sensors, telematics, and cloud-connectivity features necessary for comprehensive data collection and remote monitoring. This digital evolution is not uniform globally; developed economies show a higher saturation of automated systems, whereas emerging markets often balance manual and semi-automated machinery to maximize labor utilization while gradually improving output capacity.

- By Product Type:

- Industrial Machinery (Material Handling, HVAC, Power Transmission)

- Construction Machinery (Earthmoving, Road Building, Cranes)

- Agricultural Machinery (Tractors, Harvesters, Irrigation Equipment)

- Mining Machinery (Crushers, Drills, Excavators)

- Machine Tools and Metalworking Machinery (CNC, Lasers, 3D Printing)

- By End-User Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Manufacturing and Processing (General Industrial)

- Agriculture and Forestry

- Mining and Resources

- Food & Beverage and Packaging

- By Operational Mode:

- Conventional Machinery (Non-Automated)

- Semi-Automated Machinery

- Fully Automated Machinery and Robotics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Machinery Manufacturing Market

The value chain for the Machinery Manufacturing Market is extensive, starting from raw material sourcing and culminating in the highly specialized aftermarket service phase. Upstream activities are critical, involving the procurement of essential raw materials such as steel, high-strength aluminum, and specialized alloys, as well as high-precision components like bearings, hydraulic systems, and advanced electronic controls (sensors, microprocessors). Fluctuations in global commodity prices and securing reliable supply of high-tech components like semiconductors significantly impact upstream operational costs and manufacturing lead times. Manufacturers must manage complex global supplier networks, often employing dual-sourcing strategies and rigorous quality control protocols to ensure material integrity and component reliability, which directly translates to the performance and lifespan of the final machinery.

The core manufacturing and assembly stage involves high-precision machining, tooling, welding, and sophisticated assembly processes, increasingly relying on digital manufacturing techniques like simulation and robotic assembly to optimize throughput and minimize errors. This stage is marked by heavy capital investment in factory infrastructure and specialized labor training. Downstream, the distribution channel is multifaceted, relying heavily on a network of both direct sales teams for large strategic accounts and indirect channels comprising authorized dealers, distributors, and specialized leasing companies. Dealers play a vital role, especially for construction and agricultural machinery, providing local sales expertise, financing options, and immediate technical support, serving as the primary interface between the manufacturer and the final end-user.

The post-sales segment is increasingly defining competitive advantage. Aftermarket services include installation, maintenance, repair, and the supply of spare parts, now often augmented by digital services such as predictive maintenance contracts, software upgrades, and remote diagnostics facilitated by IoT connectivity. These services are high-margin revenue streams that foster long-term customer relationships. Digital distribution channels are also gaining prominence, particularly for software updates, digital twin components, and training modules. Effective management of this integrated distribution and service network is crucial for maximizing machine uptime and capitalizing on the shift toward 'Equipment-as-a-Service' models, where the machine’s operational efficiency, rather than just its sale price, dictates its value proposition.

Machinery Manufacturing Market Potential Customers

Potential customers for the Machinery Manufacturing Market represent a broad cross-section of global industry, ranging from multinational conglomerates running large-scale automated factories to individual farmers and small contracting firms. The primary end-users are defined by their reliance on capital equipment to execute core operational tasks efficiently. The construction industry remains a fundamental consumer, purchasing heavy equipment such as excavators, loaders, and cranes for infrastructure projects, residential building, and utility installations. Similarly, the agricultural sector, driven by the need for increased output efficiency in the face of limited arable land, consistently invests in high-tech machinery, including advanced GPS-guided tractors, automated planting systems, and precision harvesting equipment to maximize yield and minimize input costs.

The manufacturing and processing sector, spanning automotive, aerospace, and general industrial goods, constitutes another massive customer base, demanding sophisticated machine tools, CNC equipment, and industrial robotics for precision fabrication, assembly, and quality control. These customers prioritize speed, accuracy, and integration capabilities, seeking machinery that fits seamlessly into smart factory ecosystems. Energy and resource extraction industries, including mining and oil & gas, require specialized, heavy-duty machinery designed to operate reliably in harsh, often remote, environments, focusing on robustness, safety features, and high throughput capability for raw material processing and handling.

Moreover, the logistics and warehousing industry represents a rapidly expanding customer segment, driven by the explosive growth of e-commerce and the resultant need for highly automated material handling systems, including conveyors, automated storage and retrieval systems (AS/RS), and sophisticated sorting machinery. The investment decisions of all these customer types are heavily influenced by prevailing economic conditions, government infrastructure spending, regulatory requirements (especially regarding emissions and safety), and the accessibility of financing options, compelling manufacturers to offer flexible purchasing and leasing models alongside their core products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.00 billion |

| Market Forecast in 2033 | USD 1,010.50 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Deere & Company, Hitachi Construction Machinery Co., Ltd., Sandvik AB, Atlas Copco AB, Siemens AG, GE Manufacturing, Mitsubishi Heavy Industries, Ltd., Doosan Infracore, CNH Industrial N.V., Kubota Corporation, ABB Ltd., FANUC Corporation, KUKA AG, DMG MORI AG, Mazak Corporation, Terex Corporation, Sany Group, XCMG Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Machinery Manufacturing Market Key Technology Landscape

The Machinery Manufacturing Market is undergoing a rapid technological transformation, primarily centered on the digitization of physical assets and the integration of advanced computation. The central pillars of this landscape include the pervasive adoption of Industrial Internet of Things (IIoT) sensors and edge computing capabilities, which facilitate real-time data collection and processing directly at the machine level. This data is crucial for executing predictive maintenance algorithms and optimizing machine performance dynamically without heavy reliance on centralized cloud infrastructure. Furthermore, advanced robotics, including collaborative robots (cobots) designed to work safely alongside human operators, are expanding the scope of automation beyond traditional cage-protected environments, making automation accessible for smaller-scale, variable production runs. The convergence of these technologies defines the shift towards "smart factories," where assets communicate seamlessly and self-optimize production flow.

Additive Manufacturing (AM), or 3D printing, is fundamentally changing how machinery components and specialized tools are designed and produced. While not replacing traditional subtractive manufacturing entirely, AM allows for the creation of lightweight, geometrically complex parts with reduced material waste and significantly shorter lead times for prototyping and low-volume specialty tools. This capability is especially important in high-performance sectors like aerospace and custom machine building, where unique geometries are often required for optimal functionality. Concurrently, the use of Digital Twins—virtual replicas of physical machines or entire production lines—is gaining momentum. Digital twins allow manufacturers and end-users to simulate operational scenarios, test software updates, and train operators in a risk-free virtual environment, maximizing efficiency before deployment and reducing commissioning costs, thus ensuring peak operational performance throughout the machine lifecycle.

Electrification and alternative power sources are also critical technological trends, particularly in heavy machinery sectors like construction and agriculture, driven by stringent global emissions regulations and the push for reduced operating noise. Manufacturers are investing heavily in developing battery-electric and hybrid machinery, requiring innovation in high-density battery technology, advanced power management systems, and efficient electric motor design. Beyond hardware, the growing sophistication of software, including advanced Human-Machine Interface (HMI) systems and augmented reality (AR) tools for maintenance and training, significantly enhances operational usability and reduces the complexity associated with operating highly technical machinery. These software-based solutions are key to bridging the skills gap and improving overall worker safety and efficiency.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market globally, driven by large-scale government investments in infrastructure development, rapid industrialization, and massive domestic manufacturing output, particularly in China and India. China maintains its position as the world's largest consumer and producer of machinery, focusing increasingly on high-end, technologically advanced machine tools and industrial robotics to upgrade its manufacturing base (Made in China 2025 initiative). India's growing construction sector and governmental push for localization (e.g., 'Make in India') are creating significant demand for heavy machinery and agricultural equipment. This region’s growth is characterized by high volume, strong governmental support, and increasing adoption of automation to manage rising labor costs and quality demands.

- North America: North America is characterized by high adoption rates of cutting-edge technology, focusing on intelligent automation, precision agriculture, and advanced construction equipment. The U.S. market is driven by resurgence in domestic manufacturing (reshoring), strong defense spending, and significant infrastructure modernization programs. Companies here prioritize efficiency, data integration, and advanced software services (servitization), leading to higher average machinery prices and strong aftermarket revenue streams. Demand is particularly robust for specialized robotics and high-precision CNC machinery critical for aerospace, medical, and semiconductor production.

- Europe: Europe remains a powerhouse in high-quality, specialized machinery manufacturing, particularly in Germany (machine tools, industrial components) and Italy (packaging and textile machinery). The market is strongly influenced by sustainability mandates and regulatory frameworks (like the EU Machinery Directive), driving rapid adoption of electric and hydrogen-powered equipment. The focus is heavily on Industry 4.0 integration, creating highly interconnected, energy-efficient production systems. European demand is characterized by sophisticated technical requirements, durability, and a strong preference for machinery designed with circular economy principles in mind.

- Latin America (LATAM): LATAM's machinery market growth is largely tied to commodity markets, mining activities, and agricultural output (Brazil and Argentina). Demand centers around robust construction equipment for mining operations and infrastructure projects, along with reliable agricultural machinery. While adoption of highly advanced automation trails developed regions, there is a steady transition towards semi-automated and GPS-enabled equipment to improve operational productivity and resource management, especially in large-scale farming enterprises.

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven by massive non-oil economic diversification projects and large-scale urban development in the Gulf Cooperation Council (GCC) nations. There is significant demand for construction machinery and specialized equipment for energy projects (both traditional and renewable). The African segment is emerging, driven by agricultural modernization and early-stage infrastructure development, creating substantial long-term demand for durable and easily maintainable machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Machinery Manufacturing Market.- Caterpillar Inc.

- Komatsu Ltd.

- Deere & Company

- Hitachi Construction Machinery Co., Ltd.

- Sandvik AB

- Atlas Copco AB

- Siemens AG (Industrial Automation Division)

- GE Manufacturing

- Mitsubishi Heavy Industries, Ltd.

- Doosan Infracore (now Hyundai Doosan Infracore)

- CNH Industrial N.V.

- Kubota Corporation

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- DMG MORI AG

- Mazak Corporation

- Terex Corporation

- Sany Group

- XCMG Group

Frequently Asked Questions

Analyze common user questions about the Machinery Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the adoption of Industry 4.0 technologies in machinery manufacturing?

The primary drivers are the necessity for increased operational efficiency, the demand for highly customized products, and the need to mitigate rising labor costs through sophisticated automation. Industry 4.0 integrates cyber-physical systems, IIoT, and real-time data analytics, enabling predictive maintenance, autonomous operation, and optimized supply chain management, thereby enhancing profitability and competitiveness.

How is the market addressing sustainability and environmental regulations?

Manufacturers are heavily investing in electrification (battery-powered heavy equipment), developing machinery compatible with alternative fuels (hydrogen), and employing lightweight materials to reduce energy consumption. Furthermore, regulatory compliance, particularly regarding emissions standards (e.g., Tier 4/Stage V) and material recyclability, mandates continuous product innovation toward sustainable operational profiles.

Which geographic region presents the most significant growth opportunities for heavy machinery?

The Asia Pacific (APAC) region, led by China and India, offers the most substantial volume growth opportunities due to massive urbanization, aggressive infrastructure development programs, and large-scale manufacturing expansion. While North America and Europe offer high-value growth in specialized automation, APAC dominates the overall market volume and projected capital expenditure.

What role does digitalization play in the machinery aftermarket service sector?

Digitalization is transforming aftermarket services through servitization. Connected machinery provides manufacturers with critical performance data, enabling predictive maintenance models that anticipate failures before they occur, reducing downtime and optimizing maintenance schedules. This shift creates recurring, high-margin revenue streams through software and service contracts rather than relying solely on traditional parts sales.

What are the main constraints hindering faster technological adoption in the market?

The primary constraints include the high initial capital investment required for state-of-the-art automated systems, which limits adoption by SMEs, and a critical global shortage of qualified technicians and engineers skilled in maintaining and programming complex, interconnected industrial machinery and robotics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Motor Spindles Market Size Report By Type (Rolling Motor Spindles, Air-bearing Motor Spindles, Liquid Journal Motor Spindles, Others), By Application (PCB (Printed Circuit Board) Industry, Consumer Electronics Industry, Machinery Manufacturing Industry, Automotive Industry, Aerospace Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Portable Torque Testers Market Statistics 2025 Analysis By Application (Automobile and Aerospace Industry, Machinery Manufacturing Industry, Plastic and Polymer Manufacturing, Electrical and Electronics Manufacturing, Others), By Type (Pneumatic, Hydraulic, Electric), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Benchtop Torque Testers Market Statistics 2025 Analysis By Application (Automobile and Aerospace Industry, Machinery Manufacturing Industry, Plastic and Polymer Manufacturing, Electrical and Electronics Manufacturing, Others), By Type (Pneumatic, Hydraulic, Electric), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Industrial Keyboard Market Statistics 2025 Analysis By Application (Petroleum Chemical Industry, Machinery Manufacturing Industry, Transportation Industry, Defence Industry, Military Industry, Space Industry), By Type (Membrane Keyboard, Silicone Keyboard, Metal Keyboard, Explosion-Proof Keyboard, Long Stroke Keyboard, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- High-purity Vanadium Market Statistics 2025 Analysis By Application (Metallurgical Industry, Machinery Manufacturing Industry, Chemical Industry), By Type (High Purity, Low Purity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager