Macleaya Cordata Extract Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434362 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Macleaya Cordata Extract Market Size

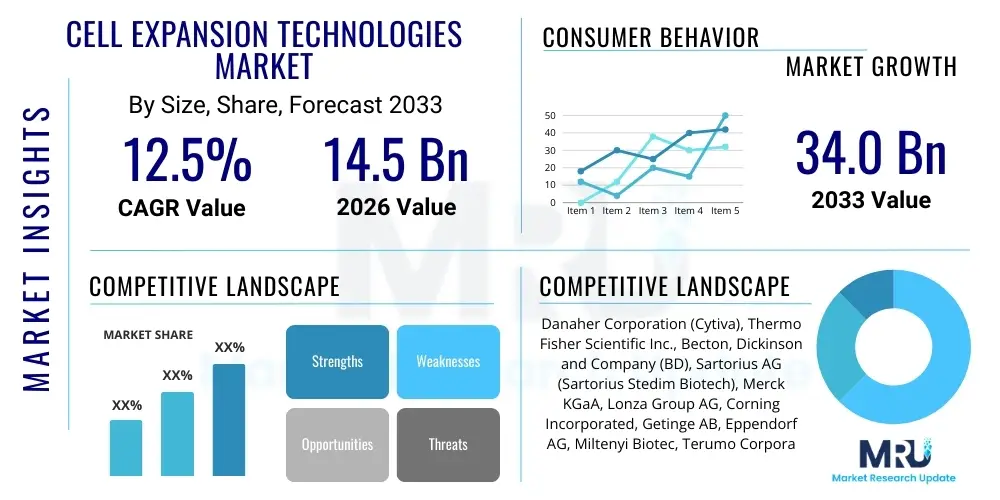

The Macleaya Cordata Extract Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Million in 2026 and is projected to reach USD 71.9 Million by the end of the forecast period in 2033.

Macleaya Cordata Extract Market introduction

The Macleaya Cordata Extract Market encompasses the production, distribution, and utilization of extracts derived from the plant Macleaya cordata, commonly known as plume poppy. This perennial herb is highly valued for its potent phytochemical composition, specifically the presence of isoquinoline alkaloids such as sanguinarine and chelerythrine. These compounds exhibit strong antimicrobial, anti-inflammatory, and antiprotozoal properties, positioning the extract as a critical ingredient across several high-growth industries. The primary product forms traded in the market include standardized powder extracts and liquid formulations, with varying concentration levels of active alkaloids tailored for specific end-use requirements. Regulatory acceptance, particularly in the European Union and North America, regarding its use as a natural alternative to synthetic performance enhancers in animal husbandry, has been a key driver defining the market landscape. The sophisticated extraction processes, often involving methods like supercritical fluid extraction (SFE) or ethanol-based extraction, are crucial for ensuring the purity and high biological activity of the final product, which directly impacts its commercial value.

Major applications of Macleaya Cordata extract span the animal feed, cosmetics, and pharmaceutical sectors. In animal nutrition, it is widely utilized as a phytogenic feed additive (PFA) to enhance gut health, improve feed conversion rates (FCR), and act as a natural growth promoter, effectively serving as a replacement for traditional antibiotic growth promoters (AGPs) due to increasing global regulatory restrictions on antibiotic use in livestock. In the cosmetic industry, its anti-inflammatory and antioxidant capabilities make it suitable for skincare formulations targeting sensitive or irritated skin, as well as products aimed at reducing signs of aging. The pharmaceutical application, though smaller, is focused on leveraging its established cytotoxic and antimicrobial properties for developing novel therapeutic agents, particularly in dermatological and oral hygiene preparations, driving ongoing research and clinical investigations into its full medicinal potential.

The market is predominantly driven by the accelerating consumer preference for natural, clean-label ingredients across all end-use sectors, coupled with stringent governmental mandates pushing the agricultural sector away from conventional synthetic chemicals. Furthermore, the rising global prevalence of antimicrobial resistance (AMR) has fueled the demand for plant-based solutions in veterinary medicine, where Macleaya Cordata extracts offer a sustainable and effective mechanism for pathogen control in livestock and poultry farming. Investment in advanced extraction technologies aimed at increasing alkaloid yield and purity, alongside expanding cultivation efforts to ensure a stable supply of raw materials, are essential factors influencing the competitive dynamics and future growth trajectory of this specialized botanical extract market.

Macleaya Cordata Extract Market Executive Summary

The Macleaya Cordata Extract market is experiencing significant upward momentum, underpinned by robust business trends emphasizing sustainability, natural sourcing, and functional efficacy. Key business trends indicate a pronounced shift towards contract manufacturing and specialized sourcing partnerships, particularly between extract producers and large animal health companies, ensuring stable supply chains and quality control for high-volume applications in poultry and swine industries. Technological innovation is concentrated on refining standardization protocols to ensure consistent alkaloid levels (sanguinarine and chelerythrine content), thereby meeting strict regulatory requirements in developed economies. Investment capital is flowing into research focused on optimizing bioavailability and stability of the extracts within complex feed matrices, thereby cementing its role as a superior phytogenic solution over synthetic alternatives, a trend that is transforming market valuation across the board.

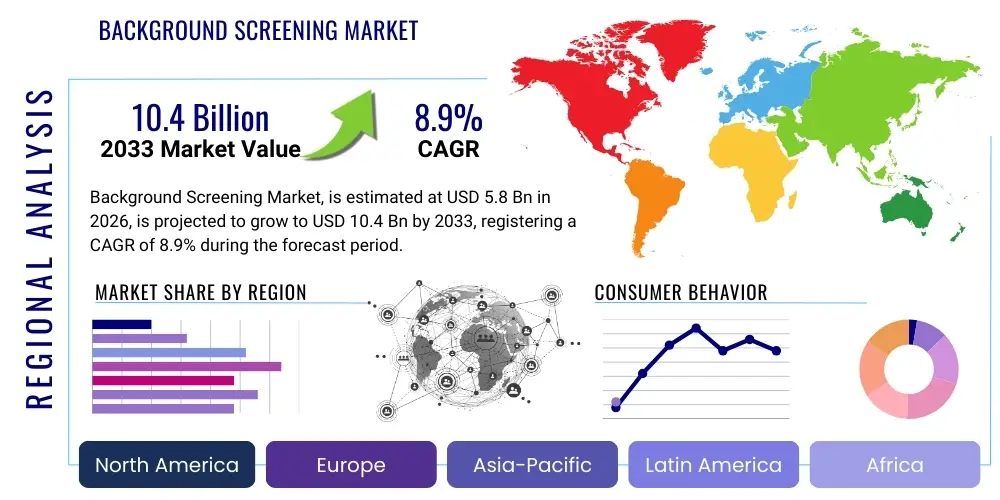

Regionally, the market exhibits divergent growth patterns. Europe currently dominates the market share due to its stringent ban on antibiotic growth promoters (AGPs) and proactive regulatory environment favoring standardized botanical additives in animal feed, making countries like Germany and the Netherlands central hubs for adoption. The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid expansion in livestock production, particularly in China and Southeast Asia, coupled with increasing consumer awareness regarding food safety and quality, prompting local feed manufacturers to integrate effective natural substitutes. North America also shows strong growth, primarily driven by the cosmetic sector and the wellness industry’s emphasis on natural, bioactive ingredients, although regulatory frameworks for veterinary use are slightly less harmonized than in the European Union, influencing the pace of market penetration.

Segmentation trends highlight the dominance of the Animal Feed application segment, which accounts for the largest revenue share and is expected to maintain its leadership throughout the forecast period due to large-scale operational requirements. Within this segment, extracts standardized for high Sanguinarine concentration are most sought after for their proven efficacy in gut health management. By product form, the Powder segment remains superior due to ease of handling, stable shelf-life, and seamless integration into dry feed formulas, although specialized liquid extracts are gaining traction in targeted medical applications and high-end cosmetic formulations, signifying a subtle diversification in product offerings aligned with specific industry needs and operational constraints.

AI Impact Analysis on Macleaya Cordata Extract Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) are being leveraged to optimize the cultivation, extraction, and formulation processes of Macleaya Cordata extract, particularly focusing on questions regarding predictive modeling for optimal harvesting times and quality control mechanisms. A significant area of concern relates to AI-driven predictive analytics for identifying market demand shifts and potential supply chain disruptions related to raw material sourcing. Key expectations revolve around using AI to accelerate the discovery of novel alkaloid derivatives or synergistic combinations within the extract, potentially broadening its applications beyond current limitations in animal feed and cosmetics. The overarching theme is the application of AI to enhance efficiency, reduce production costs, ensure standardization, and unlock new therapeutic potential through advanced computational modeling of bioactive compound behavior and interactions.

- AI-driven optimization of cultivation parameters (soil, climate, irrigation) to maximize alkaloid yield in raw Macleaya Cordata crops.

- Machine Learning algorithms employed for real-time quality control during extraction processes, ensuring consistent standardization of sanguinarine and chelerythrine concentrations.

- Predictive analytics used for demand forecasting and inventory management, optimizing supply chain efficiency and minimizing waste of high-value botanical raw materials.

- AI-facilitated drug discovery and formulation development by simulating the interaction of Macleaya Cordata alkaloids with biological targets, accelerating pharmaceutical R&D.

- Automation and robotic process optimization in large-scale manufacturing to reduce labor costs and improve batch consistency.

- Enhanced regulatory compliance tracking and data management using AI tools to navigate complex global standards for botanical additives and extracts.

DRO & Impact Forces Of Macleaya Cordata Extract Market

The Macleaya Cordata Extract market dynamics are defined by powerful driving forces centered on health and regulatory compliance, tempered by inherent supply chain limitations and competitive pressures. The foremost driver is the global paradigm shift away from antibiotic use in livestock, creating an immediate and vast demand for effective, natural alternatives like Macleaya Cordata extract. This shift is solidified by tightening regulatory frameworks, especially in major economic blocs like the EU, which mandates the search for sustainable feed additives. Furthermore, continuous scientific validation of sanguinarine and chelerythrine's efficacy in improving gut morphology and reducing inflammation in animals strengthens its commercial viability. However, the market faces significant restraints, chiefly concerning the volatility in raw material supply due to weather-dependent agricultural cycles and the limited geographical areas suitable for high-quality cultivation, leading to price fluctuations and potential supply bottlenecks that challenge stable expansion strategies for manufacturers.

Opportunities for market expansion are substantial, primarily focused on diversification into high-value pharmaceutical and specialized human nutritional supplement markets, leveraging the extract's strong antimicrobial profile for conditions such as mild gastroenteritis or immune support. Developing microencapsulation technologies represents a key opportunity, as it can significantly improve the stability, shelf-life, and targeted release of the alkaloids within the digestive tract, thereby increasing the effective dose and broadening its application scope in complex feed formulations. Geographically, penetrating underserved livestock markets in rapidly developing economies in Africa and Latin America, where antibiotic resistance is a critical public health issue, offers robust potential for future revenue streams and establishing early market dominance through strategic local partnerships and localized formulation development tailored to specific regional farming practices and disease challenges.

The impact forces influencing the competitive intensity include the bargaining power of buyers, which is moderate to high, particularly for large feed compounders who purchase in bulk and demand strict price control and quality guarantees, compelling suppliers to maintain competitive pricing strategies and robust quality assurance systems. The threat of substitutes is significant, stemming from the availability of other phytogenic alternatives (e.g., essential oils, specific probiotics, and organic acids), requiring Macleaya Cordata extract producers to consistently demonstrate superior cost-to-benefit ratios and unique mechanism of action benefits. Regulatory forces are highly impactful, acting as both a driver (by banning AGPs) and a restraint (by imposing strict limits on extract residues and purity), necessitating substantial investment in compliance and traceability systems to mitigate regulatory risk and ensure continued market access globally. This complex interplay between regulatory support for natural products and the challenges of specialized raw material sourcing defines the strategic environment for all stakeholders in the market.

Segmentation Analysis

The Macleaya Cordata Extract market is analyzed across several critical dimensions, including Application, Form, and Concentration Level, providing a granular view of revenue generation and growth pockets across the value chain. Application segmentation reveals the fundamental dependence of the market on the Animal Feed sector, which acts as the primary volume driver due to the necessity of large-scale additive incorporation in livestock diets globally. Segmentation by Form differentiates between the highly stable and easy-to-handle powdered extracts and the more specialized, concentrated liquid extracts, each addressing unique manufacturing and formulation needs. Understanding these segments is crucial for manufacturers to tailor product specifications, optimize production capacity, and strategically target distinct end-user industries with specialized product lines meeting specific technical requirements for blending efficiency and bioavailability in the final consumer or industrial product.

- By Application:

- Animal Feed (Swine, Poultry, Aquaculture, Ruminants)

- Cosmetics and Personal Care

- Pharmaceuticals and Nutraceuticals

- By Form:

- Powder Extract

- Liquid Concentrate

- By Concentration Level:

- High Sanguinarine Concentration (>1.5%)

- Low Sanguinarine Concentration (0.5% - 1.5%)

Value Chain Analysis For Macleaya Cordata Extract Market

The value chain for the Macleaya Cordata Extract market begins with upstream activities focused on raw material sourcing, predominantly involving the cultivation and harvesting of the plant. This stage is characterized by high sensitivity to climate variability and agricultural practices, requiring specialized farming techniques to maximize the alkaloid yield in the plant roots and aerial parts. Key upstream players include specialized agricultural cooperatives and contract farmers who supply the biomass to extract manufacturers. Ensuring the sustainable and traceable origin of the raw material is paramount, as purity and quality directly affect the efficiency of downstream extraction processes and the final product's compliance with international regulatory standards for botanical content and absence of contaminants, forming a critical bottleneck in scalable production.

Midstream activities involve the complex process of extraction and refinement, where raw biomass is processed to isolate and concentrate the active alkaloids, primarily sanguinarine and chelerythrine. Manufacturers employ sophisticated technologies such as Supercritical Fluid Extraction (SFE) or various solvent-based methods to produce standardized powder or liquid extracts. This stage adds significant value through technological expertise, quality assurance testing, and adherence to Good Manufacturing Practices (GMP). Subsequent formulation and compounding activities prepare the extract for end-use, such as blending the standardized powder with carrier materials for animal feed application or incorporating the liquid concentrate into specialized cosmetic bases, ensuring optimal stability and dispersion in the final product matrix, which is vital for market acceptance.

Downstream activities center on distribution channels and end-user engagement. Direct distribution is common for high-volume sales to large animal feed compounders and major cosmetic manufacturers, facilitating direct technical support and customized supply agreements. Indirect distribution involves working through specialized distributors and agents, particularly in fragmented regional markets or for smaller pharmaceutical and nutraceutical applications, providing market coverage and localized logistics expertise. Effective channel management, coupled with strong technical marketing highlighting the extract's functional benefits (e.g., gut health improvement, antimicrobial efficacy), is crucial for penetrating diverse international markets and securing long-term contracts with major buyers across the veterinary, personal care, and therapeutic sectors globally.

Macleaya Cordata Extract Market Potential Customers

The primary potential customers for Macleaya Cordata extract are concentrated within the animal health and nutrition industry, specifically large-scale commercial feed manufacturers and premix producers dedicated to swine, poultry, and increasingly, aquaculture diets. These buyers seek reliable, high-quality, and cost-effective alternatives to traditional growth promoters, prioritizing extracts with scientifically proven efficacy in managing intestinal health and reducing pathogenic load, making standardization and clinical validation key purchasing criteria. Furthermore, integrated livestock producers who manage the entire supply chain, from feed production to animal rearing, represent significant buyers due to their need for bulk, consistent supply to maintain high operational efficiencies and meet evolving consumer demands for antibiotic-free meat production, necessitating sophisticated supply chain integration.

A secondary, yet rapidly expanding, customer base includes cosmetic and personal care product formulators. These customers are focused on leveraging the anti-inflammatory, antioxidant, and mild antimicrobial properties of the extract for premium skin care, oral hygiene, and anti-aging products. They typically require smaller volumes but demand extremely high purity, certified organic sourcing (where applicable), and compliance with cosmetic safety regulations, often preferring liquid concentrates that are easily incorporated into emulsion systems. Their purchasing decisions are heavily influenced by consumer trends favoring botanical, natural, and clean-label ingredients, positioning the extract as a key active ingredient that differentiates their final product in the competitive beauty market landscape.

Tertiary potential customers are pharmaceutical and specialized nutraceutical companies involved in developing therapeutic or dietary supplements. While purchasing volumes are generally lower than the animal feed sector, the extract's value per kilogram is significantly higher in this segment due to the stringent regulatory requirements for human consumption and medicinal claims. These customers focus on the potential use of sanguinarine in oral health products, anti-cancer research, or supplements targeting inflammatory conditions. They require extensive documentation, robust toxicological data, and compliance with pharmaceutical GMP standards, signifying a highly technical and detail-oriented buyer segment that requires strategic engagement focused on clinical research partnerships and regulatory affairs expertise, indicating high-value, albeit lower-volume, commercial relationships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Million |

| Market Forecast in 2033 | USD 71.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shanghai Green-Valley Bio-Tech Co. Ltd., Botanical Innovations Pty Ltd., Sichuan Sentaiyuan Biotechnology Co., Ltd., Indena S.p.A., Blue California, DSM Nutritional Products, Kemin Industries, Huatai Bio-Fine Chemical Co., Ltd., Wuxi Gorlife Technology Co., Ltd., Changsha Natureway Co., Ltd., Hunan Nutramax Inc., Xi'an Sost Biotech Co., Ltd., Sabinsa Corporation, B&B Agro Industries, RZBC Group Co., Ltd., Alps Pharmaceutical Ind. Co., Ltd., Phytovation Ltd., Nanjing Zelang Medical Technology Co., Ltd., Synthite Industries Ltd., Fubao Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Macleaya Cordata Extract Market Key Technology Landscape

The technological landscape driving the Macleaya Cordata Extract market is heavily focused on optimizing extraction efficiency and ensuring the high purity of specific alkaloids. Conventional solvent extraction methods (such as ethanol or methanol) remain widely used for cost-effectiveness and volume production, but advanced techniques are rapidly gaining importance. Supercritical Fluid Extraction (SFE), utilizing carbon dioxide, is recognized as a cleaner, greener technology that allows for precise fractionation and concentration of desired compounds like sanguinarine without leaving residual toxic solvents. This high-purity yield is essential for pharmaceutical and high-end cosmetic applications where regulatory limits on residuals are extremely strict. Continuous innovation in SFE parameters, including pressure and temperature optimization, is central to maximizing the quality and biological activity of the final extracted product, offering a significant competitive advantage to early adopters in the extract production space.

Beyond the core extraction process, technology is crucial in post-processing and formulation. Microencapsulation and nanoencapsulation technologies are emerging as critical advancements, specifically aimed at addressing the stability and bioavailability challenges inherent in botanical extracts. Macleaya Cordata alkaloids, when used in animal feed, must remain stable under harsh processing conditions (pelleting temperatures) and survive the acidic environment of the stomach before reaching the gut where they exert their primary effects. Encapsulation techniques, using natural polymer matrices, protect the active ingredients, ensuring targeted release and superior efficacy, thereby improving the economic return for feed manufacturers. Furthermore, advanced analytical techniques, including High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS), are indispensable for the quantitative standardization and batch-to-batch quality assurance required by major industrial buyers, solidifying the technological barrier to entry.

Digital technologies and automation are also transforming manufacturing operations. Process Analytical Technology (PAT) tools are being integrated into large-scale production facilities to enable real-time monitoring and control of extraction parameters, minimizing operational variability and ensuring consistent final product quality. Data analytics and IoT sensors are used in upstream agricultural practices to monitor plant health and optimize harvesting schedules, feeding into AI-driven models that predict raw material quality before processing, significantly reducing the risk of substandard inputs. This integration of agricultural technology (AgriTech) with advanced chemical processing technology ensures a robust, traceable, and highly standardized supply chain, addressing the fundamental market requirements for consistency and reliability in high-volume industrial applications such as animal nutrition and large-scale cosmetic ingredient supply.

Regional Highlights

Regional dynamics significantly influence the Macleaya Cordata Extract Market, reflecting differences in regulatory environments, agricultural practices, and end-user demands, creating specific growth opportunities across continents.

- Europe: Dominates the market, driven by early adoption of phytogenics in animal feed following strict regulations banning antibiotic growth promoters (AGPs). Countries like Germany and the Netherlands are key markets due to advanced livestock farming and high demand for certified, traceable natural additives. The European market emphasizes standardized extracts and adherence to stringent quality control norms.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR. Growth is fueled by massive expansion in swine and poultry industries in China, India, and Vietnam, where there is a growing regulatory push towards minimizing antibiotic use and improving feed conversion efficiency. Furthermore, APAC is a primary source of raw Macleaya Cordata biomass, linking resource availability directly to manufacturing growth.

- North America: Characterized by strong demand from the cosmetic and nutraceutical sectors, leveraging the extract's anti-inflammatory properties for high-value consumer products. The animal feed segment is also expanding, spurred by voluntary initiatives and consumer pressure for 'antibiotic-free' meat production, though regulatory mandates are often less uniform than in Europe, leading to slower but steady growth.

- Latin America (LATAM): Emerging as a critical growth region, particularly in Brazil and Argentina, major global beef and poultry exporters. The need to meet international import standards, especially from Europe, drives the adoption of phytogenic alternatives like Macleaya Cordata extract to maintain competitiveness in global trade.

- Middle East & Africa (MEA): Represents a nascent market with significant long-term potential. Growth is currently localized, driven by regional investment in modernizing livestock sectors and ensuring food security, increasingly exploring natural health solutions to combat disease outbreaks in poultry and aquaculture with limited access to advanced synthetic veterinary drugs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Macleaya Cordata Extract Market.- Shanghai Green-Valley Bio-Tech Co. Ltd.

- Botanical Innovations Pty Ltd.

- Sichuan Sentaiyuan Biotechnology Co., Ltd.

- Indena S.p.A.

- Blue California

- DSM Nutritional Products

- Kemin Industries

- Huatai Bio-Fine Chemical Co., Ltd.

- Wuxi Gorlife Technology Co., Ltd.

- Changsha Natureway Co., Ltd.

- Hunan Nutramax Inc.

- Xi'an Sost Biotech Co., Ltd.

- Sabinsa Corporation

- B&B Agro Industries

- RZBC Group Co., Ltd.

- Alps Pharmaceutical Ind. Co., Ltd.

- Phytovation Ltd.

- Nanjing Zelang Medical Technology Co., Ltd.

- Synthite Industries Ltd.

- Fubao Group

Frequently Asked Questions

Analyze common user questions about the Macleaya Cordata market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary active components in Macleaya Cordata extract and their main function?

The primary active components are the isoquinoline alkaloids sanguinarine and chelerythrine. Their main function is providing potent antimicrobial, anti-inflammatory, and antiprotozoal effects, making the extract highly effective in promoting gut health in livestock and acting as a natural preservative/active agent in cosmetics.

How is the global ban on antibiotic growth promoters impacting the Macleaya Cordata extract market?

The global regulatory shift banning antibiotic growth promoters (AGPs), especially in Europe and North America, is the single strongest driver for this market, creating massive, sustained demand for natural phytogenic alternatives like Macleaya Cordata extract to maintain livestock health and productivity without compromising food safety standards.

Which application segment holds the largest share in the Macleaya Cordata extract market?

The Animal Feed application segment holds the largest market share. The high volume required for incorporation into poultry, swine, and ruminant diets globally, driven by the need for natural growth promoters and gut health regulators, ensures its dominant position over cosmetic and pharmaceutical applications.

What are the key technological challenges in producing standardized Macleaya Cordata extract?

Key technological challenges involve ensuring consistent standardization of sanguinarine and chelerythrine concentrations due to natural variations in the raw plant material. Advanced extraction methods, such as SFE, and post-processing techniques like microencapsulation are necessary to overcome these issues and enhance product stability and bioavailability in industrial use.

Which region is forecasted to exhibit the fastest growth rate for Macleaya Cordata extract?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to the rapid industrialization of livestock farming, increasing domestic focus on food safety, and growing adoption of non-antibiotic feed additives across major economies like China and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager