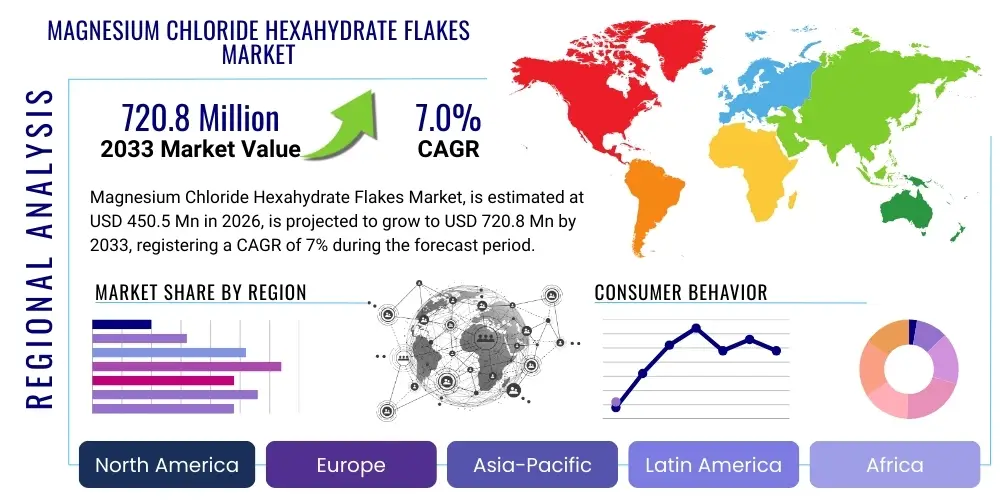

Magnesium Chloride Hexahydrate Flakes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434681 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Magnesium Chloride Hexahydrate Flakes Market Size

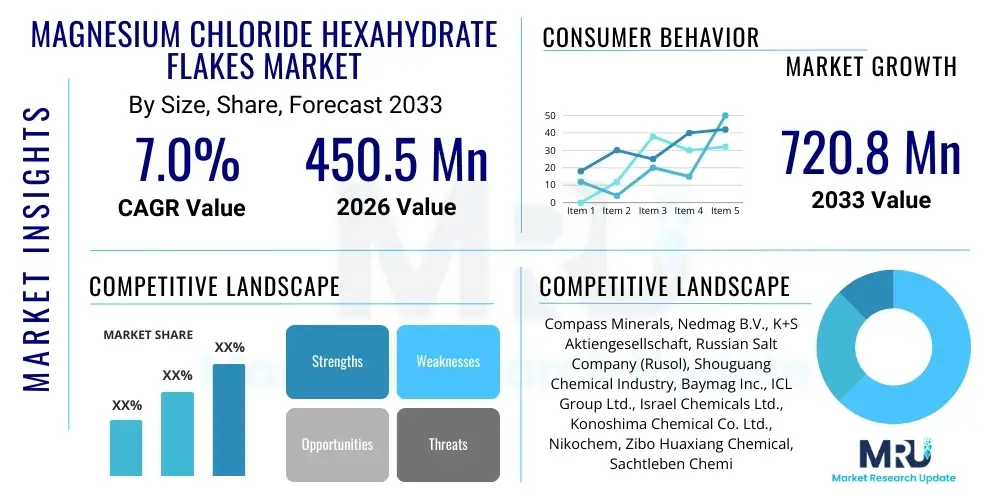

The Magnesium Chloride Hexahydrate Flakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.0% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 720.8 Million by the end of the forecast period in 2033. This steady expansion is primarily driven by increasing demand for effective and environmentally safer de-icing solutions across North America and Europe, coupled with rising adoption in dust suppression applications for industrial and municipal road maintenance. Furthermore, the pharmaceutical and agricultural sectors continue to contribute positively, utilizing the high purity of hexahydrate flakes for specialized applications.

Magnesium Chloride Hexahydrate Flakes Market introduction

The Magnesium Chloride Hexahydrate Flakes Market encompasses the production, distribution, and utilization of magnesium chloride in its highly hydrated form (MgCl2·6H2O), typically sold as white or off-white flakes. This compound is highly valued due to its hygroscopic properties, low freezing point, and relatively non-corrosive nature compared to traditional salts like sodium chloride. Major applications include road de-icing and anti-icing during winter months, effective dust control on unpaved roads and construction sites, and as a raw material in the manufacturing of various industrial chemicals, including specialized cements and fireproofing agents. Its benefits—such as superior performance at lower temperatures and reduced environmental impact on vegetation and infrastructure—drive significant market demand. Key factors propelling market growth include stringent regulations requiring effective dust mitigation in mining and construction, coupled with climate variability necessitating advanced de-icing solutions, particularly in temperate zones and regions prone to heavy snowfall. The consistent demand from the agricultural sector, where it is used as a magnesium nutrient source, further solidifies its market position, making it a critical chemical commodity globally.

Magnesium Chloride Hexahydrate Flakes Market Executive Summary

The Magnesium Chloride Hexahydrate Flakes Market demonstrates robust growth underpinned by strong business trends centered on sustainability and infrastructural maintenance. Regionally, North America and Europe remain the dominant revenue generators, primarily due to established infrastructure, high reliance on de-icing products, and stringent environmental standards promoting the use of less corrosive alternatives. Asia Pacific is emerging as the fastest-growing region, driven by rapid industrialization, increasing awareness of dust control requirements, and expanding agricultural input markets, particularly in China and India. Segmentation trends highlight the De-icing/Anti-icing application segment retaining the largest market share, though the Dust Suppression segment is expected to exhibit the highest CAGR as urbanization and construction activities intensify globally. Furthermore, the Technical Grade segment dominates volume, serving large-scale industrial and infrastructure maintenance needs, while the Pharmaceutical Grade segment commands premium pricing due to the necessity for high purity and compliance with strict regulatory standards. Strategic mergers, acquisitions, and expansions focused on securing raw material supply—predominantly brine sourcing—are key competitive strategies observed among leading market participants seeking to optimize logistics and maintain cost competitiveness in this increasingly globalized market.

AI Impact Analysis on Magnesium Chloride Hexahydrate Flakes Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Magnesium Chloride Hexahydrate Flakes Market frequently revolve around optimizing supply chain logistics, improving predictive maintenance for production facilities, and enhancing the efficiency of application methods, particularly in large-scale municipal de-icing operations. Users are keen to understand how AI-driven predictive analytics can forecast weather patterns with higher accuracy, thus optimizing inventory levels of hexahydrate flakes and minimizing waste in deployment. Furthermore, there is significant interest in using machine learning algorithms to analyze raw material sourcing (brine concentration, lake levels) to ensure consistent production quality and output efficiency. The integration of AI in optimizing distribution routes, especially during peak winter demand, is a critical area of focus, aiming to reduce operational costs and improve timely delivery to end-users such as DOTs (Departments of Transportation). Concerns also center on the initial investment required for implementing sophisticated AI and IoT solutions across older production facilities and integrating data streams from multiple, disparate sources within the supply chain. Overall, users anticipate that AI will primarily drive efficiency gains, reduce environmental oversaturation of the product, and stabilize pricing through better resource management.

- AI-powered predictive maintenance enhances efficiency in magnesium chloride extraction and crystallization processes, minimizing unexpected downtime.

- Machine learning algorithms optimize supply chain logistics by predicting peak demand periods (winter storms) and adjusting inventory levels accordingly.

- AI supports advanced weather forecasting models, enabling precision application of flakes for de-icing, reducing overuse and associated environmental impact.

- Data analytics derived from smart sensors improve quality control by monitoring brine concentration and purity during the hexahydrate formation process.

- Optimization of dust suppression routes and quantities in mining and construction using real-time environmental data analyzed by AI systems.

DRO & Impact Forces Of Magnesium Chloride Hexahydrate Flakes Market

The Magnesium Chloride Hexahydrate Flakes Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces influencing its trajectory. Primary drivers include the growing preference for magnesium chloride over traditional road salts due to its lower freezing point, faster de-icing action, and reduced corrosivity towards concrete and infrastructure, particularly in mature economies like the US and Canada. Furthermore, escalating demand for dust control agents in the mining, construction, and infrastructure development sectors, especially in developing nations, significantly boosts consumption. Restraints primarily involve the seasonal nature of the de-icing demand, which creates logistical and storage challenges for manufacturers, leading to fluctuating inventory costs and temporary overcapacity. Additionally, competition from alternative de-icing agents, such as calcium chloride and acetate-based solutions, poses a market constraint, especially in niche applications where their specific properties are preferred. Opportunities lie in expanding applications within the agricultural sector (as a fertilizer supplement) and the pharmaceutical industry, alongside developing sustainable, energy-efficient methods for extraction and crystallization. The overall impact force is strongly positive, driven by environmental responsibility mandates and continuous infrastructure investment globally, compelling end-users to seek high-performance, compliant chemical solutions for safety and maintenance needs. Innovations in product purity and granule structure also provide competitive advantages, overcoming some restraints related to handling and application efficiency.

Segmentation Analysis

The Magnesium Chloride Hexahydrate Flakes Market is meticulously segmented based on application, grade, and source, reflecting the diverse end-user requirements and the varying characteristics of the raw material supply chain. Analysis across these segments reveals distinct growth patterns and value propositions. The Application segmentation dictates the volume requirements, with de-icing dominating revenue, while the Grade segmentation (Technical, Food, Pharmaceutical) drives profitability, with higher purity grades commanding significantly better margins. Source segmentation is crucial for understanding cost structure, as brine-based extraction often provides cost efficiencies compared to mined sources. The underlying economic activity in construction and infrastructure development globally directly correlates with demand in the technical grade segment, while increasing health consciousness and regulations support the growth of specialized food and pharmaceutical grades. Understanding these granular segments allows stakeholders to tailor production processes and marketing strategies to capitalize on specific market niches and manage risks associated with seasonal volatility inherent in the largest application segment.

- By Application:

- De-icing/Anti-icing (Dominant segment due to essential winter road safety)

- Dust Suppression (Fastest growing segment driven by regulatory mandates in mining and construction)

- Industrial Chemicals (Used in cement, fireproofing, and wastewater treatment)

- Pharmaceuticals (High-purity requirement for medical applications)

- Agriculture/Fertilizers (Magnesium nutrient source for soil and foliar application)

- Oil & Gas (Drilling fluids and completion applications)

- By Grade:

- Food Grade (Used in food processing and preparation)

- Technical Grade (Highest volume segment for industrial and infrastructure use)

- Pharmaceutical Grade (Highest value segment requiring stringent purity standards)

- By Source:

- Brine/Salt Lake (Most cost-effective and dominant source globally)

- Seawater (Regional source, often integrated with desalination plants)

- Dolomite/Magnesite Mining (Less common, used where high purity is naturally available)

Value Chain Analysis For Magnesium Chloride Hexahydrate Flakes Market

The value chain for the Magnesium Chloride Hexahydrate Flakes Market begins with the upstream analysis, focusing on the sourcing and processing of raw materials. The primary raw material is concentrated brine, extracted either from natural sources like salt lakes (e.g., Great Salt Lake, Dead Sea), seawater, or as a byproduct of potash or salt mining operations. Upstream activities involve complex solar evaporation, initial concentration, and purification steps to remove contaminants like sodium and potassium salts. Efficiency in the upstream phase, particularly the energy consumption associated with evaporation and crystallization, directly dictates the final cost structure of the hexahydrate flakes. Producers investing in proprietary crystallization technologies or those situated near abundant, high-quality brine sources maintain a significant cost advantage. Geopolitical stability of key brine source regions is also a critical risk factor managed at the upstream stage, necessitating geographical diversification of sourcing strategies for major global suppliers.

The midstream component involves the manufacturing process, which includes crystallization, drying, flaking, and packaging of the magnesium chloride hexahydrate. Quality control and purity monitoring are paramount during this stage, particularly for pharmaceutical and food grade products, which require multiple recrystallization steps. Manufacturers must maintain high standards of operation to ensure the finished product meets specific flake size, moisture content, and chemical purity specifications required by different end-user applications. The downstream analysis primarily focuses on distribution channels and end-user consumption. Given the bulky nature and relatively low unit price of technical-grade flakes, efficient logistics—including bulk shipping and localized warehousing—are essential to minimize transportation costs. The distribution network relies heavily on both direct sales to large industrial customers (DOTs, large chemical producers, mining companies) and indirect channels utilizing regional distributors and specialized chemical traders who manage smaller orders and last-mile delivery. Seasonal inventory management is a critical aspect of downstream efficiency, ensuring product availability during peak winter months in the Northern Hemisphere.

The distribution channel structure is bifurcated into direct and indirect routes. Direct sales are preferred for high-volume contracts, such as supplying government agencies for road maintenance or major agricultural conglomerates. This allows manufacturers to maintain tighter control over pricing and customer relationships. Indirect channels, involving third-party logistics (3PL) providers and chemical distributors, are crucial for reaching smaller industrial buyers, specialized fertilizer mixers, and pharmaceutical compounding facilities. The effectiveness of the overall value chain is highly dependent on vertical integration, especially securing reliable brine sources and optimizing energy-intensive crystallization processes. Companies that control multiple stages of the value chain, from raw material extraction to specialized packaging, typically achieve superior market resilience and profitability margins. Continuous investment in quality assurance technologies and efficient packaging (e.g., weather-resistant bags) further enhances the perceived value and reliability delivered through the distribution network.

Magnesium Chloride Hexahydrate Flakes Market Potential Customers

Potential customers for Magnesium Chloride Hexahydrate Flakes span a broad spectrum of industries, driven primarily by the compound's highly effective hygroscopic and anti-freezing properties. The largest volume consumers are government agencies and municipal authorities responsible for maintaining public safety and infrastructure integrity, specifically through winter road de-icing and anti-icing operations. These customers prioritize performance at low temperatures and solutions that minimize long-term damage to asphalt, concrete, and bridge decks. Beyond governmental use, major consumers include mining operations and construction companies, which rely heavily on magnesium chloride for dust suppression on haul roads, aggregate stockpiles, and construction sites to comply with environmental regulations and improve worker safety. The effectiveness of the flakes in binding fine particulate matter makes them an essential tool for maintaining air quality standards and reducing equipment wear in arid or semi-arid environments.

Another significant customer base resides within the agricultural sector, encompassing fertilizer manufacturers, specialty crop growers, and organic farming operations. Magnesium is an essential macronutrient often deficient in certain soils, and magnesium chloride hexahydrate flakes provide a highly bioavailable source for correcting these deficiencies through soil application or foliar sprays. This customer segment is highly sensitive to purity, though technical grade is often sufficient, ensuring minimal heavy metal contamination is key. The pharmaceutical and food processing industries represent a smaller volume but higher-value customer segment. These buyers require stringent pharmaceutical or food-grade products used as processing aids, stabilizers, or in specialized medical applications, demanding exhaustive documentation, quality certifications, and supply chain transparency. These specialized customers are less sensitive to price fluctuations but highly dependent on consistent quality and compliance with regulatory bodies such as the FDA or European Pharmacopoeia. Securing supply contracts with these high-value customers often involves complex audit processes and long-term relationships.

Lastly, the industrial chemical sector, including companies specializing in textile manufacturing, fireproofing materials, and specialized cement production, represents another consistent consumer base. In the oil and gas industry, magnesium chloride is utilized in drilling fluids and workover operations, leveraging its density and stability under high pressure and temperature conditions. The heterogeneity of potential customers necessitates diversified marketing and sales strategies, ranging from large-scale government tendering processes to highly specialized B2B sales targeting niche pharmaceutical buyers. Manufacturers must effectively segment their product offerings—from bulk technical flakes to specialized packaged goods—to meet the unique demands and purchasing cycles of these varied end-users, ensuring that the specific grade and purity levels align precisely with the application requirements of the buyer to maximize market penetration and customer retention.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 720.8 Million |

| Growth Rate | 7.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Compass Minerals, Nedmag B.V., K+S Aktiengesellschaft, Russian Salt Company (Rusol), Shouguang Chemical Industry, Baymag Inc., ICL Group Ltd., Israel Chemicals Ltd., Konoshima Chemical Co. Ltd., Nikochem, Zibo Huaxiang Chemical, Sachtleben Chemie GmbH, Weifang Huize Chemical, Sinochem Group, Dalian Zhongmin, Huihai Chemical, Houhu Chemical, Tianjin Ruian Chemical, Qingdao Ruisong, Jining Green Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnesium Chloride Hexahydrate Flakes Market Key Technology Landscape

The technology landscape for the Magnesium Chloride Hexahydrate Flakes Market is centered primarily around highly optimized extraction, concentration, and crystallization methods designed to maximize yield and purity while minimizing energy consumption. Traditional production involves solar evaporation of brine, a time-consuming and weather-dependent process. Modern advancements focus on accelerating concentration through mechanical evaporation technologies, such as Multiple Effect Evaporators (MEE) or Mechanical Vapor Recompression (MVR), particularly in regions where solar evaporation is impractical or time-constrained. These technologies are crucial for large-scale, consistent production, offering significant energy efficiency improvements compared to older thermal processes. Furthermore, continuous crystallization techniques, which precisely control temperature and supersaturation, are increasingly adopted to produce uniform crystal size and high-purity hexahydrate flakes suitable for pharmaceutical and food applications. The use of advanced filtration and ion exchange resins in the purification stages is essential for removing trace elements, thereby upgrading the technical grade product to higher specifications, significantly enhancing market value.

Beyond core manufacturing, technology plays a critical role in application and quality assurance. In the de-icing segment, smart dispensing technology integrated with GPS and meteorological data allows for precision spreading of the flakes, ensuring optimal road coverage while preventing environmental oversaturation—a key driver for efficiency gains and compliance. For dust suppression, innovative polymer additives and mixing technologies are being developed to enhance the long-term binding capability of the magnesium chloride solution, thereby reducing the frequency of reapplication and overall material consumption. Quality control utilizes advanced spectroscopic analysis (like ICP-MS) to rapidly and accurately determine the concentration of trace minerals and contaminants, a non-negotiable requirement for sensitive end-users. The continuous improvement in these detection technologies ensures that manufacturers can confidently certify products to meet stringent regulatory guidelines, which is crucial for maintaining competitive edge in the global market. Investment in digitalization, including the use of Industrial Internet of Things (IIoT) sensors throughout the processing facilities, allows for real-time monitoring and predictive analytics, further optimizing throughput and minimizing energy waste across the entire production cycle, thereby addressing the high energy intensity inherent in chemical manufacturing.

Future technological trends are leaning towards sustainable and environmentally friendly production methods. Research is underway to explore novel membrane separation techniques, such as nanofiltration and reverse osmosis, to efficiently concentrate brine with lower energy expenditure compared to thermal processes. Additionally, efforts are focused on utilizing waste heat from other industrial operations (co-location strategies) to power the evaporation stages, further reducing the carbon footprint of magnesium chloride production. In terms of product form, encapsulation technology is being researched to create controlled-release products for agricultural and dust suppression markets, providing extended efficacy and reduced leaching into the environment. These technological innovations not only address market demands for higher purity and lower cost but also respond to increasing global pressure for sustainable chemical manufacturing. The successful integration of these technologies determines the ability of key players to scale operations, manage high energy costs, and deliver superior, value-added products to highly regulated end markets.

Regional Highlights

- North America (United States and Canada): This region is the largest and most mature market for Magnesium Chloride Hexahydrate Flakes, overwhelmingly driven by extensive usage in winter road maintenance and anti-icing programs. The robust infrastructure network, combined with severe winter weather conditions across the Northern and Central states and Canada, ensures consistently high seasonal demand. Government regulations and public safety priorities mandate the use of effective de-icing agents, and magnesium chloride is highly favored due to its lower freezing point and less corrosive profile compared to rock salt. The region also exhibits significant demand for dust suppression in mining areas (e.g., Western US, Canadian shield) and extensive industrial applications, contributing to the year-round consumption pattern. Major players in this region focus on optimizing logistics and storage capacity to manage the highly volatile demand cycle dictated by weather severity, often entering long-term supply contracts with state and municipal transportation departments. The high level of environmental awareness in North America also pushes demand toward purer, low-impact formulations.

- Europe (Germany, France, UK, Nordics): Europe represents the second-largest market, characterized by stringent environmental standards and a high reliance on winter road safety measures. Demand is concentrated in Central and Northern European nations where winter weather is intense, making effective de-icing crucial for economic activity. The market benefits from mature supply chains and sophisticated regulatory frameworks governing chemical usage. While de-icing is the primary application, the agricultural sector, particularly in countries with intensive farming practices, contributes significantly through the demand for specialized magnesium fertilizers. European manufacturers often invest heavily in sustainable production processes and high-purity products to comply with REACH regulations and meet the high quality expectations of the continent’s consumers. Competitive dynamics often involve strategic warehousing near major transport hubs to ensure rapid delivery during critical weather events. The focus here is balanced between infrastructure protection and environmental stewardship, favoring advanced, residue-minimizing products.

- Asia Pacific (China, India, Japan, Australia): APAC is the fastest-growing market globally, propelled by rapid industrialization, burgeoning infrastructure development, and increasing awareness of dust pollution control. While de-icing demand is prominent only in specific high-altitude or northern areas (e.g., Northern China, Japan), the primary growth engine is the Dust Suppression segment, particularly driven by extensive mining activities (Australia, India) and massive construction projects (China, Southeast Asia). Regulatory pressure to mitigate particulate matter pollution from industrial sources is intensifying, creating immense market opportunities for magnesium chloride flakes as a cost-effective and efficient solution. Furthermore, the expanding agricultural sectors in China and India are increasingly adopting magnesium fertilizers to improve crop yield and quality. Local manufacturers are rapidly scaling production capacity, often relying on domestic brine sources. The market is highly price-sensitive in the technical grade segment, leading to intense competition, but urbanization trends ensure continuous volume growth, making it a critical region for long-term global market expansion strategies.

- Latin America (Brazil, Mexico, Chile): The Latin American market exhibits moderate growth, with demand primarily stemming from mining and industrial applications, especially dust control in arid mining regions (Chile, Peru) and industrial processing in Brazil and Mexico. De-icing demand is negligible due to geographical and climatic factors. The region's market development is tied directly to commodity prices, particularly in the mining sector, influencing investment in dust control infrastructure. Logistical challenges and fluctuating currency exchange rates often pose hurdles for international suppliers, favoring local or regionally established producers capable of managing complex supply chain dynamics. Investment in agriculture is also growing, driving demand for magnesium inputs, though overall consumption remains smaller compared to infrastructure-heavy markets.

- Middle East and Africa (MEA): The MEA market is niche but highly focused. Demand is minimal for de-icing; instead, consumption is concentrated in the Oil & Gas sector (drilling fluids) and specialized industrial chemical processes, particularly in the UAE and Saudi Arabia. The region also utilizes hexahydrate flakes in dust suppression for large infrastructure projects and military installations, particularly in desert environments. Localized production is limited, making the region heavily reliant on imports, often sourced from Asian or European suppliers. The requirement for high-specification products in the energy sector drives premium pricing, while overall market volume remains comparatively low but stable, directly linked to energy sector investment cycles and government-led infrastructure initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnesium Chloride Hexahydrate Flakes Market.- Compass Minerals

- Nedmag B.V.

- K+S Aktiengesellschaft

- Russian Salt Company (Rusol)

- Shouguang Chemical Industry

- Baymag Inc.

- ICL Group Ltd.

- Israel Chemicals Ltd.

- Konoshima Chemical Co. Ltd.

- Nikochem

- Zibo Huaxiang Chemical

- Sachtleben Chemie GmbH

- Weifang Huize Chemical

- Sinochem Group

- Dalian Zhongmin

- Huihai Chemical

- Houhu Chemical

- Tianjin Ruian Chemical

- Qingdao Ruisong

- Jining Green Chemical

Frequently Asked Questions

Analyze common user questions about the Magnesium Chloride Hexahydrate Flakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the Magnesium Chloride Hexahydrate Flakes market?

The primary applications driving market growth are road de-icing and anti-icing, particularly in North America and Europe, due to its low freezing point and reduced corrosive impact compared to rock salt. Furthermore, robust demand for dust suppression in the global mining and construction industries significantly contributes to volume growth, especially in emerging markets where environmental regulations are tightening. Agricultural applications, utilizing the flakes as a magnesium fertilizer source, also provide consistent, non-seasonal demand.

How does Magnesium Chloride Hexahydrate compare to Calcium Chloride and Sodium Chloride for de-icing?

Magnesium Chloride Hexahydrate is generally preferred because it is effective at significantly lower temperatures (down to -15°F or -26°C) than sodium chloride (rock salt), and it is less corrosive to metal infrastructure and concrete than calcium chloride. While calcium chloride has the lowest effective temperature, magnesium chloride offers a better balance of performance, environmental impact, and cost-effectiveness for most municipal road maintenance programs, making it a critical component of blend solutions.

Which regions hold the largest market share, and which region is expected to grow the fastest?

North America currently holds the largest market share due to its established infrastructure for winter road maintenance and high seasonal consumption. Europe follows closely behind, driven by stringent safety regulations. However, the Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR), fueled by increasing infrastructure investment, rapid industrialization, and escalating demand for effective dust suppression solutions in large-scale mining and construction activities across countries like China and Australia.

What technological advancements are influencing the production efficiency of Magnesium Chloride Hexahydrate Flakes?

Technological advancements are focused on improving resource efficiency and product purity. Key areas include the adoption of energy-efficient mechanical evaporation systems (like MVR) to replace traditional thermal methods, advanced continuous crystallization techniques to ensure uniform flake size and high purity (essential for pharmaceutical grades), and the implementation of IIoT sensors and data analytics for real-time monitoring of brine concentration and overall process optimization, minimizing waste and energy expenditure.

What are the main supply chain challenges faced by manufacturers in this market?

The primary supply chain challenges involve managing the significant seasonal volatility of demand, which requires substantial investment in non-peak season storage and inventory management. Manufacturers must also navigate the logistical complexities and high costs associated with transporting a high-volume, relatively low-value product over long distances. Securing reliable, high-quality brine sources, which form the core raw material, is also a continuous upstream challenge subject to environmental and geopolitical factors impacting salt lake and seawater resource availability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager