Magnesium Hydroxide Flame Retardants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433780 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Magnesium Hydroxide Flame Retardants Market Size

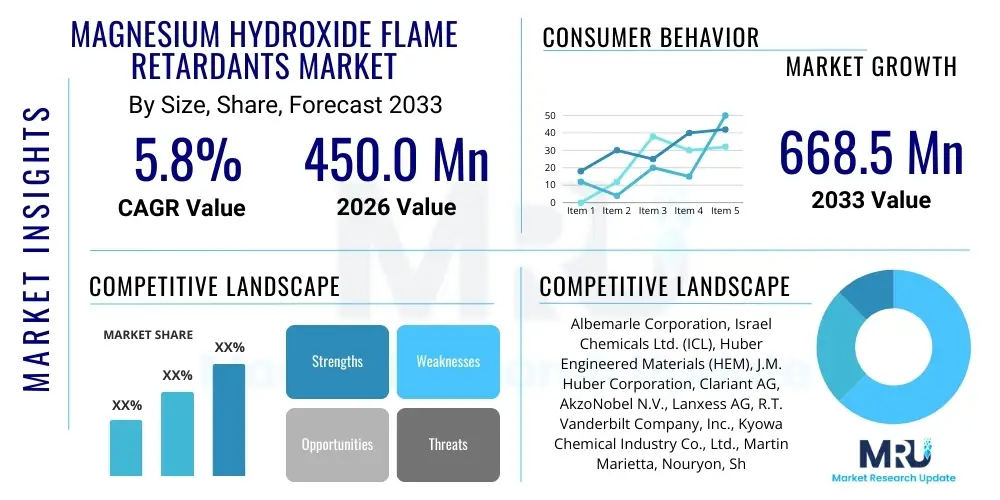

The Magnesium Hydroxide Flame Retardants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 668.5 Million by the end of the forecast period in 2033.

Magnesium Hydroxide Flame Retardants Market introduction

The Magnesium Hydroxide Flame Retardants (MDFR) market encompasses specialty chemical additives utilized primarily to suppress or inhibit combustion in various polymeric materials. Magnesium hydroxide (Mg(OH)2) functions as a non-halogenated, environment-friendly flame retardant, operating through an endothermic decomposition process. When exposed to heat, Mg(OH)2 releases water vapor, cooling the substrate material and diluting combustible gases, simultaneously forming a protective magnesium oxide char layer on the surface. This unique mechanism positions it as a preferred alternative to traditional halogenated flame retardants, which are increasingly restricted globally due to environmental toxicity concerns and smoke generation during combustion.

Product description highlights the material’s key attributes, including its high decomposition temperature (around 340°C), making it suitable for engineering plastics and polymers processed at higher temperatures, such as polyamides and polypropylene. The effectiveness of MDFR is often enhanced through surface treatment using coupling agents (like silanes or stearates) to improve compatibility and dispersion within the polymer matrix, thereby maintaining mechanical properties. The rising global focus on sustainability and stringent fire safety regulations, particularly concerning low smoke density and low toxicity, are the principal driving forces accelerating the adoption of magnesium hydroxide across critical industrial sectors.

Major applications of MDFR span across critical infrastructure and high-performance sectors. It is extensively used in wire and cable jacketing, where low smoke zero halogen (LSZH) requirements are mandatory, ensuring safety in confined spaces like tunnels, trains, and data centers. Other vital applications include construction materials (roofing, insulation), electronics and electrical components (switchgear, connectors), and transportation (automotive parts, aerospace interiors). The inherent benefits—such as thermal stability, minimal smoke generation, and favorable environmental profile—establish magnesium hydroxide as an indispensable component in modern fire safety solutions, cementing its market trajectory as regulatory compliance becomes paramount worldwide.

Magnesium Hydroxide Flame Retardants Market Executive Summary

The Magnesium Hydroxide Flame Retardants market is experiencing robust growth fueled by the pervasive shift towards non-halogenated chemistries mandated by global regulatory bodies such as the European Union’s Restriction of Hazardous Substances (RoHS) Directive and REACH regulation, alongside similar frameworks in North America and Asia Pacific. Business trends indicate significant investment in specialized surface treatment technologies to improve the dispersibility and loading levels of Mg(OH)2 in high-density polymer compounds without compromising mechanical performance. Furthermore, strategic collaborations between raw material suppliers and compounders are crucial for developing customized solutions tailored for demanding applications, particularly in the electric vehicle (EV) battery housing and high-voltage cable insulation segments, representing key commercial opportunities and diversification strategies for market participants.

Regional trends are dominated by the Asia Pacific (APAC) region, which commands the largest market share due to burgeoning infrastructure development, rapid urbanization, and escalating demand from the region’s massive electronics manufacturing and construction industries, especially in China and India. However, Europe and North America demonstrate the highest maturity and standardization regarding fire safety protocols, driving premium demand for high-purity, treated grades of magnesium hydroxide. The trend in these mature markets leans heavily towards substituting traditional antimony trioxide and brominated flame retardants entirely, solidifying the market position of eco-friendly additives. Emerging economies in Latin America and MEA are slowly adopting similar standards, presenting medium to long-term growth prospects as local building codes modernize.

Segment trends underscore the dominance of the Wire & Cables application segment, which necessitates fire safety compliance to ensure operational continuity and human safety, thereby consuming the largest volume of MDFR. In terms of product segmentation, surface-treated grades are witnessing faster growth than standard grades, primarily because surface modification enhances polymer compatibility, enabling higher filler loading and achieving superior flame retardancy while minimizing impact on the final product’s tensile strength and flexibility. This technological evolution within segmentation highlights the market's trajectory towards performance-driven specifications and high-value materials designed for specialized, stringent regulatory environments.

AI Impact Analysis on Magnesium Hydroxide Flame Retardants Market

Common user questions regarding AI’s influence typically center around optimization of synthesis processes, prediction of compound performance, and efficiency in regulatory compliance reporting. Users are seeking clarification on how predictive modeling tools based on machine learning (ML) can accelerate the discovery and formulation of new composite materials utilizing Mg(OH)2, particularly concerning optimized particle size distribution and effective surface treatments that maximize efficiency at lower loading levels. Concerns often revolve around the initial investment required for AI infrastructure and the availability of specialized data scientists knowledgeable in material science. The consensus expectation is that AI will primarily streamline R&D cycles, automate quality control, and enhance supply chain resilience by forecasting demand fluctuations and optimizing inventory management for essential raw materials.

- AI-driven optimization of magnesium hydroxide particle synthesis parameters to enhance specific surface area and decomposition kinetics.

- Machine learning algorithms applied to predict the fire performance (e.g., Limiting Oxygen Index, Heat Release Rate) of polymer-MDFR composites, reducing reliance on extensive physical testing.

- Enhanced supply chain management and logistics planning, utilizing AI for demand forecasting for high-purity flame retardants in construction and electronics sectors.

- Automated quality control systems in manufacturing, leveraging computer vision and ML for defect detection and ensuring consistent particle morphology.

- Development of digital twins for complex compounding processes, allowing simulations of extrusion and molding conditions to optimize MDFR dispersion and reduce waste.

DRO & Impact Forces Of Magnesium Hydroxide Flame Retardants Market

The Magnesium Hydroxide Flame Retardants market is strategically positioned to capitalize on powerful macro-environmental drivers, though it faces structural restraints related to material properties. The primary driver is the accelerating stringency of global fire safety standards, especially the legislative push toward halogen-free, low-smoke, and low-toxicity materials in sectors like aerospace, railway, and essential public infrastructure. This mandatory regulatory compliance, notably in developed markets like Europe and increasingly across APAC, provides an undeniable, long-term foundational impetus for the shift away from conventional brominated compounds, thereby promoting the adoption of environmentally benign alternatives like Mg(OH)2. Concurrently, the robust growth in end-use industries, particularly the unprecedented expansion in the electric vehicle (EV) sector requiring specialized thermal and fire protection for batteries and high-voltage cabling, further amplifies market demand.

Despite strong regulatory tailwinds, the market faces significant restraints inherent to the material itself. Magnesium hydroxide typically needs to be incorporated at high loading levels (up to 60-70% by weight) to achieve effective flame retardancy in polymers. This high loading often leads to a discernible deterioration in the mechanical properties—such as tensile strength, elongation at break, and processability—of the final polymer compound, posing a critical challenge for high-performance applications. Furthermore, although Mg(OH)2 is cost-competitive compared to some other mineral retardants, the cost associated with necessary advanced surface treatment technologies (e.g., silane treatment) to mitigate the adverse mechanical effects can elevate the overall formulation cost, potentially limiting its adoption in lower-margin commodity plastics where cost sensitivity is higher.

Opportunities for market expansion are centered around innovation and geographical penetration. Developing novel nanofillers and synergists (like zinc borate or red phosphorus derivatives) that allow lower loading levels of Mg(OH)2 while maintaining high efficiency represents a major area for technological breakthroughs and competitive advantage. Geographically, untapped potential resides in emerging economies within Southeast Asia and Latin America, where rapid industrialization and subsequent regulatory maturation will inevitably lead to the phased adoption of non-halogenated standards in construction and consumer electronics, mirroring the trajectory of established Western markets. The impact forces are currently weighted heavily towards drivers and opportunities, particularly as regulatory pressure continues to intensify the necessity for safe, sustainable, and high-performance flame retardant solutions globally.

Segmentation Analysis

The Magnesium Hydroxide Flame Retardants market is broadly segmented based on application, grade, and form, reflecting the diverse requirements of end-use industries ranging from specialized electronics to high-volume construction materials. This segmentation is crucial for market stakeholders to understand product differentiation and target specific regulatory niches. The dominant segmentation factor is the application, driven by the varying fire safety codes and performance specifications required for materials used in different environments, such as the mandatory Low Smoke Zero Halogen (LSZH) standards for cables versus the thermal stability required for high-temperature engineering plastics used in automotive components.

Segmentation by grade—standard versus surface-treated—is equally significant, highlighting the technological evolution within the market. Standard grades are typically used in applications where high loading is acceptable and mechanical property retention is less critical. Conversely, surface-treated grades, which undergo modification to improve hydrophobicity and polymer compatibility, command a premium due to their necessity in applications requiring maximum mechanical integrity and superior processing characteristics, such as precision injection molding parts or thin-walled components for electrical appliances. This technical differentiation reflects the industry’s ongoing effort to overcome the inherent limitations of mineral fillers.

Further analysis of segmentation reveals that geographic market dynamics heavily influence the preferred form (powder versus slurry). Powder is the most common form, utilized by compounders globally. However, slurries, which offer better handling, dosing accuracy, and reduced dusting issues, are gaining traction, especially in highly automated manufacturing processes common in developed markets. The continuous refinement of these segment offerings ensures that magnesium hydroxide remains versatile and adaptable to the evolving performance criteria mandated by sophisticated industrial buyers worldwide.

- By Application

- Wire & Cables

- Construction

- Electronics & Electrical (E&E)

- Transportation (Automotive, Aerospace)

- Coatings & Paints

- Others (Textiles, Adhesives)

- By Grade

- Standard Grade

- Surface Treated Grade (Silane, Stearate)

- By Form

- Powder

- Slurry

Value Chain Analysis For Magnesium Hydroxide Flame Retardants Market

The value chain for the Magnesium Hydroxide Flame Retardants market is characterized by several sequential stages, beginning with the extraction and beneficiation of raw materials, primarily magnesite or dolomite. Upstream analysis involves high-purity sourcing of raw materials, followed by complex precipitation or synthesis processes to create the high-quality Mg(OH)2 powder suitable for fire retardancy applications. Key challenges at this stage include ensuring consistent particle size, narrow distribution, and maximizing purity, as minor impurities can negatively affect the additive's performance and the final polymer's characteristics. Large chemical manufacturers and specialized mineral processing companies dominate this crucial initial phase, leveraging economies of scale and sophisticated chemical engineering techniques.

The mid-stream segment encompasses the critical value-addition step of surface treatment and compounding. Surface treatment, often involving silanes, titanates, or stearic acid derivatives, is applied to the raw Mg(OH)2 powder to render it organophilic, significantly improving its compatibility with hydrophobic polymers like polyethylene or polypropylene. This enhancement reduces viscosity increase and helps retain the mechanical integrity of the final polymer composite, a vital requirement for high-end applications. Specialized compounders and masterbatch producers purchase the treated or untreated powder, blending it with polymers and other synergists (such as zinc borate or smoke suppressants) to create ready-to-use flame retardant compounds that meet specific industry standards (e.g., UL 94 V-0 or IEC 60332).

The downstream distribution channel involves both direct and indirect sales pathways. High-volume buyers, particularly major wire and cable manufacturers and large-scale construction material producers, often engage in direct procurement agreements with primary chemical manufacturers or their authorized global distributors for bulk powders and compounded pellets. Indirect channels involve regional specialty chemical distributors and agents who cater to smaller batch requirements, providing technical support and localized inventory management for custom formulations required by smaller processors in the Electronics & Electrical sector. The efficiency and technical capability of the distribution network are critical, as timely delivery and adherence to stringent quality specifications are prerequisites for the construction and transportation industries.

Magnesium Hydroxide Flame Retardants Market Potential Customers

Potential customers for Magnesium Hydroxide Flame Retardants are primarily industrial entities operating within sectors governed by strict fire safety and environmental regulations, encompassing both end-product manufacturers and intermediate material compounders. The largest buyer segment comprises polymer compounders and masterbatch producers, which function as essential intermediaries. These companies purchase Mg(OH)2 in bulk, formulate it into custom pellets or compounds tailored to specific melt flow indices and mechanical properties, and then supply these compounded materials to final manufacturers. Their role is critical as they integrate the flame retardant seamlessly into various polymer matrices, ensuring compliance with standards such as NFPA, ASTM, and specific regional codes required by the ultimate end-users.

Direct end-users constitute the second major category of customers, heavily concentrated in infrastructure-related industries. This group includes manufacturers of electrical wire and cable (for energy, data, and telecommunications), producers of rigid and flexible PVC and polyolefin sheets used in construction insulation and roofing membranes, and companies specializing in electronic component encapsulation (e.g., circuit breaker housings, connectors). For these customers, the non-halogenated, low-smoke properties of Mg(OH)2 are not merely advantageous but are mandatory purchasing criteria driven by public safety and environmental responsibility policies implemented globally, especially in enclosed environments like mass transit systems or high-rise commercial buildings.

Furthermore, the automotive and aerospace industries represent high-value, high-specification customers for magnesium hydroxide. Within the transportation sector, manufacturers utilize MDFR in interior components, under-the-hood applications, and increasingly in battery packs for electric vehicles to mitigate thermal runaway risks, demanding specialized, high-purity, and thermally stable grades. The purchasing decision in these sectors is heavily influenced by quality certifications, consistency of supply, and the additive’s proven effectiveness in complex, stress-bearing polymer systems, demonstrating a clear preference for surface-treated and synergistic formulations that offer optimal performance without sacrificing lightweighting objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 668.5 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, Israel Chemicals Ltd. (ICL), Huber Engineered Materials (HEM), J.M. Huber Corporation, Clariant AG, AkzoNobel N.V., Lanxess AG, R.T. Vanderbilt Company, Inc., Kyowa Chemical Industry Co., Ltd., Martin Marietta, Nouryon, Shandong Dongfang Flame Retardant Technology Co., Ltd., Qingdao Jiahua Plastics Co., Ltd., Wego Chemical Group, Euroquartex, Konoshima Chemical Co., Ltd., Kisuma Chemicals, Jiangsu Jingye Chemical Co., Ltd., Xinyang Chemical Group, Zibo Microchem Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnesium Hydroxide Flame Retardants Market Key Technology Landscape

The technological landscape of the Magnesium Hydroxide Flame Retardants market is focused intensively on overcoming the material’s major limitation: the requirement for high loading levels, which typically compromise the mechanical integrity and processing characteristics of polymer compounds. A key technological advancement involves synthesizing ultra-fine or nano-sized magnesium hydroxide particles. Reducing particle size significantly increases the surface area, thereby boosting flame retardancy efficiency at lower incorporation ratios. However, nano-sized particles introduce challenges related to agglomeration and dispersion, necessitating highly advanced milling and homogenization techniques during manufacturing to maintain optimal performance and prevent detrimental effects on polymer flow properties during extrusion or injection molding.

Another pivotal technological area is advanced surface modification chemistry. The industry increasingly relies on sophisticated coupling agents, such as specialized silanes, titanates, and zirconates, tailored specifically for high-performance engineering plastics. These treatments create a chemical bridge between the inorganic Mg(OH)2 filler and the organic polymer matrix, improving interfacial adhesion, which is paramount for maintaining mechanical properties (e.g., impact strength, flexural modulus) even when filler content is high. Continuous research in polymerization techniques focuses on developing reactive surface treatments that chemically graft onto the Mg(OH)2 surface, leading to superior thermal stability and moisture resistance crucial for long-term product durability in demanding applications like underground cables and exterior building materials.

Furthermore, the development of synergistic formulations represents a major focus in the technological landscape. Magnesium hydroxide is increasingly used in combination with other performance-enhancing additives to achieve superior fire resistance profiles. Common synergists include zinc borate, red phosphorus compounds, or expandable graphite. These combinations allow compounders to achieve stringent fire ratings (such as V-0 ratings under UL 94) more efficiently and often at a reduced overall mineral loading level, balancing cost and performance. Integrating these synergists often requires precise compounding equipment, such as twin-screw extruders with specialized mixing zones, ensuring homogeneous dispersion of all components within the polymer matrix while preventing premature degradation of heat-sensitive synergists.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by massive infrastructure investments, especially in China, India, and Southeast Asian nations. The region’s dominance stems from its large manufacturing base for electronics, white goods, and wire & cables. While historically reliant on conventional flame retardants, increasingly stringent localized versions of international standards (e.g., focusing on LSZH cables in public transport and high-rise buildings) are rapidly accelerating the shift to magnesium hydroxide.

- Europe: Europe is characterized by regulatory maturity, being a pioneering region for environmental safety and non-halogenated standards, specifically through REACH and RoHS directives. Demand here is high for specialized, surface-treated, high-purity grades of Mg(OH)2 for use in premium automotive interiors, complex building insulation, and railway rolling stock, where fire safety specifications are exceptionally demanding.

- North America: The North American market is strongly influenced by fire safety codes set by organizations like the National Fire Protection Association (NFPA) and Underwriters Laboratories (UL). Growth is steady, particularly in the construction sector and the burgeoning electric vehicle market, where Mg(OH)2 is critical for battery fire management and protection of high-voltage wiring harnesses.

- Latin America (LATAM): LATAM represents an emerging market with significant growth potential, although current adoption is moderate. The market is slowly transitioning towards modern fire standards, spurred by international investment in infrastructure projects and the modernization of building codes in key economies like Brazil and Mexico.

- Middle East and Africa (MEA): Demand in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, fueled by large-scale commercial and residential construction projects and the associated mandatory safety regulations. The extreme climate conditions also drive demand for thermally stable and durable polymer compounds utilizing advanced magnesium hydroxide formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnesium Hydroxide Flame Retardants Market.- Albemarle Corporation

- Israel Chemicals Ltd. (ICL)

- Huber Engineered Materials (HEM)

- J.M. Huber Corporation

- Clariant AG

- AkzoNobel N.V.

- Lanxess AG

- R.T. Vanderbilt Company, Inc.

- Kyowa Chemical Industry Co., Ltd.

- Martin Marietta

- Nouryon

- Shandong Dongfang Flame Retardant Technology Co., Ltd.

- Qingdao Jiahua Plastics Co., Ltd.

- Wego Chemical Group

- Euroquartex

- Konoshima Chemical Co., Ltd.

- Kisuma Chemicals

- Jiangsu Jingye Chemical Co., Ltd.

- Xinyang Chemical Group

- Zibo Microchem Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Magnesium Hydroxide Flame Retardants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism by which magnesium hydroxide acts as a flame retardant?

Magnesium hydroxide functions via an endothermic decomposition process. Upon heating above 340°C, it decomposes into magnesium oxide and water vapor. This process absorbs significant heat (cooling the polymer) and the release of water vapor dilutes combustible gases, effectively suppressing the flame and reducing smoke generation.

Why is the market shifting from halogenated to magnesium hydroxide flame retardants?

The shift is driven by rigorous global environmental regulations (like RoHS and REACH) that restrict the use of halogenated compounds due to their potential to release toxic and corrosive smoke (dioxins/furans) upon combustion. Magnesium hydroxide offers a non-halogenated, low-smoke, and low-toxicity alternative, fulfilling modern sustainability and safety requirements, particularly in confined spaces.

What are the main challenges associated with using magnesium hydroxide in polymers?

The primary challenge is the necessity for high loading levels (often exceeding 50% weight) to achieve effective flame retardancy. This high inclusion rate can negatively impact the final polymer's mechanical properties, such as tensile strength and elongation, and may complicate polymer processing, requiring specialized surface treatments and compounding techniques.

Which application segment holds the largest share in the Magnesium Hydroxide Flame Retardants market?

The Wire & Cables segment currently dominates the market share. This is primarily due to the mandatory requirement for Low Smoke Zero Halogen (LSZH) cables in construction, transportation (rail, metro), and telecommunications infrastructure, where public safety mandates the minimization of toxic smoke release during a fire event.

How do surface-treated grades of magnesium hydroxide differ from standard grades?

Surface-treated grades are coated with coupling agents (like silanes or stearates) to improve their compatibility and dispersion within hydrophobic polymer matrices. This treatment is crucial for enhancing the filler’s adhesion, allowing for high loading without severely compromising the polymer's critical mechanical properties, making them suitable for high-performance and high-end applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Magnesium Hydroxide Flame Retardants Market Size Report By Type (Chemical Synthesis, Physical Smash), By Application (PVC, PE, Engineering Thermoplastics, Rubber, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Magnesium Hydroxide Market Statistics 2025 Analysis By Application (Environmental Protection Industry, Flame Retardant Industry, Pharmaceutical Industry), By Type (Chemical Synthesis Method, Physical Method, Chemical synthesis accounted for a major share of 56% the global magnesium hydroxide flame retardants market.), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager