Magnetic and Optical Media Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432372 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Magnetic and Optical Media Market Size

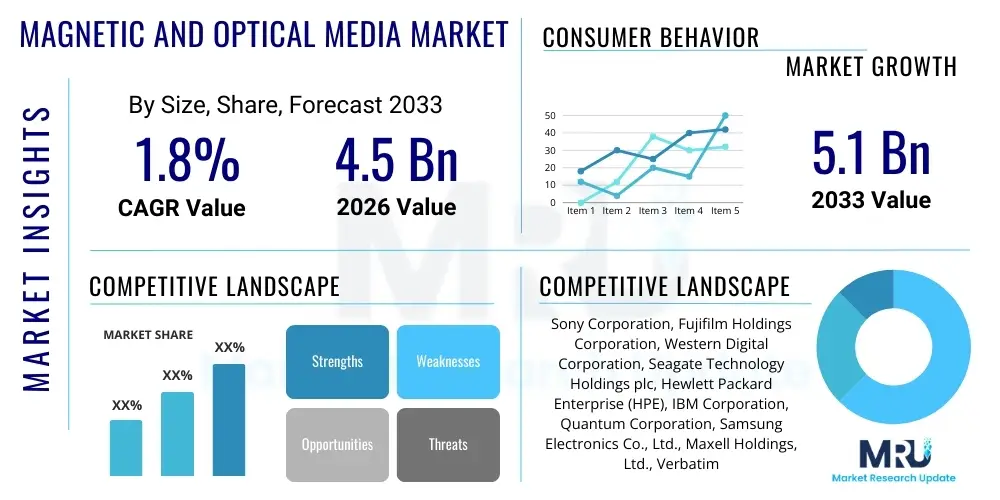

The Magnetic and Optical Media Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 5.1 billion by the end of the forecast period in 2033.

Magnetic and Optical Media Market introduction

The Magnetic and Optical Media Market encompasses devices and consumables utilizing magnetic fields or laser light for data storage and retrieval. This mature market segment includes essential technologies like Linear Tape-Open (LTO) media, hard disk drives (HDDs), and various forms of optical discs such as Blu-ray, DVDs, and CDs. While consumer demand for optical and low-capacity magnetic media has declined due to the proliferation of solid-state drives (SSDs) and cloud storage, the market maintains significant resilience driven by specialized applications, particularly long-term data archiving, regulatory compliance requirements, and cost-effective cold storage solutions in hyperscale data centers. The enduring viability of magnetic tape technology, characterized by its high density, long shelf life, and low operational energy consumption, acts as a primary stabilizer for overall market revenue, particularly within enterprise backup strategies and large-scale digital preservation projects globally.

Product descriptions within this market vary significantly, ranging from highly durable, sequential access media designed for secure, offline archival (LTO Ultrium tapes) to high-speed, random access magnetic media used in traditional computing infrastructure (HDDs). Optical media serves niche sectors requiring physical distribution of large datasets or high-definition content, such as cinematic releases or certain medical imaging records. The fundamental benefit provided by these media types is the provision of affordable, high-capacity storage solutions that offer inherent data security due to their offline nature (air-gapping) or robustness in large-scale sequential data management. This intrinsic security and scalability make them irreplaceable components in a diversified data management ecosystem, even amid intense competition from emerging technologies. Furthermore, advancements in areal density within both HDD and magnetic tape categories continue to push capacity boundaries, ensuring their cost-per-terabyte remains highly competitive.

Major applications of magnetic and optical media center around large-scale enterprise data archiving, disaster recovery planning, regulatory mandated data retention (especially in finance and healthcare sectors), and professional media distribution. Driving factors include the exponential growth in unstructured data generated globally—often referred to as 'big data'—which necessitates tiered storage architectures, where magnetic tape frequently occupies the lowest, most cost-effective tier (cold storage). Additionally, rising concerns over cybersecurity and ransomware attacks have significantly increased the adoption of air-gapped storage solutions provided by magnetic tape, reinforcing its role as a crucial component in comprehensive data protection strategies. While the consumer segment continues to shrink, the high-volume, high-capacity enterprise and hyperscaler demands counterbalance this decline, sustaining steady, albeit moderate, market growth.

- Product Description: Storage media utilizing magnetic fields (tape, HDDs) or lasers (optical discs) for non-volatile data storage.

- Major Applications: Long-term data archiving, disaster recovery, regulatory compliance, large-scale cold storage, and content distribution.

- Key Benefits: High capacity, low cost per terabyte, long shelf life, air-gapped security, and low energy consumption during idle periods.

- Driving Factors: Exponential data growth, need for cost-effective cold storage, and rising demand for air-gapped security against cyber threats.

Magnetic and Optical Media Market Executive Summary

The Magnetic and Optical Media Market exhibits stable business trends primarily anchored by enterprise demand for high-capacity magnetic tape systems and niche applications for high-density HDDs, despite the long-term structural decline in consumer optical media usage. Key business dynamics include strategic partnerships between tape drive manufacturers and cloud service providers to offer hybrid storage solutions integrating cloud infrastructure with local magnetic archival capabilities. Investment is concentrated on enhancing areal density and reliability across the LTO roadmap, ensuring continued relevance in the exabyte-scale data environment. Companies are also focusing on optimizing the total cost of ownership (TCO) for data centers, where the energy efficiency of tape storage provides a substantial operational advantage over disk-based alternatives for infrequently accessed data.

Regionally, the market is led by North America and Asia Pacific. North America, driven by the presence of major hyperscale cloud providers and strict regulatory data retention mandates (e.g., HIPAA, FINRA), represents the largest consumption hub, particularly for enterprise tape libraries. Asia Pacific is experiencing accelerated growth, fueled by rapid digitization, burgeoning data center construction in economies like China and India, and increased governmental investment in national digital archives. European markets maintain steady demand, strongly influenced by compliance with regulations such as GDPR, which necessitate robust, long-term archival solutions ensuring data integrity and accessibility over extended periods. Regional strategies are centered on localized distribution networks capable of handling sensitive media logistics and providing specialized archival services.

Segmentation trends highlight the dominance of the Magnetic Tape segment, specifically LTO technology, in terms of revenue stability and strategic importance. While HDDs still command a significant portion of the total market value due to their integration into computing devices and active storage tiers, magnetic tape captures the high-growth niche of cold and deep archival storage. Within applications, the Data Storage and Archiving segment is overwhelmingly the major consumer, far outpacing the shrinking Entertainment and Consumer Electronics segments. Technological focus within the segmentation is pivoting towards ultra-high-capacity tapes (LTO-9 and upcoming LTO generations) and specialized high-density HDDs utilizing technologies like Shingled Magnetic Recording (SMR) or Heat Assisted Magnetic Recording (HAMR) to maximize storage density for enterprise applications, thereby maximizing the efficiency of tiered storage architectures.

- Business Trends: Increased focus on TCO optimization, strong enterprise reliance on LTO tape for archival, and integration of magnetic media solutions with cloud infrastructure.

- Regional Trends: North America leads due to hyperscale demand and regulation; Asia Pacific shows the fastest growth driven by data center expansion and digitization initiatives.

- Segment Trends: Dominance of Magnetic Tape (LTO) for cold storage; Data Storage & Archiving remains the primary application sector driving demand and investment.

AI Impact Analysis on Magnetic and Optical Media Market

Common user questions regarding AI's impact on this market typically revolve around whether machine learning (ML) algorithms can render traditional, non-smart storage obsolete, or if AI's massive data requirements actually represent a future growth driver. Users frequently ask about AI's role in optimizing data retrieval from large tape archives and improving the efficiency of data tiering. Analysis of these concerns reveals two primary themes: displacement risk and enhancement opportunity. While AI-driven optimization of storage infrastructure can potentially reduce redundancy and inefficiently stored data, thus lowering the overall required storage volume in some active tiers, the sheer volume of data required to train and maintain advanced AI models, particularly large language models (LLMs) and complex simulations, necessitates unprecedented levels of archival storage. This requirement solidifies magnetic tape's position as the most cost-effective and scalable medium for storing petabytes and exabytes of raw, historical, and training data necessary for AI development.

The most immediate and positive impact of AI lies in enhancing the management and accessibility of archival media. AI algorithms are increasingly employed in sophisticated storage management software to predict access patterns, automatically classify data sensitivity, and optimize the movement of data between hot, warm, and cold storage tiers (including magnetic tape libraries). Furthermore, AI can significantly improve data indexing and retrieval processes within massive tape archives, solving the historical challenge of slow data access inherent to sequential media. By using metadata analysis and context recognition, AI can pinpoint the exact physical location of required data on a large reel, reducing seek times and accelerating the time-to-data, thereby increasing the practical utility of cold storage systems in a data-intensive AI ecosystem.

Conversely, the indirect impact of AI on the optical and consumer magnetic media sectors is largely disruptive. The rise of AI-powered streaming optimization and content delivery networks (CDNs) further diminishes the need for physical media distribution (DVDs, CDs, Blu-rays). However, for professional applications like long-term archival of high-resolution video footage or scientific datasets, where immutability and long-term offline retention are paramount, AI enhances the compliance and indexing processes. The net effect is a highly bifurcated market: AI accelerates the obsolescence of low-capacity, consumer-focused products while simultaneously creating unprecedented demand for ultra-high-capacity, offline magnetic storage tailored for deep learning datasets and historical records necessary for training future models.

- AI drives exponential data growth, necessitating vast, cost-effective archival storage solutions (Magnetic Tape).

- Implementation of AI/ML algorithms optimizes data tiering, improving efficiency and utilization of cold storage media.

- AI enhances data indexing and retrieval speed in large tape libraries by analyzing metadata and predicting access patterns.

- Accelerated decline of consumer optical media market due to AI-optimized streaming and digital distribution platforms.

- Increased demand for robust, air-gapped magnetic media for storing critical AI training data and long-term regulatory compliance data sets.

DRO & Impact Forces Of Magnetic and Optical Media Market

The market is primarily driven by the unstoppable surge in global data generation, particularly unstructured data (Driver). Data center operators and hyperscale cloud providers are perpetually seeking the lowest cost-per-terabyte solution for data that must be retained but is infrequently accessed, a requirement perfectly met by modern magnetic tape technology. Regulatory compliance mandates, such as those related to data retention in finance, healthcare, and government sectors, further compel organizations to invest in reliable, long-term archival solutions. Technological advancements in magnetic media, specifically the continuous increase in capacity density (e.g., LTO-9 and LTO-10 roadmaps) and the introduction of advanced recording technologies like HAMR in HDDs, maintain the technological competitiveness of this segment against emerging alternatives.

Significant restraints impede higher growth, most notably the pervasive market shift towards cloud computing and solid-state storage technologies (Restraint). The inherent sequential access nature of magnetic tape imposes latency in retrieval compared to disk and flash storage, making it unsuitable for active or 'hot' data tiers. The high initial capital expenditure (CapEx) required for installing and managing large-scale tape library infrastructure, including robotic handlers and specialized drives, can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, consumer obsolescence of optical media, driven by digital downloads and streaming services, continues to suppress volumes in that segment. These factors necessitate continuous innovation in access speed and system integration to maintain market viability.

Opportunities for expansion lie predominantly in expanding cold storage integration with hybrid cloud environments and addressing the escalating threat of cybercrime (Opportunity). Magnetic tape offers a fundamental, physical 'air-gap' protection against ransomware, positioning it as an integral component of resilient cybersecurity and disaster recovery planning. The growing demand for 'digital preservation' by national libraries, archives, and scientific research institutions also provides a stable, high-value niche market. Key impact forces, namely substitution threats from SSDs and emerging memory technologies, require the magnetic media sector to continually enhance capacity and cost efficiency, thus focusing competition primarily on the TCO metric for cold storage. This dynamic ensures that while the competitive pressure is high, the established cost advantage of magnetic tape in specific archival applications remains a powerful, sustained impact force.

Segmentation Analysis

The Magnetic and Optical Media Market is segmented based on Media Type, Application, and End-User. This structure provides a granular view of market dynamics, revealing that the strategic value is shifting away from generalized consumer use towards highly specific, high-capacity enterprise applications. The performance of each segment is heavily dependent on the current stage of data center infrastructure development and enterprise investment cycles. The analysis confirms the structural stability provided by magnetic tape in the archival sector, contrasting with the structural decline observed in consumer-facing optical products.

Segmentation by Media Type illustrates a dichotomy: magnetic media (especially tape and high-capacity HDDs) dominates the B2B sector, driven by storage capacity and TCO requirements, whereas optical media largely caters to legacy consumer bases and professional content distribution demanding physical immutability. The ongoing LTO roadmap is central to the future valuation of the magnetic tape segment. In terms of Application, Data Storage and Archiving is the undisputed leader, commanding substantial market share due to regulatory demands and the imperative to retain massive historical data sets for AI training and compliance. This segment's growth directly correlates with the global data explosion.

The End-User segmentation reveals that the IT & Telecom and Media & Entertainment sectors are the most significant consumers. IT & Telecom, particularly hyperscale data centers, requires mass storage for cloud services, backups, and cold data. Media & Entertainment relies on these formats for archiving massive volumes of uncompressed raw footage. The diversity of end-users underscores the necessity of tiered storage solutions across multiple industries, confirming that no single storage technology can fulfill all enterprise requirements, thereby securing a continued niche for high-density magnetic media in foundational infrastructure.

- Media Type:

- Magnetic Media (Magnetic Tape, Hard Disk Drives (HDDs))

- Optical Media (Blu-ray Discs, DVDs, CDs, Archival Discs)

- Application:

- Data Storage & Archiving

- Consumer Electronics & Personal Storage

- Broadcasting and Professional Media

- End-User:

- IT & Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Media & Entertainment

- Government and Defense

- Healthcare and Pharmaceuticals

Value Chain Analysis For Magnetic and Optical Media Market

The value chain for magnetic and optical media is characterized by several distinct stages, starting with raw material suppliers and culminating in end-user service delivery. Upstream analysis involves the procurement of highly specialized raw materials, including magnetic particles (barium ferrite for tape), polymer substrates, and precision mechanical components required for drives and cartridges. Manufacturing is a high-precision, capital-intensive process, dominated by a few global players who invest heavily in cleanroom technology and advanced coating techniques to achieve required data densities and reliability. Quality control is paramount in this stage, directly impacting the media's archival life and error rates. Intellectual property related to recording heads and magnetic formulations forms a significant entry barrier.

The downstream component involves the complex distribution of both consumables (tape cartridges, optical discs) and hardware (drives, libraries, archival systems). Distribution channels are bifurcated into direct sales to large enterprise and hyperscale data centers, characterized by long-term contracts and tailored support, and indirect channels relying on IT distributors, value-added resellers (VARs), and system integrators. VARs play a crucial role by packaging the media and drives into complete, integrated storage solutions, often including complex robotics and data management software. For optical media, traditional retail channels, though shrinking, still handle consumer purchases and niche professional distribution services.

Direct sales are critical for establishing strategic relationships with major customers in IT and cloud services, allowing manufacturers to optimize inventory and ensure timely supply of new generation media (e.g., LTO-9). Indirect channels broaden market reach, particularly to regional data centers and smaller enterprises seeking scalable backup solutions. The service component, including data migration, library maintenance, and end-of-life media destruction, is increasingly vital, adding significant value downstream. The high-value element is moving away from the physical media itself toward the comprehensive data management and security services wrapped around the archival infrastructure.

Magnetic and Optical Media Market Potential Customers

Potential customers for magnetic and optical media are highly concentrated within sectors generating and needing to retain massive volumes of data for extended periods. Hyperscale cloud providers represent the largest single customer segment, utilizing magnetic tape extensively for their cold storage services, offering clients a highly cost-effective archival tier below standard HDD storage. These providers require continuous supply of the highest capacity media (LTO) to manage the exabyte scale growth of their users' data, making them crucial drivers of volume and technological advancement in the tape segment.

The second major cohort includes large enterprises across the IT & Telecom and Financial Services (BFSI) sectors. These institutions are obligated by regulatory frameworks (e.g., SOX, GDPR) to maintain years, sometimes decades, of transactional and operational data. They purchase integrated tape libraries for disaster recovery, ensuring business continuity through air-gapped backups that are physically isolated from primary networks, offering a vital defense against cyberattacks and system failures. Furthermore, organizations involved in high-throughput data capture, such as scientific research institutions (astronomy, genomics) and oil and gas exploration, are perpetual consumers of magnetic media due to the sheer volume of sensor data they generate.

A smaller, but high-value customer base exists within the Media & Entertainment and Government/Defense industries. Media companies use magnetic tape for archiving original masters and uncompressed video streams, which require immense capacity and long-term stability. Government entities and national archives rely on both magnetic and specialized archival optical media for cultural preservation, defense intelligence, and maintaining critical citizen data records, valuing the immutability and long lifespan offered by these technologies. These customers prioritize data integrity and physical security over active access speed, aligning perfectly with the core strengths of deep archival solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 5.1 billion |

| Growth Rate | 1.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Fujifilm Holdings Corporation, Western Digital Corporation, Seagate Technology Holdings plc, Hewlett Packard Enterprise (HPE), IBM Corporation, Quantum Corporation, Samsung Electronics Co., Ltd., Maxell Holdings, Ltd., Verbatim GmbH, Moser Baer India Ltd., TDK Corporation, Toshiba Corporation, Pioneer Corporation, Hitachi-LG Data Storage (HLDS), Ritek Corporation, XEROX Corporation, Imation Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnetic and Optical Media Market Key Technology Landscape

The technology landscape for magnetic and optical media is characterized by ongoing innovation focused primarily on increasing areal density and improving data reliability across all formats. In the magnetic sector, the dominant technology is Linear Tape-Open (LTO), which follows a rigorous, collaboratively developed roadmap aimed at doubling capacity with each new generation. The shift from older Metal Particle (MP) formulations to Barium Ferrite (BaFe) magnetic particles has been crucial for achieving higher densities (LTO-7 onwards), enabling the massive capacities seen in LTO-9 and projected for LTO-10 and beyond. This focus ensures magnetic tape maintains its superior cost-per-gigabyte advantage for cold data storage over competing technologies. For Hard Disk Drives (HDDs), the technology thrust involves moving beyond traditional Perpendicular Magnetic Recording (PMR) to more advanced techniques like Shingled Magnetic Recording (SMR) and Energy-Assisted Magnetic Recording (EAMR), including Heat-Assisted Magnetic Recording (HAMR) and Microwave-Assisted Magnetic Recording (MAMR). These advancements are necessary to pack more data onto platters and sustain HDDs' relevance in the nearline and active archival tiers, specifically targeting the high-density requirements of data centers.

In the optical media space, technological innovation is centered around professional archival requirements rather than consumer use. High-density formats such as Blu-ray utilize blue-violet laser technology, enabling significantly greater storage capacity than traditional DVDs. Furthermore, specialized enterprise-grade archival optical systems (such as those offered by companies leveraging proprietary optical technologies) focus on delivering media with guaranteed lifespan exceeding 50 or 100 years, providing unparalleled data stability and immutability. These systems often employ automated library changers similar to tape libraries but designed to handle optical cartridges, creating a niche market for ultra-long-term, non-rewriteable data retention. While R&D investment in consumer optical media has largely stagnated, the professional sector continues to refine multi-layer recording techniques and disc materials to enhance durability against environmental factors.

A significant cross-cutting technological trend is the development of sophisticated storage management software. Modern tape libraries are no longer passive repositories; they integrate seamlessly with virtualization layers, cloud orchestration platforms, and AI-driven data classification engines. Software-defined storage (SDS) solutions are increasingly managing the entire data lifecycle, automatically directing data to the appropriate magnetic or optical medium based on access frequency, retention policy, and cost parameters. This integration transforms magnetic and optical media from simple physical storage components into active participants in a heterogeneous, automated storage infrastructure, ensuring optimal TCO and maximizing operational efficiency across the enterprise data center landscape.

Regional Highlights

The global Magnetic and Optical Media Market exhibits distinct consumption patterns influenced by regional economic development, regulatory environments, and the concentration of hyperscale data centers. North America maintains the leading market position, driven by robust demand from major cloud service providers (CSPs) and the stringent data retention laws in the BFSI and Healthcare sectors. The high volume of R&D and significant investment in next-generation data center construction within the US and Canada solidify this region's importance, particularly for high-end LTO tape systems and high-capacity enterprise HDDs. The regional focus is heavily skewed toward efficiency, automation, and cybersecurity resilience, making air-gapped magnetic tape solutions highly prized for disaster recovery strategies.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This acceleration is fueled by massive governmental and private investment in digital infrastructure across China, India, Japan, and Southeast Asia. Rapid urbanization, increasing internet penetration, and the subsequent explosion in data generated by both consumers and industry are driving the need for scalable storage. While Japan has historically been a key manufacturing hub for optical and magnetic media, the rising demand in emerging economies for local data centers and compliance with data sovereignty regulations necessitate increased localized adoption of magnetic archival solutions. Furthermore, the burgeoning Media & Entertainment sector in countries like India and China contributes significantly to the demand for professional archiving media.

Europe represents a mature market characterized by steady demand, strongly influenced by the General Data Protection Regulation (GDPR). GDPR mandates strict controls over data retention, integrity, and accessibility, reinforcing the need for highly reliable, long-life archival systems. Western European nations, in particular, show strong adoption of tape technology for regulatory compliance and long-term digital heritage preservation. The Middle East and Africa (MEA) and Latin America (LATAM) regions are emerging markets, where demand is currently localized but growing rapidly, spurred by new data center projects and increased digitization efforts. While still reliant on imports of advanced magnetic media, these regions are increasingly prioritizing scalable backup solutions to safeguard critical infrastructure and nascent digital economies.

- North America: Market leader; driven by hyperscale cloud infrastructure, strict regulatory requirements (HIPAA, FINRA), and high adoption of LTO tape for air-gap defense.

- Asia Pacific (APAC): Fastest growing region; propelled by massive data center construction, digital transformation initiatives, and growing indigenous data sovereignty mandates.

- Europe: Stable growth; strongly influenced by GDPR compliance, focusing on long-term data integrity and reliable disaster recovery solutions.

- LATAM & MEA: Emerging markets; increasing demand driven by new data center development and nascent government digitization efforts requiring localized backup strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnetic and Optical Media Market.- Sony Corporation

- Fujifilm Holdings Corporation

- Western Digital Corporation

- Seagate Technology Holdings plc

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Quantum Corporation

- Samsung Electronics Co., Ltd.

- Maxell Holdings, Ltd.

- Verbatim GmbH

- Toshiba Corporation

- TDK Corporation

- Pioneer Corporation

- Hitachi-LG Data Storage (HLDS)

- Ritek Corporation

- Spectra Logic Corporation

- Dell Technologies Inc.

- Oracle Corporation (Storage Products Division)

Frequently Asked Questions

Analyze common user questions about the Magnetic and Optical Media market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the long-term viability of magnetic tape compared to cloud storage?

Magnetic tape remains highly viable for long-term cold storage due to its significantly lower Total Cost of Ownership (TCO) at scale, superior energy efficiency during idle periods, and crucial air-gapped security, making it indispensable for exabyte-scale data archiving and ransomware protection, often complementing, rather than competing directly with, cloud archival tiers.

How does the Magnetic and Optical Media Market address modern cybersecurity threats?

The primary method is through providing air-gapped storage. Magnetic tape cartridges, when ejected from the library (offline), are physically disconnected from the network, creating an immune barrier against ransomware and network-borne cyberattacks, fulfilling the critical requirement for immutable, secure backups in disaster recovery plans.

Are Hard Disk Drives (HDDs) still relevant given the rise of Solid-State Drives (SSDs)?

Yes, HDDs remain highly relevant, particularly in the enterprise market for nearline and archival storage tiers. While SSDs offer speed, HDDs provide a substantially better cost-per-gigabyte for high-capacity, frequently accessed data, especially through technological advancements like HAMR and SMR, ensuring they dominate cold and warm storage infrastructure.

What is driving the current demand for Linear Tape-Open (LTO) media?

Demand for LTO is driven primarily by hyperscale data centers needing to manage the exponential growth of unstructured data efficiently. LTO offers the most economical and scalable solution for cold data archives, supported by mandatory data retention compliance and the need for offline, highly secure backup copies for organizational resilience.

Is there any technological innovation remaining in the optical media segment?

Innovation in optical media is focused on professional archival discs (Archival Grade Blu-ray and proprietary formats) designed for extremely long data lifespans (50+ years) and high immutability. This niche addresses the needs of national archives, scientific data centers, and cultural preservation efforts requiring media stability far exceeding current magnetic and standard digital storage solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager