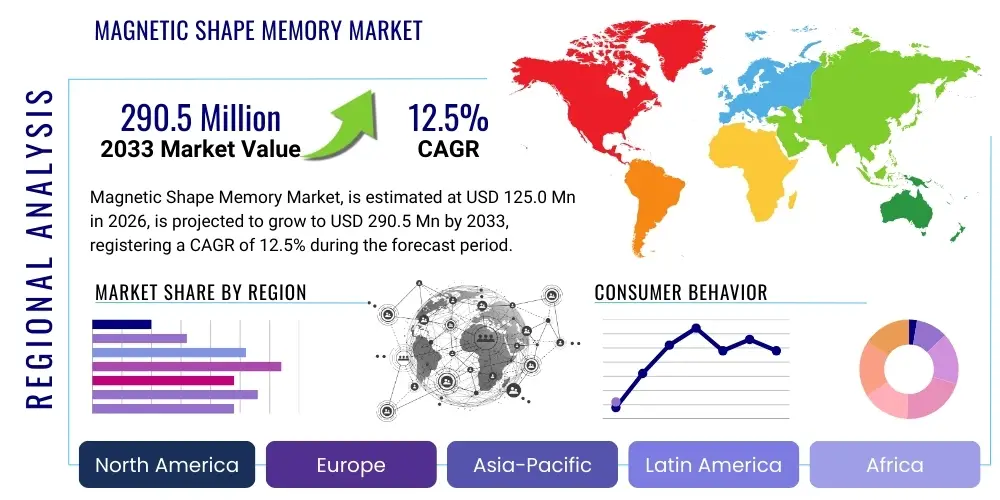

Magnetic Shape Memory Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437506 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Magnetic Shape Memory Market Size

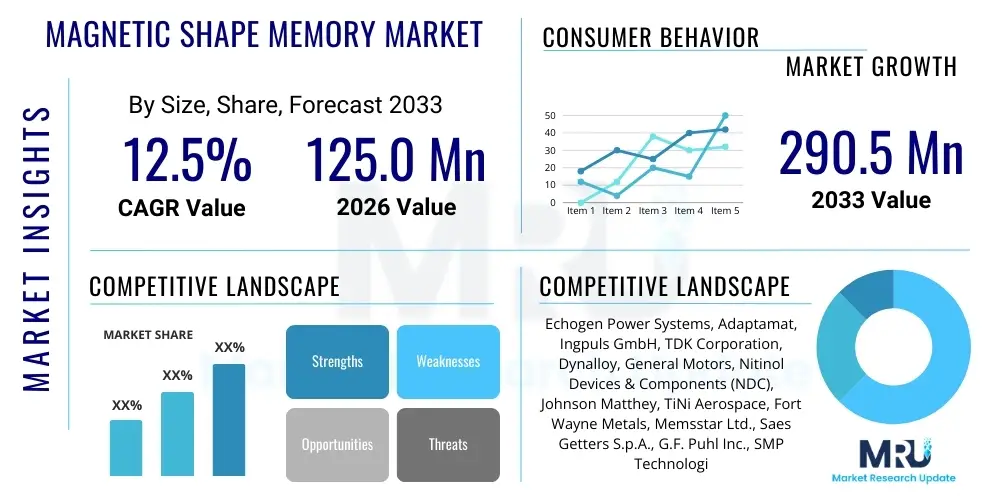

The Magnetic Shape Memory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $125.0 Million in 2026 and is projected to reach $290.5 Million by the end of the forecast period in 2033.

Magnetic Shape Memory Market introduction

The Magnetic Shape Memory (MSM) market encompasses advanced materials, typically ferromagnetic shape memory alloys (FSMAs) such as Ni-Mn-Ga, which exhibit significant stress and strain response when subjected to an external magnetic field. Unlike traditional shape memory alloys (SMAs) that rely solely on thermal effects, MSM materials offer extremely rapid, magnetically induced strains (up to 6%) and generate substantial actuation forces, making them ideal for high-precision, high-frequency applications. The core product is the crystalline alloy, which undergoes martensitic transformation influenced by magnetic fields, enabling movement without mechanical linkages or hydraulics. This unique combination of rapid response and high strain capability positions MSM alloys as critical components in next-generation actuation and sensing technologies.

Major applications of MSM materials span across several high-technology sectors, notably in robotics, aerospace, medical devices, and precision tooling. In robotics, they are utilized to create compact, energy-efficient actuators and micro-grippers. The medical field leverages their precise, controllable movement for minimally invasive surgical instruments and drug delivery systems. Furthermore, their potential in vibrational damping and noise cancellation is driving adoption in the automotive and defense industries, where fast response times and structural integrity under dynamic loads are paramount. The inherent benefits of MSM materials—including solid-state actuation, high energy density, and long operational life—are compelling factors for their increasing integration into complex mechatronic systems.

The primary driving factors for market growth include the increasing demand for miniaturization and high-frequency control in industrial automation and consumer electronics. As devices shrink, the need for powerful, compact actuators that surpass the limitations of piezoelectric or conventional electromagnetic systems becomes urgent. Additionally, significant investments in materials science research and development are continually improving the performance metrics of FSMA compositions, specifically targeting operational temperature range extension and material processing scalability. The synergy between materials innovation and technological requirements in advanced manufacturing is accelerating the commercial viability and widespread adoption of Magnetic Shape Memory technology globally.

Magnetic Shape Memory Market Executive Summary

The Magnetic Shape Memory (MSM) market is characterized by rapid technological advancement and substantial fragmentation, with growth primarily driven by the escalating demand for highly responsive, solid-state actuation technologies in niche industrial and biomedical applications. Key business trends include strategic collaborations between academic institutions and materials manufacturers to accelerate commercialization, focusing on developing cost-effective production methods for Ni-Mn-Ga and similar alloys. Furthermore, the market is witnessing increased private equity funding targeting startups specializing in micro-actuator and sensor integration, aiming to capture early market share in emerging sectors like haptics and advanced prosthetics. Stability of material performance across a wider thermal operating range remains a critical competitive differentiator.

Regional trends indicate North America and Europe currently dominating the market due to robust R&D infrastructure, high concentration of aerospace and defense contractors, and significant healthcare expenditure promoting the adoption of advanced medical devices utilizing MSM actuators. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, spurred by rapid expansion in industrial automation, consumer electronics manufacturing, and supportive governmental policies encouraging high-tech material development, particularly in nations like Japan, South Korea, and China. This shift is fueling increased localized production capabilities and supply chain maturation within APAC, transitioning it from a pure consumer base to a substantial production hub.

Segmentation trends highlight that the Ni-Mn-Ga alloy segment holds the dominant market share due to its proven magneto-strain properties, though emerging segments focused on iron-based or cobalt-based ferromagnetic shape memory alloys are gaining traction due to potential advantages in material cost and higher operational temperatures. Application-wise, the actuator and damper segments remain the largest revenue generators, reflecting the immediate industrial requirement for precise motion control and superior vibration mitigation. Conversely, the sensor segment, while smaller currently, is expected to post above-average growth rates, driven by the integration of MSM alloys into high-resolution magnetic field sensing and non-contact displacement measurement systems, further solidifying the market’s reliance on multifunctional material solutions.

AI Impact Analysis on Magnetic Shape Memory Market

Common user questions regarding AI's influence on the Magnetic Shape Memory Market frequently revolve around optimizing material composition, predicting operational lifespan under stress, and enabling autonomous control of MSM-based systems. Users are keenly interested in how machine learning can accelerate the discovery of novel FSMA compositions with superior performance characteristics (e.g., higher strain, lower hysteresis). There is significant inquiry into using AI for real-time monitoring and predictive maintenance of MSM actuators embedded in complex machinery, addressing concerns about material fatigue and failure prediction. Furthermore, users expect AI to facilitate the integration of MSM devices into smart manufacturing environments, enabling highly complex, adaptive control loops that capitalize on the high-frequency response capabilities of these specialized materials. The core themes are automation, predictive optimization, and accelerated materials discovery.

AI's role in the MSM domain begins upstream in materials science research. Generative AI and machine learning algorithms are being deployed to screen millions of hypothetical alloy compositions, significantly reducing the time and cost associated with experimental metallurgy. By inputting crystallographic data, elemental ratios, and desired magneto-mechanical properties, AI models can predict the optimal synthesis parameters for new ferromagnetic shape memory alloys, potentially unlocking materials with performance metrics currently unreachable via conventional trial-and-error methods. This accelerates the pipeline from discovery to commercial viability, lowering intellectual property hurdles and enhancing material consistency, which is critical for demanding applications like aerospace controls.

Downstream, AI provides substantial benefits in system integration and performance management. MSM actuators, known for their precise and rapid response, require sophisticated control systems to maximize their efficiency and prevent structural damage from repetitive, high-frequency cycling. AI-driven control systems employ reinforcement learning to dynamically adjust magnetic field strength and frequency based on real-time feedback and application requirements, improving energy efficiency and extending the service life of the components. Moreover, digital twin technology, informed by AI-analyzed sensor data, allows manufacturers to simulate the long-term behavior of MSM devices in variable environmental conditions, ensuring reliability and minimizing unplanned downtime in critical infrastructure and high-value machinery.

- AI accelerates the discovery of new Ferromagnetic Shape Memory Alloys (FSMAs) with tailored properties using predictive modeling.

- Machine learning optimizes material synthesis and processing techniques, reducing manufacturing variability and cost.

- AI-driven control systems enable high-frequency, adaptive actuation, maximizing the operational efficiency of MSM devices.

- Predictive maintenance algorithms monitor actuator performance in real-time to forecast material degradation and potential failure points.

- Neural networks facilitate the integration of MSM sensors for advanced data interpretation in complex monitoring systems.

- AI enhances digital twin simulations, allowing for robust performance testing across diverse operational environments.

DRO & Impact Forces Of Magnetic Shape Memory Market

The Magnetic Shape Memory (MSM) market is significantly influenced by a unique set of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces determining its growth trajectory. Key drivers include the overwhelming industry demand for high-speed, compact, and energy-efficient actuators, particularly within medical robotics and micro-electro-mechanical systems (MEMS), where conventional technologies face inherent scaling and speed limitations. The ability of MSM materials to provide solid-state actuation with superior strain rates compared to piezoelectric ceramics makes them a compelling alternative. Additionally, increasing military and defense spending on advanced vibration damping and acoustic stealth technologies further bolsters market expansion. These forces drive material research towards higher performance specifications and broader temperature ranges.

Conversely, significant restraints hinder mass market adoption. The high production cost associated with synthesizing high-purity, single-crystal MSM alloys, especially Ni-Mn-Ga, remains a major barrier, limiting their use predominantly to high-value, niche applications. Furthermore, the limited operational temperature range of current commercial alloys (often near room temperature) restricts deployment in harsh industrial or automotive environments. Material hysteresis and fatigue under repetitive cycling also pose technical challenges that require intensive research to overcome, directly impacting long-term reliability expectations. These restraints necessitate innovative, cost-saving manufacturing processes and the discovery of new, thermally stable alloy systems to unlock the market’s full potential.

Opportunities for growth are substantial, primarily rooted in the development of polycrystalline MSM alloys, which promise lower manufacturing costs and easier integration into standard industrial production lines, thereby addressing the cost restraint. Furthermore, the emerging market for smart materials in consumer electronics, specifically for advanced haptic feedback systems and adaptive optics, represents a largely untapped revenue stream. The integration of MSM technology into advanced energy harvesting solutions, leveraging the material's magneto-mechanical coupling for electricity generation, presents a long-term strategic opportunity. The synergistic effects of these DRO elements and the overarching necessity for technological miniaturization create a positive net impact force, pushing the market toward steady, specialized growth.

Segmentation Analysis

The Magnetic Shape Memory market is systematically segmented based on Material Type, Application, End-User Industry, and Geography, reflecting the diverse utilization landscape of this niche technology. The segmentation by Material Type, focusing on different alloy compositions (such as Ni-Mn-Ga, Fe-Pd, and emerging alternatives), helps stakeholders understand the current technological maturity and cost structures associated with various FSMA compositions. Application segmentation—covering actuators, sensors, dampers, and energy harvesters—provides insight into immediate revenue streams and future high-growth areas, with actuation currently dominating due to high industrial need for precise motion control.

End-User Industry segmentation is critical, dividing the market into sectors like Automotive, Aerospace & Defense, Medical, and Robotics. The medical segment, particularly for minimally invasive surgery tools, demands extremely high precision and reliability, justifying the premium cost of MSM components. In contrast, the automotive industry focuses on using MSM for active vibration damping and noise reduction, requiring materials that can withstand rigorous thermal cycling and stress, thus influencing material research priorities toward more robust and cost-effective alloys suitable for mass production scale.

Geographical segmentation reveals regional disparities in R&D investment and manufacturing capabilities. North America and Europe lead in research output and high-end application deployment, while Asia Pacific is rapidly increasing its manufacturing capacity for consumer electronics and robotics components utilizing MSM features. This layered segmentation framework enables granular market analysis, allowing companies to tailor their product development, pricing strategies, and supply chain logistics to target specific technological and regional requirements effectively.

- Material Type:

- Ni-Mn-Ga Alloys (Dominant Segment)

- Iron-based Alloys (e.g., Fe-Pd)

- Cobalt-based Alloys

- Other Emerging Compositions

- Application:

- Actuators and Micro-pumps (Largest Segment)

- Sensors and Transducers

- Dampers and Vibration Control Systems

- Energy Harvesting Devices

- End-User Industry:

- Aerospace and Defense

- Medical and Healthcare

- Robotics and Industrial Automation

- Automotive and Transportation

- Consumer Electronics and Haptics

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Magnetic Shape Memory Market

The value chain for the Magnetic Shape Memory market is highly specialized, beginning with complex upstream activities centered on raw material sourcing and metallurgical processing. Upstream analysis involves the procurement of high-purity transition metals (Nickel, Manganese, Gallium, Iron, Palladium). The most critical stage is the controlled synthesis of the ferromagnetic shape memory alloy (FSMA) itself, typically involving processes like vacuum induction melting, followed by complex crystal growth techniques (like Bridgman or Czochralski methods) to achieve the necessary single-crystal structure for maximizing magneto-strain effect. This specialized manufacturing requires significant capital investment and expertise, leading to high production costs at this foundational level. Efficient material characterization and quality control are paramount at this stage to ensure the required martensitic transformation temperatures and magnetic properties are achieved, setting the quality benchmark for subsequent fabrication.

Midstream activities involve the fabrication of the final MSM components, which includes machining the bulk alloy into micro-components, thin films, or wires, followed by integration into functional devices. Component manufacturers specialize in designing the mechanical structure and integrating the necessary electromagnetic coils and control electronics that activate the shape memory effect. This step often requires advanced microfabrication techniques, particularly for applications like MEMS actuators or medical micro-tools. Intellectual property related to component design and integration control systems provides substantial competitive leverage in this segment. The complexity here lies in integrating a highly sensitive material into a robust, packaged product ready for industrial use, demanding close collaboration between materials scientists and electronics engineers.

Downstream analysis covers distribution channels and engagement with end-users. Distribution is primarily handled through direct sales to large Original Equipment Manufacturers (OEMs) in the aerospace, defense, and medical sectors, especially for highly customized, high-value components. Indirect channels, often through specialized distributors or integrators, serve smaller industrial automation firms and research institutions. The high level of customization required for MSM components means direct interaction between the producer and the end-user (design-in process) is often mandatory. Potential customers include major manufacturers of industrial robots, advanced surgical equipment, and specialized sensors who require the unique characteristics offered by these materials to enhance the performance and miniaturization of their final products.

Magnetic Shape Memory Market Potential Customers

The primary consumers and end-users of Magnetic Shape Memory materials and components are companies operating in high-precision, high-reliability sectors where the rapid response and high power density of FSMA actuators justify the premium material cost. Key potential customers include major Aerospace and Defense contractors that utilize MSM technology for active noise and vibration control in aircraft structures, flight surface actuation, and specialized magnetic shielding applications. These customers require materials with exceptional longevity and performance consistency under extreme thermal and mechanical stresses, making them high-volume, high-value buyers of bulk alloys and integrated actuator assemblies.

Another significant customer segment is the Medical Device and Healthcare industry, comprising manufacturers of minimally invasive surgical robots, high-fidelity diagnostic imaging equipment, and advanced prosthetics. In this sector, MSM actuators provide the necessary precision for micro-manipulation within the human body, such as precise fluidic control in micro-pumps or fine movements in surgical instruments. These customers prioritize biocompatibility, sterilization robustness, and absolute reliability, demanding tightly controlled quality assurance and regulatory compliance from MSM material suppliers, often involving long-term strategic partnerships for specialized component development.

The rapidly growing Robotics and Industrial Automation sector represents a broad customer base, ranging from manufacturers of high-throughput assembly lines to developers of next-generation collaborative robots (cobots). Potential customers here seek MSM solutions to improve the efficiency and speed of robotic grippers and tool changers, replacing bulkier electromagnetic systems. Additionally, companies involved in high-end consumer electronics are emerging customers, exploring MSM alloys for advanced haptic feedback systems and tunable micro-optics, focusing on miniaturization, low power consumption, and improved user experience. These diverse end-users are unified by the need for superior magneto-mechanical coupling properties that MSM materials uniquely provide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $125.0 Million |

| Market Forecast in 2033 | $290.5 Million |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Echogen Power Systems, Adaptamat, Ingpuls GmbH, TDK Corporation, Dynalloy, General Motors, Nitinol Devices & Components (NDC), Johnson Matthey, TiNi Aerospace, Fort Wayne Metals, Memsstar Ltd., Saes Getters S.p.A., G.F. Puhl Inc., SMP Technologies, Nippon Steel Corporation, Special Metals Corporation, ATI Specialty Alloys & Components, Zhaohui New Materials, Advanced Materials Technology, Siemens Healthineers |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnetic Shape Memory Market Key Technology Landscape

The technology landscape of the Magnetic Shape Memory market is defined by advanced metallurgy, precision microfabrication, and sophisticated control systems necessary to utilize the unique properties of FSMAs. Central to the market is the precise synthesis of single-crystalline Ni-Mn-Ga alloys, which requires highly controlled growth environments, often utilizing vacuum induction furnaces and the Bridgman crystal growth method. Subsequent processing technologies focus on achieving the necessary crystalline structure and texture, which dictates the achievable magneto-strain. Furthermore, specialized thermal treatments are crucial for tuning the martensitic transformation temperature close to the desired operational range, often achieved through rapid quenching and carefully calibrated annealing protocols that ensure repeatable performance and minimal thermal hysteresis.

Beyond materials processing, the integration of MSM components into functional devices relies heavily on micro-electromagnetic system (MEMS) technologies. This involves developing compact, high-field magnetic coil arrays capable of generating the necessary magnetic field strength (often several hundred milliTesla) to trigger the shape change rapidly. The design of these coils must minimize heat generation while maximizing field homogeneity across the MSM element. Furthermore, the development of thin-film deposition techniques for FSMAs is crucial for applications in micro-robotics and sensors, demanding specialized sputtering and lithography processes that maintain the desired epitaxial quality and crystalline orientation necessary for magneto-mechanical coupling effects to occur effectively on a micro-scale.

Control electronics represent a distinct technological pillar. Due to the high-frequency response capabilities of MSM actuators, proprietary closed-loop control algorithms are essential for achieving precise displacement and force control. These systems often incorporate sophisticated sensors to measure displacement and force in real-time, feeding data back to high-speed digital controllers (DSPs or FPGAs). The control software must manage the complex non-linear behavior, including inherent hysteresis and temperature dependence, to ensure reliable operation. Continued technological focus is also placed on developing cheaper, polycrystalline MSM compositions (such as certain Fe-based alloys) that can be fabricated using more scalable methods like powder metallurgy, potentially lowering the entry barrier for mass-market applications.

Regional Highlights

- North America: This region maintains market dominance driven by substantial government funding in aerospace, defense (especially for stealth and anti-vibration systems), and advanced medical device R&D. The presence of leading research universities and technology companies specializing in smart materials ensures continuous innovation. The United States is the primary consumer, leveraging MSM technology in high-value products like surgical robots and advanced military platforms.

- Europe: Characterized by strong engineering sectors, particularly in Germany and the UK, Europe is a major adopter of MSM for industrial automation, high-performance tooling, and automotive applications (active engine mounts and noise reduction). Strict regulatory requirements for efficiency and sustainability further drive the adoption of advanced, energy-efficient actuator technologies like MSM.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by massive investment in manufacturing infrastructure, robotics, and consumer electronics production in China, Japan, and South Korea. While historically focused on components, the region is rapidly increasing its internal R&D capabilities, aiming to reduce reliance on Western material suppliers and develop cost-effective, scalable production methods for MSM alloys suitable for high-volume use.

- Latin America (LAMEA): The MSM market here is nascent, focused mainly on importing finished components for specialized applications in oil and gas and limited high-tech manufacturing. Growth is slower, constrained by economic volatility and lower levels of R&D investment compared to global leaders, though there is potential in localized industrial automation applications.

- Middle East and Africa (MEA): MSM adoption is restricted to high-end defense and specialized oil and gas infrastructure projects, particularly in the UAE and Saudi Arabia. Market growth is heavily reliant on technological transfers and partnerships with international defense contractors, leading to a smaller, project-specific market rather than widespread industrial application.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnetic Shape Memory Market.- Echogen Power Systems

- Adaptamat

- Ingpuls GmbH

- TDK Corporation

- Dynalloy

- General Motors (R&D focus)

- Nitinol Devices & Components (NDC)

- Johnson Matthey

- TiNi Aerospace

- Fort Wayne Metals

- Memsstar Ltd.

- Saes Getters S.p.A.

- G.F. Puhl Inc.

- SMP Technologies

- Nippon Steel Corporation

- Special Metals Corporation

- ATI Specialty Alloys & Components

- Zhaohui New Materials

- Advanced Materials Technology

- Siemens Healthineers

Frequently Asked Questions

Analyze common user questions about the Magnetic Shape Memory market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Magnetic Shape Memory (MSM) materials over conventional Shape Memory Alloys (SMAs)?

The primary advantage is the exceptionally rapid, non-contact, and controllable actuation speed. Unlike traditional SMAs, which rely on slow thermal cycling, MSM alloys (like Ni-Mn-Ga) use an external magnetic field to induce transformation, enabling operating frequencies far exceeding those possible with thermally activated systems, crucial for high-speed industrial applications.

Which factors currently restrain the widespread commercial adoption of MSM technology?

The primary restraints include the high cost of synthesizing high-purity single-crystal alloys, the limited operational temperature range (often restricting use to near room temperature applications), and the technical challenge of managing material hysteresis and fatigue during repetitive, high-stress cycling.

How is AI impacting the research and development pipeline for Magnetic Shape Memory materials?

AI is significantly accelerating R&D by utilizing machine learning models to predict the optimal chemical composition and processing parameters for new ferromagnetic shape memory alloys. This predictive capability reduces the reliance on costly, time-consuming experimental metallurgy, leading to faster discovery of high-performance compositions.

In which end-user industry is the highest growth anticipated for Magnetic Shape Memory components?

While aerospace and medical sectors are major consumers, the highest growth rate is anticipated within the Robotics and Industrial Automation sector, specifically driven by the demand for compact, highly responsive micro-actuators, and in the burgeoning field of advanced haptics within consumer electronics.

What are the key regional trends shaping the global MSM market?

North America and Europe currently lead in market revenue due to robust R&D and high-value aerospace and medical applications. However, the Asia Pacific region is projected for the fastest growth, driven by massive investments in industrial automation and manufacturing scalability, shifting the focus towards cost-effective production techniques.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager