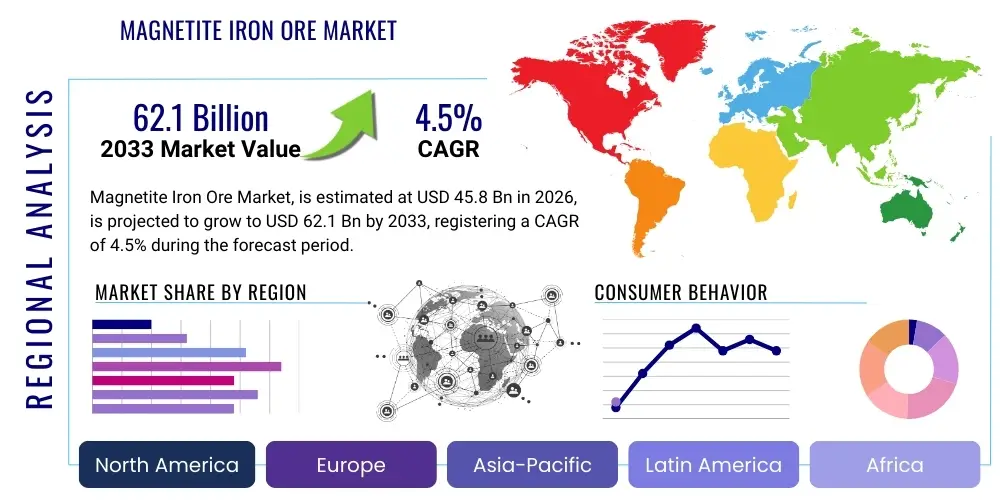

Magnetite Iron Ore Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438977 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Magnetite Iron Ore Market Size

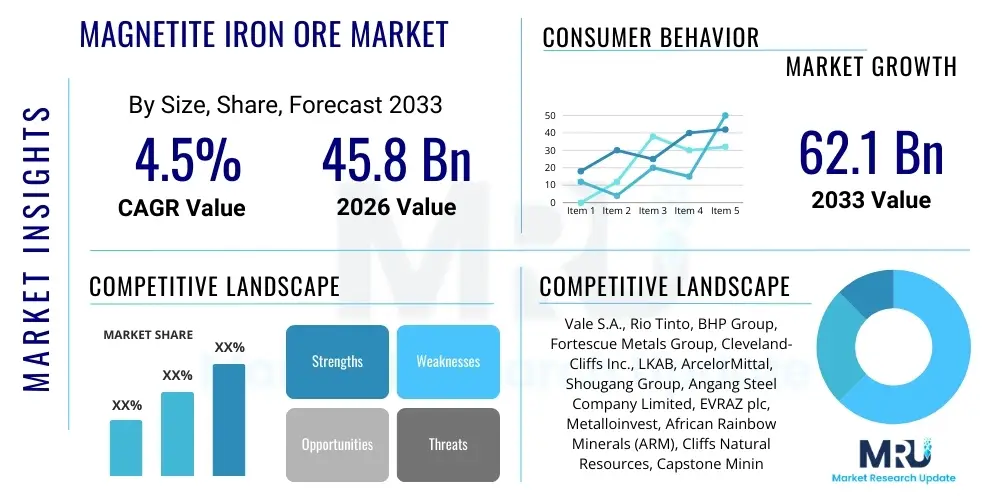

The Magnetite Iron Ore Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 62.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the global steel industry's accelerating transition towards low-carbon emission production methods, particularly Direct Reduction Iron (DRI) technology, which necessitates high-purity iron inputs, a requirement magnetite-derived pellets are uniquely positioned to fulfill.

Magnetite Iron Ore Market introduction

The Magnetite Iron Ore Market encompasses the exploration, mining, processing, and distribution of iron ore characterized predominantly by the mineral magnetite (Fe3O4). Unlike hematite, magnetite ore often requires extensive beneficiation—a process involving crushing, grinding, and strong magnetic separation—to achieve the necessary high iron content (typically above 65%) required for modern steelmaking. The final product is frequently transformed into high-quality pellets or concentrate, which are critical raw materials for both traditional blast furnace steel production and, increasingly, for the environmentally conscious Direct Reduction (DR) route.

Magnetite-based products offer several intrinsic benefits crucial for the evolving steel industry landscape. The high-grade nature of magnetite pellets reduces slag formation, decreases energy consumption during the reduction phase, and is optimally suited for use in DRI facilities, which are essential for producing green steel. Major applications include the production of hot metal in integrated steel mills, the creation of high-purity fluxed or non-fluxed pellets for DR shafts, and specialized uses in heavy media separation and other non-metallurgical applications. The strategic importance of high-grade inputs is amplified by tightening global environmental regulations and commitments to decarbonization, positioning magnetite as a premium commodity.

The market is currently being driven by strong demand from Asian economies, particularly China and India, which continue to expand their infrastructure and manufacturing sectors, maintaining high domestic steel production rates. Furthermore, global efforts to mitigate climate change are rapidly shifting investment towards DRI and electric arc furnace (EAF) production routes, substantially increasing the premium attached to low-impurity, high-grade magnetite pellets. Geopolitical stability concerning major supply regions, alongside continuous advancements in beneficiation technology that reduce processing costs, also serve as significant momentum drivers for the market's sustained growth through the forecast period.

Magnetite Iron Ore Market Executive Summary

The Magnetite Iron Ore Market is undergoing a fundamental structural shift, moving away from being solely a complementary feedstock for blast furnaces towards becoming the primary material choice for the burgeoning green steel sector. Business trends indicate a focus on vertical integration, with major mining companies investing heavily in advanced pelletizing and downstream processing capabilities to capture greater value from the supply chain and meet stringent customer specifications for DRI-grade pellets. The prevailing economic sentiment, characterized by global infrastructure stimulus packages post-2020, ensures robust demand for steel, thereby underpinning the long-term pricing stability and market volume of magnetite products.

Regionally, Asia Pacific, dominated by China and Japan, remains the largest consuming region due to immense steel production capacities, although future growth rates are expected to be strongest in regions demonstrating rapid adoption of low-carbon technologies, such as Europe and North America. European steelmakers are aggressively pursuing hydrogen-based DRI projects, creating immediate, high-premium demand for specialized magnetite pellets. Conversely, emerging markets in Latin America and Africa are focusing on developing their untapped magnetite reserves, aiming to diversify global supply away from traditional sources, particularly Australia and Brazil, thus altering the competitive landscape.

Segment trends highlight the increasing dominance of the pellet segment over traditional concentrate, driven by its superior performance characteristics in DR shafts. Within segmentation by end-user, the DRI segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the global technological transition. Financial trends show elevated capital expenditure in energy efficiency technologies within processing plants, necessary to counteract rising global energy prices, and strategic mergers and acquisitions focused on securing access to high-quality, underdeveloped magnetite deposits, ensuring future supply security and market differentiation for key players.

AI Impact Analysis on Magnetite Iron Ore Market

Common user questions regarding AI’s impact on the Magnetite Iron Ore Market frequently revolve around optimizing complex beneficiation processes, predicting equipment failure in harsh mining environments, and enhancing the efficiency of resource exploration. Users are concerned with how AI can mitigate the high energy costs associated with grinding and magnetic separation—the two most crucial steps in magnetite processing—and how machine learning algorithms can provide a competitive edge in maintaining consistent product quality required for demanding applications like hydrogen DRI. Key themes emerging from user inquiries include the expectation that AI integration will substantially reduce operational expenditure (OPEX), improve geological modeling precision, and enable fully autonomous, safer mining operations, thereby increasing overall productivity and reducing reliance on manual labor in remote or hazardous sites.

The implementation of AI and machine learning models is transforming the capital-intensive and often energy-intensive processes inherent in magnetite production. Predictive analytics are being deployed extensively to monitor the operational health of heavy machinery, such as grinding mills and crushers, allowing for proactive maintenance scheduling that minimizes unexpected downtime, a critical factor given the high throughput requirements of major mining operations. Furthermore, sophisticated algorithms are optimizing blend management, analyzing real-time input variability (ore grade, moisture content) to adjust processing parameters instantly, thus maximizing recovery rates and ensuring the final pellet product meets the tight specifications demanded by premium steel producers, especially those focused on decarbonization pathways.

AI is also playing a transformative role in upstream activities, specifically in geological exploration and resource modeling. Machine learning algorithms can process vast amounts of geophysical, seismic, and drilling data far more quickly and accurately than traditional methods, identifying potential high-grade magnetite deposits with greater precision. This targeted exploration reduces both the time and financial risks associated with resource development. Downstream, AI assists in optimizing logistics and supply chain management, using real-time data on shipping routes, port capacity, and customer demand to ensure just-in-time delivery of iron ore pellets, further enhancing market efficiency and responsiveness to volatile global commodity prices.

- AI optimizes complex grinding and magnetic separation circuits, minimizing energy consumption.

- Predictive maintenance analytics reduce operational downtime for crushing and milling equipment.

- Machine learning improves geological modeling precision, accelerating high-grade resource discovery.

- Autonomous hauling and drilling systems enhance worker safety and increase mining efficiency.

- Real-time data processing ensures consistent, high-purity pellet quality (critical for DRI).

DRO & Impact Forces Of Magnetite Iron Ore Market

The dynamics of the Magnetite Iron Ore Market are shaped by a strong interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate investment decisions and pricing strategies. The primary driver is the unparalleled global movement towards steel decarbonization, forcing steelmakers worldwide to transition to Direct Reduction Iron (DRI) technology, which mandates the use of high-purity magnetite pellets. This structural demand shift provides significant upward momentum. Conversely, major restraints include the substantial capital expenditure required for developing new magnetite mines and processing facilities, coupled with volatility in global energy prices, which heavily impact the energy-intensive crushing and beneficiation steps necessary to upgrade magnetite ore. These forces create a dual environment of high reward potential tempered by significant operational risks, making strategic planning essential for stakeholders.

Key opportunities within the market are closely linked to technological innovation and strategic resource alignment. The development of advanced, energy-efficient beneficiation techniques, such as High-Pressure Grinding Rolls (HPGR) and dry magnetic separation, presents avenues for miners to lower OPEX and improve competitiveness. Furthermore, the rising adoption of hydrogen as a reducing agent in DRI creates an ultra-premium niche for magnetite producers who can consistently meet the highest purity specifications (e.g., extremely low gangue content). The impact forces, characterized by stringent environmental, social, and governance (ESG) standards, are compelling companies to invest in cleaner processing and mine rehabilitation, thereby integrating sustainability as a core component of long-term viability and market acceptability.

The long-term influence of these forces suggests a widening gap between low-cost, high-volume producers and those who fail to adapt to the green steel mandate. Geopolitical uncertainty concerning trade tariffs and resource nationalism in key mining regions also acts as an external impact force, requiring supply chain diversification. The scarcity of readily available high-grade hematite further amplifies the strategic value of magnetite deposits, cementing their role as the feedstock of choice for future low-carbon metallurgy. Ultimately, the market trajectory is determined by the speed and success of global steel producers in executing their decarbonization roadmaps, placing magnetite iron ore at the center of the industry's transformative agenda.

Segmentation Analysis

The Magnetite Iron Ore Market segmentation provides a granular view of market dynamics based on product type, application, and end-user characteristics. The segmentation by product type typically differentiates between concentrate and pellets, reflecting the level of processing and suitability for specific furnace types, with pellets commanding a higher price due to added value and reduced impurities. Analysis by application often focuses on the division between traditional blast furnace (BF) use and the newer, high-growth Direct Reduction Iron (DRI) route, clearly illustrating the shift in demand toward inputs optimized for low-carbon steelmaking. Understanding these segments is critical for producers to tailor their product specifications, capacity expansion plans, and pricing strategies to maximize profitability in a rapidly evolving steel ecosystem.

- By Product Type:

- Magnetite Concentrate (Fines)

- Magnetite Pellets (Fluxed, Non-Fluxed, DR Grade)

- By Application:

- Sintering and Pelletizing

- Direct Reduction Iron (DRI) Production

- Non-Metallurgical Applications (Heavy Media Separation)

- By End-User Industry:

- Integrated Steel Plants

- Mini Mills (EAF-based)

- Foundries

Value Chain Analysis For Magnetite Iron Ore Market

The value chain for the Magnetite Iron Ore Market is a complex sequence extending from geological exploration to final use in steel mills, characterized by high capital intensity in the intermediate processing stages. The upstream segment involves exploration, resource definition, and extraction (mining). Given that magnetite deposits are often harder and lower grade than typical hematite, the initial mining stage requires significant investment in large-scale drilling, blasting, and material handling equipment. Efficiency at this stage is crucial, as the cost of raw input ore directly affects the viability of subsequent processing.

The midstream phase—beneficiation and processing—is the defining characteristic of the magnetite value chain and represents the core value addition point. This typically involves extensive comminution (crushing and grinding), often requiring energy-intensive High-Pressure Grinding Rolls (HPGR), followed by multiple stages of magnetic separation to achieve the required high-purity concentrate. This concentrate may then be further processed via pelletizing (agglomeration and firing in kilns) to create high-specification pellets suitable for DRI or BF use. The energy cost and technological expertise required for precise pellet chemistry and physical strength significantly influence the final market price and competitiveness.

The downstream activities involve logistics, distribution, and consumption. Distribution channels are predominantly indirect, utilizing global bulk shipping routes, major ports, and rail networks to move massive volumes of pellets and concentrate from production hubs (like Brazil, Australia, and Canada) to major consuming regions (primarily China, Europe, and the Middle East). Direct sales channels exist for long-term supply agreements between large, vertically integrated miners and specific steel producers, especially for specialized DR-grade pellets where consistent quality and supply security are paramount. Efficiency in shipping and inventory management critically impacts the total delivered cost of the commodity to the end-user.

Magnetite Iron Ore Market Potential Customers

The primary customers in the Magnetite Iron Ore Market are large-scale integrated steel producers and operators of Electric Arc Furnaces (EAFs) globally. Integrated steel plants (using BF-BOF technology) require high-quality pellets for optimal performance and reduced energy consumption in the blast furnace, although their consumption share is gradually being overtaken by the DRI sector. Specifically, manufacturers implementing decarbonization strategies are the most critical potential customers, as they demand ultra-high-purity (67%+ Fe) magnetite pellets or hot briquetted iron (HBI) derived from magnetite, which minimizes impurities detrimental to the hydrogen reduction process.

A rapidly expanding segment of potential customers includes operators of Direct Reduction Iron (DRI) plants, particularly those located in regions with access to natural gas or, increasingly, renewable hydrogen. These facilities, prevalent in the Middle East, North America, and parts of Asia, rely almost exclusively on high-grade magnetite pellets due to their superior chemical composition, which ensures efficient reduction and optimal performance when feeding subsequent EAFs. This segment is characterized by a preference for long-term, stable contracts guaranteeing specific quality parameters, highlighting the strategic relationship between supplier and consumer in the green steel value chain.

Furthermore, specialized non-metallurgical buyers, such as companies involved in heavy media separation (used in coal preparation and mineral processing) and certain chemical manufacturing processes, also represent potential niche customers for magnetite concentrate. However, the bulk of market value and volume is intrinsically tied to the performance and strategic direction of the global steel industry. Given the global shift towards EAF-based mini mills, which rely heavily on high-purity inputs like DRI/HBI derived from magnetite, these EAF operators constitute a growing and highly lucrative customer base demanding premium products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 62.1 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vale S.A., Rio Tinto, BHP Group, Fortescue Metals Group, Cleveland-Cliffs Inc., LKAB, ArcelorMittal, Shougang Group, Angang Steel Company Limited, EVRAZ plc, Metalloinvest, African Rainbow Minerals (ARM), Cliffs Natural Resources, Capstone Mining Corp., Glencore PLC, Metso Outotec, ThyssenKrupp AG, China Minmetals Corporation, Mineral Resources Limited, Samarco Mineração S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnetite Iron Ore Market Key Technology Landscape

The technological landscape for the Magnetite Iron Ore Market is characterized by innovation aimed at improving efficiency, reducing energy intensity, and ensuring compliance with increasingly strict environmental standards during the beneficiation process. Given that magnetite ore typically has a lower initial iron content compared to hematite, the primary technological focus is on comminution and separation. High-Pressure Grinding Rolls (HPGR) are a critical technology, increasingly replacing traditional ball mills. HPGR technology offers significant energy savings (up to 30-40%) and greater throughput efficiency in crushing and grinding the hard magnetite rock, reducing operational costs substantially before the magnetic separation stage. The adoption rate of HPGR is directly correlated with the necessity for large-scale, high-volume, and low-cost production demanded by global markets.

Further technological advancements focus on optimizing the magnetic separation process itself. Next-generation wet and dry magnetic separators, utilizing high-intensity fields, are being developed to maximize iron recovery rates while minimizing the contamination from gangue minerals, ensuring the final concentrate achieves the stringent 68% Fe purity required for DRI-grade pellets. Additionally, sophisticated flotation techniques and reverse flotation circuits are employed to manage specific impurities like silica and phosphorous, enhancing the overall chemical quality of the product. The integration of advanced sensors and process control systems, often utilizing AI, allows for real-time monitoring and adjustment of grinding and separation circuits, optimizing material flow and product homogeneity.

Downstream, the pelletizing process is also seeing crucial technological evolution focused on sustainability. Technology related to induration furnaces (kilns) is being upgraded to incorporate alternative fuel sources, moving away from reliance on coal or heavy oil towards natural gas or potentially hydrogen, aligning with industry decarbonization goals. Furthermore, technologies focusing on mitigating emissions, such as advanced gas cleaning and heat recovery systems, are becoming standard to improve overall energy efficiency and environmental performance. These technological shifts are not merely incremental improvements but are fundamental requirements for maintaining competitiveness and accessing the premium segment of the high-purity iron ore market.

Regional Highlights

The global Magnetite Iron Ore Market exhibits pronounced regional variances in terms of supply capability, processing technology, and consumption patterns, primarily dictated by local steel production infrastructure and environmental policies.

- Asia Pacific (APAC): APAC represents the largest consumer base globally, predominantly driven by China and India, the world’s two largest steel producers. While China traditionally relied heavily on seaborne hematite, its increasing focus on high-purity inputs for environmental compliance and the development of new internal DRI capacity are boosting demand for high-grade magnetite pellets. Infrastructure expansion across Southeast Asia further solidifies APAC's dominant market share, although the region is generally a net importer of high-quality pellets.

- North America: This region is characterized by significant domestic magnetite reserves, particularly in the US and Canada. North American producers, such as those in the Great Lakes region, are vertically integrated and specialize in producing high-quality fluxed and non-fluxed pellets. The market here is highly mature, serving established domestic integrated steel mills and increasingly supplying specialized DR-grade pellets to meet rising demand from local EAF operations focused on low-carbon steel production.

- Europe: Europe is a key strategic market due to its aggressive pursuit of 'green steel' initiatives and rapid adoption of hydrogen-based DRI technology. Although Europe has limited domestic supply (e.g., Sweden's LKAB), demand for premium, ultra-low impurity magnetite pellets is exceptionally high. This region acts as a high-premium importer, demanding the highest specifications to ensure the success of its ambitious decarbonization projects.

- Latin America (LATAM): Dominated by Brazil, this region is a global powerhouse in iron ore supply, holding vast magnetite resources. Key players here focus on high-volume production and export, leveraging superior logistics and economies of scale. Investment is increasingly directed towards sophisticated processing facilities capable of producing internationally certified DR-grade pellets, critical for maintaining global competitiveness against Australian hematite giants.

- Middle East and Africa (MEA): The Middle East is a significant growth engine for magnetite consumption, primarily due to its abundant access to affordable natural gas, making it a hub for gas-based DRI production (e.g., Saudi Arabia, UAE, Iran). These countries are major importers of high-grade magnetite pellets. Africa, conversely, holds extensive underdeveloped magnetite reserves (e.g., in South Africa and West Africa), representing long-term supply potential that is attracting significant foreign investment for resource development and export capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnetite Iron Ore Market.- Vale S.A.

- Rio Tinto

- BHP Group

- Fortescue Metals Group

- Cleveland-Cliffs Inc.

- LKAB

- ArcelorMittal

- Shougang Group

- Angang Steel Company Limited

- EVRAZ plc

- Metalloinvest

- African Rainbow Minerals (ARM)

- Cliffs Natural Resources

- Capstone Mining Corp.

- Glencore PLC

- Metso Outotec (Technology Provider)

- ThyssenKrupp AG (Key Consumer/Integrated Player)

- China Minmetals Corporation

- Mineral Resources Limited

- Samarco Mineração S.A.

Frequently Asked Questions

Analyze common user questions about the Magnetite Iron Ore market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Magnetite Iron Ore?

The primary factor driving demand is the global steel industry's shift towards decarbonization, specifically the increasing adoption of Direct Reduction Iron (DRI) technology. DRI requires ultra-high-purity iron inputs, which magnetite-derived pellets are optimally suited to provide, accelerating their market premium and consumption growth.

How does magnetite processing differ from hematite processing?

Magnetite typically requires significantly more intense beneficiation, involving extensive crushing, grinding (comminution), and strong magnetic separation to upgrade the lower-grade ore to high-purity concentrate (65%+ Fe), whereas hematite often requires less energy-intensive processing.

Which regions are leading the consumption of high-grade magnetite pellets?

Asia Pacific remains the largest consuming region by volume. However, the highest growth and premium pricing are observed in Europe and the Middle East, driven by ambitious green steel mandates and extensive deployment of gas-based and hydrogen-based Direct Reduction plants.

What is the role of technology, such as AI, in the magnetite market?

AI is crucial for optimizing energy-intensive processes like grinding and separation, enabling predictive maintenance, improving geological modeling accuracy for resource discovery, and ensuring the consistent, high-specification quality required for DRI and green steel production routes.

What major challenges restrict the growth of the magnetite iron ore market?

Key challenges include the high capital expenditure required for developing new mines, the substantial energy consumption (and associated cost volatility) inherent in the intensive beneficiation process, and stringent environmental regulations concerning tailings disposal and water usage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager