Magnetostricitive Position Sensors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431657 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Magnetostricitive Position Sensors Market Size

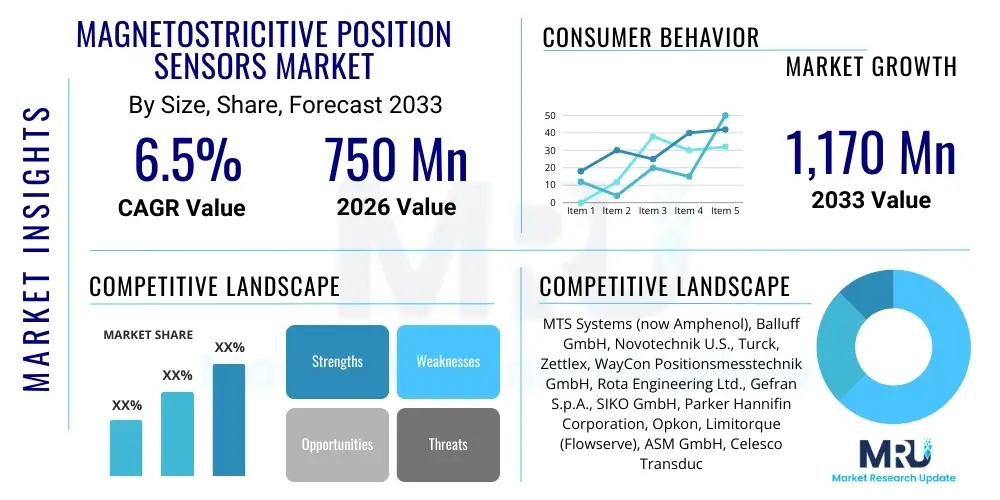

The Magnetostricitive Position Sensors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,170 Million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for highly accurate, robust, and reliable linear position sensing solutions across heavy industry and precision manufacturing, particularly in applications involving extreme temperatures, high pressure, and contaminants where conventional sensors often fail. The increasing integration of automation and smart factory concepts, aligned with Industry 4.0 initiatives, solidifies the foundational demand for these specialized sensors, which provide absolute position feedback essential for complex closed-loop control systems. Furthermore, market expansion is supported by technological advancements improving sensor resolution, responsiveness, and communication protocols, making them suitable for high-speed machinery.

Magnetostricitive Position Sensors Market introduction

The Magnetostrictive Position Sensors Market encompasses devices engineered to measure linear or angular position with exceptional precision and reliability, utilizing the magnetostrictive effect—a property where certain materials change shape when subjected to a magnetic field, and vice versa. These sensors operate by transmitting a current pulse down a waveguide wire, which, upon interacting with a secondary magnetic field generated by a permanent magnet attached to the moving object (the "position marker"), creates a torsional strain pulse. The time interval between the initiation of the current pulse and the reception of the resulting strain pulse determines the exact position of the magnet, allowing for absolute, non-contact measurement. This sophisticated design ensures inherent wear resistance, infinite resolution, and immunity to environmental contaminants like dust, grime, and oil, setting them apart from resistive or optical alternatives in demanding industrial settings such as hydraulic cylinders, plastic injection molding machines, and lumber processing equipment. The foundational benefits of magnetostrictive technology—durability, accuracy, and long operational life—are key drivers fueling their market adoption across critical manufacturing and infrastructure sectors globally, providing essential feedback for process control and quality assurance.

Magnetostrictive position sensors, often deployed within hydraulic and pneumatic cylinders (known as in-cylinder mounting), offer superior performance in terms of linearity and repeatability compared to traditional technologies like potentiometers or LVDTs (Linear Variable Differential Transformers). Their primary advantage lies in the absolute measurement capability, meaning that the sensor retains the last measured position even after a power outage, eliminating the need for recalibration or homing cycles upon system restart. This feature is particularly crucial in safety-critical machinery and continuous operations where downtime must be minimized. Major applications span industrial automation, including food and beverage packaging, metal forming, and robotic control; heavy mobile equipment such as construction machinery, agricultural vehicles, and material handling systems; and specialized fields like medical imaging and tidal monitoring. The continuous evolution toward digital outputs (e.g., EtherCAT, PROFINET) and smaller form factors further enhances their versatility and integration ease into contemporary networked control architectures, positioning them as essential components for advanced automated processes seeking maximum throughput and efficiency.

The driving factors for market growth extend beyond mere technological superiority. Increased regulatory requirements in sectors like automotive manufacturing and aerospace necessitate highly reliable position monitoring for safety protocols and quality control, favoring the robust nature of magnetostrictive sensors. Furthermore, the global shift towards automated manufacturing processes in emerging economies, coupled with significant investments in infrastructure development, is broadening the application base. The sensors’ ability to function effectively over long measurement strokes (up to several meters) without compromising accuracy makes them indispensable for large-scale industrial machinery. The integration of advanced signal processing techniques and robust housing materials capable of withstanding extreme vibration and shock further reinforces their position in the premium segment of the industrial sensor market, ensuring sustained demand as industries continue to digitize and optimize their operational footprints worldwide.

Magnetostricitive Position Sensors Market Executive Summary

The Magnetostrictive Position Sensors Market is witnessing robust expansion driven primarily by accelerated adoption in industrial automation and the sustained growth of the mobile hydraulics sector, particularly within construction and agricultural machinery. Business trends highlight a strong emphasis on digital connectivity, with manufacturers increasingly integrating standardized industrial Ethernet protocols (such as PROFINET and EtherNet/IP) into their sensor offerings to facilitate seamless communication within complex Industrial Internet of Things (IIoT) ecosystems. Key players are focusing on miniaturization, enhanced resolution specifications (reaching micrometer levels), and developing specialized sensors certified for hazardous environments (ATEX/IECEx), thereby opening new revenue streams in oil and gas and chemical processing industries. Strategic alliances focusing on embedded systems and predictive maintenance solutions are becoming commonplace, moving the market value proposition from pure measurement devices to integral components of sophisticated diagnostic architectures. This trend towards intelligence and connectivity defines the current competitive landscape, rewarding vendors who offer comprehensive data solutions alongside hardware performance.

Regional trends indicate that Asia Pacific (APAC) is poised to be the fastest-growing market, fundamentally powered by massive industrialization initiatives, particularly in China and India, focusing on domestic automotive manufacturing expansion and rapid investment in high-throughput machinery. North America and Europe, while mature, maintain leading market shares owing to high levels of existing automation infrastructure, significant presence of leading hydraulic equipment OEMs, and continuous refurbishment and technological upgrades of legacy systems. The emphasis in Western markets is shifting towards precision engineering, robotics, and adapting sensors for extreme environments (e.g., deep-sea exploration, renewable energy infrastructure), driving demand for premium, high-specification products. Furthermore, stringent safety regulations enforced by bodies like OSHA and the EU Machinery Directive compel end-users in these regions to adopt the highly reliable feedback provided by magnetostrictive technology, ensuring regional market stability and growth in value, if not always in volume.

Segment trends reveal that the linear position sensor segment dominates the market due to its overwhelming application in hydraulic cylinders and machine tooling, representing the core utility of the technology. Within applications, the industrial automation segment—encompassing factory automation, material handling, and process control—holds the largest share, driven by continuous integration of advanced robotics and automated assembly lines globally. However, the mobile hydraulic equipment segment, crucial for heavy construction and agricultural machinery, is exhibiting the highest CAGR, spurred by global infrastructure investment cycles and the necessity for ruggedized, high-pressure compliant sensors. Technological advancements in sensor materials and electronics are enabling wider temperature ranges and superior electromagnetic compatibility (EMC), addressing historical limitations and further cementing magnetostrictive sensors as the preferred solution over less durable alternatives in high-stress, dynamic applications across all major industrial segments.

AI Impact Analysis on Magnetostricitive Position Sensors Market

Common user questions regarding AI's influence on the Magnetostrictive Position Sensors Market predominantly revolve around how artificial intelligence will enhance predictive maintenance capabilities, improve sensor accuracy through data fusion, and optimize complex industrial processes using real-time positional data. Users are keen to understand if AI can effectively process the vast, high-resolution data streams generated by these sensors to detect subtle anomalies indicative of system wear or failure before they manifest as critical downtime events. A key concern often raised is the challenge of integrating proprietary sensor communication protocols with centralized AI/ML platforms, seeking assurance that future magnetostrictive sensors will be designed for seamless data ingestion and edge processing. The overall expectation is that AI will transform the sensor from a passive measurement device into an active diagnostic tool, enabling automated process adjustments and significantly extending the Mean Time Between Failures (MTBF) for high-value industrial assets like injection molding presses and steel mill machinery, thereby enhancing their overall return on investment.

- AI algorithms facilitate advanced predictive maintenance by analyzing high-frequency position data captured by magnetostrictive sensors, identifying patterns indicative of seal degradation, cylinder misalignment, or hydraulic fluid contamination.

- Integration of AI at the edge allows for immediate, localized data processing of sensor outputs, reducing latency and enabling rapid, autonomous adjustments to machine parameters, crucial in high-speed manufacturing environments.

- Machine learning models are employed to calibrate and compensate for environmental variances (temperature fluctuations, pressure changes) affecting sensor output, thereby enhancing the overall measurement accuracy and repeatability in real-world operational conditions.

- AI drives the development of self-diagnosing sensors capable of reporting not only position but also internal health status, simplifying troubleshooting and minimizing manual intervention for calibration and repair.

- Optimization of complex motion profiles in robotics and CNC machinery is achieved using AI that utilizes real-time magnetostrictive position feedback to refine control loops, leading to smoother operation, reduced energy consumption, and increased component lifespan.

- Data fusion techniques, powered by AI, combine magnetostrictive sensor data with inputs from pressure, temperature, and vibration sensors to create comprehensive digital twins of machinery, offering deeper insights into operational efficiency and anomaly detection.

- AI assists in standardizing data formats and APIs for magnetostrictive sensors, overcoming historical barriers related to proprietary communications and promoting easier integration into large-scale IIoT platforms and cloud-based analytical tools.

- The development of intelligent control systems relies on the precision and reliability of magnetostrictive sensors as foundational data providers; AI ensures this data is utilized efficiently for decision-making processes such as material handling optimization and automated quality control inspections.

- Improved anomaly detection, specific to position and speed deviations, prevents catastrophic equipment failures, thereby decreasing operational costs and improving safety compliance in hazardous industrial settings like mining or chemical plants.

- AI assists manufacturers in designing application-specific magnetostrictive sensors by analyzing operational profiles and failure modes observed in deployed units, leading to tailored product developments optimized for durability and specific performance metrics.

- Enhanced security protocols are often layered with AI/ML techniques to monitor the integrity and authenticity of position data transmitted from sensors, protecting industrial control systems from data manipulation or unauthorized access.

DRO & Impact Forces Of Magnetostricitive Position Sensors Market

The dynamics of the Magnetostrictive Position Sensors Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the mandatory need for high-precision, non-contact absolute position feedback in advanced manufacturing and process control, coupled with the increasing global trend toward industrial automation and the integration of smart factory infrastructure where data reliability is paramount. The sensors' inherent robustness against extreme environments (high pressure, vibration, temperature) makes them indispensable in hydraulic systems, a sector experiencing continuous growth, particularly in the heavy construction and agricultural machinery industries globally. Conversely, significant restraints hinder wider adoption, primarily the higher initial procurement cost compared to conventional sensor technologies like linear potentiometers or encoders, which can deter cost-sensitive small and medium-sized enterprises (SMEs). Furthermore, technical challenges related to sensor vulnerability to strong external magnetic fields, although mitigating measures are employed, occasionally limit deployment in specific electromagnetic interference-heavy environments. The market presents considerable opportunities through the expansion into emerging applications such as deep-sea robotics and renewable energy generation (e.g., pitch control in wind turbines), where their durability and reliability offer significant competitive advantage, alongside the pervasive trend of developing smart sensors featuring built-in diagnostics and standardized digital communication interfaces for IIoT integration, broadening their functional appeal.

The core Impact Forces driving market trajectory are technological innovation, competitive pricing pressure, and regulatory alignment. Technological advancements focused on increasing resolution, reducing footprint, and integrating advanced microprocessors for edge intelligence are substantially expanding the addressable market by making magnetostrictive sensors viable for precision applications previously dominated by optical encoders, such as high-end machine tools. Competitive dynamics compel manufacturers to optimize production processes and supply chain efficiency to mitigate the high initial cost, attempting to close the price gap with lower-cost alternatives without compromising the signature performance attributes. Regulatory frameworks, particularly those governing machinery safety (e.g., ISO 13849, SIL certification) and environmental impact, strongly favor the non-contact, durable nature of these sensors, positioning them as preferred components for achieving high Safety Integrity Levels (SIL) in critical applications. These forces collectively dictate the speed and direction of market penetration, favoring suppliers who can successfully balance high performance, connectivity, and cost-effectiveness in their product portfolios, enabling widespread integration across diverse industrial processes seeking enhanced efficiency and compliance.

Furthermore, global macroeconomic forces, including infrastructure spending and industrial capital expenditure, exert a strong influence. Periods of increased government investment in infrastructure, such as road networks, mining operations, and large-scale utility projects, directly translate into higher demand for heavy mobile equipment utilizing magnetostrictive sensors in their hydraulic control systems. The structural shift in manufacturing supply chains towards localized, highly automated production centers, spurred by geopolitical considerations and the desire for resilience, further necessitates investment in precision automation components. The opportunity to leverage the technology in emerging fields like electric vehicle battery manufacturing (where accurate control of assembly presses is vital) represents a substantial future growth vector. Therefore, market participants who proactively invest in R&D targeting these specific high-growth areas, while simultaneously addressing the cost barrier through scalable production and streamlined design, are positioned to capture disproportionate market share in the upcoming forecast period. Successfully navigating the challenge of simplifying integration for non-expert users through plug-and-play solutions will also be a critical factor influencing market acceleration.

Segmentation Analysis

The Magnetostrictive Position Sensors Market is comprehensively segmented based on product type, output signal, application, and end-user industry, reflecting the diverse requirements of the global industrial and mobile equipment sectors. Understanding these segmentations is crucial for strategic market planning, as different segments exhibit varying growth rates and adoption drivers. By Product Type, the market is broadly divided into Linear Position Sensors, which constitute the largest and most established segment dueately to their extensive use in hydraulic cylinders and linear actuation systems, and Angular Position Sensors, a smaller but rapidly growing niche utilized for rotational feedback in specialized machinery and robotics. Output signals are critical differentiators, ranging from Analog Outputs (voltage or current), traditionally prevalent but decreasing in importance, to modern Digital Outputs, including specialized protocols such as SSI (Synchronous Serial Interface) and industrial Ethernet variants (Profinet, EtherCAT, Powerlink), which cater to the demand for seamless data communication in IIoT environments, showing the highest growth trajectory. This granularity in segmentation allows manufacturers to tailor sensor specifications precisely to the technical demands and communication standards prevalent in target industries, maximizing product relevance and competitiveness.

- By Product Type:

- Linear Position Sensors (Dominant segment used in hydraulic and pneumatic cylinders, press applications, and material handling systems.)

- Angular Position Sensors (Used for rotational feedback, primarily in robotics, specialized machinery, and valve control systems.)

- By Output Signal:

- Analog Output (Voltage/Current) (Traditional and simpler interfaces, still used for basic controls.)

- Digital Output (SSI, CANbus, IO-Link) (Growing rapidly due to demand for high-speed data transfer and integration into networked control architectures.)

- Industrial Ethernet Protocols (PROFINET, EtherCAT, EtherNet/IP) (Highest growth segment, essential for Industry 4.0 and complex automated systems.)

- By Application:

- Hydraulic Cylinders (Core application, offering in-cylinder mounting for extreme durability.)

- Industrial Automation (Factory automation, machine tools, plastic injection molding, and packaging machinery.)

- Mobile Equipment (Construction machinery, agricultural vehicles, mining equipment, and material handling systems.)

- Process Control and Measurement (Level sensing, valve position monitoring, and continuous casting processes.)

- Others (Medical devices, aerospace test rigs, and lumber industry applications.)

- By End-User Industry:

- Manufacturing (Automotive, Aerospace, Metal Processing, Food & Beverage)

- Oil & Gas (Hazardous area applications, valve control, and platform machinery)

- Construction and Infrastructure (Heavy machinery and structural monitoring)

- Energy and Power Generation (Wind turbine pitch control and hydro power systems)

- Agriculture (Precision farming machinery and equipment control)

Value Chain Analysis For Magnetostricitive Position Sensors Market

The Value Chain for the Magnetostrictive Position Sensors Market is characterized by a high degree of technological specialization, beginning with upstream raw material sourcing and culminating in complex system integration at the downstream end-user level. Upstream activities involve the procurement of specialized materials, including specific magnetostrictive alloys (like nickel alloys or iron-cobalt-vanadium compounds) for the waveguide, high-performance electronics components (ASICs, microprocessors) for signal processing, and durable housing materials (stainless steel, specialized plastics) required for harsh environment applications. The manufacturing stage is crucial, involving precise assembly, complex winding techniques for the waveguide, and rigorous calibration and testing procedures to ensure high accuracy and linearity. Key manufacturers often maintain significant intellectual property regarding signal processing algorithms, which differentiate their products in terms of resolution and speed, representing a high-value creation point within the chain. Efficiency in this stage, including lean manufacturing and quality control systems, directly impacts product reliability and cost competitiveness in the final market.

Downstream activities focus heavily on distribution and integration. The distribution channel is typically bifurcated into direct sales to large Original Equipment Manufacturers (OEMs), particularly those in hydraulic cylinder manufacturing and machine tool production, and indirect sales through specialized industrial distributors and system integrators. Indirect channels provide local support, inventory management, and technical expertise to smaller end-users and maintenance, repair, and overhaul (MRO) markets. System integrators play a vital role, often modifying or customizing standard sensors to fit bespoke machinery requirements, bridging the gap between standard product offerings and unique industrial applications. The complexity of integrating digital output sensors (e.g., EtherCAT) into existing or new control platforms necessitates skilled technical support, forming a critical service component in the downstream chain. Successful market players prioritize robust global distribution networks capable of providing rapid access to products and specialized technical assistance globally.

The shift towards smarter manufacturing mandates that the distribution and downstream integration segments increasingly focus on providing software and analytical services alongside hardware. For instance, sensors sold today often come bundled with configuration software or diagnostic tools. Direct sales to major OEMs are critical as these relationships often involve long-term supply contracts and co-development of next-generation sensor architectures optimized for specific machine platforms. In contrast, the indirect channel is essential for market penetration into diverse regional markets and smaller industries, requiring distributors to be highly knowledgeable about the nuances of magnetostrictive technology and its competitive advantages over alternatives. Optimizing logistics and reducing lead times for customized sensor lengths or special configurations is a key competitive advantage, as industrial users often require rapid deployment to minimize production halts, making the efficiency of both direct and indirect channels a significant determinant of overall market share and customer satisfaction.

Magnetostricitive Position Sensors Market Potential Customers

The primary potential customers and end-users of Magnetostrictive Position Sensors are diverse organizations operating complex machinery requiring continuous, precise monitoring of linear or angular motion, spanning across heavy industry, manufacturing, and mobile equipment sectors. Leading Original Equipment Manufacturers (OEMs) of hydraulic and pneumatic systems represent a core customer base, integrating these sensors directly into high-pressure cylinders for feedback loops in critical applications such as injection molding machines, die-casting equipment, and servo-hydraulic test stands, valuing their ability to withstand extreme operating conditions inside the cylinder rod. Another major customer segment includes systems integrators and engineering firms specializing in industrial automation projects, who select and configure these sensors for automated assembly lines, robotic work cells, and material handling systems where high throughput and repeatability are essential. Furthermore, companies involved in infrastructure and heavy mobile machinery, including manufacturers of excavators, cranes, loaders, and agricultural tractors, rely on magnetostrictive technology for robust position monitoring in critical boom and implement control, ensuring safety and operational efficiency in challenging outdoor environments and demanding duty cycles.

Secondary but significant customer groups include end-user facilities requiring upgrades or maintenance (MRO market), particularly in industries like steel production, lumber processing, and power generation (both conventional and renewable). In the steel industry, they are used for precise control of continuous casting rollers and furnace mechanisms, while in the lumber sector, they ensure optimal cutting head positioning for maximizing yield. The energy sector uses them extensively in wind turbine pitch control systems, demanding sensors capable of operating reliably in harsh, often remote, conditions with minimal maintenance. These customers are motivated by the sensor's long-term reliability and low cost of ownership over its lifecycle, seeking solutions that minimize unplanned downtime. The purchasing decision is typically driven not only by initial cost but heavily by technical specifications such as linearity, resolution, durability against contaminants, and compatibility with specific fieldbus protocols necessary for their existing centralized control systems, making technical performance the paramount criterion for customer selection across all segments.

The trend towards Industry 4.0 and the increasing complexity of machinery is expanding the customer base to include high-tech manufacturers specializing in complex, multi-axis motion control, such as semiconductor fabrication equipment suppliers and advanced robotics manufacturers. These customers prioritize the extremely high resolution and fast update rates offered by modern digital magnetostrictive sensors, essential for sub-micron precision positioning required in lithography or high-speed pick-and-place robotics. Furthermore, the oil and gas industry, facing intense regulatory pressure and hazardous environments, procures certified explosion-proof (ATEX/IECEx rated) versions of these sensors for monitoring valve and actuator positions on drilling platforms and pipelines. Overall, the ideal potential customer is characterized by a high tolerance for initial capital expenditure if it guarantees superior reliability, precision, and longevity, particularly in applications where failure carries a significant financial or safety risk, positioning the magnetostrictive sensor as a premium, critical component supplier across global industrial value chains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,170 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MTS Systems (now Amphenol), Balluff GmbH, Novotechnik U.S., Turck, Zettlex, WayCon Positionsmesstechnik GmbH, Rota Engineering Ltd., Gefran S.p.A., SIKO GmbH, Parker Hannifin Corporation, Opkon, Limitorque (Flowserve), ASM GmbH, Celesco Transducer Products, Eltra S.p.A., BEI Sensors (Sensata Technologies), Meggitt Sensing Systems, H.G. Schaevitz LLC (Trans-Tek), Sensor Technology Ltd., Althen Sensors & Controls. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnetostricitive Position Sensors Market Key Technology Landscape

The technological landscape of the Magnetostrictive Position Sensors Market is defined by continuous advancements aimed at improving resolution, increasing operational speed, and enhancing digital integration capabilities necessary for Industry 4.0 adoption. The core principle remains the precise measurement of the time interval (Time-of-Flight) between the initiation and reception of the ultrasonic strain pulse, but modern sensors employ highly sophisticated digital signal processors (DSPs) and custom-designed ASICs to drastically improve signal-to- noise ratio and linearity, achieving resolutions down to the micron level, making them competitive even with highly specialized optical systems in certain applications. A critical development is the transition from purely analog or pulse-width modulated (PWM) outputs to high-speed digital communication protocols. The widespread adoption of industrial Ethernet protocols, such as EtherCAT, PROFINET, and POWERLINK, allows the sensors to transmit position, velocity, and diagnostic data simultaneously and in real-time, enabling synchronized motion control across multiple axes and reducing wiring complexity in large-scale automated systems, which significantly contributes to reducing installation and commissioning time in complex factory setups.

Further innovation is concentrated in material science and mechanical design to enhance sensor durability and resilience against extreme operating conditions. Manufacturers are utilizing advanced corrosion-resistant materials, specialized potting compounds, and robust pressure housings to certify sensors for use in ultra-high-pressure hydraulic applications (up to 600 bar) and in corrosive environments prevalent in the chemical processing and marine industries. The design evolution includes modular sensors with interchangeable heads and standardized mounting interfaces, simplifying integration and maintenance procedures for end-users. The development of intrinsically safe (IS) versions, certified under standards like ATEX and IECEx, is critical for market penetration into the hazardous zones of the oil & gas and petrochemical industries, where safety regulations are stringent. These technological refinements ensure that magnetostrictive sensors maintain their competitive edge by addressing industry demands for both precision and ruggedization in an increasingly digitized industrial environment, ensuring long-term operational reliability with minimal signal degradation.

The emerging technological focus is on embedding intelligence and connectivity directly into the sensor head, moving toward "smart sensor" status. This includes incorporating microprocessors capable of performing basic diagnostic and condition monitoring tasks at the sensor level, often referred to as edge computing. These smart sensors can monitor internal parameters such as temperature, signal strength, and power supply stability, proactively reporting deviations that might compromise measurement accuracy or indicate impending hardware failure, thereby supporting true predictive maintenance regimes. Furthermore, there is ongoing research into optimizing the magnetostrictive waveguide material itself to reduce hysteresis and thermal drift, ensuring consistent accuracy across wider temperature spans. The ability to integrate features like dual redundancy or integrated pressure sensing within a single compact housing further highlights the technological maturity and diversification of the magnetostrictive portfolio, solidifying its role as a high-value data source within contemporary industrial control and monitoring architectures.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, driven by aggressive infrastructure development, large-scale government investments in industrialization (e.g., Made in China 2025, 'Make in India' initiatives), and the rapid expansion of domestic automotive manufacturing and heavy equipment production bases. Countries like China, Japan, and South Korea are major consumers, characterized by high levels of factory automation and an increasing appetite for high-resolution position sensing in advanced machine tooling and robotics. The region's focus on adopting smart factory technologies and building sophisticated automated assembly lines provides a robust, long-term demand foundation for digital output magnetostrictive sensors, often prioritizing cost-effective yet reliable solutions to support massive volume manufacturing.

- North America: North America represents a mature yet high-value market, characterized by stringent safety and performance standards in sectors like aerospace, oil and gas, and high-tech manufacturing. The demand here is centered on premium, high-specification sensors, particularly those with hazardous location certifications (Class I Div 1/2) and compliance with specialized military or critical infrastructure standards. Growth is stable, driven primarily by the replacement and modernization of aging industrial infrastructure, continuous investment in specialized mobile hydraulic machinery (agriculture and construction), and the pioneering adoption of IIoT technologies and edge computing, making the United States the single largest national market globally due to its large installed base of industrial assets.

- Europe: Europe is a significant market, leading in the adoption of advanced automation standards (Industry 4.0) and safety regulations (SIL/PL ratings). Germany, Italy, and Scandinavia are key markets, benefiting from strong local industries in machine tool manufacturing, plastic injection molding, and renewable energy (wind power). European OEMs prioritize high durability, advanced connectivity (especially EtherCAT and PROFINET integration), and sensors designed for energy efficiency. The market is highly competitive, emphasizing technical performance, environmental compliance, and long product lifecycles, ensuring sustained demand for high-end magnetostrictive products that offer validated precision and reliability in complex manufacturing environments across the continent.

- Latin America (LATAM): LATAM is an emerging market with growth largely tied to capital investment cycles in key natural resource sectors, primarily mining, oil extraction (especially offshore), and large-scale agriculture (Brazil and Argentina). Demand is project-driven, necessitating robust, heavy-duty sensors capable of withstanding extreme environmental conditions and high duty cycles typical of mining and construction equipment operating in remote locations. Market penetration requires strong regional partnerships and technical support, with purchasing decisions often heavily influenced by durability, simple integration, and total cost of ownership over rugged duty cycles rather than absolute technological sophistication.

- Middle East and Africa (MEA): The MEA market, while smaller, shows steady growth propelled by significant investments in the region's expansive oil and gas infrastructure, coupled with diversification efforts into manufacturing and logistics (e.g., Saudi Vision 2030). The demand is highly specific, requiring certified hazardous-area sensors (ATEX/IECEx) for pipeline monitoring, refinery control, and sophisticated valve actuation. South Africa leads the African market due to its established mining and industrial base. The region emphasizes sensors that guarantee long-term operational stability under extreme temperatures and dusty conditions, positioning reliability and high-pressure ratings as crucial market entry requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnetostricitive Position Sensors Market.- MTS Systems Corporation (now part of Amphenol)

- Balluff GmbH

- Novotechnik U.S. Inc.

- Turck Holding GmbH

- Gefran S.p.A.

- SIKO GmbH

- Parker Hannifin Corporation

- WayCon Positionsmesstechnik GmbH

- Rota Engineering Ltd.

- Opkon Optik Elektronik San. ve Tic. A.Ş.

- Limitorque (Flowserve Corporation)

- ASM GmbH

- Celesco Transducer Products, Inc.

- Eltra S.p.A.

- BEI Sensors (Sensata Technologies Holding plc)

- Zettlex (Celera Motion)

- Meggitt Sensing Systems (now part of Parker Hannifin)

- H.G. Schaevitz LLC (Trans-Tek)

- Sensor Technology Ltd.

- Althen Sensors & Controls

Frequently Asked Questions

Analyze common user questions about the Magnetostricitive Position Sensors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of magnetostrictive position sensors compared to alternatives like LVDTs or potentiometers?

Magnetostrictive sensors offer superior durability, non-contact operation minimizing wear, and provide absolute position feedback, meaning position is retained even after power loss. They feature higher resolution (often infinite), excellent linearity, and are robustly protected against contaminants, making them ideal for high-pressure hydraulic cylinders and harsh industrial environments, offering a longer operational lifespan than contact-based alternatives.

In which specific industrial applications do magnetostrictive sensors provide the most significant operational benefits?

The most significant benefits are realized in hydraulic applications, particularly plastic injection molding machines, die-casting equipment, and servo-hydraulic press control, where high accuracy and repeatability under extreme pressure and vibration are critical. They are also essential in mobile hydraulics (construction and agriculture) and sophisticated multi-axis industrial robotics requiring reliable, absolute position monitoring in high-duty cycle operations.

How is the integration of industrial communication protocols influencing the demand for these sensors?

The shift towards Industry 4.0 mandates sensors with digital connectivity. Integration of industrial Ethernet protocols like EtherCAT and PROFINET allows magnetostrictive sensors to transmit position, velocity, and comprehensive diagnostic data simultaneously and in real-time. This connectivity is crucial for centralized control, advanced diagnostics, and seamless inclusion into sophisticated IIoT platforms, driving significant demand in high-end automation projects.

What factors contribute to the higher initial cost of magnetostrictive position sensors?

The higher initial cost is attributed to the specialized materials required for the waveguide (magnetostrictive alloys), the precision manufacturing and calibration processes, and the integration of sophisticated electronics (DSPs/ASICs) necessary for high-speed, high-resolution signal processing. Furthermore, robust construction for extreme pressure and environmental sealing significantly adds to the material and assembly complexity compared to simpler linear alternatives.

Are magnetostrictive position sensors suitable for hazardous or explosive environments, and what certifications are required?

Yes, magnetostrictive sensors are suitable for hazardous environments, provided they carry the necessary safety certifications. Users must seek models specifically certified as intrinsically safe (IS) or explosion-proof, typically bearing ATEX (European) or IECEx (International) certifications, ensuring they comply with stringent safety regulations required for deployment in industries such as oil and gas, petrochemicals, and mining operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager