Mainframe Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438043 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mainframe Sales Market Size

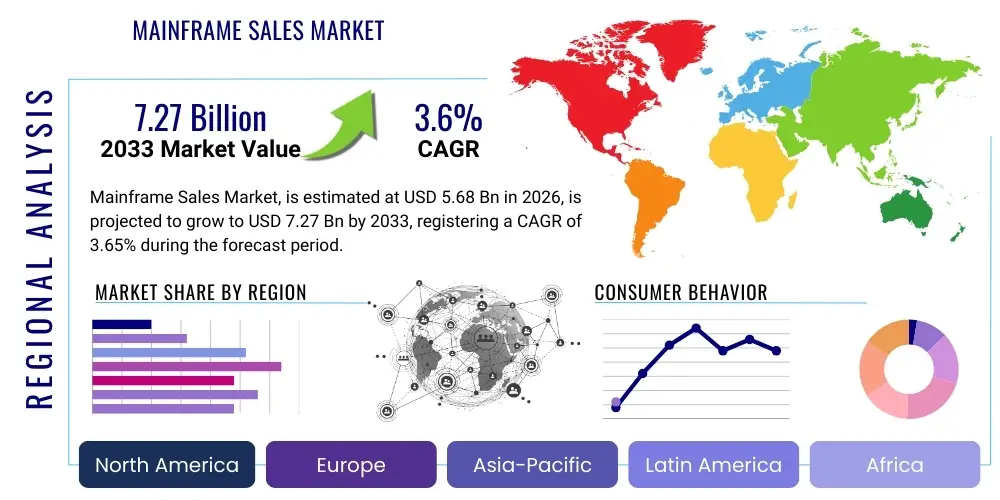

The Mainframe Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.65% between 2026 and 2033. The market is estimated at USD 5.68 Billion in 2026 and is projected to reach USD 7.27 Billion by the end of the forecast period in 2033. This growth trajectory is primarily driven by the indispensable role mainframes play in supporting mission-critical operations across highly regulated industries, coupled with ongoing vendor investments aimed at integrating contemporary technologies like cloud, AI, and cybersecurity enhancements directly into the mainframe architecture.

Mainframe Sales Market introduction

The Mainframe Sales Market encompasses the revenue derived from the procurement, deployment, and ongoing servicing of high-performance computing systems designed for large-scale transaction processing, database management, and enterprise resource planning. These systems, epitomized by platforms like the IBM Z series, are essential for organizations requiring extremely high levels of reliability, security, scalability, and throughput, particularly in environments handling billions of transactions daily. The core product description involves robust hardware capable of massive input/output (I/O) operations, coupled with sophisticated operating systems (such as z/OS) and specialized middleware tailored for complex business applications.

Major applications for mainframes span across key industry verticals, including Banking, Financial Services, and Insurance (BFSI), where they manage core banking systems and global payment networks; Government and Public Administration, used for managing massive citizen data repositories and tax processing; and Retail, facilitating high-volume inventory management and e-commerce transaction processing. The enduring benefits of mainframes include unparalleled uptime (often achieving six nines of availability), integrated hardware and software security layers superior to distributed environments, and exceptional vertical scaling capabilities that efficiently accommodate rapid business growth without massive infrastructure overhaul.

Key driving factors propelling the continuous demand for mainframes include the relentless increase in data volumes generated by digitalization and IoT, necessitating powerful and resilient central processing units; the escalating global regulatory requirements surrounding data privacy and security (like GDPR and CCPA), which mainframes inherently address through advanced encryption and compartmentalization; and the high cost and risk associated with migrating core legacy applications to alternative, often less secure or less reliable, distributed architectures. Furthermore, the strategic move by key vendors to position mainframes as a central component in modern hybrid cloud strategies ensures their continued relevance and market viability.

Mainframe Sales Market Executive Summary

The global Mainframe Sales Market is undergoing a strategic renaissance driven by critical business trends focused on hybrid cloud integration and advanced data analytics. Leading enterprises are leveraging mainframes not just as legacy platforms but as highly secure data hubs capable of integrating seamlessly with modern public cloud services, primarily through containerization (such as LinuxONE and z/OS Container Extensions). This integration is extending the lifespan of mainframe applications while enabling new capabilities like running large-scale AI inferencing models directly on transactional data, thus mitigating data movement risk and enhancing regulatory compliance.

Regional trends indicate North America remains the dominant market segment, anchored by a deep installed base in the BFSI sector and extensive government utilization, although growth acceleration is observed in the Asia Pacific (APAC) region. APAC countries, particularly in emerging economies, are investing heavily in new core banking systems and modern digital government infrastructure, often opting for modernized mainframe solutions due to their reputation for security and resilience against growing cyber threats. Europe maintains stable demand, largely driven by strict compliance mandates (like PSD2 and MiFID II) that mandate high standards of data integrity and system availability, areas where mainframes inherently excel.

In terms of segmentation trends, the Services segment consistently exhibits the highest growth rate, overshadowing hardware sales. This trend is fueled by the complexity of modern mainframe environments requiring specialized expertise in maintenance, integration, security patching, and application modernization (e.g., refactoring COBOL applications). While hardware procurement cycles remain long, the ongoing demand for hardware upgrades is concentrated on integrating specialized accelerators (like cryptographic co-processors and AI chips) and maximizing internal capacity to reduce operational expenditure in the long term, thereby shifting the focus from raw unit sales to capacity on demand models and enhanced system features.

AI Impact Analysis on Mainframe Sales Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Mainframe Sales Market frequently revolve around whether AI represents a threat (due to new cloud-native AI tools) or an opportunity (by enhancing mainframe capabilities). Key themes users seek clarity on include the ability of mainframes to support large-scale machine learning workloads, how AI tools can assist in modernizing decades-old COBOL codebases, and the security implications of integrating AI models that handle sensitive, mission-critical data residing on the mainframe. Users are also highly concerned about the concept of "data gravity"—the difficulty and cost associated with moving vast amounts of transactional data off the mainframe for cloud-based AI processing—and how vendors are addressing this dilemma.

The prevailing expectation is that AI technology will act as a significant catalyst for mainframe revitalization rather than obsolescence. Mainframe vendors are aggressively integrating AI capabilities directly into the hardware and operating system layers, allowing inference to occur close to the data source. This strategy significantly reduces latency and ensures the data remains within the highly secure, controlled environment of the mainframe, fulfilling crucial regulatory requirements. Furthermore, AI tools are being developed and deployed to enhance mainframe operational efficiency, automate system management tasks, and drastically improve threat detection capabilities by analyzing performance metrics and security logs in real time, leading to proactive maintenance and reduced downtime.

This integration supports a shift where mainframes become the definitive platform for transactional AI—processing highly secure, real-time inferences based on core business data. For example, AI running on a mainframe can detect fraudulent financial transactions instantly or optimize retail inventory based on real-time sales velocity without compromising the security posture or reliability of the core application. This strategic alignment leverages the mainframe's unique strengths in data management and security, ensuring its continued necessity in the age of pervasive data analytics and machine intelligence.

- AI-enabled Operations (AIOps): Automation of maintenance, resource allocation, and troubleshooting processes on z/OS, reducing operational expenditure and dependency on scarce legacy skills.

- In-Place AI Inference: Running AI models directly on the mainframe using specialized integrated processors (e.g., Integrated Accelerator for AI) to eliminate data gravity issues and ensure regulatory compliance.

- Enhanced Cybersecurity: Utilization of machine learning algorithms to analyze system behavior, identify sophisticated zero-day threats, and automate rapid security responses within the mainframe environment.

- Code Modernization Tools: AI-assisted tools speeding up the refactoring, documentation, and translation of legacy COBOL and PL/I code into modern languages (like Java or Python) for seamless integration with contemporary interfaces.

- Hybrid Cloud Data Synchronization: AI algorithms optimizing data replication and synchronization between the secure mainframe core and public cloud services, ensuring data consistency for distributed applications.

DRO & Impact Forces Of Mainframe Sales Market

The dynamics of the Mainframe Sales Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively define the overall Impact Forces shaping vendor strategies and enterprise purchasing decisions. The primary drivers center on non-negotiable requirements for massive transaction throughput and enterprise-grade security, which legacy distributed systems struggle to match at scale. These driving factors are consistently countered by significant restraints, chiefly the perceived high upfront acquisition costs, the ongoing scarcity of personnel trained in mainframe technologies, and the competitive pressure exerted by agile, cloud-native solutions offering pay-as-you-go flexibility. However, these challenges are balanced by compelling opportunities, particularly the advent of hybrid cloud models, which position the mainframe as the secure, high-performance foundation of modern enterprise IT architecture, allowing organizations to maintain core stability while embracing cloud agility for non-critical workloads.

The major impact forces solidify the market position of mainframes in high-stakes environments. Impact Force 1 is the necessity of extreme security and resilience, particularly in financial services and national defense, rendering mainframes irreplaceable for core systems. Impact Force 2 relates to application modernization, where enterprises are increasingly choosing to modernize and integrate their existing mainframe applications using APIs and containers rather than undertaking risky, multi-year, and failure-prone rip-and-replace migration projects. This preference for evolution over revolution stabilizes the demand for hardware and professional services related to integration.

Impact Force 3 is the vendor commitment to future relevance; continuous research and development by key players like IBM into quantum-safe cryptography, specialized AI acceleration, and improved energy efficiency ensure that the platform remains technically superior and compliant with future technological standards. Collectively, these forces result in a market characterized by cyclical hardware refreshment demands from a loyal, high-value customer base, supplemented by persistent, high-margin software and services revenue tied to modernization and security enhancements, ultimately ensuring steady, moderate growth.

Segmentation Analysis

The Mainframe Sales Market is broadly segmented across three primary dimensions: Component, End-User Industry, and Geographic Region. Analyzing the market by Component reveals a detailed breakdown of revenue streams derived from proprietary Hardware sales (the physical mainframes), System Software (operating systems like z/OS, middleware, and database management systems), and the critically important Professional Services (installation, migration, modernization, and managed services). The End-User analysis focuses on the sectors that are functionally dependent on mainframes, with BFSI dominating the consumption due to transaction volume, followed closely by Government for managing large public records, and Retail for high-scale point-of-sale and supply chain operations. Geographical segmentation confirms the mature market dominance of North America and Europe, contrasted with the high-growth potential identified within the emerging digital economies of the Asia Pacific.

- By Component:

- Hardware (Mainframe Systems, Peripheral Devices)

- Software (Operating Systems, Security Software, Database Management Systems, Application Development Tools)

- Services (Consulting, Managed Services, Implementation and Integration, Application Modernization)

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Retail and E-commerce

- IT and Telecommunication

- Manufacturing

- Healthcare

- By Deployment Model:

- On-Premise

- Mainframe-as-a-Service (MaaS) / Cloud-based Mainframe

- By Processing Capacity:

- Low-End Mainframes

- Mid-Range Mainframes

- High-End Mainframes

Value Chain Analysis For Mainframe Sales Market

The value chain for the Mainframe Sales Market is highly proprietary and concentrated, fundamentally differing from standard commodity IT infrastructure chains. The upstream analysis is dominated by a few key Original Equipment Manufacturers (OEMs), notably IBM, which maintain tight control over the design, manufacturing of specialized processors (like z processors), and development of proprietary operating systems (z/OS). This high level of integration and intellectual property protection at the manufacturing and system software stages ensures high barriers to entry and guarantees proprietary pricing power for the few dominant players. Component suppliers, while numerous, often operate under strict non-disclosure agreements, providing highly specialized components optimized for mainframe performance and resilience.

Downstream analysis primarily involves two critical pathways: Direct Sales and indirect distribution through highly specialized partners. Direct sales remain crucial for large-scale, strategic deals with global banks and governments, where high-touch consulting and long-term relationships are paramount. The indirect channel involves System Integrators (SIs) and Value-Added Resellers (VARs) who possess deep expertise in mainframe deployment, legacy system migration, and integrating mainframes into hybrid IT landscapes. These partners are essential for reaching mid-sized enterprises and for delivering complex, customized professional services that complement the core hardware and software offerings.

The distribution channel is characterized by heavy reliance on Professional Services, which often represent the majority of the total contract value. Sales are driven less by traditional box-moving and more by consulting engagements focused on business outcomes, such as regulatory compliance assurance, transaction speed optimization, and application modernization. The distinction between direct and indirect is often blurred, as OEM sales teams frequently collaborate with SIs to deliver the complex, long-term servicing contracts that ensure customer retention and recurring revenue, making the value chain heavily weighted toward service delivery expertise.

Mainframe Sales Market Potential Customers

Potential customers for Mainframe Sales are overwhelmingly characterized as large, globally operating organizations that require absolute system reliability, massive computational power for transactional processing, and industry-leading security features. The primary end-users or buyers of mainframe systems are typically senior IT decision-makers, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Heads of Infrastructure, within highly regulated industries. These customers prioritize Total Cost of Ownership (TCO) efficiency over sheer initial acquisition cost, recognizing that the mainframe's high utilization rates and low failure rates translate into superior business continuity and reduced long-term operational costs compared to sprawling distributed environments.

The core segments include major global banks, insurance carriers, and large credit card processing firms that must manage peaks of millions of transactions per second securely and reliably. Governmental bodies, particularly national treasury departments, defense agencies, and large social security administrators, represent another significant customer base due to their need to process and store vast quantities of sensitive citizen data under strict legal mandates. Furthermore, large multinational retailers with extensive global supply chains and massive holiday season transaction peaks rely on the mainframe's scalable I/O capabilities to maintain high service levels during critical business periods. These buyers look for integrated solutions offering seamless hybrid cloud connectivity and guaranteed future support for evolving technologies like quantum computing resilience and advanced AI integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.68 Billion |

| Market Forecast in 2033 | USD 7.27 Billion |

| Growth Rate | 3.65% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Fujitsu, Hitachi Vantara, NEC Corporation, Hewlett Packard Enterprise (HPE), Unisys, Compuware (acquired by BMC Software), Micro Focus, CA Technologies (Broadcom), Software AG, DXC Technology, T-Systems, Kyndryl, Atos, BMC Software, Accenture, Deloitte, Capgemini, Infosys, Wipro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mainframe Sales Market Key Technology Landscape

The technology landscape governing the Mainframe Sales Market is characterized by continuous, high-investment innovation focused on integration, security, and performance efficiency, fundamentally driven by the architecture of leading platforms like the IBM Z series and associated operating environments such as z/OS and z/VM. Key technological differentiators include the integration of specialized co-processors and accelerators directly onto the core chip architecture. This ensures that demanding workloads like data compression, cryptographic processing (e.g., pervasive encryption capabilities), and increasingly, AI inferencing, can be handled at wire speed without impacting the performance of core transactional engines. Furthermore, the development of secured enclaves and tamper-resistant hardware modules provides a level of data protection that remains unmatched by commodity hardware solutions, addressing critical compliance needs.

A crucial technological shift is the embrace of open standards and containerization, specifically allowing Linux workloads and modern application frameworks (like Java, Python, and Node.js) to run natively on the mainframe, often utilizing LinuxONE systems. This allows organizations to attract modern developers and integrate contemporary microservices architectures directly alongside decades-old mission-critical COBOL applications, leveraging the mainframe's unparalleled I/O throughput and shared resource security. This technological convergence alleviates the "legacy island" issue, repositioning the mainframe as a versatile platform capable of hosting both traditional core systems and modern cloud-native components within a unified, highly secure environment.

Future-proofing the mainframe platform is a significant focus, particularly through the development of quantum-safe cryptographic modules. Given the extremely long operational lifespan of mainframe systems (often exceeding 10 years), vendors are incorporating technologies designed to withstand potential attacks from future quantum computers, thereby securing sensitive data for decades to come. Furthermore, advanced hardware diagnostics and AIOps integration are leveraging machine learning to predict system failures, automate capacity planning, and optimize energy consumption, driving down the overall operational complexity and cost, ensuring the mainframe remains a competitive technological choice for enterprise computing infrastructure.

Regional Highlights

The demand for Mainframe Sales is geographically concentrated, with significant regional variations in growth drivers and modernization priorities.

- North America: This region holds the largest market share, driven primarily by the extensive existing installed base within the U.S. financial sector (major banks, payment processors) and federal government agencies. The market here is characterized by high rates of professional services consumption focused on application modernization (API enablement) and hybrid cloud integration, ensuring that core business logic remains on the secure mainframe while front-end services leverage public cloud elasticity. Investment is heavily skewed towards security upgrades, specialized processors for AI, and ensuring seamless data synchronization across multi-cloud environments.

- Europe: The European market exhibits steady growth, strongly influenced by stringent regulatory frameworks such as GDPR (data privacy) and specific financial directives (MiFID II, PSD2). This regulatory environment necessitates the robust security, auditing capabilities, and proven resilience offered by mainframes, particularly in managing cross-border transactions and sovereign data. While some sectors pursue distributed cloud architectures, core banking and insurance systems across major economies like the UK, Germany, and France remain anchored to mainframe platforms, driving consistent demand for software and compliance services.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, fueled by rapid digital transformation, increasing urbanization, and the modernization of banking infrastructure in high-growth economies (e.g., India, China, Southeast Asia). Many institutions in this region are leapfrogging older distributed architectures and investing directly in modern, cloud-enabled mainframe solutions to handle massive customer growth and transactional throughput. Government investment in digital identity and services also contributes significantly, requiring scalable and trustworthy centralized computing power.

- Latin America and Middle East & Africa (MEA): These regions represent emerging opportunities, where growth is highly localized. In the MEA region, investments are concentrated in major financial hubs (e.g., UAE, Saudi Arabia) and key government digitization initiatives. In Latin America, adoption is primarily centered around major banking institutions in Brazil and Mexico that require robust, always-on capabilities to handle volatile economic and transactional conditions. Growth here is often linked to greenfield deployment or major generational upgrades rather than gradual modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mainframe Sales Market.- IBM (International Business Machines Corporation)

- Fujitsu

- Hitachi Vantara

- NEC Corporation

- Unisys

- Hewlett Packard Enterprise (HPE)

- Broadcom (CA Technologies)

- BMC Software (Compuware)

- Micro Focus

- Software AG

- Kyndryl

- DXC Technology

- T-Systems

- Atos

- Accenture

- Capgemini

- Wipro

- Infosys

- Deloitte

- Tata Consultancy Services (TCS)

Frequently Asked Questions

Analyze common user questions about the Mainframe Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for current Mainframe Sales?

The primary driver is the non-negotiable requirement for mission-critical system resilience and unparalleled data security, especially within the BFSI and government sectors. Modern mainframes offer six nines (99.9999%) uptime and pervasive encryption, which remains superior to distributed and commodity server environments for managing high-volume, sensitive transactional data.

Are mainframes compatible with modern cloud strategies?

Yes, modern mainframes are foundational to enterprise hybrid cloud strategies. Vendors have enabled seamless integration via APIs, containerization (z/OS Container Extensions, LinuxONE), and standardized tools, allowing organizations to run modern microservices and workloads alongside core legacy applications while maintaining centralized security and data integrity.

How is the skill gap issue being addressed in the Mainframe Market?

The mainframe skill gap is being addressed through two key strategies: implementing AIOps tools to automate system management and reduce dependency on manual operations, and integrating modern development tools (like VS Code extensions and Git workflows) to attract younger developers and allow them to interact with mainframe codebases using familiar interfaces and languages (Java, Python, Node.js).

What is the most significant competitive restraint faced by the Mainframe Sales Market?

The most significant competitive restraint is the perception of high initial capital expenditure (CapEx) associated with purchasing new mainframe hardware, coupled with strong competition from hyper-scale cloud providers offering highly elastic, pay-as-you-go Infrastructure-as-a-Service (IaaS) models for non-mission-critical or greenfield applications.

Which geographical region exhibits the fastest growth potential for mainframe adoption?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth potential. This is driven by large-scale digital transformation initiatives, rapid expansion of financial services, and governmental efforts to modernize infrastructure in high-growth markets, which require the proven security and scalability offered by modern mainframe platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager