Management Consulting Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435370 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Management Consulting Services Market Size

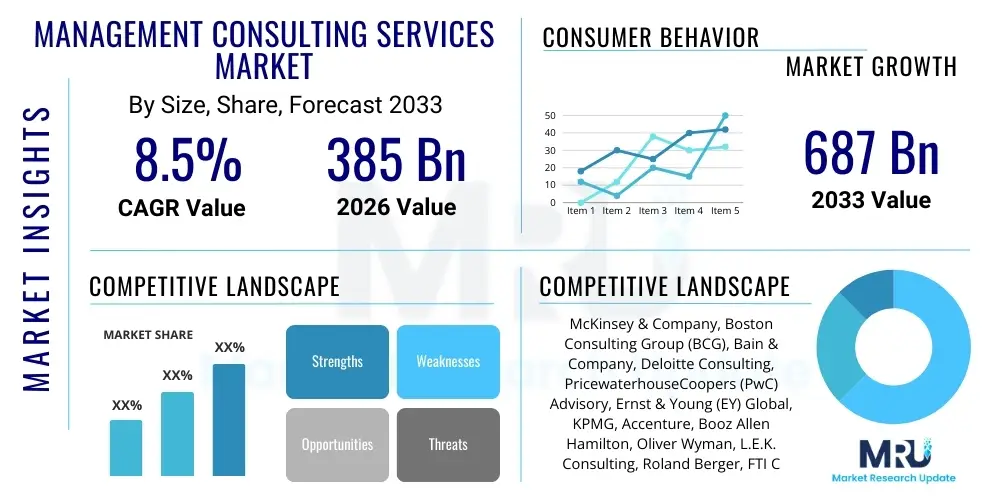

The Management Consulting Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $385 Billion in 2026 and is projected to reach $687 Billion by the end of the forecast period in 2033.

Management Consulting Services Market introduction

The Management Consulting Services Market encompasses advisory services provided to organizations to improve their overall performance, strategy, structure, and operations. This sector is characterized by intense knowledge capital, tailored solutions, and a strong focus on high-impact results, particularly concerning complex business challenges like digital transformation, supply chain resiliency, and sustainability mandates. Services range from specialized IT consulting and human resources management to overarching corporate strategy development and risk mitigation, positioning consultants as indispensable partners in navigating macroeconomic volatility and rapid technological change.

The core offering involves leveraging specialized expertise, proprietary methodologies, and deep industry knowledge to diagnose organizational issues and recommend actionable improvements. The product description of management consulting, while intangible, fundamentally centers on delivering intellectual property and implementation support that enhances client value proposition, optimizes cost structures, and ensures compliance with evolving global regulatory standards. Major applications span across almost all economic sectors, including financial services, healthcare, manufacturing, government, and technology, driven by the universal need for continuous optimization and strategic innovation in the face of competitive pressures.

Key benefits derived from engaging management consultants include accelerated access to cutting-edge tools and expertise, objective external perspective, and the capacity to undertake large-scale organizational restructuring without overburdening internal resources. Driving factors for market expansion are primarily technological disruption, necessitating comprehensive digital strategy overhauls; globalization, requiring complex international market entry and operational restructuring; and the increasing complexity of regulatory environments (e.g., ESG reporting), which mandate expert guidance for adherence and strategic advantage. These pressures ensure sustained demand across enterprises of all sizes seeking competitive differentiation.

Management Consulting Services Market Executive Summary

The global Management Consulting Services Market is experiencing a robust period of expansion, fundamentally driven by pervasive digital transformation initiatives and the imperative for organizations to establish resilient operating models capable of weathering geopolitical and economic instability. Current business trends indicate a significant pivot towards specialized services, moving away from generalized advice to targeted expertise in areas such as cyber security, cloud infrastructure migration, advanced analytics implementation, and Environmental, Social, and Governance (ESG) strategy. Consultancies are heavily investing in proprietary AI and data platforms to augment human expertise, thereby increasing delivery efficiency and the scale of actionable insights provided to clients, signaling a fundamental shift in service delivery methods.

Regional trends reveal that North America maintains its position as the largest market, largely due to high technological adoption rates and substantial expenditure on complex regulatory compliance and post-pandemic restructuring. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid industrialization, massive infrastructure development, and the emergence of domestic multinational corporations requiring strategic support for international expansion and organizational maturation. Europe is defined by a focus on sustainable business models and complex privacy regulations (like GDPR), driving demand for specialized consulting in compliance and green energy transition strategies, creating specific niche growth opportunities.

Segmentation trends highlight that the Operations Consulting segment, including supply chain optimization and process automation, is registering accelerated growth as companies seek immediate cost efficiencies and operational resilience improvements. Simultaneously, Strategy Consulting remains a high-value, albeit cyclical, segment, experiencing rejuvenation through advisory services focused on portfolio restructuring, merger integration (M&A), and strategic technology investment decisions. The blending of IT consulting (now commonly labeled Technology Consulting) with traditional management advice is a pervasive trend, illustrating the market's evolution from providing recommendations to delivering end-to-end transformation and execution support, ultimately solidifying the indispensable role of consultants in the modern enterprise landscape.

AI Impact Analysis on Management Consulting Services Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Management Consulting Services Market revolve primarily around four key themes: the potential for AI tools to automate routine analytical tasks traditionally performed by junior consultants, leading to potential job displacement; the necessity for consultants to acquire deep AI implementation expertise to remain relevant; the ethical implications of using AI in strategic decision-making processes; and the emergence of platform-based, AI-driven consulting models that threaten the traditional high-fee, human-intensive structure. Users are highly interested in understanding how AI will transform strategic data analysis, accelerate report generation, and, crucially, whether AI can successfully replicate the nuanced relationship building and tacit knowledge transfer that defines high-level management consulting engagement, creating a dichotomy between efficiency gains and relationship dependency.

AI is fundamentally repositioning the role of the consultant from a primary data gatherer and analyst to a strategic interpreter and synthesizer of AI-generated insights. The integration of Generative AI (GenAI) models is significantly enhancing proposal generation, market analysis, and risk modeling speed, enabling firms to dramatically reduce the time spent on preliminary research and focusing senior staff on complex problem-solving and client relationship management. This transformation implies a higher barrier to entry for firms without substantial technology investment and necessitates a profound upskilling of existing consultant workforces in prompt engineering, machine learning governance, and data science interpretation. Furthermore, AI tools are creating a new line of service focused specifically on helping clients understand, implement, and govern their own enterprise AI initiatives, generating novel revenue streams for the consulting sector.

The long-term impact analysis suggests that while AI tools will commoditize basic advisory functions, the demand for highly sophisticated strategic guidance addressing systemic, non-linear business challenges will intensify, justifying premium pricing for specialized consulting services. AI serves as a catalyst for market consolidation, favoring large firms that can afford to develop proprietary, data-intensive platforms that offer superior predictive capabilities. Small and niche consultancies, however, must strategically partner or specialize fiercely in areas where human ingenuity and contextual understanding remain irreplaceable, such as complex M&A due diligence or sensitive organizational change management, ultimately requiring a strategic pivot toward tech-enabled human expertise.

- AI significantly automates routine data analysis and report generation, compressing delivery timelines.

- Demand shifts toward implementation and governance consulting for client AI systems.

- Consulting models evolve to become platform-centric, utilizing proprietary algorithms for predictive insights.

- Risk of commoditization for generalized, low-value advisory tasks.

- Increased need for consultants skilled in machine learning, data ethics, and GenAI applications.

- AI-driven tools enhance decision support systems for strategic consulting, improving accuracy.

DRO & Impact Forces Of Management Consulting Services Market

The Management Consulting Services Market is shaped by a powerful interplay of accelerating technological drivers and persistent economic and structural restraints, creating significant windows of opportunity defined by global paradigm shifts. Drivers, such as pervasive digital transformation, the need for stringent regulatory compliance (especially in financial and health sectors), and the pursuit of operational excellence through advanced technologies like IoT and automation, continuously fuel demand for external expertise. Conversely, the market faces significant restraints, including the high cost of premium consulting services, which leads many organizations to develop robust internal consulting functions; the cyclical nature of strategic projects, which are often the first to be cut during economic downturns; and substantial client skepticism regarding the quantifiable return on investment (ROI) from consulting engagement. These restraining forces necessitate a constant demonstration of value by service providers.

Opportunities in the market are abundant, primarily centered on sustainability and resilience. The mandate for Environmental, Social, and Governance (ESG) adherence presents a massive new area for advisory services, covering everything from supply chain sustainability audits to corporate transition strategy towards net-zero targets. Furthermore, the increasing geopolitical uncertainty and resulting supply chain fragmentation drive demand for specialized risk management and geopolitical advisory services. Another key opportunity lies in the mid-market segment, traditionally underserved by Tier 1 firms, where scalable, tech-enabled advisory services can penetrate effectively. These opportunities require specialized skills and rapid adaptation, favoring agile consulting practices.

The impact forces driving the competitive dynamics include intense competition from Big Four accounting firms, specialized technology integrators, and boutique firms, creating a highly fragmented yet fiercely competitive landscape. Technological forces, particularly AI and automation, act as disruptive elements, redefining service delivery and lowering the entry barrier for specific analytical tasks, while macroeconomic forces, such as fluctuating interest rates and inflation, directly influence corporate spending on discretionary consulting projects. Collectively, these forces mandate that consulting firms continuously refresh their intellectual capital, refine their value proposition toward measurable outcomes, and invest heavily in technology platforms to maintain relevance and competitive advantage in a volatile global market.

Segmentation Analysis

The Management Consulting Services Market is comprehensively segmented based on the type of service offered, the specific functional area addressed, the industry served, and the size of the client organization. This multi-faceted segmentation allows consulting firms to tailor their proprietary methodologies and expert resource pools to highly specific client needs, ensuring specialized value delivery and optimized pricing models. Service type segmentation distinguishes between advisory focus areas such as strategy formulation versus implementation support, while industry segmentation recognizes the unique regulatory, operational, and technological challenges inherent in sectors like Banking, Financial Services, and Insurance (BFSI) compared to Healthcare or Government.

Key drivers behind the segmentation structure include the increasing specialization demanded by clients facing complex challenges, the necessity for consultants to possess deep vertical expertise, and the global trend toward regulatory harmonization, which requires dedicated compliance advisory services. The segmentation by functional area, covering everything from supply chain logistics to customer relationship management, reflects the enterprise-wide scope of transformation projects. The detailed segment analysis is crucial for market participants seeking to identify high-growth niches, allocate resources efficiently, and benchmark their competitive position against specialized rivals within distinct service lines and geographic markets.

- By Type: Strategy Consulting, Operations Consulting, Financial Advisory, HR Consulting, Technology Consulting (IT Consulting).

- By Functional Area: Sales and Marketing, Supply Chain Management, Finance and Accounting, Organizational Change Management.

- By Industry Vertical: BFSI, Healthcare and Pharmaceuticals, Energy and Utilities, Manufacturing, Retail and Consumer Goods, Government and Public Sector, Telecommunications, Technology, Media & Entertainment.

- By Organization Size: Large Enterprises, Small and Medium Enterprises (SMEs).

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA).

Value Chain Analysis For Management Consulting Services Market

The value chain for Management Consulting Services is knowledge-intensive and generally comprises four primary stages: Knowledge Infrastructure and Upstream Support, Core Consulting Service Delivery, Implementation and Execution, and Downstream Client Relationship Management. The Upstream Analysis focuses on the foundational elements, including academic research partnerships, investment in proprietary technology platforms (such as AI-driven data analytics and proprietary methodology development), and continuous talent acquisition and training. This stage represents the capital expenditure required to maintain intellectual superiority and is crucial for developing the specialized knowledge capital that differentiates high-tier firms. Efficient upstream resource management dictates the quality and uniqueness of the services offered later in the chain.

The Core Consulting Delivery stage involves the actual client engagement, encompassing problem diagnosis, data gathering, strategic formulation, and recommendation generation. This stage is characterized by high human capital intensity, utilizing highly skilled consultants to apply proprietary frameworks and deep industry insight to tailor solutions. Distribution channels are predominantly direct, relying heavily on existing client relationships, successful project references, and C-suite networking, defining the market's relationship-centric nature. Indirect distribution often occurs through formalized partnerships with technology vendors (e.g., cloud providers) or system integrators, allowing consultants to bundle their advisory services with complex technological implementations.

Downstream Analysis centers on the Implementation and Execution phase, where advisory recommendations are translated into tangible organizational changes, often requiring project management oversight, technological integration, and change management support. This phase solidifies the ROI for the client and fosters long-term retention. Subsequent client relationship management involves post-project reviews, continuous monitoring of strategic performance indicators, and identification of future phases of transformation. The transition from pure advisory (upstream) to deep implementation (downstream) represents a strategic shift among major consulting players, aiming to capture a larger share of the overall transformation budget and establish more enduring client partnerships based on demonstrated, measurable outcomes.

Management Consulting Services Market Potential Customers

Potential customers for Management Consulting Services span the entire spectrum of the global economy, primarily characterized by organizations undergoing periods of significant change, facing intense competitive pressures, or mandated by regulation to restructure or comply. The primary end-users are C-suite executives—CEOs, CFOs, and CIOs—in large enterprises (>$1 billion revenue) across heavily regulated or technologically advanced sectors such as BFSI, where complex risk modeling and digital acceleration are prerequisites for survival. These customers seek expertise to unlock new markets, streamline global operations, manage large-scale mergers and acquisitions, or navigate major technological pivots like cloud migration and cyber security overhaul.

Beyond the large corporate sector, Small and Medium Enterprises (SMEs) represent a rapidly expanding segment of potential customers, particularly those experiencing high-growth trajectories or needing specialized assistance in managing their first phase of internationalization or institutionalizing professional management practices. While SMEs traditionally lack the budgets for Tier 1 firms, the rise of modular, subscription-based, or technology-enabled consulting services now makes specialized advice more accessible. These buyers typically focus on immediate operational efficiency gains, market entry strategy, or specialized HR consulting to rapidly scale their workforce and organizational structure effectively.

The third major category includes government and public sector entities, encompassing federal, state, and municipal organizations, as well as non-profits and international bodies. These customers engage consultants for complex societal and infrastructural challenges, such as large-scale IT modernization, public health system restructuring, defense optimization, and developing public-private partnership models. Their procurement is often driven by efficiency mandates, legislative requirements, and the need for objective, politically neutral strategic planning, making them stable but complex buyers requiring specialized compliance knowledge and public sector expertise from their consulting partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385 Billion |

| Market Forecast in 2033 | $687 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte Consulting, PricewaterhouseCoopers (PwC) Advisory, Ernst & Young (EY) Global, KPMG, Accenture, Booz Allen Hamilton, Oliver Wyman, L.E.K. Consulting, Roland Berger, FTI Consulting, Capgemini Invent, Mercer, Willis Towers Watson, Aon Hewitt, Gartner Consulting, Infosys Consulting, Wipro Consulting Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Management Consulting Services Market Key Technology Landscape

The technology landscape underpinning the Management Consulting Services Market is rapidly shifting towards proprietary, platform-based solutions designed to enhance the speed, depth, and scalability of consulting delivery. A cornerstone of this evolution is the development and deployment of specialized AI and Machine Learning (ML) platforms that automate complex data synthesis, predictive modeling, and scenario planning, dramatically reducing the reliance on manual analytical labor. These platforms are often cloud-native, offering robust capabilities for handling massive datasets related to market trends, customer behavior, and operational efficiency metrics, enabling consultants to provide insights at unprecedented speed and precision. Furthermore, blockchain technology is emerging as a critical focus area, not only for advisory services focused on financial services clients but also internally for establishing immutable records of project milestones and intellectual property management within consulting engagements.

Another crucial element of the technology landscape involves advanced visualization tools and workflow automation software, which are instrumental in both internal operations and client deliverables. Consultants are increasingly utilizing sophisticated data dashboards and simulation environments to communicate complex strategic recommendations clearly and interactively to C-suite clients, enhancing comprehension and buy-in. Internally, Robotic Process Automation (RPA) is being applied to administrative tasks, resource allocation, and knowledge management systems, freeing up high-value consultant time for client-facing strategic activities. This technological integration ensures that the consultant’s core value remains focused on qualitative judgment and strategic interpretation rather than quantitative processing.

The preparedness for disruptive technologies, such as Quantum Computing (QC) and the expansion of immersive technologies like the Metaverse for corporate training and virtual collaboration, also defines the cutting-edge of the consulting technology landscape. While QC is still nascent, leading consulting firms are actively building advisory practices focused on helping clients understand potential applications in optimization and drug discovery, positioning themselves at the forefront of technological evangelism. Ultimately, the successful technology strategy in this market is defined by the ability to seamlessly integrate advanced analytics and proprietary AI tools into bespoke client engagements, creating a continuous feedback loop that drives recurring revenue through tech-enabled managed services, moving beyond time-and-materials project delivery.

Regional Highlights

- North America: Dominates the global market share, driven by high technology expenditure, the presence of major global consulting headquarters, and the continuous demand for cyber security and digital transformation expertise. The US market is characterized by complex regulatory frameworks (e.g., healthcare and financial compliance), necessitating intensive advisory services. The region leads in the adoption of AI-driven consulting platforms and proprietary methodologies.

- Europe: A mature market characterized by slower but stable growth, highly influenced by sustainability mandates (Green Deal) and stringent data privacy regulations (GDPR). Demand is strong for ESG consulting, large-scale public sector IT modernization, and supply chain restructuring due to regional geopolitical shifts. The market is fragmented, with strong regional boutique firms specializing in localized regulations.

- Asia Pacific (APAC): Exhibits the highest CAGR, fueled by rapid economic expansion, urbanization, and increasing foreign direct investment in countries like China, India, and Southeast Asia. Key growth drivers include large-scale infrastructure projects, manufacturing optimization, and the need for organizational maturity consulting as local companies scale internationally. The demand for digital and operations consulting is particularly robust.

- Latin America (LATAM): Growth is steady, focusing primarily on financial services modernization, energy sector optimization, and navigating economic volatility. Demand is often concentrated in Brazil and Mexico, where companies seek external expertise to improve efficiency and attract international investment, often requiring risk management and turnaround strategy consulting.

- Middle East and Africa (MEA): Emerging market with high potential, driven by national diversification agendas (e.g., Saudi Vision 2030) that necessitate massive government and infrastructure consulting projects. Digitalization initiatives, particularly in telecommunications and energy transition, are key focus areas, demanding specialized expertise in project management and public sector transformation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Management Consulting Services Market.- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Deloitte Consulting

- PricewaterhouseCoopers (PwC) Advisory

- Ernst & Young (EY) Global

- KPMG

- Accenture

- Booz Allen Hamilton

- Oliver Wyman

- L.E.K. Consulting

- Roland Berger

- FTI Consulting

- Capgemini Invent

- Mercer

- Willis Towers Watson

- Aon Hewitt

- Gartner Consulting

- Infosys Consulting

- Wipro Consulting Services

Frequently Asked Questions

Analyze common user questions about the Management Consulting Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is digital transformation impacting the demand for consulting services?

Digital transformation significantly increases demand by requiring specialized expertise in areas like cloud migration, cyber security, AI implementation, and complex system integration. Consultants are essential for defining the strategic roadmap and executing these large-scale technology pivots effectively.

Which consulting segment is projected to show the highest growth rate?

Technology Consulting (IT Consulting) is consistently projected to show the highest growth rate, fueled by the accelerating adoption of AI, Generative AI applications, and the constant need for enterprises to modernize their core IT infrastructure and enhance digital customer experience.

What are the primary restraints affecting market growth?

Primary restraints include the high cost of premium consulting services, which often leads to client price sensitivity, the cyclical nature of strategic projects during economic downturns, and the increasing trend of companies developing robust, cost-effective internal consulting capabilities.

How does the rise of AI affect the role of a management consultant?

AI automates basic analytical tasks, shifting the consultant's role from data processing to higher-value activities such as strategic interpretation, complex problem framing, relationship management, and advising clients on AI ethics and governance frameworks.

Which region currently holds the largest market share for management consulting services?

North America holds the largest market share, predominantly driven by substantial investment in advanced technologies, strong corporate spending on complex organizational restructuring, and persistent demand for specialized regulatory compliance advice across sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Management Consulting Services Market Size Report By Type (Online Service, Offline Service), By Application (Large Enterprises, SMEs), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Management Consulting Services Market Statistics 2025 Analysis By Application (Less than $500m, $500-$1bn, $1bn-$5bn, $5bn+), By Type (Operations Advisory, Strategy Advisory, HR Advisory), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Management Consulting Services Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Operations Services Consulting, Strategy Services Consulting, HR Services Consulting, Financial Services Consulting, Technology Services Consulting), By Application (Private Sector, Public Sector), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Automotive Management consulting Services Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Passenger car, Light Commercial Vehicle (LCV), Truck, Bus), By Application (Engine cooling, Front air conditioning, Rear air conditioning, Transmission system, Heated/ventilated seats, Heated steering, Waste heat recovery), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager