Mandarin Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433955 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Mandarin Oil Market Size

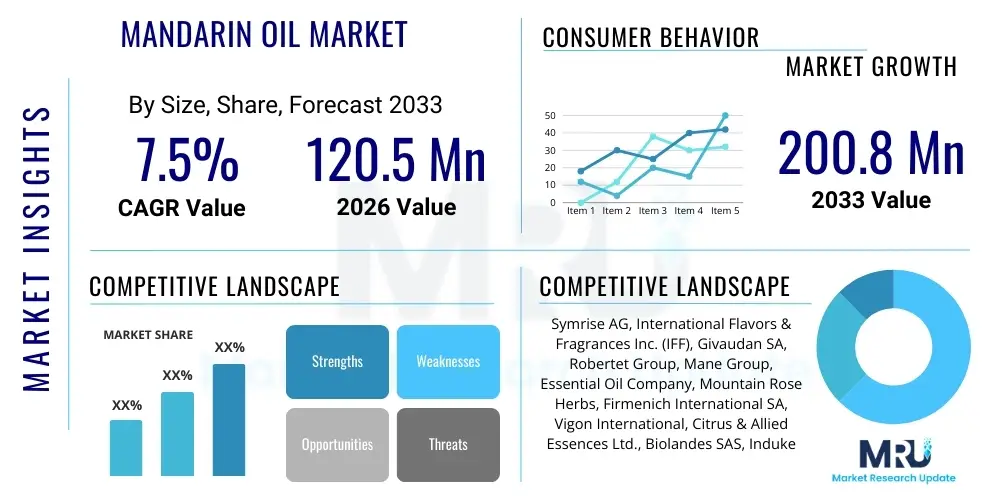

The Mandarin Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 120.5 Million in 2026 and is projected to reach USD 200.8 Million by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the accelerating demand for natural and clean-label ingredients across the cosmetics, food and beverage, and aromatherapy sectors. Consumer preference is shifting decisively towards essential oils recognized for their therapeutic properties and pleasant, non-synthetic aromas, positioning mandarin oil as a key growth commodity in the global natural extracts market. The market valuation reflects increasing industrial application, particularly in high-end fragrance formulation and functional food development, driving both volume and value growth throughout the forecast timeframe.

Mandarin Oil Market introduction

The Mandarin Oil Market encompasses the production, distribution, and utilization of essential oil extracted primarily from the peel of the mandarin fruit (Citrus reticulata). This oil is characterized by its sweet, citrus, and slightly floral aroma, making it highly valuable across multiple industries. Product characteristics vary significantly based on the maturity of the fruit at harvest, leading to varieties such as green, yellow, and red mandarin oil, each offering unique olfactory profiles suitable for specific applications. The major applications span the flavor and fragrance industry, where it is a core component in colognes and fine perfumes; the cosmetic sector, utilized for its skin-toning and anti-inflammatory properties; and the food and beverage industry, serving as a natural flavoring agent in confectioneries, beverages, and baked goods. The inherent natural composition, rich in beneficial monoterpenes like limonene, ensures high efficacy and consumer appeal in health-conscious segments.

The principal benefits driving the market include mandarin oil's established use in aromatherapy for stress relief, calming effects, and mood enhancement, aligning perfectly with global wellness trends. Furthermore, its antiseptic and mild analgesic properties contribute to its application in over-the-counter pharmaceutical products and traditional remedies. From a consumer perspective, the oil’s natural origin supports the global movement away from synthetic additives, enhancing its marketability as a premium, sustainable ingredient. This transition towards natural sourcing mandates stringent quality control and supply chain transparency, influencing production methodologies and pricing strategies across all geographical regions.

Driving factors sustaining the market's robust growth include the burgeoning popularity of clean beauty and personalized fragrance trends, requiring high-purity essential oils. Increasing awareness regarding the therapeutic efficacy of essential oils, especially in developed economies like North America and Europe, further propels demand. Moreover, innovations in extraction technology, such as cold-pressing methods that preserve the oil’s volatile compounds, enhance product quality and broaden application scope. The strategic expansion of cultivation areas in key producing nations, coupled with supportive governmental policies for agricultural exports, ensures a stable raw material supply necessary to meet escalating industrial requirements, solidifying mandarin oil’s position as a cornerstone in the natural ingredients landscape.

Mandarin Oil Market Executive Summary

The Mandarin Oil Market is navigating a dynamic phase characterized by strong business trends centered around sustainability, vertical integration, and digital transformation. Key business trends indicate a focused effort among major players to secure long-term raw material supply through contracts with grower cooperatives, mitigating price volatility stemming from climate change impacts on citrus harvests. The shift towards certified organic and ethically sourced mandarin oil represents a significant commercial imperative, allowing premiumization and access to high-value European and North American consumer segments. Consolidation activities, including strategic acquisitions of smaller extraction specialists by large flavor and fragrance houses, are observed to enhance processing capabilities and market share. Furthermore, the adoption of advanced supply chain management tools is optimizing inventory levels and reducing waste, contributing positively to overall market efficiency and profitability across the value chain, ensuring resilience against market fluctuations.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by rapid urbanization, rising disposable incomes, and the widespread use of essential oils in traditional Chinese medicine and local cosmetic formulations. While North America and Europe remain the largest revenue contributors, their growth is tempered by market maturity, focusing intensely on high-purity, therapeutic-grade products. Latin America, particularly Brazil and Argentina—significant citrus producers—is emerging not just as a supplier but also as a growing consumer market for domestic industrial applications, leveraging proximity to raw materials. Market penetration strategies in the Middle East and Africa (MEA) are concentrating on introducing mandarin oil within luxury personal care and fragrance markets, capitalizing on the region's strong cultural affinity for high-quality aromatic compounds, presenting lucrative, albeit specific, investment opportunities.

Segmentation trends reveal that the application segment is dominated by the Flavor and Fragrance industry, accounting for the largest revenue share, though the Cosmetics and Personal Care segment is exhibiting the highest CAGR, spurred by demand for anti-aging and skin-soothing ingredients. In terms of product type, Red Mandarin Oil, known for its deep aroma and stability, maintains strong demand, but the Green Mandarin Oil segment is gaining traction due to its use in niche, innovative fragrance profiles that appeal to younger demographics seeking unique sensory experiences. Distribution-wise, the Business-to-Business (B2B) sales channel remains paramount for bulk orders supplied to industrial manufacturers, but the rapid growth of specialized e-commerce platforms focused on essential oils is fundamentally changing how smaller artisanal producers reach end-consumers, necessitating adaptable marketing and logistics frameworks.

AI Impact Analysis on Mandarin Oil Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Mandarin Oil Market revolve primarily around efficiency, quality assurance, and sustainability. Users frequently inquire: "How can AI predict mandarin yield and quality?" "Will AI reduce the cost of essential oil extraction?" and "Can AI systems detect adulteration in high-value essential oils more accurately than traditional methods?" These concerns reflect an expectation that AI will address the fundamental vulnerabilities of the market: dependence on unpredictable agricultural output, high processing costs, and the persistent challenge of ensuring product purity in a globalized supply chain. The consensus is that AI offers transformative potential, moving the industry towards precision agriculture and predictive logistics, thereby stabilizing supply and enhancing quality verification processes, minimizing risk for industrial buyers.

The immediate practical impact of AI deployment is centered on precision agriculture and supply chain optimization. Machine learning algorithms, processing data from satellite imagery, weather patterns, and soil sensors, can accurately predict citrus yields several months in advance. This capability allows producers to optimize harvesting schedules, resource allocation, and storage capacities, drastically reducing post-harvest losses and ensuring timely delivery to processors. Furthermore, AI-driven sorting and grading systems utilize computer vision to assess the quality of mandarin peel before extraction, ensuring only optimal feedstock is processed, thereby maximizing the quality and consistency of the extracted oil. This level of optimization minimizes human error and significantly boosts the yield efficiency of expensive cold-pressing machinery, offering a tangible reduction in operational expenditure over time.

Looking forward, AI is set to revolutionize quality control and the development of synthetic alternatives. Deep learning models are being trained on Gas Chromatography-Mass Spectrometry (GC-MS) data profiles to instantly identify subtle chemical anomalies indicative of adulteration, which is a critical concern for high-pvalue essential oils. This provides a robust defense against counterfeiting and ensures compliance with stringent international quality standards (e.g., ISO, IFRA). Moreover, AI-driven biotechnology platforms are exploring synthetic pathways for key aromatic compounds, such as limonene or gamma-terpinene, potentially offering stable, high-purity, cost-effective ingredients that could partially substitute natural mandarin oil in non-therapeutic industrial applications, creating a dual market structure and compelling traditional producers to emphasize sustainability and provenance as core differentiators.

- AI-enabled precision agriculture optimizes mandarin yield forecasts and resource usage.

- Machine learning algorithms enhance the speed and accuracy of detecting oil adulteration (Quality Control).

- Predictive analytics stabilize supply chain logistics, reducing time-to-market and storage costs.

- AI facilitates robotics integration for automated harvesting and processing, improving operational efficiency.

- Generative models accelerate the discovery of novel flavor and fragrance formulations using mandarin oil components.

DRO & Impact Forces Of Mandarin Oil Market

The dynamics of the Mandarin Oil Market are governed by a complex interplay of internal and external forces categorized as Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact on market growth trajectory and profitability. The primary drivers are rooted in escalating consumer preference for natural ingredients and the expansion of key end-user industries, particularly clean cosmetics and therapeutic aromatherapy. However, the market faces notable restraints centered around the inherent volatility of agricultural commodity pricing, vulnerability to climate change, and the presence of synthetic substitutes offering competitive pricing. Opportunities, conversely, lie in technological advancements that enhance extraction efficiency and the untapped potential of emerging markets adopting Western consumer trends, necessitating strategic investments in research and sustainable sourcing practices to mitigate the adverse impacts of prevailing restraints.

Key drivers are fundamentally linked to demographic and cultural shifts. The global wellness movement emphasizes holistic health, elevating essential oils from mere fragrance ingredients to therapeutic components. Mandarin oil, with its proven calming and digestive properties, is highly sought after by certified aromatherapists and incorporated extensively into DIY health solutions, solidifying its presence in the fast-growing wellness sector. Furthermore, stringent regulatory scrutiny, especially in Europe, regarding synthetic cosmetic ingredients has compelled manufacturers to switch to natural alternatives. Mandarin oil serves as a preferred natural fragrance and active ingredient in 'free-from' and organic product lines, significantly increasing its industrial consumption volume. The rise of flavored alcoholic and non-alcoholic beverages requiring natural citrus extracts further broadens the industrial application base, insulating the market against reliance on any single end-user segment for growth stabilization.

Restraints pose persistent challenges, mainly stemming from the agricultural foundation of the raw material. Mandarin harvests are highly susceptible to unpredictable weather patterns, pests, and diseases, leading to significant fluctuations in annual yield and subsequent price volatility for the essential oil. This instability makes long-term industrial planning difficult for bulk purchasers. Secondly, while consumers prefer natural oils, the market contends with readily available synthetic alternatives (nature-identical chemicals) that offer far greater price stability, standardization, and higher volume availability, particularly challenging natural mandarin oil's market share in basic industrial applications where cost minimization is the priority. Moreover, the extensive and time-consuming regulatory requirements for essential oils, including registration and safety data submissions in diverse regions, act as a barrier to entry, particularly for small and medium-sized producers attempting to penetrate international high-value markets.

Opportunities for exponential market expansion are concentrated in geographic and technological advancements. Geographically, the rapidly developing economies in Asia Pacific and Latin America present vast untapped potential, characterized by growing middle classes and increasing acceptance of Western-style beauty and wellness products. Establishing robust local supply chains and distribution networks in these regions offers substantial revenue growth pathways. Technologically, the ongoing refinement of supercritical CO2 extraction methods promises higher purity yields and reduced environmental impact compared to traditional cold pressing, enhancing the oil’s appeal to premium-tier industrial users. Furthermore, investment in certified sustainable and organic cultivation practices not only addresses environmental concerns but also allows producers to capture premium pricing, aligning the product offering with the ethical sourcing demands of modern global consumers and securing long-term market competitiveness.

Segmentation Analysis

The Mandarin Oil Market is meticulously segmented based on Type, Application, and Distribution Channel, reflecting the diverse utilization patterns and end-user requirements across the global industry. Understanding these segments is crucial for strategic positioning, allowing market participants to tailor their sourcing, processing, and marketing efforts to specific demand pockets. The Type segmentation distinguishes between Green, Yellow, and Red Mandarin Oils, reflecting differing maturity levels of the fruit at the point of extraction, resulting in distinct chemical profiles and aromatic intensities. Application segmentation reveals the breadth of industrial use, ranging from the pervasive flavor and fragrance sector to the highly regulated pharmaceutical domain. Finally, the Distribution Channel segment highlights the pathways through which the oil reaches end-users, differentiating between industrial B2B sales and consumer-facing retail models.

The Type segment’s divergence is critical for high-end industrial buyers. Green Mandarin Oil, extracted from immature fruit, offers a tart, fresh profile, highly valued in contemporary, vibrant fragrance and flavor formulations. Yellow Mandarin Oil, derived from slightly more mature fruit, provides a balanced, slightly sweeter aroma, making it versatile for general cosmetic and aromatherapy use. Red Mandarin Oil, extracted from fully ripe fruit, possesses the deepest, sweetest, and most tenacious aroma, making it the preferred choice for sophisticated fine fragrances and pharmaceutical preparations where olfactory longevity is essential. The Application segmentation clearly shows that the Flavor & Fragrance industry remains the dominant volume purchaser, utilizing mandarin oil for its core aromatic properties. However, the fastest growth is observed in the Cosmetics and Personal Care segment, where its gentle, non-phototoxic characteristics make it ideal for inclusion in children's products and high-end facial serums, necessitating extremely high purity standards from suppliers.

Segmentation by Distribution Channel defines market access strategies. The Business-to-Business (B2B) channel, involving direct contracts between essential oil manufacturers/traders and large industrial buyers (like international flavor houses or major cosmetic producers), accounts for the vast majority of transaction volume and value. This channel prioritizes bulk supply, consistent quality, and competitive pricing based on long-term agreements. Conversely, the retail channel, encompassing physical stores, specialized essential oil boutiques, and increasingly, direct-to-consumer (DTC) e-commerce platforms, caters primarily to individual consumers, small-scale practitioners (e.g., aromatherapists), and artisanal producers. The growth of the e-commerce channel is particularly disruptive, lowering the entry barrier for smaller brands and creating specialized demand for organic, single-origin, and traceable products, demanding enhanced digital marketing and secure logistics capabilities from suppliers.

- By Type:

- Green Mandarin Oil

- Yellow Mandarin Oil

- Red Mandarin Oil

- By Application:

- Flavor & Fragrance Industry

- Cosmetics & Personal Care

- Aromatherapy

- Pharmaceuticals

- Food & Beverages (Non-Flavor & Fragrance Use)

- By Distribution Channel:

- Business-to-Business (B2B)

- Retail (Physical Stores, Specialized Outlets)

- E-commerce/Online Sales

Value Chain Analysis For Mandarin Oil Market

The Value Chain for the Mandarin Oil Market is a structured progression starting from raw material cultivation and extending through specialized processing to final market distribution, encompassing critical stages of extraction, purification, and trade. The upstream segment involves the cultivation and harvesting of mandarin fruit, which is highly sensitive to agricultural inputs, climate, and ethical labor standards. Midstream activities focus on the transformation process, predominantly cold-pressing the peel to extract the oil, followed by stringent quality testing and standardization protocols necessary to meet IFRA or FDA guidelines. The downstream segment involves complex logistics, storage, formulation by industrial users (flavor houses, cosmetic manufacturers), and ultimately, distribution through wholesale networks or direct retail channels, where brand reputation and certification play pivotal roles in price realization.

Upstream analysis emphasizes the critical reliance on sustainable citrus farming practices. Key producing regions, such as Italy, Brazil, and the U.S. (California/Florida), invest heavily in high-density planting and efficient irrigation to maximize yield per hectare, simultaneously managing phytosanitary risks that threaten crop stability. For mandarin oil, the quality of the raw material—specifically the peel's oil content and integrity—is paramount, leading processors to establish strong, often vertically integrated, relationships with growers. Processing (midstream) is characterized by the need for specialized, energy-intensive cold-pressing equipment, as heat distillation is generally avoided to preserve the delicate, volatile compounds characteristic of high-grade mandarin oil. Investment in analytical laboratories (using GC-MS) at the processing stage is non-negotiable for ensuring batch-to-batch consistency and confirming the absence of pesticide residues or solvent contamination, upholding the oil’s premium status.

Downstream analysis is dominated by sophisticated distribution networks tailored for high-value, sensitive commodities. The majority of mandarin oil moves via indirect channels, where global traders and specialty chemical distributors act as intermediaries, bridging the gap between regional processors and multinational flavor/fragrance corporations that require just-in-time delivery and customized blend specifications. Direct distribution, although less voluminous, is increasingly common among certified organic producers who leverage e-commerce platforms to sell smaller volumes directly to aromatherapy practitioners and health-food retailers, offering greater control over branding and margin capture. The distribution strategy must account for the oil's requirement for temperature-controlled storage and dark containers to maintain shelf life and prevent oxidative degradation, adding complexity and cost compared to non-volatile commodities, thereby influencing the final price structure for industrial and consumer buyers alike.

Mandarin Oil Market Potential Customers

The primary customer base for Mandarin Oil is segmented into three major industrial sectors: the Flavor and Fragrance industry, the Cosmetics and Personal Care manufacturing sector, and the Pharmaceutical and Nutraceutical industries. The Flavor and Fragrance houses are typically the largest volume buyers, utilizing mandarin oil as a key note in countless perfumery creations, particularly citrus and oriental fragrances, and as a natural flavoring agent in beverages and confectionery. Their purchasing decisions are driven by bulk availability, established purity certifications (IFRA standards), and competitive, long-term contractual pricing, emphasizing consistency across annual batches to maintain product identity in their end-products.

The Cosmetics and Personal Care industry represents a high-growth segment, using mandarin oil not just for its aroma but for its documented skincare benefits, including mild astringency, detoxifying properties, and its gentle nature suitable for sensitive skin formulations. Customers in this sector—ranging from multinational corporations developing mass-market body washes to niche organic brands crafting high-end facial oils—demand rigorous documentation regarding origin, organic certification, and allergen disclosures. Their focus is heavily weighted towards sustainability credentials and evidence of non-phototoxicity, requiring suppliers to provide comprehensive analytical data packs alongside the physical product. This segment often purchases smaller, highly refined batches compared to the fragrance industry.

The Pharmaceutical and Nutraceutical industries constitute a smaller but highly specialized customer segment. These buyers incorporate mandarin oil into traditional remedies, dietary supplements, and over-the-counter topical treatments, leveraging its historical use as a digestive aid and sedative agent. Purity requirements here are the most stringent, demanding compliance with pharmacopeial standards (e.g., USP, EP) and traceability back to the exact cultivation site. Customer engagement in this highly regulated sector requires suppliers to demonstrate full Good Manufacturing Practice (GMP) compliance, ensuring that processing and handling meet pharmaceutical-grade cleanliness and sterilization criteria, making this segment a premium but difficult-to-enter market for standard essential oil suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 120.5 Million |

| Market Forecast in 2033 | USD 200.8 Million |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Symrise AG, International Flavors & Fragrances Inc. (IFF), Givaudan SA, Robertet Group, Mane Group, Essential Oil Company, Mountain Rose Herbs, Firmenich International SA, Vigon International, Citrus & Allied Essences Ltd., Biolandes SAS, Indukern, Döhler Group, A. G. Industries, Young Living Essential Oils, Edens Garden, Floracopeia, Bontoux SAS, Citrus and Allied Essences, Inc., Sigma-Aldrich. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mandarin Oil Market Key Technology Landscape

The technological landscape for Mandarin Oil production is primarily defined by the evolution of extraction techniques aimed at maximizing yield, enhancing purity, and minimizing environmental impact. Cold-pressing, specifically expressed oil extraction, remains the dominant commercial method for mandarin oil as it preserves the integrity of the delicate volatile compounds found in the peel and avoids heat degradation, crucial for retaining the oil’s signature aroma profile. However, ongoing innovations are focusing on optimizing the pressing parameters—pressure, temperature, and processing time—through automation and process control sensors to ensure greater batch consistency and efficiency. Furthermore, research into enzyme-assisted extraction techniques is gaining traction, potentially offering a method to enhance oil recovery from the fruit peel residues, improving resource utilization and sustainability in the upstream segment.

Crucial technological advancements are also evident in the analytical and quality assurance domain. Sophisticated analytical instruments, predominantly Gas Chromatography-Mass Spectrometry (GC-MS) coupled with High-Performance Liquid Chromatography (HPLC), are now standard requirements for verifying the complex chemical composition of mandarin oil. These technologies allow suppliers to detect minute traces of synthetic additives, solvent residues, and pesticide contamination, ensuring compliance with strict regulatory bodies and consumer expectations for "natural" labeling. The use of advanced chemometrics and machine learning models, as discussed in the AI analysis, is accelerating the interpretation of GC-MS data, enabling rapid authentication checks and providing a significant competitive advantage to firms investing in high-precision laboratory infrastructure for quality documentation.

In the cultivation sector, technological integration focuses on mitigating agricultural risks and improving sustainable sourcing. The adoption of smart farming techniques, utilizing Internet of Things (IoT) sensors for real-time monitoring of soil health, water needs, and pest infestation levels, allows for precise intervention, minimizing the use of chemical inputs and maximizing the health of the mandarin trees. Biotechnology is also playing a role, with research aimed at developing resilient citrus varieties that exhibit higher oil yield and greater resistance to common diseases, such as citrus greening (HLB), which pose existential threats to traditional citrus farms. Collectively, these technologies across the value chain drive down operational costs, enhance product quality, and align the industry with global mandates for environmental stewardship and traceability.

Regional Highlights

The global Mandarin Oil Market exhibits distinct regional dynamics, with North America and Europe currently serving as the largest consumers due to high penetration rates of aromatherapy, natural cosmetics, and sophisticated fine fragrance industries. North America, characterized by high disposable income and a strong consumer commitment to wellness products, drives demand for therapeutic-grade, organic certified mandarin oil. The regulatory environment, although complex, encourages premiumization and transparency, rewarding suppliers who can ensure full traceability and purity. The region's large food and beverage sector also constitutes a steady demand source for natural citrus flavorings, underpinning stable long-term growth.

Europe stands out due to its stringent cosmetic and chemical regulations (REACH, Cosmetics Regulation), which have accelerated the shift away from synthetic ingredients, creating a massive opportunity for natural essential oils like mandarin oil. Countries such as France, Germany, and the UK are major hubs for the flavor and fragrance industry, driving high-volume consumption. The high consumer acceptance of ethical sourcing and sustainability labels in Europe places continuous pressure on suppliers to adhere to third-party certifications (e.g., Fair Trade, ECOCERT), influencing supply chain decisions far upstream in the producing nations.

Asia Pacific (APAC) represents the future growth engine of the market. While consumption historically lagged behind Western markets, rapid economic growth, changing lifestyles, and increasing urbanization in countries like China, India, and Southeast Asia are fueling exponential demand for Western-style personal care products and wellness treatments. Local markets often integrate essential oils into traditional practices, compounding the growth. Latin America, particularly Brazil and Argentina, plays a dual role as both a key global supplier (due to extensive citrus farming) and a rapidly maturing consumer market. The Middle East and Africa (MEA) market, though smaller, is showing significant traction driven by luxury perfume consumption and expansion of local cosmetic manufacturing, focusing on high-quality oil variants for exclusive formulations.

- North America (USA, Canada): Dominant consumer of therapeutic-grade and organic oil, driven by wellness trends.

- Europe (France, Germany, UK): Largest volume consumer in Flavor & Fragrance; highly regulated market prioritizing ethical sourcing.

- Asia Pacific (China, India, Japan): Fastest-growing region; increasing adoption in cosmetics, driven by rising middle-class income.

- Latin America (Brazil, Argentina): Major production hub and a rapidly emerging consumer market for domestic applications.

- Middle East and Africa (MEA): Growth concentrated in high-end fragrance and luxury cosmetic sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mandarin Oil Market.- Symrise AG

- International Flavors & Fragrances Inc. (IFF)

- Givaudan SA

- Robertet Group

- Mane Group

- Essential Oil Company

- Mountain Rose Herbs

- Firmenich International SA

- Vigon International

- Citrus & Allied Essences Ltd.

- Biolandes SAS

- Indukern

- Döhler Group

- A. G. Industries

- Young Living Essential Oils

- Edens Garden

- Floracopeia

- Bontoux SAS

- Citrus and Allied Essences, Inc.

- Sigma-Aldrich

Frequently Asked Questions

Analyze common user questions about the Mandarin Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Red, Yellow, and Green Mandarin Oil?

The difference lies in the fruit's maturity at extraction. Green Mandarin Oil (immature fruit) is fresh and tart; Yellow Mandarin Oil (semi-ripe) is balanced and versatile; Red Mandarin Oil (fully ripe) is the sweetest, deepest, and most commonly used in fine fragrances due to its olfactory stability and depth.

Is Mandarin Oil safe for use in cosmetics, and is it phototoxic?

Mandarin Oil is generally considered one of the safer citrus oils for topical use. Unlike many other cold-pressed citrus oils (like Bergamot), Mandarin Oil, especially the Red variety, contains very low levels of furanocoumarins, making it non-phototoxic or minimally phototoxic, which enhances its safety profile for cosmetic formulation compared to high-bergaptene alternatives.

Which extraction method is most widely used for commercial Mandarin Oil production?

The most widely adopted commercial method is cold-pressing (expression) of the mandarin fruit peel. This method utilizes mechanical pressure without high heat, which is crucial for retaining the oil’s delicate volatile aromatic compounds and ensuring the highest quality, most authentic citrus profile preferred by the flavor and fragrance industries.

How does the volatile nature of mandarin oil impact supply chain logistics?

The volatile and sensitive nature of mandarin oil requires specialized logistics, including storage in dark, airtight containers and often temperature-controlled environments. This is necessary to prevent oxidation and degradation of key chemical components like limonene, ensuring the oil maintains its therapeutic and aromatic efficacy throughout global distribution and until its use by industrial buyers.

What role does sustainability certification play in the Mandarin Oil Market?

Sustainability certification (e.g., organic, Fair Trade, ECOCERT) is increasingly vital, particularly in developed markets (North America, Europe). It assures industrial buyers and consumers of responsible sourcing, ethical labor practices, and absence of synthetic pesticides, directly influencing premium pricing, brand reputation, and access to high-value end-user segments like clean beauty and certified organic food manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager