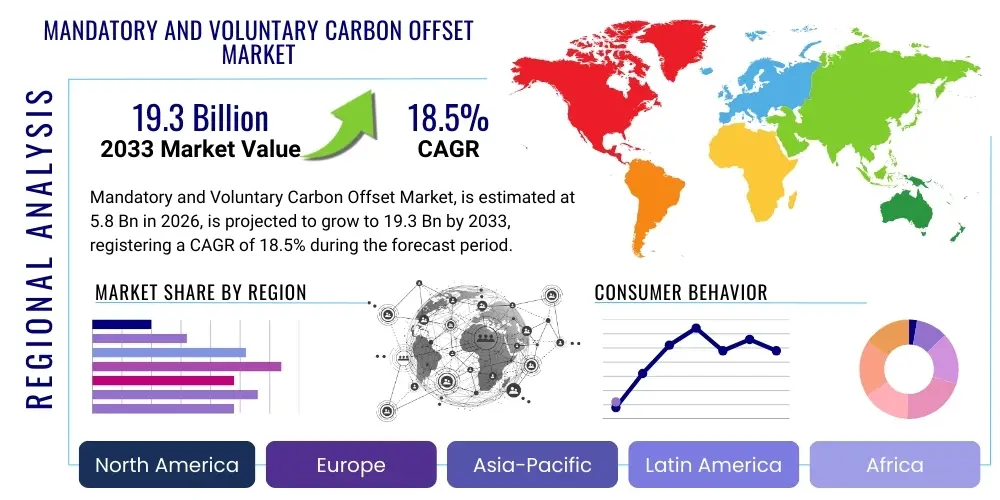

Mandatory and Voluntary Carbon Offset Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440186 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Mandatory and Voluntary Carbon Offset Market Size

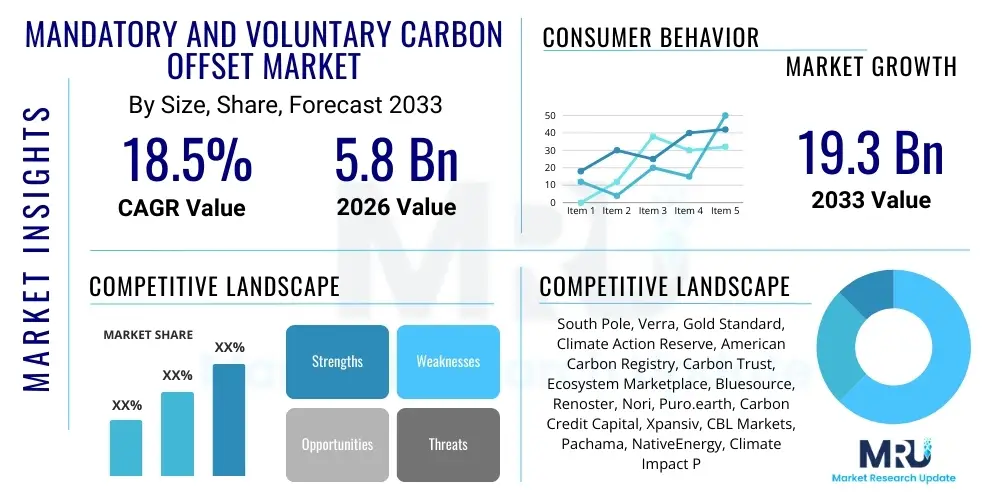

The Mandatory and Voluntary Carbon Offset Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 5.8 billion in 2026 and is projected to reach USD 19.3 billion by the end of the forecast period in 2033.

Mandatory and Voluntary Carbon Offset Market introduction

The Mandatory and Voluntary Carbon Offset Market represents a critical and evolving mechanism designed to mitigate greenhouse gas emissions by allowing entities to compensate for their unavoidable emissions. This market operates on the principle that emissions reduced or removed from the atmosphere in one location can be used to offset emissions generated elsewhere. The mandatory segment, often referred to as the compliance market, is driven by government regulations and international agreements, such as the European Union Emissions Trading System (EU ETS) or California's Cap-and-Trade program, compelling industrial emitters to purchase and surrender carbon allowances or credits to meet legally binding emission reduction targets. These programs establish a cap on total emissions, which is then divided into allowances that can be traded, creating a financial incentive for companies to reduce their carbon footprint or invest in carbon reduction projects.

Conversely, the voluntary carbon market is driven by corporate social responsibility, ethical consumerism, and the increasing demand from businesses and individuals to demonstrate climate leadership beyond regulatory requirements. Participants in this market voluntarily purchase carbon credits generated from projects that reduce or remove greenhouse gases, such as reforestation initiatives, renewable energy installations, or methane capture projects. The credits, verified by independent third-party standards like Verra (VCS), Gold Standard, or American Carbon Registry, represent one metric ton of carbon dioxide equivalent (tCO2e) emissions avoided or removed. Major applications for these offsets span diverse sectors including aviation, energy, manufacturing, and technology, enabling companies to achieve net-zero commitments, enhance brand reputation, and attract environmentally conscious investors and consumers.

The primary benefits of engaging in the Mandatory and Voluntary Carbon Offset Market extend beyond direct emissions reduction. These markets foster innovation in sustainable technologies and practices, drive investment into climate-friendly projects in developing countries, and provide crucial financing for conservation efforts. They also offer flexibility for businesses to meet their climate goals, particularly for hard-to-abate sectors where direct emissions reductions are technically or economically challenging. Key driving factors propelling market growth include escalating global climate ambitions, tightening regulatory frameworks, increasing corporate net-zero pledges, heightened public and investor pressure for environmental stewardship, and advancements in carbon measurement, reporting, and verification (MRV) technologies. The growing understanding of climate change risks and opportunities across all levels of society is further solidifying the foundational demand for robust carbon offsetting solutions, positioning the market as a pivotal tool in the global fight against climate change.

Mandatory and Voluntary Carbon Offset Market Executive Summary

The Mandatory and Voluntary Carbon Offset Market is undergoing a period of unprecedented expansion and transformation, characterized by dynamic business trends, evolving regional market architectures, and diversified segment growth. Business trends within this sector are largely shaped by the accelerating adoption of net-zero emissions targets by corporations across various industries, pushing them to integrate carbon offsetting strategies into their core sustainability frameworks. This has led to a surge in demand for high-quality, verifiable carbon credits and an increased focus on supply chain decarbonization. Furthermore, technological innovation, particularly in areas like blockchain for enhanced transparency and AI for improved monitoring and verification, is becoming a crucial differentiator for market participants. Investor interest in environmental, social, and governance (ESG) performance is also funneling significant capital into carbon-reducing projects and offset purchasing, making climate action a strategic imperative rather than a mere compliance exercise.

Regional trends reveal a heterogeneous landscape influenced by local regulatory environments, economic development, and climate vulnerabilities. Europe continues to lead in compliance market maturity with the EU ETS serving as a global benchmark, while North America's market is a complex interplay of federal and state-level initiatives, most notably in California and emerging regional cap-and-trade programs. Asia Pacific is rapidly emerging as a significant growth engine, driven by ambitious national climate pledges from countries like China, India, and South Korea, alongside burgeoning voluntary market activity as corporations in the region prioritize sustainability. Latin America and Africa, rich in natural carbon sinks and renewable energy potential, are increasingly critical as project development hubs, attracting investment for nature-based solutions and community-focused carbon initiatives, although they often face challenges related to governance and project scalability.

Segmentation trends indicate strong growth across multiple dimensions. By market type, the voluntary market is witnessing exponential growth rates, driven by voluntary corporate commitments, while the mandatory market remains a foundational pillar for industrial decarbonization, albeit with more predictable growth. Project type segmentation shows a pronounced shift towards nature-based solutions, particularly afforestation, reforestation, and improved forest management (ARR/IFM), reflecting their co-benefits for biodiversity and local communities. Renewable energy projects continue to be a stable source of credits, though some older projects face scrutiny over additionality. The end-user segment is broadening beyond traditional heavy industries to include technology firms, financial institutions, and consumer goods companies, all seeking to mitigate their carbon footprint. This diversification across business models, geographies, and project types underscores the market's adaptability and its pivotal role in global climate finance.

AI Impact Analysis on Mandatory and Voluntary Carbon Offset Market

User questions regarding AI's impact on the Mandatory and Voluntary Carbon Offset Market frequently revolve around its potential to enhance transparency, improve the accuracy of measurement, reporting, and verification (MRV), detect fraud, and optimize project development and credit trading. Users are keen to understand how AI can address historical challenges in the market, such as issues of additionality, permanence, and double counting, which have sometimes undermined confidence. There's significant interest in AI's role in scaling MRV processes for nature-based solutions, where traditional methods can be costly and labor-intensive. Furthermore, users explore how AI might streamline the entire carbon credit lifecycle, from initial project feasibility assessments to market liquidity and pricing mechanisms, ultimately aiming for a more efficient, credible, and scalable carbon market that better serves global climate objectives.

- AI-driven satellite imagery analysis and remote sensing for highly accurate and scalable measurement, reporting, and verification (MRV) of carbon sequestration in forestry and agricultural projects.

- Predictive analytics and machine learning algorithms for forecasting carbon credit supply and demand, informing pricing strategies, and identifying market inefficiencies.

- Enhanced fraud detection and risk assessment through AI-powered data analysis, identifying anomalies in project data and verifying project integrity, thereby boosting market trust.

- Optimization of carbon project development, including site selection, project design, and impact assessment, leveraging AI to analyze vast datasets for optimal environmental and economic outcomes.

- Facilitation of smart contracts and blockchain integration for carbon credit issuance and trading, with AI overseeing automated compliance checks and transaction validation to increase transparency and reduce transaction costs.

- Personalized carbon footprint tracking and offsetting recommendations for businesses and individuals, using AI to analyze consumption patterns and suggest tailored offsetting solutions.

- Advanced monitoring of environmental co-benefits, such as biodiversity improvements and water quality, alongside carbon impacts, providing a more holistic view of project effectiveness.

DRO & Impact Forces Of Mandatory and Voluntary Carbon Offset Market

The Mandatory and Voluntary Carbon Offset Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively forming the impact forces shaping its trajectory. A primary driver is the escalating global consensus and regulatory pressure regarding climate change mitigation. National governments are increasingly implementing or strengthening carbon pricing mechanisms, cap-and-trade systems, and carbon taxes, compelling major emitters to participate in mandatory markets. Concurrently, voluntary corporate commitments to net-zero and carbon neutrality are surging, driven by consumer demand for sustainable products, investor pressure for ESG performance, and brand reputation management. Technological advancements in remote sensing, data analytics, and blockchain are also enhancing the transparency and credibility of carbon offset projects, making them more appealing to buyers. Furthermore, the growing recognition of nature-based solutions, which offer co-benefits like biodiversity conservation and community development, is attracting significant investment and expanding the project pipeline.

Despite these robust drivers, significant restraints temper the market's growth. Issues surrounding the credibility and integrity of carbon credits, including concerns about additionality (whether the project would have happened anyway), permanence (long-term storage of carbon), and the risk of double counting, have historically plagued both mandatory and voluntary markets. The lack of standardized methodologies and varying verification standards across different registries can create confusion and reduce buyer confidence. Furthermore, the limited supply of high-quality, verified carbon projects, especially those with strong co-benefits, struggles to meet the rapidly growing demand, leading to price volatility and liquidity challenges. Economic downturns or policy uncertainties can also slow investment in carbon projects and reduce corporate budgets for offset purchases, introducing an element of market fragility.

Opportunities within the Mandatory and Voluntary Carbon Offset Market are vast and transformative. The expansion into new geographies, particularly emerging economies with vast potential for nature-based and renewable energy projects, offers substantial growth avenues. The increasing sophistication of digital MRV technologies, integrating AI, IoT, and satellite data, promises to address credibility concerns by providing real-time, transparent, and immutable verification of carbon reductions. The development of innovative financing mechanisms, such as blended finance and tokenized carbon credits, can unlock significant private capital for large-scale carbon projects. Moreover, the emergence of new offset types, including direct air capture (DAC) and bioenergy with carbon capture and storage (BECCS), despite being nascent, represents long-term opportunities for addressing residual emissions. The ongoing integration of carbon markets into broader sustainability and supply chain decarbonization strategies also offers a pathway for sustained, impactful growth, positioning carbon offsets as an indispensable tool in achieving global climate targets.

Segmentation Analysis

The Mandatory and Voluntary Carbon Offset Market is highly segmented, reflecting the diverse mechanisms, project types, end-users, and geographies involved in carbon emission reduction and sequestration. This granular segmentation allows for a detailed understanding of market dynamics, identifies specific growth areas, and highlights the varied motivations and regulatory landscapes driving participation. Analysis typically distinguishes between compliance-driven purchases and discretionary voluntary actions, alongside categorizations by the nature of the carbon-reducing activity (e.g., renewable energy, forestry), the sector of the buyer, and the underlying technology or mechanism used to generate or trade credits. Understanding these segments is crucial for stakeholders to tailor strategies, develop targeted projects, and navigate the complex global carbon landscape effectively, ensuring investments align with both regulatory requirements and sustainability objectives.

- By Type

- Compliance Carbon Market: Driven by legally binding emission reduction targets imposed by governments or international bodies (e.g., EU ETS, California Cap-and-Trade).

- Voluntary Carbon Market: Driven by corporate social responsibility, ethical consumerism, and voluntary net-zero commitments beyond regulatory mandates.

- By Project Type

- Forestry and Land Use (FLU): Includes Afforestation/Reforestation (A/R), Improved Forest Management (IFM), Reduced Emissions from Deforestation and Forest Degradation (REDD+), and sustainable agricultural land management.

- Renewable Energy: Projects such as solar, wind, hydro, and geothermal power generation that displace fossil fuel-based electricity.

- Energy Efficiency: Initiatives that reduce energy consumption in industrial processes, buildings, or transportation.

- Waste Management: Projects involving methane capture from landfills, wastewater treatment, or industrial waste.

- Industrial Processes: Reductions in emissions from specific industrial activities, such as cement production or chemical manufacturing.

- Blue Carbon: Conservation and restoration of coastal and marine ecosystems (e.g., mangroves, seagrasses) for carbon sequestration.

- By End-User

- Energy & Utilities: Power generation companies, oil and gas firms.

- Transportation: Airlines, shipping companies, logistics providers.

- Manufacturing: Heavy industry, consumer goods manufacturers.

- Residential & Commercial Buildings: Real estate developers, property management firms.

- Financial Services: Banks, investment firms, insurance companies.

- Technology: Software companies, data centers, hardware manufacturers.

- Agriculture: Farming enterprises, food processing companies.

- Other (e.g., Public Sector, Individuals): Government agencies, non-profits, individual consumers.

- By Mechanism

- Direct Project Development: Entities developing their own carbon reduction projects to generate credits.

- Brokerage & Trading Platforms: Intermediaries and online platforms facilitating the buying and selling of carbon credits.

- Retail Offsets: Smaller-scale purchases by individuals or small businesses, often through online marketplaces or specific product offerings.

Value Chain Analysis For Mandatory and Voluntary Carbon Offset Market

The value chain of the Mandatory and Voluntary Carbon Offset Market is a complex ecosystem involving multiple stakeholders, each playing a crucial role from project inception to credit retirement. The upstream segment primarily involves project developers who identify, design, and implement projects that reduce or remove greenhouse gas emissions. These can range from renewable energy installations and waste management facilities to large-scale afforestation and conservation initiatives. These developers are responsible for the initial technical feasibility studies, engaging with local communities, securing land rights, and ensuring compliance with specific carbon project methodologies. Critical partners in the upstream also include technical consultants, environmental engineers, and local community groups, whose expertise is vital for project success and adherence to best practices, laying the groundwork for carbon credit generation.

Midstream activities are centered around the crucial processes of validation, verification, and registration. Once a project is implemented, it undergoes rigorous validation by independent third-party auditors to ensure it meets the requirements of a specific carbon standard (e.g., Verra's VCS, Gold Standard). Following this, ongoing monitoring reports are periodically verified by accredited bodies to confirm the actual emission reductions or removals achieved. Upon successful verification, the project is registered with a designated registry, and carbon credits are issued, each representing one tonne of CO2e. Registries (like Verra, Gold Standard, ACR) act as central databases for tracking credits, ensuring unique identification and preventing double counting. These processes are fundamental to maintaining the integrity and credibility of the entire carbon market, providing assurance to buyers about the environmental impact of their purchased credits.

The downstream segment focuses on the distribution, trading, and ultimate retirement of carbon credits. Once issued, credits enter the market where they can be traded directly between project developers and end-buyers, or facilitated through various distribution channels. These include brokers and trading platforms, who connect buyers and sellers, provide market intelligence, and manage transactions. Investment funds and financial institutions also play a significant role by investing in project development and aggregating credits. Direct channels involve buyers sourcing credits directly from specific projects they wish to support, often for strategic corporate social responsibility initiatives. Indirect channels leverage brokers, online marketplaces, or even retail platforms for individuals. The final step is the retirement of credits, where a credit is permanently removed from the registry once it has been used to offset an emission, marking the completion of the carbon compensation cycle and ensuring its singular environmental claim. Each stage of this value chain is underpinned by the need for robust data, transparent processes, and strong governance to ensure market efficacy and integrity.

Mandatory and Voluntary Carbon Offset Market Potential Customers

The Mandatory and Voluntary Carbon Offset Market serves a diverse and expanding base of potential customers, primarily driven by a dual imperative of regulatory compliance and voluntary sustainability commitments. In the mandatory market segment, the primary customers are large industrial emitters, power generators, airlines, and other entities operating in sectors subject to national or international carbon pricing schemes, such as the European Union Emissions Trading System (EU ETS), California's Cap-and-Trade program, or similar mechanisms in other jurisdictions. These entities are legally obligated to surrender a certain number of allowances or credits corresponding to their emissions, making offset purchasing a necessary cost of doing business. Their demand is driven by regulatory deadlines, permit allocations, and the need to manage compliance costs efficiently while avoiding penalties for non-compliance. Their purchasing decisions are often highly sensitive to carbon prices and market liquidity, favoring large-volume, verifiable, and compliance-eligible credits.

In the voluntary market, the customer base is significantly broader and more heterogeneous, reflecting a growing awareness and commitment to environmental stewardship across various organizational types and individuals. Large multinational corporations across all sectors—including technology, finance, consumer goods, and manufacturing—are increasingly prominent buyers, driven by ambitious net-zero targets, ESG investment pressures, and a desire to enhance their brand reputation among environmentally conscious consumers and stakeholders. These companies often seek high-quality carbon credits that not only offset emissions but also align with their corporate values, offer co-benefits (e.g., biodiversity, community development), and provide transparent, verifiable impact stories. Medium and small enterprises (SMEs) are also entering the voluntary market, often through streamlined purchasing platforms, as they too face pressure from customers and supply chains to demonstrate sustainability.

Beyond corporate entities, governmental bodies, non-profit organizations, and even individual consumers represent growing segments of potential customers in the voluntary market. Governments may purchase offsets for public sector climate initiatives or to meet specific national pledges. Non-profits and educational institutions acquire credits to achieve their own sustainability goals or as part of broader environmental advocacy. Individual consumers, driven by personal environmental concerns, are increasingly purchasing retail carbon offsets for their travel, household energy consumption, or daily activities, often through airline programs, online marketplaces, or integrated into service offerings. This widening customer base, ranging from mandated industrial giants to individual eco-conscious citizens, underscores the pervasive and growing demand for credible carbon offset solutions as a critical tool in the global climate action portfolio.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 19.3 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | South Pole, Verra, Gold Standard, Climate Action Reserve, American Carbon Registry, Carbon Trust, Ecosystem Marketplace, Bluesource, Renoster, Nori, Puro.earth, Carbon Credit Capital, Xpansiv, CBL Markets, Pachama, NativeEnergy, Climate Impact Partners, Plan Vivo, Sylvera, finite carbon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mandatory and Voluntary Carbon Offset Market Key Technology Landscape

The Mandatory and Voluntary Carbon Offset Market is increasingly reliant on a sophisticated and rapidly evolving technology landscape to enhance its efficiency, transparency, and credibility. A cornerstone of this technological evolution is advanced Measurement, Reporting, and Verification (MRV) systems. These systems leverage a combination of remote sensing technologies, including satellite imagery and aerial drones, to monitor land use changes, forest cover, and biomass carbon stocks with unprecedented accuracy and scalability. Coupled with Geographic Information Systems (GIS) and IoT sensors deployed in the field, MRV technologies provide real-time data on project performance, ensuring that carbon reductions or removals are precisely quantified and verifiable. This digital transformation of MRV processes significantly reduces the costs and labor traditionally associated with manual monitoring, thereby democratizing access to carbon project development and increasing investor confidence by providing robust, auditable data trails.

Another pivotal technological advancement driving the carbon offset market is the application of blockchain and distributed ledger technologies (DLT). Blockchain offers an immutable, transparent, and secure ledger for the registration, issuance, and trading of carbon credits. By tokenizing carbon credits, blockchain can prevent issues such as double counting, enhance traceability from project origin to retirement, and streamline transaction processes, reducing intermediaries and associated costs. Smart contracts, built on blockchain platforms, can automate compliance checks and credit transfers based on predefined conditions, further enhancing efficiency and reducing the potential for fraud. This technological integration is not only improving the operational integrity of the market but also creating new avenues for liquidity and broader participation, allowing for fractional ownership of credits and micro-offsetting initiatives that were previously unfeasible.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are playing an increasingly critical role in optimizing various aspects of the carbon offset market. AI algorithms can analyze vast datasets from MRV systems to detect anomalies, predict future carbon sequestration potential, and assess project risks more effectively. This allows for more informed decision-making in project selection and management, optimizing environmental outcomes and financial returns. AI also aids in market analysis, providing predictive insights into supply-demand dynamics and pricing trends, which is invaluable for buyers and sellers. Beyond these, digital platforms for carbon credit marketplaces are becoming more sophisticated, offering enhanced user interfaces, data analytics tools, and seamless integration with corporate sustainability reporting systems. These technological innovations collectively build a more resilient, trustworthy, and scalable carbon market, essential for supporting global efforts to achieve ambitious climate targets by providing verifiable and efficient pathways for emissions mitigation.

Regional Highlights

- North America: This region is characterized by a mature compliance market, particularly through California's Cap-and-Trade program and regional initiatives, alongside a rapidly growing voluntary market driven by corporate net-zero pledges and innovation in digital MRV. Significant investment in nature-based solutions and renewable energy projects is prevalent.

- Europe: As a pioneer in carbon markets, Europe boasts the highly developed EU Emissions Trading System (EU ETS), which serves as a global benchmark for mandatory compliance. The voluntary market is also robust, fueled by strong corporate sustainability mandates, stringent regulations, and a high level of environmental awareness among consumers.

- Asia Pacific (APAC): This region is emerging as a critical growth engine for both mandatory and voluntary carbon markets. Countries like China, South Korea, and India are implementing or expanding their own emissions trading schemes, while significant potential exists for project development, especially in renewable energy and forestry, driven by economic growth and increasing climate commitments.

- Latin America: Rich in biodiversity and natural carbon sinks, Latin America is a key region for nature-based carbon project development, particularly in forestry (REDD+). While compliance markets are less mature, voluntary market activities are increasing, attracting foreign investment for projects that also offer significant co-benefits for local communities and biodiversity.

- Middle East & Africa (MEA): This region presents substantial untapped potential for carbon project development, especially in renewable energy and sustainable land management. While compliance markets are nascent, increasing awareness of climate risks and a drive for economic diversification are spurring interest in the voluntary market and the development of regional carbon initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mandatory and Voluntary Carbon Offset Market.- South Pole

- Verra

- Gold Standard

- Climate Action Reserve

- American Carbon Registry

- Carbon Trust

- Ecosystem Marketplace

- Bluesource

- Renoster

- Nori

- Puro.earth

- Carbon Credit Capital

- Xpansiv

- CBL Markets

- Pachama

- NativeEnergy

- Climate Impact Partners

- Plan Vivo

- Sylvera

- finite carbon

Frequently Asked Questions

Analyze common user questions about the Mandatory and Voluntary Carbon Offset market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between mandatory and voluntary carbon offset markets?

The mandatory (or compliance) market is driven by legal obligations and regulatory caps on emissions, requiring entities to purchase or surrender carbon allowances. The voluntary market, conversely, is driven by voluntary corporate or individual commitments to mitigate emissions beyond regulatory requirements, often for ESG goals or brand reputation, purchasing credits for various climate projects.

How do carbon offsets contribute to achieving net-zero emissions targets?

Carbon offsets allow entities to compensate for residual, unavoidable emissions by funding projects that reduce or remove an equivalent amount of greenhouse gases elsewhere. This is a crucial component of net-zero strategies, providing a mechanism to balance remaining emissions after all feasible direct emission reductions have been implemented within an organization's operations.

What are the key challenges in ensuring the credibility and integrity of carbon credits?

Key challenges include ensuring additionality (that emission reductions would not have occurred without the offset project), permanence (that sequestered carbon remains stored long-term), preventing leakage (emissions shifting elsewhere), and avoiding double counting (one credit claimed by multiple parties). Robust MRV and independent verification are essential to address these concerns and maintain market trust.

What role do technologies like AI and blockchain play in the evolution of carbon markets?

AI enhances MRV by analyzing remote sensing data for precise project monitoring and fraud detection. Blockchain provides transparency and security for credit issuance and trading through immutable ledgers and smart contracts, preventing double counting and streamlining transactions, thus significantly improving market integrity and efficiency.

Which types of projects generate the most commonly traded carbon offsets?

Historically, renewable energy projects were dominant. However, there's a growing shift towards nature-based solutions, such as afforestation, reforestation, and improved forest management (REDD+), due to their significant co-benefits for biodiversity and local communities. Energy efficiency, waste management, and industrial process improvements also remain important project types in the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager