Manipulators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432089 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Manipulators Market Size

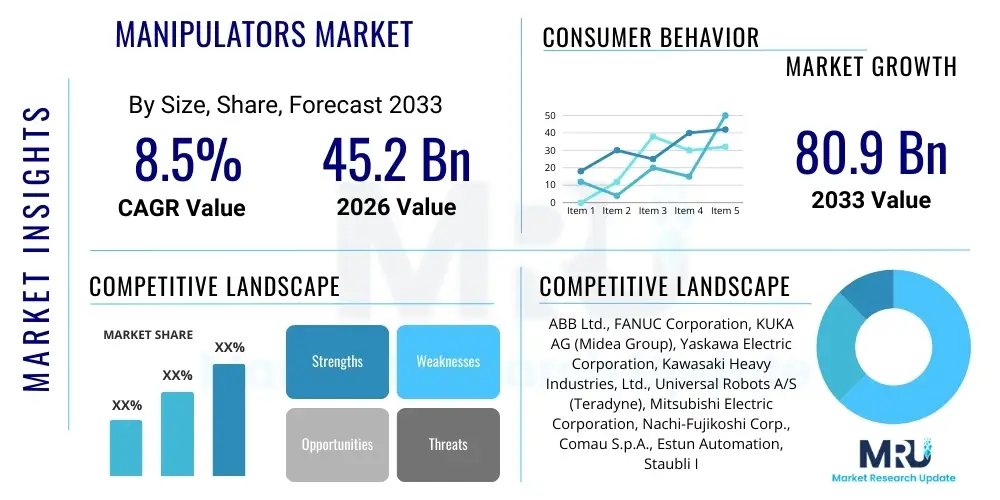

The Manipulators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 80.9 Billion by the end of the forecast period in 2033.

This substantial growth is primarily driven by the accelerating global adoption of Industry 4.0 initiatives, necessitating sophisticated automation solutions capable of handling complex, high-precision, and hazardous tasks. Manipulators, ranging from heavy-duty industrial robotic arms to delicate surgical micro-systems and teleoperated devices, are crucial for enhancing operational efficiency, ensuring worker safety, and maintaining stringent quality control across various vertical industries. The market expansion reflects a crucial shift from basic pick-and-place automation toward systems integrated with advanced sensor technology and real-time data processing capabilities, enabling adaptive and collaborative functionalities necessary for flexible manufacturing environments.

Furthermore, the escalating need for automation in non-traditional sectors, such as logistics, healthcare (especially robotic surgery), and remote maintenance in critical infrastructure (nuclear decommissioning, offshore oil and gas), significantly contributes to market size expansion. Geopolitical factors, including ongoing supply chain vulnerabilities and increasing labor costs in developed nations, propel manufacturers to invest heavily in manipulators to achieve resilience through localized, highly automated production centers. This demand is further amplified by technological convergence, where improvements in materials science, actuator performance, and advanced control algorithms make manipulators more compact, energy-efficient, and dexterous, broadening their application scope significantly beyond conventional assembly lines.

Manipulators Market introduction

The Manipulators Market encompasses the development, production, and deployment of mechanical devices designed to handle, position, and process materials or objects with precision, speed, and force control, often replicating or exceeding human capabilities. These systems are defined by their degrees of freedom (DoF), payload capacity, and operating environment suitability. Major applications span high-volume manufacturing (welding, painting, assembly), intricate biomedical procedures (laparoscopic and robotic-assisted surgery), remote handling in hazardous or inaccessible locations (deep-sea, space, nuclear facilities), and complex logistical operations (palletizing and sorting). The primary benefit of adopting advanced manipulators includes significant improvements in production throughput, enhanced consistency and quality of output, and substantial reduction in occupational hazards by removing human workers from dangerous environments, thereby maximizing operational uptime and overall profitability for end-users across industrial and non-industrial sectors.

The product portfolio within this market is diverse, including Cartesian, SCARA, articulated, delta, and collaborative robotic arms, as well as specialized teleoperated systems. Driving factors for market growth involve the rapid advancement of sensor technologies, particularly force-torque sensing and advanced vision systems, which allow manipulators to interact dynamically with unstructured environments. Additionally, the decreasing total cost of ownership (TCO) for robotic systems, coupled with governmental initiatives promoting digitalization and automation (such as Germany's Industry 4.0 or China’s Made in China 2025), fuel widespread investment. As manufacturing processes become increasingly customized and require higher flexibility, manipulators that feature modular design and easy programming interfaces are experiencing heightened demand, positioning them as fundamental components of modern intelligent factories.

Key market dynamics also revolve around the push toward collaborative robotics (cobots), which are specifically designed to work alongside human operators without traditional safety barriers, dramatically lowering the barrier to entry for Small and Medium-sized Enterprises (SMEs). This integration is enhancing human-machine collaboration, allowing manipulators to handle repetitive, strenuous tasks while humans focus on complex problem-solving and quality inspection. Furthermore, the market is characterized by intense competition regarding software intelligence, where sophisticated simulation tools and AI-powered path optimization are becoming standard features, enabling faster deployment and higher utility across complex production scenarios that require real-time adaptation and fine motor control capabilities.

Manipulators Market Executive Summary

The Manipulators Market is poised for robust expansion, driven by crucial business trends centered around hyper-automation and supply chain localization. Current business trends indicate a strong move toward highly integrated, modular manipulator systems that are easier to program and redeploy, catering specifically to the needs of agile manufacturing environments that require rapid changeovers. Investment is particularly concentrated in high-payload and high-speed manipulators for sectors like automotive and aerospace, alongside significant growth in lightweight collaborative manipulators essential for electronics assembly and general logistics automation. The integration of advanced safety protocols and seamless communication standards (like OPC UA) is critical, transforming individual robots into interconnected nodes within a larger, intelligent factory ecosystem, thereby achieving unprecedented levels of efficiency and predictability in production schedules across global enterprises.

Regionally, Asia Pacific (APAC) currently dominates the market share, fueled by massive ongoing investments in automation by manufacturing giants in China, South Korea, and Japan, especially in the electronics and automotive sectors. However, North America and Europe are exhibiting the highest Compound Annual Growth Rates (CAGR), predominantly due to the focus on high-precision manipulators for medical devices and aerospace defense, combined with significant government incentives encouraging reshoring of manufacturing capacities. Regional trends highlight a bifurcation: APAC focuses on volume and cost-efficiency through industrial robots, while Western markets prioritize intelligence, dexterity, and human-robot collaboration capabilities in sophisticated applications like remote surgical systems and complex logistics sorting facilities requiring dynamic path correction and object recognition.

Segment-wise, the market is primarily segmented by type (Articulated, SCARA, Cartesian), application (Handling, Processing, Assembly, Welding), and end-user industry (Automotive, Electrical & Electronics, Healthcare, Metal & Machinery). The Articulated segment holds the largest revenue share due to its flexibility and extensive use in welding and painting, while the Collaborative Manipulator segment is projected to grow fastest, driven by SME adoption and enhanced safety features. There is a notable trend towards specialized manipulators within the healthcare segment, specifically precision surgical robots, which command higher average selling prices (ASPs) and are rapidly gaining acceptance as standard tools for minimally invasive procedures, contributing significantly to high-margin growth areas within the overall market structure.

AI Impact Analysis on Manipulators Market

User queries regarding AI's influence on the Manipulators Market frequently revolve around practical concerns such as the economic viability of AI-driven systems versus traditional programmed systems, the potential for widespread job displacement among factory workers and technicians, and the complexities associated with integrating advanced machine learning models into existing robotic infrastructure. There is also a keen interest in how AI can enhance the adaptability and dexterity of manipulators, particularly in unstructured environments, and the role of predictive maintenance algorithms in minimizing downtime. Key expectations center on AI unlocking true autonomy in material handling and assembly tasks, enabling manipulators to perform sophisticated decision-making, learn from errors, and self-optimize their paths and grasps in real-time, thereby maximizing efficiency and reducing the reliance on constant human supervision and detailed, static programming required in older systems.

AI integration is fundamentally transforming manipulators from mere programmed tools into intelligent, adaptive partners. Deep reinforcement learning enables robotic arms to master complex tasks, such as cable routing or fluid assembly, which were previously too varied or complex for conventional robotics. Machine vision systems powered by convolutional neural networks (CNNs) provide superior object recognition and defect detection, allowing manipulators to accurately handle non-uniform or randomly presented parts, a critical step toward fully flexible production lines. This heightened level of sensory processing and cognitive ability allows manufacturers to deploy manipulators in environments previously requiring human judgment, dramatically expanding the serviceable market for automation beyond rigid, high-volume production into low-volume, high-mix manufacturing.

Furthermore, AI algorithms are vital for optimizing robot fleet management and minimizing total operational expenditure. Predictive maintenance systems analyze sensor data streams to anticipate component failure before it occurs, scheduling maintenance precisely and avoiding costly, unscheduled downtime. In collaborative settings, AI ensures safety and efficiency by predicting human movement patterns and adjusting the manipulator's speed and trajectory accordingly, fostering a safer, more productive work environment. The next wave of AI integration focuses on decentralized learning, where manipulators can share learned expertise across a network, accelerating deployment cycles for new tasks and standardizing best practices globally across multiple factory locations simultaneously.

- AI-driven real-time path planning enhances efficiency and reduces cycle times.

- Machine learning improves object recognition, enabling manipulation of varied and unstructured items.

- Predictive maintenance minimizes unscheduled downtime and optimizes component lifespan.

- Deep reinforcement learning facilitates mastering complex, high-dexterity tasks previously limited to human operators.

- AI enables seamless human-robot collaboration by predicting and adapting to human movements.

- Increased autonomy allows manipulators to operate in fully lights-out manufacturing settings.

- Enhanced quality control through AI-powered vision inspection and defect detection.

DRO & Impact Forces Of Manipulators Market

The Manipulators Market is shaped by a potent combination of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market evolution and competitive dynamics. Key drivers include the global push toward fully automated manufacturing facilities (Industry 4.0), persistent labor shortages in high-cost regions requiring automated substitutes, and the critical need to improve worker safety by automating hazardous processes like nuclear handling, heavy lifting, and material application in toxic environments. These drivers compel continuous investment in robotics, favoring high-performance, resilient systems. Simultaneously, opportunities arise from the proliferation of collaborative robotics (cobots) lowering the entry barrier for SMEs and the rapidly expanding market for specialized medical and surgical manipulators, which promise high growth rates due to aging populations and advances in minimally invasive procedures, offering vendors highly profitable specialized niches.

However, significant restraints temper the market's explosive potential. The high initial capital expenditure associated with purchasing and integrating advanced manipulator systems remains a primary hurdle, particularly for smaller enterprises operating on tight budgets. Furthermore, the complexity involved in programming, integrating diverse robotic systems, and maintaining a specialized workforce capable of troubleshooting sophisticated automation presents operational challenges. There is also ongoing public and regulatory resistance concerning the potential for large-scale job displacement caused by automation, often leading to slow adoption in politically sensitive regions. The lack of universal standards for integration and data communication across different vendor platforms also poses a technical restraint, increasing implementation time and project costs for multi-vendor facilities.

The cumulative effect of these Impact Forces is driving innovation towards solutions that offer higher versatility and easier deployment. The market is shifting focus from raw speed and payload capacity to intelligence and adaptability, evidenced by the rising demand for vision-guided and sensor-rich systems. Suppliers are aggressively addressing the restraints by offering Robotics-as-a-Service (RaaS) models to mitigate upfront costs and developing standardized, low-code programming interfaces to simplify integration and lower the necessary skill level for deployment. This strategic shift ensures that market growth remains robust, capitalizing on the persistent need for productivity gains while actively mitigating barriers related to cost and complexity, thereby accelerating the penetration of manipulators into previously underserved segments like agriculture and small-scale logistics.

Segmentation Analysis

The Manipulators Market is extensively segmented across multiple axes, defining specific product types and their applicability across diverse industrial and non-industrial landscapes. Primary segmentation categories include robot type, application, payload capacity, and end-user industry, which allow for granular analysis of demand trends and competitive positioning. Understanding these segments is crucial as technological advances often favor one category over another; for instance, advancements in harmonic drive systems bolster the articulated robot segment, while improvements in vision systems propel the demand for SCARA robots in fast pick-and-place operations. The segmentation reflects the market’s maturity, characterized by highly specialized solutions tailored for specific industrial requirements, such as high-temperature tolerance manipulators for foundry work or clean-room compliant manipulators for semiconductor manufacturing, highlighting the customization complexity inherent in this domain.

Application segmentation reveals the areas of highest investment, with material handling and welding applications traditionally dominating revenue, driven by heavy industries like automotive and construction machinery. However, the fastest growth is observed in emerging applications like inspection and quality assurance, utilizing high-precision manipulators equipped with 3D scanners and non-destructive testing tools. Payload capacity segmentation dictates the primary target markets, with heavy-duty manipulators (above 100 kg) focused on primary processing and high-volume assembly, while lightweight and collaborative manipulators (under 10 kg) are rapidly adopted in electronics, consumer goods, and laboratory automation. This diversity ensures market resilience, as fluctuations in one industrial sector can be offset by sustained growth in others, such as the consistent demand from the resilient healthcare sector.

- By Type:

- Articulated Manipulators (6-axis and above)

- SCARA Manipulators (Selective Compliance Assembly Robot Arm)

- Cartesian Manipulators (Gantry Robots)

- Delta/Parallel Manipulators

- Collaborative Manipulators (Cobots)

- Cylindrical Manipulators

- By Application:

- Material Handling and Transfer (Pick-and-Place, Palletizing)

- Processing Operations (Welding, Cutting, Painting, Dispensing)

- Assembly and Disassembly

- Inspection and Quality Assurance

- Remote Operation/Telemanipulation (Nuclear, Space, Subsea)

- Surgical Assistance and Medical Handling

- By Payload Capacity:

- Low Payload (< 10 kg)

- Medium Payload (10 kg – 100 kg)

- Heavy Payload (> 100 kg)

- By End-User Industry:

- Automotive

- Electrical & Electronics (Semiconductors)

- Metal & Machinery

- Healthcare and Pharmaceuticals

- Food & Beverages

- Chemical, Rubber, and Plastics

- Aerospace & Defense

- Logistics and E-commerce

Value Chain Analysis For Manipulators Market

The value chain for the Manipulators Market is complex and highly specialized, beginning with upstream activities focused on the procurement and manufacturing of sophisticated components. This upstream segment is dominated by specialized suppliers providing crucial elements such as high-performance servo motors, precision gearboxes (especially harmonic drives), advanced sensors (force-torque, proximity, vision systems), and proprietary control software and operating systems. The quality and intellectual property associated with these components, particularly actuators and control systems, heavily influence the overall performance and cost of the final manipulator system. Key upstream analysis focuses on supply chain resilience, component miniaturization trends, and the concentration of critical component manufacturers, often situated in specific industrial clusters in countries like Germany, Japan, and Switzerland, necessitating robust logistics and intellectual property protection for major robot manufacturers.

The midstream segment involves the core activities of robot manufacturing, encompassing design, assembly, testing, and system integration. Direct distribution channels are often favored by large established manufacturers who sell standardized manipulator models and software packages directly to large automotive or electronics OEMs, maintaining close control over installation and post-sale service contracts. Conversely, indirect distribution channels, involving certified system integrators and specialized distributors, are crucial for reaching Small and Medium-sized Enterprises (SMEs) and specialized vertical markets (like food processing or laboratory automation). System integrators play a vital role in customizing the base manipulator by adding application-specific tooling (end-effectors), integrating safety systems, and programming complex task sequences, bridging the gap between the core robot technology and the specific demands of the end-user's manufacturing process, making them indispensable partners in market penetration.

Downstream analysis focuses on end-user adoption, after-sales service, maintenance, and software updates. The profitability in the downstream phase is increasingly reliant on maintenance contracts and the provision of advanced analytical and diagnostic services, often delivered through cloud-based platforms utilizing IoT data generated by the manipulators. The market dynamics show a shift where robot manufacturers are increasingly competing on service and software superiority, rather than just hardware specifications. The downstream value is enhanced by training programs, ensuring that the end-user workforce is competent in operating and optimizing these complex systems, turning the manipulator investment into a sustainable competitive advantage. The efficiency of the distribution channel—whether direct sales or reliance on a network of skilled local integrators—directly correlates with the speed of market expansion and customer satisfaction, particularly in regions where technical support accessibility is a differentiating factor.

Manipulators Market Potential Customers

Potential customers for manipulator systems span a vast array of high-value and high-risk industries, fundamentally being any organization seeking to automate repetitive, strenuous, or precision-critical tasks. The most significant end-users are high-volume manufacturers, particularly in the Automotive sector, which utilizes manipulators extensively for spot welding, painting, assembly, and quality inspection, requiring high-payload, 6-axis articulated robots operating in high-speed, demanding environments. Following closely is the Electrical & Electronics industry, which demands extremely precise, high-speed SCARA and Cartesian robots for handling delicate components, soldering, and microscopic assembly in cleanroom settings. These sectors are characterized by large capital investments and continuous automation upgrade cycles, making them the foundation of current market revenue, necessitating robust, reliable, and easily reprogrammable systems capable of handling rapidly evolving product designs.

Emerging and high-growth potential customers include organizations operating in hazardous or remote environments, categorized as specialized buyers. This segment encompasses nuclear facilities requiring teleoperated manipulators for decommissioning, waste handling, and inspection in radiation zones; deep-sea exploration and offshore oil and gas entities needing remotely operated underwater vehicles (ROVs) equipped with heavy-duty manipulators for subsea infrastructure maintenance; and aerospace and defense companies using manipulators for assembling large composite structures, drilling, and handling explosive or sensitive materials. These buyers prioritize reliability, extreme environmental resilience, redundancy, and haptic feedback capabilities, making customized solutions the norm, and often leading to long-term, high-value contracts for highly specialized vendor platforms, driven by safety compliance and mission criticality.

Furthermore, the rapidly expanding healthcare sector represents a major future customer base, particularly hospitals, specialized surgical centers, and pharmaceutical manufacturers. Surgeons and medical facilities are the primary end-users of minimally invasive surgical robotic systems, demanding high dexterity, micron-level precision, and integrated imaging capabilities. Pharmaceutical companies and clinical laboratories utilize manipulators for high-throughput screening, automated drug discovery processes, and precision dispensing, where consistency and contamination avoidance are paramount. These customers value compliance with stringent regulatory requirements (e.g., FDA, CE marking) and the provision of secure, validated, and sterile manipulator platforms, positioning the healthcare segment as a key driver for technological innovation in micro-manipulation and human-safe interaction capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 80.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., FANUC Corporation, KUKA AG (Midea Group), Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Universal Robots A/S (Teradyne), Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Comau S.p.A., Estun Automation, Staubli International AG, Omron Corporation, DENSO WAVE INCORPORATED, Siemens AG, Seiko Epson Corporation, Schunk GmbH & Co. KG, Rethink Robotics, Inc., HIWIN Corporation, Apex Automation, and DAIHEN Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manipulators Market Key Technology Landscape

The technological landscape of the Manipulators Market is defined by the convergence of advanced mechanical engineering, sophisticated control systems, and artificial intelligence, all aimed at enhancing dexterity, precision, and ease of use. A cornerstone of modern manipulators is the use of high-performance actuators, particularly brushless DC servo motors coupled with high-precision transmission systems like cycloidal, planetary, and harmonic drives, which allow for high torque-to-weight ratios and minimal backlash, essential for maintaining path accuracy at high speeds. This mechanical precision is complemented by sophisticated feedback control systems utilizing high-resolution encoders and specialized force-torque sensors embedded near the end-effector. Furthermore, the shift towards modular hardware design allows for faster repair and reconfiguration, while improved lightweight materials (like carbon fiber composites) reduce the manipulator's inertia, enabling faster acceleration and enhancing energy efficiency, critical differentiators in the highly competitive industrial robotics segment.

Software and digital technologies represent the primary frontier for innovation. Advanced programming environments are moving away from proprietary, text-based code toward intuitive, graphical, and simulation-driven interfaces, significantly reducing the required programming expertise and deployment time. Machine Vision, integrated with manipulators through high-speed cameras and 3D sensing (e.g., LiDAR, structured light), allows robots to locate, inspect, and handle items with high variability, transitioning from fixed automation to truly flexible systems. Furthermore, the incorporation of Digital Twin technology facilitates pre-deployment simulation and continuous process optimization without impacting live production, dramatically lowering the risk associated with integrating new automation systems and providing invaluable insights into potential operational bottlenecks and system performance variations.

A critical technology trend driving the collaborative segment is the development of advanced safety features, including power and force limiting (PFL) functions and integrated proximity sensors that enable safe interaction with human workers. Haptic feedback technology is also gaining traction, particularly in teleoperated and surgical systems, where the operator needs to perceive and respond to physical resistances in the remote environment, enhancing control and minimizing damage to delicate materials or tissues. Finally, the move towards cloud-based connectivity and IoT enables remote diagnostics, over-the-air software updates, and fleet management analytics, transforming the manipulator into an intelligent device that constantly communicates its performance and maintenance requirements, ensuring maximized utilization and minimizing the total cost of ownership across distributed manufacturing networks.

Regional Highlights

The global Manipulators Market exhibits distinct growth trajectories and dominance based on regional economic characteristics, industrial maturity, and governmental automation policies.

- Asia Pacific (APAC): APAC currently stands as the largest and most dynamic market, predominantly driven by massive investments in automation across key manufacturing hubs in China, South Korea, and Japan. China's "Made in China 2025" initiative heavily subsidizes automation, leading to the high-volume deployment of industrial robots in the electronics, automotive, and logistics sectors, focusing heavily on price competitiveness and rapid capacity expansion. Japan and South Korea, established leaders in precision engineering and semiconductors, continue to drive demand for high-speed SCARA and cleanroom manipulators. The region's growth is characterized by the high adoption rate of new technologies and fierce local competition, keeping pricing competitive while driving efficiency improvements across the supply chain.

- North America: North America is a critical market, characterized by high investment in sophisticated, high-value applications, particularly in aerospace, defense, medical devices, and advanced logistics. High labor costs and a strong push toward reshoring manufacturing facilities emphasize the demand for highly intelligent, flexible, and collaborative manipulators. The US market is also a leading consumer of surgical robotics and specialized teleoperated systems for infrastructure inspection and maintenance (e.g., oil and gas pipelines), favoring quality, precision, and integration capabilities over sheer volume. Regulatory support and venture capital flowing into AI and automation startups further accelerate technological adoption, specifically for advanced vision-guided and adaptive systems.

- Europe: Europe is recognized for its excellence in precision engineering, regulatory compliance, and a strong focus on sustainable and collaborative manufacturing practices. Germany, Italy, and Scandinavia lead the adoption of high-quality industrial robots, especially in complex assembly and welding processes within the automotive and machinery sectors. Strict occupational safety regulations in the EU heavily favor the quick integration of collaborative robots (cobots), designed to operate safely alongside humans, boosting the low-to-medium payload manipulator segment. Government-backed initiatives, such as the European Factories of the Future Research Association (EFFRA), promote the development of highly flexible and secure manufacturing environments, ensuring consistent long-term demand for advanced robotic solutions.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, primarily driven by investments in modernization in key industrial economies like Mexico and Brazil. The automotive and food & beverage sectors are the primary users, focusing on articulated robots for welding, painting, and high-speed packaging applications. Adoption is often dictated by macroeconomic stability and the need for global competitiveness, requiring manufacturers to upgrade aging infrastructure with cost-effective, reliable automation solutions, leading to increased import of established robot models from global leaders.

- Middle East and Africa (MEA): The MEA market is developing, with significant growth potential tied to large-scale infrastructure projects, expansion in the oil and gas sector, and diversification efforts in nations like Saudi Arabia and the UAE. Demand is centered on heavy-duty manipulators for construction and maintenance, and specialized systems for remote inspection in hazardous environments. The logistics and e-commerce segments are emerging rapidly, requiring sophisticated sorting and material handling systems to manage increasing regional trade volume, though political and economic volatility can influence the timing and scale of major automation investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manipulators Market.- ABB Ltd.

- FANUC Corporation

- KUKA AG (Midea Group)

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Universal Robots A/S (Teradyne)

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Comau S.p.A.

- Estun Automation

- Staubli International AG

- Omron Corporation

- DENSO WAVE INCORPORATED

- Siemens AG

- Seiko Epson Corporation

- Schunk GmbH & Co. KG

- Rethink Robotics, Inc.

- HIWIN Corporation

- Apex Automation

- DAIHEN Corporation

Frequently Asked Questions

Analyze common user questions about the Manipulators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the current high growth rate in the Manipulators Market?

The primary driver is the global implementation of Industry 4.0 paradigms, necessitating automated, interconnected, and flexible production systems. This, combined with persistent labor shortages in key manufacturing regions and the urgent need to enhance operational efficiency and quality control, accelerates the demand for advanced manipulators and robotics across all major industrial verticals.

How are Collaborative Manipulators (Cobots) influencing market dynamics?

Cobots are fundamentally lowering the barrier to entry for Small and Medium-sized Enterprises (SMEs) due to their affordability, ease of programming, and ability to work safely alongside humans without extensive protective guarding. They are primarily driving growth in logistics, electronics assembly, and specialized medical applications, shifting the market focus toward dexterity and safety rather than just heavy payload capacity or speed.

Which geographical region dominates the Manipulators Market in terms of volume and revenue?

The Asia Pacific (APAC) region currently dominates both market volume and revenue, largely attributable to massive, government-backed automation campaigns and high industrial density, particularly in China, South Korea, and Japan. However, North America and Europe are experiencing the highest growth rates in high-value, specialized manipulator segments like aerospace and surgical robotics.

What major challenges or restraints limit the widespread adoption of advanced manipulators?

The primary restraints include the high initial capital expenditure (CapEx) required for sophisticated robotic systems, which can deter smaller companies. Other significant challenges involve the complexity of integrating diverse robotic hardware and software platforms, and the necessity of specialized technical expertise for maintenance and rapid troubleshooting.

How significant is Artificial Intelligence (AI) in developing the next generation of manipulator systems?

AI is highly significant, acting as a core technological differentiator. AI enables manipulators to perform predictive maintenance, execute real-time path optimization, and adapt to unstructured environments using advanced machine vision and deep learning techniques. This shift allows manipulators to transition from rigidly programmed tools to intelligent, autonomous, and adaptive production assets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Manipulators Market Size Report By Type (Pneumatic, Electronic, Hydraulic), By Application (Automotive, Manufacturing, Transport and Logistics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Micromanipulators Market Size Report By Type (Hydraulic Micromanipulator, Electric Micromanipulator, Manual Micromanipulator), By Application (Cell Micromanipulation, Industrial Micromanipulation), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager