Manual and automatic coffee machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434724 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Manual and automatic coffee machines Market Size

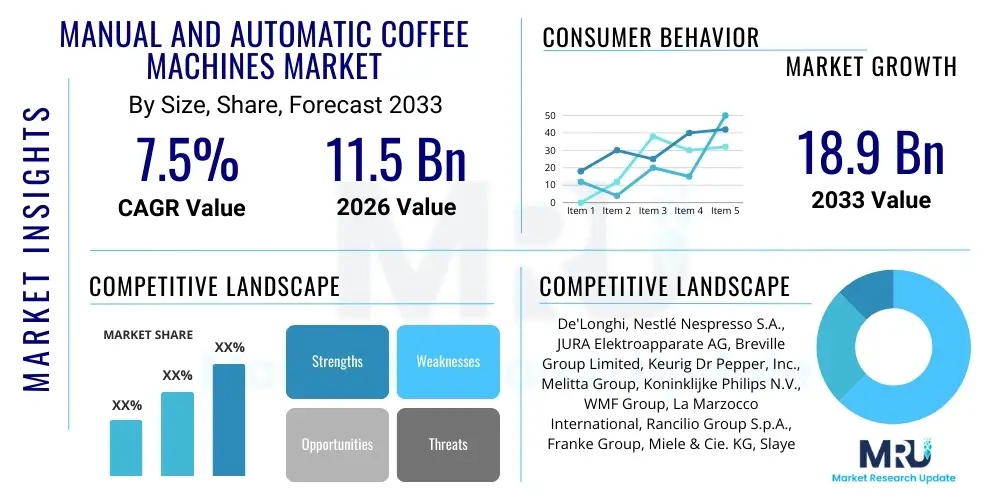

The Manual and automatic coffee machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 18.9 billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global coffee consumption trends, particularly the demand for premium and specialized coffee beverages prepared conveniently at home or in commercial settings. Technological advancements focused on enhancing brewing quality, machine connectivity, and user personalization are key factors fueling this upward trajectory, positioning the market for significant expansion across developed and emerging economies.

The distinction between manual and automatic segments highlights a polarized consumer preference: professionals and enthusiasts often gravitate towards manual machines for precise control over the brewing process, while the broader consumer base demands the speed and consistency offered by fully automatic and super-automatic models. The commercial sector, including cafes, restaurants, and corporate offices, remains a pivotal revenue stream, continually investing in high-capacity, robust automatic espresso machines to meet high-volume demand efficiently. Residential adoption is expanding rapidly due to lifestyle changes emphasizing in-home comfort and the desire to replicate cafe-quality experiences, thereby widening the market base for sophisticated yet user-friendly appliances.

Manual and automatic coffee machines Market introduction

The Manual and automatic coffee machines Market encompasses a diverse range of appliances designed for brewing coffee, catering to varying degrees of user intervention and automation. Products span from simple manual pour-over devices and traditional espresso levers to sophisticated, fully automatic super-machines capable of grinding beans, tamping, brewing, and frothing milk at the touch of a button. The fundamental objective of these products is to optimize the extraction process, delivering consistent quality and flavor profiles desired by consumers globally. Major applications include residential use, enhancing daily routines with specialty coffee, and extensive commercial applications in the foodservice industry, hospitality, and corporate environments where efficiency and high throughput are essential.

The primary benefits associated with modern coffee machines include enhanced convenience, time savings, and the ability to customize beverages according to specific preferences regarding strength, temperature, and volume. Driving factors for market growth involve rising disposable incomes, urbanization, the pervasive influence of coffee culture globally (often termed the "third wave" of coffee), and continuous product innovation focused on sustainability, connectivity (IoT integration), and improved energy efficiency. The market is increasingly competitive, with manufacturers focusing on ergonomic design, material quality, and the integration of advanced brewing algorithms to achieve optimal results, thereby driving consumers away from traditional, less precise brewing methods.

Manual and automatic coffee machines Market Executive Summary

The global Manual and automatic coffee machines Market is undergoing significant evolution, characterized by a rapid shift towards automated systems in high-volume commercial settings and an increasing appreciation for manual precision among home enthusiasts. Business trends indicate strong investment in smart features, enabling remote operation, maintenance diagnostics, and personalized recipe storage, particularly within the premium automatic segment. Manufacturers are also prioritizing sustainable materials and modular designs to appeal to environmentally conscious consumers and reduce the total cost of ownership through easier repairs. The market exhibits robust competition, forcing companies to innovate continuously on features like integrated grinders, precise temperature control (PID systems), and sophisticated milk frothing technologies.

Regional trends highlight North America and Europe as mature markets driven by replacement cycles and the persistent demand for specialty espresso-based drinks, while the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by increasing disposable income, Westernization of consumer habits, and the rapid expansion of organized retail and café chains in countries like China and India. Segment trends confirm that the fully automatic and super-automatic segments are dominating revenue generation due to unparalleled convenience, especially in office environments and busy households. However, the manual segment, encompassing high-end lever machines and sophisticated pour-over equipment, maintains a steady niche driven by quality-focused consumers seeking maximum control over the brewing variables.

AI Impact Analysis on Manual and automatic coffee machines Market

User queries regarding AI in the coffee machine market frequently center on themes such as automated personalization, predictive maintenance, and optimizing the brewing process based on bean type and environmental factors. Consumers are keen to know if AI can truly replicate the skill of a professional barista, asking about algorithms that adjust grinder settings, water temperature, and pressure profiles in real-time. Key concerns revolve around the cost implications of integrating such technology and potential privacy issues related to collecting usage data. Overall, expectations are high for AI to transform high-end automatic machines into adaptive systems that guarantee optimal extraction quality consistently, minimize waste, and proactively schedule necessary maintenance interventions before failures occur.

- AI-powered adaptive brewing systems optimize extraction parameters (grind size, water flow, pressure) based on real-time bean recognition and environmental humidity, ensuring consistency.

- Predictive maintenance algorithms analyze machine performance data to forecast component failure, reducing downtime in commercial environments and improving machine longevity.

- Personalization engines utilize machine learning to understand user preferences, automatically suggesting recipes, adjusting strength profiles, and ordering necessary supplies (beans, filters).

- Voice control integration allows hands-free operation and complex recipe execution, enhancing the convenience of smart automatic coffee machines.

- Supply chain optimization through AI helps manufacturers forecast demand for specific machine types and spare parts, improving inventory management and reducing logistical costs.

DRO & Impact Forces Of Manual and automatic coffee machines Market

The Manual and automatic coffee machines Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and impact forces. Primary drivers include the global expansion of coffee culture and increasing consumer demand for specialty coffee experiences at home, coupled with technological advancements in automation and IoT integration that enhance user convenience and brewing precision. Restraints typically involve the high initial cost of premium automatic machines, potential complexity in maintenance for super-automatic models, and consumer preference shifts towards out-of-home coffee consumption during economic upturns. However, significant opportunities exist in emerging markets, the commercial sector's need for high-throughput, reliable equipment, and the growing focus on sustainable and energy-efficient appliance designs.

Impact forces within this market are substantial. The increasing availability of affordable, high-quality beans and capsules acts as a powerful driver, encouraging machine purchase. Conversely, stringent energy efficiency regulations in regions like the EU impose cost pressures and design limitations (restraints) on manufacturers. The opportunity presented by digital connectivity, allowing for remote diagnostics and software updates, significantly elevates the value proposition of modern machines. The rapid penetration of single-serve pod systems also acts as a disruptive force, necessitating continuous innovation in traditional espresso and filter machine segments to maintain competitive relevance. Overall, consumer lifestyle trends favoring convenience and customization remain the most potent enduring impact force driving product development and market penetration.

Segmentation Analysis

The Manual and automatic coffee machines Market is comprehensively segmented based on machine type, application, and distribution channel, providing a granular view of consumer behavior and commercial demand. Type segmentation differentiates products by their level of automation, separating highly automated, user-friendly super-automatic models from precision-focused manual espresso and pour-over devices. Application segmentation distinctly splits the market between the high-volume, durability-focused commercial sector (hotels, offices, cafes) and the aesthetic, convenience-driven residential consumer base. Understanding these segments is crucial for manufacturers in tailoring product specifications, pricing strategies, and marketing campaigns to specific target groups, optimizing both market penetration and profitability.

- By Type:

- Manual Machines (Espresso Lever, Pour-Over, Drip)

- Semi-Automatic Machines

- Fully Automatic Machines

- Super-Automatic Machines (Bean-to-Cup)

- By Application:

- Residential

- Commercial (Cafes, Restaurants, Offices, Hotels)

- By Technology/Operation:

- Drip Coffee Makers

- Espresso Machines (Pump-Driven, Steam-Driven)

- Single-Serve/Pod Machines

- Cold Brew Systems

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Specialty Stores, Department Stores, Hypermarkets)

Value Chain Analysis For Manual and automatic coffee machines Market

The value chain for the Manual and automatic coffee machines Market begins with upstream activities, primarily involving the sourcing of raw materials such as specialized stainless steel, high-grade plastics, electronic components (e.g., PID controllers, sensors), and complex pumping mechanisms. Key upstream suppliers focus on quality assurance and precision engineering, as the reliability and longevity of the final product heavily depend on these core components. Manufacturers then engage in design, assembly, and rigorous quality control testing, often incorporating proprietary software and patented brewing technologies. Efficiency in manufacturing and minimizing material waste are crucial competitive differentiators at this stage. Effective management of the upstream segment ensures product consistency and minimizes production costs, which directly impacts final market pricing.

The downstream segment encompasses the intricate processes of market entry, distribution, and after-sales service. Distribution channels are varied, including direct sales to large commercial clients, partnerships with specialty coffee retailers, and significant reliance on both mass-market retailers and sophisticated e-commerce platforms. The shift towards online sales has necessitated robust logistics and digital marketing strategies. After-sales service, including warranties, maintenance support, and provision of spare parts, holds substantial value, particularly for high-cost automatic machines in commercial settings where downtime is critical. Strong service networks enhance brand loyalty and ensure optimal machine performance throughout its lifecycle.

Direct distribution channels often involve sales teams targeting large corporate clients, hotel chains, and premium café franchises, allowing for customized pricing and service agreements. Indirect channels, primarily retail and e-commerce, leverage established physical and digital infrastructure to reach the broader residential and small commercial market. Successful value chain management hinges on optimizing the balance between component cost, manufacturing precision, and the efficiency and reach of the distribution network. Furthermore, the increasing complexity of smart machines necessitates specialized technical training across all levels of the distribution and service ecosystem.

Manual and automatic coffee machines Market Potential Customers

Potential customers for the Manual and automatic coffee machines Market are broadly categorized into two primary groups: residential consumers and commercial enterprises, each possessing distinct purchase criteria and product needs. Residential consumers range from entry-level users seeking basic convenience (often opting for drip or single-serve machines) to passionate coffee enthusiasts willing to invest heavily in high-precision manual or semi-automatic espresso machines that offer maximum control and quality. The demographic skews towards middle to high-income households in urban areas globally, prioritizing appliance aesthetics, counter space utilization, and integration with smart home ecosystems. These buyers are typically driven by convenience, customization, and the desire to save money compared to purchasing daily coffee from cafes.

The commercial sector represents the high-volume demand segment, including cafes, restaurants, quick-service eateries, large hotel chains, and corporate offices. Customers in this segment prioritize durability, high throughput capacity, operational consistency, and energy efficiency. Cafes and restaurants often require professional-grade semi-automatic machines operated by trained baristas, while corporate offices favor super-automatic, bean-to-cup machines that provide quick, consistent coffee with minimal staff intervention. Institutional buyers place a high value on comprehensive service contracts, rapid technical support, and the ability of the machine to handle continuous, intense usage cycles without compromising beverage quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.9 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | De'Longhi, Nestlé Nespresso S.A., JURA Elektroapparate AG, Breville Group Limited, Keurig Dr Pepper, Inc., Melitta Group, Koninklijke Philips N.V., WMF Group, La Marzocco International, Rancilio Group S.p.A., Franke Group, Miele & Cie. KG, Slayer Espresso, BUNN, Rocket Espresso Milano, Schaerer AG, Astoria, Gaggia S.p.A., Nuova Simonelli, Siemens AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manual and automatic coffee machines Market Key Technology Landscape

The technology landscape of the Manual and automatic coffee machines Market is dominated by innovations aimed at achieving precise control over the four primary brewing variables: temperature, pressure, grind size, and water quality. Key technologies include the pervasive use of PID (Proportional Integral Derivative) controllers, which maintain highly stable and accurate water temperature throughout the brewing process, crucial for consistent espresso extraction. High-end machines utilize sophisticated pump technology, often rotary pumps in commercial models, to deliver consistent nine-bar pressure necessary for authentic espresso. Furthermore, integrated conical burr grinders are becoming standard in automatic machines, allowing for immediate, customizable grinding, which is essential for maximizing flavor retention and freshness.

The rise of the Internet of Things (IoT) has fundamentally altered the consumer experience, allowing machines to be connected via Wi-Fi or Bluetooth. This connectivity supports features such as remote initiation, maintenance alerts, software updates, and inventory tracking for commercial users. Super-automatic machines leverage advanced sensors and complex algorithms to manage the entire process, from grinding to milk frothing, utilizing thermodynamic boiler systems (like Thermoblocks) that heat water almost instantaneously, improving energy efficiency and speed. Furthermore, advancements in milk frothing technology, specifically automated steam wands and integrated milk systems, ensure high-quality microfoam consistency, addressing a critical aspect of specialty beverage preparation.

In the manual segment, innovation focuses on material science and ergonomic design, particularly optimizing flow profiling and pressure manipulation through mechanisms like pressurized baskets or internal mechanical levers, giving the user maximum tactile feedback and control. Conversely, the high-growth single-serve segment relies on proprietary capsule technology, ensuring hermetic sealing and precise dosing. Manufacturers are continuously investing in developing biodegradable or recyclable capsule materials to address mounting environmental concerns, demonstrating a commitment to sustainable technology while maintaining the convenience factor that drives this highly lucrative segment of the automatic coffee machine market.

Regional Highlights

- North America (U.S., Canada, Mexico): This region is characterized by high penetration of single-serve and super-automatic machines, driven by busy professional lifestyles and substantial disposable income. The U.S. is a mature market focused on premiumization and replacement sales, with significant demand for high-end espresso equipment for residential use, reflecting the strong influence of third-wave coffee culture. Manufacturers here prioritize smart connectivity and convenience features.

- Europe (Germany, UK, France, Italy): Europe is the historical heartland of espresso culture, particularly Italy and Germany, dominating the market for traditional espresso and high-quality semi-automatic machines. Germany leads in the adoption of fully automatic bean-to-cup machines. Sustainability and energy efficiency standards are extremely stringent here, strongly influencing product design and technology choices across the continent.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC is the fastest-growing market, driven by rapidly increasing urbanization, rising middle-class disposable income, and the globalization of Western coffee consumption habits. While Japan and South Korea have mature coffee cultures with high demand for specialty manual equipment, China and India are emerging markets seeing explosive growth in commercial application (café chains) and the introduction of entry-level automatic machines in households.

- Latin America (Brazil, Argentina): Growth in Latin America is tied to local coffee production and consumption. While traditional filter methods remain popular, there is increasing adoption of automatic espresso machines in urban centers and the hospitality sector, seeking to cater to both local preferences and international tourism standards.

- Middle East and Africa (MEA): This region shows nascent but growing demand, primarily concentrated in the Gulf Cooperation Council (GCC) countries driven by high-end luxury residential consumption and rapid growth in the hotel and service sectors. Demand is skewed towards technologically advanced, aesthetically pleasing super-automatic machines suitable for corporate and high-end residential settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manual and automatic coffee machines Market.- De'Longhi S.p.A.

- Nestlé Nespresso S.A.

- JURA Elektroapparate AG

- Breville Group Limited

- Keurig Dr Pepper, Inc.

- Melitta Group

- Koninklijke Philips N.V.

- WMF Group

- La Marzocco International

- Rancilio Group S.p.A.

- Franke Group

- Miele & Cie. KG

- Slayer Espresso

- BUNN

- Rocket Espresso Milano

- Schaerer AG

- Astoria Macchine da Caffè

- Gaggia S.p.A.

- Nuova Simonelli

- Siemens AG

Frequently Asked Questions

Analyze common user questions about the Manual and automatic coffee machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Super-Automatic Coffee Machine segment?

The Super-Automatic segment is driven by consumer demand for ultimate convenience, speed, and the ability to produce specialty, café-quality beverages at home with minimal effort. Integrated features like automatic milk frothing, integrated grinders, and customizable digital interfaces substantially increase adoption, especially among time-constrained urban populations seeking premiumization.

How does the integration of IoT technology benefit commercial coffee machine operations?

IoT integration significantly benefits commercial operations by enabling remote diagnostics, predictive maintenance scheduling, real-time monitoring of performance metrics (like throughput and fault analysis), and automated inventory management, leading to reduced operational downtime and improved service efficiency.

Which geographical region exhibits the highest growth potential for coffee machines?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, presents the highest growth potential. This growth is underpinned by rising disposable incomes, rapid Westernization of consumer habits, and extensive expansion within the commercial foodservice and hospitality sectors.

What are the key differences between manual and automatic coffee machines regarding price and quality?

Manual machines generally require higher user skill but offer maximum control over extraction variables, often resulting in superior quality for enthusiasts, typically at a moderate to high initial price. Automatic machines offer consistency and convenience with less skill required; their pricing ranges broadly, with super-automatic models often commanding the highest premium due to technological complexity.

Are single-serve coffee machines facing environmental regulatory challenges?

Yes, single-serve machines face growing environmental challenges primarily related to the non-biodegradability and difficulty in recycling common coffee pods and capsules. Regulatory bodies and consumer pressure are forcing manufacturers to innovate using sustainable materials, such as compostable or easily recyclable aluminum and plastic alternatives, to mitigate environmental impact.

The preceding sections detail the current market structure, technological influences, and consumer dynamics shaping the Manual and automatic coffee machines sector. Further analysis explores strategic implications for manufacturers and retailers operating within this highly dynamic and competitive global appliance landscape. Understanding the precise requirements of both the residential and commercial sub-markets is paramount for sustained competitive advantage, requiring continuous investment in user-centric design and connectivity features that enhance the overall coffee preparation experience.

Focus on market differentiation through patented brewing techniques, superior material longevity, and adherence to stringent global energy efficiency standards is crucial. Specifically, the future trajectory will be defined by the ability of automatic machine manufacturers to integrate AI effectively, moving beyond simple automation towards genuinely personalized and adaptive brewing cycles. For manual machine producers, emphasizing craftmanship, repairability, and premium materials continues to solidify their position within the enthusiast niche, resisting pressure from high-convenience automatic alternatives. The commercial segment will continue to prioritize reliability and total cost of ownership (TCO) over initial machine cost, making robust service networks a deciding factor.

Geographically, while North American and European markets provide a stable base characterized by replacement and upgrade cycles, APAC represents the principal avenue for volume expansion. Manufacturers targeting APAC must adapt their product offerings to suit diverse power standards, smaller kitchen spaces, and varying regional taste profiles, potentially emphasizing compact, multi-functional automatic solutions. Successful market penetration necessitates comprehensive understanding of local distribution infrastructure, including the rapidly expanding network of specialty e-commerce platforms and high-volume retail chains that dominate appliance sales in urbanized areas.

The Manual and automatic coffee machines Market remains resilient against minor economic fluctuations due to the essential nature of coffee consumption globally, coupled with the strong desire for premium, at-home experiences. Manufacturers must navigate complexities such as volatile raw material pricing, increased logistics costs, and intense intellectual property competition surrounding patented brewing systems. Strategic mergers and acquisitions are anticipated as large appliance conglomerates seek to integrate specialized espresso technology providers to rapidly enhance their product portfolio and acquire established brand equity within specific consumer niches. This strategic maneuvering is indicative of the high-stakes competition defining the contemporary market environment.

Addressing the growing sustainability imperative involves more than just capsule recycling; it encompasses reducing the energy consumption of machines during standby modes (a critical factor in European regulation), extending product life cycles through modular design and repairability, and minimizing water waste during the brewing and cleaning cycles. Consumers are increasingly willing to pay a premium for brands that transparently demonstrate commitment to environmental stewardship. Therefore, future product development must incorporate green technology and life-cycle assessment into the core design philosophy, turning regulatory constraints into commercial opportunities for market leadership and ethical branding.

The influence of technology extends deeply into the user interface (UI) and user experience (UX) of both manual and automatic machines. Automatic models now feature large, intuitive touchscreens and connectivity with smartphone applications, allowing users precise control over parameters previously reserved for professional baristas. Manual machines, while resisting electronic complexity, incorporate highly engineered mechanisms and precision gauges to provide maximum feedback. The convergence of these two segments is evident in semi-automatic machines, which blend the control of manual brewing with automated features like programmable volumetric dosing and temperature stability, representing a sweet spot for many dedicated home baristas seeking convenience without sacrificing control over the final cup quality.

Furthermore, the competitive dynamic is heavily shaped by continuous advancements in grinding technology. The quality of the grinder is arguably as crucial as the machine itself. Market leaders are integrating sophisticated flat or conical burr grinders with micrometric adjustment capabilities directly into their automatic machines, ensuring optimum particle consistency, which is vital for high-quality extraction. This emphasis on integrated, high-precision grinding technology removes a key barrier for consumers by simplifying the complex process of pairing a machine with a separate, high-quality grinder, thereby boosting the appeal and usability of super-automatic systems in the residential market.

The institutional segment, encompassing hospitals, universities, and military bases, represents a specialized application demanding high-volume, extremely reliable, and low-maintenance machines. These environments require industrial-grade durability and standardized beverage preparation. Manufacturers often supply customized versions of commercial automatic coffee makers tailored to handle less frequent cleaning cycles and interface with existing vending or payment systems. The contract terms often include mandatory, preventative maintenance schedules, reinforcing the reliance on strong service infrastructure mentioned earlier in the value chain analysis.

Finally, the growing health and wellness trend influences product development, leading to increased demand for machines capable of brewing diverse beverages beyond espresso, such as tea, cold brew, and specialized milk alternatives (oat, almond). Automatic machines are adapting by incorporating flexible milk systems designed to handle various protein and fat structures found in plant-based milks, ensuring proper frothing and texture. This diversification of beverage capabilities ensures that coffee machine manufacturers capture a wider share of the household beverage appliance market, broadening their consumer base beyond traditional coffee drinkers and maintaining relevance in evolving consumer dietary preferences.

The global Manual and automatic coffee machines Market is thus characterized by high technological sophistication, intense branding competition, and a persistent drive towards enhancing both convenience and quality. Success in this environment requires manufacturers to balance complex engineering with intuitive design, ensuring their products meet the diverse demands of both the efficiency-focused commercial buyer and the quality-conscious residential consumer seeking the ultimate coffee experience at home. The ongoing market evolution guarantees continued innovation, particularly regarding IoT integration and sustainable practices, shaping the industry's future trajectory towards greater customization and environmental responsibility.

The penetration of e-commerce platforms continues to disrupt traditional retail distribution, offering consumers unparalleled access to a wide range of international brands and highly specialized equipment, particularly manual pour-over apparatus and niche espresso components. Digital marketing and robust product reviews play a pivotal role in consumer purchasing decisions, necessitating strong brand presence and detailed, informative digital content from manufacturers. This shift emphasizes the importance of digital shelf presence and streamlined logistics management to meet fast delivery expectations associated with online purchasing.

Furthermore, pricing strategies are highly segmented. Manual devices often employ a premium, heritage-based pricing model, appealing to connoisseurs who value craftsmanship and longevity. Automatic machines employ value-based pricing, correlating closely with the level of automation and connectivity features offered. In the commercial sector, pricing often includes complex leasing and servicing packages, embedding long-term revenue streams for manufacturers through maintenance contracts and dedicated supply agreements for specific consumables or spare parts, minimizing customer churn.

In conclusion, the market is poised for sustained growth, underpinned by fundamental shifts in consumer behavior towards premium, convenience-oriented coffee consumption. Technological convergence, particularly between smart home systems and sophisticated brewing algorithms, will define the next generation of automatic machines. Addressing environmental concerns related to energy consumption and capsule waste will remain critical mandates for industry leaders, dictating both compliance and innovation pathways through the forecast period toward 2033, ensuring a high level of market dynamism.

The detailed market analysis reveals that regional growth differences are substantial, requiring tailored strategies. In highly saturated markets like Western Europe, the focus must shift from new customer acquisition to securing replacement sales through superior product longevity and upgrade incentives. Conversely, in the burgeoning APAC market, initial sales efforts should concentrate on educating emerging middle-class consumers on the benefits of automatic systems over traditional methods, utilizing competitive entry-level pricing to establish brand loyalty early in the growth curve.

Innovation in material science also contributes significantly to market trends. The use of specialized ceramics, enhanced aluminum alloys, and food-grade silicone ensures thermal stability, reduces maintenance issues, and improves the overall aesthetic appeal of the appliances. This focus on material quality supports both the functional precision required for high-quality extraction and the consumer desire for durable, aesthetically pleasing kitchen appliances that align with modern interior design trends, particularly within the residential high-end segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager