Manual Chain Hoist Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433726 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Manual Chain Hoist Market Size

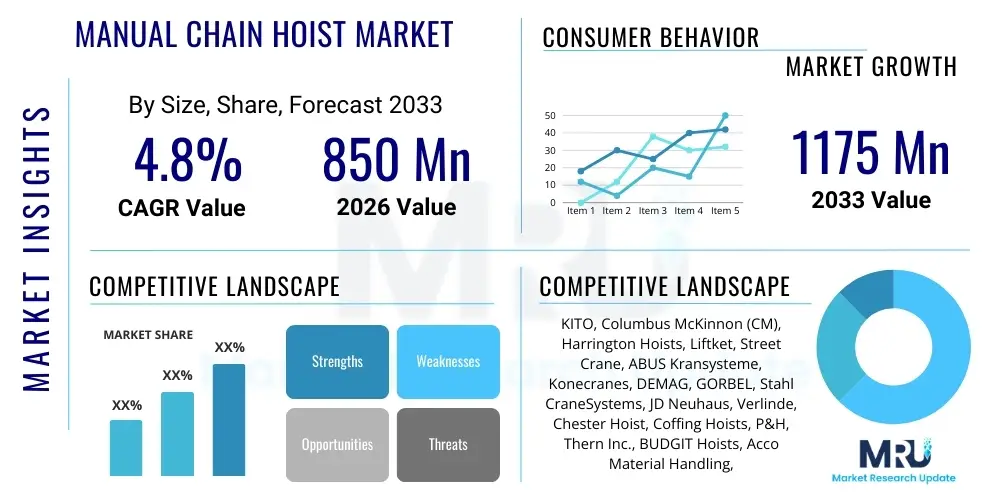

The Manual Chain Hoist Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1175 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the expanding need for cost-effective, reliable, and versatile material handling equipment across emerging economies, particularly within the construction and standardized manufacturing sectors. Manual chain hoists offer inherent advantages such as portability, ease of operation, and minimal maintenance requirements, making them indispensable in environments where electrical power access is limited or high-precision lifting operations are necessary.

The resilience of the market size, despite the rise of electric and pneumatic alternatives, stems from its crucial role in niche applications and environments requiring intrinsic safety, such as explosive or highly corrosive settings where powered equipment presents significant hazards. Furthermore, small and medium enterprises (SMEs) in developing regions often prioritize manual solutions due to lower initial capital expenditure and robust durability. Regulatory emphasis on worker safety and ergonomic standards also indirectly supports the manual hoist segment, as modern designs incorporate features that minimize strain and maximize load stability during manual operation, cementing their fundamental position in the industrial landscape.

Manual Chain Hoist Market introduction

Manual Chain Hoists, also known as chain blocks or hand chain hoists, are mechanical devices utilized for lifting and lowering heavy loads using a system of chains and gears. These devices operate on the principle of mechanical advantage, where a relatively small input force applied to the hand chain generates a significant lifting force on the load chain. Their applications span across diverse industrial sectors, including general manufacturing, infrastructure development, mining, shipyards, and specialized maintenance tasks. The primary benefit of employing manual chain hoists lies in their independence from external power sources, providing high portability, ease of installation, and inherent reliability in remote or harsh operating environments. Key factors driving the market include global infrastructural investments, increasing adherence to occupational safety standards, and the requirement for secondary or backup lifting solutions in heavy industries.

Manual Chain Hoist Market Executive Summary

The Manual Chain Hoist Market demonstrates stable growth supported by strong demand from the construction and general manufacturing industries, particularly in the Asia Pacific region. Business trends indicate a shift toward high-capacity, heavy-duty manual hoists capable of handling extreme conditions, alongside a focus on incorporating lightweight yet robust materials like high-grade alloy steel for enhanced portability and longevity. Manufacturers are also integrating features that improve ergonomic efficiency and comply with stringent international load testing and safety certifications, positioning the product not merely as a budget option but as a specialized, reliable lifting tool.

Regional trends highlight the dominance of the Asia Pacific market, fueled by massive infrastructural projects in China, India, and Southeast Asia, demanding basic, reliable lifting gear. North America and Europe, conversely, exhibit steady replacement demand driven by stricter safety regulations and the need to upgrade older equipment with modern, CE or ASME certified models. Segment trends show that the 1-3 Ton capacity segment remains the largest volume contributor, owing to its versatility across standard workshop and maintenance applications, while the manufacturing industry continues to be the dominant end-user segment globally, leveraging manual hoists for precision assembly and short-distance material movement.

AI Impact Analysis on Manual Chain Hoist Market

User queries regarding AI’s influence on the manual hoist market often center on whether automation technologies, powered by AI and machine learning, will render manual lifting obsolete, or if AI can enhance the design, maintenance, and safety protocols associated with traditional hoists. Concerns also arise about predictive maintenance integration, specifically how non-powered equipment can leverage IoT sensors and AI analytics for optimal service intervals. The analysis suggests that while AI-driven robotics threaten replacement in highly automated facilities, the core market for manual hoists—characterized by low volume, sporadic usage, limited space, and zero power dependency—remains fundamentally immune to large-scale AI disruption. However, AI is profoundly impacting the manufacturing supply chain, optimizing raw material procurement, enhancing quality control through vision systems, and refining inventory management for hoist components, leading to leaner production and faster delivery times for manual products.

- AI optimizes supply chain logistics for raw materials (steel, alloys), reducing production costs.

- Predictive maintenance platforms, utilizing external vibration sensors and usage logging, can recommend service schedules for manual hoists used infrequently.

- AI-driven quality control systems enhance the precision manufacturing of critical components (gears, load hooks), improving hoist reliability and safety factors.

- Integration of advanced ergonomic design validated by AI simulation minimizes operator strain and fatigue during manual lifting operations.

- AI contributes to automated compliance checking of hoist designs against global safety standards (e.g., ASME B30.16, EN 13157).

DRO & Impact Forces Of Manual Chain Hoist Market

The Manual Chain Hoist Market is shaped by a confluence of driving factors, operational restraints, and strategic opportunities that collectively define its trajectory. Key drivers include the low operational cost and high portability of these devices, making them ideal for fieldwork and construction sites without readily available electrical infrastructure. The global expansion of standardized manufacturing facilities and warehousing activities, particularly in emerging economies, creates consistent, baseline demand for reliable, backup lifting apparatus. Counterbalancing these drivers are significant restraints, primarily the increasing penetration of electric hoists offering higher speed and reduced operator fatigue, especially in high-cycle rate environments, coupled with the persistent challenge of strict manual lifting limitations imposed by various occupational health and safety bodies regarding maximum load and frequency of lift.

Opportunities for growth are concentrated in specialty sectors, such as hazardous environments (oil and gas, chemical processing) where the non-sparking nature of manual hoists is mandatory, and in maintenance, repair, and overhaul (MRO) operations within capital-intensive industries. Furthermore, modernization initiatives focused on upgrading legacy infrastructure worldwide necessitate reliable rigging and manual handling tools for precision positioning and installation tasks. The principal impact force influencing the market is governmental safety regulation; as standards become stricter, manufacturers are compelled to invest heavily in robust material science and anti-corrosion treatments, thereby enhancing product quality and reinforcing the market's reputation for safety, despite the slow speed of manual operation. These regulations drive replacement cycles and set high entry barriers for substandard, low-cost manufacturers.

Segmentation Analysis

The Manual Chain Hoist Market is structurally segmented based on crucial dimensions including capacity, end-user industry, and sales channel, each reflecting distinct consumer requirements and application environments. Capacity segmentation is vital as it directly dictates the material structure and size of the hoist, catering to everything from light workshop tasks (under 1 ton) to heavy machinery assembly (over 5 tons). The industry segmentation reveals where the primary value resides, with construction and manufacturing being the bedrock consumers due to constant material movement requirements. Analysis of these segments is crucial for manufacturers to tailor product specifications, ranging from robust, weather-resistant models for construction sites to precision, clean-room compliant hoists for specialized manufacturing.

- By Capacity:

- Under 1 Ton

- 1–3 Ton

- 3–5 Ton

- Above 5 Ton

- By Industry:

- Construction and Infrastructure

- Manufacturing (General Fabrication, Machinery Assembly)

- Automotive and Transportation

- Mining and Metals

- Logistics and Warehousing

- Marine and Shipyards

- Oil and Gas/Chemical

- By Sales Channel:

- Direct Sales

- Distributors/Dealers

- E-commerce

Value Chain Analysis For Manual Chain Hoist Market

The value chain for the manual chain hoist market begins with upstream activities dominated by raw material suppliers, predominantly specializing in high-strength carbon and alloy steel necessary for load chains, hooks, and gear assemblies. Component manufacturing, involving precision forging, casting, and heat treatment, is a critical stage ensuring the safety and longevity of the final product. Key manufacturers then assemble, test, and certify these hoists according to international standards (e.g., ASME, EN, ISO). Efficiency in the upstream segment, particularly minimizing steel commodity price volatility and ensuring component quality, directly impacts the profitability and reliability of the final hoist unit.

The distribution of manual chain hoists primarily relies on a sophisticated mix of direct sales and an extensive network of industrial distributors and dealers. Direct sales are often utilized for large, custom orders placed by major EPC (Engineering, Procurement, and Construction) firms or specialized mining operations, ensuring technical consultation and after-sales support are closely managed. Conversely, the vast majority of standardized hoists are sold through indirect channels, leveraging distributors that maintain local inventories, offer immediate availability, and handle localized compliance documentation. The downstream segment involves end-users, rental companies, and MRO service providers who require prompt replacement parts and certified repair services, creating a continuous service demand loop that supports the long-term market value.

Manual Chain Hoist Market Potential Customers

Potential customers for manual chain hoists are highly diversified, encompassing any entity requiring reliable, temporary, or power-independent means of vertical load handling. The largest customer base resides within the construction and infrastructure development sectors, where hoists are used daily for lifting scaffolding, structural components, and construction materials across various phases of a project. Manufacturing facilities, particularly those involved in heavy equipment fabrication, automotive assembly, and machinery maintenance, represent another critical segment, utilizing hoists for precision component positioning and tool handling in non-automated workstations. These customers prioritize high duty cycles, robust design, and adherence to specific lifting height requirements, often demanding certification traceability for safety audit purposes.

Secondary, yet rapidly growing, customer segments include the logistics and warehousing industry for manual operations in receiving or shipping docks, and specialized sectors such as the oil and gas (O&G) industry. In O&G, manual hoists are crucial for offshore platform maintenance and pipeline installation, where the risk of sparking from electric equipment is unacceptable. Rental equipment companies also constitute a major customer group, purchasing hoists in bulk to meet the short-term, project-based demands of SMEs and temporary site operations. Customer decision-making is typically guided by three factors: load capacity certification, corrosion resistance (especially in marine/coastal environments), and the availability of immediate spare parts and certified service personnel provided by the distributor network.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1175 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KITO, Columbus McKinnon (CM), Harrington Hoists, Liftket, Street Crane, ABUS Kransysteme, Konecranes, DEMAG, GORBEL, Stahl CraneSystems, JD Neuhaus, Verlinde, Chester Hoist, Coffing Hoists, P&H, Thern Inc., BUDGIT Hoists, Acco Material Handling, Zhejiang Wuyi, Vulcan Hoist |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manual Chain Hoist Market Key Technology Landscape

While manual chain hoists are inherently mechanical, the underlying technology landscape is continuously evolving, focusing predominantly on material science, ergonomic engineering, and enhanced safety mechanisms rather than digital integration. The core technological advancements revolve around the development of specialized load chain materials, such as Grade 100 or higher alloy steel, which allows for increased strength-to-weight ratios. This innovation permits manufacturers to produce hoists that are lighter and more compact while maintaining or exceeding rated load capacities and safety factors. Furthermore, anti-corrosion technology, including specialized galvanization and marine-grade coatings, is critical, expanding the operational lifespan and applicability of manual hoists in harsh, chemically aggressive or high-humidity coastal environments.

A secondary technological trend involves the optimization of gearing mechanisms to reduce the effort required by the operator to lift a load (reducing hand chain pull force), thus improving ergonomics and compliance with worker health standards. Ratchet and pawl brake systems have also seen continuous refinement to ensure absolute load security, especially under dynamic loading conditions. Modern hoists incorporate enclosed gearboxes and self-lubricating bearings to minimize maintenance downtime and prevent contamination, thereby increasing the hoist’s operational reliability. While AI/IoT integration remains minimal in the hoist itself, technology impacts manufacturing processes through Computer-Aided Design (CAD) for precision component modeling and simulation testing to validate safety under extreme conditions, ensuring compliance with global regulatory mandates before market release.

Regional Highlights

The global Manual Chain Hoist Market exhibits varied growth patterns influenced by regional industrial maturity, safety regulations, and infrastructure spending velocity. The Asia Pacific (APAC) region is the undisputed leader in terms of market volume and growth, propelled by robust growth in construction, infrastructure, and manufacturing sectors across China, India, and ASEAN nations. These economies utilize manual hoists extensively due to lower capital costs and versatility on vast, distributed worksites. Demand in APAC is high for mid-capacity hoists (1-3 Ton) and low-cost units, driven by continuous factory expansion and general material handling needs.

North America and Europe represent mature markets characterized primarily by replacement demand and a strong emphasis on certified, high-quality, and ergonomically optimized products. Regulatory bodies like OSHA in North America and CE standards in Europe necessitate frequent equipment inspection and replacement, fostering stable demand for premium brands known for superior reliability and low cost of ownership over the equipment's lifecycle. The Middle East and Africa (MEA) region shows significant potential, particularly driven by large-scale oil and gas projects and urbanization initiatives, creating specific demand for explosion-proof and corrosion-resistant manual lifting solutions.

- Asia Pacific (APAC): Dominates the market share due to rapid industrialization, large-scale construction projects, and high utilization in SMEs seeking cost-effective lifting solutions. Key markets include China and India.

- North America: Stable market driven by strict safety regulations (OSHA) leading to mandatory equipment upgrades and high demand for premium, certified hoists in specialized industrial maintenance and repair.

- Europe: Focuses on ergonomic design and adherence to strict CE standards. Demand is concentrated in manufacturing, specialized engineering, and high-precision assembly operations.

- Latin America (LATAM): Emerging market characterized by growing mining and infrastructure investment, fueling increased demand for robust, high-capacity hoists suitable for remote and rugged environments.

- Middle East and Africa (MEA): Growing demand linked to expansive oil & gas exploration, petrochemical projects, and logistics hub development, requiring specialized, often anti-sparking, manual equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manual Chain Hoist Market.- KITO

- Columbus McKinnon (CM)

- Harrington Hoists

- Liftket

- Street Crane

- ABUS Kransysteme

- Konecranes

- DEMAG

- GORBEL

- Stahl CraneSystems

- JD Neuhaus

- Verlinde

- Chester Hoist

- Coffing Hoists

- P&H

- Thern Inc.

- BUDGIT Hoists

- Acco Material Handling

- Zhejiang Wuyi

- Vulcan Hoist

Frequently Asked Questions

Analyze common user questions about the Manual Chain Hoist market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the growth of the Manual Chain Hoist Market?

Market growth is primarily driven by expanding global infrastructure and construction activities, high demand from emerging economies requiring low-cost and portable lifting solutions, and the mandated use of manual hoists in hazardous environments (e.g., oil and gas) where powered equipment is prohibited due to spark risk.

What is the most popular capacity segment in the Manual Chain Hoist Market?

The 1 to 3 Ton capacity segment holds the largest market share due to its versatility, meeting the majority of lifting requirements in standard workshops, light manufacturing, and construction site maintenance tasks, providing an optimal balance between lifting power and manual effort required.

How do stringent safety regulations affect manual hoist sales?

Strict safety regulations (such as ASME and CE standards) positively influence the market by driving demand for certified, high-quality, and replacement hoists. Regulations ensure that older, non-compliant equipment is retired, leading to consistent sales of new, safer models that incorporate enhanced braking and load security technologies.

Which region dominates the global Manual Chain Hoist Market?

The Asia Pacific (APAC) region currently dominates the global market, accounting for the highest volume demand. This dominance is attributed to rapid industrialization, large-scale construction booms, and the widespread adoption of cost-efficient lifting tools in developing economies like China and India.

Are Manual Chain Hoists being replaced by electric alternatives?

While electric hoists are preferred for high-speed, high-duty cycle applications, manual hoists maintain a critical, irreplaceable role in environments requiring zero electrical power, exceptional portability, inherent safety (non-sparking), precision positioning, and low initial capital investment, ensuring stable market existence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager