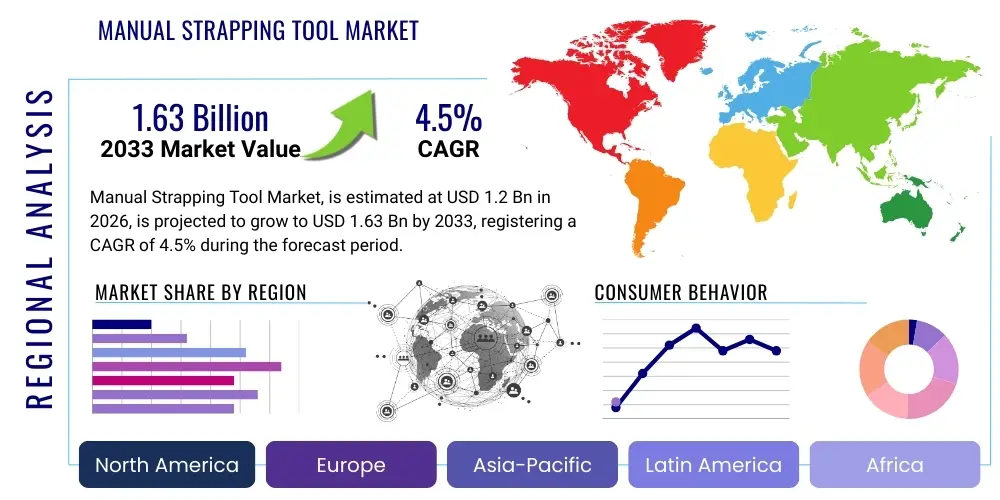

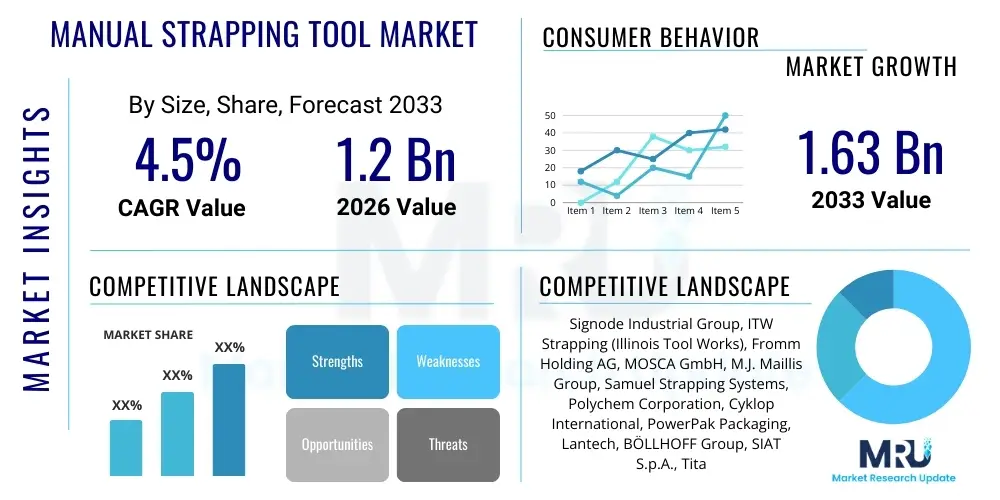

Manual Strapping Tool Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437682 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Manual Strapping Tool Market Size

The Manual Strapping Tool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.63 Billion by the end of the forecast period in 2033. This steady growth is primarily attributed to the continuous expansion of the logistics and packaging industries globally, especially in emerging economies where cost-effectiveness and operational simplicity of manual tools remain highly valued for low-to-medium volume applications. The durability and low maintenance requirements of manual strapping tools further stabilize their market position despite the increasing adoption of automated and semi-automatic systems in large-scale manufacturing environments.

Manual Strapping Tool Market introduction

The Manual Strapping Tool Market encompasses equipment utilized for securing packages, pallets, and bundles using various strapping materials such as polypropylene (PP), polyester (PET), and steel. These tools are essential components in end-of-line packaging processes, providing tensioning, sealing, and cutting capabilities without relying on external power sources. Products range from tensioners (which pull the strap tight), sealers (which crimp a metal seal or buckle onto the strap), and combination tools (which integrate both functions). These manual solutions are distinctively characterized by their robustness, portability, and minimal capital investment, making them indispensable across decentralized operations, construction sites, and repair facilities.

Major applications of manual strapping tools span across critical sectors including logistics and transportation, building materials, food and beverage, and metals processing. In logistics, these tools ensure load stability during transit, reducing product damage and enhancing supply chain integrity. For the building materials industry, they are crucial for bundling lumber, bricks, and piping for safe handling. The primary benefits driving their consistent demand include operational flexibility, reliability in harsh environments where electricity access is limited, and significantly lower operational expenditure compared to pneumatic or battery-powered alternatives. This combination of low cost and high utility firmly roots manual tools in the essential toolkit for packaging professionals worldwide.

Key driving factors supporting the sustained relevance of the manual strapping tool segment include the proliferation of small and medium-sized enterprises (SMEs) requiring affordable packaging solutions, the robust growth of e-commerce necessitating effective secondary packaging for shipping, and the inherent simplicity of operation that minimizes the need for extensive training. Furthermore, advancements in strapping material technology, offering stronger and lighter materials like high-strength PET, indirectly boost the demand for reliable manual tools designed to handle these modern materials. While automated systems gain traction in high-volume settings, the foundational need for quick, on-demand, and mobile strapping operations ensures the manual segment maintains its strategic significance.

Manual Strapping Tool Market Executive Summary

The Manual Strapping Tool Market exhibits stable growth, driven predominantly by infrastructural development in developing nations and the expanding global supply chain. Business trends indicate a strategic focus among manufacturers on improving the ergonomic design and durability of tools, specifically addressing user fatigue and extending tool lifecycle. Although the market is mature, product differentiation is occurring through the introduction of specialized manual tools optimized for specific strap types (e.g., heavy-duty steel strapping vs. lightweight PP) and application environments (e.g., extreme temperatures or corrosive settings). Competitive strategies revolve around robust distribution networks and efficient after-sales service to secure long-term contracts with regional logistics hubs and construction conglomerates.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive manufacturing output and rapid urbanization, particularly in China, India, and Southeast Asian nations. North America and Europe, while being mature markets, maintain significant demand for high-quality, specialized manual tools, often due to stringent safety regulations governing load securement in warehousing and transportation. The Middle East and Africa (MEA) are emerging areas benefiting from significant infrastructure investments and associated demand for manual tools for construction material packaging and resource extraction industries. Regional dynamics also show varying preference levels for strapping material; steel strapping tools dominate heavy industries in industrialized regions, while plastic strapping tools are favored for general packaging across all geographical areas.

Segment trends reveal that combination tools are gaining market share due to their efficiency and convenience, consolidating the tensioning and sealing processes into a single unit, which reduces operator handling time. By product type, tensioners remain the highest volume segment, universally required across all applications. By strapping material, the PP and PET segment is experiencing faster growth than the traditional steel segment, driven by lower material costs and environmental considerations. The end-user analysis confirms that third-party logistics (3PL) providers and the general manufacturing sector represent the largest consumer base, continually investing in portable, reliable strapping solutions to manage diverse packaging requirements efficiently and cost-effectively.

AI Impact Analysis on Manual Strapping Tool Market

User inquiries regarding AI's influence on the Manual Strapping Tool Market primarily focus on displacement concerns, integration potential, and operational efficiency improvements. Common questions include whether AI-driven automation will render manual tools obsolete, how predictive maintenance concepts could apply to simple mechanical tools, and if AI can optimize the manual strapping process itself (e.g., recommending optimal tension levels). Analysis reveals that while AI directly influences high-volume automated packaging lines, its impact on the manual segment is largely indirect and focused on optimizing upstream and downstream logistics, inventory management of strapping supplies, and improving training modules through machine learning insights. The core function of manual tools—simplicity and independence from power—insulates them somewhat from immediate AI replacement, shifting the focus instead to smart integration within overall operational planning.

- Indirect optimization of logistics routes using AI, leading to increased demand for robust manual load securement tools during transit.

- AI-powered inventory management systems providing real-time data on strapping material usage, subsequently informing procurement cycles for manual tools and supplies.

- Development of machine vision systems used in quality control (QC) checkpoints that verify the tension and sealing quality performed by manual tools.

- Enhanced safety training simulations utilizing augmented reality (AR) guided by AI analysis of best practices for manual tool operation, reducing human error.

- Predictive maintenance analytics applied to the usage patterns of manual tool fleets, recommending repair schedules based on operational frequency and environmental factors.

- Minimal direct replacement threat, as AI integration remains cost-prohibitive and unnecessary for low-volume, decentralized manual applications.

DRO & Impact Forces Of Manual Strapping Tool Market

The Manual Strapping Tool Market is fundamentally driven by the robust growth of global trade and logistics activities, necessitating secure packaging solutions. Restraints include the increasing shift towards automation in large manufacturing facilities seeking faster cycle times, and the potential for operator injury if tools are improperly used. Opportunities lie in developing ergonomic and lightweight tools compatible with high-strength composite straps, opening new niche markets. The critical impact forces influencing market trajectories include technological substitution pressure from battery-powered tools and regulatory standards mandating specific load securement practices, forcing tool manufacturers to meet evolving safety requirements.

Key drivers include the global expansion of warehousing and distribution networks, particularly in emerging economies where labor costs favor manual operations over capital-intensive automation. Furthermore, the inherent need for backup or mobile strapping solutions, even within facilities heavily invested in automation, maintains a baseline demand for manual tools. The simplicity of maintenance and longevity of manual tools also appeal to industries operating in remote locations or developing infrastructure, such as mining and infrastructure construction, where robust, non-electric solutions are essential. These drivers collectively ensure steady, reliable demand regardless of economic cyclicality.

Major restraints involve the competitive edge held by pneumatic and battery-powered tools in terms of speed and consistency of tension application, particularly in high-throughput environments. Concerns regarding the repeatability and potential variability of tensioning achieved by manual tools often push larger operations toward powered alternatives to minimize cargo shift risks. Additionally, the proliferation of counterfeit or low-quality manual tools, particularly in price-sensitive markets, poses a challenge to established manufacturers who prioritize durability and safety compliance, creating market saturation at the lower end of the pricing spectrum.

Segmentation Analysis

The Manual Strapping Tool Market is segmented primarily by product type, strapping material compatibility, and end-user application. Product segmentation delineates between basic tensioners, dedicated sealers, and highly functional combination tools, each catering to specific operational workflows and required throughput levels. Segmentation by material is crucial, dividing the market into tools optimized for steel strapping (used for extremely heavy loads) and plastic strapping (PP and PET, used for general packaging due to cost and flexibility). Understanding these segments allows manufacturers to tailor features such as gripping mechanisms and sealing methods to maximize efficiency and strap joint integrity for diverse industrial needs.

- By Product Type:

- Tensioners (Windlass, Feedwheel, Push-type)

- Sealers (Crimp sealers, Notch sealers)

- Combination Tools (Tensioning and sealing integrated)

- Cutters

- By Strapping Material:

- Steel Strapping Tools (Heavy-duty applications)

- Plastic Strapping Tools (Polypropylene (PP), Polyester (PET))

- By End-User Industry:

- Logistics and Warehousing (3PL)

- Construction and Building Materials

- Metals and Manufacturing

- Food and Beverage

- Paper and Printing

- Textiles and Apparel

Value Chain Analysis For Manual Strapping Tool Market

The value chain for the Manual Strapping Tool Market starts with upstream activities focused on raw material procurement, primarily high-grade steel alloys, aluminum, and durable plastics required for tool construction. Manufacturers concentrate on precision engineering, machining, and assembly to ensure the tools meet stringent durability and ergonomic standards. Key differentiation at this stage often relates to proprietary mechanical designs that enhance tensioning capability and reduce operational friction, which ultimately dictates the longevity and reliability of the final product.

Downstream activities involve specialized distribution channels, which are critical for market reach. Due to the high number of dispersed SMEs and diverse applications, manufacturers rely on strong partnerships with industrial equipment suppliers, specialized packaging distributors, and large retail hardware chains. Direct sales channels are typically reserved for large-volume industrial clients or specialized heavy-duty tools. The distribution phase includes comprehensive training and technical support, as proper tool usage is essential for ensuring load security and preventing premature tool wear.

The structure of the distribution channel is categorized into direct and indirect sales. Direct sales offer tighter control over pricing and customer relationship management, often utilized for serving large manufacturing corporations needing customized tools or bulk orders. Indirect channels, which involve wholesalers, distributors, and e-commerce platforms, ensure broad market penetration, especially reaching small-scale users and regional businesses globally. The effectiveness of the value chain is highly dependent on managing inventory efficiency for both the tools and associated consumables, such as seals and strapping materials, to maintain rapid fulfillment capabilities crucial for the packaging sector.

Manual Strapping Tool Market Potential Customers

Potential customers for manual strapping tools span a wide array of industrial and commercial entities that require portable, reliable, and cost-effective solutions for securing packaged goods. The primary end-users are those sectors involved in logistics, storage, and transportation where variable load sizes and decentralized packaging operations are common. This includes small and medium-sized third-party logistics (3PL) providers who manage diverse cargo types, as well as freight forwarders who need to quickly secure loads on trucks, rail cars, or shipping containers in varying environments.

Beyond logistics, a significant customer base resides within the heavy industrial sectors. Construction companies utilize these tools extensively for bundling and securing building materials (e.g., scaffolding, piping, insulation boards) at worksites. The metals industry, including steel mills and aluminum processors, relies on heavy-duty manual steel strapping tools to bundle massive, heavy loads of coils, sheets, and rods for internal handling and external shipment. The durability and high tension capabilities of manual steel tools make them irreplaceable in these demanding, high-impact environments where power access may be intermittent.

Finally, general manufacturing and fabrication workshops represent a constant demand segment. Any facility producing goods that need palletizing before shipment, from furniture makers to machinery parts producers, requires manual strapping tools for intermittent or low-volume packaging needs. The low initial investment and ease of integration into existing processes make manual tools the preferred choice for businesses focusing on capital expenditure control and operational simplicity. The agricultural sector also serves as a niche but consistent customer, using these tools for securing feed, produce, and bulk items.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.63 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signode Industrial Group, ITW Strapping (Illinois Tool Works), Fromm Holding AG, MOSCA GmbH, M.J. Maillis Group, Samuel Strapping Systems, Polychem Corporation, Cyklop International, PowerPak Packaging, Lantech, BÖLLHOFF Group, SIAT S.p.A., Titan Strapping Systems, Orgapack, Messersi Packaging, Strapack, Inc., Ascentron, Strapex, PNEUMATIC STRAPPING TOOL, PACKWAY |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manual Strapping Tool Market Key Technology Landscape

While fundamentally mechanical, the technology landscape in the Manual Strapping Tool Market focuses heavily on material science, ergonomic design, and precision mechanical engineering to enhance performance and user safety. Key technological advancements include the use of higher-grade, lighter alloys (such as hardened aluminum and specialized steels) to reduce tool weight without compromising the extreme tensioning forces required, particularly for steel strapping applications. Manufacturers are also integrating wear-resistant components and modular designs to simplify field maintenance, thus increasing the tool's lifespan and reducing total cost of ownership (TCO).

A significant technological focus is placed on tensioning mechanisms. Modern manual tools feature refined feedwheel and windlass designs that achieve higher and more consistent strap tension with less physical effort from the operator. For plastic strapping tools, the key is developing tensioners capable of handling the high elasticity and memory retention properties of PET straps effectively. Similarly, sealing technology has advanced, with sealers now incorporating multi-notch crimping patterns that maximize joint strength and reliability, crucial for compliance with transportation safety standards, thereby minimizing the risk of load failure during harsh logistics operations.

Furthermore, technology is applied to improve ergonomics and user experience (UX). This includes anti-slip grips, improved weight distribution, and leverage systems that minimize repetitive strain injury (RSI) risks for operators who use the tools continuously. While digital integration is minimal compared to powered tools, some premium manual tools feature simple mechanical indicators or gauges to ensure specified tension levels are met, offering a rudimentary form of quality assurance verification directly at the point of application. These incremental mechanical improvements are vital for maintaining the competitive relevance of manual systems.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns for manual strapping tools, heavily influenced by localized economic activity, labor costs, and existing infrastructure maturity. Asia Pacific (APAC) represents the largest and fastest-growing market due to its dominance in global manufacturing, burgeoning e-commerce sectors, and extensive infrastructure development projects, all requiring robust, affordable packaging and bundling solutions. Countries like China and India drive volume demand, prioritizing cost-effectiveness, leading to a high uptake of manual PP and PET strapping tools across diverse manufacturing supply chains.

North America and Europe maintain a significant, though relatively stable, market share. These regions are characterized by stringent safety and load securement regulations, driving demand for specialized, high-quality manual tools, particularly those compatible with heavy-duty steel strapping used in the metals and construction industries. While automation rates are higher, manual tools are essential for decentralized operations, repair, and specialized applications where powered machinery is impractical. Innovation in these regions often focuses on ergonomic design and regulatory compliance rather than sheer volume capacity.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting accelerating demand tied directly to investment in resource extraction, transportation infrastructure, and new manufacturing facility establishment. In MEA, the challenging environmental conditions (e.g., high heat, dust) often favor the mechanical simplicity and resilience of manual strapping tools over sensitive powered machinery, particularly in remote construction and oil & gas logistics operations. This regional preference for rugged, low-tech reliability underscores the continuing global necessity of the manual strapping segment.

- North America (USA, Canada, Mexico): Focus on high-quality steel strapping tools for heavy industry and advanced ergonomic designs; stable growth driven by strict logistics standards.

- Europe (Germany, UK, France, Italy): High adoption of PP/PET tools in manufacturing, emphasis on regulatory compliance (e.g., DIN standards) and sustainable strapping materials.

- Asia Pacific (China, India, Japan, South Korea): Highest volume demand fueled by manufacturing and logistics growth; strong preference for cost-effective manual tensioners and sealers.

- Latin America (Brazil, Argentina): Growing infrastructure and warehousing sectors; increasing adoption of plastic strapping tools for commodity exports.

- Middle East and Africa (UAE, Saudi Arabia, South Africa): Demand concentrated in construction, oil & gas, and mining sectors, valuing tool durability and reliability in harsh conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manual Strapping Tool Market.- Signode Industrial Group

- ITW Strapping (Illinois Tool Works)

- Fromm Holding AG

- MOSCA GmbH

- M.J. Maillis Group

- Samuel Strapping Systems

- Polychem Corporation

- Cyklop International

- PowerPak Packaging

- Lantech

- BÖLLHOFF Group

- SIAT S.p.A.

- Titan Strapping Systems

- Orgapack

- Messersi Packaging

- Strapack, Inc.

- Ascentron

- Strapex

- PNEUMATIC STRAPPING TOOL

- PACKWAY

Frequently Asked Questions

Analyze common user questions about the Manual Strapping Tool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for manual strapping tools over automated systems?

The primary factor driving sustained demand for manual strapping tools is their inherent cost-effectiveness, portability, and independence from external power sources, making them ideal for low-volume applications, decentralized packaging operations, and use in remote field environments where automated systems are neither feasible nor economical.

How do I choose the correct manual strapping tool for my application?

Selecting the correct tool depends mainly on the strapping material (steel or plastic) and the required tension level. Heavy loads, such as metals and construction materials, require steel strapping tools (tensioners and heavy-duty sealers), while general packaging and palletizing utilize plastic strapping tools (PP or PET), often preferring combination tools for efficiency.

What are the key ergonomic considerations for modern manual strapping tools?

Modern manual strapping tools prioritize minimizing operator strain. Key ergonomic features include reduced tool weight through the use of lightweight alloys, optimized leverage ratios to reduce the force required for tensioning, and improved grip designs to enhance comfort and reduce the risk of repetitive strain injuries (RSI) during prolonged use.

Is the manual strapping tool market being phased out by battery-powered tools?

While battery-powered friction weld tools are growing rapidly, they are not phasing out the manual market entirely. Manual tools maintain a niche for emergency repairs, environments where battery charging is difficult, or applications requiring specific mechanical sealing (especially steel strapping), ensuring continued relevance as a reliable, zero-power alternative.

Which geographic region shows the highest growth potential for manual strapping tool adoption?

Asia Pacific (APAC), particularly driven by expansive growth in China, India, and Southeast Asia, exhibits the highest growth potential. This is attributed to massive industrial and infrastructural development, coupled with high reliance on cost-effective manual labor solutions in the rapidly scaling logistics and manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager