Manual Tile Cutter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433347 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Manual Tile Cutter Market Size

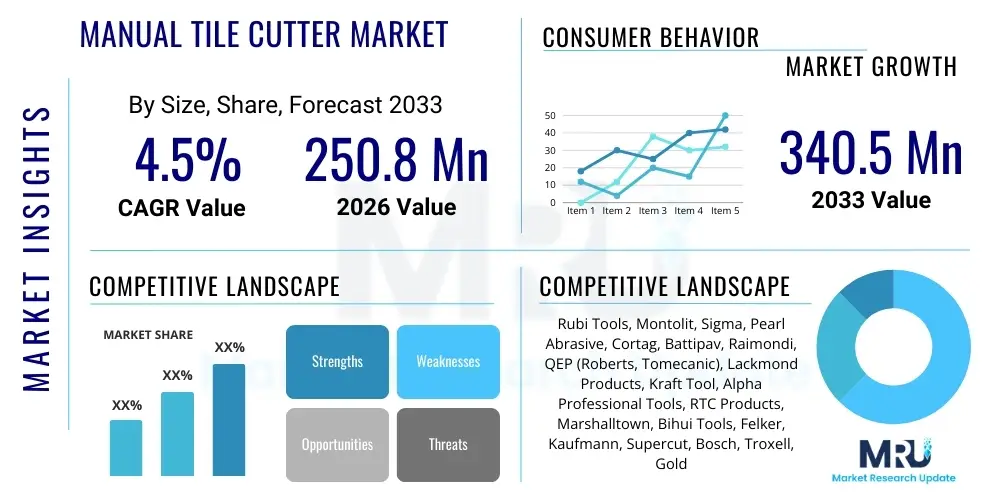

The Manual Tile Cutter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $250.8 million in 2026 and is projected to reach $340.5 million by the end of the forecast period in 2033.

Manual Tile Cutter Market introduction

The Manual Tile Cutter Market encompasses tools designed for scoring and snapping ceramic, porcelain, and stone tiles without the need for electricity. These essential tools are characterized by a scoring wheel, a rail system, and a breaking mechanism, providing precision and clean cuts necessary for professional and residential tiling projects. The fundamental principle revolves around creating a shallow score line and then applying controlled pressure to snap the tile along this line. This low-tech yet highly effective solution is favored in environments where noise reduction, dust minimization, and portability are critical operational requirements. The market serves a diverse clientele, ranging from large-scale commercial contractors needing supplementary tools for minor adjustments to individual homeowners engaged in Do-It-Yourself (DIY) renovations.

Major applications for manual tile cutters span residential building construction, commercial infrastructure development such as shopping centers and hospitals, and specialized repair and remodeling (R&M) activities. The primary benefit derived from these tools is the exceptional speed and efficiency for straight-line cuts compared to wet saws, especially for smaller format tiles or when setting up electric equipment is cumbersome. Furthermore, manual cutters are significantly cheaper to purchase and maintain, positioning them as an indispensable tool for cost-sensitive projects and small-to-medium enterprises (SMEs) specializing in tiling work. Their simple operation minimizes the required training, further broadening their appeal.

Key driving factors accelerating market expansion include the sustained global growth in the housing sector, particularly in emerging economies undergoing rapid urbanization. The increasing popularity of ceramic and porcelain tiles as durable and aesthetically pleasing flooring and wall materials directly boosts demand for associated cutting tools. Additionally, the flourishing DIY culture, supported by readily available tutorial content and the desire for home improvement, has expanded the non-professional consumer base. Manufacturers are continually innovating, focusing on improved ergonomics, enhanced rail durability, and specialized cutting wheels designed for harder porcelain tiles, thereby maintaining the competitive edge of manual cutters against automated alternatives.

Manual Tile Cutter Market Executive Summary

The Manual Tile Cutter Market is currently defined by robust competition, driven by technological enhancements focused on improving precision, reducing operator fatigue, and handling increasingly hard porcelain tiles. Key business trends indicate a strategic shift towards lightweight, highly portable models featuring specialized titanium-coated scoring wheels and advanced synchronized breaking systems to ensure clean, consistent snap lines. Manufacturers are increasingly prioritizing supply chain resilience and expanding direct-to-consumer (D2C) channels alongside traditional big-box retailers and specialized construction distributors. The competitive landscape sees established European and North American brands maintaining premium positioning based on durability and brand loyalty, while Asian manufacturers leverage cost-efficiency and rapidly deployable product updates to gain market share, particularly in high-volume DIY segments.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure investment, high rates of new residential construction, and burgeoning middle-class spending on home aesthetics. While North America and Europe remain mature markets characterized by replacement demand and a strong professional contractor base, growth here is steady, focusing on high-end, large-format cutters capable of handling premium tiles up to 1200mm or more. Latin America and the Middle East & Africa (MEA) represent high-potential emerging markets, where rapid urbanization and low initial adoption rates suggest significant future expansion, provided localized distribution challenges related to logistics and retail penetration are effectively managed by global vendors.

Segment trends highlight the enduring dominance of the Professional application segment in terms of revenue, primarily due to the high frequency of use and the preference for durable, high-precision, and larger-capacity models. However, the DIY segment exhibits the highest growth velocity, driven by accessible pricing and simplified tool designs catering to occasional users. Regarding product types, the demand is subtly shifting towards push-style cutters, which often offer better visibility and greater mechanical advantage for breaking modern, dense materials compared to traditional pull-style models. The distribution channel analysis shows a clear trend: although physical retail still accounts for the majority of sales, e-commerce platforms are critical for market penetration, allowing manufacturers to effectively market specialized accessories and innovative, smaller-capacity cutters directly to the DIY community.

AI Impact Analysis on Manual Tile Cutter Market

Common user questions regarding AI's influence on the Manual Tile Cutter Market often revolve around obsolescence, asking: "Will advanced robotic tiling replace manual cutting entirely?" or "Can AI optimize the manual cutting process?" and "How will material waste be minimized using smart technologies?". The primary concerns center on the perceived threat of automation—the belief that AI-driven robotic arms or fully automated production lines might completely negate the need for human intervention and simple hand tools. However, the prevailing expert analysis suggests a relationship of augmentation rather than replacement. Users expect AI to primarily contribute to upstream optimization, such as predictive maintenance of manufacturing machinery, enhanced quality control for scoring wheels via machine vision, or optimizing the layout patterns for tile installation software, which subsequently dictates the required cuts. Ultimately, AI's role is currently limited in the manual use phase itself but significantly impacts the ecosystem supporting the tool's quality and the efficiency of the overall tiling project.

The practical application of AI in this specific domain is indirect. While the physical act of manually scoring and snapping a tile remains a skill-based mechanical process, AI algorithms are becoming instrumental in streamlining the supply chain and R&D phases. For instance, predictive analytics based on field usage data (collected through smart inventory or contractor apps, though not the cutter itself) helps manufacturers forecast demand for specific cutter sizes and component materials, preventing stockouts of critical parts like titanium carbide scoring wheels. Furthermore, generative design processes, powered by AI, are being explored to optimize the structural integrity and ergonomic profile of manual cutter frames, reducing weight while maximizing rigidity for handling larger, heavier tiles, translating into better user experience and longevity.

In the near future, the most tangible impact of 'smart' technology might involve integration with accessories or complementary tools. Imagine a measurement device equipped with computer vision that uses AI to analyze complex cuts, automatically calculates offsets and angles, and displays the exact scoring line needed, transferring this precision back to the human operator using a laser guide attached to the manual cutter sled. This fusion maintains the portability and simplicity of the manual tool while introducing precision capabilities traditionally reserved for digital systems. The market is thus witnessing a subtle incorporation of AI-enabled peripheral technologies aimed at minimizing human error and maximizing material yield during the preparation phase of manual cutting.

- AI enhances upstream manufacturing quality control for scoring wheel durability.

- Predictive analytics optimize inventory and supply chain management for cutter components.

- AI-driven generative design aids in creating lighter, more robust cutter frame ergonomics.

- Machine learning algorithms inform future tool design based on accumulated field performance data.

- Peripheral smart measuring tools utilize AI vision to guide precise manual cut calculations, reducing waste.

DRO & Impact Forces Of Manual Tile Cutter Market

The dynamics of the Manual Tile Cutter Market are governed by a complex interplay of drivers, restraints, and opportunities, culminating in defining impact forces. Key drivers include the accelerated pace of global residential and commercial construction, particularly in developing nations, coupled with the inherent advantages of manual tools—namely, zero dust generation, low noise footprint, and superior portability compared to bulky wet saws. The sustained shift towards larger, high-density porcelain tiles demands continuous innovation in manual cutter technology, forcing manufacturers to produce more robust rail systems and specialized cutting blades, which sustains value generation. Simultaneously, the burgeoning popularity of DIY home renovation projects, driven by online educational resources and economic pressures, expands the consumer base significantly, ensuring consistent demand for entry-level and mid-range products.

However, significant restraints temper the market's growth potential. The most considerable constraint is the direct, often fierce, competition posed by electric wet saws and radial tile cutters, which offer faster processing speeds and superior capability for intricate cuts (e.g., curves, notches) and extremely hard materials like thick natural stone. Additionally, manual cutters are inherently limited in handling complex shapes and extremely large, thick format tiles, where the risk of improper snapping and tile breakage increases substantially, leading to material waste—a critical consideration for professional contractors. Furthermore, the market faces commoditization pressure in lower-end segments, where numerous regional players compete solely on price, impacting the profit margins of global brands that invest heavily in research and material quality.

Opportunities for expansion lie primarily in emerging geographical markets where electrification rates are low or initial capital expenditure budgets prohibit the widespread adoption of expensive electric tools. Product diversification focused on niche applications, such as cutters optimized specifically for glass tiles or extra-thin porcelain panels (often requiring different scoring pressures and wheel geometries), presents viable growth avenues. The ultimate impact forces driving market evolution are rooted in material science and ergonomic engineering. Continuous improvements in the composition of scoring wheels (e.g., Tungsten Carbide vs. Titanium Nitride coatings) determine the cutting lifespan and precision, while ergonomic enhancements directly influence professional productivity and reduce strain, making manual cutting a more sustainable choice for high-volume jobs, thereby securing its market relevance against automated alternatives.

Segmentation Analysis

The Manual Tile Cutter Market is strategically segmented based on product type, application, tile size capacity, and distribution channel, providing a granular view of consumer preferences and market dynamics. Understanding these segments is crucial for manufacturers in tailoring their product lines, marketing strategies, and channel partnerships to maximize penetration across professional and consumer demographics. The inherent technical differences between push-style and pull-style cutters fundamentally affect their suitability for different tile materials and professional preferences, forming a core technical segmentation axis. Furthermore, capacity segmentation (e.g., small, medium, and large format cutters) directly correlates with urbanization trends and the rising popularity of large-format architectural tiles.

The application segment distinguishes between professional contractors and the DIY/home user segment, reflecting vastly different requirements in terms of durability, cutting accuracy, and investment capability. Professional users prioritize industrial-grade durability, precision rail systems (often chrome-plated steel or aluminum extrusion), and synchronized breaking systems for large-scale, repetitive tasks, demanding premium-priced tools. Conversely, DIY consumers focus on ease of use, compact storage, and affordability, often opting for simpler, smaller-capacity cutters suitable for standard 300mm or 400mm tiles typical in residential bathrooms or kitchens. This bifurcated demand requires manufacturers to maintain two distinct product portfolios and marketing approaches.

Distribution channel analysis reveals the importance of specialized trade outlets and established industrial supply stores for reaching professional contractors, who rely on expert advice and immediate availability. However, the rapidly expanding e-commerce channel, including both major global retailers (like Amazon or specialized trade sites) and manufacturer D2C platforms, dominates sales to the DIY segment, offering competitive pricing and extensive product comparison options. Geographical segmentation is also vital, showing significant variation in preferred tile format sizes (e.g., large format in high-end European construction vs. smaller standard sizes in parts of APAC), which directly dictates the regional demand for specific cutter capacities and functionality.

- By Product Type:

- Push-style Cutters

- Pull-style Cutters

- By Capacity (Maximum Tile Length):

- Small Capacity (Under 500mm)

- Medium Capacity (500mm – 900mm)

- Large Capacity (Over 900mm)

- By Application:

- Professional Contractors (Commercial and Residential Tiling)

- Do-It-Yourself (DIY) Users

- By Distribution Channel:

- Offline Retail (Specialized Stores, Hardware Stores, Big-Box Retailers)

- Online Retail (E-commerce Platforms, Manufacturer Websites)

Value Chain Analysis For Manual Tile Cutter Market

The value chain for the Manual Tile Cutter Market begins with upstream activities focused on raw material sourcing and component manufacturing. Key raw materials include high-grade aluminum and steel for the frame and guide rails, ensuring structural rigidity and minimizing flex, which is crucial for precision cutting, especially for long tiles. Specialized materials like tungsten carbide, often coated with titanium or other ceramics, are procured for the scoring wheels, which dictate the tool’s performance and lifespan. Suppliers in this phase are subject to volatility in global metal commodity prices. Efficient procurement and quality control of these high-wear components are critical for manufacturers to maintain competitive pricing and product quality differentiation, particularly in the professional-grade segment where durability is non-negotiable.

The midstream stage involves the design, precision machining, assembly, and quality assurance processes carried out by the manufacturers. Modern manufacturing involves advanced techniques to ensure the linearity and flatness of the rail systems, often relying on computer numerical control (CNC) machining to achieve the necessary tolerances. Design innovation is central here, focusing on ergonomic handles, improved breaking pads, and integrated measuring scales. Following production, the logistics of storing and shipping these often bulky, long tools constitute a significant cost factor. Effective packaging is essential to prevent damage to the delicate scoring mechanism and rail alignment during transit, particularly across long intercontinental supply routes common among global market leaders.

The downstream segment encompasses distribution channels, marketing, and the ultimate sale to the end-users. Distribution is bifurcated into direct and indirect channels. Indirect distribution, leveraging specialized construction equipment wholesalers, regional distributors, and large multinational hardware chains (big-box retailers), remains the dominant method for achieving broad market reach, especially for DIY and mid-range products. Direct channels (online sales and direct agreements with major commercial construction firms) are utilized primarily by premium brands to control pricing, ensure brand message consistency, and service professional buyers with specific, customized needs. The effectiveness of the downstream value chain is highly dependent on localized inventory management and strong relationships with professional trade associations and contractor networks, which provide invaluable feedback for future product development.

Manual Tile Cutter Market Potential Customers

Potential customers for manual tile cutters are broadly categorized into three distinct groups: professional tiling contractors, residential DIY enthusiasts, and specialized commercial entities. Professional contractors represent the highest revenue-generating segment, requiring high-volume, heavy-duty cutters with maximum cutting capacity (upwards of 1200mm) and superior material quality for daily, repetitive use on commercial and high-end residential projects. These buyers prioritize minimal maintenance, high-precision adjustability, and proven longevity, often relying on brand reputation and specialized warranties. Their purchasing decisions are highly influenced by trade distributor recommendations and comparative testing data regarding tile breakage rates and efficiency gains on large job sites. Manufacturers must focus on durability and specialized features, such as laser guides and swivel measuring capabilities, to capture this lucrative segment.

The second major customer group is the residential Do-It-Yourself (DIY) market, which encompasses homeowners and amateur renovators undertaking smaller projects such as kitchen backsplashes, bathroom floors, or small-scale patio installations. This segment prioritizes affordability, ease of setup, and simplicity of operation. They typically require smaller to medium-capacity cutters and are less concerned with industrial-grade material strength. Purchasing decisions in this segment are heavily influenced by online reviews, promotional pricing, and accessibility through mass-market retail channels like Home Depot, Lowe’s, or equivalent regional chains. Content marketing, including instructional videos and simplified manuals, is essential for successfully engaging and converting DIY customers.

The third group includes rental equipment companies and vocational training centers. Rental companies purchase commercial-grade cutters to lease out to small contractors or DIY users who do not wish to incur the full purchase cost of specialized equipment. These buyers require robust, tamper-resistant models that can withstand multiple users and rough handling. Similarly, vocational and technical schools invest in durable manual cutters to train the next generation of tile setters. While these segments represent lower unit volume compared to professionals or DIY, they are crucial for brand exposure and setting industry standards. Manufacturers targeting this niche must emphasize repairability, readily available replacement parts (especially scoring wheels), and robust, standardized designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.8 Million |

| Market Forecast in 2033 | $340.5 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rubi Tools, Montolit, Sigma, Pearl Abrasive, Cortag, Battipav, Raimondi, QEP (Roberts, Tomecanic), Lackmond Products, Kraft Tool, Alpha Professional Tools, RTC Products, Marshalltown, Bihui Tools, Felker, Kaufmann, Supercut, Bosch, Troxell, Goldblatt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manual Tile Cutter Market Key Technology Landscape

The technological landscape of the Manual Tile Cutter Market, while fundamentally mechanical, is constantly evolving, focusing on material science, mechanical precision, and ergonomic design to enhance cutting performance, particularly on modern, high-density porcelain and large-format tiles. The most crucial area of innovation lies in the scoring wheel technology. Manufacturers are moving beyond standard tungsten carbide wheels, introducing wheels coated with specialized materials such as Titanium Nitride (TiN) or even utilizing high-grade industrial diamond composites. These advanced materials significantly increase the lifespan of the wheel, maintain a sharper edge for longer periods, and reduce the friction required to score dense materials, resulting in cleaner, more reliable breaks. The development of interchangeable wheel systems allows professionals to quickly adapt their cutters to different tile types, such as switching to specialized wheels for abrasive quarry tiles or delicate glass tiles, maximizing the tool's versatility.

Another significant technological advancement centers on the guide rail and carriage system, which directly determines the cutter's precision and capacity. High-end professional models feature sophisticated, multi-bearing systems, often incorporating linear ball bearings or high-quality self-lubricating polymer slides to ensure extremely smooth, frictionless movement of the scoring carriage. This smoothness is vital for maintaining consistent scoring pressure over long lengths (up to 1500mm or more) and preventing micro-vibrations that can lead to an inconsistent score line and eventual tile breakage outside the intended snap. Extruded aluminum or robust, hardened steel rails minimize flex under load, which is especially critical when dealing with heavy, large-format tiles that require substantial force for snapping.

Furthermore, technology is applied to the snapping mechanism itself. Modern manual cutters incorporate synchronized or differential breaking systems that apply pressure equally on both sides of the score line, distributing the force optimally to minimize stress points and achieve a clean, straight break, even on challenging materials. Ergonomics has also become a critical area of technological focus, with manufacturers designing articulated handles, shock-absorbing grip materials, and adjustable height settings to reduce muscle strain and fatigue associated with high-volume cutting. Integrated features like swiveling measurement heads, which allow rapid switching between 90-degree and 45-degree (diagonal) cuts without re-calibration, exemplify how simple mechanical engineering refinements continue to drive professional efficiency in the manual tile cutter sector.

Regional Highlights

Geographic analysis of the Manual Tile Cutter Market reveals distinct consumption patterns and growth trajectories across major global regions, influenced primarily by construction activity, labor practices, and technological adoption rates. North America and Europe, representing mature markets, exhibit stable demand driven largely by replacement cycles and stringent quality requirements in professional construction. In these regions, the focus is heavily skewed toward high-end, large-capacity cutters (over 900mm) capable of handling the premium, oversized porcelain tiles favored in modern architectural design. Brand loyalty, durability, and ergonomic features command premium pricing, ensuring European companies, in particular, maintain a strong market presence through innovation and quality assurance.

Asia Pacific (APAC) stands out as the unequivocal epicenter of market growth, buoyed by the rapid urbanization, massive infrastructure projects (particularly in China, India, and Southeast Asian nations), and continuous development of the residential housing sector. The sheer volume of new construction translates directly into high unit sales for manual cutters, spanning from entry-level DIY models to sophisticated professional tools. While price sensitivity is generally higher in APAC compared to Western markets, there is increasing demand for mid-range and quality professional tools as the labor force professionalizes and tile sizes gradually increase, offering substantial long-term expansion opportunities for manufacturers willing to establish localized supply and distribution networks.

Latin America and the Middle East & Africa (MEA) are designated as high-potential emerging markets. In Latin America, residential building continues to expand, maintaining steady demand for affordable, functional manual cutters. The MEA region, particularly the GCC countries, is witnessing substantial investment in commercial and tourism infrastructure, necessitating professional-grade tools for luxury tiling applications. However, both regions often face challenges related to logistical complexity, fragmented distribution channels, and varying levels of regulatory standards. Successful market penetration here requires strategic partnerships with local distributors and offering robust customer service and technical support to navigate diverse operational environments.

- North America: Focus on high-precision, large-format cutters; strong demand from professional contractors and robust DIY market.

- Europe: Dominant position of key manufacturers; emphasis on innovative scoring wheel technology and premium ergonomics for adherence to high labor standards.

- Asia Pacific (APAC): Fastest growth region driven by urbanization and massive construction volume; dual demand for cost-effective DIY tools and professional equipment.

- Latin America (LATAM): Stable demand for essential tiling tools; market characterized by affordability constraints and rising middle-class consumerism.

- Middle East & Africa (MEA): High demand linked to large-scale commercial and hospitality projects; preference for durable, heavy-duty tools suitable for challenging job site conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manual Tile Cutter Market.- Rubi Tools

- Montolit

- Sigma

- Pearl Abrasive

- Cortag

- Battipav

- Raimondi

- QEP Co., Inc. (Roberts, Tomecanic)

- Lackmond Products

- Kraft Tool Co.

- Alpha Professional Tools

- RTC Products

- Marshalltown Company

- Bihui Tools

- Felker (Part of Forney Industries)

- Kaufmann

- Supercut

- Bosch Power Tools (via specialized hand tools division)

- Troxell USA

- Goldblatt Tool Co.

Frequently Asked Questions

Analyze common user questions about the Manual Tile Cutter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key advantage of a manual tile cutter over a wet saw?

The primary advantage of a manual tile cutter is its operational simplicity, portability, and zero dust and noise production, making it ideal for interior residential projects where minimizing mess and disruption is critical. It is also significantly faster for making straight, non-complex cuts.

How should professionals select the correct scoring wheel material?

Professionals should select scoring wheels based on tile hardness. Tungsten carbide wheels are standard, but harder, dense materials like porcelain require high-grade Titanium Nitride or titanium-coated carbide wheels (typically 18mm or 22mm) for optimal lifespan and clean scoring.

Are manual tile cutters effective for cutting large format porcelain tiles?

Yes, modern manual cutters are highly effective for large format porcelain tiles, provided the cutter has a robust rail system, a cutting capacity exceeding 900mm, and incorporates a synchronized breaking system to distribute pressure evenly and prevent irregular snapping or breakage.

Which regional market shows the highest growth rate for manual tile cutters?

The Asia Pacific (APAC) region currently exhibits the highest growth rate, primarily driven by expansive new construction projects, rapid urbanization, and increasing investment in residential and commercial infrastructure across nations like China and India.

What technological advancements are driving precision in manual cutting?

Key technological advancements include advanced scoring wheel coatings (e.g., Titanium Nitride), high-precision linear bearing guide systems that ensure smooth carriage movement, and ergonomic designs that reduce operator fatigue and improve the consistency of the score line.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager