Manufacturing After Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431514 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Manufacturing After Market Size

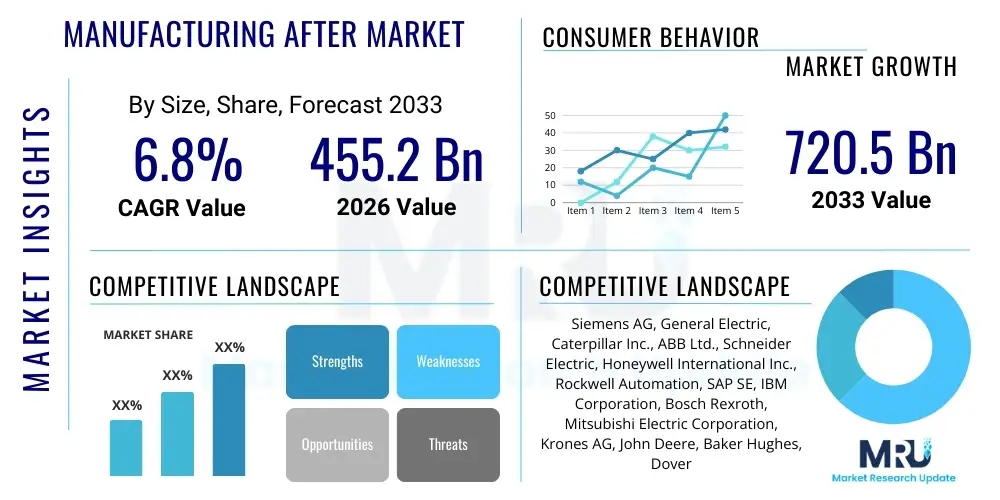

The Manufacturing After Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 455.2 Billion in 2026 and is projected to reach USD 720.5 Billion by the end of the forecast period in 2033.

Manufacturing After Market introduction

The Manufacturing After Market (MAM) encompasses all services, parts, and maintenance activities required to keep manufactured assets operational, productive, and efficient after their initial sale. This vital sector includes Maintenance, Repair, and Overhaul (MRO) services, the supply of replacement components and spare parts, field service management, retrofitting, modernization packages, and advanced digital services such as predictive maintenance and remote monitoring. The market scope covers various heavy industries, including automotive, aerospace, industrial machinery, power generation, and specialized equipment manufacturing. The increasing complexity of modern machinery, driven by integration of IoT and automation, necessitates specialized after-sales support to maximize equipment lifespan and uptime, cementing the MAM's role as a critical revenue and stability driver for original equipment manufacturers (OEMs) and third-party service providers alike.

Product descriptions within the MAM are highly varied, ranging from high-precision, proprietary replacement parts essential for regulatory compliance and performance integrity, to comprehensive service contracts that guarantee operational availability. Major applications include routine preventative maintenance programs designed to minimize unexpected failures, advanced diagnostics utilizing sensor data for condition-based monitoring, and crucial emergency repair services that mitigate prolonged production downtimes. Furthermore, the market is characterized by a significant shift towards "Servitization," where manufacturers transition from mere product sales to offering integrated solutions, bundling machinery with long-term maintenance agreements and performance guarantees, thereby creating reliable, recurring revenue streams.

Key benefits of a robust Manufacturing After Market include enhanced customer loyalty, optimized operational efficiency for end-users, and significant revenue stability for providers, often yielding higher profit margins than initial equipment sales. Driving factors fueling this growth include the global trend of industrial automation, the imperative for sustainable operations requiring equipment lifetime extension, the rapid deployment of Industrial Internet of Things (IIoT) sensors necessitating data-driven service models, and stringent regulatory environments demanding certified parts and maintenance practices. These factors collectively push manufacturers to invest heavily in digital aftermarket infrastructure and skilled service personnel to meet evolving customer expectations for seamless, high-availability operations.

Manufacturing After Market Executive Summary

The Manufacturing After Market is currently undergoing a structural transformation characterized by robust integration of digital technologies and a profound shift toward service-centric business models. Business trends indicate a strong move away from reactive repair services towards proactive, outcome-based contracts facilitated by real-time data analytics and machine learning, significantly enhancing asset predictability and reducing total cost of ownership for customers. OEMs are leveraging digital twins and remote diagnostics capabilities to bypass traditional physical constraints, offering global support from centralized expert hubs. This strategic realignment is increasing competition from specialized third-party MRO providers who are also rapidly adopting advanced digital toolsets to gain market share, emphasizing cost-efficiency and flexible service delivery.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, driven by massive investments in infrastructure development, rapid industrialization, and the increasing installation base of complex machinery, particularly in China and India. North America and Europe maintain dominance in terms of technological adoption and market maturity, setting global standards for predictive maintenance and subscription-based service models. However, these established regions face challenges related to talent shortages in specialized technical fields, prompting substantial investments in augmented reality tools and remote guidance systems to optimize existing workforce productivity and knowledge transfer across generations of equipment.

Segment trends reveal that the Service Type segment, specifically Predictive Maintenance, is witnessing exponential growth due to its demonstrated ability to optimize uptime and inventory management. Simultaneously, the Components segment remains foundational, driven by the recurring need for specialized spare and replacement parts, though sourcing strategies are evolving toward enhanced supply chain resilience and localized production. The focus across all segments is on sustainability and circular economy principles, leading to increased demand for certified refurbished components and modernization packages that extend the useful life of existing capital equipment, aligning market activity with global environmental and operational efficiency goals.

AI Impact Analysis on Manufacturing After Market

User inquiries regarding Artificial Intelligence (AI) in the Manufacturing After Market predominantly center on how AI will fundamentally change maintenance practices, service delivery, and supply chain logistics. Key concerns revolve around the displacement of human technicians versus the need for new specialized roles, the reliability and security of AI-driven predictive models, and the necessary investment in data infrastructure required for effective deployment. Users consistently seek clarity on AI's ability to transition the industry from scheduled or reactive maintenance to genuine condition-based and prescriptive maintenance, maximizing asset lifetime and availability. Furthermore, there is significant interest in how AI can optimize spare parts inventory management, forecasting demand with higher accuracy, and streamlining complex repair procedures through intelligent decision support systems and remote diagnostics.

The integration of AI algorithms, particularly machine learning (ML), is revolutionizing the entire service lifecycle, moving the industry far beyond simple data logging. AI models process massive streams of sensor data from industrial assets—vibration analysis, thermal signatures, power consumption—to identify subtle anomalies that precede equipment failure. This capability allows service teams to schedule interventions precisely when needed, minimizing disruption and maximizing the lifespan of critical components. Consequently, AI acts as a crucial enabler for outcome-based contracts, where service providers guarantee a certain level of machine uptime or production output, fundamentally shifting financial risk and incentivizing optimization.

Moreover, AI is dramatically improving the efficiency of field service operations. Generative AI and natural language processing (NLP) are used to sift through vast technical documentation and service history databases, providing field technicians with immediate, highly contextualized repair guidance via mobile or augmented reality devices. This not only speeds up the mean time to repair (MTTR) but also reduces reliance on the highest-tier expert technicians for routine issues, democratizing specialized knowledge across the service workforce. In inventory management, AI algorithms optimize global distribution networks by predicting failure probabilities across geographically diverse machine fleets, ensuring critical spares are positioned optimally, reducing warehousing costs, and eliminating costly delivery delays.

- Enhanced Predictive Maintenance: AI models forecast equipment failure with greater accuracy using multi-source sensor data.

- Optimized Inventory Management: Machine learning improves spare parts demand forecasting, reducing stockouts and excess inventory costs.

- Automated Diagnostics: AI-driven systems diagnose complex machine faults instantly, accelerating resolution times.

- Generative AI for Service Guidance: Provides real-time, context-aware instructions to field technicians via AR/VR interfaces.

- Pricing and Contract Optimization: AI analyzes usage patterns to create dynamic, optimized pricing for service level agreements (SLAs).

- Remote Monitoring Efficiency: Reduces the need for physical inspections through sophisticated remote anomaly detection and reporting.

- Quality Control and Warranty Analysis: AI identifies manufacturing or component weaknesses post-sale, informing future product design and reducing warranty claims.

DRO & Impact Forces Of Manufacturing After Market

The dynamics of the Manufacturing After Market are strongly influenced by a confluence of accelerating drivers, structural restraints, and emerging opportunities, all mediated by significant impact forces reshaping global industrial strategies. Key drivers include the massive global installed base of complex, interconnected industrial equipment that mandates continuous, sophisticated maintenance, coupled with the critical need for operational resilience against supply chain disruptions, pushing companies toward proactive service models. These drivers are tempered by significant restraints such as the persistent shortage of highly specialized technical talent capable of maintaining complex digital and mechanical systems, and the substantial initial investment required to deploy comprehensive IIoT infrastructure and cybersecurity measures across industrial assets, particularly for smaller and mid-sized enterprises. Opportunities are abundant in the expansion of servitization models, the penetration of new geographical markets undergoing industrialization, and the commercialization of proprietary advanced diagnostics and optimization software.

The primary driver is the accelerating pace of technological obsolescence combined with the customer demand for maximum asset uptime. As capital equipment becomes more expensive and mission-critical, end-users are increasingly demanding performance guarantees rather than just repair services. This shift fuels the adoption of subscription-based MRO contracts, offering OEMs stable, long-term revenue. Furthermore, global sustainability mandates strongly favor extending the lifespan of existing machinery through continuous upgrades and high-quality parts, minimizing the environmental footprint associated with manufacturing new equipment. This regulatory pressure reinforces the value proposition of the aftermarket, particularly focusing on certified refurbishment and modernization kits that improve energy efficiency and meet evolving emissions standards.

Major restraints include intellectual property (IP) protection challenges, where OEMs must balance the need to restrict unauthorized third-party repairs that compromise safety and performance against growing regulatory pressures that advocate for "right to repair" legislation, potentially fragmenting the genuine parts market. The impact forces acting on this market are primarily technological and economic. Digital transformation, driven by 5G, edge computing, and AI, is the most powerful impact force, fundamentally redefining service delivery from reactive to predictive. Economically, global inflationary pressures on raw materials and labor costs necessitate highly efficient service logistics and remote resolution capabilities to maintain profitable service margins, forcing companies to aggressively pursue digital optimization strategies.

Segmentation Analysis

The Manufacturing After Market is strategically segmented based on factors such as component type, service offered, end-use industry, and deployment model, allowing for precise market sizing and targeted strategic development. This granular analysis is crucial for understanding specific customer needs and allocating resources effectively, particularly as the market transitions toward highly customized, data-driven service packages. The core segments reflect the fundamental dichotomy between physical goods (parts and components) and intangible expertise (services and software), with increasing convergence between the two as digital platforms facilitate the delivery and management of both.

Understanding segmentation provides key insights into revenue drivers. For instance, while high-value replacement parts often constitute a major portion of immediate revenue, long-term service contracts (Preventive and Predictive Maintenance) offer greater financial predictability and recurring revenue stability, indicating the strategic importance of balancing both transactional and relational segments. Furthermore, geographical segmentation highlights disparities in digital readiness; developed economies lead in software-based segments (remote monitoring, advanced analytics), whereas developing regions still heavily rely on traditional component supply chains and core repair services, presenting distinct investment opportunities and localized supply chain requirements.

- By Component Type:

- Spare Parts (e.g., filters, bearings, seals, structural components)

- Consumables (e.g., lubricants, chemicals)

- Software & Analytics Tools (e.g., diagnostic platforms, asset management systems)

- Tools & Equipment (e.g., specialized diagnostic hardware)

- By Service Type:

- Maintenance & Repair (M&R)

- Overhaul & Refurbishment

- Predictive Maintenance (PdM)

- Field Service Management (FSM)

- Technical Consulting & Training

- By End-Use Industry:

- Automotive Manufacturing

- Aerospace & Defense

- Industrial Machinery & Equipment

- Power & Utilities

- Heavy Construction & Mining

- Electronics & Semiconductor Manufacturing

- By Deployment Model:

- On-Premise (for proprietary systems)

- Cloud-Based (for scalable data analysis and remote access)

Value Chain Analysis For Manufacturing After Market

The Value Chain for the Manufacturing After Market is a complex ecosystem starting with the upstream production of raw materials and specialized components, extending through manufacturing, assembly, distribution, and culminating in the critical downstream service delivery to the end-user. Upstream analysis focuses on the sourcing and production of genuine and certified replacement parts. OEMs often rely on highly specialized tier-one suppliers for critical components, necessitating strict quality control, rigorous certification processes, and robust inventory management systems to ensure part availability and authenticity, particularly for safety-critical applications like aerospace or medical devices. Challenges in this stage involve managing supply chain volatility, maintaining material provenance, and optimizing global logistics networks to reduce lead times for urgent repairs.

The midstream of the value chain is dominated by logistics, warehousing, and the initial integration of digital service platforms. Distribution channels are highly varied, including direct sales from OEMs, authorized dealership networks, independent distributors, and, increasingly, sophisticated e-commerce portals for spare parts. The shift towards direct-to-customer service models allows OEMs to capture greater value and control the customer relationship, while also integrating diagnostic data directly back into the design and engineering phases—a critical feedback loop. The increasing digitization facilitates inventory centralization and cross-regional fulfillment optimization, reducing logistical waste and improving response times significantly, particularly for high-volume, standard consumables.

Downstream analysis centers on service delivery and customer interaction, which represents the highest value-addition stage in the modern aftermarket. Direct service delivery involves OEM-employed field service technicians utilizing advanced tools and digital assistance (AR/VR, mobile FSM software) for complex repairs and installations. Indirect channels involve authorized third-party service providers or franchised MRO facilities that handle maintenance under strict contractual obligations, broadening geographical reach without massive capital expenditure. The long-term success of the downstream segment relies heavily on maintaining a highly skilled workforce, investing in continuous training programs, and leveraging customer feedback systems to constantly refine service offerings and improve overall customer satisfaction and retention metrics.

Manufacturing After Market Potential Customers

The potential customers and end-users of the Manufacturing After Market are diverse, spanning virtually every industrial sector that relies on capital equipment for production and operation. These customers are broadly classified into high-volume industrial entities, specialized infrastructure operators, and smaller maintenance-intensive businesses. High-volume buyers typically include large multinational manufacturing corporations (e.g., automotive assembly plants, chemical processing facilities) that require comprehensive, long-term service level agreements (SLAs) focusing heavily on predictive maintenance and guaranteed uptime to sustain high production rates and minimize the financial impact of line stoppages. These buyers prioritize operational efficiency and sophisticated data integration.

Specialized infrastructure operators, such as power generation facilities, airlines, and heavy mining companies, represent another critical customer segment. For these entities, safety, regulatory compliance, and extreme reliability are paramount. They often require specialized, highly certified components and complex overhaul services (e.g., engine MRO in aerospace) that only OEMs or authorized high-tier providers can deliver. Their procurement processes are often lengthy, demanding rigorous documentation and clear evidence of component authenticity and service quality, making long-term strategic partnerships essential for suppliers operating in this segment.

The third group includes smaller to mid-sized enterprises (SMEs) that utilize industrial equipment but may lack the internal capacity for advanced maintenance or large-scale parts stocking. These customers frequently rely on independent third-party service organizations or local distributors who offer flexible, cost-effective repair options and readily available non-proprietary parts. As digitalization progresses, SMEs are increasingly seeking accessible, cloud-based monitoring solutions that minimize capital outlay while providing basic predictive capabilities, signifying a growing demand for subscription-based, modular service packages tailored to constrained operational budgets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 455.2 Billion |

| Market Forecast in 2033 | USD 720.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, General Electric, Caterpillar Inc., ABB Ltd., Schneider Electric, Honeywell International Inc., Rockwell Automation, SAP SE, IBM Corporation, Bosch Rexroth, Mitsubishi Electric Corporation, Krones AG, John Deere, Baker Hughes, Dover Corporation, Fanuc Corporation, KUKA AG, Komatsu Ltd., Sandvik AB, Thermo Fisher Scientific |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Manufacturing After Market Key Technology Landscape

The technological landscape of the Manufacturing After Market is rapidly evolving, driven primarily by the maturation and industrial application of the Industrial Internet of Things (IIoT) and advanced analytical capabilities. The IIoT forms the foundational layer, comprising interconnected sensors and gateways attached to industrial assets that continuously stream operational data (temperature, pressure, vibration) to centralized cloud platforms. This infrastructure is essential for shifting from time-based scheduling to condition-based and predictive strategies. Furthermore, the increasing bandwidth capabilities provided by 5G networks and edge computing allow for real-time data processing closer to the machinery, which is crucial for applications requiring ultra-low latency, such as instantaneous anomaly detection and safety shutdowns in highly automated environments.

Augmented Reality (AR) and Virtual Reality (VR) technologies are proving transformative in service delivery, primarily through remote assistance and training applications. AR overlays digital instructions, schematics, and performance data onto a technician's real-world view, guiding them through complex repairs step-by-step, dramatically reducing errors and reliance on physical manuals. VR is heavily utilized for simulation-based training, allowing service personnel to practice complicated maintenance procedures on digital twins of expensive machinery without incurring downtime or risk. These immersive technologies effectively bridge the widening skills gap by accelerating the expertise transfer process and enabling senior engineers to remotely mentor junior field staff across global sites, improving first-time fix rates.

The implementation of Digital Twin technology represents a pinnacle of integration in the aftermarket. A Digital Twin is a precise, real-time virtual replica of a physical asset, system, or process. By continually feeding the twin with live performance data, service providers can accurately simulate the effects of maintenance actions, optimize operating parameters, and predict future component degradation under various stress scenarios before implementing changes on the physical machine. This capability moves the market from merely reactive prediction to prescriptive action, allowing companies to maximize asset utilization while minimizing service expenditure, fundamentally altering the economics of long-term equipment ownership and support contracts.

Regional Highlights

Geographical analysis is paramount in the Manufacturing After Market due to variations in industrial maturity, regulatory standards, and technology adoption rates across continents. North America, characterized by its mature manufacturing base and early adoption of advanced digital solutions, holds a significant market share. The focus here is on maximizing existing asset efficiency through sophisticated software-as-a-service (SaaS) models for predictive maintenance, cybersecurity resilience, and integrated supply chain management. High labor costs also drive rapid adoption of automation in field service, including drones for inspections and extensive use of AR/VR for remote guidance and collaboration. Strict environmental regulations further boost demand for modernization and retrofitting services aimed at improving energy efficiency.

Europe, driven by the robust German manufacturing sector (Industry 4.0 initiatives) and strong emphasis on sustainability and circular economy principles, also constitutes a major market. European manufacturers are leaders in servitization, utilizing advanced telematics and data analytics to offer highly customized performance-based contracts. The market is highly regulated, necessitating compliance-focused aftermarket services and genuine parts usage to maintain certification standards. The regional dynamic is heavily influenced by cross-border logistics complexity, pushing investment into highly efficient, digitized warehousing and distribution networks capable of rapid fulfillment across multiple countries.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid industrialization, massive infrastructure projects (particularly in construction and utilities), and the increasing establishment of multinational manufacturing hubs. While traditional reactive maintenance still dominates in many segments, there is escalating investment in digital transformation, especially in technologically advanced nations like Japan, South Korea, and China, which are rapidly deploying IIoT platforms to manage newly installed, digitally enabled machinery. The sheer volume of new machinery installed annually creates immense demand for spare parts and localized technical support, demanding scaling capabilities from global service providers.

Latin America and the Middle East & Africa (MEA) represent emerging opportunities. Growth in Latin America is tied to the expansion of the mining, petrochemical, and automotive industries, requiring specialized MRO services for heavy machinery. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is investing heavily in diversification away from oil, focusing on logistics, utilities, and high-tech manufacturing, creating demand for advanced industrial maintenance services. These regions often face unique logistical challenges and require robust, locally supported supply chains for parts, emphasizing the importance of strategic local partnerships for market entry and sustained growth.

- North America: Focus on AI-driven predictive maintenance, cybersecurity services, high adoption of AR/VR remote assistance, driven by high labor costs and regulatory compliance.

- Europe: Strong emphasis on Industry 4.0, circular economy principles, highly regulated MRO practices, leading adoption of servitization models, particularly in Germany and Scandinavian countries.

- Asia Pacific (APAC): Highest growth rate due to rapid industrialization, massive installed base expansion in China and India, increasing investment in localized IIoT infrastructure and scaling of traditional repair services.

- Latin America (LATAM): Growth driven by mining, oil and gas, and automotive sectors; increasing need for robust, resilient supply chains and specialized heavy equipment MRO.

- Middle East & Africa (MEA): Market growth linked to economic diversification programs (non-oil sectors), infrastructure development, requiring strategic local service partnerships and certified international standards compliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Manufacturing After Market.- Siemens AG

- General Electric

- Caterpillar Inc.

- ABB Ltd.

- Schneider Electric

- Honeywell International Inc.

- Rockwell Automation

- SAP SE

- IBM Corporation

- Bosch Rexroth

- Mitsubishi Electric Corporation

- Krones AG

- John Deere

- Baker Hughes

- Dover Corporation

- Fanuc Corporation

- KUKA AG

- Komatsu Ltd.

- Sandvik AB

- Thermo Fisher Scientific

- Danaher Corporation

- Eaton Corporation

Frequently Asked Questions

Analyze common user questions about the Manufacturing After market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Manufacturing After Market?

The primary factor is the increasing global installed base of complex, interconnected industrial machinery, coupled with the critical business need to maximize asset uptime and operational efficiency through advanced services like predictive maintenance and digital remote monitoring.

How is the concept of Servitization reshaping the aftermarket business model?

Servitization is shifting the focus from selling equipment and parts to selling integrated outcomes, such as guaranteed uptime or specific production levels, financed through long-term service contracts and subscription models. This provides stable, recurring revenue for OEMs.

Which geographical region is expected to exhibit the highest growth rate in the forecast period?

The Asia Pacific (APAC) region is forecasted to have the highest growth rate, driven by accelerated industrialization, massive government investments in infrastructure, and rapid expansion of manufacturing capacities across countries like China, India, and Southeast Asia.

What role does Artificial Intelligence play in optimizing spare parts logistics?

AI utilizes machine learning algorithms to analyze historical failure rates and real-time operational data, drastically improving the accuracy of spare parts demand forecasting, optimizing inventory stocking levels, and ensuring timely delivery to minimize equipment downtime.

What is the difference between Predictive Maintenance (PdM) and Traditional Preventive Maintenance (PM)?

Traditional PM relies on fixed time intervals or usage metrics, leading to unnecessary maintenance. PdM, enabled by IIoT and AI, monitors asset health in real-time and schedules maintenance precisely when degradation is detected, maximizing asset lifespan and minimizing maintenance costs.

What are the primary restraints affecting the expansion of the Manufacturing After Market?

Key restraints include the severe shortage of skilled technical professionals capable of servicing complex digital and mechanical systems, high initial capital investment required for comprehensive IIoT infrastructure deployment, and legal challenges related to intellectual property and "right to repair" legislation.

How do Digital Twins enhance aftermarket service capabilities?

Digital Twins provide a real-time virtual replica of physical assets, allowing service engineers to run predictive simulations, test maintenance strategies, and diagnose complex faults remotely and non-invasively, leading to highly optimized and prescriptive service interventions.

What key strategic advantage do OEMs maintain over independent service providers (ISPs) in the aftermarket?

OEMs maintain critical advantages through proprietary technical knowledge, exclusive access to certified genuine parts manufactured to original specifications, and direct integration of service data feedback into future product design, ensuring superior quality and performance guarantees.

In which end-use industry is the aftermarket demand for Overhaul & Refurbishment services particularly high?

The demand for Overhaul and Refurbishment services is exceptionally high in the Aerospace & Defense industry, where stringent safety regulations and high capital costs necessitate extensive, certified MRO procedures to extend the operational life of highly expensive components like jet engines and airframes.

How does the shift to cloud-based deployment models benefit aftermarket software?

Cloud-based deployment enables scalable data processing, centralized management of globally dispersed assets, rapid software updates, and secure, immediate access to diagnostic information and service history for field technicians, lowering upfront costs and improving operational flexibility for end-users.

What challenges do aftermarket providers face concerning cybersecurity?

Connecting industrial assets to the cloud for monitoring introduces significant cybersecurity risks, including potential vulnerability to ransomware or data breaches targeting operational technology (OT) networks. Providers must integrate robust encryption and access controls to secure sensitive industrial data and remote access points.

What is the significance of the circular economy in the Manufacturing After Market?

The circular economy promotes reducing waste and maximizing resource utilization. In the aftermarket, this translates to increased demand for certified refurbished components, remanufacturing programs, and modernization packages that extend the useful life of existing machinery, aligning with sustainability goals and providing cost-effective alternatives.

How is Augmented Reality (AR) used to improve field service management (FSM)?

AR is deployed via smart glasses or tablets to overlay step-by-step repair instructions, real-time diagnostic data, and component schematics onto the physical machine, enabling field technicians to complete complex repairs faster and with higher accuracy, particularly when requiring remote expert assistance.

What is the primary difference between a component segment and a service segment in the MAM?

The component segment deals with the tangible physical products (spare parts, consumables) necessary for repair and operation. The service segment deals with intangible expertise, labor, and knowledge-based solutions (maintenance contracts, diagnostics, consulting) delivered to the customer.

Why is supply chain resilience a critical factor for the Manufacturing After Market?

Resilience is critical because unexpected equipment failure requires immediate parts availability. Disruptions in the global supply chain can significantly delay repairs, resulting in costly downtime for end-users. Aftermarket providers must invest in localized stocking and dual-sourcing strategies to mitigate this risk.

What are the main segments covered under the Component Type segmentation?

The main segments covered under Component Type include Spare Parts (e.g., mechanical components, filters), Consumables (e.g., specialized oils, coolants), Software & Analytics Tools (embedded diagnostic applications), and Tools & Specialized Equipment (hardware necessary for repair).

Which service type is experiencing the fastest growth and technological advancement?

Predictive Maintenance (PdM) is experiencing the fastest growth and technological advancement, driven by the integration of AI, machine learning, and IIoT data streams, which allow for a highly granular and prescriptive approach to asset care.

How do stringent regulatory environments influence aftermarket activities?

Stringent regulatory environments, particularly in aerospace, medical, and power generation, mandate the use of only genuine or certified parts and require highly documented, compliant maintenance procedures, thereby increasing demand for OEM-level certification and service quality.

What challenges does the aftermarket face regarding talent development?

The industry faces a talent gap where traditional mechanical skills must be augmented with expertise in data science, coding, cloud architecture, and IIoT diagnostics. Training programs need significant restructuring to cultivate this hybrid skill set necessary for modern digital service delivery.

What is the role of edge computing in remote diagnostics for the aftermarket?

Edge computing allows critical data analysis and anomaly detection to occur directly on the asset or near it (at the "edge" of the network), reducing data latency and bandwidth requirements. This enables immediate responses to critical conditions without relying solely on cloud connectivity.

How is the automotive manufacturing segment impacting the aftermarket?

The automotive segment drives aftermarket complexity through the rise of electric vehicles (EVs) and autonomous systems, requiring new specialized MRO services, high-voltage battery maintenance, and constant software updates for vehicle electronic control units (ECUs).

What is meant by the "upstream analysis" in the MAM value chain?

Upstream analysis involves the initial stages of the value chain, focusing on the sourcing, procurement, and manufacturing processes for raw materials and highly specialized, certified components required to produce genuine aftermarket replacement parts.

Why are customization and personalization becoming more important in aftermarket services?

Customers operating different machinery fleets in varied environments require tailored maintenance strategies. Digital platforms enable service providers to personalize contracts, monitor specific asset conditions, and offer highly customized service packages based on usage and operational criticality.

What is the primary objective of field service management (FSM) software in the MAM?

FSM software aims to optimize the deployment and efficiency of field technicians by automating scheduling, dispatching, routing, inventory allocation, and providing real-time data access, ultimately maximizing the utilization rate of service personnel and improving first-time fix rates.

How do economic pressures, such as inflation, influence aftermarket strategic planning?

Inflationary pressures increase costs for labor, raw materials, and logistics. This forces aftermarket strategists to prioritize digital solutions, remote service capabilities, and optimized inventory management to maintain profitability and competitiveness against cost-effective independent service alternatives.

What is the function of Technical Consulting & Training within the service segment?

Technical Consulting and Training provides specialized knowledge transfer, helping end-users optimize machine operation, comply with regulations, and train their in-house staff on basic maintenance procedures, thereby empowering the customer and strengthening the provider-client relationship.

What challenges do SMEs face when trying to adopt advanced digital aftermarket solutions?

SMEs typically face challenges related to high upfront capital costs for IIoT sensors and platforms, lack of internal expertise to manage complex data analytics, and concerns regarding data security and integration with legacy operational systems.

What key infrastructure investments are necessary for effective remote monitoring?

Effective remote monitoring requires investments in high-quality industrial sensors, reliable networking hardware (including 5G or dedicated industrial Wi-Fi), secure edge computing gateways, and robust cloud platforms capable of handling large volumes of streaming time-series data and running complex AI algorithms.

Why is the Manufacturing After Market generally considered to have higher profit margins than equipment sales?

Aftermarket services often involve proprietary parts and specialized knowledge, creating higher barriers to entry for competitors. Furthermore, service contracts provide reliable, long-term revenue streams, and the costs associated with selling replacement parts are often lower relative to the high R&D and manufacturing costs of the original capital equipment.

How does the mining industry impact the demand for heavy equipment MRO services?

The mining industry utilizes extremely large, complex, and high-wear machinery (e.g., massive haul trucks, excavators) operating under harsh conditions. This necessitates constant, rigorous MRO, specialized component overhauls, and robust field service support, driving demand for heavy equipment aftermarket providers.

What are the key considerations for managing inventory of high-value, low-volume spare parts?

For high-value, low-volume parts, the key considerations are highly accurate AI-driven demand forecasting, strategic centralization of inventory, minimizing obsolescence risk, and implementing just-in-time (JIT) manufacturing or 3D printing capabilities to ensure availability without excessive stocking costs.

How are OEMs utilizing e-commerce in their aftermarket strategy?

OEMs are establishing sophisticated e-commerce platforms to facilitate direct sales of genuine spare parts and consumables, enhancing customer experience by providing transparent pricing, easy ordering, technical documentation access, and integration with customer-specific maintenance schedules and purchasing history.

What is the impact of standardization (e.g., OPC UA) on the development of aftermarket software platforms?

Industrial communication standards like OPC UA facilitate interoperability by allowing different machine brands and generations to communicate effectively. This standardization lowers the integration effort for aftermarket software platforms, enabling easier data collection and comprehensive fleet management solutions across diverse equipment landscapes.

How does the aerospace MRO sector differ from general industrial machinery aftermarket?

Aerospace MRO is characterized by extremely high regulatory scrutiny, mandatory component traceability, longer component lifecycles, non-negotiable safety requirements, and vastly higher costs and complexity associated with component overhaul, making authorized certification and compliance paramount.

What is the current trend regarding the sourcing of spare parts—localized or globalized?

The trend is moving toward localized sourcing and enhanced regional supply chain hubs, driven by the need for speed, resilience against geopolitical disruptions, and reduced logistical costs. Advanced technologies like additive manufacturing (3D printing) further support on-demand localized production of specific parts.

What is the primary challenge faced by service providers when integrating data from legacy equipment?

Legacy equipment often lacks the necessary embedded sensors or standardized communication protocols required for seamless IIoT connectivity. Service providers must employ retrofitting solutions, specialized gateway devices, and custom middleware to extract and standardize data for modern diagnostic platforms, increasing complexity and cost.

How does training utilizing Virtual Reality (VR) improve technician readiness?

VR training offers a risk-free environment for technicians to repeatedly practice highly technical and dangerous repair procedures on accurate digital models of equipment. This builds muscle memory, improves decision-making under pressure, and reduces the learning curve associated with complex machinery.

What are the implications of "Right to Repair" legislation for OEMs?

Right to Repair legislation may compel OEMs to share proprietary diagnostic tools, schematics, and genuine parts with independent repair shops. This threatens OEM control over service revenue and intellectual property, while also raising concerns about unauthorized repairs potentially compromising equipment safety and performance integrity.

Why is the Manufacturing After Market considered an economic stabilizer for manufacturing companies?

The aftermarket provides counter-cyclical revenue stability. While new equipment sales fluctuate heavily with economic cycles, demand for maintenance, parts, and repair remains relatively constant, or even increases (as companies defer new capital expenditure), ensuring a stable revenue baseline for manufacturers.

What specific type of analysis is used to predict the optimal service lifecycle of an asset?

Life Cycle Assessment (LCA) and Reliability-Centered Maintenance (RCM) analysis, often enhanced by machine learning and digital twin simulation, are used to determine the ideal points for preventative maintenance, overhaul, and eventual retirement or modernization of industrial assets, maximizing return on investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager