Map Monitoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437826 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Map Monitoring Market Size

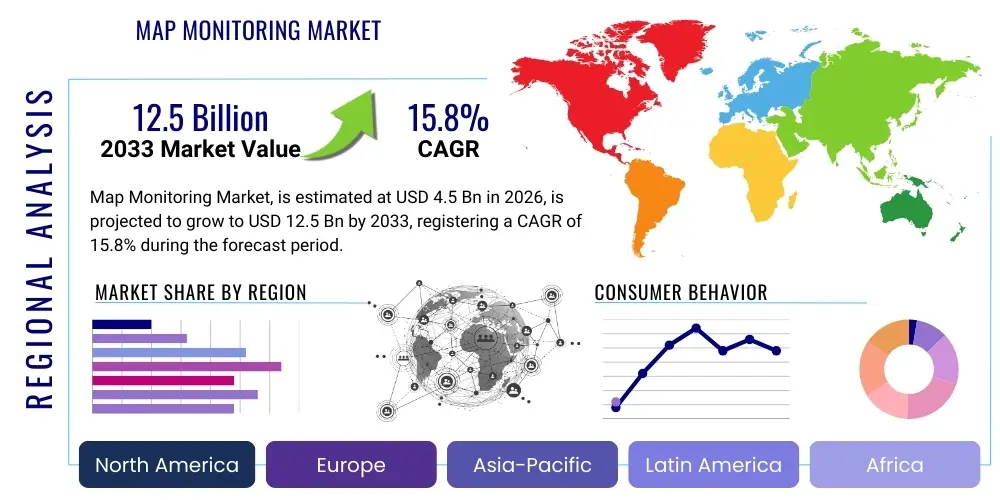

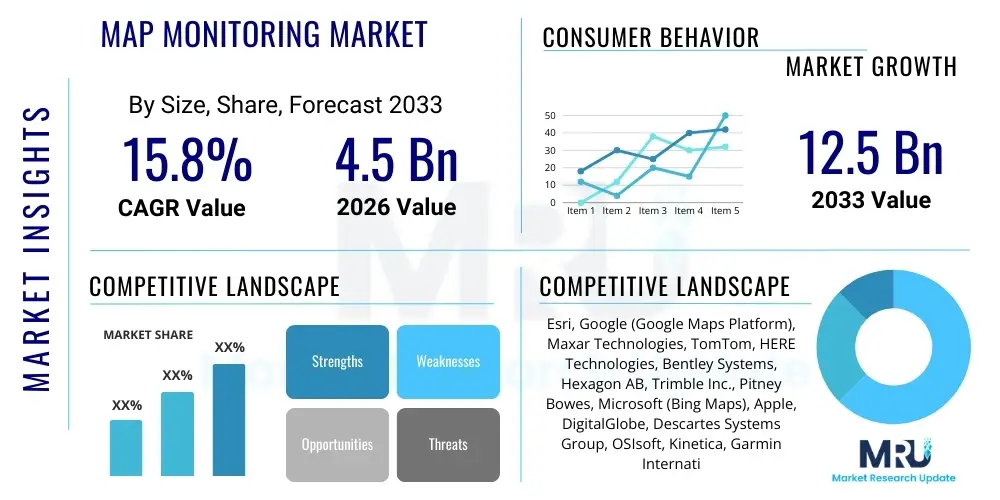

The Map Monitoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% (CAGR) between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.5 Billion by the end of the forecast period in 2033.

Map Monitoring Market introduction

The Map Monitoring Market encompasses a range of solutions and services designed to track, visualize, and analyze real-time spatial data overlaid onto geographic maps. This technology is critical for maintaining situational awareness across diverse sectors, including logistics, defense, environmental management, and utility operations. Core functionalities include tracking assets (vehicles, personnel), monitoring infrastructure integrity, assessing environmental changes, and optimizing resource allocation based on dynamic geographic conditions. These sophisticated systems utilize inputs from GPS, IoT sensors, satellite imagery, and drone data, processing vast amounts of information through advanced Geographic Information Systems (GIS) platforms to deliver actionable intelligence. The product portfolio ranges from specialized enterprise software for asset tracking and telemetry to public-facing platforms used for traffic management and emergency response coordination. Adoption is accelerating primarily due to the global expansion of IoT devices and the increasing necessity for real-time operational efficiency.

Major applications of map monitoring span critical areas such as fleet management, where companies leverage these tools to optimize routes, reduce fuel consumption, and enhance driver safety through continuous location and performance tracking. In the public safety and defense sectors, map monitoring provides indispensable support for rapid deployment, disaster management, and border surveillance by offering immediate visualization of assets and threats. Furthermore, the environmental sector relies heavily on these solutions for monitoring deforestation, pollution spread, and climate-related changes, enabling regulatory bodies and conservation groups to intervene proactively. The inherent benefit of map monitoring lies in its ability to transform raw geographic data into strategic insights, facilitating quicker decision-making and operational resilience in dynamic environments.

Key driving factors fueling the market expansion include the rapid proliferation of smart city initiatives worldwide, which necessitate centralized monitoring of urban infrastructure and services. The increasing demand for location-based services (LBS) across consumer and enterprise applications, coupled with advancements in high-resolution satellite mapping technology, further accelerates growth. Moreover, the integration of 5G networks is drastically improving the speed and reliability of data transmission, making real-time map monitoring feasible even in remote or complex operational settings. These technological and infrastructural developments collectively establish a strong foundation for sustained market growth throughout the forecast period, positioning map monitoring as an essential tool for modern enterprise and government operations.

Map Monitoring Market Executive Summary

The Map Monitoring Market is characterized by robust growth, driven primarily by the confluence of advanced geospatial analytics and the massive uptake of Internet of Things (IoT) sensors in industrial and urban settings. Current business trends indicate a strong shift toward cloud-based GIS platforms, favoring subscription models (SaaS) over traditional on-premise installations, which lowers the barrier to entry for smaller enterprises and enhances scalability. Key players are increasingly focusing on strategic partnerships with satellite data providers and telecom operators to ensure comprehensive global coverage and high-frequency data updates. Furthermore, market innovation is centered around incorporating machine learning algorithms to automate anomaly detection, predictive maintenance scheduling, and dynamic routing optimization, moving the capability of map monitoring beyond simple visualization toward proactive intelligence.

Regional trends highlight North America and Europe as dominant markets, primarily due to high technological maturity, established smart city frameworks, and significant military and defense spending allocated to advanced surveillance and tracking systems. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid acceleration is attributed to extensive infrastructural development projects, particularly in countries like China and India, coupled with increasing governmental investments in logistical infrastructure and digital transformation initiatives. Emerging economies in Latin America and the Middle East and Africa (MEA) are also showing promising growth, particularly in sectors related to oil and gas pipeline monitoring, large-scale agriculture, and resource extraction, where geographic oversight is crucial for operational safety and regulatory compliance.

Segment trends emphasize the dominance of the software and platform segment, as sophisticated GIS processing capabilities form the backbone of all map monitoring applications. Within application segments, the fleet and logistics management category remains the largest consumer, fueled by global supply chain pressures requiring optimized efficiency. However, the environmental monitoring and infrastructure management segments are poised for the fastest growth, driven by stringent regulatory requirements concerning climate change impact and the need to manage aging infrastructure, such as utility grids, road networks, and rail lines, using predictive spatial analytics. The trend across all segments is towards greater integration of diverse data sources, moving from static map views to dynamic, interactive digital twins of the real world.

AI Impact Analysis on Map Monitoring Market

User queries regarding the impact of Artificial Intelligence (AI) on the Map Monitoring Market frequently revolve around automation capabilities, predictive accuracy, and the handling of massive geospatial datasets. Common concerns include: "How does AI enhance real-time anomaly detection?" "Will machine learning replace human analysts in surveillance?" and "What AI models are best suited for predictive traffic flow or infrastructure failure?" Users also keenly inquire about the ethical implications of AI-driven surveillance using map monitoring tools. The consensus expectation is that AI will fundamentally transform map monitoring by moving systems from reactive reporting to proactive forecasting and automated decision support. Key themes synthesized from user inquiries highlight the need for scalable AI solutions capable of ingesting high-volume satellite and IoT data, identifying subtle patterns invisible to human operators, and delivering highly accurate, context-aware spatial insights necessary for effective operational response across industries.

- AI enables automated feature extraction from satellite and aerial imagery, significantly reducing manual mapping effort.

- Machine learning algorithms enhance predictive modeling for environmental changes, such as wildfire spread or flood trajectories.

- AI drives advanced anomaly detection in infrastructure monitoring, identifying subtle stress points or unauthorized activities on pipelines and utility networks.

- Natural Language Processing (NLP) integrated with map platforms allows for automated interpretation of geo-tagged textual data (social media, incident reports).

- Computer Vision is utilized for real-time classification and tracking of mobile assets (vehicles, ships, drones) within complex geographic environments.

- AI optimizes dynamic route planning in logistics, adjusting routes instantaneously based on live traffic, weather, and operational constraints.

- Generative AI models are beginning to be explored for creating synthetic, yet realistic, training environments for scenario planning and disaster response simulation.

DRO & Impact Forces Of Map Monitoring Market

The Map Monitoring Market's trajectory is shaped by a powerful interplay of growth drivers, structural restraints, and emerging opportunities, all of which are managed by the pervasive impact forces of technological advancement and regulatory shifts. Key drivers include the exponential growth in global demand for real-time location intelligence, the increasing investment in smart infrastructure projects worldwide, and the drastic reduction in the cost of satellite imagery and IoT sensors, making pervasive monitoring economically viable for smaller entities. Conversely, significant restraints involve the inherent complexity of integrating disparate data sources (sensor data, proprietary map layers, legacy GIS systems), concerns over data privacy and security, and the persistent challenge of ensuring highly accurate positioning and mapping, particularly in dense urban or GPS-denied environments. Opportunities lie primarily in the expanding integration of augmented reality (AR) and virtual reality (VR) for immersive geo-visualization and the untapped potential of 5G network deployment to enable ultra-low-latency real-time applications.

Impact forces are strongly concentrated around technological innovation and governmental policy. The ongoing democratization of geospatial data, spearheaded by open-source GIS platforms and initiatives like Copernicus and Landsat, exerts a downward pressure on proprietary data pricing, simultaneously stimulating broader market adoption. Regulatory requirements related to critical infrastructure protection (CIP) and environmental reporting mandate the use of advanced monitoring systems, acting as a crucial non-market driver for compliance-based uptake. These forces necessitate continuous innovation in data fusion techniques and cyber security protocols specific to spatial data, ensuring that map monitoring systems remain reliable, secure, and compliant with evolving international standards.

The combined effect of these factors creates a highly dynamic competitive environment. While rapid technological adoption accelerates market expansion, the high capital expenditure required for developing proprietary mapping software and maintaining large-scale data infrastructures acts as a partial restraint, favoring established players with deep resources. However, niche opportunities exist for agile startups specializing in specific applications, such as drone-based mapping for construction or AI-driven change detection for agricultural monitoring. Ultimately, the market success of participants is increasingly tied to their ability to provide end-to-end, integrated solutions that offer superior spatial resolution and analytical depth, moving beyond mere visualization to delivering strategic operational intelligence.

Segmentation Analysis

The Map Monitoring Market is extensively segmented across multiple dimensions, including component type, application vertical, deployment model, and end-user profile. Component segmentation differentiates between hardware (sensors, trackers, GPS modules), software (GIS platforms, spatial analytics tools), and services (consulting, integration, managed services). This stratification helps in understanding which parts of the value chain are experiencing the most intense technological investment and revenue generation. The application spectrum is broad, ranging from established uses like fleet management and logistics to emerging, high-growth areas such as smart infrastructure monitoring and precise location-based marketing. Analyzing these segments is essential for identifying specific growth pockets and tailoring product development strategies to meet specialized vertical needs.

Deployment models primarily split the market into cloud-based (SaaS) and on-premise solutions. Cloud deployment has become the predominant choice due to its scalability, reduced maintenance burden, and capability to handle large, distributed datasets required for real-time monitoring. However, on-premise solutions remain critical in highly regulated sectors (e.g., defense, banking) where data sovereignty and stringent security mandates necessitate local data storage and control. Furthermore, the segmentation by end-user, including government, defense, transportation, retail, and energy & utilities, reveals varying levels of technological maturity and spending capacity, dictating the feature set and complexity required for successful market penetration.

The fastest-growing segment often shifts based on macro-economic factors; currently, the services segment is accelerating as organizations increasingly seek expert consulting and managed services to integrate complex geospatial data streams and derive maximum value from their monitoring investments without developing in-house expertise. This trend underscores the increasing complexity of modern map monitoring solutions, which require specialized knowledge in areas like spatial data fusion, advanced analytics, and regulatory compliance. Strategic planning must, therefore, balance investment in core software capabilities with the provision of comprehensive, value-added professional services to capture maximum market share.

- By Component:

- Hardware (GPS/GNSS receivers, Sensors, Telemetry Devices)

- Software/Platform (Geographic Information Systems (GIS), Location Intelligence Platforms)

- Services (Managed Services, Consulting, Implementation & Integration)

- By Application:

- Fleet Management and Logistics

- Infrastructure Monitoring (Utilities, Roads, Rail)

- Public Safety and Emergency Response

- Defense and National Security

- Environmental Monitoring and Resource Management

- Location-Based Services (LBS)

- By Deployment Model:

- On-Premise

- Cloud-Based (SaaS)

- By End-User Industry:

- Transportation and Logistics

- Government and Public Sector

- Energy and Utilities

- Construction and Mining

- Retail and eCommerce

Value Chain Analysis For Map Monitoring Market

The value chain of the Map Monitoring Market is structured around the acquisition, processing, dissemination, and application of spatial data, beginning with upstream data sources and culminating in downstream end-user deployment. Upstream activities involve the crucial supply of raw geographic data, dominated by providers of satellite imagery (both high-resolution commercial and free open-source data), aerial mapping services (drones, aircraft), and sensor manufacturers (IoT device vendors, GPS module producers). Strategic control over high-frequency, high-quality data feeds is a key competitive differentiator in this phase. The value generated here is primarily through ensuring data accuracy, coverage, and temporal resolution, which dictates the quality of the subsequent monitoring service.

The midstream segment is characterized by data processing and platform development, where Geographic Information Systems (GIS) software companies and platform providers play a central role. This involves data fusion, geo-spatial analytics, real-time data streaming, and the development of user-friendly visualization dashboards. Companies here invest heavily in AI/ML capabilities to automate analysis and improve the predictive power of the monitoring systems. Distribution channels are bifurcated into direct sales (typical for large enterprise or government contracts requiring custom implementation) and indirect channels, predominantly involving system integrators, value-added resellers (VARs), and strategic channel partners who localize the core platform and integrate it with existing enterprise resource planning (ERP) or customer relationship management (CRM) systems. Cloud marketplaces are increasingly becoming a vital indirect channel for SaaS delivery.

Downstream activities focus on the delivery of actionable intelligence and support services to the end-users. This includes customized report generation, proactive alert systems, and post-implementation maintenance and consulting. The direct channel ensures deep client relationships and tailored solutions, common in defense or critical infrastructure segments where bespoke features are required. The indirect channel, through VARs, allows for rapid market scaling and geographical penetration, particularly into SME markets that require affordable, off-the-shelf monitoring solutions. The success downstream is measured by the measurable improvement in operational efficiency, risk mitigation, and compliance adherence achieved by the end-user through the map monitoring solution.

Map Monitoring Market Potential Customers

Potential customers for Map Monitoring solutions are diverse and span governmental bodies, large multinational corporations, and specialized industry sectors requiring precise location intelligence and asset oversight. Government agencies, including municipal planning departments, defense organizations, and homeland security, constitute a primary customer segment, utilizing map monitoring for urban planning, emergency response coordination, and critical national infrastructure surveillance. These entities require highly secure, robust, and scalable systems capable of integrating proprietary data streams with publicly available geographic information. Their purchasing decisions are heavily influenced by regulatory compliance, data security certifications, and the provider's track record in handling sensitive data.

The transportation and logistics sector represents one of the largest commercial buyer groups. Fleet operators, shipping companies, and railway authorities rely on real-time map monitoring to optimize routes, manage driver behavior, ensure asset security, and comply with regulatory mandates regarding vehicle performance and emissions. For these buyers, the key metrics driving adoption are Return on Investment (ROI) derived from fuel savings, labor efficiency improvements, and reduced incident rates. Solutions must offer robust telemetry integration and seamless integration with existing logistics software suites.

Furthermore, the energy and utilities sector, encompassing oil and gas, power generation, and water management, forms a high-value customer base. These organizations require continuous map monitoring for pipeline integrity management, remote asset tracking (e.g., solar farms, wind turbines), and environmental impact assessment. Due to the geographically dispersed nature of their assets, they prioritize solutions offering high-resolution change detection, predictive maintenance alerts based on spatial analysis, and reliable performance in remote operational environments. The mining and construction industries are also rapidly increasing adoption for site planning, progress monitoring, and ensuring worker safety within large, dynamic construction zones.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Esri, Google (Google Maps Platform), Maxar Technologies, TomTom, HERE Technologies, Bentley Systems, Hexagon AB, Trimble Inc., Pitney Bowes, Microsoft (Bing Maps), Apple, DigitalGlobe, Descartes Systems Group, OSIsoft, Kinetica, Garmin International, GeoTab, Waze (Google), Teletrac Navman, Verizon Connect |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Map Monitoring Market Key Technology Landscape

The technological landscape of the Map Monitoring Market is rapidly evolving, defined by the convergence of high-resolution sensing capabilities and advanced data processing architectures. Core technologies include sophisticated Geographic Information Systems (GIS), which serve as the foundational framework for spatial data storage, analysis, and visualization. Modern GIS platforms are moving beyond desktop applications to highly scalable, web-based, and cloud-native solutions, capable of handling petabytes of streaming data. A significant trend is the adoption of real-time kinematic (RTK) and precise point positioning (PPP) techniques, enhancing the accuracy of GPS/GNSS data from meters down to centimeters, which is crucial for applications like autonomous vehicle navigation and precision agriculture.

Furthermore, the integration of Internet of Things (IoT) technology is fundamental to real-time map monitoring. IoT devices, including asset trackers, environmental sensors, and telemetry systems embedded within vehicles and infrastructure, provide the dynamic data inputs that transform static maps into living digital representations. These devices rely heavily on low-power wide-area networks (LPWAN) such as LoRaWAN and Narrowband IoT (NB-IoT), alongside 5G connectivity, to ensure continuous, high-throughput data transmission, even from remote or challenging locations. The seamless fusion of this diverse sensor data with traditional satellite and aerial imagery datasets requires robust data processing pipelines based on big data technologies.

Another crucial technological development involves the increasing utilization of photogrammetry and remote sensing, specifically leveraging drone and satellite platforms. High-frequency revisit satellite constellations enable near-daily updates on global infrastructure and environmental conditions, driving applications in change detection and rapid disaster assessment. Simultaneously, the proliferation of open-source mapping libraries and spatial databases (such as PostGIS, QGIS, and open-source routing engines) is lowering development costs and fostering innovation, enabling smaller developers to create highly specialized map monitoring tools, thereby diversifying the technological ecosystem and increasing competition across specialized application areas.

Regional Highlights

The global Map Monitoring Market exhibits significant regional variations in terms maturity, regulatory landscape, and growth potential. North America maintains market leadership, largely driven by substantial expenditure on advanced military and defense surveillance systems, pervasive smart city investments, and a highly mature ecosystem of GIS technology providers and location data startups. Key drivers in this region include the high adoption rate of fleet management solutions and mandatory government regulations requiring accurate asset tracking across various sectors. The regional market is characterized by technological maturity and a willingness to invest in cutting-edge AI and data fusion technologies for predictive insights.

Europe is the second-largest market, benefiting from rigorous regulatory frameworks focused on environmental monitoring (e.g., Copernicus program data usage) and stringent transportation safety standards. Countries like Germany, the UK, and France are heavily investing in monitoring critical infrastructure, including railways and utility networks. The European emphasis on data privacy (GDPR) forces technology providers to adopt advanced anonymization and security protocols for location data, shaping the way map monitoring services are developed and deployed across the continent. Innovation frequently centers on cross-border cooperation for logistics and security.

Asia Pacific (APAC) is positioned as the fastest-growing region, fueled by rapid urbanization, massive infrastructure projects (e.g., China's Belt and Road Initiative), and increasing government investment in public safety technologies. Emerging economies within APAC are deploying map monitoring solutions to manage unprecedented population growth and complex logistical challenges. While North America focuses on technological sophistication, APAC prioritizes scalability and cost-efficiency, often integrating map monitoring with large-scale telecom and internet service rollouts. Latin America and the Middle East & Africa (MEA) are emerging regions, where growth is currently concentrated in resource-intensive sectors like oil, gas, mining, and agriculture, leveraging monitoring solutions to optimize extraction logistics and ensure remote asset security.

- North America: Dominates the market due to high technological maturity, extensive defense spending, and rapid adoption of autonomous vehicle monitoring systems.

- Europe: Strong market for infrastructure monitoring, driven by strict environmental and safety regulations, with high adoption rates in utility and rail sectors.

- Asia Pacific (APAC): Highest projected CAGR, propelled by rapid urbanization, large-scale smart city deployments, and massive infrastructural investment in China, India, and Southeast Asian nations.

- Latin America: Growth concentrated in natural resource management, agriculture optimization, and logistical efficiency improvements for export economies.

- Middle East and Africa (MEA): Key adoption areas include oil and gas pipeline surveillance, border security, and major smart city projects in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Map Monitoring Market.- Esri

- Google (Google Maps Platform)

- Maxar Technologies

- TomTom

- HERE Technologies

- Bentley Systems

- Hexagon AB

- Trimble Inc.

- Pitney Bowes

- Microsoft (Bing Maps)

- Apple

- DigitalGlobe

- Descartes Systems Group

- OSIsoft

- Kinetica

- Garmin International

- GeoTab

- Waze (Google)

- Teletrac Navman

- Verizon Connect

Frequently Asked Questions

Analyze common user questions about the Map Monitoring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Map Monitoring Market?

The primary factor driving growth is the massive expansion of the Internet of Things (IoT) devices and the necessity for real-time location intelligence (RTLI) across critical sectors like logistics, public safety, and infrastructure management. This data inflow mandates sophisticated, scalable map-based visualization and analysis tools.

How is Artificial Intelligence (AI) integrated into modern Map Monitoring systems?

AI is integrated to automate key functions, including real-time change detection from satellite imagery, predictive maintenance scheduling based on geospatial asset performance, and dynamic optimization of logistics and routing paths, thereby transforming reactive monitoring into proactive decision-making.

Which geographical region is expected to show the highest growth rate (CAGR)?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, extensive government investment in smart city projects, and large-scale infrastructure development across countries such as China and India.

What are the main security concerns associated with real-time Map Monitoring solutions?

The main security concerns revolve around data privacy (especially regarding tracking personnel and vehicles), the security of proprietary spatial data layers, and the resilience of the monitoring platform against cyber-attacks, necessitating robust encryption and access control protocols compliant with global standards like GDPR.

What is the difference between On-Premise and Cloud-Based deployment models in this market?

Cloud-Based (SaaS) deployment offers high scalability, reduced initial capital expenditure, and simplified real-time data handling, making it ideal for distributed assets. On-Premise deployment, conversely, provides enhanced data sovereignty and control, making it preferred by highly regulated sectors such as defense and critical infrastructure where data must remain local.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager