Marine Cylinder Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440456 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Marine Cylinder Oil Market Size

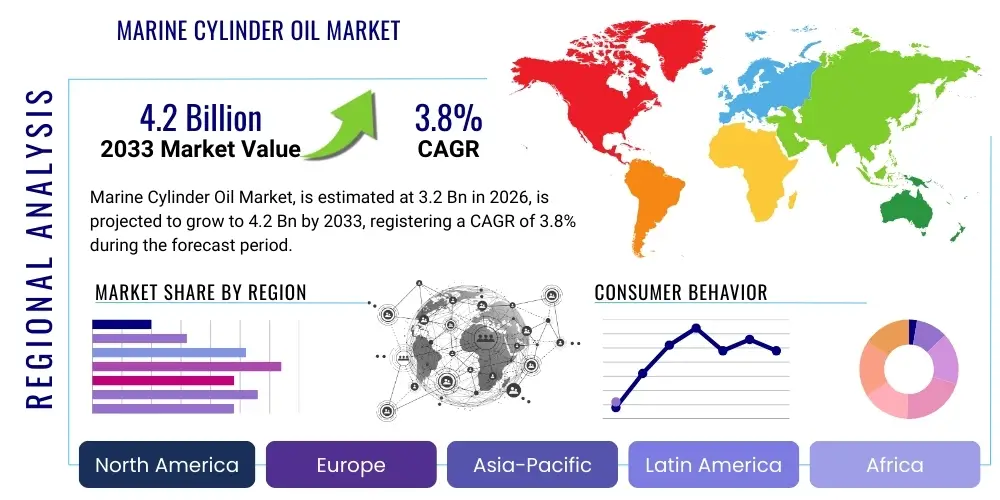

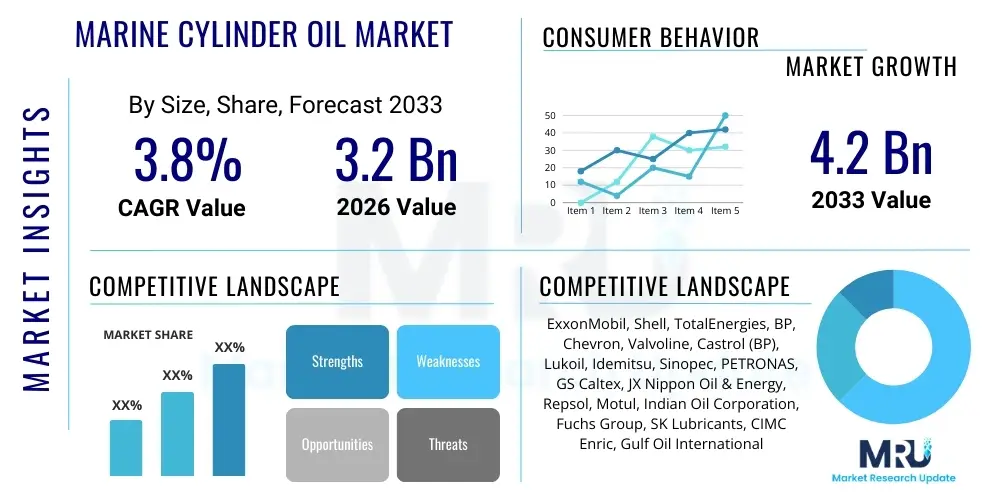

The Marine Cylinder Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033.

Marine Cylinder Oil Market introduction

The Marine Cylinder Oil Market stands as a critical pillar supporting the global shipping industry, providing essential lubrication and protection for the large two-stroke marine diesel engines that power the vast majority of commercial vessels. These specialized lubricants are meticulously formulated to operate under the most arduous conditions, combating severe wear, corrosion, and deposit formation inherent in the combustion of heavy fuel oils (HFOs). The product’s primary function involves neutralizing corrosive sulfuric acids, lubricating piston rings against cylinder liners, and ensuring optimal sealing for efficient combustion. The demand for marine cylinder oils is intrinsically linked to global trade volumes, the expansion of the world merchant fleet, and the increasing complexity of engine designs that demand higher performance and compatibility with diverse fuel types, including low-sulfur fuels and emerging alternative fuels.

Product innovation within this market is driven by a constant pursuit of enhanced engine cleanliness, extended component life, and improved fuel efficiency, all while adapting to evolving regulatory landscapes. Major applications span across various vessel types, including container ships, bulk carriers, oil tankers, and cruise ships, each requiring specific lubrication strategies based on engine type, operating conditions, and fuel characteristics. The benefits derived from high-quality marine cylinder oils are multifaceted, encompassing reduced maintenance costs through prolonged engine life, minimized unscheduled downtime, and optimized fuel consumption, directly contributing to the operational profitability and sustainability of shipping companies. As the industry navigates stricter environmental mandates and embraces digitalization, the development of intelligent, condition-monitoring compatible lubricants is gaining significant traction.

Driving factors for market growth are numerous and interconnected. Foremost among these is the sustained growth in global seaborne trade, which continues to rely heavily on marine transportation for goods movement, thereby increasing demand for vessel operation and maintenance. The stringent regulations imposed by the International Maritime Organization (IMO) regarding sulfur emissions (IMO 2020) have compelled the adoption of very low sulfur fuel oils (VLSFOs) and ultra low sulfur fuel oils (ULSFOs), necessitating the development of new cylinder oil formulations tailored to these fuels. Furthermore, ongoing technological advancements in marine engine design, aiming for higher efficiency and lower emissions, require lubricants with superior performance attributes. The increasing focus on fleet optimization, predictive maintenance, and the gradual shift towards alternative fuels like LNG, methanol, and ammonia are also shaping the future requirements and growth trajectories of the marine cylinder oil market.

Marine Cylinder Oil Market Executive Summary

The Marine Cylinder Oil Market is navigating a complex landscape shaped by dynamic business trends, evolving regional demands, and significant shifts across its various segments. Globally, the industry is experiencing a strategic pivot towards sustainability and enhanced operational efficiency, compelling lubricant manufacturers to invest heavily in research and development for advanced formulations. Key business trends include the consolidation of market players, strategic partnerships between oil majors and engine manufacturers, and the expansion of service offerings beyond just product sales to include lubrication management and technical support. The IMO 2020 regulations have fundamentally altered purchasing patterns and product requirements, leading to a surge in demand for lubricants compatible with very low sulfur fuel oils (VLSFOs) and the emergence of specialized formulations for exhaust gas cleaning systems (scrubbers) and alternative fuels. Furthermore, digitalization and data analytics are increasingly influencing lubricant selection and maintenance schedules, enabling predictive maintenance and optimizing operational costs for shipping companies.

Regional trends reveal a diverse market performance influenced by varying economic growth rates, regulatory enforcement, and fleet compositions. Asia Pacific, particularly countries like China, Japan, and South Korea, continues to dominate the market due to its robust shipbuilding industry, extensive port infrastructure, and high volume of maritime trade. The region's rapid industrialization and growing intra-regional trade contribute significantly to the demand for marine cylinder oils. Europe and North America, while mature markets, are leading in the adoption of advanced lubricant technologies and compliance with stricter environmental standards, driving innovation in sustainable and high-performance products. Emerging markets in Latin America, the Middle East, and Africa are showing promising growth, fueled by increasing seaborne trade, infrastructure development, and the expansion of their merchant fleets, although these regions often face challenges related to logistical complexities and fluctuating economic conditions.

Segmentation trends indicate a clear shift towards higher-performance and specialized products. By product type, the market is witnessing a strong uptake of low-BN (Base Number) and ultra-low-BN cylinder oils for vessels burning compliant low-sulfur fuels, alongside continued demand for high-BN oils for HFO-fueled vessels equipped with scrubbers. The development of multi-functional lubricants capable of handling a range of fuel types is also gaining traction. Application-wise, container ships and bulk carriers remain the largest consumers due to their sheer numbers and frequent voyages, but the specialized requirements of LNG carriers and cruise ships are creating niche growth opportunities. The market is also seeing differentiation based on vessel type, with distinct lubrication needs for different engine designs and operational profiles. The overall trend points towards a future where customization, regulatory compliance, and environmental performance will be paramount in defining successful market strategies across all segments.

AI Impact Analysis on Marine Cylinder Oil Market

The integration of Artificial Intelligence (AI) and machine learning (ML) technologies is poised to revolutionize the Marine Cylinder Oil Market, addressing long-standing challenges related to operational efficiency, maintenance, and environmental compliance. Users are keenly interested in how AI can enhance the predictive capabilities of lubrication systems, moving beyond traditional scheduled maintenance to real-time, condition-based optimization. Common questions revolve around AI’s potential to analyze vast datasets from engine sensors, fuel consumption, and lubricant performance to provide actionable insights. Shipping companies and engine operators are looking for solutions that can accurately predict wear rates, optimize lubricant feed rates, prevent costly breakdowns, and ensure compliance with stringent environmental regulations by optimizing combustion and reducing emissions. Expectations are high for AI to deliver significant cost savings through reduced lubricant consumption, extended engine life, and minimized downtime, while also contributing to the shipping industry’s decarbonization efforts.

AI's influence extends deeply into the lifecycle management of marine cylinder oils, from formulation and manufacturing to in-service performance monitoring. In the research and development phase, AI-driven simulations can accelerate the discovery of new additive packages and base oil combinations, optimizing properties for specific engine types and fuel chemistries, including alternative fuels. Predictive modeling allows chemists to foresee lubricant behavior under various operational stressors, reducing the need for extensive physical testing. For manufacturers, AI can optimize production processes, improve quality control, and streamline supply chain logistics, ensuring the timely availability of specialized lubricants globally. This sophisticated level of analysis and optimization, driven by advanced algorithms, allows for the creation of more robust and adaptable cylinder oils that can meet the dynamic demands of modern marine engines and diverse operational environments.

Once deployed on vessels, AI algorithms can continuously process sensor data from engine parameters, lubricant condition monitoring, and fuel analysis. This allows for dynamic adjustment of lubricant feed rates, ensuring that engines receive precisely the right amount of oil needed for optimal protection and efficiency, rather than adhering to static, often over-generous, schedules. The implications for predictive maintenance are profound: AI can detect subtle anomalies indicating potential wear or upcoming failures long before they become critical, enabling proactive intervention and preventing catastrophic engine damage. Furthermore, AI can contribute to environmental performance by optimizing combustion efficiency, which in turn reduces harmful emissions and fuel consumption. This holistic impact, encompassing predictive maintenance, operational efficiency, and environmental stewardship, positions AI as a transformative force in the marine cylinder oil sector, addressing the core concerns and aspirations of market stakeholders for a more sustainable and economically viable future.

- Predictive Maintenance: AI algorithms analyze engine sensor data to forecast cylinder wear and optimize lubricant feed rates, reducing oil consumption and extending engine life.

- Optimized Formulations: AI-driven simulations accelerate the development of new marine cylinder oil formulations, tailoring them for diverse engine types and fuel chemistries.

- Enhanced Efficiency: Real-time data analysis by AI leads to improved combustion efficiency, reducing fuel consumption and operational costs for shipping companies.

- Condition Monitoring: AI integrates with onboard sensors to provide continuous monitoring of lubricant performance and engine health, enabling proactive maintenance decisions.

- Supply Chain Optimization: AI enhances logistics for marine cylinder oil distribution, ensuring timely delivery and minimizing stockouts across global ports.

- Emissions Reduction: By optimizing engine performance and lubricant use, AI contributes to lower NOx, SOx, and particulate matter emissions, aiding regulatory compliance.

- Fault Detection: Machine learning models can identify subtle anomalies in engine operation, signaling potential issues with lubrication or engine components before failure occurs.

- Personalized Lubrication: AI can recommend bespoke lubricant strategies based on specific vessel routes, fuel types, and historical engine performance data, moving beyond generic recommendations.

- Training and Simulation: AI-powered tools can be used for training crew on optimal lubrication practices and troubleshooting scenarios without real-world risk.

DRO & Impact Forces Of Marine Cylinder Oil Market

The Marine Cylinder Oil Market is profoundly shaped by a complex interplay of drivers, restraints, and opportunities, all underscored by significant impact forces that dictate its trajectory. A primary driver is the relentless growth in global seaborne trade, which directly correlates with an increased demand for shipping services and, consequently, for marine lubricants. As economies expand and international supply chains become more intricate, the sheer volume of goods transported by sea continues to climb, necessitating the continuous operation and maintenance of a vast global merchant fleet. Complementing this, the ongoing technological advancements in marine diesel engines, designed for higher efficiency, greater power output, and reduced emissions, demand increasingly sophisticated and high-performance cylinder oils that can withstand extreme pressures and temperatures while ensuring minimal wear. These advancements compel lubricant manufacturers to continuously innovate, developing formulations that offer superior protection and performance tailored to the latest engine designs and operational demands, thereby fueling market expansion.

However, the market also faces considerable restraints that temper its growth potential. Foremost among these is the inherent volatility of crude oil prices, which directly impacts the cost of base oils—a major component in marine cylinder oil formulations. Fluctuations in crude oil markets can lead to unpredictable manufacturing costs, affecting profit margins for lubricant producers and pricing stability for end-users. Additionally, the shipping industry’s high operational costs, including bunker fuel, crewing, and maintenance, often pressure vessel operators to seek cost-effective lubricant solutions, sometimes leading to a compromise on premium products. The intensifying competition from alternative marine fuels, such as LNG, methanol, and potentially ammonia or hydrogen, presents a long-term restraint, as these fuels require entirely different lubrication strategies, potentially reducing the demand for conventional cylinder oils formulated for HFO or VLSFO. This transition necessitates significant R&D investment for lubricant manufacturers to adapt their product portfolios.

Despite these challenges, substantial opportunities exist for market players to capitalize on emerging trends and unmet needs. The most significant opportunity lies in the development and proliferation of bio-based and environmentally friendly lubricants. With escalating environmental concerns and stricter regulations, there is a growing demand for sustainable lubrication solutions that minimize ecological impact. Companies investing in biodegradable and low-toxicity formulations are poised for significant market gains. Furthermore, the expansion of the LNG-fueled fleet, while a restraint for conventional oils, creates a new segment for specialized lubricants designed for gas engines, offering a lucrative growth avenue. Emerging markets in Southeast Asia, Africa, and Latin America, driven by infrastructure development and increasing trade activities, present untapped potential for market expansion. The increasing adoption of condition-based monitoring and predictive maintenance solutions, often integrated with AI, also opens opportunities for lubricant suppliers to offer value-added services and smart lubrication products that enhance operational efficiency and reduce lifetime costs for shipping companies, fostering long-term customer relationships and market differentiation.

Segmentation Analysis

The Marine Cylinder Oil Market is meticulously segmented to provide a granular understanding of its diverse landscape, reflecting variations in product composition, application demands, vessel types, and geographical distribution. This segmentation enables market participants to tailor their strategies, product offerings, and distribution channels to specific customer needs and regulatory environments. The inherent complexity of marine engine operation and the wide array of fuel choices necessitate a highly specialized product range, leading to distinctions based on chemical properties, performance characteristics, and compliance with environmental standards. Analyzing these segments is crucial for identifying growth hotspots, competitive dynamics, and future investment opportunities, particularly as the maritime industry continues its journey towards decarbonization and digital transformation.

- By Product Type:

- High-BN Cylinder Oils: Typically used with heavy fuel oil (HFO) containing high sulfur content, primarily for vessels equipped with exhaust gas scrubbers. These oils have a high Base Number (BN) to neutralize the large amounts of sulfuric acid formed during combustion, protecting engine components from corrosive wear. Their robust additive packages ensure excellent cleanliness and wear protection under severe operating conditions, catering to a significant portion of the global fleet still reliant on HFO.

- Low-BN Cylinder Oils: Designed for use with very low sulfur fuel oil (VLSFO) or ultra low sulfur fuel oil (ULSFO), which have sulfur content below 0.5% or 0.1% respectively. These oils feature lower BN values as less acid neutralization is required, balancing lubrication and cleanliness without over-alkalinity. Their formulations focus on preventing deposit formation and ensuring compatibility with the specific chemistry of low-sulfur fuels.

- Mid-BN Cylinder Oils: A versatile category formulated for a broader range of sulfur content fuels, often used in cases where vessels might switch between compliant low-sulfur fuels and higher sulfur fuels, or for certain engine types requiring balanced alkalinity. These oils offer a flexible solution for operators facing varied fuel bunkering options.

- Dual-Fuel Cylinder Oils: Specialized lubricants for engines capable of running on both traditional fuels (HFO/MGO) and alternative fuels like Liquefied Natural Gas (LNG). These oils are designed to handle the unique combustion characteristics and temperature profiles associated with gas combustion, ensuring optimal performance and protection across different fuel modes, typically featuring a blend of technologies to address both fuel types.

- By Application:

- Main Propulsion Engines: The primary application segment, covering the large two-stroke diesel engines that power the vessel's main propulsion system. These engines are the largest consumers of cylinder oils due to their continuous operation and high power output, requiring superior protection against wear and corrosion over extended periods.

- Auxiliary Engines: Smaller diesel engines used for generating electrical power onboard, operating pumps, and other shipboard systems. While consuming less oil than main engines, their reliable operation is critical for vessel functionality, necessitating specific lubricant formulations adapted to their operational cycles and loads.

- By Vessel Type:

- Container Ships: High-speed vessels with demanding operational profiles, characterized by frequent port calls and tight schedules. They require lubricants that ensure maximum engine reliability and efficiency to minimize downtime.

- Bulk Carriers: Large vessels transporting dry bulk commodities such as coal, iron ore, and grain. They operate on long voyages with varying loads, requiring robust cylinder oils that can maintain performance under diverse conditions and extended operating hours.

- Oil Tankers: Vessels transporting crude oil and petroleum products. Their operational parameters often involve varied speeds and loads, necessitating lubricants that provide consistent protection and minimize sludge formation.

- Chemical Tankers: Specialized vessels for transporting chemicals, often with unique engine requirements due to the nature of their cargo and potential risks.

- Cruise Ships: Characterized by frequent maneuvering, varied power demands, and a strong emphasis on passenger comfort, requiring lubricants that contribute to low emissions and quiet engine operation.

- LNG Carriers: Vessels specifically designed to transport Liquefied Natural Gas, often equipped with dual-fuel engines that require specialized cylinder oils compatible with both gas and liquid fuel combustion.

- Offshore Support Vessels: Including platform supply vessels, anchor handling tugs, and other support craft for offshore oil and gas operations. These vessels often operate dynamically in challenging environments, demanding high-performance lubricants.

- By Distribution Channel:

- Direct Sales: Sales made directly from lubricant manufacturers or their regional offices to shipping companies, large fleet operators, and shipyards. This channel often involves long-term contracts and technical support services.

- Distributors & Agents: Sales through third-party distributors and agents who provide local market access, warehousing, and logistics services. This channel is crucial for reaching smaller operators and providing timely supply to diverse ports.

- Bunker Suppliers: Integration of lubricant supply with fuel bunkering services, offering a convenient one-stop solution for vessels at port.

Value Chain Analysis For Marine Cylinder Oil Market

The value chain for the Marine Cylinder Oil Market is a complex and multi-layered ecosystem, beginning with the foundational upstream activities and extending through production, distribution, and ultimately, to the end-users in the maritime industry. Upstream analysis reveals the critical role of crude oil refining and the subsequent production of base oils, which form the bulk of any lubricant formulation. Major oil companies, often integrated across the value chain, extract crude oil, refine it into various fractions, and then process specific cuts to produce Group I, Group II, Group III, and increasingly Group IV (PAO) and Group V (esters) base oils. The quality and availability of these base oils significantly influence the performance characteristics and cost structure of the final cylinder oil product. In parallel, a highly specialized chemical industry develops and supplies the complex additive packages—including detergents, dispersants, anti-wear agents, and corrosion inhibitors—that impart the specific performance properties required for marine engines. These upstream suppliers are foundational, as their innovations directly enable lubricant manufacturers to meet evolving engine demands and environmental regulations.

Midstream activities primarily encompass the formulation, blending, and manufacturing processes undertaken by lubricant producers. Leading marine lubricant companies strategically combine various base oils with proprietary additive packages to create specialized cylinder oil formulations with specific Base Numbers (BN) and performance characteristics tailored for different engine types, fuel sulfur contents, and operational conditions. This phase involves extensive research and development, quality control, and testing to ensure compliance with industry standards, engine manufacturer approvals, and regulatory requirements. The blending process itself is highly technical, requiring precision and sophisticated facilities to ensure homogeneity and consistent product quality. Furthermore, packaging and storage are crucial steps to prevent contamination and maintain product integrity before distribution. Efficiency in this midstream segment is paramount, as it directly impacts product cost, reliability, and the ability to respond swiftly to market changes and new regulatory mandates, thereby maintaining a competitive edge in a highly demanding global market.

Downstream analysis focuses on the distribution channels and the ultimate consumption of marine cylinder oils. The distribution network is expansive and global, designed to ensure timely supply to vessels operating in every major port worldwide. This network typically involves a combination of direct sales from lubricant manufacturers to large shipping companies and fleet operators, as well as sales through a vast network of authorized distributors, agents, and bunker suppliers. Direct channels facilitate technical support, long-term contracts, and customized solutions, while indirect channels provide widespread market access, local warehousing, and logistics services to smaller operators and individual vessels. The end-users—shipping companies, vessel owners, and fleet managers—are responsible for procuring, storing, and applying these lubricants according to engine manufacturer specifications and operational requirements. The interaction between lubricant suppliers and end-users often involves technical consultation, oil analysis services, and training to optimize lubricant performance and engine health. The effectiveness of the entire value chain hinges on seamless coordination between all stakeholders, from raw material suppliers to the final application on board, to ensure the efficient and reliable operation of the global maritime fleet.

Marine Cylinder Oil Market Potential Customers

The primary potential customers for marine cylinder oils are the diverse array of entities involved in global maritime transport, ranging from large, multinational shipping conglomerates to individual vessel owners and operators. These customers share a common need for high-performance lubricants that ensure the reliable, efficient, and compliant operation of their marine diesel engines. Specifically, companies that own and operate container ships, bulk carriers, oil tankers, chemical tankers, cruise ships, LNG carriers, and offshore support vessels constitute the core demand base. Their purchasing decisions are influenced by a multitude of factors including the size and composition of their fleet, the type of fuels they consume (e.g., HFO, VLSFO, LNG), their operational routes, regulatory compliance requirements, and their overall commitment to sustainability and cost-efficiency. Long-term contracts and strong technical support are often critical factors in securing these large fleet accounts, as reliability and performance are paramount for minimizing expensive downtime and maximizing vessel uptime.

Beyond the direct vessel owners, other significant potential customers include ship management companies that handle the technical operation, crewing, and maintenance for third-party vessel owners. These entities are responsible for sourcing all necessary consumables, including lubricants, and often have considerable influence over brand selection based on performance, cost-effectiveness, and logistical convenience. Shipyards and engine manufacturers also represent a segment of potential customers, particularly during the newbuild phase or for after-sales service and spare parts. While not direct end-users in the operational sense, their specifications and recommendations for initial fill and subsequent maintenance can significantly impact brand adoption. Furthermore, military and government naval fleets, although often operating under different procurement processes, also require marine cylinder oils for their vessels, albeit with often more stringent performance and security specifications, representing a niche but important customer segment.

The evolving regulatory landscape and technological advancements are also shaping the customer base, creating new segments and demands. For instance, companies investing in alternative fuel vessels (e.g., LNG-powered ships) become potential customers for specialized dual-fuel or gas engine cylinder oils. Similarly, operators seeking to optimize their environmental footprint are increasingly interested in lubricants that contribute to lower emissions and are potentially biodegradable, drawing in customers with strong corporate social responsibility initiatives. The growing trend of digitalization and predictive maintenance also creates opportunities for lubricant suppliers to offer integrated solutions that include oil condition monitoring services, technical analytics, and lubrication management platforms, appealing to customers who prioritize operational data and efficiency gains. In essence, any entity responsible for the reliable and compliant operation of a large two-stroke marine diesel engine, regardless of their specific role in the maritime ecosystem, is a potential customer for marine cylinder oils, with varying needs and purchasing drivers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 3.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces | >|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, TotalEnergies, BP, Chevron, Valvoline, Castrol (BP), Lukoil, Idemitsu, Sinopec, PETRONAS, GS Caltex, JX Nippon Oil & Energy, Repsol, Motul, Indian Oil Corporation, Fuchs Group, SK Lubricants, CIMC Enric, Gulf Oil International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Cylinder Oil Market Key Technology Landscape

The Marine Cylinder Oil Market is a realm of continuous technological advancement, driven by the relentless pursuit of enhanced engine performance, extended component life, and adherence to ever-tightening environmental regulations. At the core of this landscape lies sophisticated additive chemistry. Lubricant manufacturers heavily invest in developing novel additive packages that can perform multiple functions simultaneously: providing superior detergency and dispersancy to keep engines clean, offering robust anti-wear and anti-scuffing properties for piston rings and cylinder liners, and exhibiting excellent acid neutralization capabilities to combat corrosive combustion byproducts. The challenge lies in creating synergistic additive systems that maintain stability and effectiveness under the extreme temperatures, pressures, and varying fuel compositions encountered in large two-stroke marine diesel engines, ensuring optimal protection without compromising other critical lubricant properties.

Another pivotal technological area involves the evolution of base oil formulations. While Group I and Group II mineral base oils remain widely used, there is a growing trend towards higher-performance Group III (hydrocracked) and synthetic base oils (Group IV PAO and Group V esters). These advanced base oils offer superior thermal stability, oxidation resistance, and lower volatility, which translate into longer oil drain intervals, reduced oil consumption, and enhanced engine cleanliness. The selection of base oils is increasingly critical, particularly with the advent of low-sulfur fuels and dual-fuel engines, where specific base oil characteristics are required to ensure compatibility and optimal performance. Furthermore, the integration of bio-based and biodegradable base oils is gaining traction, reflecting the industry's push towards more sustainable and environmentally friendly lubrication solutions, albeit with ongoing challenges in matching the performance of conventional alternatives.

Beyond the chemical composition, the technology landscape is also shaped by digitalization and sensor integration. The development of intelligent lubricants that can interact with onboard monitoring systems is a significant trend. This includes incorporating marker compounds that enable real-time oil condition analysis and the use of smart sensors within engine systems to monitor lubricant film thickness, temperature, and contamination levels. These technologies support condition-based maintenance strategies, allowing operators to optimize lubricant feed rates and schedule oil changes based on actual engine conditions rather than fixed intervals, thereby reducing consumption and maintenance costs. The advancement of AI and machine learning techniques for data analytics also plays a crucial role in predicting lubricant performance, identifying potential engine issues, and tailoring lubrication strategies for specific operational profiles, thereby enhancing overall fleet efficiency and reliability in a data-driven maritime environment.

Regional Highlights

- Asia Pacific (APAC): Dominates the Marine Cylinder Oil Market due to its robust shipbuilding industry, extensive manufacturing base, and high volume of international trade, particularly driven by economic powerhouses like China, Japan, South Korea, and Singapore. The region hosts some of the world's busiest ports and largest shipping fleets, leading to sustained demand for marine lubricants. Rapid industrialization, increasing intra-regional trade routes, and significant investment in port infrastructure further solidify APAC's leading position, with a growing focus on meeting environmental regulations and adopting advanced lubricant technologies.

- Europe: A mature market characterized by stringent environmental regulations, advanced technological adoption, and a strong emphasis on sustainability. Countries such as Germany, the UK, the Netherlands, and Scandinavia are at the forefront of implementing low-emission shipping practices and embracing alternative fuels. This drives demand for specialized low-BN and dual-fuel cylinder oils, alongside bio-lubricants. The region also benefits from a well-established network of lubricant manufacturers and research institutions pushing innovation in marine lubrication solutions, serving a sophisticated fleet with high operational standards.

- North America: Exhibits steady growth, propelled by significant maritime trade through major coastal ports and a focus on regulatory compliance, particularly in Emissions Control Areas (ECAs). The market here is characterized by demand for high-performance, environmentally compliant lubricants, with a growing interest in digital solutions for lubrication management. The presence of major oil and gas players and a technologically advanced shipping sector ensures continuous adoption of cutting-edge cylinder oil formulations, catering to a diverse fleet, including offshore support vessels and domestic cargo carriers.

- Middle East and Africa (MEA): Emerging as a significant growth region, driven by expanding energy exports, increasing intra-regional trade, and strategic geographic location along major shipping lanes. Countries like UAE, Saudi Arabia, and South Africa are investing in port infrastructure and expanding their merchant fleets. This region sees a mixed demand for both high-BN oils for HFO-burning vessels and low-BN oils for compliant ships, as regulatory enforcement varies. Logistical challenges and fluctuating economic conditions, however, can influence market dynamics, but long-term prospects remain strong due to rising trade volumes.

- Latin America: Demonstrates promising growth potential, fueled by increasing commodity exports (e.g., agricultural products, minerals) and expanding international trade. Countries like Brazil, Mexico, and Chile are witnessing investments in port development and fleet modernization. The demand for marine cylinder oils in this region is steadily rising, albeit with regional disparities in technological adoption and regulatory implementation. Local and international lubricant suppliers are focusing on strengthening distribution networks to serve the growing number of vessels operating in the region's diverse maritime environment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Cylinder Oil Market.- ExxonMobil

- Shell

- TotalEnergies

- BP

- Chevron

- Valvoline

- Castrol (BP)

- Lukoil

- Idemitsu

- Sinopec

- PETRONAS

- GS Caltex

- JX Nippon Oil & Energy

- Repsol

- Motul

- Indian Oil Corporation

- Fuchs Group

- SK Lubricants

- CIMC Enric

- Gulf Oil International

Frequently Asked Questions

What are the primary functions of marine cylinder oil in large two-stroke engines?

Marine cylinder oil serves three critical functions: it neutralizes corrosive sulfuric acids formed during combustion of heavy fuel oils, lubricates the cylinder liner and piston rings to prevent wear and reduce friction, and provides sealing between the piston rings and cylinder liner for efficient combustion and power generation. Its composition is highly specialized to withstand extreme temperatures, pressures, and corrosive environments found in these engines, thereby ensuring their long-term reliability and performance under arduous operating conditions.

How have IMO 2020 regulations impacted the demand and types of marine cylinder oils?

The IMO 2020 regulations, which mandated a global cap of 0.5% sulfur content in marine fuels, significantly reshaped the marine cylinder oil market. This led to a surge in demand for low-BN (Base Number) cylinder oils, specifically formulated for vessels burning compliant very low sulfur fuel oils (VLSFOs) or ultra low sulfur fuel oils (ULSFOs). Conversely, high-BN oils continue to be used by vessels equipped with exhaust gas scrubbers that still burn high sulfur fuel oil (HFO). The regulations spurred extensive research and development into new, highly specialized formulations designed to ensure optimal engine protection and cleanliness with the varied chemistries of low-sulfur fuels, preventing issues like cold corrosion and deposit formation.

What role does Artificial Intelligence (AI) play in optimizing marine cylinder oil performance and management?

Artificial Intelligence (AI) is increasingly vital in optimizing marine cylinder oil performance and management by enabling predictive maintenance and enhancing operational efficiency. AI algorithms analyze vast datasets from engine sensors, fuel consumption, and lubricant analysis to predict cylinder wear, optimize lubricant feed rates, and identify potential issues before they escalate. This condition-based monitoring reduces lubricant consumption, extends engine life, minimizes downtime, and contributes to fuel efficiency and lower emissions. AI also assists in the development of new lubricant formulations by accelerating simulations and predicting behavior under diverse operational conditions, leading to more robust and tailored products for modern marine engines.

What are the key drivers for growth in the Marine Cylinder Oil Market?

The key drivers for growth in the Marine Cylinder Oil Market include the sustained increase in global seaborne trade, which directly escalates demand for shipping services and consequently for vessel operation and maintenance. Stricter environmental regulations, particularly those from the IMO, necessitate advanced lubricant formulations compatible with low-sulfur fuels and alternative energy sources. Furthermore, continuous technological advancements in marine engine design, aiming for higher efficiency and lower emissions, demand specialized, high-performance cylinder oils capable of withstanding extreme operational conditions. The increasing adoption of predictive maintenance strategies and digital solutions also fuels demand for advanced lubricant management systems, driving market expansion.

What are the future trends in marine cylinder oil formulation and application?

Future trends in marine cylinder oil formulation and application are heavily influenced by the shipping industry's decarbonization efforts and the adoption of alternative fuels. This includes a growing focus on developing specialized lubricants for LNG, methanol, and ammonia-fueled engines, which require unique additive chemistries. There's also an increasing emphasis on creating bio-based and biodegradable lubricants to improve environmental sustainability. Furthermore, smart lubricants that integrate with digital monitoring systems for real-time condition assessment, predictive maintenance, and optimized feed rates are becoming more prevalent. These innovations aim to enhance engine efficiency, reduce operational costs, and ensure compliance with future environmental regulations, shaping a more sustainable and technologically advanced maritime future.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager