Marine Deck Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436081 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Marine Deck Machinery Market Size

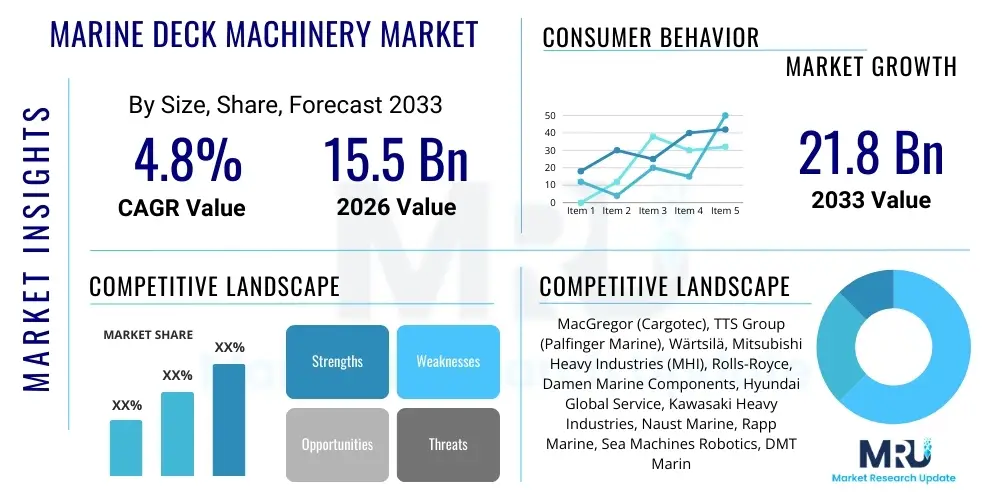

The Marine Deck Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $21.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the sustained expansion of global seaborne trade, necessitating increased capacity and advanced technological integration in newly built and retrofitted vessels. The consistent demand for efficient, safe, and automated operations across diverse marine applications—ranging from large container ships and specialized offshore vessels to naval fleets—drives significant investment in high-performance deck machinery, including sophisticated winches, cranes, and anchoring systems.

Marine Deck Machinery Market introduction

The Marine Deck Machinery Market encompasses all mechanical equipment utilized on the deck of a vessel, crucial for safe navigation, mooring, anchoring, and cargo handling operations. This machinery includes, but is not limited to, anchor windlasses, mooring winches, cargo cranes, steering gear, and specialized handling systems required for offshore activities. The product scope extends across various vessel types, incorporating solutions that rely on hydraulic, electric, and increasingly, hybrid power systems to maximize operational efficiency and minimize environmental impact. Modern deck machinery is characterized by enhanced automation capabilities, enabling precise control and reducing the reliance on manual labor, which in turn improves safety metrics and speeds up critical port operations, directly addressing the pressure points faced by the contemporary maritime logistics sector.

Major applications of marine deck machinery span commercial shipping, offshore exploration and production (E&P), and naval operations. In commercial shipping, machinery is vital for the swift loading and unloading of cargo (cranes and hatch covers) and ensuring vessel security during docking (mooring systems). For the offshore sector, highly customized and robust machinery, such as heavy-duty winches and specialized lifting equipment, is essential for deep-sea installations, pipe laying, and subsea maintenance. The immediate benefit derived from investing in high-quality deck machinery includes improved operational reliability, reduced downtime, compliance with stringent international maritime regulations, and significant fuel efficiency gains achieved through optimized equipment design and power management systems. These systems are integral components ensuring the overall seaworthiness and commercial viability of a vessel.

Key driving factors accelerating market expansion include the continued globalization of trade, which necessitates the expansion of the global merchant fleet, particularly in the container and bulk segments. Furthermore, stringent environmental regulations, particularly those focusing on emissions reduction (IMO 2020 and subsequent guidelines), are pushing ship operators to replace aging, energy-intensive hydraulic systems with modern, electric, or hybrid machinery, offering better power efficiency and lower leakage risks. Technological advancements, such as the integration of smart sensors and IoT connectivity for predictive maintenance and remote monitoring, are also stimulating demand. This shift towards smart shipping requires deck machinery capable of seamless integration into the vessel’s central control and data processing network, facilitating safer and more automated operations in challenging marine environments worldwide.

Marine Deck Machinery Market Executive Summary

The global Marine Deck Machinery Market is currently undergoing a significant transition driven by twin forces of digital transformation and sustainability mandates. Business trends emphasize the shift from conventional hydraulic power transmission systems towards electric and electro-hydraulic solutions, which offer superior energy efficiency, reduced maintenance costs, and easier integration with shipboard power management systems, aligning with the industry’s decarbonization goals. Manufacturers are heavily focused on developing modular and standardized equipment that can be quickly installed and maintained, improving shipyard efficiency and reducing vessel delivery times. Furthermore, the rise of remote diagnostics and data-driven service models is changing the traditional after-sales support landscape, offering vessel operators proactive maintenance schedules and minimizing costly unforeseen equipment failures at sea.

Regional trends indicate that Asia Pacific (APAC), spearheaded by shipbuilding giants like China, South Korea, and Japan, remains the epicenter of demand, accounting for the majority of new installations due to robust new vessel construction activities. However, Europe demonstrates high growth in the retrofit and specialized vessel segments, driven by strong regulatory pushes for energy efficiency and the presence of leading technology providers specializing in high-end offshore and naval machinery. North America shows steady demand, primarily focused on modernizing existing fleets, enhancing security in naval applications, and supporting the burgeoning offshore wind energy sector, which requires highly specialized jacking and handling systems. These regional dynamics highlight a market bifurcated between high-volume production in the East and high-value specialization and retrofitting in the West, ensuring sustained global market activity.

Segment trends confirm that the Electric Winches and Mooring Systems segment is experiencing the fastest rate of adoption, largely displacing older hydraulic models in new builds due to their superior efficiency and lower complexity. The Cargo Handling Machinery segment remains the largest revenue contributor, intrinsically linked to the volume of global container and bulk shipping trade. Within the Vessel Type segmentation, Offshore Vessels and Naval Vessels are driving demand for highly customized, high-specification equipment engineered to withstand extreme operating conditions and meet stringent reliability requirements. Conversely, the Tanker and Bulk Carrier segments prioritize standardized, robust, and cost-effective solutions. The market exhibits a clear trend toward integrated systems where anchoring, mooring, and maneuvering functionalities are managed through a unified digital platform, optimizing performance and safety across all vessel operations.

AI Impact Analysis on Marine Deck Machinery Market

Common user questions regarding AI’s impact on marine deck machinery frequently revolve around automation capabilities, the potential for fully autonomous berthing and anchoring operations, the effectiveness of predictive maintenance using machine learning, and the subsequent implications for crew requirements and training. Users are keen to understand how AI algorithms process sensor data from winches and cranes to anticipate failures, optimize load handling based on real-time sea conditions, and ultimately reduce operational risks. Concerns often focus on the cybersecurity vulnerabilities introduced by increased connectivity and the necessary regulatory framework required to certify AI-driven operations, ensuring safety standards are maintained or exceeded. The overarching expectation is that AI will transform deck machinery from static mechanical components into dynamic, self-optimizing systems, significantly enhancing vessel efficiency and reducing human error in critical maneuvering phases.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is rapidly transitioning marine deck machinery into intelligent assets. AI-powered diagnostic systems analyze continuous data streams—including motor torque, hydraulic pressure, strain gauge readings, and environmental factors—to generate highly accurate Remaining Useful Life (RUL) predictions for critical components. This predictive capability fundamentally shifts maintenance from time-based schedules to condition-based intervention, minimizing unplanned downtime at sea, which is extremely costly for operators. Furthermore, in cargo handling, computer vision combined with ML is used to optimize crane paths and speeds, improving turnaround times in port and enhancing safety by preventing collisions or overloads during complex lifting operations in dynamic environments.

Beyond maintenance and optimization, AI is central to the development of autonomous ship capabilities. AI systems are being trained to manage complex operations such as automated berthing and anchor deployment by integrating inputs from GPS, lidar, cameras, and the vessel’s dynamic positioning system. This integration allows the machinery (winches, thrusters, steering gear) to execute maneuvers with precision far exceeding human capabilities, particularly under high-stress conditions or in congested waterways. While full autonomy is still progressing through regulatory hurdles, the partial automation driven by AI algorithms is already enhancing crew support, reducing workload, and ensuring more consistent execution of standard operating procedures, marking a profound technological shift in how deck operations are managed across the maritime domain.

- AI-driven Predictive Maintenance (PdM) for component failure forecasting, reducing unplanned downtime by up to 30%.

- Machine Learning optimization of cargo crane operations, enhancing loading/unloading speed and ensuring stability during lifts.

- Autonomous Berthing and Mooring Systems utilizing AI to manage winch tension and coordinate movements with dynamic positioning.

- Real-time sensor data analytics for energy consumption optimization across electric and hydraulic machinery systems.

- Enhanced crew safety through AI monitoring of operational envelopes and alerting operators to potentially hazardous conditions or stress levels.

DRO & Impact Forces Of Marine Deck Machinery Market

The Marine Deck Machinery Market is primarily driven by the robust growth in global seaborne trade volumes, which mandates continuous investment in new, larger vessels requiring advanced, heavy-duty deck equipment, alongside mandatory fleet modernization and replacement cycles in developed economies. Restraints include the extremely high capital expenditure associated with sophisticated electric and automated machinery, posing financial barriers, particularly for smaller shipping companies, coupled with the complexity of integrating diverse machinery types under unified control systems. Opportunities are substantial in the burgeoning offshore renewable energy sector, demanding specialized equipment like heavy lift cranes and cable laying machinery, and the global push toward vessel decarbonization, creating a massive retrofit market for energy-efficient electric winches. These dynamics result in a set of impact forces where regulatory compliance (IMO standards) and technological advancements (IoT and electrification) are the primary shapers of market direction, ensuring continuous innovation despite the prevailing cost pressures.

The inherent drivers of the market are deeply rooted in macroeconomics and international regulations. The increasing size of modern container ships and bulk carriers requires significantly more powerful and larger deck machinery, particularly anchoring and mooring systems, to handle the immense loads and inertia of these vessels. Furthermore, regulatory bodies like the IMO are continually updating safety standards (e.g., Load Handling Standards and LSA Code requirements), compelling operators to upgrade or replace legacy equipment with certified, modern machinery that incorporates higher safety factors and enhanced redundancies. The global emphasis on improving port turnaround times also fuels demand for faster, automated cargo handling solutions, where speed and precision are paramount, directly influencing the design specifications of marine cranes and specialized spreaders.

However, the market faces notable restraining factors. The long lifespan of marine assets means replacement cycles are often decades long, slowing down the adoption rate of new technologies. Moreover, the shortage of highly skilled marine engineers capable of maintaining and troubleshooting complex, integrated electro-hydraulic and AI-driven systems represents a significant operational restraint globally. These high costs and logistical challenges are partially mitigated by the burgeoning market opportunities. The strategic expansion into the specialized vessel market—such as cruise ships (requiring advanced stabilization and access systems), mega yachts, and particularly Floating Production Storage and Offloading (FPSO) units and Liquefied Natural Gas (LNG) carriers—offers manufacturers lucrative, high-margin opportunities that balance the volume sales of standard merchant shipping equipment. This continuous interplay between global trade volume, regulatory stringency, capital expenditure barriers, and high-value specialization defines the market’s competitive landscape and growth potential.

Segmentation Analysis

The Marine Deck Machinery market is comprehensively segmented based on the type of product, the vessel on which it is installed, the power source or mode of operation, and its primary application. This detailed segmentation allows manufacturers to target specific niche markets with customized solutions, addressing the unique demands of, for instance, a naval vessel versus a large commercial tanker. The largest segments by value typically include mooring and anchoring systems, given their universal requirement across all vessel types and their critical safety function, closely followed by sophisticated cargo handling equipment, which drives profitability in the commercial sector. The shift toward electric operation is the most notable trend impacting the segmentation by power source, signifying a fundamental technological redirection across all product categories as the industry seeks cleaner and more efficient ship operations globally.

By segmenting the market based on Vessel Type, manufacturers can align their R&D efforts and product ruggedness to the specific environmental and operational stress factors encountered. Offshore vessels, for example, require Dynamic Positioning (DP) compliant winches and specialized subsea cranes that can operate reliably in harsh deep-water environments, whereas container ships prioritize robust, high-speed cargo cranes. Similarly, the Application segment differentiates demand between safety-critical functions (e.g., life-saving appliance handling systems) and revenue-generating functions (e.g., heavy-lift offshore installation). This detailed view ensures that market strategies are highly tailored, capitalizing on growth pockets driven by specific industry needs, such as the increasing demand for specialized equipment to service offshore wind farms.

- Product Type:

- Mooring Systems (Winches, Capstans, Fairleads)

- Anchoring Systems (Windlasses, Anchor Chains)

- Cargo Handling Machinery (Cranes, Davits, Specialized Load Handling)

- Steering Gear and Rudder Systems

- Towing and Lifting Equipment

- Vessel Type:

- Tankers (Oil, Chemical, Gas)

- Bulk Carriers

- Container Ships

- Offshore Vessels (PSVs, AHTS, OSVs, FPSOs)

- Naval and Defense Vessels

- Passenger and Cruise Ships

- Operation/Power Source:

- Hydraulic

- Electric

- Electro-Hydraulic

- Pneumatic

- Application:

- Cargo Operations

- Vessel Positioning and Maneuvering

- Towing and Salvage

- Safety and Emergency Operations (Lifeboat/Rescue Boat Handling)

Value Chain Analysis For Marine Deck Machinery Market

The value chain for marine deck machinery begins with the upstream suppliers providing high-grade raw materials, specifically specialized steel alloys, high-strength cables, precision castings, and complex electronic components like sophisticated sensors and programmable logic controllers (PLCs). The reliability of the final product hinges critically on the quality and certification of these input materials, often requiring sourcing from highly specialized vendors adhering to maritime standards (e.g., ABS, DNV, Lloyd’s Register). Manufacturing involves complex assembly, precision machining of large gears and drums, and the integration of hydraulic or electric power packs. Leading manufacturers often operate integrated facilities to ensure rigorous quality control over the entire production process, particularly for high-specification machinery destined for offshore or naval applications where failure rates must be near zero. This stage is capital-intensive and requires substantial engineering expertise.

The midstream process involves the direct delivery of the finished machinery to shipyards, which act as the primary immediate buyers. Shipyards integrate the deck machinery during the construction or refurbishment phase of the vessel. The distribution channel is heavily skewed towards direct sales and technical consultation, as deck machinery often requires customization based on the vessel’s class, size, and intended route or operation profile. Indirect channels, typically local agents or specialized equipment distributors, play a role in providing maintenance spares and smaller, standardized equipment components to the aftermarket and retrofit segments. The complexity of the equipment mandates close collaboration between the machinery manufacturer and the shipyard’s engineering teams throughout the installation and commissioning phases to ensure seamless integration with the vessel’s hull structure and power systems.

The downstream element of the value chain focuses heavily on after-sales service, spare parts provision, and maintenance contracts, which constitute a significant and profitable revenue stream for market leaders. As vessels operate globally, manufacturers must maintain an extensive worldwide network of certified service engineers and parts depots, often strategically located near major shipping lanes and ports. The adoption of IoT and AI-driven monitoring has led to the emergence of service models based on long-term performance contracts rather than just transactional sales. Potential customers, including major ship owners and offshore operators, place significant weight on the manufacturer’s capability to provide rapid, global support, making the aftermarket service network a critical competitive differentiator in this high-reliability sector.

Marine Deck Machinery Market Potential Customers

The primary customers for the Marine Deck Machinery Market are segmented into distinct operational groups, each possessing unique purchasing drivers and technical requirements. Shipyards represent the most immediate customer base, acquiring machinery for integration into new vessel builds, driven primarily by competitive pricing, adherence to strict delivery schedules, and the ability of the machinery to meet classification society rules required by the eventual vessel owner. Vessel owners and fleet operators, who are the ultimate end-users, exert significant influence over shipyard purchasing decisions, often specifying preferred brands based on historical reliability, global service network availability, and operational efficiency, particularly concerning fuel savings offered by advanced electric systems. These commercial operators are focused intensely on Total Cost of Ownership (TCO), operational uptime, and crew safety features.

A second crucial customer segment comprises global Navies and Coast Guards. These customers prioritize equipment engineered to the highest specifications for reliability, redundancy, and ruggedization, capable of operating effectively under combat or extreme weather conditions. Their procurement processes are often governed by national defense contracts and require highly customized solutions, sophisticated stealth technologies, and strict compliance with military standards, leading to premium pricing but stable, long-term contracts. The purchasing decisions in this sector are heavily influenced by geopolitical considerations, domestic manufacturing capabilities, and strategic partnership agreements between defense contractors and deck machinery suppliers. Equipment for naval use, such as specialized replenishment-at-sea systems or large aircraft elevators, represents the apex of technical complexity in the market.

Finally, the Offshore Oil & Gas and Offshore Renewable Energy industries constitute specialized customer groups. Offshore operators, including drilling contractors and subsea construction companies, require extremely high-capacity mooring systems, ultra-deepwater winches, and dynamic positioning (DP) thrusters that can maintain station in volatile sea states. The nascent but rapidly expanding offshore wind sector is a major consumer of specialized installation vessels (WTIVs) which require heavy-lift cranes, jack-up systems, and precision handling equipment for turbine components. These potential customers base purchasing decisions on proven track records in high-stress environments, certification for hazardous operations, and the ability of the equipment to integrate sophisticated real-time monitoring and safety systems, ensuring regulatory compliance and asset integrity throughout demanding, multi-year projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $21.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MacGregor (Cargotec), TTS Group (Palfinger Marine), Wärtsilä, Mitsubishi Heavy Industries (MHI), Rolls-Royce, Damen Marine Components, Hyundai Global Service, Kawasaki Heavy Industries, Naust Marine, Rapp Marine, Sea Machines Robotics, DMT Marine Equipment, Fincantieri, Liebhherr, ZED Marine, Palfinger AG, KraussMaffei Berstorff, Plimsoll, Huisman Equipment B.V., Kongsberg Gruppen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Deck Machinery Market Key Technology Landscape

The Marine Deck Machinery technology landscape is primarily defined by the ongoing transition from traditional hydraulic systems to advanced electric and electro-hydraulic technology, fundamentally driven by efficiency mandates and environmental regulations. Electric deck machinery (EDM), particularly electric winches and windlasses, offer immediate benefits over hydraulic counterparts, including significantly lower energy consumption, reduced noise and vibration, and minimal risk of hydraulic fluid leaks, which are major environmental hazards. Modern EDM often incorporates Variable Frequency Drives (VFDs) and sophisticated motor control systems, allowing for precise speed and torque management, which is crucial for dynamic operations like active heave compensation (AHC) used on offshore vessels. This technological pivot necessitates substantial investments in power electronics and specialized robust marine electric motors, establishing a high barrier to entry for manufacturers.

Another major technological trend is the pervasive integration of digital monitoring and Internet of Things (IoT) capabilities. Deck machinery is now commonly outfitted with arrays of smart sensors—measuring temperature, pressure, vibration, strain, and electrical current—all feeding data back to a central vessel management system. This connectivity enables condition-based monitoring, real-time diagnostics, and remote technical support, drastically improving equipment reliability and reducing reliance on traditional maintenance checks. The integration of IoT extends to remote operability, where non-critical machinery operations, such as minor tension adjustments or equipment checks, can be performed from the bridge or even shore-based control centers. This increased connectivity is essential for the future development of unmanned or highly automated vessels, where human intervention on deck is minimized.

Furthermore, significant advancements are being made in material science and structural design to enhance the durability and reduce the weight of deck equipment. The utilization of high-strength, lightweight composite materials and optimized gear box designs is increasing the power-to-weight ratio, which is critical for maximizing vessel payload and stability, particularly on complex cargo and offshore vessels. Hydraulic technology, while receding in standard applications, is evolving through smarter electro-hydraulic hybrid systems. These systems leverage the high power density of hydraulics for intermittent, high-load operations (like anchor dropping) while using electric power for standby and low-load continuous operations, representing a practical compromise for vessels where sheer brute force capacity is still a necessity. This focus on hybrid solutions demonstrates a commitment to bridging the gap between legacy reliability and modern efficiency requirements.

Regional Highlights

The global demand for marine deck machinery is highly concentrated geographically, correlating directly with global shipbuilding capacity and major maritime trade routes. Asia Pacific (APAC) stands out as the dominant region, driven by the massive shipbuilding output from yards in China, South Korea, and Japan. These nations collectively account for the majority of the world’s new commercial vessel construction, ensuring continuous, high-volume demand for standard anchoring, mooring, and cargo handling machinery. Furthermore, rapid economic expansion and infrastructural development within Southeast Asia, particularly concerning port expansion and naval modernization programs, further cement APAC’s leadership position in both new installations and specialized equipment procurement. The regional focus often balances cost-effectiveness with regulatory compliance.

Europe represents a crucial market for high-value, specialized deck machinery, dominating the segments related to offshore energy, advanced naval applications, and the construction of specialized vessels like large cruise ships and complex research vessels. European companies are often at the forefront of technological innovation, particularly in developing electric and hybrid systems, active heave compensation technology, and specialized deep-water handling systems required for subsea mining and construction. Stringent environmental regulations imposed by the European Union drive significant investment in retrofitting existing European-flagged fleets with more efficient, modern deck machinery to comply with EEDI (Energy Efficiency Design Index) and EEXI (Energy Efficiency Existing Ship Index) requirements, creating a robust aftermarket opportunity.

North America maintains a stable market position, primarily focused on the modernization of the domestic fleet (Title XI financing), increasing activity in the Gulf of Mexico offshore sector, and substantial investment in the US Navy and Coast Guard fleet renewal programs. The emergence of the offshore wind energy sector along the Atlantic coast presents a rapidly accelerating demand for specialized installation and support vessel machinery, adhering to strict Jones Act requirements which favor domestic manufacturing or assembly. The Middle East and Africa (MEA) region, though smaller, exhibits significant potential driven by strategic port developments, naval expansion, and continued, albeit fluctuating, investment in offshore oil and gas exploration infrastructure, particularly in the Arabian Gulf and West African deep waters, necessitating heavy-duty, certified equipment.

- Asia Pacific (APAC): Dominant market share due to global shipbuilding leadership; high volume of new construction, particularly Bulk Carriers and Container Ships; rising naval modernization across Southeast Asia.

- Europe: Leading market for high-specification equipment, technology innovation (electric/hybrid), and high-value retrofits; strong demand driven by offshore wind, cruise ship construction, and strict environmental mandates.

- North America: Stable demand fueled by naval spending, domestic fleet renewal, and rapid expansion of the US offshore wind market; focus on high-reliability, certified equipment for challenging operational zones.

- Middle East & Africa (MEA): Growth driven by strategic oil & gas infrastructure projects and significant port expansion initiatives in key maritime hubs like the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Deck Machinery Market.- MacGregor (Cargotec)

- TTS Group (Palfinger Marine)

- Wärtsilä

- Mitsubishi Heavy Industries (MHI)

- Rolls-Royce

- Damen Marine Components

- Hyundai Global Service

- Kawasaki Heavy Industries

- Naust Marine

- Rapp Marine

- Sea Machines Robotics

- DMT Marine Equipment

- Fincantieri

- Liebhherr

- ZED Marine

- Palfinger AG

- KraussMaffei Berstorff

- Plimsoll

- Huisman Equipment B.V.

- Kongsberg Gruppen

Frequently Asked Questions

Analyze common user questions about the Marine Deck Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of electric deck machinery over hydraulic systems?

The shift is primarily driven by global environmental regulations and the need for greater energy efficiency. Electric systems offer significantly lower fuel consumption, reduced maintenance costs, and eliminate the risk of hydraulic oil leakage, aligning with industry decarbonization goals and EEDI/EEXI compliance.

How is digitalization impacting the reliability and maintenance of marine deck equipment?

Digitalization, through IoT sensors and AI/ML integration, enables Condition-Based Monitoring (CBM) and Predictive Maintenance (PdM). This allows operators to monitor the health of winches and cranes in real-time, accurately forecasting component failures and minimizing unscheduled vessel downtime, thereby dramatically increasing reliability.

Which geographic region holds the largest market share for new deck machinery installations?

The Asia Pacific (APAC) region holds the largest market share, predominantly due to the concentration of the world's largest shipyards in countries such as China, South Korea, and Japan, which drive high-volume demand for deck machinery in new commercial vessel construction.

What role does the offshore wind energy sector play in marine deck machinery demand?

The offshore wind sector is a critical growth opportunity, creating specialized demand for heavy-lift cranes, precise jacking systems for installation vessels (WTIVs), and advanced cable laying machinery, all requiring high-specification, reliable, and durable deck equipment.

Are autonomous ships currently utilizing advanced deck machinery, and what are the limitations?

Yes, autonomous vessel prototypes and highly automated vessels utilize advanced, AI-integrated deck machinery for operations like automated anchoring and mooring. Current limitations involve regulatory frameworks, standardization challenges, and the need for robust cybersecurity measures to ensure safe, uncrewed operation in international waters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager