Marine Loading Arms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434985 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Marine Loading Arms Market Size

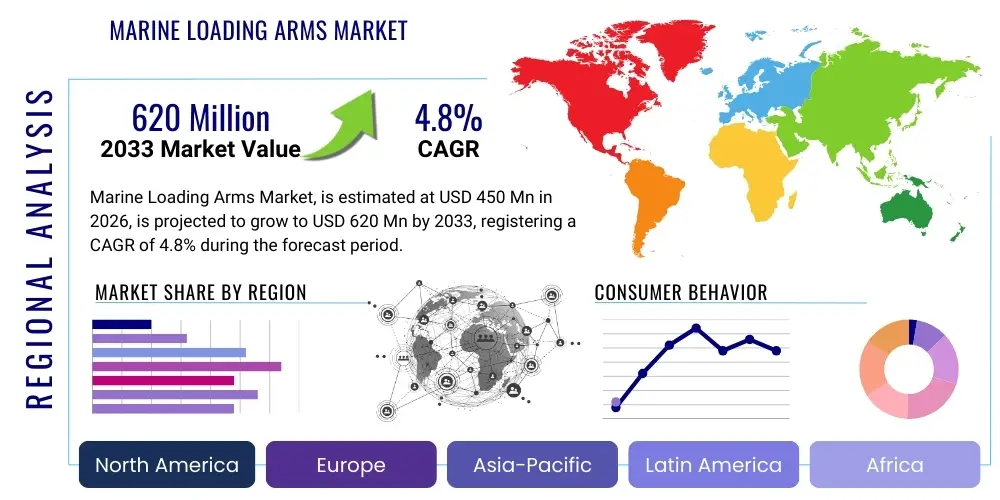

The Marine Loading Arms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033.

Marine Loading Arms Market introduction

The Marine Loading Arms Market encompasses specialized mechanical systems designed for the safe and efficient transfer of bulk liquids, gases, and powders between marine vessels (tankers, barges) and storage facilities on shore. These essential pieces of equipment replace traditional hose connections, offering superior structural integrity, operational flexibility, and enhanced safety features, especially when handling hazardous or volatile substances such as crude oil, refined petroleum products, Liquefied Natural Gas (LNG), and various chemicals. The primary function of marine loading arms is to maintain a continuous, leak-proof connection despite the movement caused by tides, waves, and cargo loading variations, ensuring environmental compliance and reducing spill risks during high-volume transfer operations.

Product sophistication is driven by the need for larger transfer capacities and increased automation. Modern marine loading arms incorporate complex swivel joints, counterweight systems, and sophisticated hydraulic controls that allow for significant operational envelopes in three dimensions—vertical, horizontal, and radial movement—essential for accommodating the drift and size variations of modern supertankers. Major applications are concentrated within port terminals, refineries, petrochemical plants, and large-scale gas processing facilities. The reliability and speed offered by these systems are paramount, directly impacting the throughput and efficiency of global trade logistics, particularly in the energy sector where rapid loading and unloading cycles are crucial for profitability.

Key benefits include drastically improved safety due to integrated emergency release couplings (ERC) and automated monitoring systems, minimal product loss, and operational longevity compared to flexible hoses which require frequent replacement. Driving factors for market growth involve the escalating global demand for energy, leading to increased maritime trade of oil and gas, coupled with stringent international regulations (such as those imposed by IMO and local environmental agencies) requiring safer, more contained transfer methods. The expansion of LNG infrastructure globally, driven by the transition toward cleaner energy sources, further solidifies the demand for cryogenic loading arms designed to handle extreme low temperatures.

Marine Loading Arms Market Executive Summary

The Marine Loading Arms Market exhibits steady growth, predominantly fueled by global investments in upstream and downstream oil and gas infrastructure and the burgeoning liquefied natural gas (LNG) trade. Current business trends indicate a strong shift towards highly automated and intelligent loading systems equipped with condition monitoring sensors and advanced diagnostic capabilities to minimize downtime and enhance predictive maintenance schedules. Key stakeholders are focusing on developing loading arms capable of handling diverse products, including highly viscous crude oil and extremely low-temperature LNG, necessitating material innovation and robust design methodologies. Furthermore, consolidation among leading manufacturers is driving standardization of safety protocols, improving the overall product reliability offered to end-users.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive industrialization in countries like China, India, and Southeast Asian nations, leading to extensive construction of new ports and refining capacity. North America and Europe, while mature markets, emphasize replacement cycles and modernization projects, driven primarily by stricter environmental mandates and the need to upgrade aging infrastructure to handle larger vessels (VLCCs and ULCCs). The growth in the Middle East and Africa (MEA) is intrinsically linked to their role as major global hydrocarbon exporters, necessitating continuous investment in high-capacity loading terminals to manage export volumes efficiently. These regional dynamics create varied demand profiles, ranging from new installations in developing economies to technological upgrades in established ones.

Segment trends reveal a noticeable preference for hydraulically powered loading arms due to their precise control and high load-bearing capacity, crucial for handling large tankers. In terms of application, the Oil & Gas segment, particularly the sub-segment concerning LNG and LPG transfer, is witnessing exponential growth, reflecting the global energy transition strategies. Moreover, the demand for fixed reach arms remains high for standardized terminals, while customized, variable reach designs are increasingly sought after for terminals with complex dockside layouts or multi-product handling requirements. Manufacturers are strategically positioning themselves by offering modular solutions that can be quickly adapted to different fluid characteristics and port specifications, ensuring market responsiveness to evolving energy logistics.

AI Impact Analysis on Marine Loading Arms Market

User queries regarding AI's influence in the Marine Loading Arms Market frequently revolve around automation capabilities, predictive maintenance accuracy, and the integration of smart sensors for enhanced operational safety. Users are primarily concerned with how AI-driven systems can manage dynamic environmental conditions—such as unpredictable vessel drift and wave action—more effectively than traditional hydraulic control loops. Key expectations center on achieving "zero-spill" operations through real-time anomaly detection and predictive failure analysis of critical components like swivel joints and emergency release systems (ERS). There is also significant interest in using machine learning algorithms to optimize loading schedules and flow rates, thereby maximizing port throughput and minimizing the idle time of expensive maritime assets, positioning AI as a crucial tool for both safety assurance and economic efficiency.

- AI-powered Predictive Maintenance: Utilization of machine learning to analyze vibration, pressure, and temperature data from loading arm components, predicting failure points (especially in swivel joints) up to weeks in advance, drastically reducing unplanned downtime.

- Automated Dynamic Positioning: AI algorithms adjust arm position instantaneously based on real-time data input from laser sensors and GPS on the vessel, maintaining optimal connection integrity despite high winds or turbulent waters.

- Optimized Flow Control: AI determines the most efficient product transfer rates, adjusting pump speeds and valve positions dynamically to prevent surges, cavitation, and stress on the piping system, leading to safer and faster operations.

- Enhanced Safety Monitoring: Computer vision and deep learning models monitor the coupling process and surrounding environment for human errors or unauthorized access, providing instant alerts to terminal operators.

- Digital Twin Implementation: Creation of high-fidelity virtual models of the loading arm and terminal operations, allowing operators to simulate various scenarios and train AI systems for complex emergency response procedures.

DRO & Impact Forces Of Marine Loading Arms Market

The dynamics of the Marine Loading Arms Market are characterized by powerful internal drivers and external forces that shape investment and technological development. The core drivers include the undeniable global dependency on maritime transport for energy resources, particularly the movement of crude oil, refined products, and specialized gases like LNG and ammonia. Furthermore, governmental and international regulatory bodies are continuously tightening environmental and safety standards—suchately demanding the replacement of older, less reliable hose systems with modern, permanently installed loading arms equipped with advanced safety features like automatic disconnect systems (ADS) and emergency release couplings (ERC). This legislative push acts as a consistent market stimulant, ensuring a steady demand for modern, compliant equipment across all major trading ports.

However, the market faces significant restraints. The initial capital expenditure for constructing and installing a marine loading arm system is exceptionally high, often involving complex civil engineering and specialized hydraulic and control systems, which can deter smaller port operators or necessitate substantial long-term financing. Furthermore, the operational environment is demanding; marine environments accelerate corrosion and wear, necessitating expensive, specialized maintenance routines and highly skilled technical personnel, contributing significantly to the total cost of ownership (TCO). Geopolitical instability and trade disputes also pose risks, potentially slowing down major infrastructure projects in key resource-exporting regions, thus delaying equipment procurement decisions.

Opportunities are strongly concentrated in the rapid expansion of the global LNG infrastructure, driven by the global energy transition. This transition necessitates advanced cryogenic loading arms, which represent a high-value segment. Additionally, the increasing focus on automation and remote operation presents opportunities for manufacturers to integrate IoT sensors, robotics, and AI into their products, improving efficiency and reducing the need for human intervention in hazardous environments. The rising adoption of cleaner fuels, such as green ammonia and methanol for shipping, also opens up niche markets requiring specialized, corrosive-resistant loading arm designs. The primary impact forces are regulatory mandates, technological advancement (automation), and global energy price volatility, the latter directly influencing investment decisions in oil and gas export/import facilities.

Segmentation Analysis

The Marine Loading Arms Market is intricately segmented based on Type, Design, Application, and Capacity, reflecting the specialized requirements of maritime fluid transfer operations worldwide. Understanding these segments is crucial for manufacturers to tailor their product offerings to specific terminal needs, whether it involves handling highly volatile chemical feedstocks or massive volumes of crude oil. The segmentation highlights the critical difference between legacy manual systems and sophisticated hydraulic units, which offer the precision and power required for large-scale, high-pressure transfers, setting the trajectory for future market development focused on reliability and operational speed.

In terms of application, the dominance of the Oil & Gas sector is undeniable, yet the fastest growth is seen within the specific niches of Liquefied Natural Gas (LNG) and Liquefied Petroleum Gas (LPG) due to global efforts to transition to cleaner energy and the subsequent proliferation of regasification and liquefaction terminals. Design segmentation differentiates between standard fixed-reach arms, suitable for dedicated berths with minimal vessel variation, and highly flexible variable-reach arms, often necessary for multi-purpose jetties or terminals accommodating a wide range of ship sizes and types. This variability in design underscores the market’s need for customizable solutions that maximize terminal utilization.

The underlying technical specifications related to capacity—low, medium, or high—are directly linked to the operational scale of the terminal and the size of the vessels being served, influencing the necessary structural integrity and hydraulic system power. Furthermore, the segmentation by Type—manual, hydraulic, and pneumatic—reflects the evolution of control mechanisms, with hydraulic systems now dominating the high-capacity transfer segment owing to their robust control and handling capabilities under extreme load. These segmentations collectively enable a precise market analysis, identifying high-growth areas such as high-capacity LNG arms and advanced hydraulic systems for crude oil export.

- By Type:

- Manual Loading Arms

- Hydraulic Loading Arms

- Pneumatic Loading Arms

- By Design:

- Fixed Reach Loading Arms

- Variable Reach Loading Arms (Articulated and Straight Boom Designs)

- Truck/Barge Loading Arms (Small Scale)

- By Application:

- Oil & Gas

- Crude Oil Transfer

- Refined Petroleum Products (Gasoline, Diesel)

- Liquefied Natural Gas (LNG)

- Liquefied Petroleum Gas (LPG)

- Chemical and Petrochemical

- Bulk Liquids (e.g., Molasses, Edible Oils)

- Oil & Gas

- By Capacity:

- Low Capacity (Up to 6 inches)

- Medium Capacity (8 to 12 inches)

- High Capacity (14 inches and above)

Value Chain Analysis For Marine Loading Arms Market

The value chain for the Marine Loading Arms Market is complex, starting with the specialized procurement of high-grade raw materials and extending through sophisticated manufacturing, installation, and long-term maintenance services. Upstream analysis reveals reliance on specialized suppliers for critical components, especially materials resistant to specific products (like stainless steel for chemical resistance or specialized alloys for cryogenic temperatures) and high-precision mechanical parts such as swivel joints and hydraulic cylinders. The procurement phase requires rigorous quality control, as the failure of a single component, like a seal or a swivel joint bearing, can lead to catastrophic spills, emphasizing the need for robust supplier partnerships and material traceability throughout the manufacturing process.

The midstream focuses on engineering, fabrication, and assembly. Manufacturers invest heavily in R&D to optimize stress resistance, improve swivel joint reliability, and integrate advanced sensor technology. The construction phase is highly customized, as loading arms must be tailored to the specific berth geometry, vessel type, and product characteristics of the end-user terminal. Distribution channels are typically direct or through highly specialized local agents and engineering procurement and construction (EPC) contractors who manage the full terminal project lifecycle. Given the complexity and high cost, standard off-the-shelf distribution is rare; instead, sales involve consultative selling, detailed engineering specifications, and long lead times.

Downstream activities center around installation, commissioning, and continuous post-sales service. The installation process is critical, often requiring specialized teams to integrate the arms into the terminal’s piping and control infrastructure. The most significant value addition in the downstream segment comes from maintenance, inspection, and refurbishment services, particularly for systems operating in harsh marine environments. Direct interaction with the customer (terminal operators) for maintenance contracts and spare parts supply generates significant recurring revenue. Indirectly, consultants and certification bodies play a vital role, ensuring compliance with international maritime safety standards, thereby facilitating market acceptance and adoption of new technologies.

Marine Loading Arms Market Potential Customers

Potential customers for Marine Loading Arms are predominantly large-scale industrial entities and governmental port authorities that manage the logistics of bulk fluid and gas transfer globally. The primary end-users are major national and international oil companies (NOCs and IOCs) operating vast refinery complexes and export terminals for crude oil and refined products. These entities require high-capacity, durable arms capable of sustained operation under peak loading demands, prioritizing safety standards and operational efficiency to maintain their supply chain integrity. The investment cycles of these large energy players directly dictate the demand volatility in the loading arms market.

A rapidly expanding customer base includes operators of Liquefied Natural Gas (LNG) terminals—both export liquefaction plants and import regasification terminals. As global energy consumption shifts toward gas, these customers require specialized, often proprietary, cryogenic loading arms that can safely handle fluid transfer at temperatures as low as -162°C. Furthermore, chemical and petrochemical manufacturers running specialized port facilities represent a steady customer segment, needing loading arms engineered with specific corrosion-resistant materials to handle aggressive chemical feedstocks and finished products like ammonia, methanol, and specialty solvents.

In addition to the private sector, governmental and quasi-governmental port authorities and military logistics organizations also constitute key buyers, particularly when upgrading older port infrastructure or constructing new strategic storage facilities. These public entities often prioritize compliance with stringent public safety regulations and look for providers offering long-term reliability and comprehensive service agreements. The decision-making process for these customers is characterized by detailed engineering tenders, focusing heavily on safety certifications, proven operational track records, and the ability of the manufacturer to provide customized installation and maintenance solutions specific to their geographical location and climatic conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% ( CAGR ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FMC Technologies (TechnipFMC), Emco Wheaton (IDEX Corporation), Wiese Europe, Sentry Equipment, Jereh Global Development, MIB Italiana, Woodfield Systems, Loadtec Engineered Systems, Kanon Loading Equipment, Marine Loading Systems, Yokogawa Electric Corporation, OPW Engineered Systems, Varec, Inc., C.R.P. Group, Carbo-Link. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Loading Arms Market Key Technology Landscape

The technological evolution within the Marine Loading Arms market is driven primarily by the need for enhanced safety, efficiency, and reliability in dynamic operational settings. A crucial core technology remains the precision engineering of swivel joints, which allow rotational movement under high pressure and temperature without leakage. Advancements here focus on optimizing seal longevity, reducing friction, and ensuring robustness against corrosive agents and extreme temperatures, particularly critical for cryogenic applications where materials must withstand significant thermal cycling. Hydraulic control systems are increasingly sophisticated, moving away from simple manual controls toward integrated proportional valving and electro-hydraulic actuators that allow for highly precise maneuvering and delicate docking procedures, minimizing shock loads on the vessel connection point.

The modern technology landscape is heavily influenced by digitalization and sensor integration. Loading arms are now equipped with extensive arrays of sensors—including inclination sensors, pressure transducers, temperature probes, and proximity sensors—that feed real-time data into a central control unit. This allows for continuous monitoring of the arm's stress points, position relative to the vessel, and integrity of the transfer process. A key innovation is the Emergency Release Coupling (ERC) technology, which utilizes automated sensors and hydraulic triggers to safely and rapidly disconnect the loading arm from the vessel in a controlled manner during unexpected vessel drift or terminal emergency, effectively minimizing the risk of major spills or structural damage.

Furthermore, technology is rapidly moving toward full automation and remote diagnostics, heavily leveraging the principles of Industry 4.0. Laser-guided docking systems ensure accurate alignment between the arm and the vessel manifold, reducing operator error and speeding up connection time. Manufacturers are also integrating Industrial Internet of Things (IIoT) platforms for remote condition monitoring, enabling predictive maintenance schedules. This shift from reactive to predictive servicing extends the operational lifespan of the equipment and significantly reduces the total cost of ownership for terminal operators, making advanced loading arm technology a vital component of smart port infrastructure planning worldwide.

Regional Highlights

- North America: This region is characterized by a mature market with high safety and environmental compliance standards, driving demand for technologically advanced replacement systems and upgrades. The proliferation of LNG export facilities, particularly along the US Gulf Coast, mandates substantial investment in high-capacity cryogenic loading arms. Operational excellence and minimization of environmental risk are key purchase drivers, leading to the early adoption of AI-driven predictive maintenance and automated positioning systems.

- Europe: Europe remains a key innovator in terminal efficiency and environmental protection. Demand is stable, primarily driven by the modernization of existing oil refining infrastructure and the continuous expansion of LNG receiving terminals across Northern and Southern Europe. Strict adherence to EU safety directives necessitates frequent upgrades and replacements of older equipment. Key countries, including the Netherlands, Germany, and the UK, focus on integrating loading arms into complex, multi-modal transport hubs, requiring highly flexible, customized designs.

- Asia Pacific (APAC): Representing the fastest-growing market, APAC’s demand is fueled by massive infrastructure investment, rapid industrial growth, and surging energy consumption, particularly in China, India, and Southeast Asia. The region is building new greenfield refineries, petrochemical complexes, and LNG import facilities at an unprecedented rate. This leads to high demand for new installations rather than just replacements. Price competitiveness, coupled with robust technical service capabilities, is crucial for market penetration in this dynamic region.

- Middle East and Africa (MEA): This region is critical due to its status as the world’s largest exporter of crude oil and gas. Demand is driven by large-scale capital projects aimed at increasing export capacity and maximizing loading efficiency for VLCCs (Very Large Crude Carriers) and ULCCs (Ultra Large Crude Carriers). The focus is on high-throughput, heavy-duty loading arms designed to withstand high operational frequency and extreme climatic conditions. State-owned enterprises dominate procurement, emphasizing reliability and long-term service agreements.

- Latin America: Market growth here is largely tied to specific national energy policies and the development of deep-water oil reserves (e.g., Brazil). While volatile, there are significant opportunities in infrastructure modernization and the establishment of new petroleum handling terminals, particularly in countries stabilizing their export capabilities. Investment decisions are highly sensitive to global commodity prices and government financing, necessitating modular and cost-effective solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Loading Arms Market.- FMC Technologies (TechnipFMC)

- Emco Wheaton (IDEX Corporation)

- Wiese Europe

- Sentry Equipment

- Jereh Global Development

- MIB Italiana

- Woodfield Systems

- Loadtec Engineered Systems

- Kanon Loading Equipment

- Marine Loading Systems

- Yokogawa Electric Corporation

- OPW Engineered Systems

- Varec, Inc.

- C.R.P. Group

- Carbo-Link

- Tianjin Dingli Engineering Co., Ltd.

- Guangzhou Ocean Loading Equipment Co., Ltd.

- Trelleborg Group

- Seatrax, Inc.

- Zhejiang Aike Pipeline Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Marine Loading Arms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between hose systems and marine loading arms?

Marine loading arms offer superior safety, durability, and operational efficiency compared to flexible hose systems. Loading arms feature rigid piping, counterbalanced support, precise hydraulic controls, and integrated emergency release mechanisms (ERC), making them essential for high-volume, high-pressure, and hazardous fluid transfers, significantly reducing spill risk and maintenance frequency.

How does the expansion of LNG trade influence the demand for loading arms?

The rapid growth of the global LNG trade is a key market driver, specifically increasing demand for specialized cryogenic loading arms. These arms must be engineered with nickel alloys and advanced insulation to handle super-cooled liquefied gas (-162°C) safely, representing a high-value, high-technology segment of the overall market.

What role does automation and AI play in modern loading arm operations?

Automation, guided by AI and sensor integration, is crucial for enhancing safety and efficiency. AI algorithms power predictive maintenance, monitoring swivel joint integrity and preventing unplanned downtime. Furthermore, automated positioning systems use laser technology to achieve precise, rapid vessel connection, minimizing human error in hazardous docking procedures.

Which geographical region exhibits the highest growth potential for Marine Loading Arms?

The Asia Pacific (APAC) region demonstrates the highest growth potential due to massive investments in new port infrastructure, refinery construction, and LNG import terminals across nations like China, India, and Southeast Asia. This region's need for new installations far surpasses the replacement demand seen in mature markets.

What are the main segments of Marine Loading Arms by capacity and application?

Capacity segments range from Low (under 6 inches) to High (14 inches and above), correlating with vessel size and transfer volume. Application segments are dominated by Oil & Gas (crude, refined products, and LNG/LPG) but also include significant usage in the Chemical, Petrochemical, and specialized Bulk Liquid transfer industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager