Marine Stoves and Ovens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431700 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Marine Stoves and Ovens Market Size

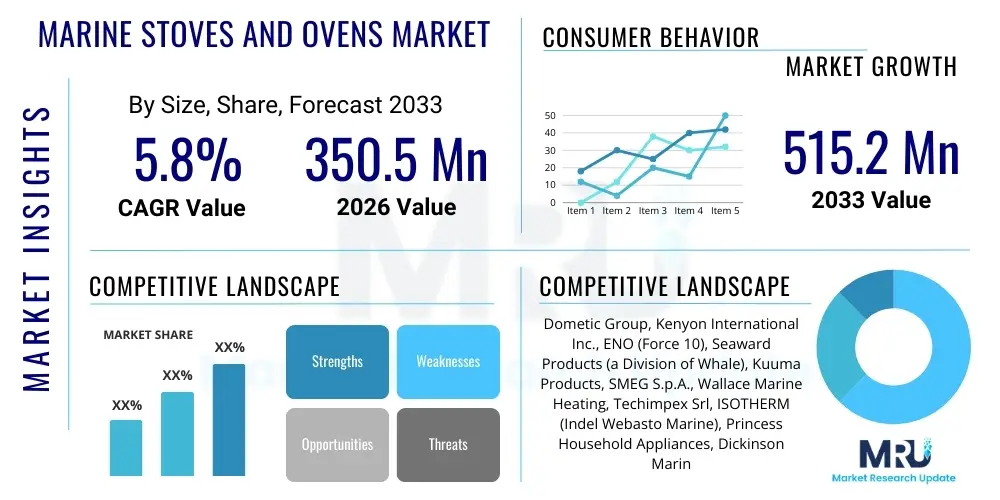

The Marine Stoves and Ovens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 515.2 Million by the end of the forecast period in 2033.

Marine Stoves and Ovens Market introduction

The Marine Stoves and Ovens Market encompasses specialized cooking appliances designed for installation and use aboard various marine vessels, ranging from small recreational yachts and cruising sailboats to large commercial ships and naval vessels. These devices are engineered to operate safely and efficiently in dynamic environments, accommodating the unique challenges of movement, limited space, and safety regulations associated with maritime operations. The primary product categories include freestanding units, built-in cooktops, and integrated stove/oven combinations, utilizing fuel sources such as Liquefied Petroleum Gas (LPG), electricity (AC/DC), diesel, and alcohol, each selected based on vessel size, intended use, and regional safety standards. The necessity for reliable food preparation capabilities during long voyages or extended stays at sea drives the consistent demand for these durable, marine-grade appliances. The market is highly segmented by vessel type and fuel preference, emphasizing compact design, energy efficiency, and robust construction capable of resisting corrosive saltwater environments.

Major applications for marine cooking systems span the recreational boating segment, including luxury cruisers, fishing boats, and charter yachts, where comfort and domestic amenities are paramount, as well as the commercial maritime industry, which requires heavy-duty, certified equipment for crew galleys on tankers, cargo ships, and offshore platforms. The benefits derived from these specialized products include enhanced onboard safety through features like flame failure devices and gimbal mounts that keep appliances level regardless of sea conditions, improved energy management optimized for battery or limited fuel sources, and maximized spatial efficiency through smart, integrated designs. Marine stoves and ovens are fundamental components of a vessel’s infrastructure, ensuring crew and passenger welfare by providing access to hot meals, which is crucial for morale and operational effectiveness, especially on extended trips where shore access is infrequent or impossible. The continuous advancement in material science, particularly in stainless steel alloys and composite materials, is leading to lighter yet more durable appliances that can withstand the harsh marine climate.

Driving factors in this market include the sustained growth in the global recreational boating industry, particularly in North America and Europe, coupled with the rising trend of extended liveaboard cruising. Furthermore, strict international maritime safety regulations (e.g., those imposed by the IMO and classification societies) necessitate the periodic replacement and upgrade of older, non-compliant galley equipment, providing a stable replacement demand cycle. Technological innovations focusing on induction cooking for improved energy efficiency and enhanced safety, mitigating the risks associated with open flames, are also accelerating market penetration in the high-end yachting sector. The increasing global fleet size of commercial vessels, driven by expanding international trade, ensures continuous demand for robust, certified galley equipment suitable for large crew capacities and rigorous, continuous use in harsh operational environments. The convenience, safety, and operational longevity offered by modern marine appliances position them as essential capital investments for both private and commercial vessel owners.

Marine Stoves and Ovens Market Executive Summary

The Marine Stoves and Ovens Market is characterized by steady growth underpinned by the dual pressures of luxury consumer demand in recreational marine sectors and regulatory compliance requirements in commercial shipping. Business trends indicate a strong shift towards induction and electric cooking systems, driven by increasing safety concerns related to propane and alcohol use on smaller vessels, alongside advancements in marine battery technology that make electric power viable. Manufacturers are focusing heavily on developing compact, highly durable, and energy-efficient models that integrate seamlessly into modern galley designs, often incorporating smart features for enhanced user control and diagnostics. Geographically, North America and Europe remain the core revenue generators due to high vessel ownership rates and robust regulatory frameworks, though the Asia Pacific region is demonstrating the highest growth trajectory, fueled by burgeoning shipbuilding activities and rising disposable incomes leading to greater recreational boat purchases in coastal economies like China and Australia. The competitive landscape is moderately fragmented, with specialized marine equipment suppliers competing through product innovation, certified quality, and established distribution networks focused on shipyards and marine supply retailers.

Regional trends highlight distinct market dynamics. European markets prioritize certified gas systems (LPG) alongside specialized diesel-powered stoves, particularly in Northern European cruising where diesel is already plentifully carried for propulsion and heating. Conversely, North America shows a greater adoption rate of advanced electric and induction cooking systems, often installed in larger, high-amperage luxury yachts. The Asia Pacific commercial sector is defined by high-volume demand for robust, entry-level, and mid-range gas and electric ovens designed for large crew sizes on cargo and fishing fleets. The drive toward sustainability is also influencing procurement, with some major shipping lines beginning to evaluate greener power solutions for galleys, although traditional fuels like LPG and diesel remain dominant due to their high energy density and reliability in remote settings. Government subsidies and infrastructure investments in recreational marine facilities, such as new marinas and improved docking capabilities, indirectly support market growth by facilitating boat ownership and usage, thus requiring the installation and maintenance of quality cooking facilities.

Segmentation trends reveal that the Gas/LPG segment currently holds the largest market share due to its established reliability and ease of installation, particularly outside regions with limited electrical capacity. However, the Electric and Induction segment is poised for the fastest growth, propelled by safety advantages—eliminating open flames and stored combustible fuel risks—and technological advancements making electric cooking practical at sea. In terms of application, the Recreational Vessel segment dominates the market volume, driven by high customization rates and the focus on residential-quality amenities for liveaboards and cruisers. Conversely, the Commercial Vessel segment, while lower in unit volume, demands higher-specification, durable, and costly equipment, contributing significantly to revenue value and maintaining stringent standards dictated by maritime regulatory bodies. The aftermarket segment for replacement parts and upgrades also represents a substantial revenue stream, ensuring market stability even during periods of slow new vessel construction, as existing fleets require ongoing maintenance and modernization to remain compliant and operational.

AI Impact Analysis on Marine Stoves and Ovens Market

User inquiries regarding the integration of Artificial Intelligence (AI) in marine galley equipment frequently center on enhanced safety monitoring, predictive maintenance capabilities, and energy optimization. Users are keen to understand how AI can reduce the inherently higher risks associated with cooking at sea, such as detecting minor gas leaks before they become critical or shutting down appliances automatically upon sensing dangerous temperature excursions or high vessel motion (gimbal lock). Furthermore, significant interest exists in using AI algorithms to manage power consumption of high-draw electric ovens and induction cooktops, optimizing usage patterns based on available battery capacity, generator cycling, and time of day, crucial for energy management on off-grid vessels. The expectations revolve around creating truly "smart galleys" that not only cook efficiently but also autonomously diagnose faults, predict component failures, and assist in inventory management, translating to reduced operational downtime and improved safety profiles for both recreational and commercial users. The adoption of AI is not about replacing the core function of heating food, but rather adding layers of intelligent control and safety oversight that address the unique challenges of the marine environment, offering a significant value proposition in terms of crew safety and operational efficiency, especially for large, modern, and complex vessels where integrated system management is vital. This focus on preventative safety measures using continuous data analysis is expected to become a key differentiator in the high-end market segment, offering vessel owners peace of mind and reducing insurance liabilities related to galley incidents.

- AI-Powered Safety Monitoring: Real-time analysis of gas pressure, ambient temperature, and heat signatures, enabling proactive shutdown or alarm triggering in emergency situations or sensing combustion issues. AI models are trained on failure signatures to differentiate genuine threats from normal operational variances, minimizing false alarms.

- Predictive Maintenance Schedules: Algorithms analyze usage data, temperature fluctuations, and component stress to forecast potential failures of heating elements, igniters, or control boards, recommending timely replacements well before catastrophic failure occurs, crucial for vessels on long voyages.

- Optimized Energy Management: AI systems intelligently modulate the power draw of electric stoves based on the vessel’s available electrical load and battery state of charge, preventing power outages and maximizing energy efficiency by optimizing cooking cycles to align with low-cost or high-availability power periods.

- Automated Cooking Assistance: Integration of AI for precise temperature control and timed operations, particularly beneficial in high-volume commercial kitchens, ensuring consistent food quality despite rough sea conditions by dynamically compensating for vessel movement and ambient temperature changes.

- Supply Chain and Inventory Tracking: Use of computer vision or sensor data coupled with AI to manage food inventory within associated refrigeration units and monitor required consumables for the stove and oven systems (e.g., fuel levels), automating reordering processes for long duration trips.

- Enhanced User Interface and Diagnostics: Implementation of machine learning to personalize cooking settings based on crew preferences and simplify troubleshooting via intuitive diagnostic reporting accessible through marine navigation displays, reducing reliance on specialized technicians for minor faults.

- Dynamic Ventilation Control: AI systems analyze cooking activity and ambient air quality to adjust galley ventilation rates automatically, minimizing heat buildup and ensuring optimal air quality, contributing to crew comfort and regulatory compliance (e.g., MARPOL).

DRO & Impact Forces Of Marine Stoves and Ovens Market

The market for marine stoves and ovens is significantly shaped by a confluence of driving factors, restrictive constraints, and opportunistic pathways, all magnified by critical external impact forces. Primary drivers include the robust expansion of the global leisure marine sector, particularly the trend toward larger, more amenity-rich yachts that demand high-quality, residential-grade cooking apparatus. Regulatory mandates for improved fire safety and emission control in commercial shipping also act as a crucial catalyst, necessitating the periodic replacement and upgrade of older, non-compliant galley equipment. The increasing awareness among vessel owners regarding the intrinsic safety benefits of induction cooking compared to open-flame systems further accelerates adoption, supported by continuous improvements in marine power generation and storage. Furthermore, the mandatory need for catering and sustenance on all commercial vessels, irrespective of economic downturns, provides a fundamental layer of stable, non-cyclical demand for robust equipment.

However, market growth is consistently restrained by the high initial cost of specialized marine-grade appliances compared to residential alternatives, coupled with installation complexities and limited galley space, especially on smaller vessels. The necessity for advanced corrosion resistance and complex, certified safety features drives up manufacturing expenses, making market entry prohibitive for budget-conscious consumers. Furthermore, volatility in raw material prices, notably stainless steel and specialized ceramics, introduces cost pressures for manufacturers, which are often passed on to the consumer, potentially deterring budget-conscious buyers in the mid-range segment. Another significant constraint is the challenge of providing specialized technical support and certified spare parts in remote maritime locations globally, leading to potential maintenance delays and increased operational costs for commercial fleets, which favor appliance simplicity and widespread serviceability.

Opportunities in the market primarily revolve around technological shifts. The move towards safer, open-flame-free cooking solutions, such as induction and advanced electric systems powered by increasingly efficient marine battery banks and solar arrays, presents a substantial avenue for innovation and market penetration. Developing lighter, modular, and highly customized appliances specifically targeting the rapidly growing catamaran and multihull segment, known for stringent weight limitations, offers another lucrative pathway. Moreover, geographical opportunities are pronounced in emerging maritime economies, particularly within Southeast Asia and Latin America, where rapid industrialization and growing middle-class wealth are driving investment in coastal tourism and private yachting infrastructure, creating new localized demand centers that require specific product adaptations for regional fuel and electrical standards. Manufacturers that can secure early certification and strong local distribution partners in these regions stand to capture significant future market share, particularly if they can offer energy-efficient solutions compliant with local environmental standards.

The key impact forces exerting influence on the market include stringent international standards imposed by organizations like the International Maritime Organization (IMO) and classification societies (e.g., Lloyd's Register, ABS). These bodies dictate material quality, installation protocols, and required safety features, directly affecting product design cycles and mandatory replacement rates. Economic cycles, especially global trade volume and consumer discretionary spending, indirectly determine the rate of new vessel construction and recreational purchases, thereby fluctuating demand for new equipment. Lastly, environmental sustainability goals are becoming a powerful force, pushing both commercial operators and private owners towards more energy-efficient cooking methods and appliances that minimize heat waste and reduce dependency on fossil fuels, creating a long-term shift away from older, less efficient technologies and fostering innovation in waste heat recovery systems applicable to marine galley environments. These forces compel continuous adaptation and investment in research and development to maintain competitive relevance and compliance within the sector. Furthermore, cybersecurity risks associated with smart, internet-connected galley appliances, though currently minor, represent a future impact force demanding secure integration protocols as AI adoption increases.

Segmentation Analysis

The Marine Stoves and Ovens Market is comprehensively segmented based on fuel type, product type, application, and distribution channel, providing a multi-dimensional view of market dynamics. Segmentation by fuel type is perhaps the most critical, differentiating between Gas (LPG/CNG), Electric (AC/DC/Induction), Diesel, and Alcohol/Kerosene systems, reflecting specific safety requirements, energy availability on board, and regional preferences. Gas remains favored for its energy density and ease of installation in mid-sized recreational vessels, while electric and induction systems dominate the high-end and large commercial segments due to enhanced safety. Product type segmentation distinguishes between highly specialized integrated stove/oven units, modular cooktops, and freestanding ranges, addressing varying space limitations and functional needs across different vessel sizes. Integrated combos offer maximum space efficiency, crucial for small sailboats, whereas freestanding ranges are essential for large cruise ship galleys requiring institutional capacity.

Application segmentation is crucial for understanding demand volume and complexity, dividing the market into the high-volume Recreational Vessel segment (cruisers, sailboats, yachts) and the high-value Commercial Vessel segment (cargo, naval, passenger ships). Recreational demand is heavily driven by amenity and aesthetics, mirroring home cooking experience, whereas commercial demand is purely driven by mandated safety, durability, and certification for continuous, heavy-duty use. The commercial segment also demands specific features such as anti-vibration design and simplified maintenance procedures. Distribution channel analysis separates OEM sales (appliances supplied directly to shipyards for new builds) from the Aftermarket (sales through retailers, distributors, and service centers for replacement and refurbishment), with the aftermarket providing a stable revenue stream less sensitive to fluctuations in new shipbuilding orders. The structure of these segments dictates the varying certification requirements and pricing strategies adopted by manufacturers.

- By Fuel Type:

- Gas (LPG, CNG, Propane)

- Electric (AC/DC)

- Induction

- Diesel

- Alcohol / Kerosene

- By Product Type:

- Integrated Stove and Oven Combos

- Separate Cooktops/Hobs

- Freestanding Ranges (Commercial Grade)

- Built-in Ovens and Broilers

- Microwaves and Specialty Appliances (as supplementary systems)

- By Application:

- Recreational Vessels (Yachts, Sailboats, Cruisers, Catamarans)

- Commercial Vessels (Cargo Ships, Tankers, Ferries, Fishing Trawlers)

- Naval and Military Vessels (Requires Mil-Spec Certification)

- By Distribution Channel:

- OEM (Original Equipment Manufacturers - Shipyards)

- Aftermarket (Marine Retailers, Distributors, Service Centers, E-commerce)

- By Material:

- Stainless Steel (316 Marine Grade)

- Composite Materials and Enamels

- Ceramic Glass Cooktops

Value Chain Analysis For Marine Stoves and Ovens Market

The value chain for the Marine Stoves and Ovens Market commences with the rigorous procurement of specialized raw materials. This upstream activity is dominated by suppliers providing high-grade materials, particularly marine-grade 316 stainless steel, essential for resisting corrosion from the saline environment, and specialized components such as advanced flame safety devices, precise gas regulators, and robust electric heating elements. Given the niche, high-specification requirement, these components often command a premium compared to standard industrial inputs. Manufacturers must engage in stringent supplier qualification processes to ensure compliance with maritime standards (e.g., ISO, ABYC), necessitating long-term relationships with certified component providers. Effective inventory management at this stage is crucial, as supply chain disruptions, particularly for specialized electronic controls or corrosion-resistant alloys, can significantly impact production schedules and lead times for shipyards.

The manufacturing and assembly stage involves complex, often manual, fabrication processes unique to marine equipment, such as constructing the specialized gimbal systems that allow the stove to pivot with the vessel's motion, and integrating advanced thermal insulation to prevent fire spread. This stage is heavily regulated, requiring substantial investment in testing and obtaining certifications from bodies like Lloyd's Register or the U.S. Coast Guard, adding intellectual and operational overhead. Manufacturers often specialize by product type (e.g., gas vs. induction) and target segment (recreational vs. commercial), tailoring production lines to meet high durability standards for commercial use or sophisticated aesthetic demands for luxury yacht outfitting. Maintaining consistent quality control is paramount, as failure at sea carries high risk and liability. Furthermore, packaging must be robust to withstand global shipping and transfer to often remote shipyard locations.

The downstream flow is primarily segregated into two distribution channels: direct and indirect. The direct channel focuses on OEM sales, where manufacturers negotiate and supply large volumes of equipment directly to global shipyards for new vessel construction. Success in this channel relies on technical collaboration during the vessel design phase, competitive pricing for bulk orders, and reliable delivery timelines. The indirect channel, serving the lucrative Aftermarket, utilizes a network of global distributors, specialized marine retailers, and authorized service centers. This channel focuses on accessibility, speed of delivery for replacement parts, and providing local technical support, which is a critical success factor for vessel maintenance. The final stage involves specialized installation and ongoing service, often performed by certified marine technicians who understand the complexities of coupling the appliance safely to the vessel's fuel or electrical infrastructure and ventilation systems. Customer feedback from service centers loops back into R&D for product improvement and enhanced durability.

Marine Stoves and Ovens Market Potential Customers

The primary customer base for the Marine Stoves and Ovens Market is bifurcated into two major segments: original equipment manufacturers (OEMs) and end-users comprising both commercial and recreational vessel owners. OEM customers are global shipyards, ranging from multinational corporations building massive cargo ships, naval vessels, and cruise liners to smaller, bespoke boat builders specializing in luxury yachts and custom sailing vessels. These buyers require high-volume supply, adherence to stringent build schedules, customized sizing, and guaranteed certification for regulatory bodies worldwide. Their purchasing decisions are primarily driven by cost efficiency, reliable supply chains, and proven product longevity under continuous use. Securing contracts with key global shipyards ensures long-term, stable demand for manufacturers, often necessitating investment in advanced manufacturing techniques to meet highly specific technical requirements outlined in shipbuilding contracts.

The end-user segment is highly diverse. Recreational boat owners, including those who own small fishing boats, mid-sized weekend cruisers, and large liveaboard yachts, constitute a significant portion of the aftermarket demand. These customers prioritize user convenience, aesthetic integration into the galley design, safety features like gimbaling systems, and energy efficiency, particularly favoring induction and modern LPG appliances. Their purchasing decisions are often influenced by brand reputation, dealer advice, and peer reviews within the boating community. Commercial vessel operators, such as shipping companies, offshore platform management firms, and ferry operators, represent the other crucial end-user group. These buyers focus relentlessly on durability, low maintenance requirements, ease of repair, and compliance with maritime labor laws regarding crew welfare, demanding heavy-duty systems designed for continuous, institutional-scale use, often preferring highly robust electric or diesel systems that align with the vessel's primary fuel source.

Furthermore, specialized governmental entities, particularly naval forces, coast guards, and research institutions operating specialized maritime vessels, form a highly selective customer base. These organizations demand the highest level of ruggedization, specialized shielding, and certification, often adhering to military specifications (Mil-Spec). Their purchasing processes are complex, involving stringent bidding and security checks, but offer opportunities for high-margin contracts for highly customized and reliable systems. Finally, the growing charter fleet sector, which operates yachts and smaller cruise vessels, represents a rapidly expanding customer segment that demands appliances capable of withstanding high turnover and consistent user wear, often seeking commercial-grade durability within recreational dimensions, thus bridging the gap between standard recreational and heavy-duty commercial specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 515.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dometic Group, Kenyon International Inc., ENO (Force 10), Seaward Products (a Division of Whale), Kuuma Products, SMEG S.p.A., Wallace Marine Heating, Techimpex Srl, ISOTHERM (Indel Webasto Marine), Princess Household Appliances, Dickinson Marine, Taylor’s Paraffin Stoves, Vitrifrigo, Origo (Electrolux), Miele, Subzero Group (Viking Marine Appliances), Fisher & Paykel Appliances, WAECO (Dometic), Electrolux Professional, Glem Gas S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Marine Stoves and Ovens Market Key Technology Landscape

The technological landscape of the Marine Stoves and Ovens Market is rapidly evolving, driven primarily by safety demands, energy efficiency mandates, and the pursuit of residential-grade convenience at sea. A significant technological shift is the widespread adoption of induction cooking, which utilizes electromagnetic fields to heat cookware directly, offering superior safety by eliminating open flames, stored gas, and residual heat on the cooktop surface and avoiding the need for stored flammable fuels. This technology is becoming viable even on smaller vessels due to advancements in inverter technology and marine battery management systems that can handle the high transient power draw of induction units efficiently. Furthermore, manufacturers are focusing on integrating advanced microprocessors and digital control systems that enable precise temperature regulation, programmable cooking cycles, and connectivity with vessel management systems (VMS), allowing for remote monitoring and diagnostics, a crucial feature for commercial shipping operations where reliability is paramount. The incorporation of IoT sensors allows for real-time monitoring of performance metrics such as energy consumption and component health, feeding into predictive maintenance models.

Another area of concentrated innovation lies in enhanced safety and structural integrity. Gimbal mounting technology, which ensures the appliance remains level despite the vessel’s pitch and roll, is being refined using smoother bearings, hydraulic dampening systems, and dynamic stabilization materials to improve usability in rough seas, making high-precision cooking feasible regardless of weather conditions. For gas-powered units, the development of sophisticated thermocouple flame failure devices and automatic gas shutoff valves triggered by excessive vibration or system faults is standard, often mandated by classification societies. Material science also plays a vital role; the use of marine-grade 316 stainless steel, known for its high resistance to chlorides and pitting corrosion in saltwater environments, ensures product longevity. Additionally, advanced multi-layer insulation technology within ovens is being improved to maximize energy retention and minimize heat transfer to the surrounding galley structure, significantly reducing the fire risk and decreasing the load on the vessel's air conditioning system, thereby enhancing overall energy efficiency.

The technological trajectory also includes the integration of multi-fuel capabilities and improved exhaust/ventilation systems, particularly for diesel and kerosene stoves popular in harsh environments. Modern diesel cookers often incorporate fan-assisted combustion chambers, sometimes utilizing catalytic converters, to ensure clean burning and minimal particulate emissions, addressing historical issues related to soot and exhaust odors. The ongoing development of compact, modular designs allows for easier integration into space-constrained galleys, utilizing pop-up controls, touch-sensitive interfaces, and flush-mount installations to save critical space. Finally, energy harvesting and optimization are key themes; some high-end electric appliances are now designed with algorithms to preferentially use shore power or generator power when available, or manage load shedding during peak battery draw, contributing directly to the vessel’s overall energy management strategy and increasing the viability of all-electric yachting, representing a fundamental paradigm shift from traditional reliance on stored gas fuels. Research into solid-state heating elements that are faster and more resilient than traditional coiled elements also promises future advancements in durability and rapid heating capabilities.

Regional Highlights

- North America (NA): This region represents a mature and high-value market, characterized by strong demand for large recreational vessels and luxury yachts. Demand drivers include high consumer spending power and a preference for high-tech, safety-focused appliances, particularly induction and electric stoves, reflecting the region's strong electrical infrastructure standards (ABYC compliance). The US Gulf Coast and Pacific Northwest are major commercial hubs, maintaining consistent demand for heavy-duty, certified equipment for fishing fleets, oil and gas offshore supply vessels, and naval applications, often requiring US Coast Guard certification. The aftermarket for replacement parts is highly developed and robust.

- Europe: Europe holds a dominant position in the global market, driven by centuries of maritime tradition, a large fleet of sailing vessels, and rigorous regulatory oversight (CE certification, SOLAS). The Northern European segment shows strong, specialized demand for diesel and high-quality gas systems due to prevalent cruising habits, environmental regulations favoring reduced emissions, and the integration of heating systems. Southern Europe, especially the Mediterranean, drives high demand for luxury marine appliances in the yachting and charter industries, with strong preference for efficient, aesthetically pleasing stainless steel gas and electric units that meet high consumer aesthetic standards alongside technical compliance.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by rapidly increasing shipbuilding activities in countries like China, South Korea, and Japan, both for commercial shipping (tankers, container ships) and emerging recreational yacht ownership in coastal cities such as Hong Kong and Sydney. While cost-sensitivity remains a factor in certain commercial sub-segments, the region’s increasing emphasis on maritime safety standards and crew comfort is accelerating the adoption of mid-to-high-range, globally certified marine cooking solutions, often sourced via OEM contracts. Infrastructure development for marinas is a key enabling factor.

- Latin America (LATAM): The LATAM market is nascent but shows potential, primarily concentrated in localized recreational boating hubs such as Brazil, Argentina, and Mexico, alongside the management of fishing fleets. Market growth is often dependent on fluctuations in commodity prices impacting national economies. Demand is typically focused on durable, reliable gas and electric systems for local coastal cruising and modest commercial fishing fleets, with pricing and robust serviceability being key competitive factors due to often fragmented distribution channels and import complexities.

- Middle East and Africa (MEA): MEA presents a complex market with pockets of high-end demand driven by luxury yacht ownership and massive infrastructure projects in the Gulf states (e.g., UAE, Qatar, Saudi Arabia), contrasting sharply with the essential commercial demand across African shipping routes. The demand profile is highly polarized, requiring either extremely luxurious appliances for private vessels or robust, certified commercial systems designed to withstand high temperatures and dust, often prioritizing reliable diesel or heavy-duty electric models that can operate reliably in austere supply environments and comply with regional safety standards for offshore platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Marine Stoves and Ovens Market.- Dometic Group

- Kenyon International Inc.

- ENO (Force 10)

- Seaward Products (a Division of Whale)

- Kuuma Products

- SMEG S.p.A.

- Wallace Marine Heating

- Techimpex Srl

- ISOTHERM (Indel Webasto Marine)

- Princess Household Appliances

- Dickinson Marine

- Taylor’s Paraffin Stoves

- Vitrifrigo

- Origo (Electrolux)

- Miele

- Subzero Group (Viking Marine Appliances)

- Fisher & Paykel Appliances

- WAECO (Dometic)

- Electrolux Professional

- Glem Gas S.p.A.

- Webasto Group

- Tecma (Thetford Marine)

- Frigidaire (Specialty Marine Lines)

Frequently Asked Questions

Analyze common user questions about the Marine Stoves and Ovens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the safest fuel type for marine stoves and ovens?

Induction cooking systems are generally considered the safest marine cooking option because they eliminate open flames, stored combustible gas, and residual heat on the cooktop surface, significantly reducing the risk of fire or burns in dynamic vessel environments. Electric systems are highly preferred when sufficient and stable DC or AC power is available onboard, ensuring high safety standards compliant with ABYC and CE regulations.

How do marine-grade stoves differ from standard residential appliances?

Marine stoves are differentiated by specialized engineering, including gimbal mounting systems to maintain level operation in rough seas, use of highly corrosion-resistant materials (e.g., 316 stainless steel), integrated thermocouple flame failure devices, robust construction to withstand vibration, and mandatory regulatory certification (e.g., CE, ABYC, USCG) confirming their suitability and safety for confined, high-corrosion maritime environments.

What factors drive the high cost of marine cooking appliances?

The high cost results from mandatory regulatory compliance and comprehensive certification processes, the necessity of using expensive, durable, corrosion-resistant materials (marine-grade alloys), low-volume specialized manufacturing runs tailored to specific vessel requirements, and the integration of complex safety features like advanced gimbal mounts and electronic monitoring systems required for reliable operation at sea.

Is the Marine Stoves and Ovens market shifting towards electric power?

Yes, the market is exhibiting a strong, accelerated shift towards electric and induction power. This transition is primarily driven by heightened safety awareness, efforts to eliminate onboard storage of flammable gases, technological advancements in efficient marine battery systems, and the desire for residential-like convenience and speed in high-end yacht galleys, supported by robust vessel electrical infrastructures.

Which geographical region exhibits the fastest growth rate for marine galley equipment?

The Asia Pacific (APAC) region is projected to register the fastest growth rate in the forecast period. This acceleration is fueled by substantial expansion in commercial shipbuilding capacity (especially in China and South Korea) and the emerging demand for luxury and recreational vessel ownership driven by increasing disposable income and greater investment in coastal tourism infrastructure across key regional maritime hubs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager