Maritime Analytics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434539 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Maritime Analytics Market Size

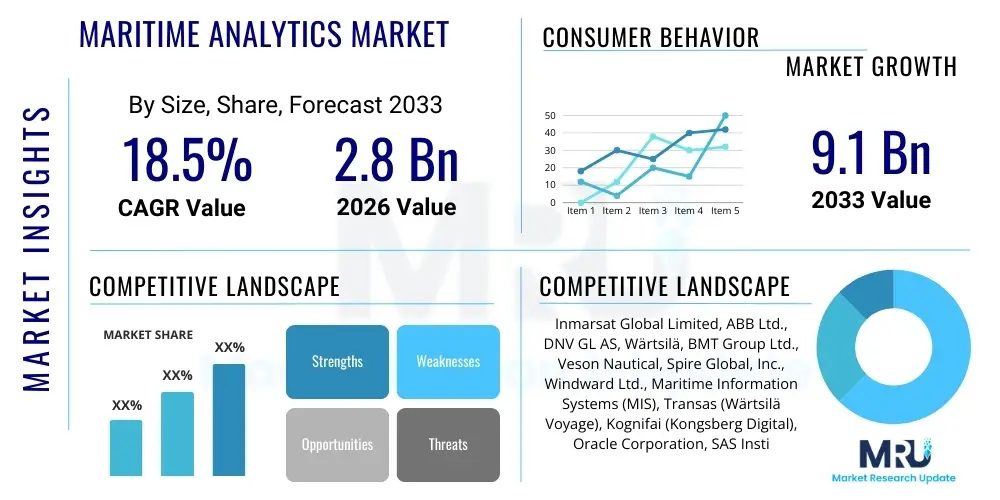

The Maritime Analytics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 9.1 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing necessity for operational efficiency, stringent environmental regulations necessitating data-driven compliance, and the expansive digitalization initiatives across global shipping and port operations. The integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) sensors is fundamentally reshaping maritime data processing capabilities, leading to more accurate predictive maintenance, optimal route planning, and enhanced supply chain visibility.

The valuation reflects the rapidly accelerating adoption of sophisticated software solutions designed to manage complex maritime logistics. As global trade volumes rebound and the pressure to reduce carbon footprints intensifies, maritime stakeholders—including shipping liners, port authorities, and government agencies—are prioritizing investments in robust analytical platforms. These platforms enable real-time data ingestion from vessels, weather sources, and terrestrial tracking systems, transforming raw data into actionable business intelligence. Furthermore, the shift towards cloud-based analytical services is providing scalable and cost-effective solutions, lowering the barrier to entry for smaller fleet operators and fueling broader market expansion.

Market expansion is also driven by strategic collaborations between technology providers and marine equipment manufacturers, aimed at creating integrated ecosystems that streamline data flow from ship to shore. The increasing sophistication of satellite communication infrastructure facilitates high-speed data transmission, crucial for real-time risk assessment and decision-making regarding security, fuel consumption, and cargo integrity. This confluence of technological advancement, regulatory pressure, and economic imperative establishes the maritime analytics sector as a critical component of the future global blue economy, ensuring sustained double-digit growth throughout the projected forecast period.

Maritime Analytics Market introduction

Maritime Analytics encompasses the use of advanced data science techniques, software tools, and domain expertise to process vast quantities of operational, environmental, and commercial data generated by the global shipping industry and associated infrastructure. The core purpose of these analytical solutions is to enhance decision-making, optimize resource utilization, ensure regulatory compliance, and mitigate risks across the complex maritime ecosystem. Products within this market range from sophisticated vessel performance monitoring software and dynamic routing optimization systems to predictive risk modeling platforms utilized by insurance and financial institutions. Major applications span fleet performance management, encompassing fuel consumption and hull efficiency; predictive maintenance for critical vessel machinery; real-time vessel tracking; port operation optimization; and comprehensive maritime surveillance for security purposes.

The primary benefits derived from the deployment of maritime analytics solutions include significant reductions in operational expenditure, primarily through optimized bunker fuel usage and minimized unplanned downtime associated with equipment failures. Furthermore, these tools substantially enhance safety standards by providing early warnings regarding operational hazards and non-compliance issues. From an environmental perspective, analytical solutions are crucial for complying with increasingly stringent mandates, such as the IMO’s Carbon Intensity Indicator (CII) regulations, by enabling precise measurement and strategic reduction of greenhouse gas emissions. The market's foundational driving factors include the escalating requirement for transparency and accountability within supply chains, the imperative to manage rising fuel costs effectively, and the growing complexity of international maritime law necessitating digital compliance tools.

The maritime sector, historically characterized by conservative adoption of digital technologies, is undergoing rapid transformation, propelled by the availability of affordable high-bandwidth connectivity at sea and the maturation of Big Data processing capabilities. Stakeholders are leveraging analytics to gain a competitive advantage by shortening transit times, improving cargo handling efficiency in ports, and offering differentiated services based on reliability and speed. The shift from reactive operational management to proactive, predictive intelligence defines the current market landscape, ensuring that data-driven insights form the basis of all strategic and tactical decisions, thereby maximizing asset utilization across the global fleet and port networks.

Maritime Analytics Market Executive Summary

The Maritime Analytics Market is experiencing robust expansion driven by converging business trends, compelling regional growth profiles, and distinct segmentation dynamics. Business trends emphasize the proliferation of ‘as-a-service’ models, offering subscription-based access to complex analytical tools, which lowers upfront capital expenditure for shipping companies. There is a marked shift toward comprehensive platform solutions that integrate multiple functionalities—such as weather routing, performance monitoring, and crew management—into a single interface, increasing overall value proposition. Furthermore, sustainable shipping initiatives are driving demand for specialized analytics focused on optimizing hydrodynamic performance and ensuring compliance with emerging global environmental standards, making green shipping data a premium analytical requirement.

Regionally, North America and Europe maintain dominance, characterized by high technological maturity, extensive port infrastructure modernization projects, and early adoption of regulatory compliance analytics. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth CAGR, fueled by the massive growth in Chinese and Southeast Asian shipbuilding, fleet expansion, and the substantial investment in smart ports across major trading hubs like Singapore, Shanghai, and Busan. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, particularly in oil and gas maritime logistics and coastal surveillance, reflecting growing governmental focus on maritime security and exploitation of offshore resources, necessitating advanced tracking and predictive maintenance capabilities.

Segment trends reveal that the Services component segment is growing faster than the Software segment, reflecting the complexity of implementing and managing analytical solutions, requiring specialized consulting and integration services. Cloud deployment models are increasingly favored over on-premise solutions due to scalability, accessibility, and reduced infrastructure overhead. Application-wise, Predictive Maintenance and Route Optimization remain the most critical segments, directly impacting operational costs and safety margins. End-user demand is consistently high from large shipping companies and governmental maritime agencies, who utilize analytics for strategic operational control and regulatory enforcement, respectively, solidifying their role as primary revenue drivers within the market structure.

AI Impact Analysis on Maritime Analytics Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on Maritime Analytics frequently center on the tangible benefits regarding cost reduction, the reliability of autonomous decision-making systems, and the implications for job roles within the industry. Users consistently ask: "How much fuel can AI optimization truly save?" "Is AI-driven predictive maintenance accurate enough to replace traditional inspection routines?" and "What infrastructure changes are needed to support deep learning models at sea?" These questions highlight a demand for concrete Return on Investment (ROI) figures, validation of AI's predictive accuracy, and clarity on the technical requirements for implementation. The key themes revolve around AI's capacity to deliver real-time operational efficiency gains, enhance safety protocols through advanced pattern recognition, and ultimately pave the path toward fully autonomous vessel operations.

AI’s integration is fundamentally transforming maritime analytics from descriptive reporting to prescriptive action. Machine learning algorithms are crucial for processing high-velocity, high-volume data streams generated by IoT sensors on modern vessels, identifying subtle operational anomalies that traditional statistical methods overlook. This capability is paramount in predictive maintenance, where AI models can forecast equipment failure probabilities months in advance based on vibration, temperature, and pressure data signatures, significantly reducing costly unplanned downtime and maximizing vessel availability. Furthermore, AI-powered route optimization utilizes reinforcement learning to dynamically adjust voyage plans in real-time, factoring in complex variables like fluctuating weather patterns, current speeds, tidal predictions, and port congestion estimates, leading to optimal speed-fuel profiles.

The profound impact extends to compliance and security. AI systems are deployed to automatically monitor and audit adherence to environmental regulations (such as sulfur caps and CII), flagging deviations instantly and recommending corrective measures. In maritime security and surveillance, computer vision coupled with deep learning algorithms enables automated identification and tracking of suspicious vessel behavior or unauthorized activity across vast ocean expanses, augmenting the capabilities of coast guards and naval forces. As AI systems become more sophisticated, they will increasingly automate complex decision-making processes, leading to safer, faster, and demonstrably more environmentally conscious shipping operations, thereby cementing AI as the central technological catalyst for market growth.

- AI enhances Predictive Maintenance by analyzing sensor data patterns to anticipate equipment failure with high accuracy.

- Machine Learning optimizes global shipping routes dynamically, minimizing fuel consumption and transit time under varying environmental conditions.

- Computer Vision and AI algorithms improve maritime surveillance efficiency, identifying potential security threats and unauthorized fishing activities.

- Natural Language Processing (NLP) is utilized for processing vast quantities of unstructured data, including accident reports and regulatory documents, for risk modeling.

- AI facilitates compliance reporting by automatically monitoring and verifying adherence to environmental regulations like the Carbon Intensity Indicator (CII).

DRO & Impact Forces Of Maritime Analytics Market

The Maritime Analytics Market is governed by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and powerful Impact Forces. Key drivers include the stringent mandate from the International Maritime Organization (IMO) regarding emission reduction targets, specifically the implementation of the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII), compelling fleet operators to adopt analytics for verifiable compliance. A secondary major driver is the escalating volatility of bunker fuel prices, which necessitates highly precise, data-driven optimization of vessel performance and route selection to maintain profitability. The desire for enhanced supply chain resilience, highlighted by recent global disruptions, further fuels demand for visibility tools.

Conversely, significant restraints hinder market potential. These include the traditionally high initial capital investment required for implementing comprehensive analytical solutions, particularly for smaller fleet owners with limited technology budgets. Furthermore, the inherent reluctance of the maritime industry to rapidly adopt new technologies, coupled with the critical challenge of integrating legacy operational technology (OT) systems on older vessels with modern IT infrastructure, presents substantial implementation hurdles. Data security concerns, particularly regarding sensitive operational and proprietary commercial data transmitted across satellite networks, remain a persistent barrier to widespread adoption, necessitating robust cybersecurity measures within analytical platforms.

Opportunities for growth are vast, predominantly centered on the development of specialized analytics for autonomous shipping systems, offering immense future potential for fully integrated, remote-controlled fleets. The rising deployment of IoT sensors across ports and terminals creates opportunities for optimizing hinterland logistics and throughput, expanding the market scope beyond just vessel operations. Moreover, the emergence of niche analytical services tailored for the offshore energy sector, focusing on asset integrity management and operational efficiency of support vessels, offers lucrative avenues for specialization. The primary impact forces shaping the market are technological advancements in satellite communication, making real-time data transmission affordable, and the structural shift toward sustainability, which is now a core operational priority rather than a peripheral concern.

Segmentation Analysis

The Maritime Analytics Market is comprehensively segmented across several key dimensions, including Component, Deployment Mode, Application, and End-User, reflecting the diverse requirements and delivery mechanisms within the global maritime ecosystem. Understanding these segments is crucial for technology providers to tailor solutions and for end-users to identify platforms that best address their specific operational challenges, ranging from vessel optimization to port infrastructure management. This segmentation facilitates targeted strategic planning, ensuring that product development aligns with the evolving demands of large shipping conglomerates, regional port authorities, and governmental regulatory bodies. The inherent complexity of maritime operations mandates highly specialized solutions, which drives the proliferation of niche analytical platforms within the broader market structure.

Segmentation by component highlights the dichotomy between tangible software platforms and the requisite professional services needed for integration, customization, and ongoing data interpretation. While the core analytical engine resides within the software, the Services segment, encompassing consultation, maintenance, and training, often represents a higher growth rate due to the specialized expertise required to handle maritime data and integrate systems across disparate fleets and legacy architectures. Deployment segmentation underscores the industry's gradual but firm migration towards cloud-based solutions, favoring the scalability, flexibility, and reduced infrastructure footprint offered by SaaS models, especially for global fleet management where constant remote access is paramount.

The Application segmentation reveals where the highest value is generated, with Fleet Performance Monitoring (focused on fuel and maintenance) and Predictive Maintenance consistently dominating investment portfolios due to their direct impact on reducing high operational costs. Conversely, segments like Pricing and Capacity Optimization, while smaller, are growing rapidly as shipping companies employ sophisticated analytical tools to maximize profitability in volatile freight markets. The end-user analysis confirms that major commercial shipping companies remain the primary revenue source, yet government and defense sectors are becoming increasingly important buyers, driven by needs related to coastal surveillance, illegal activity monitoring, and maritime domain awareness (MDA) initiatives.

- By Component:

- Software

- Services (Consulting, Integration, Managed Services)

- By Deployment Mode:

- On-Premise

- Cloud-Based

- By Application:

- Fleet Performance Monitoring and Optimization

- Predictive Maintenance

- Vessel Tracking and Monitoring

- Route Optimization and Scheduling

- Maritime Security and Surveillance

- Port and Terminal Management

- Pricing and Capacity Optimization

- Logistics and Supply Chain Management

- By End-User:

- Shipping Companies and Fleet Owners

- Port Authorities and Terminal Operators

- Government and Defense (Navy, Coast Guard)

- Insurance Providers and Financial Institutions

- Logistics and Freight Forwarders

Value Chain Analysis For Maritime Analytics Market

The value chain for the Maritime Analytics Market begins with the Upstream component, which encompasses sensor manufacturing, satellite communications infrastructure providers, and raw data collection systems installed on vessels and ports. Key activities here involve R&D into durable, precise IoT sensors (for engine parameters, hull performance, weather conditions), and the maintenance of reliable satellite constellations (VSAT, L-band) necessary for the high-volume, continuous transmission of operational data from remote maritime environments. The integrity and latency of this upstream data acquisition are foundational, directly influencing the quality and timeliness of subsequent analytical insights. The technology providers in this stage are crucial for ensuring high data fidelity.

The Midstream stage involves the core analytical platform development and processing. This stage is dominated by specialized software vendors who design, develop, and host the analytical engines, incorporating AI, Machine Learning, and proprietary algorithms tailored for maritime domain specifics. Activities include data cleaning, integration with existing Enterprise Resource Planning (ERP) systems, creation of sophisticated visualization dashboards, and the development of predictive models (e.g., fuel consumption forecasting, equipment failure prediction). This is the value creation nexus, where raw data is transformed into actionable intelligence that drives operational decisions. System integrators and specialized data science consultants play a pivotal role in bridging the gap between platform capabilities and end-user needs.

The Downstream segment involves the distribution and final consumption of the analytical insights. Distribution channels are predominantly direct sales to major shipping companies and port groups, often accompanied by long-term service contracts. Indirect channels involve partnerships with system integrators, maritime equipment manufacturers (Original Equipment Manufacturers - OEMs), and regional value-added resellers (VARs) who bundle analytics with hardware or broader operational packages. End-users—shipping management teams, captains, port operators, and regulators—utilize the outputs to make real-time adjustments to speed, route, maintenance schedules, and security posture. The efficiency of the downstream adoption process, supported by robust customer support and training, determines the ultimate realization of ROI for the market.

Maritime Analytics Market Potential Customers

The primary End-Users and potential customers for Maritime Analytics solutions are entities whose core operational or regulatory functions depend heavily on the efficient movement and management of goods and assets across the world’s oceans. Shipping companies, encompassing both container liners (like Maersk, CMA CGM) and bulk/tanker operators, represent the largest and most immediate customer segment. Their purchasing decisions are critically driven by the necessity to reduce bunker fuel costs, minimize regulatory penalties (especially concerning emissions), and maximize fleet uptime. They seek sophisticated, fleet-wide platforms that offer centralized control and granular performance monitoring for thousands of geographically dispersed assets, viewing analytics as essential competitive leverage in a high-volume, low-margin industry.

A secondary, yet rapidly growing, customer base includes Port Authorities and Terminal Operators globally. These entities utilize analytics not primarily for vessel performance, but for optimizing shore-side logistics, berth allocation, yard management, and minimizing turnaround times for vessels. Their investment focuses on predictive models for congestion management and integration of land-side supply chain data to create ‘smart ports.’ Government and Defense agencies, including coast guards, naval forces, and customs, constitute another critical segment, purchasing specialized analytical tools for Maritime Domain Awareness (MDA), tracking illicit activities (piracy, smuggling, illegal fishing), and border security, valuing high-accuracy real-time surveillance capabilities.

Furthermore, tangential customer segments such as marine insurance providers and financial institutions are increasing their reliance on maritime analytics. Insurers use historical and predictive data derived from analytical platforms to accurately assess risk profiles for vessels and cargo, influencing premium calculation and loss prevention strategies. Similarly, trade financiers use analytical data to verify cargo movements and vessel compliance, reducing transactional risk. Logistics and freight forwarding firms also employ these tools to provide enhanced tracking visibility and greater certainty regarding delivery schedules to their final customers, thereby differentiating their service offerings in a complex global supply chain environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 9.1 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Inmarsat Global Limited, ABB Ltd., DNV GL AS, Wärtsilä, BMT Group Ltd., Veson Nautical, Spire Global, Inc., Windward Ltd., Maritime Information Systems (MIS), Transas (Wärtsilä Voyage), Kognifai (Kongsberg Digital), Oracle Corporation, SAS Institute, IBM Corporation, LMI Technologies, Seerist, Inc., Clarksons Research, Ocean Network Express (ONE) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Maritime Analytics Market Key Technology Landscape

The technological backbone of the Maritime Analytics Market is defined by the convergence of advanced data acquisition, processing, and delivery mechanisms. Central to this landscape are Internet of Things (IoT) sensors, which form the crucial data collection layer. Modern vessels are instrumented with thousands of sensors monitoring everything from engine temperatures, fuel flow, and propeller pitch to hull fouling levels and cargo conditions. The data generated by these sensors is transmitted via sophisticated satellite communication systems, primarily using Very Small Aperture Terminal (VSAT) technology for high-throughput connectivity, ensuring continuous, low-latency data flow from ship to shore-based analytical hubs, even in remote ocean areas, thereby enabling real-time decision-making capabilities.

The processing layer heavily relies on Big Data architectures, specifically cloud-based platforms utilizing scalable storage solutions and distributed computing frameworks (such as Hadoop or Spark). This infrastructure is necessary to handle the petabytes of structured and unstructured data, including AIS (Automatic Identification System) signals, meteorological forecasts, and oceanographic data, which must be fused and analyzed simultaneously. At the forefront of data processing are Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies drive the predictive capabilities of the market, executing complex tasks such as forecasting optimal trim and ballast configurations, identifying maintenance needs before breakdown occurs, and performing advanced pattern recognition for anomaly detection in security contexts, drastically enhancing operational precision beyond traditional methods.

Furthermore, Geographic Information Systems (GIS) technology is integral for visualization and route planning, providing the spatial context necessary for maritime operations. GIS platforms integrate satellite imagery, navigational charts, and real-time vessel positions to offer intuitive, map-based interfaces for fleet managers. Blockchain technology is also beginning to emerge, particularly in the port management and trade finance segments, offering immutable record-keeping and enhanced transparency for cargo documentation and smart contract execution, thereby streamlining historically cumbersome administrative processes. The overall technological emphasis remains on creating interoperable, secure, and highly automated analytical pipelines that minimize human intervention and maximize data-driven insights across the operational lifecycle.

Regional Highlights

Regional dynamics within the Maritime Analytics Market reflect the differing levels of digitalization, regulatory pressures, and the concentration of global shipping and port activities. North America, driven by significant defense spending (US Coast Guard, Navy) and large, technologically advanced logistics firms, maintains a high market share. The focus in this region is strongly placed on high-end solutions for security surveillance, robust supply chain visibility, and the adoption of cutting-edge satellite and terrestrial connectivity technologies. Regulatory compliance, particularly related to environmental mandates and secure data handling (cybersecurity), compels continuous investment in advanced analytical platforms tailored for regional regulations and global compliance frameworks.

Europe is a matured market, holding a substantial share primarily due to the presence of leading maritime technology providers, major global shipping companies, and influential regulatory bodies (e.g., European Maritime Safety Agency - EMSA). European demand is predominantly fueled by the need for adherence to the strictest environmental mandates and the rapid development of autonomous and semi-autonomous vessel projects, requiring advanced data collection and remote monitoring analytics. Countries like Norway, Germany, and the UK are pioneering intelligent shipping initiatives, focusing heavily on optimizing vessel energy efficiency and integrating complex sensor data for high-stakes operational environments, maintaining a competitive edge through innovation and regulatory foresight.

The Asia Pacific (APAC) region is poised for the fastest growth, capitalizing on rapidly expanding fleet sizes, massive investments in state-of-the-art port infrastructure (especially in China, South Korea, and Singapore), and the increasing volume of intra-regional trade. Government-led digitalization programs aimed at establishing "Smart Ports" and improving trade efficiency are key drivers. While cost sensitivity remains a factor, the sheer scale of maritime operations in APAC necessitates scalable, cloud-based analytical solutions for vessel tracking, congestion management, and logistics optimization. The MEA region is also growing, primarily driven by investments in the oil and gas maritime sector and enhanced coastal security requirements, focusing on surveillance and tracking solutions for critical national infrastructure.

- North America: High concentration of defense and security analytics demand; strong focus on cyber-resilience in maritime data infrastructure.

- Europe: Regulatory innovation leader; strong adoption of solutions for environmental compliance (CII) and energy efficiency; headquarters for many key technology vendors.

- Asia Pacific (APAC): Fastest-growing market segment; driven by expansion of fleet capacity and large-scale smart port development initiatives in major hubs like Singapore and Shanghai.

- Latin America: Emerging market focusing on trade efficiency improvements, port optimization, and resource protection analytics.

- Middle East and Africa (MEA): Growth centered around oil & gas offshore support vessel management, security surveillance, and leveraging strategic trade chokepoints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Maritime Analytics Market.- Inmarsat Global Limited

- ABB Ltd.

- DNV GL AS

- Wärtsilä

- BMT Group Ltd.

- Veson Nautical

- Spire Global, Inc.

- Windward Ltd.

- Maritime Information Systems (MIS)

- Transas (Wärtsilä Voyage)

- Kognifai (Kongsberg Digital)

- Oracle Corporation

- SAS Institute

- IBM Corporation

- LMI Technologies

- Seerist, Inc.

- Clarksons Research

- Ocean Network Express (ONE)

Frequently Asked Questions

Analyze common user questions about the Maritime Analytics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary cost-saving benefits of implementing maritime analytics?

The primary cost-saving benefits stem from optimizing bunker fuel consumption through dynamic route optimization and minimizing unplanned downtime via AI-driven predictive maintenance, which identifies potential equipment failures before they cause operational disruptions. Analytics also reduce regulatory fines by ensuring precise, continuous compliance reporting.

How does the Maritime Analytics Market address the IMO's environmental regulations like the CII?

Maritime analytics solutions are crucial for complying with the IMO's Carbon Intensity Indicator (CII) by providing real-time calculation and verification of greenhouse gas emissions. These platforms offer prescriptive recommendations on operational adjustments, such as optimal speed and trim, necessary to meet annual reduction targets and avoid non-compliance penalties.

What role does the Cloud play in the future growth of maritime analytics?

Cloud deployment is essential for future market growth due to its scalability and accessibility. Cloud platforms allow global shipping companies to integrate vast, dispersed data streams and provide centralized access to analytical insights across their fleet and shore operations efficiently, minimizing required on-premise infrastructure investments and facilitating faster software updates.

Which application segment within maritime analytics is currently showing the highest ROI?

The Fleet Performance Monitoring and Optimization segment typically shows the highest immediate Return on Investment (ROI). By focusing on core operational efficiency metrics, particularly fuel consumption optimization (which constitutes a significant portion of operating costs), companies often see tangible returns within the first 12–18 months of solution deployment.

What are the key differences between on-premise and cloud-based maritime analytics deployment?

On-premise deployment offers greater data control and requires substantial upfront IT infrastructure investment, often favored by large governmental or defense organizations with strict security requirements. Cloud-based deployment, conversely, provides subscription flexibility, lower initial costs, automatic updates, and superior scalability, making it the preferred choice for commercial fleet operators requiring global, real-time access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager