Maritime VSAT Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435641 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Maritime VSAT Market Size

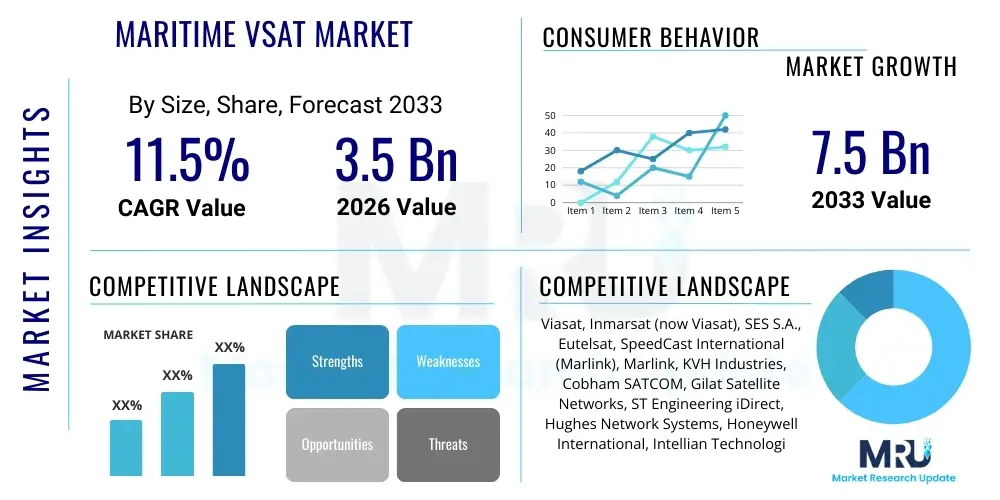

The Maritime VSAT Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Maritime VSAT Market introduction

The Maritime VSAT (Very Small Aperture Terminal) Market encompasses the provision of high-speed, always-on broadband connectivity solutions specifically tailored for vessels operating across global oceans. This technology utilizes satellite constellations, operating primarily in the Ku, Ka, and C bands, to deliver essential communication capabilities far beyond the reach of terrestrial cellular networks. The core product involves sophisticated stabilized antennas, modem units, and network management services designed to ensure seamless data transmission despite constant vessel motion and changing environmental conditions. Major applications span commercial shipping, where efficiency and regulatory compliance necessitate real-time data exchange; offshore oil and gas operations requiring robust remote monitoring; and the growing cruise and ferry sectors focused on delivering high-quality passenger connectivity and crew welfare services.

The principal benefits derived from the implementation of Maritime VSAT systems include enhanced operational efficiency through digitalization, superior access to vessel performance monitoring (VPM) and predictive maintenance systems, and improved safety protocols enabled by reliable communication links. Furthermore, VSAT facilitates crucial aspects of modern vessel management, such as electronic chart updating, remote diagnostics, and the integration of sophisticated IoT devices across the fleet. The consistent, high-throughput connectivity offered by VSAT services allows ship owners to reduce operational expenditure associated with manual reporting and delayed decision-making, while significantly improving the quality of life for seafarers through access to personal internet and voice communications.

Key factors driving the expansion of the Maritime VSAT market include the global mandate for digitalization in the shipping industry, spurred by IMO regulations and the necessity for remote diagnostics and autonomous operations integration. The surging demand for increased bandwidth, largely fueled by crew welfare requirements and the proliferation of internet-intensive applications (such as high-definition streaming and video conferencing) onboard vessels, acts as a primary market catalyst. Moreover, the recent deployment of high-throughput satellite (HTS) systems and the rapid emergence of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations are fundamentally altering the cost structure and performance capabilities of maritime connectivity, making VSAT technology more competitive and accessible across diverse maritime segments.

Maritime VSAT Market Executive Summary

The Maritime VSAT market is characterized by a rapid technological transition driven by the convergence of traditional geostationary (GEO) satellite services with disruptive Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) constellations, fundamentally reshaping business trends. Strategic shifts include the consolidation of major service providers, aggressive investment in hybrid network infrastructure capable of seamless switching between satellite orbits, and a growing focus on integrating managed IT services with connectivity provision to offer comprehensive digital solutions. The competitive landscape is intensifying, forcing established players to rapidly upgrade hardware and service offerings to compete with high-speed, low-latency solutions introduced by new market entrants. Furthermore, there is a pronounced trend towards flexible, consumption-based subscription models replacing traditional fixed-term contracts, catering to the variable operational needs of different maritime segments, especially container shipping and offshore activities.

Regionally, Asia Pacific is emerging as the fastest-growing market, primarily fueled by massive shipbuilding activity, rapid expansion of the commercial shipping fleet, and increasing governmental investments in naval modernization and coastal surveillance programs, particularly in countries such as China, South Korea, and Japan. North America and Europe currently hold the largest market shares, benefiting from early adoption, robust established maritime trade routes, and the presence of sophisticated oil and gas offshore infrastructure requiring highly resilient communication links. The Middle East and Africa (MEA) are also showing strong growth, driven by investments in maritime logistics hubs, port digitalization, and the rising energy exploration activities in deep-water environments, necessitating reliable connectivity for remote management and safety compliance across expansive operational areas.

Segmentation trends highlight the commercial shipping segment (including container vessels, bulk carriers, and tankers) as the dominant application area, prioritizing operational data offloading and crew communication needs, demanding increasingly high data limits. The component segmentation indicates a significant shift towards advanced, multi-band, and electronically steerable flat panel antennas (FPA) hardware, essential for tracking non-geostationary satellites (NGSO) and maximizing bandwidth efficiency. Additionally, the services segment, particularly value-added services such as cyber security solutions, cloud integration, and application management services layered onto the core connectivity offering, is demonstrating the highest growth trajectory, reflecting the market’s pivot from purely bandwidth provision to integrated maritime digital ecosystem management.

AI Impact Analysis on Maritime VSAT Market

User queries regarding AI's influence on the Maritime VSAT market predominantly center on how Artificial Intelligence can optimize network performance, predict equipment failures, and automate complex bandwidth management tasks across thousands of moving vessels. Users frequently ask about the role of machine learning algorithms in dynamic beam switching and spectrum allocation in congested zones, seeking assurance that next-generation VSAT networks will leverage AI to maintain service quality and stability during severe weather or high-demand periods. A core theme is the expectation that AI will transition VSAT connectivity from a passive utility to an active, intelligent management system, drastically reducing latency and operational costs while enhancing cybersecurity posture through automated threat detection and response mechanisms specific to maritime environments.

The integration of AI is expected to revolutionize network orchestration within the VSAT ecosystem. AI models analyze real-time usage patterns, weather conditions, vessel routing, and satellite availability to predict connectivity requirements and proactively adjust network resources. This predictive capability allows VSAT service providers to dynamically allocate bandwidth, prioritize mission-critical data flows (like safety and navigation information) over non-essential traffic (like crew streaming), and perform intelligent load balancing between different satellite beams or even across different constellations (GEO, MEO, LEO). Such optimizations ensure that the customer receives the contracted quality of service (QoS) with minimal wasted capacity, maximizing the efficiency of the satellite segment, which is a major operational expenditure.

Furthermore, AI significantly enhances the maintenance and reliability of both the shipboard terminal hardware and the ground infrastructure. Machine learning algorithms process telemetry data from antennas, modems, and power systems to detect subtle anomalies that precede equipment failure, enabling highly accurate predictive maintenance schedules. This shift from reactive repairs to proactive component replacement minimizes expensive vessel downtime and unnecessary service interruptions, a crucial concern for commercial shipping operators. By optimizing data routing and reducing manual intervention required for troubleshooting, AI lowers the total cost of ownership (TCO) for maritime connectivity, making high-speed broadband an even more compelling proposition for fleet digitalization initiatives across all maritime sectors.

- AI-driven Predictive Maintenance: Reduces equipment failure rates and minimizes vessel downtime by analyzing terminal telemetry data.

- Dynamic Bandwidth Allocation: Optimizes satellite resource usage by instantly adjusting capacity based on real-time traffic demand and vessel location.

- Intelligent Network Steering: Enables seamless, autonomous handover between GEO, MEO, and LEO satellite beams and constellations.

- Enhanced Cybersecurity: Utilizes machine learning to detect and mitigate maritime-specific cyber threats in real time across the VSAT link.

- Automated Quality of Service (QoS): Ensures critical applications receive guaranteed minimum bandwidth regardless of network congestion or environmental factors.

DRO & Impact Forces Of Maritime VSAT Market

The Maritime VSAT Market is propelled by compelling Drivers, balanced by significant Restraints, and presented with transformative Opportunities, all interacting to create dynamic Impact Forces. The primary drivers include the escalating global demand for high-throughput connectivity to support fleet digitalization, the operational necessity for real-time data exchange for compliance (e.g., IMO 2020 data reporting), and the increasing emphasis on improving crew morale through high-quality internet access. These drivers necessitate greater capacity and lower latency, directly fueling investment in advanced satellite technology and hybrid VSAT solutions. Conversely, major restraints involve the inherently high capital expenditure (CAPEX) required for sophisticated stabilized antenna systems and shipboard installations, the complexity of managing highly fragmented and often incompatible regulatory frameworks across different port states, and persistent concerns regarding network reliability and service continuity during extreme weather conditions or in polar regions lacking adequate satellite coverage.

Opportunities for growth are largely centered around the integration of Non-Geostationary Orbit (NGSO) constellations, such as Starlink and OneWeb, which promise significantly lower latency and expanded global coverage, especially in traditionally underserved polar routes and deep ocean zones. Furthermore, the market opportunity is amplified by the expansion into specialized markets, including autonomous vessel operations requiring ultra-low latency and highly secure communication channels, and the burgeoning need for robust remote monitoring solutions for offshore renewable energy platforms. Strategic alliances between satellite operators and maritime IT service providers to deliver holistic 'vessel-as-a-node' solutions represent a significant pathway for market expansion and value capture, moving beyond mere connectivity sales to comprehensive digital partnership models.

These internal market forces generate substantial impact across the value chain. The demand for HTS and NGSO constellations exerts strong pressure on traditional GEO operators to rapidly innovate or risk obsolescence, leading to massive infrastructure upgrade cycles. The increasing integration of data and connectivity necessitates highly capable maritime IT infrastructure and specialized cybersecurity offerings, transforming VSAT providers into essential maritime digital enablers rather than just communication utility suppliers. The competition driven by LEO constellations is forcing service pricing downwards, making VSAT accessible to a wider array of vessels, including smaller commercial fishing fleets and leisure yachts, thus accelerating overall market adoption and increasing the global footprint of high-speed maritime internet services.

Segmentation Analysis

The Maritime VSAT market is segmented across several critical dimensions, including the type of platform utilizing the service, the components comprising the connectivity solution, the frequency bands leveraged for transmission, and the specific applications driving data consumption. This granular segmentation is essential for understanding the varying connectivity requirements, budgetary constraints, and geographical focus of different end-users. Commercial shipping, requiring operational data and basic crew connectivity, represents the volume segment, while specialized sectors like cruise lines and military vessels represent the high-demand, high-revenue segments. Analysis across these segments reveals distinct technological preferences and service level expectations, driving tailored product development and strategic market positioning by key providers.

The component segmentation highlights the increasing technological sophistication required on board, with a clear migration toward hybrid terminal solutions capable of accessing multiple orbits and frequencies simultaneously. Furthermore, the services segment continues to grow its proportional value within the total market, reflecting the shift from simple bandwidth sales to complex, integrated solutions encompassing network security, cloud synchronization, and remote IT management. The frequency band segmentation showcases the competitive transition: while Ku-band remains the foundational technology due to its broad global coverage and established infrastructure, Ka-band is rapidly gaining traction due to its higher throughput capacity, primarily driven by the deployment of new HTS and NGSO satellites offering superior performance characteristics necessary for modern digital applications and crew streaming demands.

Understanding the interplay between platform type and frequency band is vital; for instance, large cruise ships invariably utilize high-capacity Ka-band services supplemented by Ku-band for redundancy and global coverage, demanding massive bandwidth to support thousands of simultaneous users and complex onboard systems. Conversely, offshore oil and gas platforms prioritize C-band for guaranteed reliability and resilience in challenging weather, alongside Ku-band for general communications. This multifaceted segmentation confirms that the Maritime VSAT market is not a monolith but rather a complex ecosystem requiring customized hardware, flexible service level agreements (SLAs), and regionally optimized network architectures to meet the diverse operational requirements of the global maritime industry effectively and efficiently.

- By Platform:

- Commercial Vessels (Container Ships, Tankers, Bulk Carriers)

- Cruise Ships and Ferries

- Offshore Oil & Gas (Drilling Rigs, FPSOs, Support Vessels)

- Government and Military Vessels (Naval, Coast Guard)

- Leisure and Yachting Vessels

- By Component:

- Hardware (Antennas, Modems, Baseband Equipment, LNBs, BUCs)

- Services (Bandwidth Provision, Installation and Maintenance, Value-Added Services, Managed IT Services)

- By Frequency Band:

- Ku-band

- Ka-band

- C-band

- L-band (Complementary Services)

- By End-User Application:

- Vessel Operations and Management

- Crew Welfare and Connectivity

- Offshore Exploration and Production

- Maritime Security and Surveillance

Value Chain Analysis For Maritime VSAT Market

The Maritime VSAT value chain is intricate, beginning with the upstream segment involving sophisticated hardware manufacturing and orbital infrastructure development. Upstream activities are dominated by specialized players in satellite manufacturing (GEO, MEO, LEO platforms), launch service providers, and component manufacturers producing highly advanced, stabilized parabolic or flat panel antennas, high-power amplifiers (HPAs/BUCs), and modems designed to withstand harsh marine environments. The quality and technological capability of this hardware are fundamental to the service performance, driving continuous innovation toward multi-band, electronically steerable arrays capable of seamless integration across hybrid satellite networks, necessitating high barriers to entry for new component vendors.

The midstream section involves the core service provision, dominated by satellite operators who own and manage the space segment and gateway infrastructure (teleports). These operators sell bulk capacity to maritime service providers (MSPs) and integrators, who then package the bandwidth with value-added services (such as network management, firewall protection, and managed QoS) and customize the offering for specific maritime segments. This segment is highly competitive, marked by intense negotiations over satellite capacity pricing and the rapid deployment of specialized gateway infrastructure optimized for global coverage and reduced latency, ensuring effective ground-to-space communications management.

The downstream component focuses on sales, installation, and ongoing maintenance, predominantly carried out by Maritime Service Providers (MSPs) and specialized maritime electronics integrators. Distribution channels are typically indirect, relying on a global network of dealers and installers to handle shipboard integration, especially for retrofit projects and new builds in major shipyard locations worldwide. Direct channels are generally reserved for large, institutional clients like major cruise lines or government agencies, where the service provider maintains direct control over the entire solution lifecycle. Effective logistics, specialized maritime expertise, and rapid global field service capability are crucial differentiators in the downstream market, ensuring customer satisfaction and maximizing long-term contract renewal rates for service provisioning.

Maritime VSAT Market Potential Customers

The potential customers and end-users of Maritime VSAT technology span the entirety of the global marine industry, driven by the universal need for reliable, high-throughput connectivity far from shore. The largest volume segment includes commercial vessel operators, such as container shipping lines, bulk cargo carriers, and oil and chemical tanker fleets, whose primary buying motivations are operational efficiency, regulatory compliance regarding data logging and reporting, and minimizing the risk of costly service outages. These buyers require robust, often standardized VSAT solutions capable of global coverage and integrated with fleet management software platforms, increasingly prioritizing hybrid solutions that offer redundancy and cost-effective bandwidth pricing models.

Another high-value customer group consists of the cruise and ferry industry, representing the segment demanding the highest peak throughput capacity per vessel. Cruise lines are acutely focused on enhancing the guest experience by offering terrestrial-like broadband speeds for streaming, social media, and business connectivity, alongside maintaining sophisticated on-board IT networks. Their purchasing decisions are highly sensitive to latency, reliability, and the service provider’s ability to deliver consistent quality across various cruising itineraries, often driving the early adoption of cutting-edge technologies like multi-orbit LEO/MEO access, justifying significant investments in premium hardware and bandwidth packages.

Specialized segments include offshore energy companies (oil & gas, wind energy) and global government and military organizations. Offshore platforms and support vessels require VSAT for crucial functions such as remote control of drilling operations, safety monitoring, and video surveillance, prioritizing system resilience (often utilizing C-band for extreme weather resistance) and high levels of encryption and network security. Naval and coast guard fleets demand highly customized, ruggedized terminals capable of operation in harsh environments and require dedicated, secure military frequency bands (like X-band or specialized government Ka-band), making the procurement process complex and highly technical, focusing on global interoperability and resilience against hostile interference or jamming attempts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viasat, Inmarsat (now Viasat), SES S.A., Eutelsat, SpeedCast International (Marlink), Marlink, KVH Industries, Cobham SATCOM, Gilat Satellite Networks, ST Engineering iDirect, Hughes Network Systems, Honeywell International, Intellian Technologies, Satcom Global, NSSLGlobal, GomSpace, Thuraya, Globalstar, Tesat-Spacecom, O3b Networks (SES) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Maritime VSAT Market Key Technology Landscape

The Maritime VSAT technology landscape is undergoing its most significant transformation since its inception, largely driven by the shift from solely Geostationary Earth Orbit (GEO) satellites to highly sophisticated hybrid networks incorporating Medium Earth Orbit (MEO) and Low Earth Orbit (LEO) constellations. The core technological advancement lies in the development of multi-orbit capable hardware, particularly highly stabilized, automated tracking parabolic antennas and, increasingly, solid-state electronically steerable array (ESA) flat panel antennas (FPAs). These FPAs offer significantly smaller footprints, lower maintenance, and the necessary rapid beam-switching capabilities required to maintain connectivity with fast-moving LEO satellites that pass overhead quickly. This hardware innovation is essential for leveraging the low latency benefits associated with NGSO constellations, crucial for real-time applications such as remote piloting and cloud-based operational systems.

Accompanying the hardware evolution is the massive advancement in modem and baseband technology, characterized by software-defined networking (SDN) and Network Function Virtualization (NFV) principles. Modern VSAT systems utilize intelligent modems capable of managing traffic across multiple frequencies and satellite paths simultaneously (link aggregation), dynamically prioritizing data streams, and incorporating advanced waveform technologies for maximizing spectral efficiency. This software intelligence extends to the terrestrial ground segment, where sophisticated network management systems are required to handle the complexity of managing handover and resource allocation across diverse, globally distributed satellite footprints and varying network architectures, demanding high levels of integration and automation.

Further technological innovations include the deployment of High-Throughput Satellite (HTS) capacity, which uses spot beam technology to reuse frequencies and deliver dramatically higher data rates than conventional wide-beam satellites, directly lowering the cost per bit transmitted. The integration of robust cybersecurity measures directly into the VSAT stack is also now standard, moving beyond simple firewall protection to encompass AI-powered anomaly detection and encryption across the entire link. These technological advancements collectively reduce overall system latency, increase throughput capacity, enhance network resilience, and lower the overall total cost of ownership (TCO) for maritime operators, pushing VSAT far beyond its original role as a basic communication link.

Regional Highlights

Regional dynamics play a crucial role in shaping the deployment and adoption rates of Maritime VSAT services, dictated by local maritime activity levels, geopolitical stability, and governmental investment in naval and coastal security infrastructure. Each major region presents unique challenges and opportunities for service providers, requiring tailored network coverage, regulatory compliance strategies, and localized service support infrastructure to effectively capture market share. The competitive landscape is often bifurcated, with global operators competing against strong regional players who specialize in localized service delivery and deep knowledge of specific regional regulatory requirements, particularly concerning spectrum licensing and data sovereignty laws within national territorial waters.

North America and Europe, representing mature maritime markets, are characterized by a high penetration of VSAT technology, driven by the presence of major cruise line headquarters, extensive offshore energy operations in the North Sea and Gulf of Mexico, and substantial investment in advanced naval fleets. These regions demand premium service level agreements (SLAs), highly reliable C-band redundancy, and are the primary early adopters of LEO/MEO solutions due to their sophisticated infrastructure and willingness to invest in high-performance connectivity necessary for advanced digitalization initiatives, including shoreside integration of vessel IoT data.

Asia Pacific (APAC) stands out as the future growth engine for the Maritime VSAT market. This expansion is powered by the region's dominance in global shipbuilding, the rapid increase in the size of its commercial shipping fleet operating vital global trade routes, and significant government spending on establishing regional maritime domain awareness (MDA) capabilities. The dense concentration of shipping traffic in East Asia and Southeast Asia creates a critical need for high-density HTS coverage, driving rapid capacity expansion by both regional and global satellite operators seeking to meet the explosive demand for cost-effective bandwidth for both operational efficiency and crew welfare purposes across this vital trade zone.

- North America: Leads in early adoption of LEO services, driven by demanding offshore oil and gas operations and sophisticated naval requirements. Key markets include the Gulf of Mexico and coastal US logistics hubs.

- Europe: Dominant market share fueled by the North Sea offshore industry, major cruise line operations, and stringent environmental and operational data reporting regulations requiring guaranteed high bandwidth.

- Asia Pacific (APAC): Highest projected growth rate due to massive commercial shipping fleet expansion, regional trade growth, and government modernization efforts across key maritime nations like China, Singapore, and South Korea.

- Middle East and Africa (MEA): Growth driven by strategic maritime choke points, large-scale investment in port modernization (e.g., UAE, Saudi Arabia), and increasing deep-water oil and gas exploration requiring resilient connectivity.

- Latin America: Characterized by specific demands related to fishing fleets and regional energy exploration off the coasts of Brazil and Mexico, focusing on affordable and reliable Ku-band services for widespread coverage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Maritime VSAT Market.- Viasat

- Inmarsat (now Viasat)

- SES S.A.

- Eutelsat

- Marlink

- KVH Industries

- Cobham SATCOM

- Gilat Satellite Networks

- ST Engineering iDirect

- Hughes Network Systems

- Honeywell International

- Intellian Technologies

- Satcom Global

- NSSLGlobal

- Thuraya

- Globalstar

- Tesat-Spacecom

- O3b Networks (SES)

- Castor Marine

- Singtel

Frequently Asked Questions

Analyze common user questions about the Maritime VSAT market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Ku-band and Ka-band VSAT services in the maritime sector?

Ku-band offers wide global coverage due to established satellite infrastructure but provides lower throughput capacity. Ka-band utilizes newer High-Throughput Satellites (HTS) delivering significantly faster data speeds and higher efficiency, though coverage may be geographically limited by spot beams. The choice often depends on the required bandwidth and operational cruising routes.

How are LEO satellite constellations impacting the traditional Maritime VSAT market?

LEO constellations introduce game-changing ultra-low latency and very high throughput, directly addressing demands for real-time applications and superior crew welfare services. This innovation is driving down service costs, increasing competition, and accelerating the development of multi-orbit hybrid VSAT terminals capable of seamlessly switching between LEO, MEO, and GEO satellites.

What major hardware advancements are critical for next-generation maritime VSAT?

The transition to electronically steerable array (ESA) flat panel antennas (FPAs) is crucial. FPAs are smaller, lighter, require less maintenance, and are essential for rapidly tracking LEO/MEO satellites, providing flexibility and better performance compared to traditional, mechanically stabilized parabolic dishes.

What are the primary drivers for increased bandwidth consumption on commercial vessels?

The twin primary drivers are fleet digitalization (IoT integration, remote monitoring, and cloud-based operational systems required for efficiency and compliance) and escalating crew welfare demands, where seafarers expect high-speed internet access for personal communication, streaming, and social media connectivity comparable to shore-based services.

What role does cybersecurity play in the procurement of Maritime VSAT solutions?

Cybersecurity is now a mandatory component. VSAT systems serve as the primary gateway for fleet IT networks, making them vulnerable to attack. Operators demand integrated, managed security services from providers, including firewalls, intrusion detection systems, and vulnerability monitoring, to comply with increasing regulatory scrutiny (e.g., IMO 2021 mandates).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager