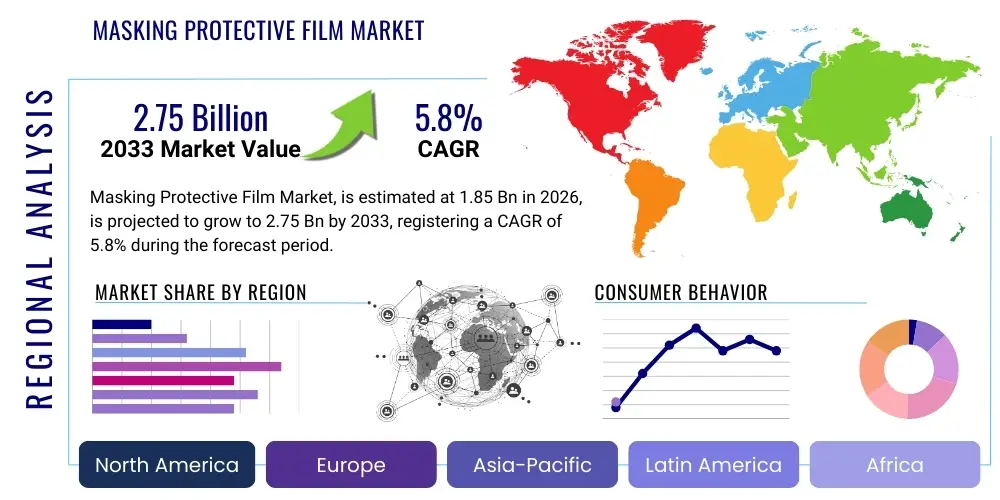

Masking Protective Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439871 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Masking Protective Film Market Size

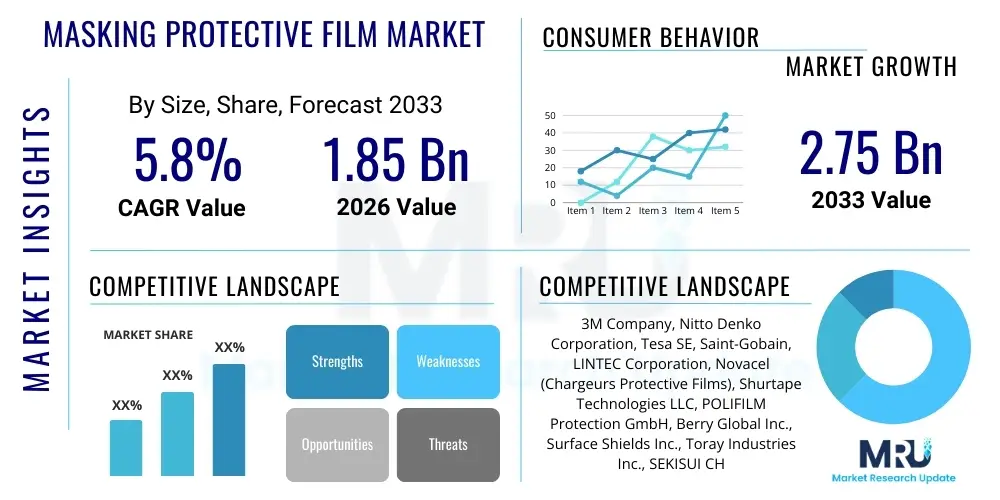

The Masking Protective Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.75 billion by the end of the forecast period in 2033.

Masking Protective Film Market introduction

The Masking Protective Film Market encompasses a diverse range of polymer-based films designed to safeguard surfaces from damage during manufacturing, transportation, storage, and installation processes. These films provide temporary protection against scratches, abrasion, dirt, moisture, and chemical exposure, ensuring the pristine condition of sensitive materials and finished products. Key products include films made from polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC), each selected for its specific adhesive properties, tensile strength, and environmental resistance. The versatility of these films allows for customization in terms of thickness, adhesion level, color, and UV resistance, catering to a wide array of industrial requirements.

Major applications for masking protective films span across numerous industries, including automotive for painted parts and interior components, construction for windows, flooring, and decorative surfaces, electronics for screens and housings, and medical devices for sterile packaging and component protection. Beyond these primary sectors, the films are extensively used in home appliances, metals and plastics fabrication, and printing industries. The fundamental benefit of employing masking protective films lies in their ability to preserve product integrity, reduce waste from damage, and minimize rework, thereby enhancing manufacturing efficiency and customer satisfaction. They act as an invisible shield, maintaining the aesthetic and functional quality of high-value surfaces throughout the product lifecycle.

Driving factors for market growth are multifaceted, propelled significantly by the global expansion of manufacturing industries and increasing demand for high-quality, defect-free finished goods. The rising adoption of automation in production lines necessitates robust surface protection to withstand mechanical stresses. Furthermore, the burgeoning construction sector, particularly in developing economies, fuels demand for films to protect architectural elements. Technological advancements in film materials and adhesive formulations, offering improved performance, residue-free removal, and environmental sustainability, also contribute to market expansion. The growing focus on aesthetic appeal and durability across consumer and industrial products underscores the critical role of masking protective films in value preservation.

Masking Protective Film Market Executive Summary

The Masking Protective Film Market is currently undergoing a dynamic phase characterized by evolving business trends, significant regional shifts, and distinct segment-specific developments. From a business perspective, there is a pronounced move towards sustainable and eco-friendly film solutions, driven by stringent environmental regulations and increasing consumer demand for green products. Manufacturers are investing heavily in R&D to develop biodegradable, recyclable, and bio-based films, aiming to reduce their environmental footprint and gain a competitive edge. Automation and digitalization of production processes are also key trends, leading to improved film quality, consistency, and reduced manufacturing costs. Furthermore, strategic collaborations and mergers and acquisitions are prevalent, as companies seek to expand their product portfolios, technological capabilities, and geographical reach. Customization remains a crucial aspect, with end-users demanding tailored film properties for specialized applications, pushing manufacturers to offer more flexible and diverse product lines.

Regionally, the Asia Pacific (APAC) market continues to dominate in terms of production and consumption, primarily due to robust manufacturing activities across automotive, electronics, and construction sectors in countries like China, India, Japan, and South Korea. This region benefits from lower labor costs and a large industrial base, fostering significant growth. North America and Europe, while mature markets, are witnessing steady growth, largely driven by technological advancements, demand for high-performance films, and a strong emphasis on quality and premium product protection. These regions are also at the forefront of adopting sustainable film technologies. Latin America and the Middle East & Africa (MEA) are emerging as high-growth markets, fueled by increasing industrialization, infrastructure development, and growing foreign investments in manufacturing facilities, creating new opportunities for market players.

Segment-wise, the market is seeing notable trends across different materials, adhesion types, and end-use applications. Polyethylene (PE) films continue to hold the largest market share due to their cost-effectiveness and versatility, but there is growing interest in polypropylene (PP) and polyethylene terephthalate (PET) films for applications requiring higher strength, heat resistance, and optical clarity. In terms of adhesion, specialized films with ultra-low and specific high adhesion levels are gaining traction for sensitive surfaces and demanding industrial processes, respectively. The automotive and electronics industries remain major consumers, with increasing demand for films that protect delicate components during assembly and shipping. The construction sector, particularly for pre-finished materials, is also a significant growth driver. The medical and aerospace sectors represent niche but high-value segments, requiring films with specialized properties like cleanroom compatibility and anti-microbial features, propelling innovation in these areas.

AI Impact Analysis on Masking Protective Film Market

User inquiries regarding Artificial Intelligence's impact on the Masking Protective Film Market frequently revolve around its potential to enhance manufacturing efficiency, improve product quality, and revolutionize material development. Common themes include how AI can optimize production lines, predict and prevent defects, personalize film properties for specific applications, and accelerate the discovery of novel, sustainable materials. Users are keen to understand if AI can lead to more consistent film adhesion, better surface finish preservation, and more efficient waste management throughout the film's lifecycle. There's also curiosity about AI's role in supply chain optimization, demand forecasting, and enabling smart factories within the protective film industry, leading to a more agile and responsive market. The overarching expectation is that AI will drive significant innovation and operational excellence, addressing current market challenges related to quality control, customization, and sustainability.

- AI-driven quality control systems leverage computer vision and machine learning to detect microscopic defects in films during production, drastically reducing waste and ensuring consistent product quality before application.

- Predictive maintenance analytics, powered by AI, optimize machinery operation, forecasting potential equipment failures in film extrusion and coating processes, thereby minimizing downtime and enhancing production efficiency.

- AI algorithms analyze vast datasets of material properties and performance characteristics, accelerating the research and development of new film formulations, including biodegradable polymers and advanced adhesive systems with tailored properties.

- Personalized film solutions are becoming feasible through AI, which can process specific client requirements and rapidly generate optimal film specifications, including thickness, adhesion strength, and UV resistance, for diverse applications.

- Supply chain optimization is significantly improved by AI-driven demand forecasting and inventory management, ensuring timely raw material procurement and efficient distribution of finished protective films, reducing logistical costs and lead times.

- Smart manufacturing integration, enabled by AI and IoT, allows for real-time monitoring and adaptive control of the entire film production process, from polymer synthesis to final slitting, leading to unparalleled operational agility and cost-effectiveness.

DRO & Impact Forces Of Masking Protective Film Market

The Masking Protective Film Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively shape its trajectory and competitive landscape. Key drivers include the relentless growth of various end-use industries such as automotive, electronics, and construction, which continuously demand advanced surface protection solutions to maintain product integrity and aesthetic appeal during manufacturing, transit, and installation. Furthermore, the increasing adoption of pre-finished materials in construction and the rise of automated manufacturing processes that require robust surface safeguarding also contribute significantly to market expansion. Technological advancements in film materials, particularly the development of high-performance polymers and sophisticated adhesive systems offering residue-free removal and enhanced durability, further stimulate demand. The growing global emphasis on product quality and defect reduction across all manufacturing sectors reinforces the necessity of reliable masking protective films.

However, the market faces several notable restraints. Volatility in the prices of raw materials, primarily petrochemical-derived polymers and adhesive components, poses a significant challenge, impacting production costs and profit margins. Environmental concerns related to the disposal of plastic-based films and growing regulatory pressures for sustainable alternatives push manufacturers towards higher-cost, eco-friendly materials, which can initially hinder market adoption due to price sensitivity. The intense competition within the market, characterized by numerous global and regional players, leads to price erosion and reduced profitability, compelling companies to innovate constantly. Moreover, the availability of alternative surface protection methods, such as coatings or temporary sprays, while not always as effective, can also present a competitive challenge to traditional protective films. Additionally, the economic slowdowns or geopolitical uncertainties can temporarily dampen demand from end-use industries, creating market fluctuations.

Despite these restraints, significant opportunities abound for market participants. The most prominent opportunity lies in the development and widespread adoption of sustainable and biodegradable masking films, aligning with global environmental objectives and consumer preferences. Innovation in smart films with integrated functionalities, such as self-healing properties or temperature indicators, presents lucrative niche markets. The expansion of manufacturing bases in emerging economies, particularly in Asia Pacific and Latin America, offers untapped growth potential. Furthermore, the increasing demand for protective films in specialized applications like medical devices, aerospace components, and renewable energy equipment provides avenues for product diversification and value-added solutions. Collaborations with end-use industries to develop highly customized protective films for specific, complex applications also represent a substantial opportunity for market differentiation and growth, allowing companies to cater to unique performance requirements and drive innovation in adhesion science and material engineering.

Segmentation Analysis

Segmentation analysis of the Masking Protective Film Market provides a comprehensive understanding of its diverse components, allowing for targeted strategic planning and detailed market insights. The market can be broadly segmented based on material type, adhesion level, application, and end-use industry, each category revealing distinct growth patterns, competitive dynamics, and technological requirements. This granular view helps manufacturers tailor their product offerings, develop specific marketing strategies, and identify emerging opportunities within various sub-sectors. Understanding these segmentations is critical for stakeholders to navigate the market effectively, optimize their product portfolios, and capitalize on evolving demand across different customer groups and geographical regions. The intricate nature of protective film applications necessitates such detailed segmentation to capture the full scope of market activity and inform robust business decisions.

- By Material Type

- Polyethylene (PE) Films

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP) Films

- Biaxially Oriented Polypropylene (BOPP)

- Cast Polypropylene (CPP)

- Polyethylene Terephthalate (PET) Films

- Polyvinyl Chloride (PVC) Films

- Acrylic Films

- Other Polymer Films (e.g., Polyurethane, EVA)

- Polyethylene (PE) Films

- By Adhesion Level

- Low Adhesion

- Medium Adhesion

- High Adhesion

- Ultra-High Adhesion

- By Application Type

- Surface Protection (temporary)

- Masking (for painting, sandblasting)

- Laminating (for enhanced durability)

- Specialty Applications (e.g., medical, optical)

- By End-Use Industry

- Automotive

- Automotive Interior Protection

- Automotive Exterior Protection

- Automotive Parts Protection

- Electronics

- Display Screens

- Housings and Components

- Construction

- Windows and Doors

- Flooring and Carpets

- Countertops and Surfaces

- Architectural Panels

- Metal Fabrication

- Stainless Steel Sheets

- Aluminum Profiles

- Coated Metals

- Home Appliances

- Refrigerators

- Washing Machines

- Ovens

- Plastics and Composites

- Medical Devices

- Aerospace

- Printing and Graphics

- General Industrial

- Automotive

Value Chain Analysis For Masking Protective Film Market

The value chain for the Masking Protective Film Market is a multi-stage process involving raw material suppliers, film manufacturers, converters, distributors, and ultimately, a diverse range of end-users. At the upstream stage, the value chain begins with the procurement of essential raw materials, predominantly various polymer resins such as polyethylene, polypropylene, PET, and PVC, along with specialized adhesives and additives. Key suppliers in this segment include major petrochemical companies and chemical manufacturers who provide these base ingredients. The quality and cost of these raw materials significantly influence the final product's performance and market price. Research and development activities also form a crucial upstream component, focusing on new polymer formulations, adhesive technologies, and sustainable material solutions to meet evolving market demands and regulatory requirements. Continuous innovation in this segment is vital for competitive advantage, driving advancements in film strength, adhesion properties, and environmental impact.

Moving downstream, the raw materials are processed by film manufacturers who specialize in extrusion, co-extrusion, and coating techniques to produce the base protective film. This stage involves complex manufacturing processes where the film's thickness, mechanical properties, and adhesive characteristics are meticulously controlled. Following the manufacturing, some films undergo converting processes, where they are slit, die-cut, or perforated into specific dimensions or shapes required by end-users. The distribution channel then plays a critical role in bridging the gap between manufacturers and the diverse customer base. Direct sales often occur for large industrial clients with specific, high-volume needs, allowing for customized solutions and direct technical support. Indirect distribution, involving wholesalers, distributors, and specialized industrial suppliers, is more common for smaller businesses or those requiring a broader range of standard products, extending market reach and providing logistical efficiencies.

Both direct and indirect distribution channels are crucial for market penetration. Direct sales allow for closer client relationships, particularly for complex and high-value applications, enabling manufacturers to offer tailored advice and quick responses to technical issues. This approach is often favored by major automotive or electronics manufacturers who require precise film specifications and just-in-time delivery. Indirect channels, conversely, leverage the established networks of distributors who possess strong regional market knowledge and logistical capabilities. These partners aggregate demand from numerous smaller clients across various industries, making protective films accessible to a broader market segment. The choice of distribution strategy often depends on the manufacturer's size, product range, target market, and the level of customization required, aiming to optimize market reach, cost-efficiency, and customer service. The effectiveness of the entire value chain hinges on seamless coordination and strong relationships between all participants, from raw material sourcing to final product delivery and application.

Masking Protective Film Market Potential Customers

The Masking Protective Film Market serves a vast and diverse customer base, primarily comprising businesses across various manufacturing and service industries that require temporary surface protection for their products or assets. The end-users or buyers of these films are entities focused on preserving the integrity, aesthetic quality, and functional performance of surfaces during critical stages such as fabrication, assembly, transportation, storage, and installation. These customers seek solutions that can prevent scratches, abrasions, dirt accumulation, chemical exposure, and other forms of damage, thereby reducing rework, minimizing waste, and ensuring customer satisfaction with the final product. Their demand is driven by the need for quality assurance, cost reduction associated with repair or replacement of damaged items, and the desire to uphold brand reputation by delivering pristine goods. The value proposition for these customers lies in the ability of protective films to act as an indispensable, yet temporary, barrier against a multitude of potential damages, safeguarding their investments and production efficiency.

Key potential customers include original equipment manufacturers (OEMs) in the automotive industry, who utilize masking films extensively to protect painted body panels, interior trim, and various components from damage during assembly, shipping, and dealer preparation. In the electronics sector, manufacturers of smartphones, tablets, televisions, and other devices are significant buyers, employing films to shield delicate screens, casings, and circuit boards from scratches and contaminants throughout the production process. The construction industry represents another major customer segment, with builders, contractors, and material suppliers using films to protect windows, doors, flooring, countertops, and pre-fabricated panels during construction, renovation, and transportation. Furthermore, metal fabrication companies, especially those working with stainless steel, aluminum, and coated metals, rely heavily on these films to prevent surface damage during cutting, bending, and shaping operations, maintaining the aesthetic and corrosion resistance of their materials.

Beyond these prominent sectors, the market extends to manufacturers of home appliances like refrigerators, washing machines, and ovens, where films protect exterior surfaces. The medical device industry uses specialized sterile protective films for components and packaging, while the aerospace sector employs high-performance films for delicate aircraft parts during manufacturing and maintenance. Plastic and composite manufacturers, as well as companies involved in printing and graphics, also represent substantial customer segments. Essentially, any industry that deals with valuable surfaces susceptible to temporary damage during handling, processing, or transit qualifies as a potential customer for masking protective films. The increasing complexity and value of manufactured goods, combined with a growing emphasis on quality and waste reduction, continually broaden the spectrum of potential customers seeking reliable surface protection solutions across the global economy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Nitto Denko Corporation, Tesa SE, Saint-Gobain, LINTEC Corporation, Novacel (Chargeurs Protective Films), Shurtape Technologies LLC, POLIFILM Protection GmbH, Berry Global Inc., Surface Shields Inc., Toray Industries Inc., SEKISUI CHEMICAL CO. LTD., Coveris Holdings S.A., MAIN TAPE INC., American Biltrite Inc., PROTAPE AG, DUNMORE, CCL Industries Inc., Intertape Polymer Group Inc., Scapa Group plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Masking Protective Film Market Key Technology Landscape

The Masking Protective Film Market is continuously evolving, driven by significant advancements in material science, manufacturing processes, and application technologies. A core technological aspect involves the development of diverse polymer substrates, including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC), each selected for its specific mechanical, thermal, and optical properties. Innovation focuses on enhancing the film's strength-to-weight ratio, puncture resistance, and clarity, while also exploring multi-layer co-extrusion techniques to combine desirable properties into a single film. This allows for customized solutions that cater to specific end-use requirements, such as high-temperature resistance for automotive painting processes or superior optical clarity for screen protection in electronics. The ongoing research into bio-based and biodegradable polymers represents a significant technological frontier, aiming to address environmental concerns and meet the growing demand for sustainable products, pushing the boundaries of traditional plastic film manufacturing.

Another critical area of technological innovation lies in adhesive formulations. The performance of a masking protective film is largely determined by its adhesive system, which must provide optimal adhesion during application, maintain integrity throughout its use, and allow for clean, residue-free removal. Technologies include acrylic, rubber-based, and silicone adhesives, with continuous development focused on tailoring adhesion levels (from ultra-low to high tack) to various surface types and environmental conditions. Advanced adhesive technologies also incorporate UV-curable systems for enhanced durability and specific release characteristics, preventing adhesive transfer or ghosting on sensitive surfaces. Furthermore, smart adhesive systems are emerging, designed to respond to external stimuli, offering features like temporary bond strength adjustment or color-changing indicators upon removal. These innovations are crucial for expanding the applicability of masking films to more delicate, high-value, and complex surfaces without compromising their integrity.

Beyond material and adhesive science, manufacturing technologies are being revolutionized by automation and digital integration. Advanced extrusion and coating lines incorporate precise control systems, enabling consistent film thickness, uniform adhesive application, and rapid production speeds. Robotics and artificial intelligence (AI) are increasingly employed for quality control, defect detection, and optimization of production parameters, ensuring high-quality output and reducing waste. Furthermore, technologies for surface treatment, such as corona or plasma treatment, are utilized to enhance film printability and adhesion properties. The adoption of digital printing technologies allows for customized branding, instructions, or patterns directly onto the films. The overall technology landscape is moving towards more integrated, sustainable, and intelligent manufacturing processes, providing highly customized, high-performance protective films that can meet the rigorous demands of modern industries while minimizing environmental impact.

Regional Highlights

- Asia Pacific (APAC): This region stands as the largest and fastest-growing market for masking protective films, driven by robust growth in manufacturing sectors across countries like China, India, Japan, South Korea, and Southeast Asian nations. APAC's dominance is attributed to its vast industrial base, burgeoning automotive and electronics production, significant construction activities, and expanding consumer goods manufacturing. The region benefits from lower production costs and increasing foreign investments, fostering innovation and capacity expansion. Demand for protective films in APAC is propelled by the need to safeguard high-value components and finished products throughout complex supply chains and local consumption.

- North America: A mature yet steadily growing market, North America is characterized by high demand for advanced, high-performance protective films, particularly in the automotive, aerospace, and electronics industries. The region emphasizes product quality, technological innovation, and sustainable solutions. Stringent regulatory standards and a focus on premium products drive the adoption of sophisticated film technologies. Key countries like the United States and Canada are leading in R&D for biodegradable films and specialized adhesion systems, catering to niche applications and high-end manufacturing.

- Europe: The European market demonstrates consistent growth, fueled by strong manufacturing sectors in Germany, France, the UK, and Italy, alongside strict environmental regulations. European industries prioritize precision, durability, and eco-friendliness in their protective film solutions. The automotive, construction, and home appliance sectors are significant end-users, demanding films that offer superior protection and comply with circular economy principles. Investment in sustainable film technologies and advanced adhesive research is a major trend across the region, positioning it at the forefront of green material development.

- Latin America: This emerging market is experiencing increasing industrialization and infrastructure development, particularly in Brazil, Mexico, and Argentina. Growth is driven by expanding automotive assembly plants, burgeoning construction projects, and increasing foreign direct investment in manufacturing. While cost-effectiveness remains a key factor, there is a growing awareness and demand for quality protective films to prevent damage and reduce waste, signifying a gradual shift towards higher-performance solutions as industrial maturity progresses.

- Middle East and Africa (MEA): The MEA region represents a developing market with significant potential, primarily driven by large-scale construction projects, diversification efforts beyond oil and gas, and growing manufacturing capabilities. Countries like UAE, Saudi Arabia, and South Africa are investing heavily in infrastructure and industrialization, leading to increased demand for protective films in construction and emerging industrial applications. The market here is still nascent but is expected to witness substantial growth as industrial development accelerates and supply chains become more sophisticated.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Masking Protective Film Market.- 3M Company

- Nitto Denko Corporation

- Tesa SE

- Saint-Gobain

- LINTEC Corporation

- Novacel (Chargeurs Protective Films)

- Shurtape Technologies LLC

- POLIFILM Protection GmbH

- Berry Global Inc.

- Surface Shields Inc.

- Toray Industries Inc.

- SEKISUI CHEMICAL CO. LTD.

- Coveris Holdings S.A.

- MAIN TAPE INC.

- American Biltrite Inc.

- PROTAPE AG

- DUNMORE

- CCL Industries Inc.

- Intertape Polymer Group Inc.

- Scapa Group plc.

Frequently Asked Questions

What is a masking protective film and its primary purpose?

A masking protective film is a temporary, self-adhesive polymer-based film designed to protect surfaces from scratches, dirt, abrasion, and damage during manufacturing, transportation, storage, and installation. Its primary purpose is to preserve the pristine condition and aesthetic quality of valuable surfaces, reducing defects and rework.

Which industries are the largest consumers of masking protective films?

The largest consumers of masking protective films include the automotive industry for vehicle components, the electronics industry for screens and housings, the construction sector for windows and finished surfaces, and metal fabrication for protecting various metal sheets and profiles during processing.

What are the key types of materials used in masking protective films?

Key materials used in masking protective films primarily include polyethylene (PE) in various densities (LDPE, LLDPE, HDPE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC). These polymers are chosen based on required properties like strength, flexibility, clarity, and cost-effectiveness.

How do environmental concerns impact the Masking Protective Film Market?

Environmental concerns significantly impact the market by driving demand for sustainable solutions such as recyclable, biodegradable, and bio-based films. This leads to increased R&D investments in eco-friendly materials and manufacturing processes, aiming to reduce the environmental footprint of plastic waste and comply with evolving regulations.

What role does adhesion level play in selecting a protective film?

Adhesion level is crucial for selecting a protective film as it determines how strongly the film adheres to a surface and how cleanly it can be removed. Films are available in low, medium, high, and ultra-high adhesion, tailored to different surface sensitivities and protection durations, ensuring residue-free removal and optimal surface preservation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager