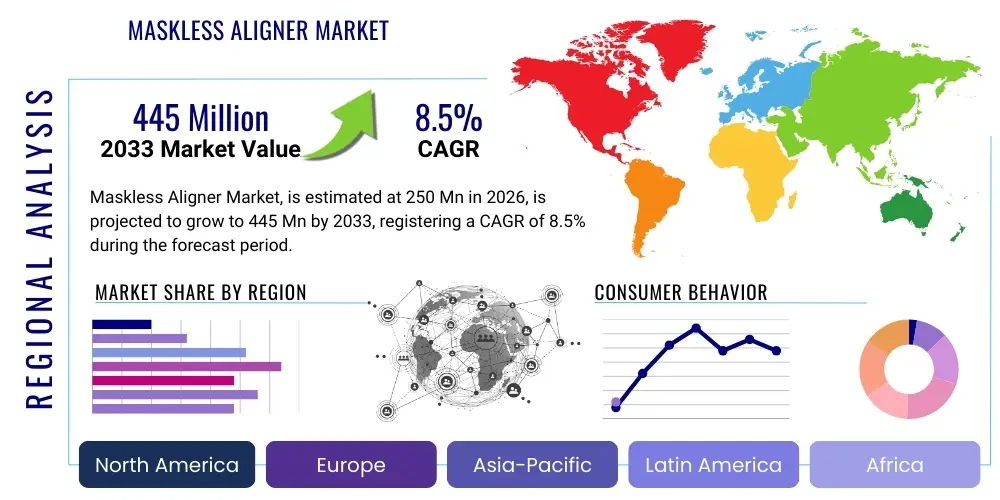

Maskless Aligner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439582 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Maskless Aligner Market Size

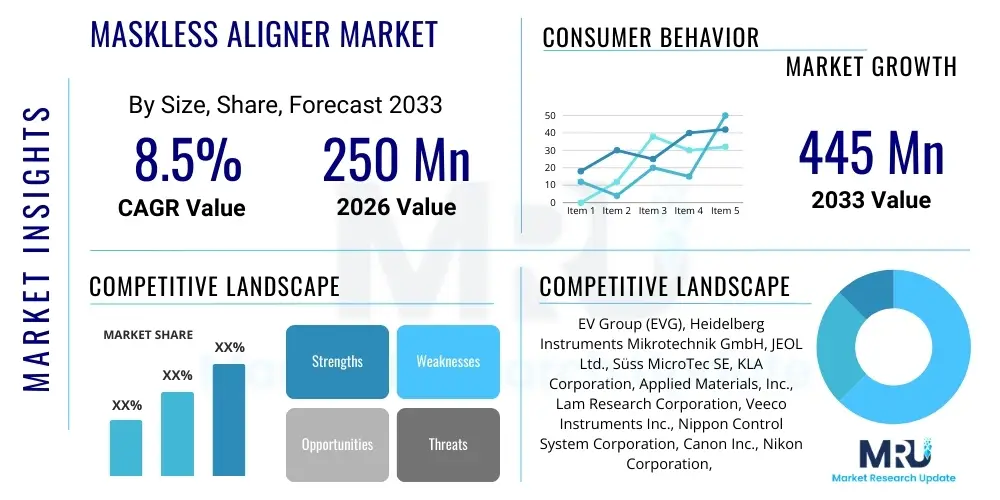

The Maskless Aligner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 250 million in 2026 and is projected to reach USD 445 million by the end of the forecast period in 2033. This growth trajectory is fueled by the relentless demand for advanced semiconductor devices, necessitating more precise and flexible lithography solutions, particularly in rapidly evolving sectors like IoT, AI hardware, and automotive electronics. The agility and cost-efficiency offered by maskless aligners for prototyping and low-volume production are key drivers propelling this expansion.

Maskless Aligner Market introduction

The Maskless Aligner Market encompasses innovative photolithography systems that eliminate the need for physical photomasks, traditionally used to pattern semiconductor wafers. These systems employ direct-write technologies, such as digital micromirror devices (DMDs) or electron beam scanners, to project circuit patterns onto photoresist-coated substrates. This fundamental shift offers unparalleled flexibility, significantly reducing design-to-production cycles and enabling rapid prototyping and low-to-medium volume manufacturing of complex devices. The market's evolution is closely tied to advancements in microelectronics and optoelectronics, where increasing device complexity and miniaturization demand more versatile and cost-effective patterning solutions than conventional mask-based lithography can provide for certain applications.

Maskless aligners find extensive application across various critical industries. In semiconductor manufacturing, they are crucial for advanced packaging, MEMS device fabrication, and the production of compound semiconductors and power devices, where diverse designs and material characteristics benefit from highly adaptable patterning. Furthermore, these systems are indispensable in research and development environments, allowing scientists and engineers to rapidly test new designs and materials without the prohibitive costs and lead times associated with mask creation. Their ability to handle various substrate sizes and materials, including glass, silicon, and flexible substrates, makes them a versatile tool in both academic and industrial settings, fostering innovation across a broad spectrum of technological fields.

The core benefits driving the adoption of maskless aligners include significantly reduced operational costs due to the elimination of mask production and maintenance, enhanced design flexibility allowing for real-time pattern modifications, and accelerated product development cycles. These advantages are particularly potent for R&D, customized device manufacturing, and niche applications where the economic burden of mask creation would otherwise be prohibitive. Moreover, the driving factors for market growth extend to the increasing complexity of integrated circuits, the proliferation of Internet of Things (IoT) devices requiring specialized chip designs, and the ongoing push for miniaturization in consumer electronics, medical devices, and industrial sensors, all of which benefit from the agility and precision offered by maskless aligner technology.

Maskless Aligner Market Executive Summary

The Maskless Aligner Market is experiencing robust growth, driven by key business trends such as the escalating demand for advanced packaging solutions and the rapid proliferation of niche semiconductor applications. Manufacturers are increasingly seeking flexible, cost-effective patterning tools that can accelerate time-to-market for complex, custom-designed components, making maskless aligners an attractive investment. A significant trend is the shift towards localized manufacturing and supply chain resilience, prompting companies to invest in versatile in-house capabilities that reduce reliance on external mask fabrication. This strategic pivot aims to mitigate risks associated with geopolitical instabilities and global supply chain disruptions, enhancing operational autonomy and fostering innovation within regional ecosystems.

Regionally, Asia Pacific continues to dominate the market, primarily due to the concentration of major semiconductor manufacturing hubs and a thriving electronics industry in countries like China, South Korea, Taiwan, and Japan. This region is a hotbed for both advanced packaging and compound semiconductor production, driving significant investments in maskless lithography. North America and Europe are also experiencing substantial growth, fueled by strong R&D activities, the expansion of high-tech manufacturing, and increasing governmental support for domestic semiconductor production. These regions are actively fostering innovation in MEMS, photonics, and power electronics, creating a sustained demand for flexible patterning tools that can support diverse research and industrial applications, from academic labs to high-volume foundries.

Segmentation trends highlight the increasing importance of maskless aligners in advanced packaging and MEMS applications, where their ability to handle varied substrate materials and complex, multi-level structures is particularly advantageous. By type, UV maskless aligners currently hold a dominant share due to their maturity and cost-effectiveness, though Electron Beam and Extreme Ultraviolet (EUV) maskless technologies are gaining traction for ultra-high resolution requirements in cutting-edge research and next-generation device fabrication. Furthermore, the market is seeing a growing adoption in academic and research institutions, underscoring the technology's role in fundamental science and early-stage product development, alongside its expanding utility in commercial manufacturing facilities. This diverse application base ensures a resilient and continuously expanding market landscape.

AI Impact Analysis on Maskless Aligner Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize the precision and efficiency of maskless aligner systems, questioning its potential to automate complex alignment processes, optimize pattern generation algorithms, and enhance defect detection capabilities. Concerns often revolve around the integration challenges, the need for specialized data infrastructure, and the ethical implications of autonomous decision-making in critical manufacturing stages. However, there is a strong expectation that AI will unlock new levels of performance, enabling faster throughput, higher yields, and the ability to fabricate even more intricate and novel device architectures, thereby positioning maskless aligners as an indispensable tool for future semiconductor innovation and advanced material processing.

- AI-driven pattern optimization: Algorithms can analyze design rules and material properties to generate optimal exposure patterns, reducing trial-and-error cycles and improving resolution.

- Automated alignment and calibration: Machine learning models can precisely align substrates and optics, compensating for environmental variations and increasing alignment accuracy and speed.

- Real-time defect detection and correction: AI-powered vision systems can identify sub-micron defects during the lithography process and trigger immediate adjustments or flagging for rework.

- Predictive maintenance: AI can monitor equipment performance data to predict potential failures, enabling proactive maintenance and minimizing downtime for maskless aligner systems.

- Enhanced process control: Machine learning can continuously fine-tune exposure parameters, intensity, and focus in real-time based on in-situ measurements, optimizing fabrication consistency.

- Accelerated material characterization: AI can quickly analyze interactions between photoresists, substrates, and exposure conditions, speeding up the development of new materials for lithography.

- Custom pattern generation for personalized devices: AI facilitates the on-demand creation of unique patterns for highly specialized or patient-specific microdevices, expanding market applications.

DRO & Impact Forces Of Maskless Aligner Market

The Maskless Aligner Market is primarily driven by the escalating demand for miniaturization in electronic devices and the continuous pursuit of cost-efficiency in semiconductor manufacturing. The elimination of physical masks significantly reduces upfront tooling costs and lead times, making these systems highly attractive for R&D, rapid prototyping, and flexible production runs. Furthermore, the inherent flexibility to modify designs on the fly without incurring additional mask fabrication expenses provides a substantial competitive advantage, especially for companies operating in dynamic markets with short product lifecycles. This adaptability is crucial for industries developing specialized components, such as custom sensors for IoT or unique integrated circuits for medical applications, where rapid iteration and design changes are commonplace and economically necessary.

However, the market faces significant restraints, including the high initial capital investment required for advanced maskless aligner systems, which can be prohibitive for smaller enterprises or academic institutions with limited budgets. Technical complexities associated with achieving high throughput for mass production, especially for designs requiring extremely fine feature sizes over large areas, also pose a challenge. While maskless systems excel in flexibility and low-to-medium volume production, their overall throughput might not yet match that of conventional mask-based lithography for ultra-high volume manufacturing, impacting their broader adoption in certain segments of the semiconductor industry. Additionally, the need for specialized expertise to operate and maintain these sophisticated systems contributes to the operational overhead.

Opportunities for growth are abundant, particularly with the integration of advanced technologies like AI and machine learning into maskless aligner operations, which promise further enhancements in precision, speed, and automation. The emergence of new semiconductor materials, such as gallium nitride (GaN) and silicon carbide (SiC), and the rapid expansion of advanced packaging techniques (e.g., 3D ICs, fan-out wafer-level packaging) create new application niches where the flexibility of maskless aligners is highly advantageous. Moreover, the increasing focus on customized and specialized devices across various industries, from automotive to biomedical, positions maskless aligners as a critical technology for enabling future innovation and market diversification. These technological advancements and evolving market needs are poised to overcome existing restraints and propel the market forward.

Segmentation Analysis

The Maskless Aligner Market is meticulously segmented to provide a granular understanding of its diverse applications, technological underpinnings, and end-user adoption patterns. These segmentations allow for a detailed analysis of market dynamics, identifying specific growth pockets and competitive landscapes within the broader industry. By dissecting the market along these various axes, stakeholders can better understand current trends, forecast future demands, and strategically position their products and services to capitalize on emerging opportunities across the microfabrication ecosystem.

- By Type:

- UV Maskless Aligner: Utilizes ultraviolet light for patterning, offering a balance of resolution and cost-effectiveness for a wide range of applications.

- EUV Maskless Aligner: Employs extreme ultraviolet light for ultra-fine resolution patterning, critical for next-generation devices at the leading edge of semiconductor technology.

- Electron Beam Maskless Aligner: Uses focused electron beams to achieve the highest resolution, primarily for advanced R&D and specialized device fabrication.

- By Application:

- Advanced Packaging: Crucial for the fabrication of complex 3D ICs, fan-out wafer-level packaging, and other heterogeneous integration techniques.

- MEMS (Micro-Electro-Mechanical Systems): Essential for patterning intricate structures in sensors, actuators, and microfluidic devices.

- Power Devices: Supports the manufacturing of high-voltage and high-current components using materials like SiC and GaN.

- Compound Semiconductors: Key for producing high-speed, high-frequency devices for wireless communications and optoelectronics.

- Photonics: Used in the creation of optical waveguides, gratings, and other light-manipulating structures.

- Research & Development: Indispensable tool in academic and industrial labs for exploring new materials, designs, and processes.

- Others: Includes applications in biomedical devices, displays, and custom electronics.

- By End-User:

- Semiconductor Manufacturers: For in-house fabrication of specialized chips and advanced packaging.

- Research Institutions: Universities and national labs utilizing maskless aligners for fundamental and applied research.

- Foundries: Offering flexible patterning services for diverse client needs, from prototyping to low-volume production.

- Defense & Aerospace: For manufacturing robust and high-performance components for sensitive applications.

- Biomedical & Healthcare: Enabling the creation of microfluidic chips, biosensors, and customized medical devices.

- Universities: Educational and research purposes, allowing students and faculty access to advanced fabrication capabilities.

Value Chain Analysis For Maskless Aligner Market

The value chain for the Maskless Aligner Market begins with extensive upstream activities, primarily involving the research, development, and manufacturing of highly specialized components and raw materials. This includes the production of ultra-precision optical elements, high-power light sources (UV, EUV, or electron sources), advanced digital micromirror devices (DMDs) or spatial light modulators, and sophisticated control electronics. Key suppliers in this segment focus on material purity, component reliability, and meeting stringent specifications for resolution and accuracy. The intellectual property associated with these specialized components is immense, often requiring significant R&D investment from niche technology providers. Furthermore, the development of specialized photoresists and chemical solutions, optimized for maskless exposure techniques, forms another critical upstream segment, driving innovation in material science to enhance patterning fidelity and process efficiency.

Moving downstream, the value chain involves the integration and assembly of these advanced components into complete maskless aligner systems, followed by rigorous testing, calibration, and software development. Manufacturers invest heavily in precision engineering and cleanroom facilities to ensure the highest quality and performance of the final systems. Following manufacturing, the distribution channel plays a crucial role. Direct distribution is often preferred for high-value capital equipment like maskless aligners, allowing manufacturers to maintain direct relationships with end-users, provide specialized technical support, and offer comprehensive service contracts. This direct approach facilitates knowledge transfer and allows for customized solutions based on specific client requirements, which is vital given the complexity and application-specific nature of these tools. Direct sales teams and field service engineers are integral to this model, ensuring seamless installation, training, and ongoing support for the sophisticated machinery.

Indirect distribution, though less common for primary sales, can involve strategic partnerships with distributors or integrators who have established regional presence or specialized expertise in certain application areas. These partners can extend market reach, particularly in emerging markets or for providing supplementary services. Post-sale activities, including maintenance, spare parts supply, software upgrades, and application support, constitute a significant portion of the downstream value chain. These services are critical for ensuring optimal equipment uptime and performance, and for maximizing the return on investment for end-users. The continuous evolution of semiconductor technology also necessitates ongoing research and development from maskless aligner manufacturers to innovate and introduce next-generation systems, thereby sustaining their competitive edge and adding value throughout the product lifecycle for their global clientele.

Maskless Aligner Market Potential Customers

The primary potential customers for maskless aligners are entities deeply involved in the fabrication and development of micro- and nano-scale devices, particularly those valuing flexibility, speed, and cost-efficiency over extremely high volume mass production that might be served by conventional mask-based lithography. Semiconductor manufacturers, especially those focused on advanced packaging, heterogeneous integration, or specialized chip designs, represent a significant customer base. These companies often require rapid prototyping capabilities and the ability to produce diverse, low-to-medium volume batches of highly customized integrated circuits and advanced modules, where the economic burden of traditional masks becomes prohibitive. The demand for flexible, high-precision patterning tools for specific applications within their larger production lines makes maskless aligners an attractive, complementary investment.

Beyond traditional semiconductor players, research institutions, including universities, national laboratories, and corporate R&D centers, form a crucial segment of potential customers. These organizations leverage maskless aligners for fundamental scientific research, developing novel materials and device architectures, and rapid iteration of experimental designs. The ability to quickly pattern and test new concepts without the lead time and expense of mask fabrication significantly accelerates the pace of discovery and innovation. This makes maskless aligners an indispensable tool for academic programs focused on microelectronics, MEMS, photonics, and biotechnology, providing hands-on experience with cutting-edge fabrication techniques and enabling breakthroughs in various fields of science and engineering. These institutions value the versatility and adaptability of these systems for their diverse project needs.

Furthermore, specialized foundries and niche device manufacturers, particularly those in the MEMS, compound semiconductor, power electronics, and biomedical industries, represent another growing segment of potential customers. These companies often deal with a wide variety of substrate materials, intricate 3D structures, and custom production runs that are not conducive to standard mask-based processes. For instance, manufacturers of custom biosensors, microfluidic devices, or specialized RF components find maskless aligners ideal for their unique production requirements. The defense and aerospace sectors also emerge as key end-users, demanding high-reliability, custom-designed components often produced in smaller volumes, for which maskless aligners offer the necessary flexibility and precision. These diverse end-users underscore the broad applicability and expanding market penetration of maskless aligner technology across high-tech manufacturing and innovation-driven industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 445 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EV Group (EVG), Heidelberg Instruments Mikrotechnik GmbH, JEOL Ltd., Süss MicroTec SE, KLA Corporation, Applied Materials, Inc., Lam Research Corporation, Veeco Instruments Inc., Nippon Control System Corporation, Canon Inc., Nikon Corporation, ASML Holding N.V., Carl Zeiss SMT GmbH, Microlight3D, TryX Inc., GenISys GmbH, Vistec Electron Beam GmbH, Nano Dimension, Ushio Inc., Toppan Photomasks Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Maskless Aligner Market Key Technology Landscape

The technological landscape of the Maskless Aligner Market is characterized by a sophisticated interplay of optical, mechanical, and software innovations, all converging to achieve unparalleled patterning precision and flexibility. At its core are the direct-write engines, which vary significantly by system type. UV maskless aligners commonly leverage Digital Micromirror Devices (DMDs) or Spatial Light Modulators (SLMs) to dynamically project patterns. These micromirror arrays can be individually addressed to steer light, creating a pixelated pattern directly onto the wafer. Electron Beam Maskless Aligner systems, on the other hand, utilize highly focused electron beams, often generated from field emission sources, to directly expose photoresist, achieving resolutions far beyond optical limits, crucial for cutting-edge nanotechnology and advanced material science research. The choice of technology dictates the achievable resolution, throughput, and operational cost, aligning with specific application requirements.

Beyond the primary patterning engine, critical auxiliary technologies ensure the high performance of maskless aligners. Advanced alignment and stage positioning systems, often employing laser interferometry and sophisticated motion control, are essential for sub-micron overlay accuracy across multiple layers and large substrates. Furthermore, the light sources themselves represent a key technological frontier, with continuous development in high-power UV lamps, excimer lasers, and, for EUV maskless concepts, synchrotron-based or laser-produced plasma sources. These sources must provide stable, uniform, and precisely controlled illumination. Software plays an equally vital role, managing complex data conversion for pattern generation, real-time process control, defect management, and seamless integration with existing semiconductor manufacturing execution systems (MES). The algorithms for proximity effect correction in electron beam systems, for example, are highly intricate and continuously refined to optimize pattern fidelity.

Innovations in photoresist chemistry are also fundamental, as maskless aligners require specialized resists optimized for specific exposure wavelengths and energy levels to achieve desired resolution and process latitude. Resist materials must be highly sensitive, offer good adhesion, and be capable of uniform coating on various substrate types. Emerging technologies such as multi-beam electron lithography and advanced holographic patterning techniques are also being explored to enhance throughput while maintaining resolution. The trend towards integrating AI and machine learning into these systems for predictive maintenance, process optimization, and automated defect detection is rapidly gaining traction, promising to further enhance efficiency and reduce operational complexities. This confluence of hardware, software, and materials science ensures the continuous evolution and expansion of maskless aligner capabilities, addressing the increasingly stringent demands of microfabrication. This technological evolution is pivotal for enabling the next generation of highly integrated and specialized electronic components.

Regional Highlights

- Asia Pacific: Dominated by major semiconductor manufacturing hubs in China, South Korea, Taiwan, and Japan, this region represents the largest market share. The robust growth in consumer electronics, automotive electronics, and the establishment of new fabrication plants drive significant investments in maskless aligner technology, particularly for advanced packaging and high-volume prototyping.

- North America: Driven by strong R&D activities, a vibrant startup ecosystem, and increasing government initiatives to bolster domestic semiconductor manufacturing, North America shows substantial growth. Key applications include MEMS, compound semiconductors, and defense-related microelectronics, with a strong focus on high-precision and flexible patterning solutions.

- Europe: Characterized by a strong emphasis on automotive, industrial, and medical electronics, Europe is a significant market for maskless aligners. Countries like Germany, France, and the Netherlands lead in microelectronics research and specialized device manufacturing, fostering demand for advanced lithography tools for both industrial production and academic innovation.

- Latin America: While a smaller market compared to others, Latin America is experiencing gradual growth fueled by increasing investments in industrial automation and the burgeoning electronics assembly sector. The region presents opportunities for maskless aligners in niche manufacturing and academic research, particularly in countries like Brazil and Mexico.

- Middle East and Africa (MEA): This region is an emerging market for maskless aligners, driven by diversification efforts in economies, investments in technology infrastructure, and growing interest in localized manufacturing capabilities. The adoption is primarily concentrated in research institutions and new industrial ventures seeking advanced microfabrication tools for specialized applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Maskless Aligner Market.- EV Group (EVG)

- Heidelberg Instruments Mikrotechnik GmbH

- JEOL Ltd.

- Süss MicroTec SE

- KLA Corporation

- Applied Materials, Inc.

- Lam Research Corporation

- Veeco Instruments Inc.

- Nippon Control System Corporation

- Canon Inc.

- Nikon Corporation

- ASML Holding N.V.

- Carl Zeiss SMT GmbH

- Microlight3D

- TryX Inc.

- GenISys GmbH

- Vistec Electron Beam GmbH

- Nano Dimension

- Ushio Inc.

- Toppan Photomasks Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Maskless Aligner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a maskless aligner and how does it differ from traditional lithography?

A maskless aligner is a photolithography system that directly patterns circuit designs onto a substrate without using a physical photomask. Unlike traditional lithography which requires a pre-fabricated mask for each design, maskless aligners use digital data and dynamically reconfigurable optical elements (like DMDs) or electron beams to project patterns. This offers significant advantages in flexibility, cost reduction for prototyping, and faster design iteration cycles, particularly beneficial for low-to-medium volume production and research applications.

What are the primary benefits of using maskless aligners in semiconductor manufacturing?

The key benefits include significant cost savings by eliminating expensive mask production and storage, enhanced design flexibility allowing for real-time pattern modifications and rapid prototyping, and reduced turnaround times for new device development. Maskless aligners are ideal for customized chips, R&D, and heterogeneous integration, enabling faster innovation and a quicker response to market demands for specialized semiconductor components across various industries.

What are the main applications of maskless aligner technology?

Maskless aligners are widely used across diverse applications. Prominent uses include advanced packaging (e.g., 3D ICs, fan-out WLP), MEMS device fabrication, production of power devices and compound semiconductors (like SiC and GaN), photonics, and critical research and development in academic and industrial settings. Their versatility makes them suitable for industries requiring intricate designs and varied substrate materials.

What are the key technological advancements driving the Maskless Aligner Market?

Major advancements include the development of higher-resolution direct-write engines (such as advanced DMDs, EUV, and multi-beam electron beam technologies), more precise alignment and stage systems, sophisticated software for pattern optimization and defect correction, and novel photoresist chemistries. The integration of AI and machine learning for enhanced automation, predictive maintenance, and real-time process control is also a significant driver, pushing the boundaries of precision and efficiency.

What is the market outlook for maskless aligners and expected growth regions?

The market outlook is highly positive, with a projected strong CAGR driven by the demand for miniaturization, specialized devices, and faster product development cycles. Asia Pacific is expected to remain the dominant growth region due to its robust semiconductor manufacturing ecosystem. North America and Europe are also anticipated to experience significant growth, fueled by R&D investments and increasing focus on advanced manufacturing in high-tech sectors like automotive, industrial, and medical electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager